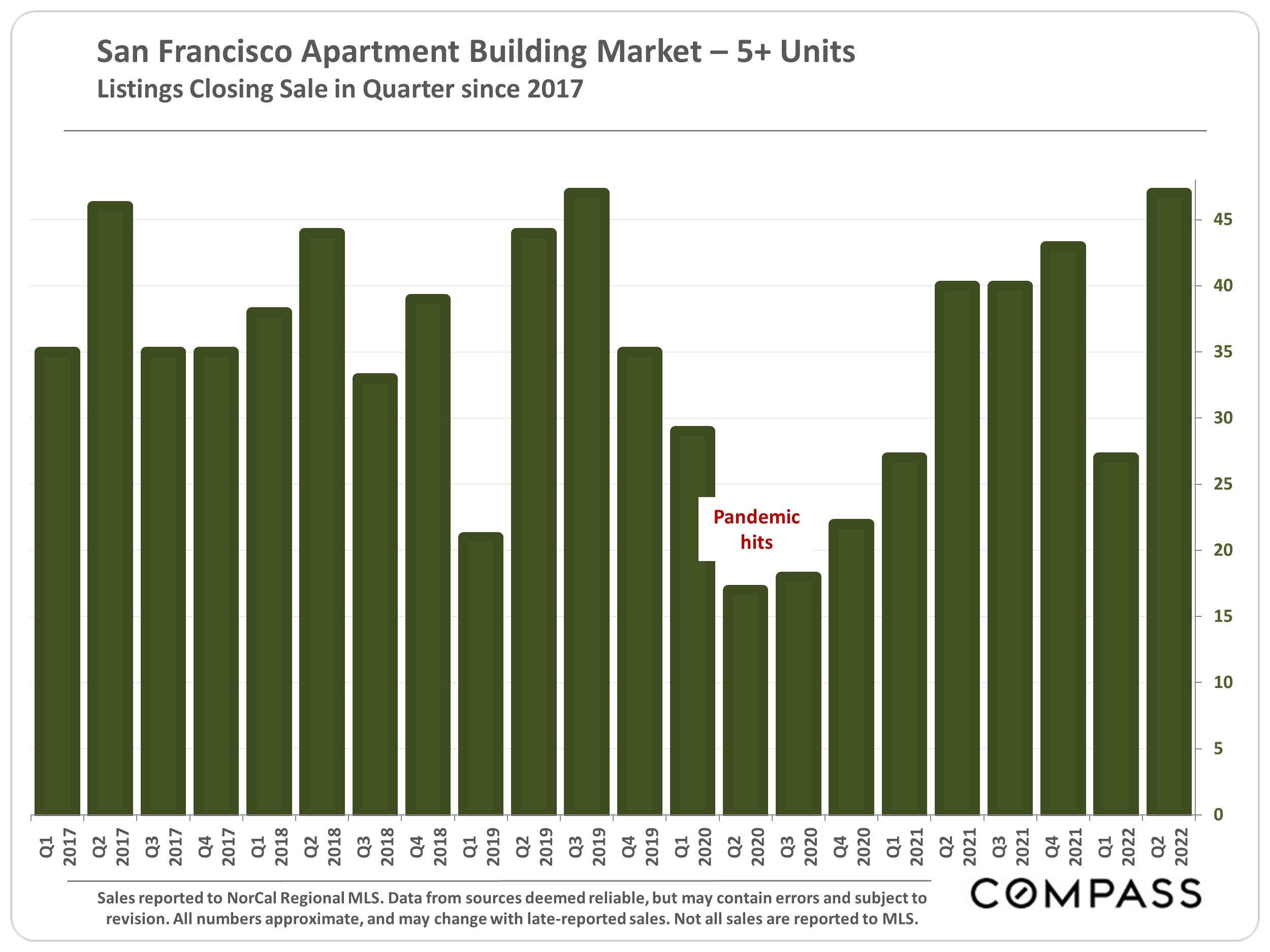

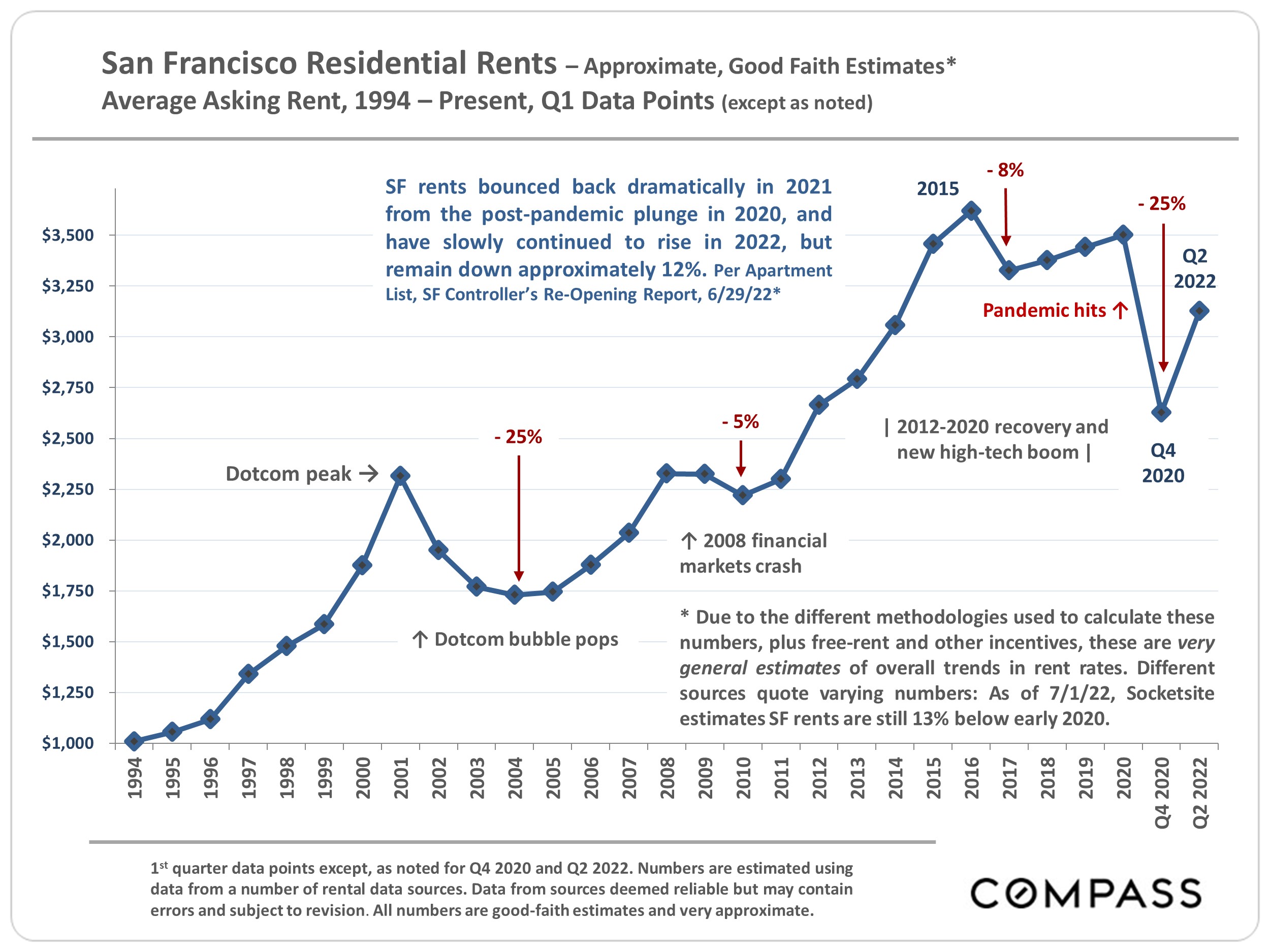

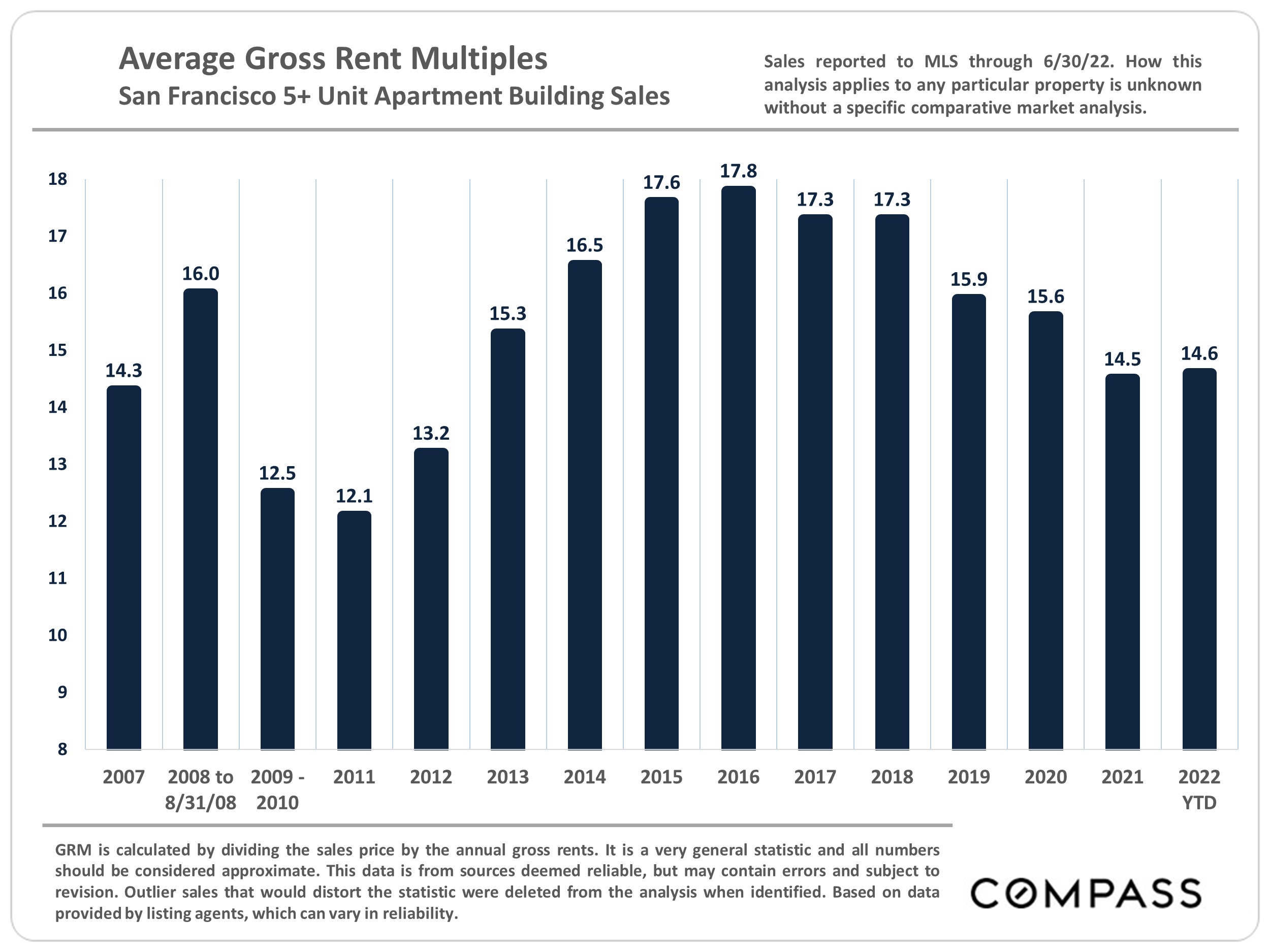

