Moving into Spring, Markets Remain Very Heated

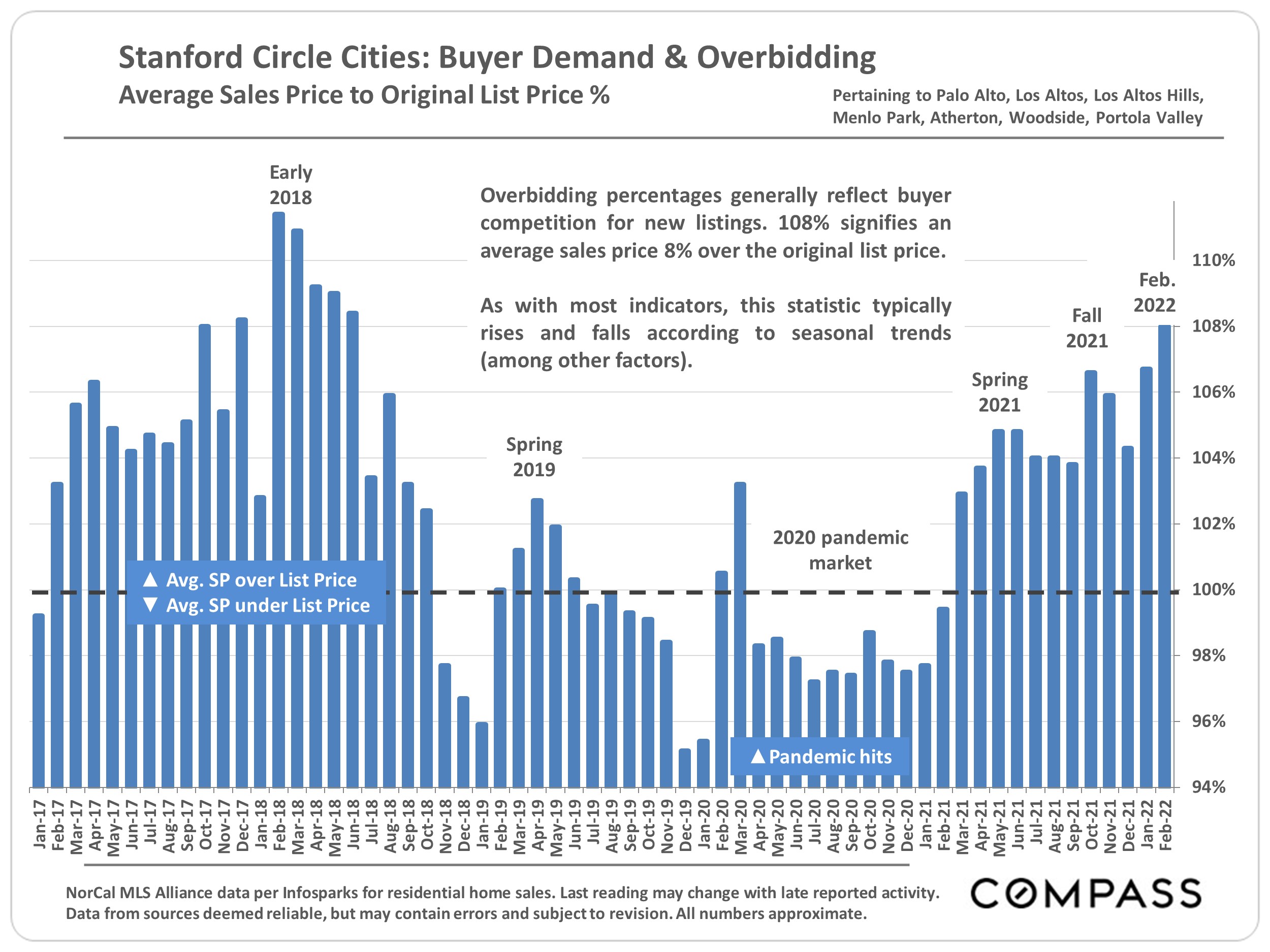

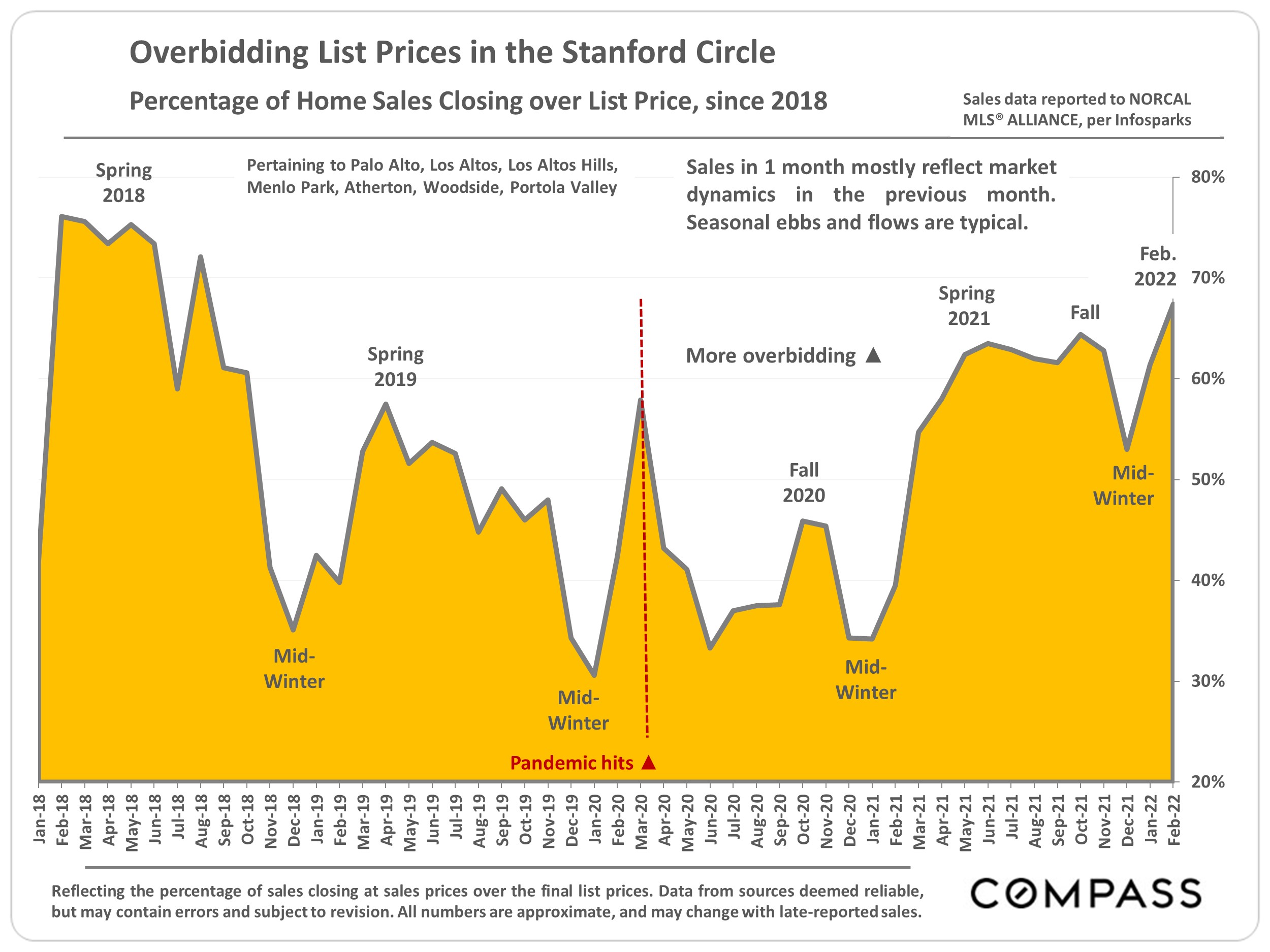

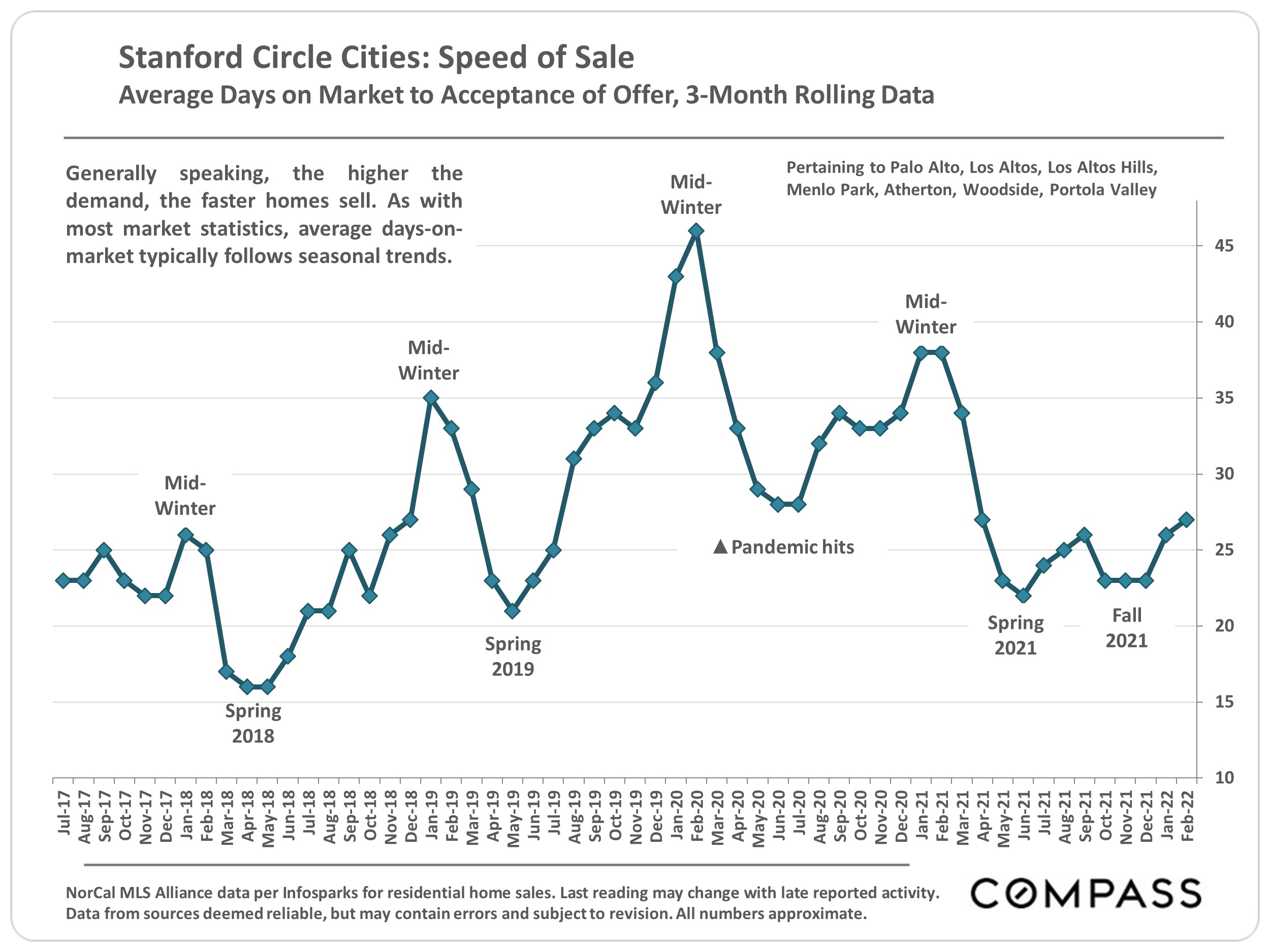

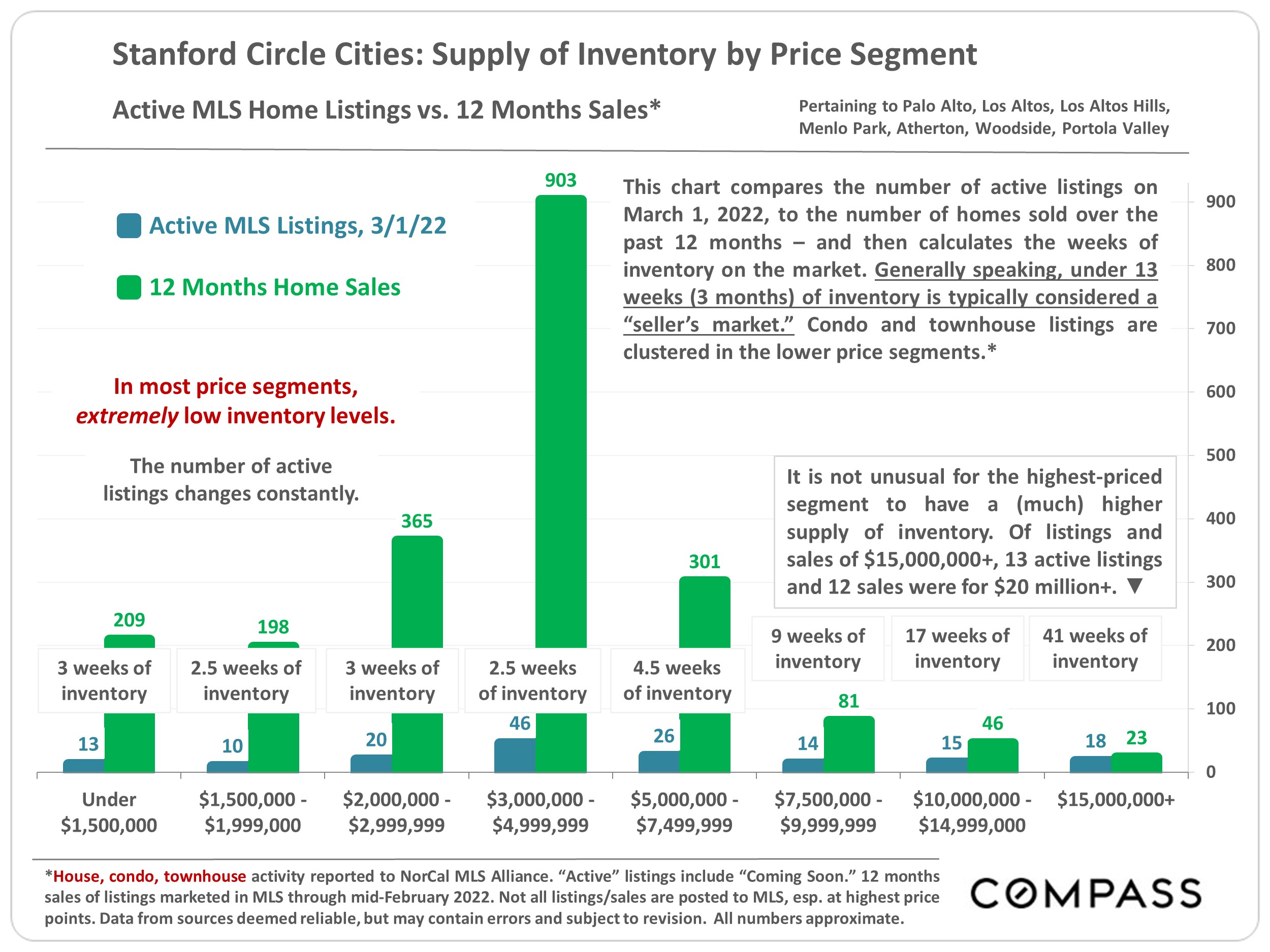

