Indications of Changing Market Dynamics

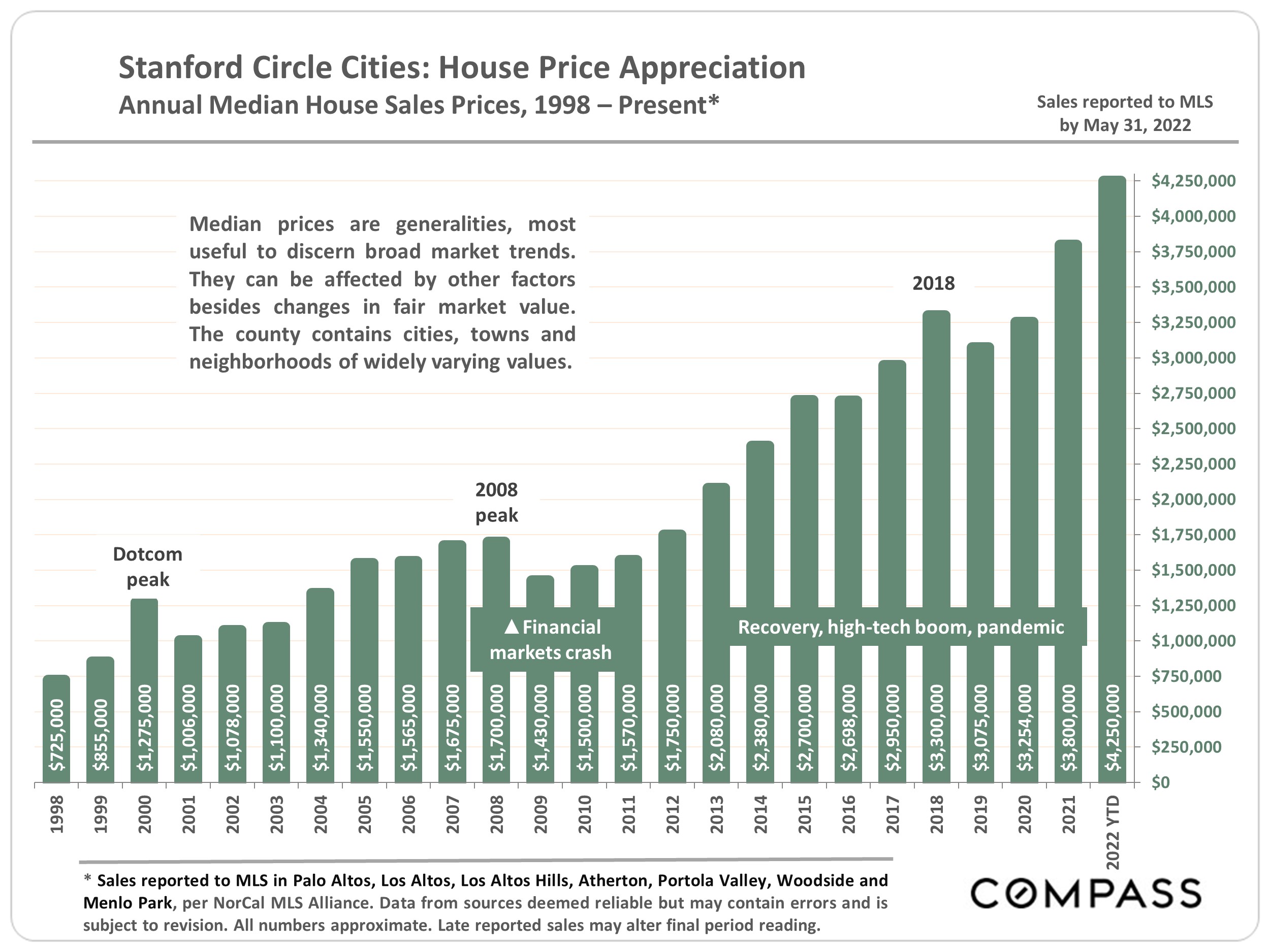

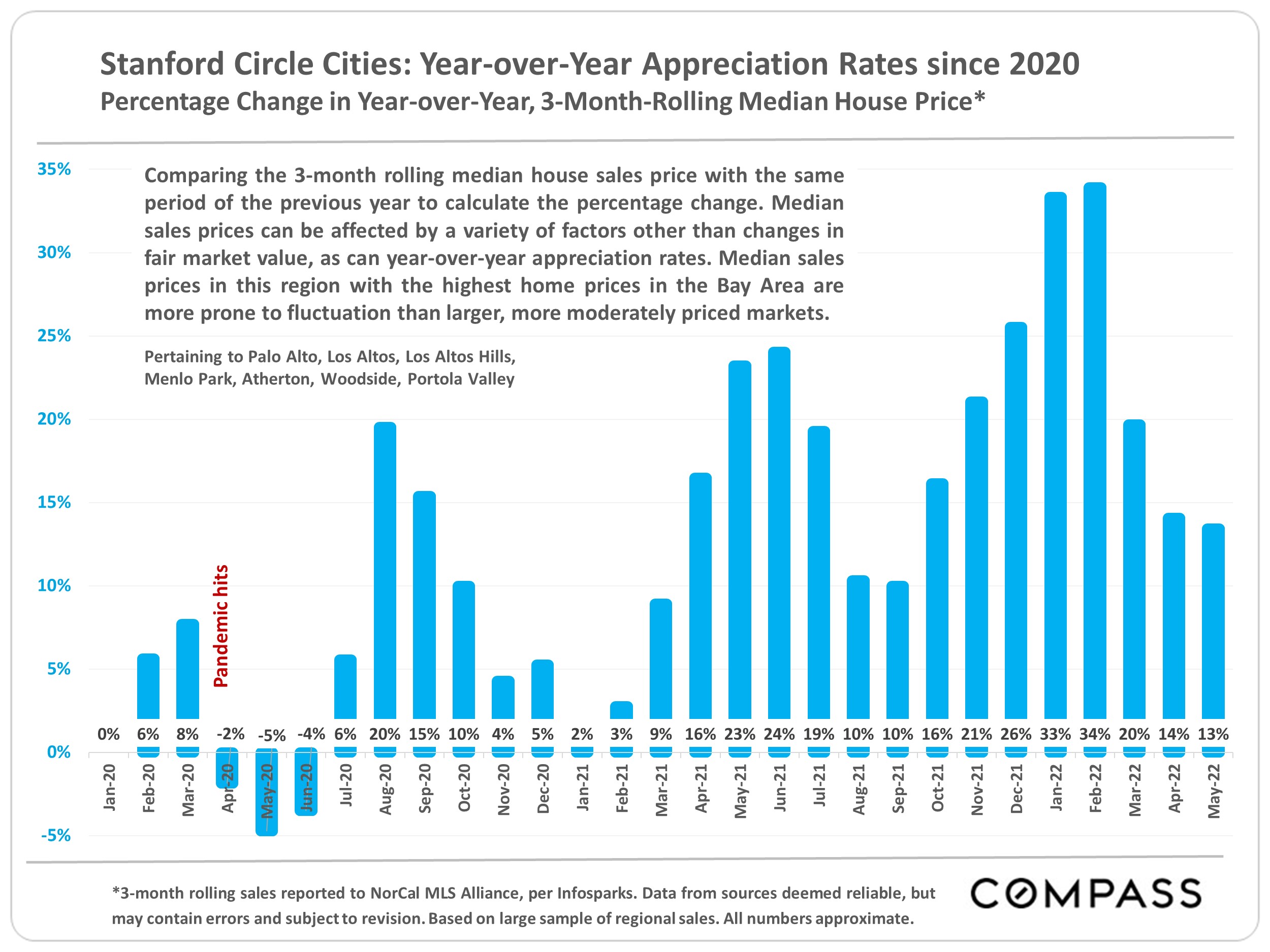

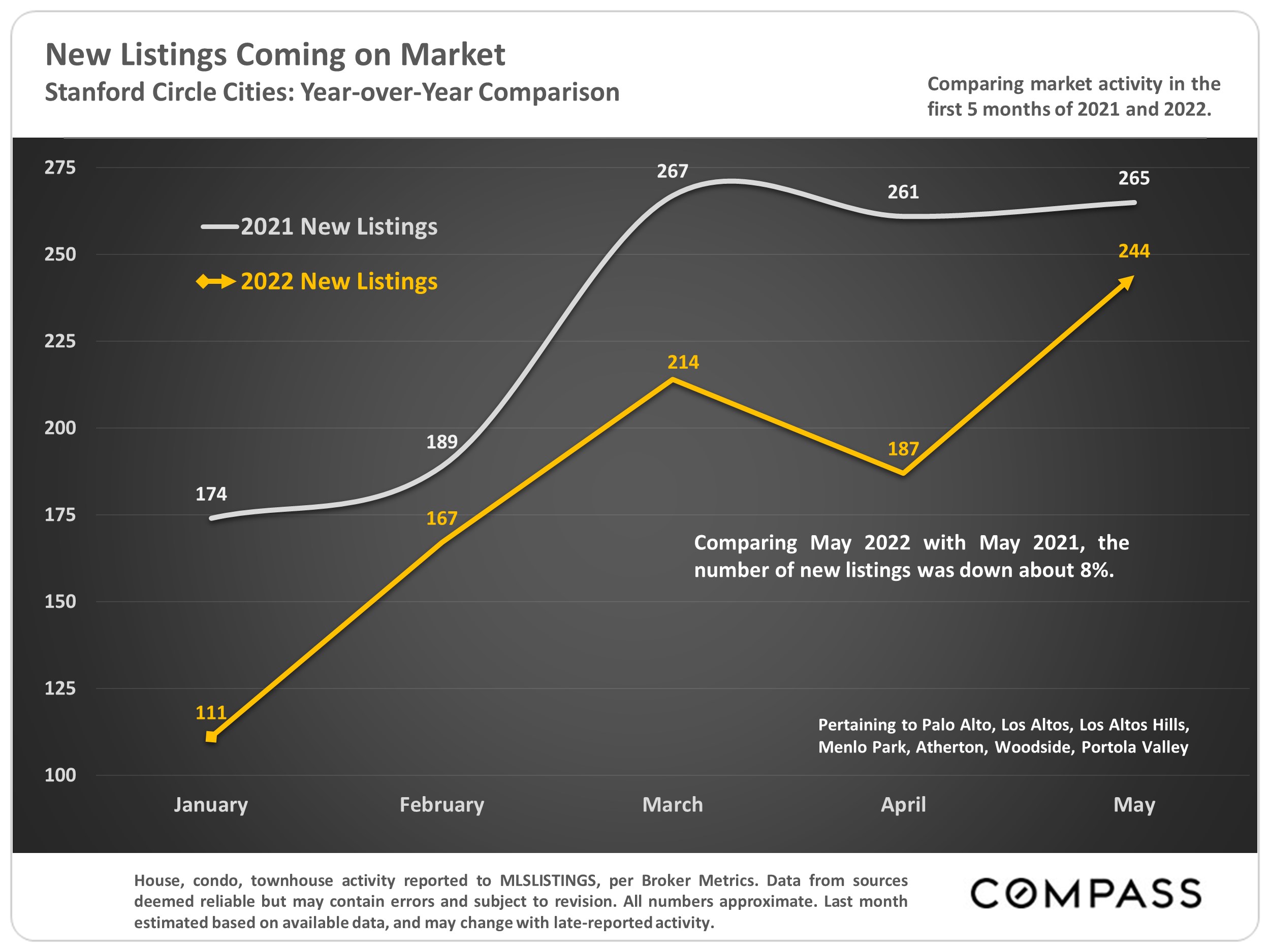

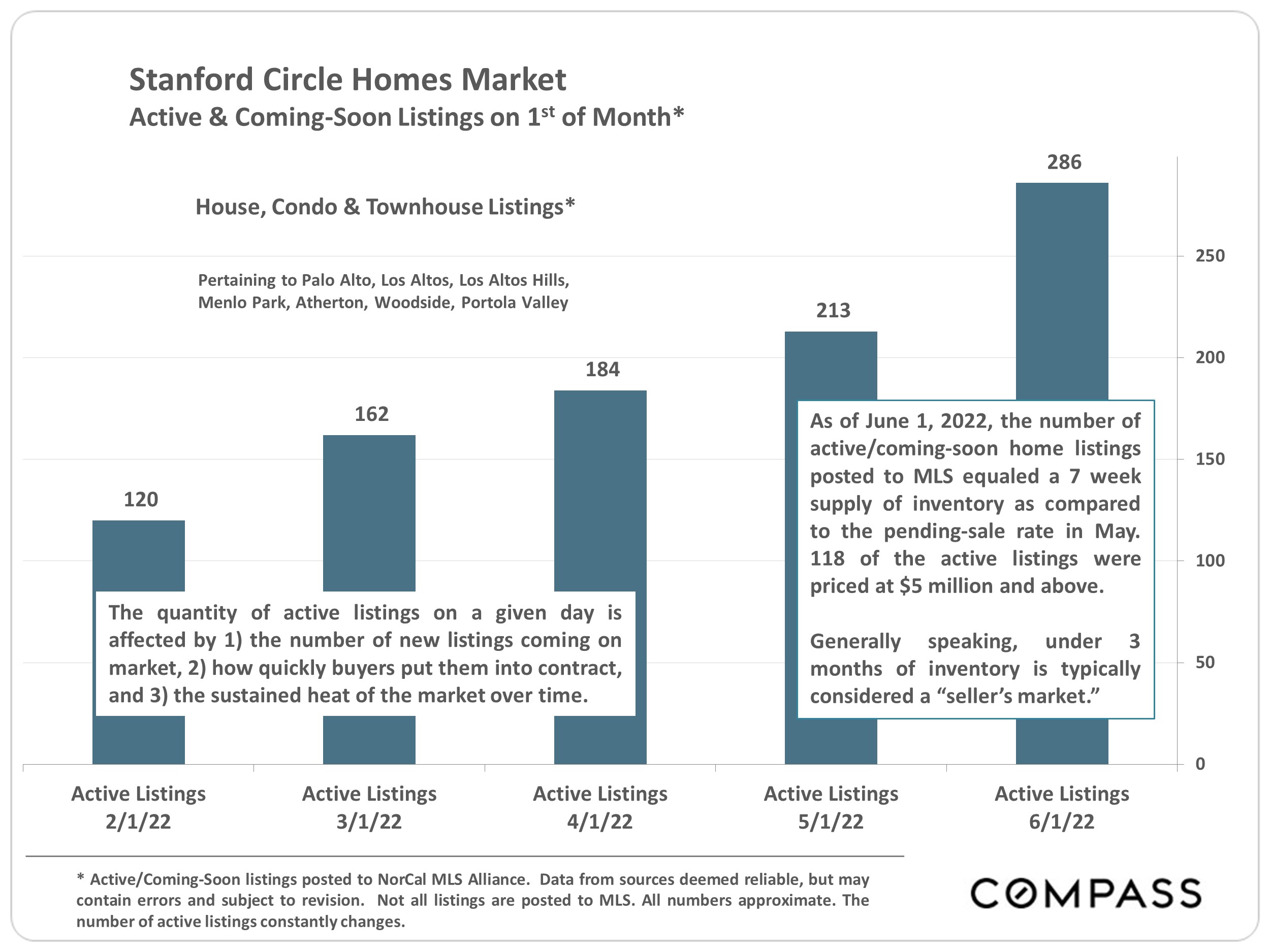