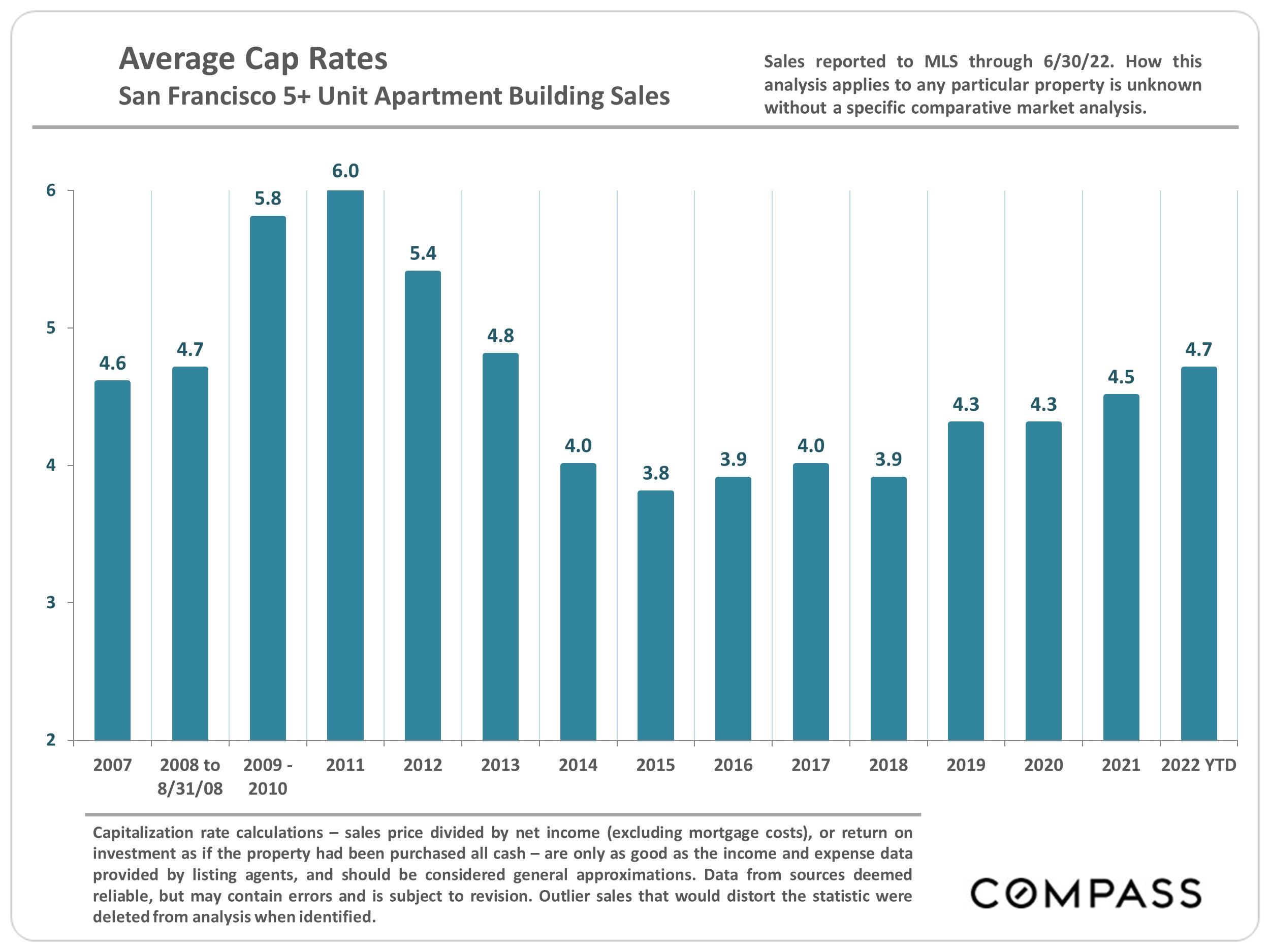

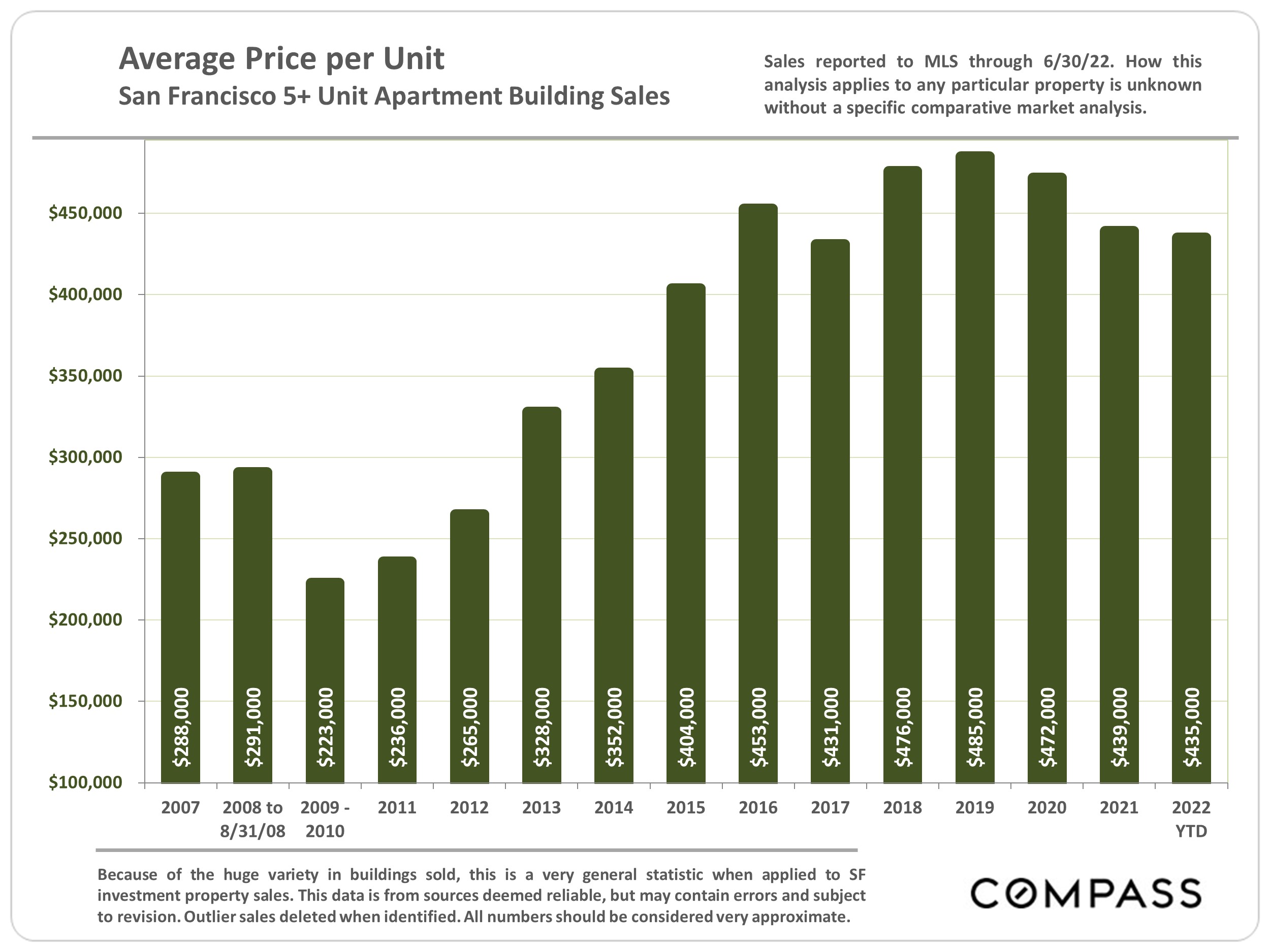

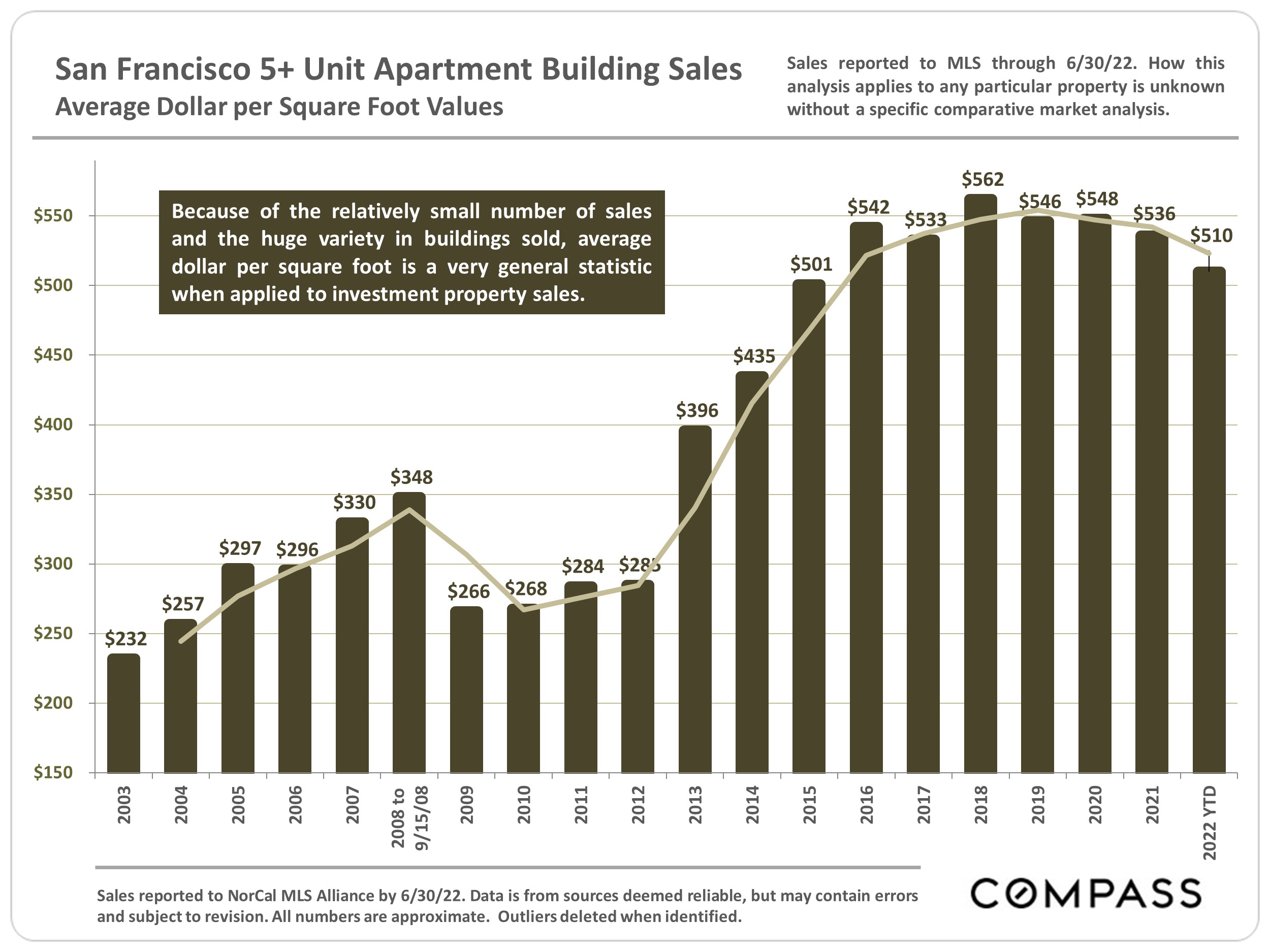