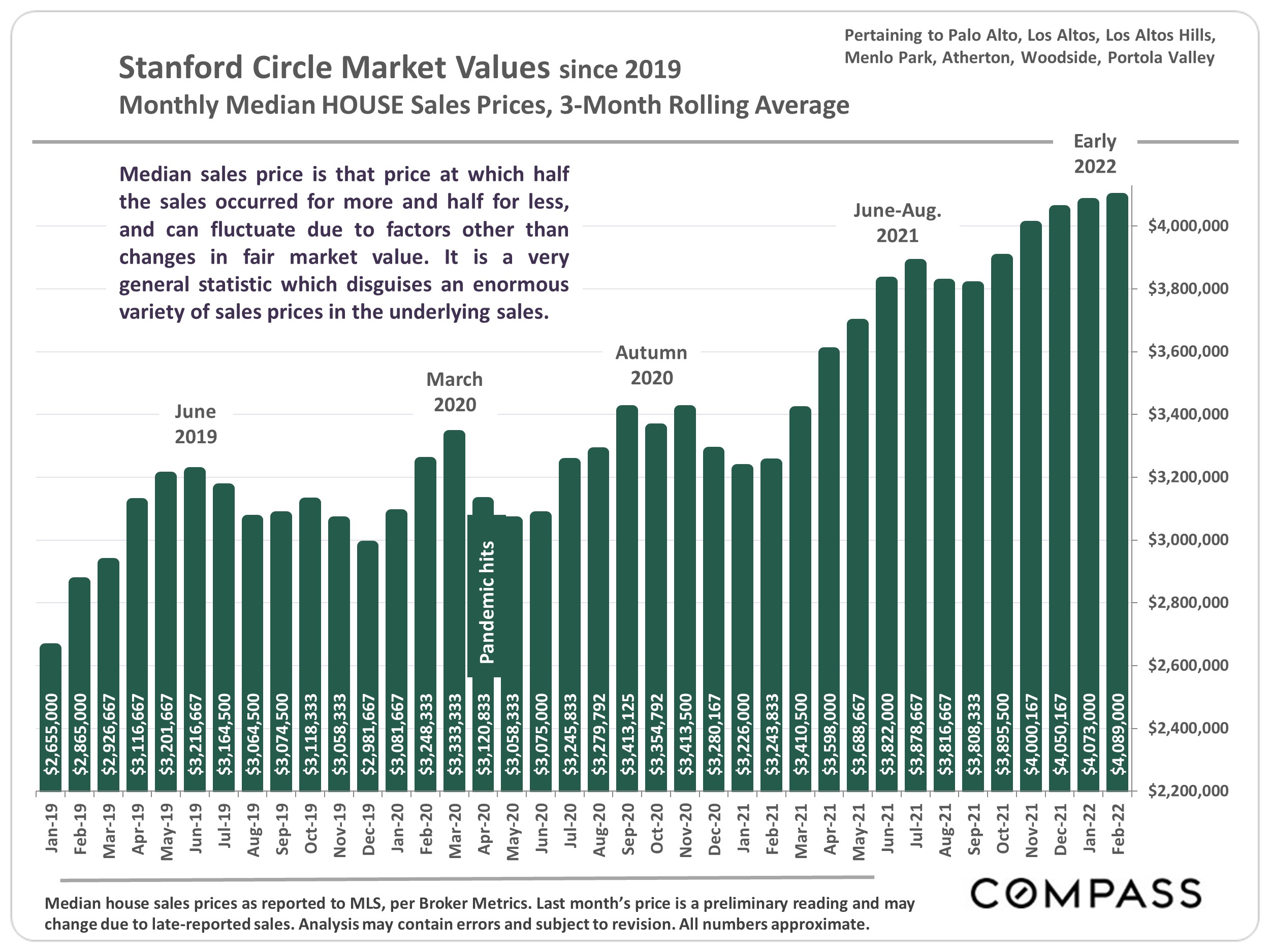

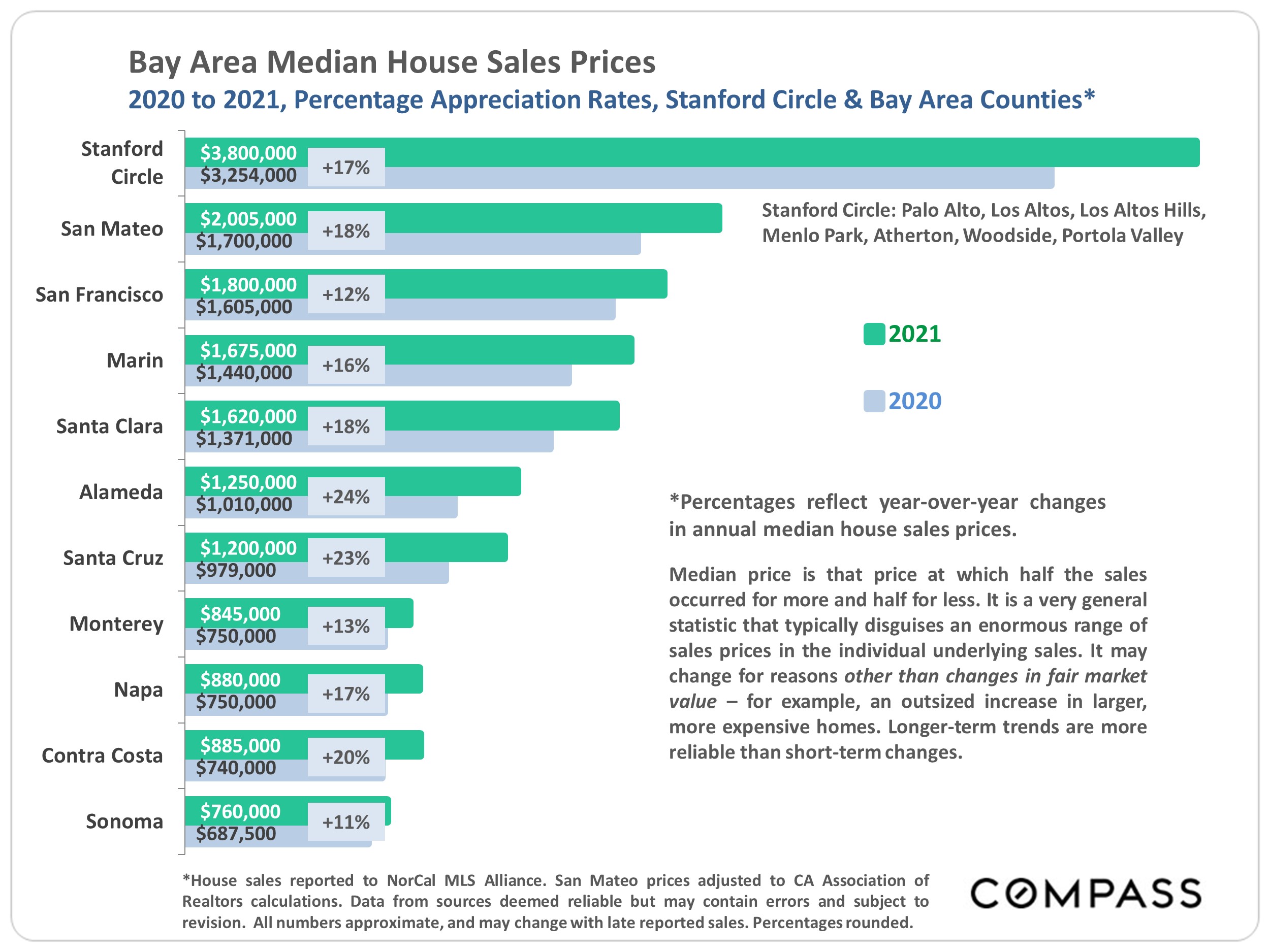

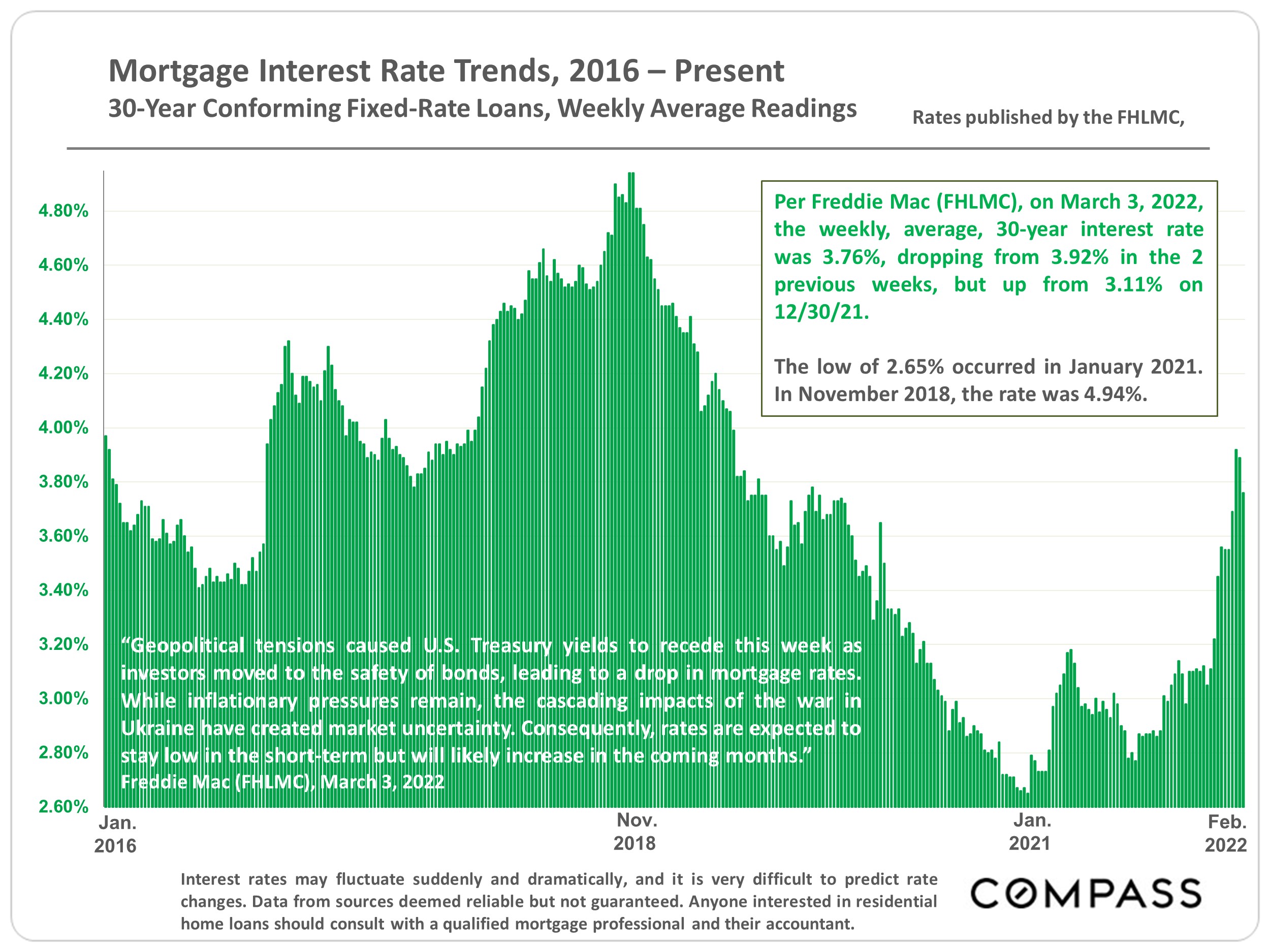

So far in 2022, Bay Area real estate markets appear largely unfazed by higher interest rates, volatility in financial markets, and troubling international events. The prevailing dynamic remains one of strong buyer demand competing for an inadequate inventory of listings for sale: Crowded open houses, multiple offers, fierce overbidding, fast sales, and rising prices remain the norm. That is not to say there haven’t been buyers negatively impacted by higher loan rates and/or recent declines in stock portfolios; and some buyers and sellers have become more hesitant or paused their plans, awaiting more clarity amid recent developments. But not enough to move the needle on the fundamentally very-high-demand/very-low-supply conditions which dominated 2021.

