A Compass Review for the San Francisco Metro Area, June 30, 2020

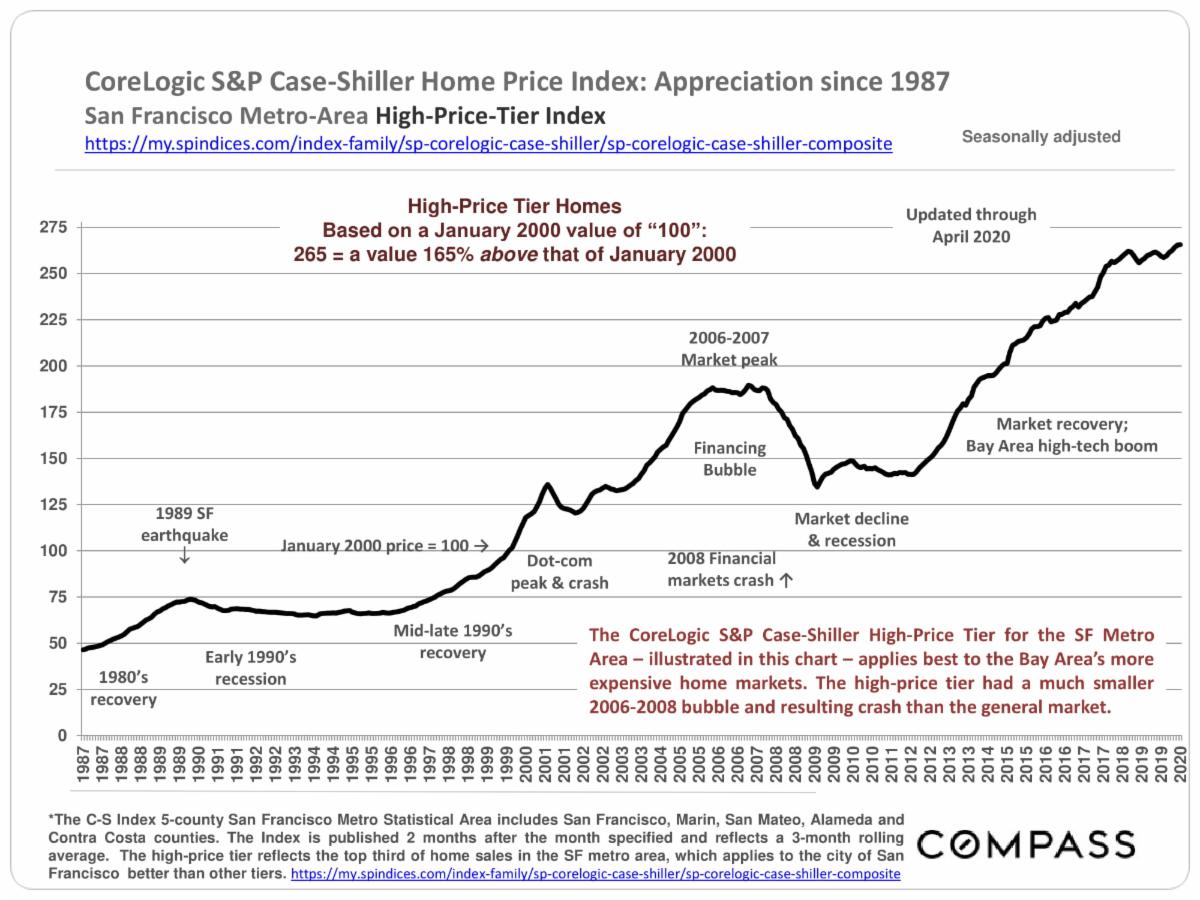

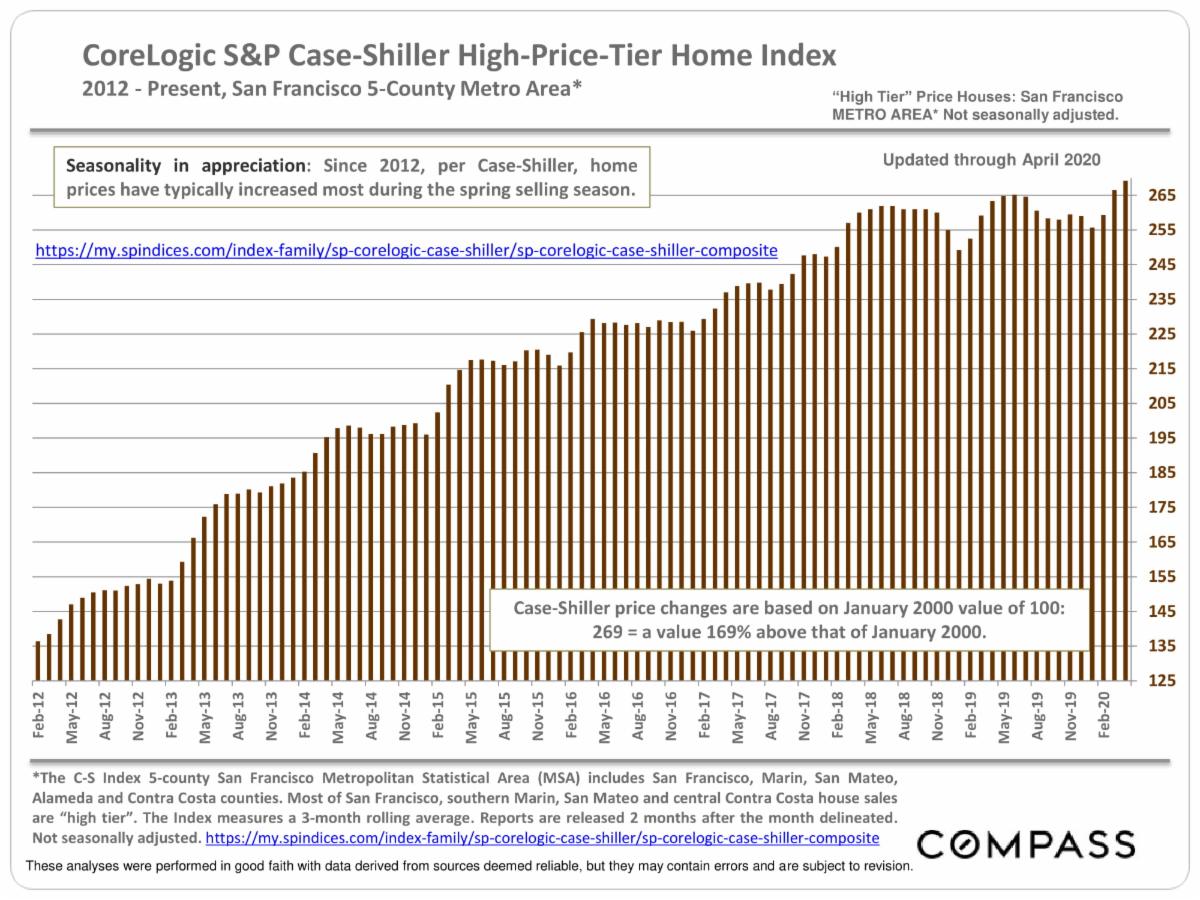

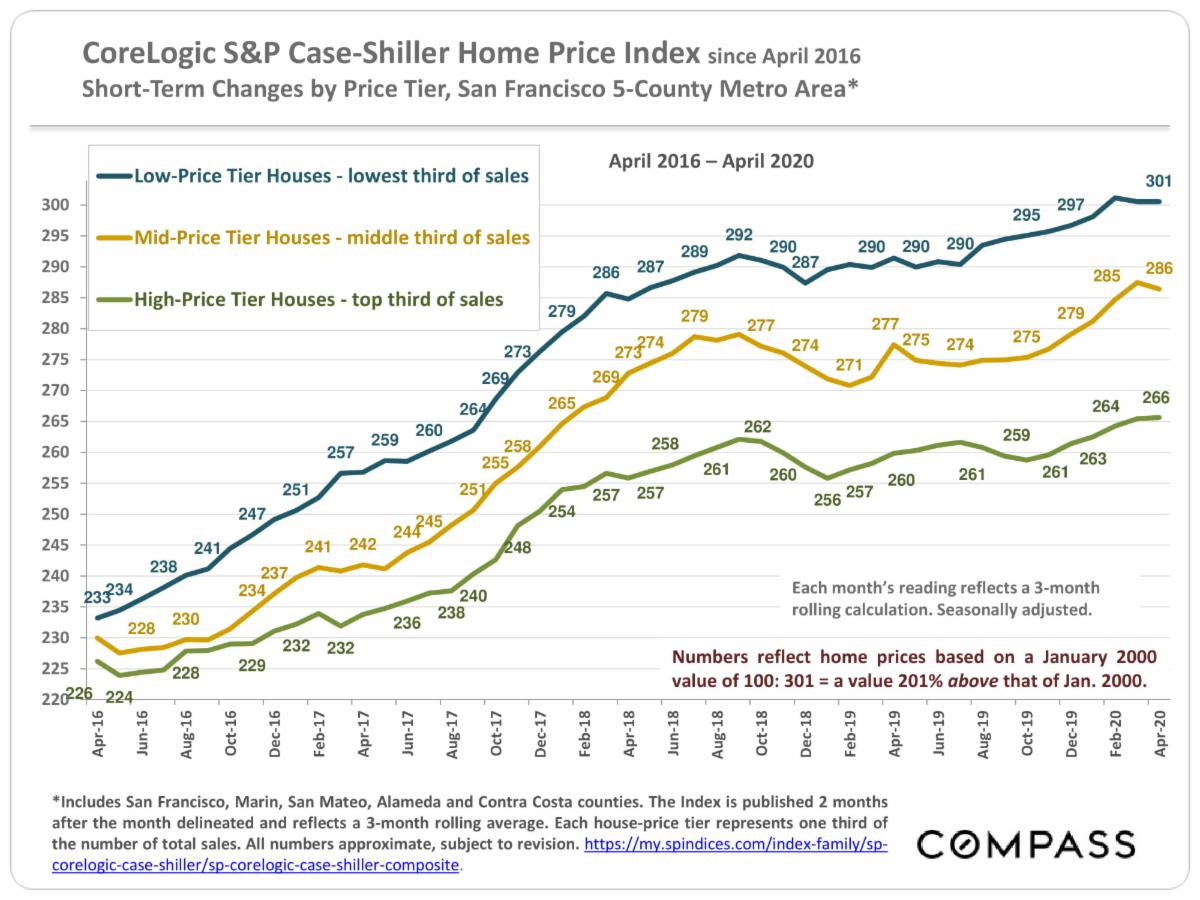