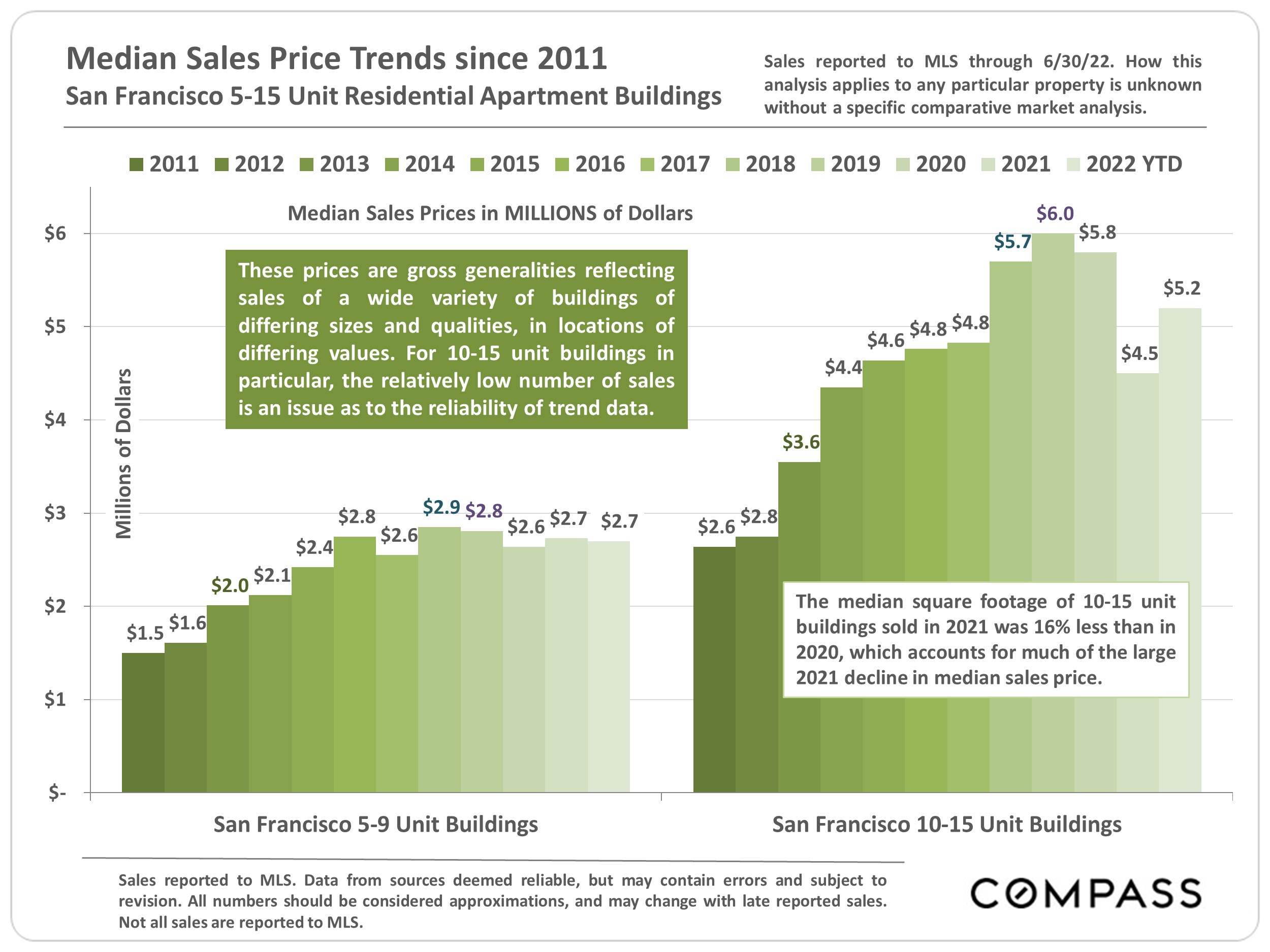

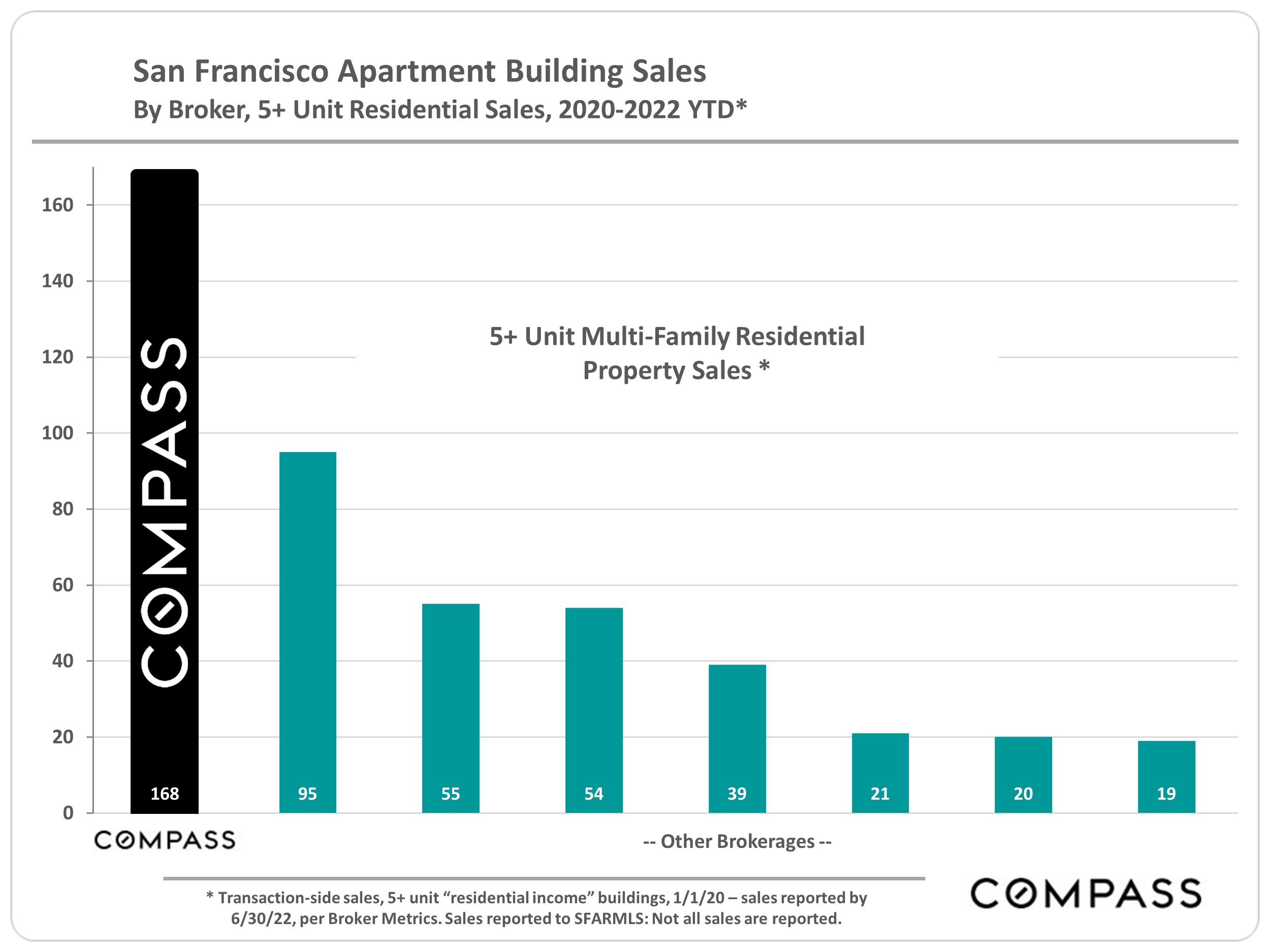

The economic headwinds impacting real estate and financial markets continued to grow in the second quarter of the year, but the sales volume of 5+ unit apartment buildings hit its highest quarterly number since 2019. Rent rates remain well down from before the pandemic hitting, and standard measures of value have generally softened incrementally over that period.