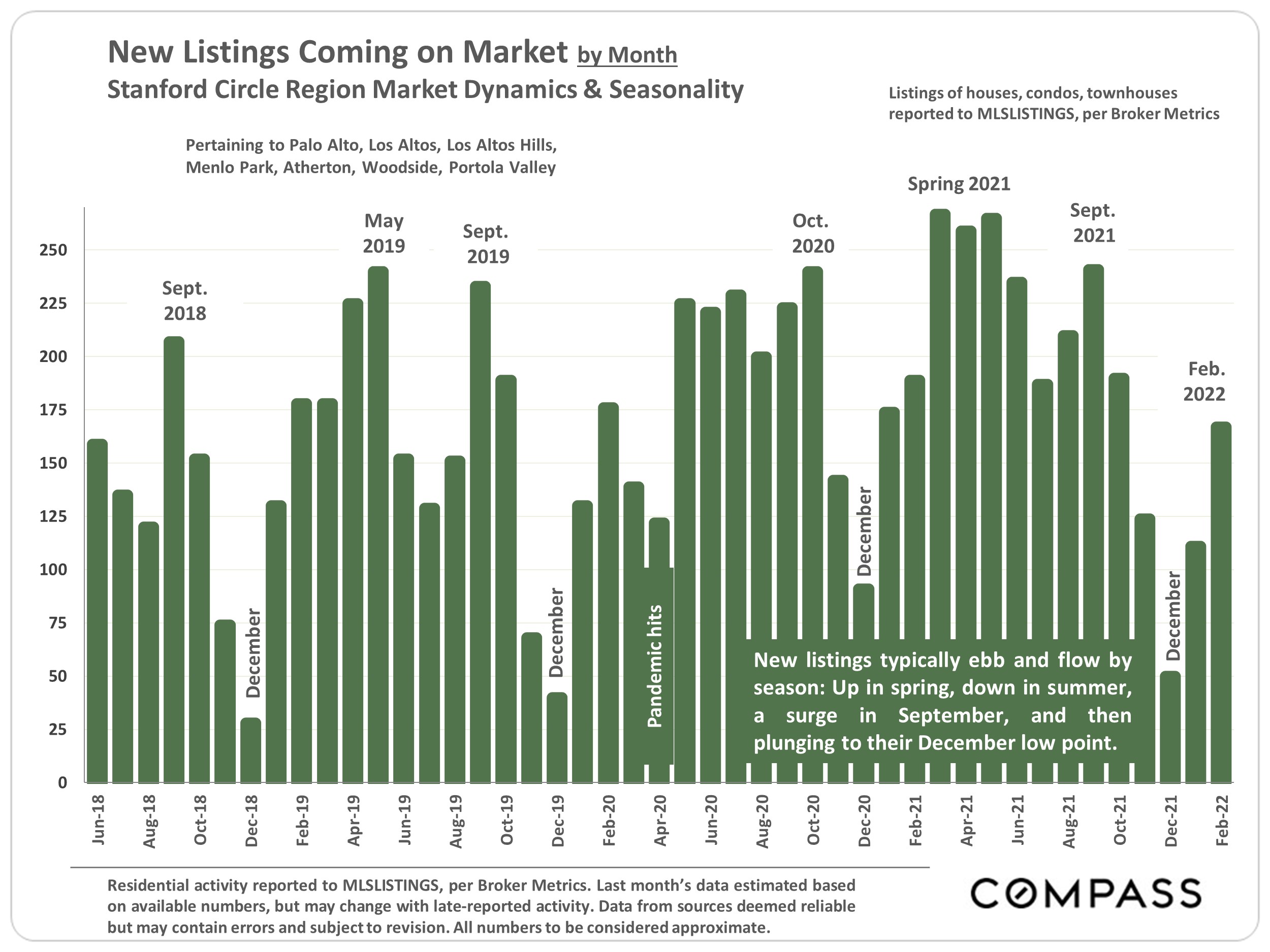

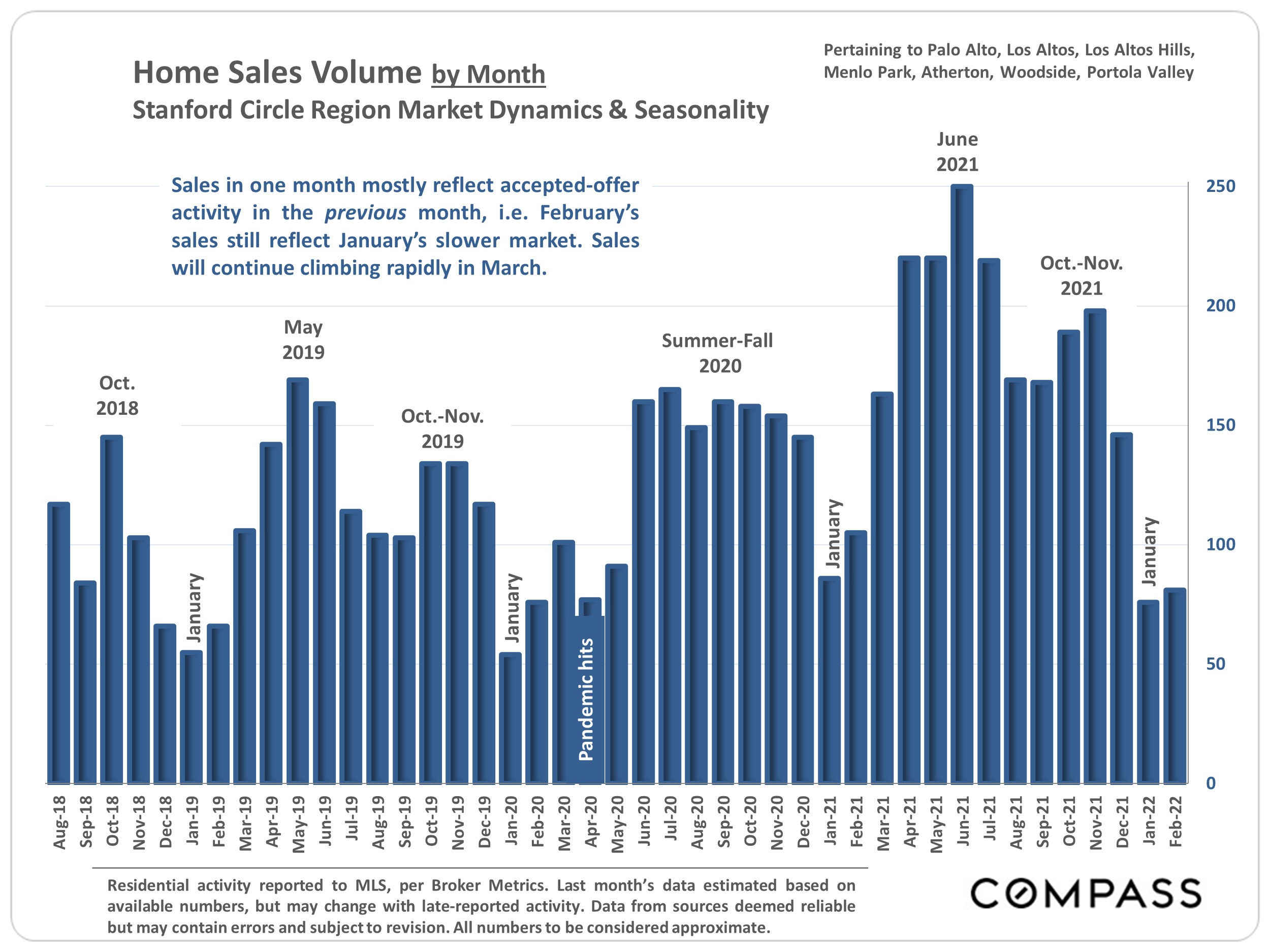

As typical at the start of the year, the number of new listings coming on market and the number of listings going into contract continue to rise. These normally climb rapidly through spring, characteristically the biggest selling season of the year.