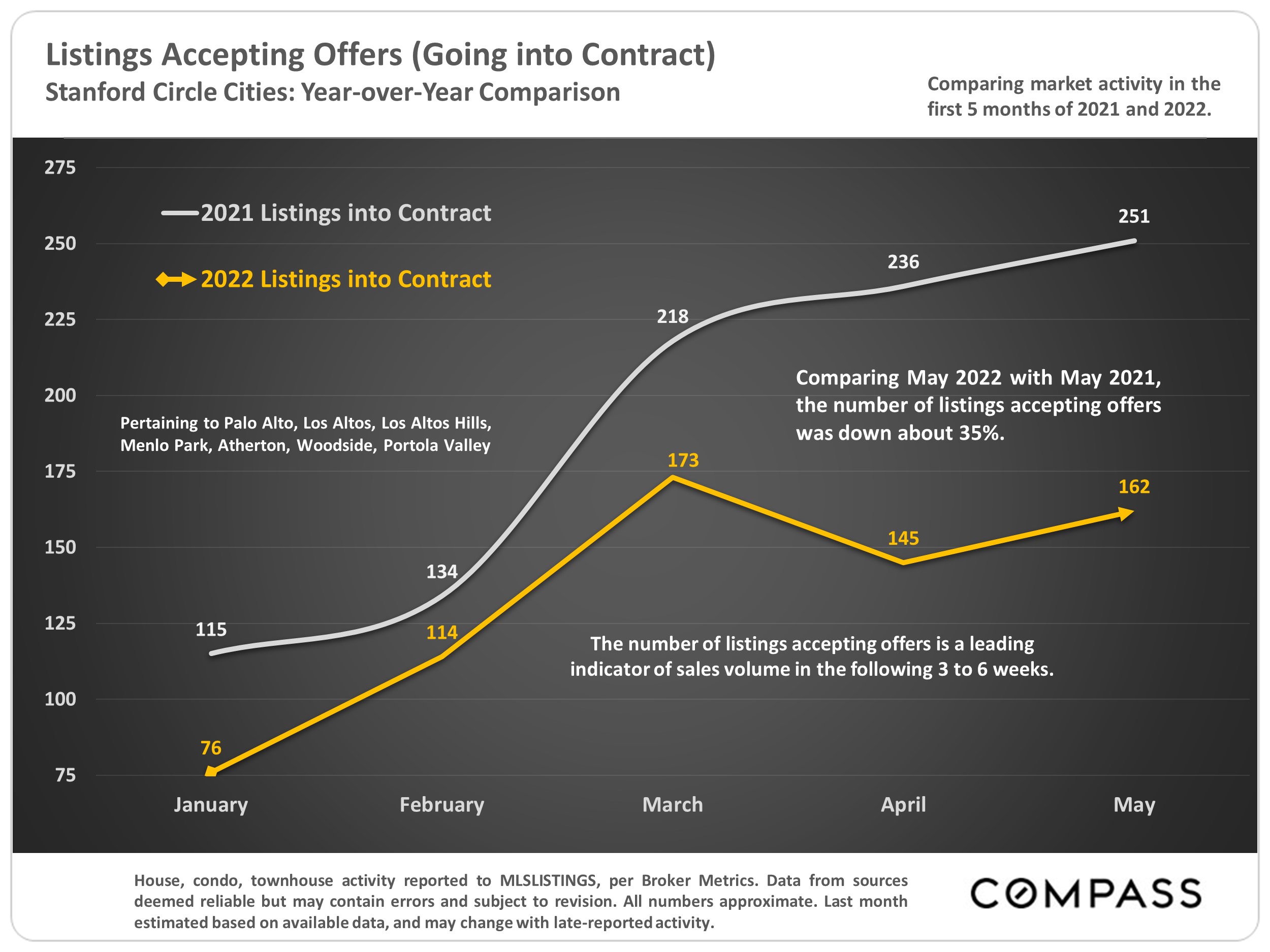

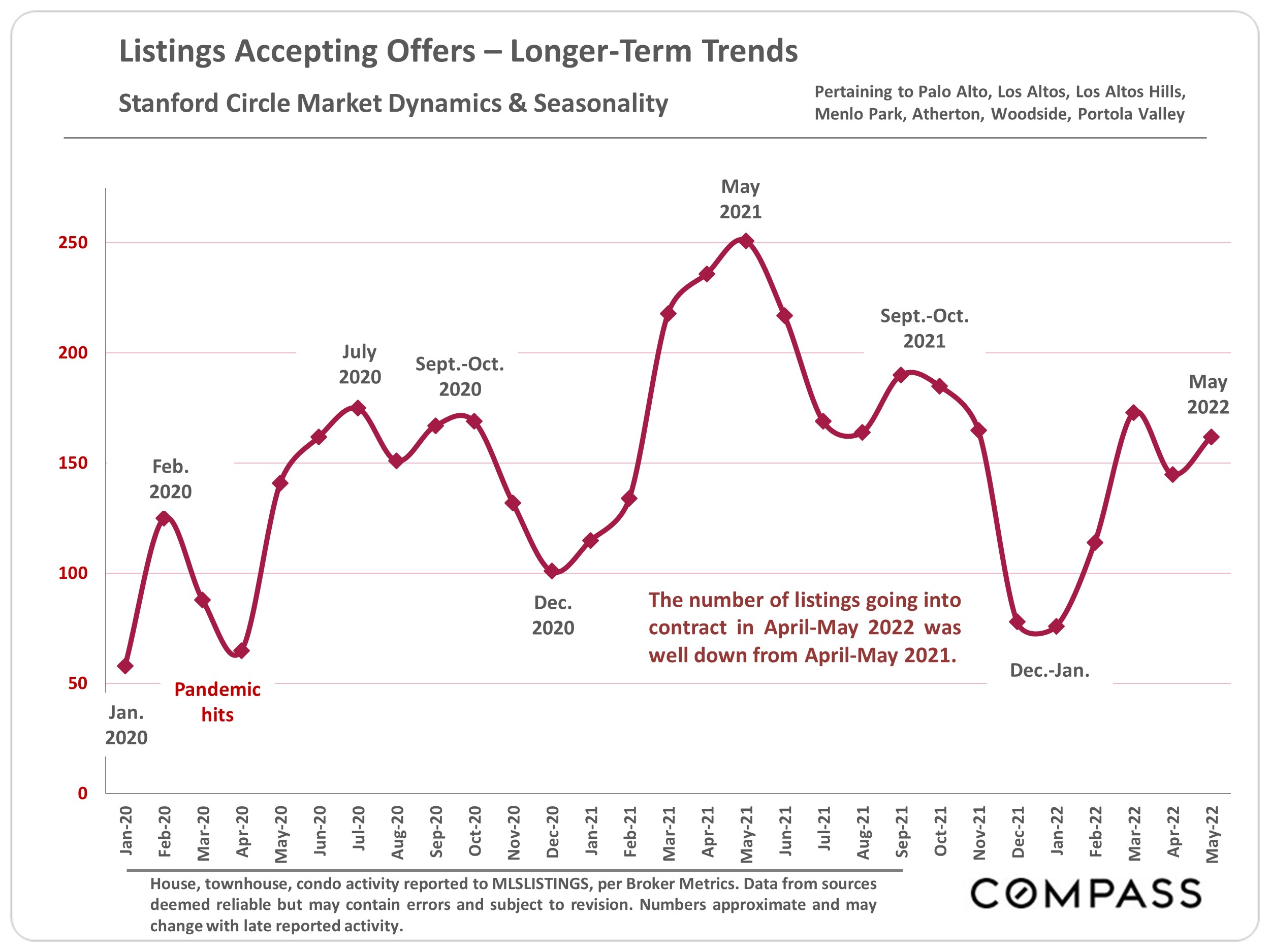

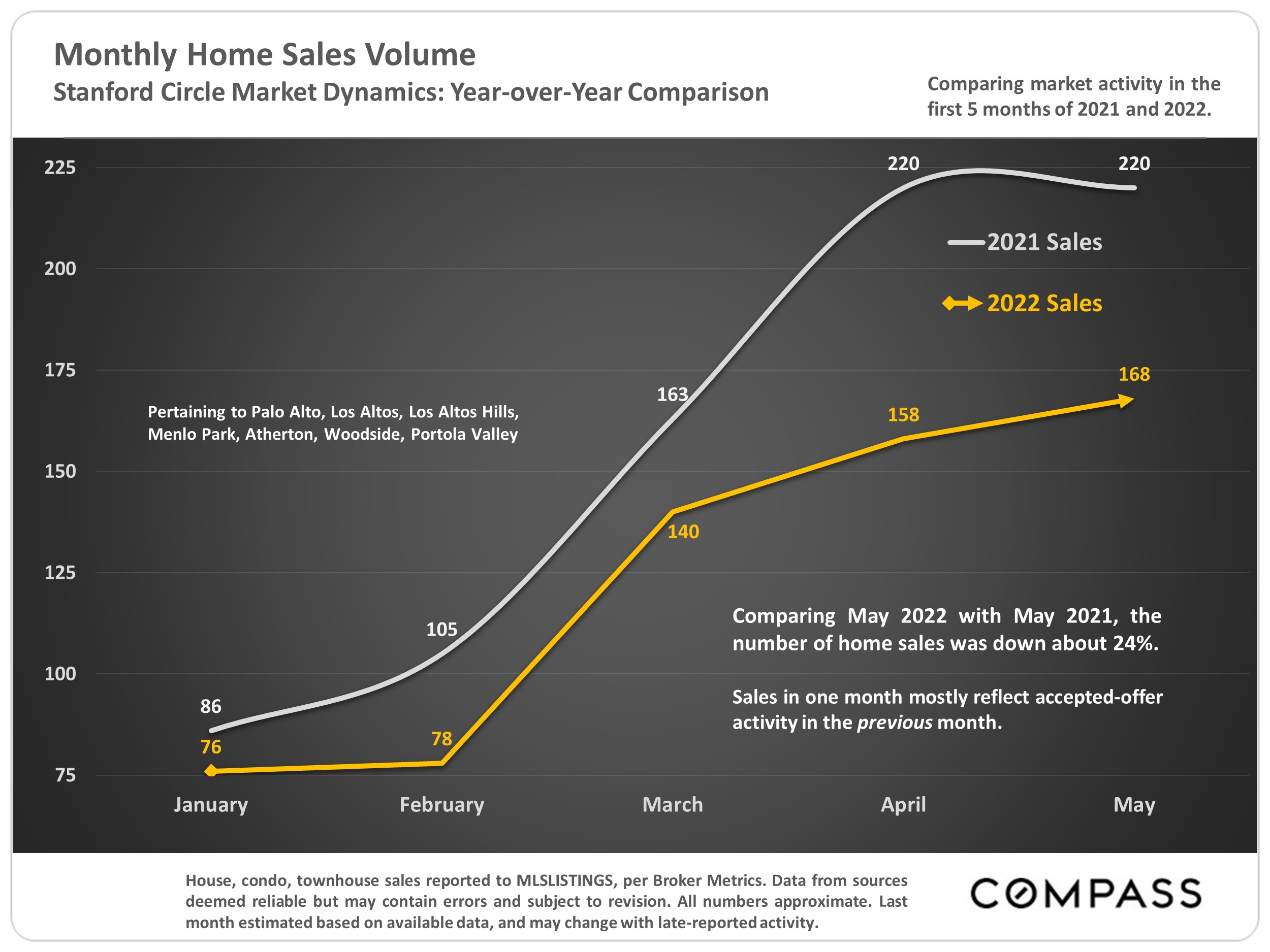

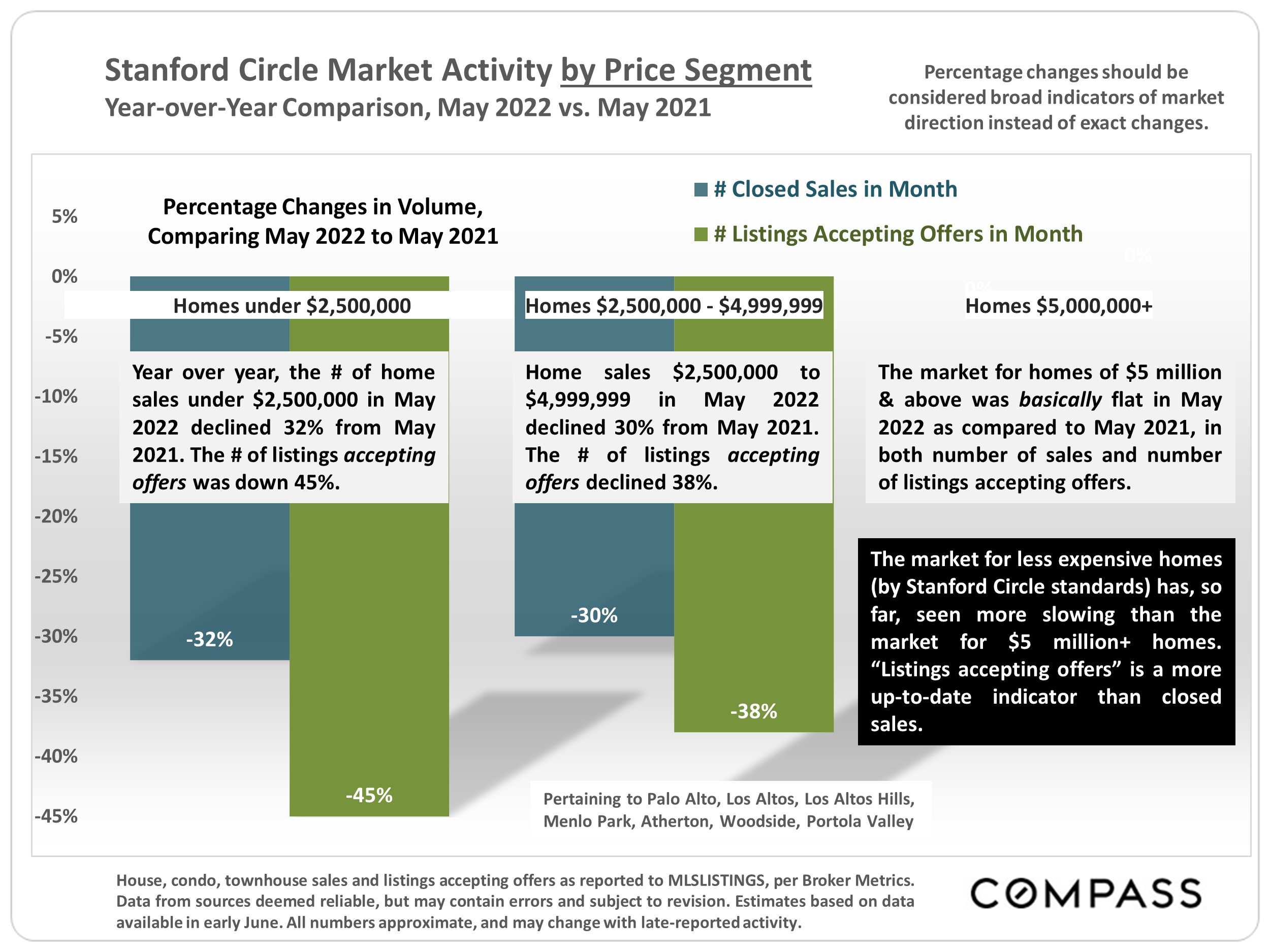

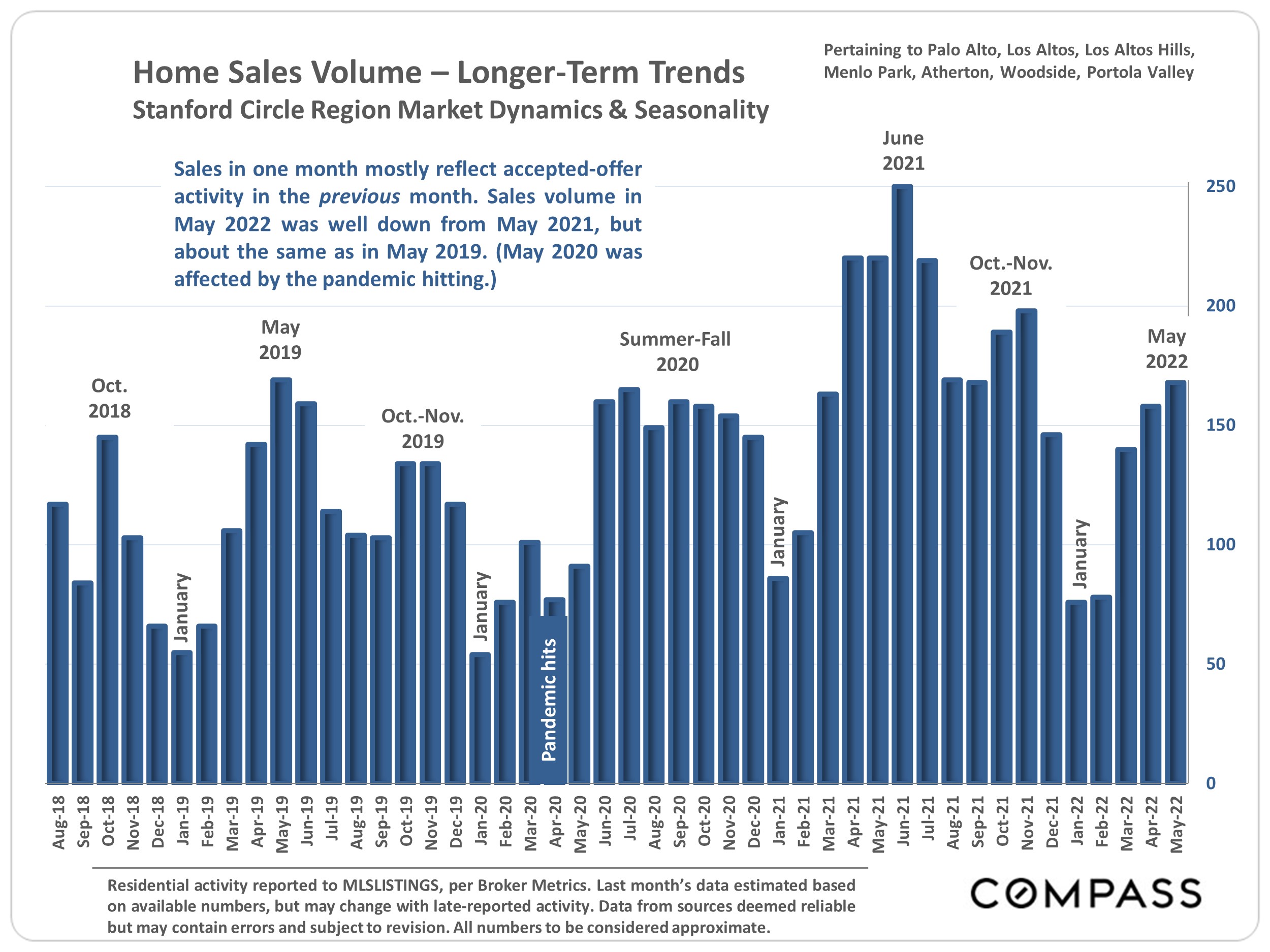