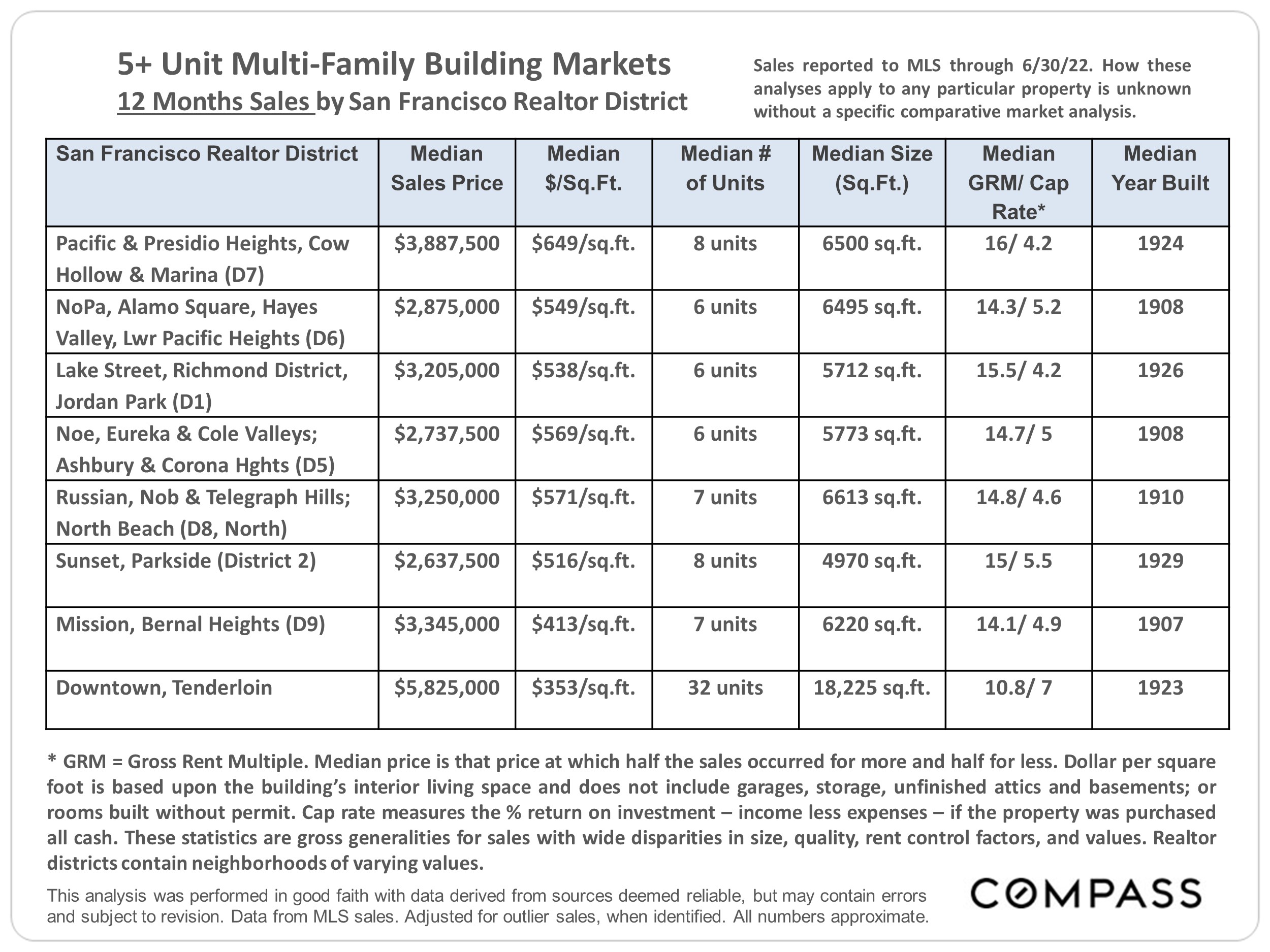

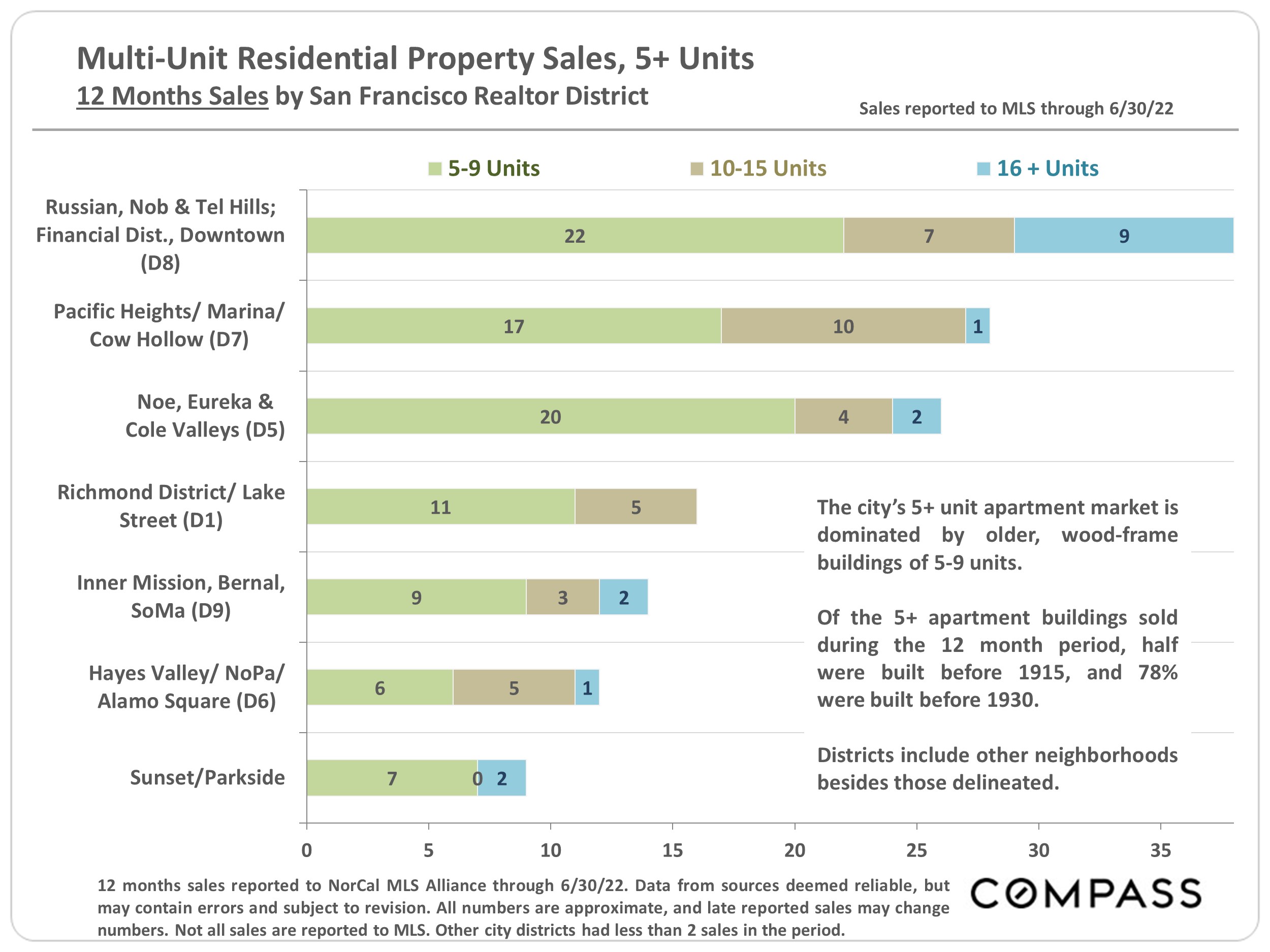

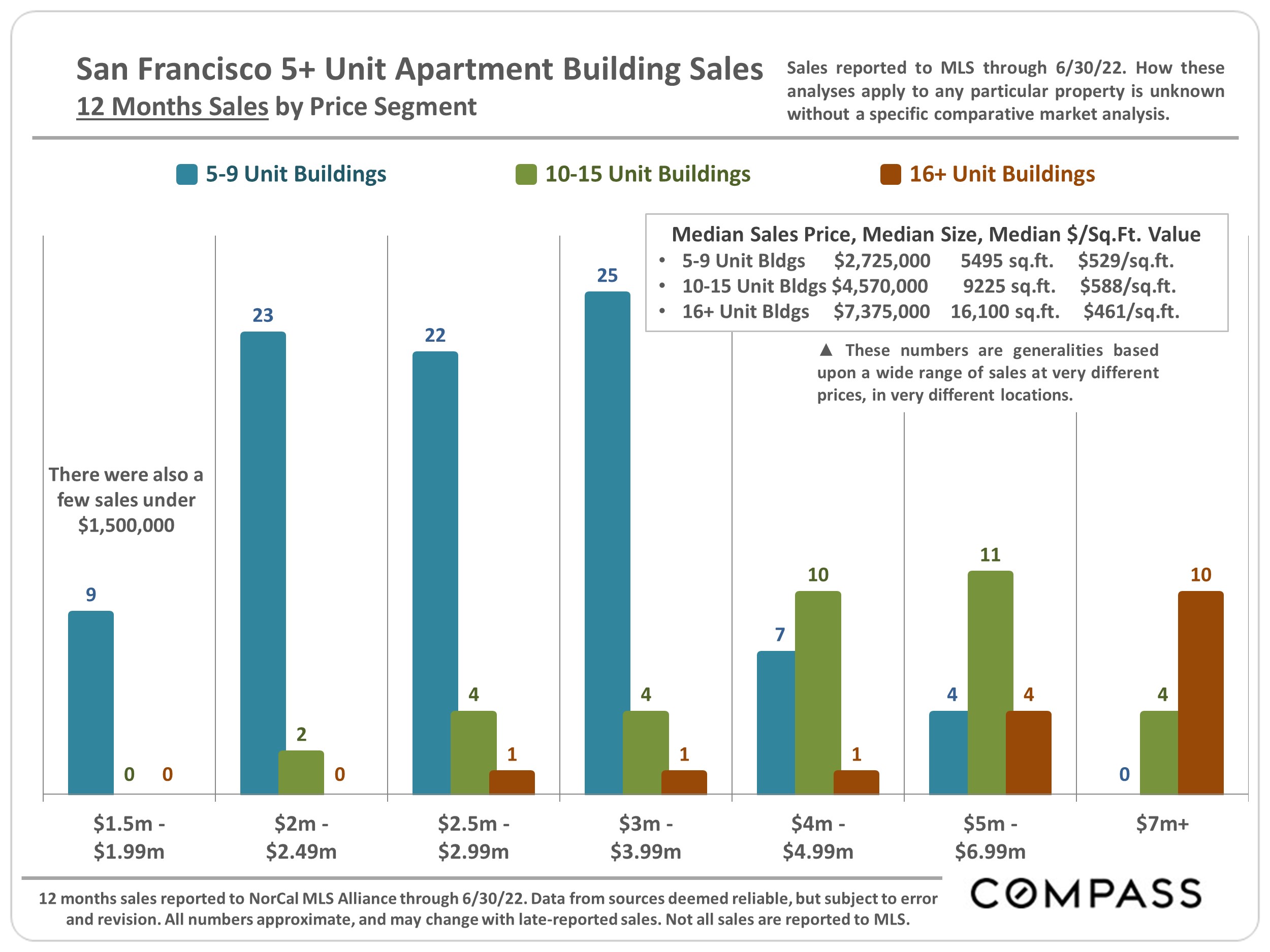

5+ unit residential income buildings. Sales reported to SF and NorCal MLS. This market consists of a relatively small number of sales, of buildings of widely varying sizes, qualities and financial characteristics, across a broad range of locations: This makes meaningful statistical analysis more difficult. Data from sources deemed reliable, but may contain errors and subject to revision. Q2 2022 numbers are estimates using data available in early July 2022: Late reported sales may alter these numbers. All numbers approximate. How these analyses apply to any particular property is unknown without a specific comparative market analysis.

|