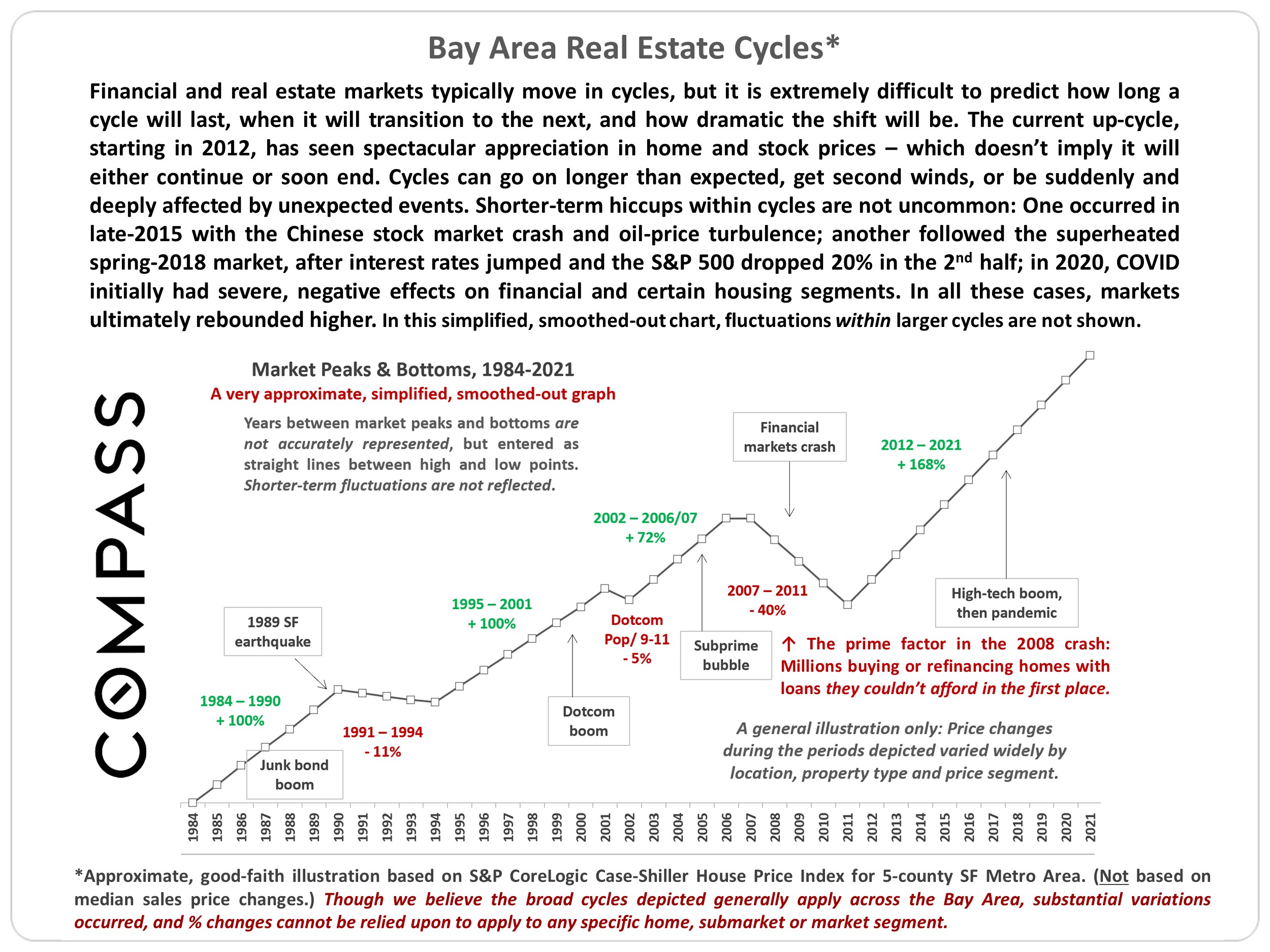

This report will review a number of standard indicators, as well as home values, interest rates, factors that can affect real estate markets, and how market cycles have broadly played out over the last 4 decades. March and April data will soon provide further indications of the market’s direction in 2022.