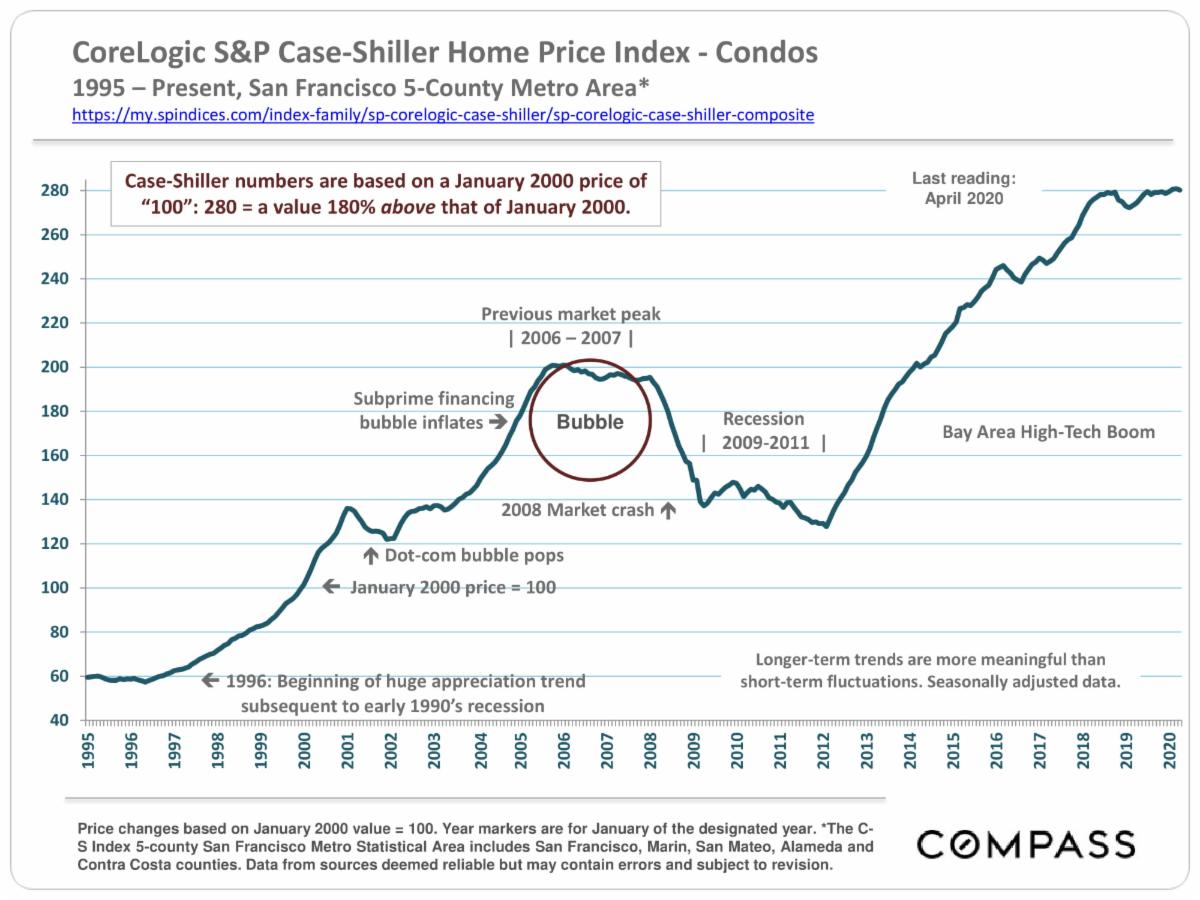

The Index is published 2 months after the month delineated – the new April 2020 index was released 6/30/20 – and reflects a 3-month rolling calculation,and one month’s sales generally reflect accepted-offer activity in the previous month. Thus, the Index is looking into a rear-view mirror at the market 3 to 5 months ago. So far, the Index is not showing any negative effects on home prices from the COVID-19 crisis that began to seriously affect Bay Area home markets in mid-March with the imposition of shelter in place rules.