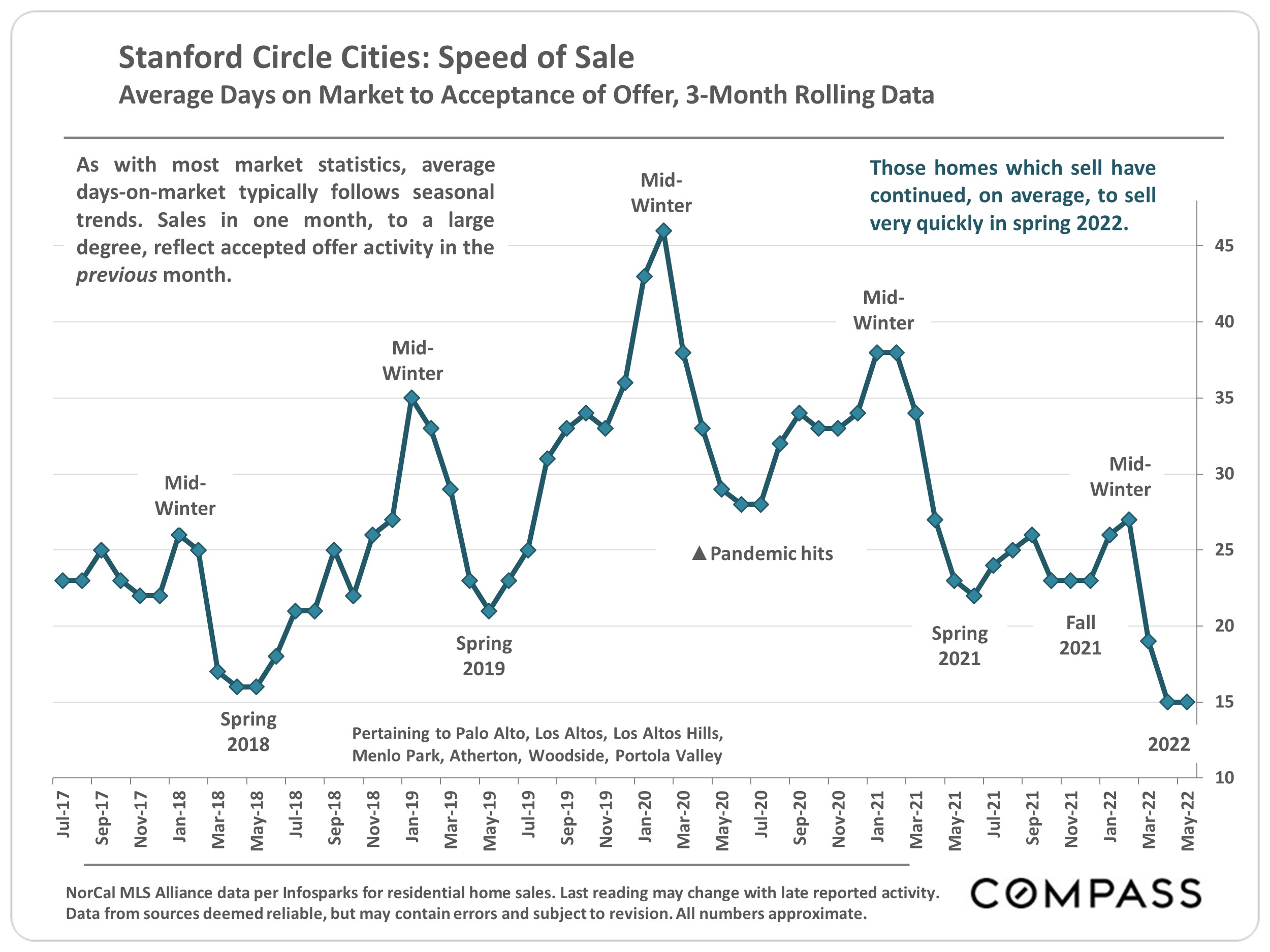

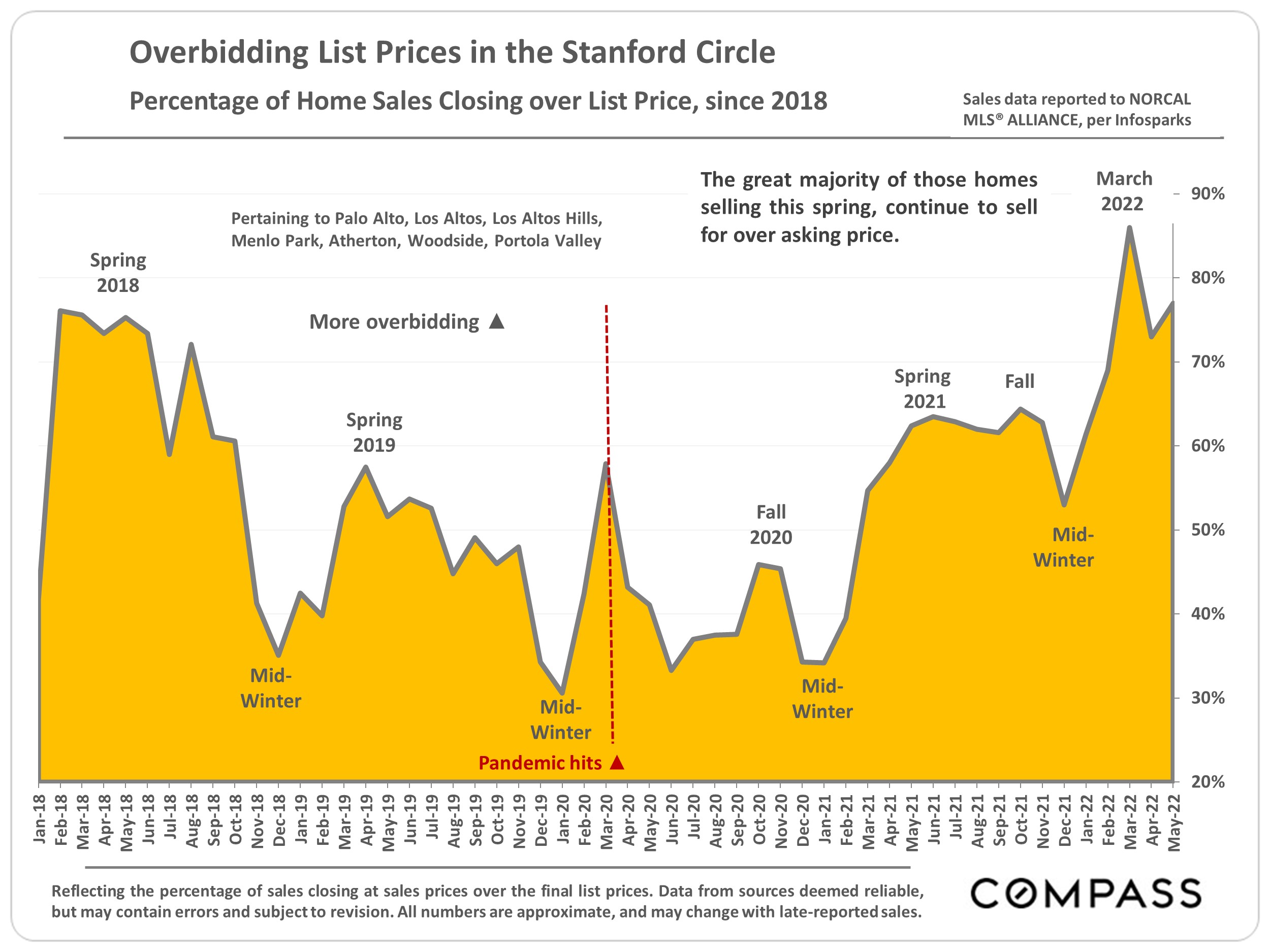

Year-over-year, the number of sales and listings going into contract have significantly dropped, but the homes that are selling are still, on average, selling very quickly for well over asking. Median sales prices and yearover-year appreciation rates remain high. When an overheated market cools, the change is typically gradual (absent a disaster event), and does not mean the market is weak by any normal standard. As an analogy, if traffic is going 120 miles per hour and drops to 75, it feels a lot slower, but cannot reasonably be described as slow. After 2 years of scorching demand, it may be difficult to remember what a more normal market feels like, but people will continue to buy and sell homes in the elite neighborhoods of the Stanford Circle cities.