Sales in one month mostly reflect market dynamics in the previous month, and activity typically ebbs and flows by season. Data from sources deemed reliable, but may contain errors and subject to revision. All numbers approximate, and may change with late-reported activity.

|

Source: Compass

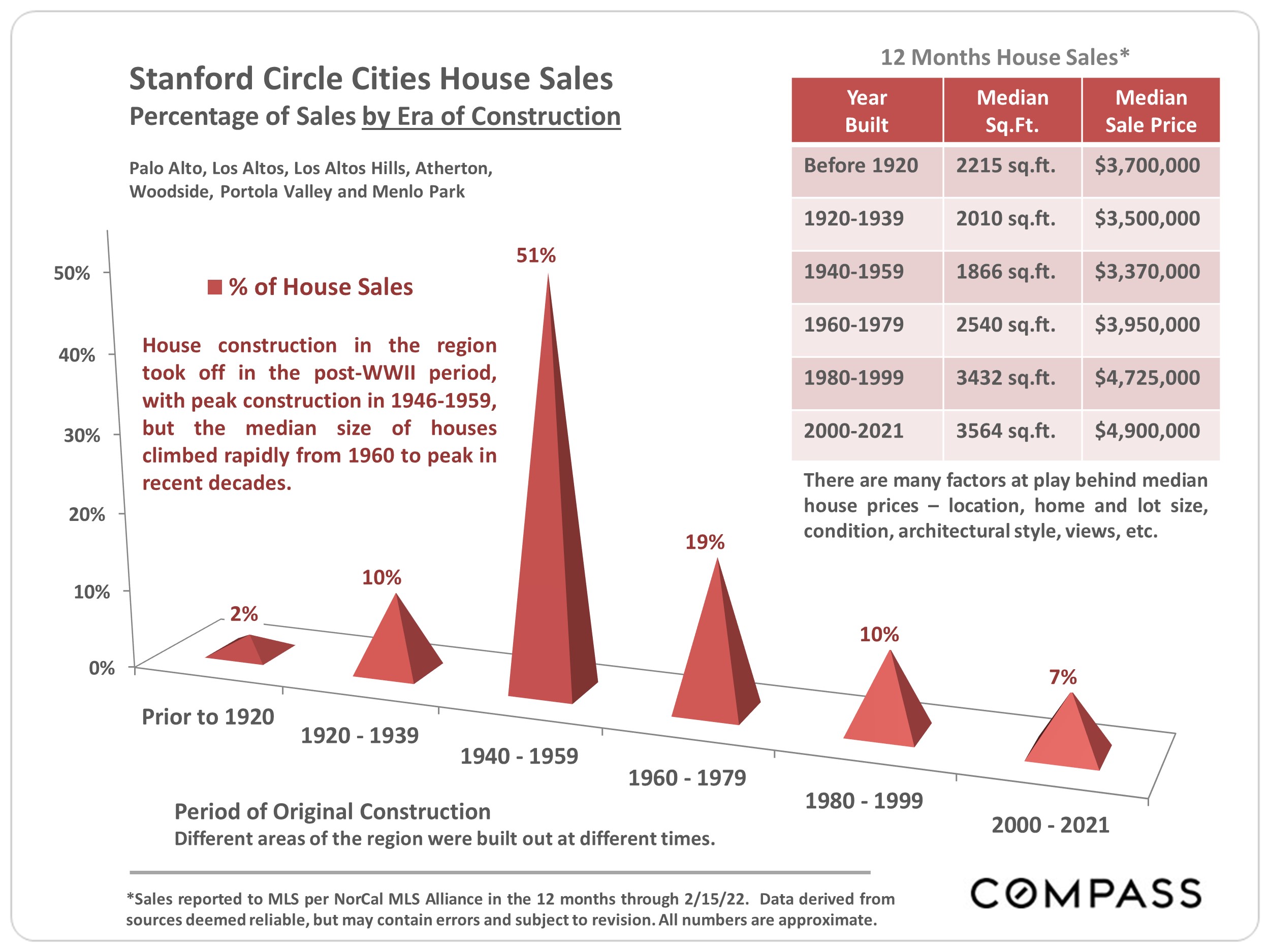

It is impossible to know how median and average value statistics apply to any particular home without a specific comparative market analysis. These analyses were made in good faith with data from sources deemed reliable, but may contain errors and are subject to revision. It is not our intent to convince you of a particular position, but to attempt to provide straightforward data and analysis, so you can make your own informed decisions. Median and average statistics are enormous generalities: There are hundreds of different markets in San Francisco and the Bay Area, each with its own unique dynamics. Median prices and average dollar per square foot values can be and often are affected by other factors besides changes in fair market value. Longer term trends are much more meaningful than short-term.

Compass is a real estate broker licensed by the State of California, DRE 01527235. Equal Housing Opportunity. This report has been prepared solely for information purposes. The information herein is based on or derived from information generally available to the public and/or from sources believed to be reliable. No representation or warranty can be given with respect to the accuracy or completeness of the information. Compass disclaims any and all liability relating to this report, including without limitation any express or implied representations or warranties for statements contained in, and omissions from, the report. Nothing contained herein is intended to be or should be read as any regulatory, legal, tax, accounting or other advice and Compass does not provide such advice. All opinions are subject to change without notice. Compass makes no representation regarding the accuracy of any statements regarding any references to the laws, statutes or regulations of any state are those of the author(s). Past performance is no guarantee of future results.