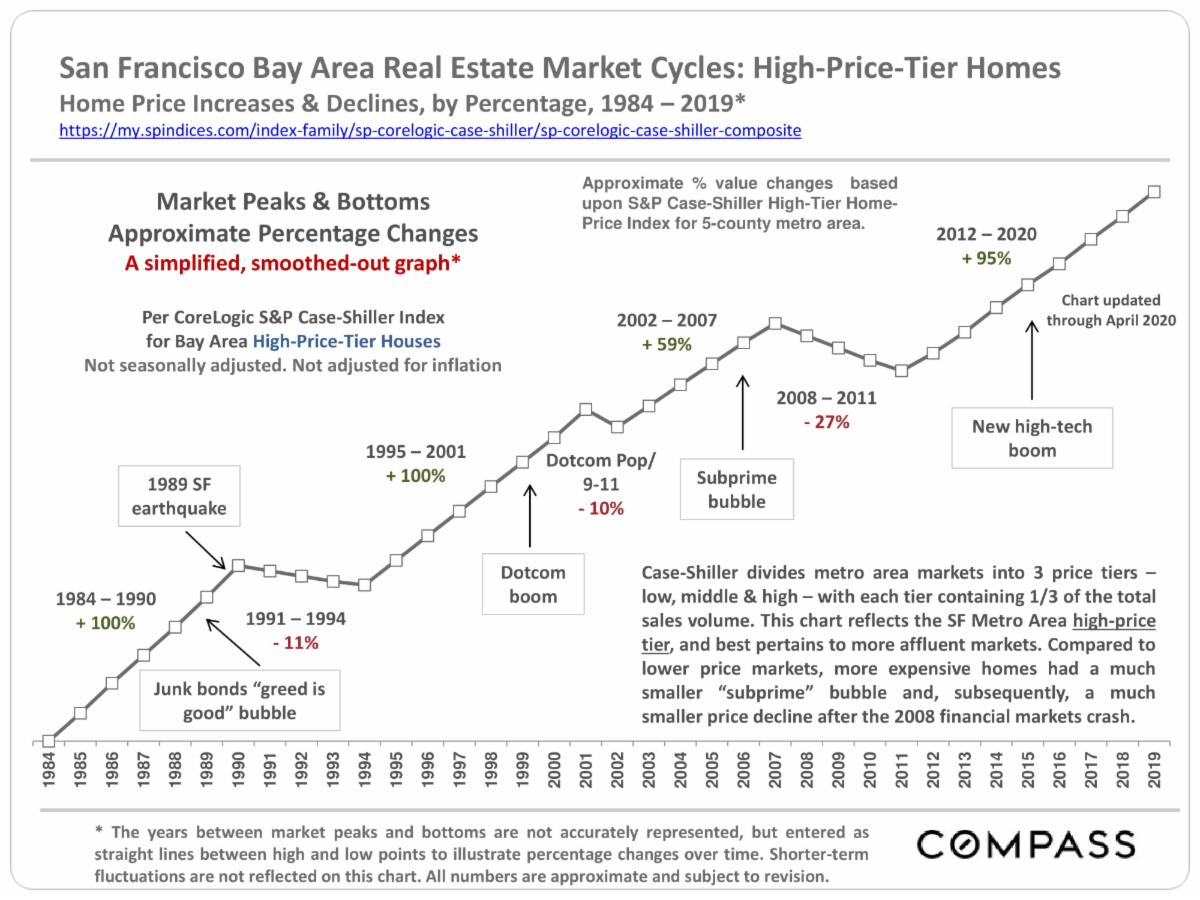

The Corelogic S&P Case-Shiller Home Price Index does not evaluate median sales price changes, but employs its own proprietary algorithm to measure home price appreciation over time. Since its indices cover large areas with hundreds of communities of widely varying home values, the C-S chart numbers do not refer to specific prices, but instead reflect prices as compared to those prevailing in January 2000, all designated as having a consistent value of 1 00. A reading of 250 signifies that home prices in the area and segment being measured have appreciated 150% above the price prevailing in January 2000.

The 5 counties in the Case-Shiller San Francisco Metro Statistical Area are San Francisco, Marin, San Mateo, Alameda and Contra Costa. (Alameda and Contra Costa have by far the greatest numbers of house sales being analyzed.) The Index trend lines, in their ups and downs, generally apply well to other Bay Area counties, such as Santa Clara and Sonoma. In northern California, Case-Shiller only tracks prices for the 5 counties of the SF Metro Area. C-S calculations are huge generalities.

Case-Shiller divides all the house sales into thirds, or tiers:The third of sales with the lowest prices is the low-price tier; the third of sales with the highest sales prices is the high-price tier; and the third in between is the mid-price. The price ranges of these tiers change as the market changes. The 3 price tiers experienced dramatically different bubbles, crashes and recoveries over the past 18+ years, to a large degree determined by how badly the tier was affected by the subprime financing crisis. The low price tier was worst affected – huge bubble, huge crash, most dramatic recovery – and the high-price least affected (but still significantly so). However, in the last 4 years, the low- and mid-price tiers have seen appreciation rates accelerating above that of the high-price tier.

Most house sales in the more affluent Bay Areas communities are in the “high price tier,” and many would qualify for an “ultra-high price tier,” if such existed. However,all counties, to varying degrees,have sales in all 3 price tiers.

There are hundreds of unique real estate markets and segments in such a broad region, with different dynamics, moving at varying speeds, sometimes in different directions. How the C-S Index applies to any particular property is impossible to know without a specific

comparative market analysis. * https://my.spindices.com/index-family/sp-corelogic-case-shiller/sp-corel ogic-case-shiller-composite