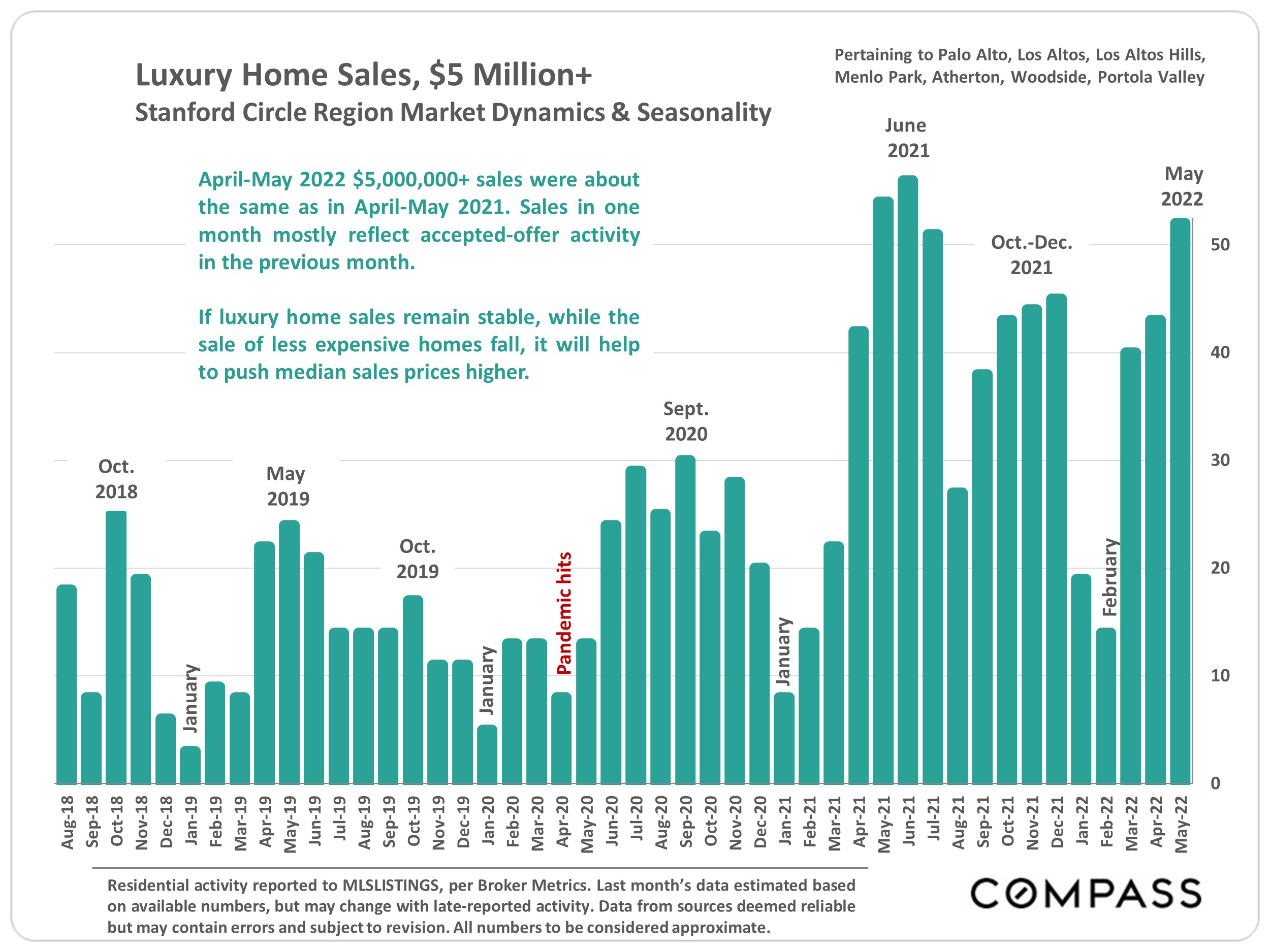

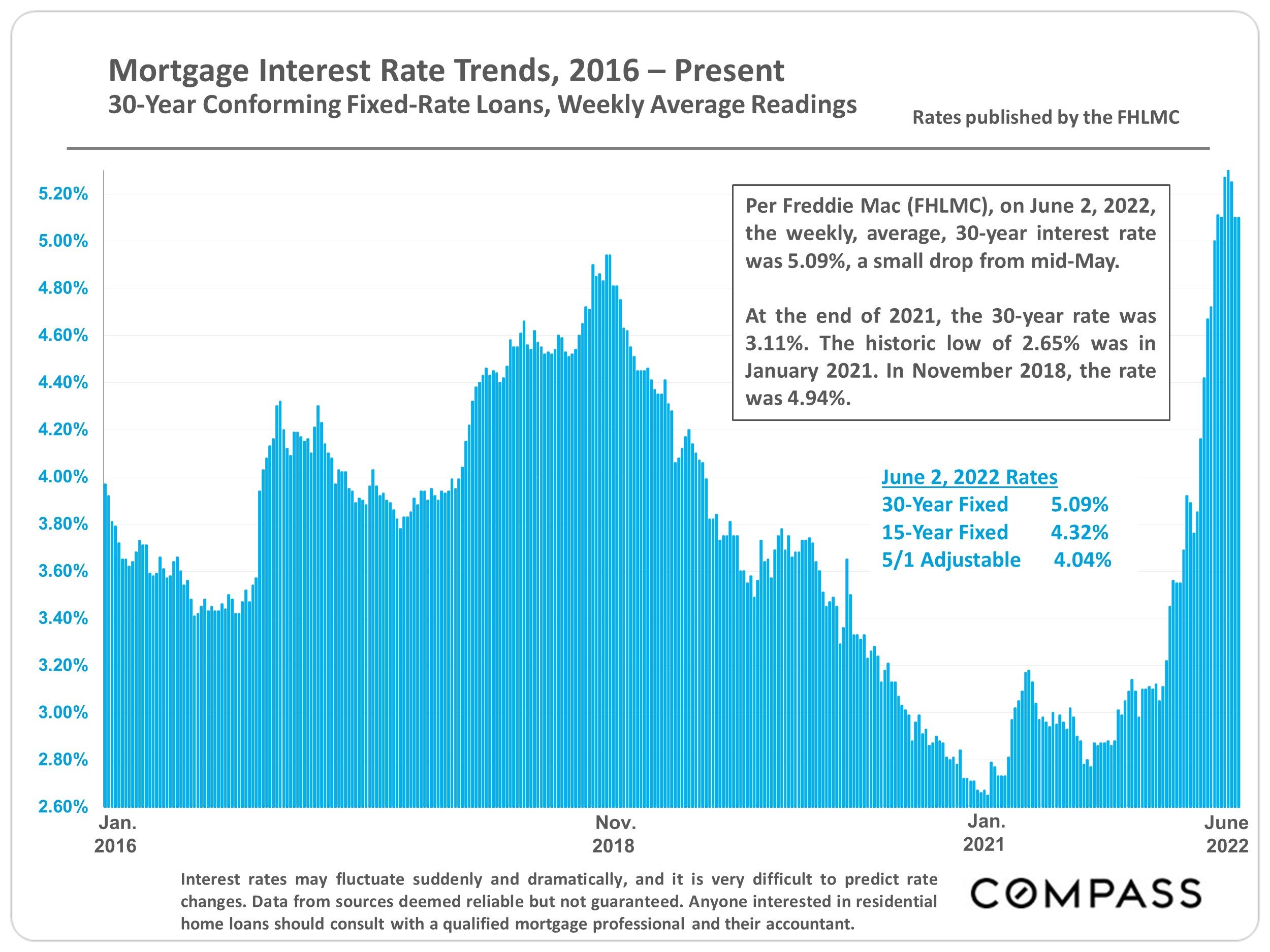

As of late spring, less expensive home sales (by very elevated, Stanford Circle standards) have generally seen considerable declines. For the time being, sales of luxury homes ($5 million+) have held up, but in most of the Bay Area, cooling demand is showing up clearly in pending-sale data for luxury homes – though not yet here. Affluent buyers tend to be more affected by financial markets, which became very volatile in May. Market changes are often uneven in the early months of a transition, with one home selling in days at 25% over list price, while next door, the seller has to reduce their price to get an offer. As markets cool – and markets are cooling across the country – buyers become more discriminating. Negative conditions previously ignored are noticed; more negotiation occurs; multiple offers and overbidding decline. Listings that are well prepared, show well, and priced right will have an increasing advantage.

After peaking in spring, market activity typically slows through summer. Autumn usually sees another, shorter spike in activity prior to the big mid-winter slowdown. These are common seasonal dynamics, though other factors can come into play. We will have to wait and see what occurs in the economy in coming months.

This report will look at recent, year-over-year changes in inventory and demand, while also reviewing longer term trends for more context. Included is a link to a report reviewing city/town submarkets.

|

Source: Compass

It is impossible to know how median and average value statistics apply to any particular home without a specific comparative market analysis. These analyses were made in good faith with data from sources deemed reliable, but may contain errors and are subject to revision. It is not our intent to convince you of a particular position, but to attempt to provide straightforward data and analysis, so you can make your own informed decisions. Median and average statistics are enormous generalities: There are hundreds of different markets in San Francisco and the Bay Area, each with its own unique dynamics. Median prices and average dollar per square foot values can be and often are affected by other factors besides changes in fair market value. Longer term trends are much more meaningful than short-term.

Compass is a real estate broker licensed by the State of California, DRE 01527235. Equal Housing Opportunity. This report has been prepared solely for information purposes. The information herein is based on or derived from information generally available to the public and/or from sources believed to be reliable. No representation or warranty can be given with respect to the accuracy or completeness of the information. Compass disclaims any and all liability relating to this report, including without limitation any express or implied representations or warranties for statements contained in, and omissions from, the report. Nothing contained herein is intended to be or should be read as any regulatory, legal, tax, accounting or other advice and Compass does not provide such advice. All opinions are subject to change without notice. Compass makes no representation regarding the accuracy of any statements regarding any references to the laws, statutes or regulations of any state are those of the author(s). Past performance is no guarantee of future results.