Amid Dramatic Home-Price Gains to New Peaks,

Preliminary Signs of Markets Shifting Cooler

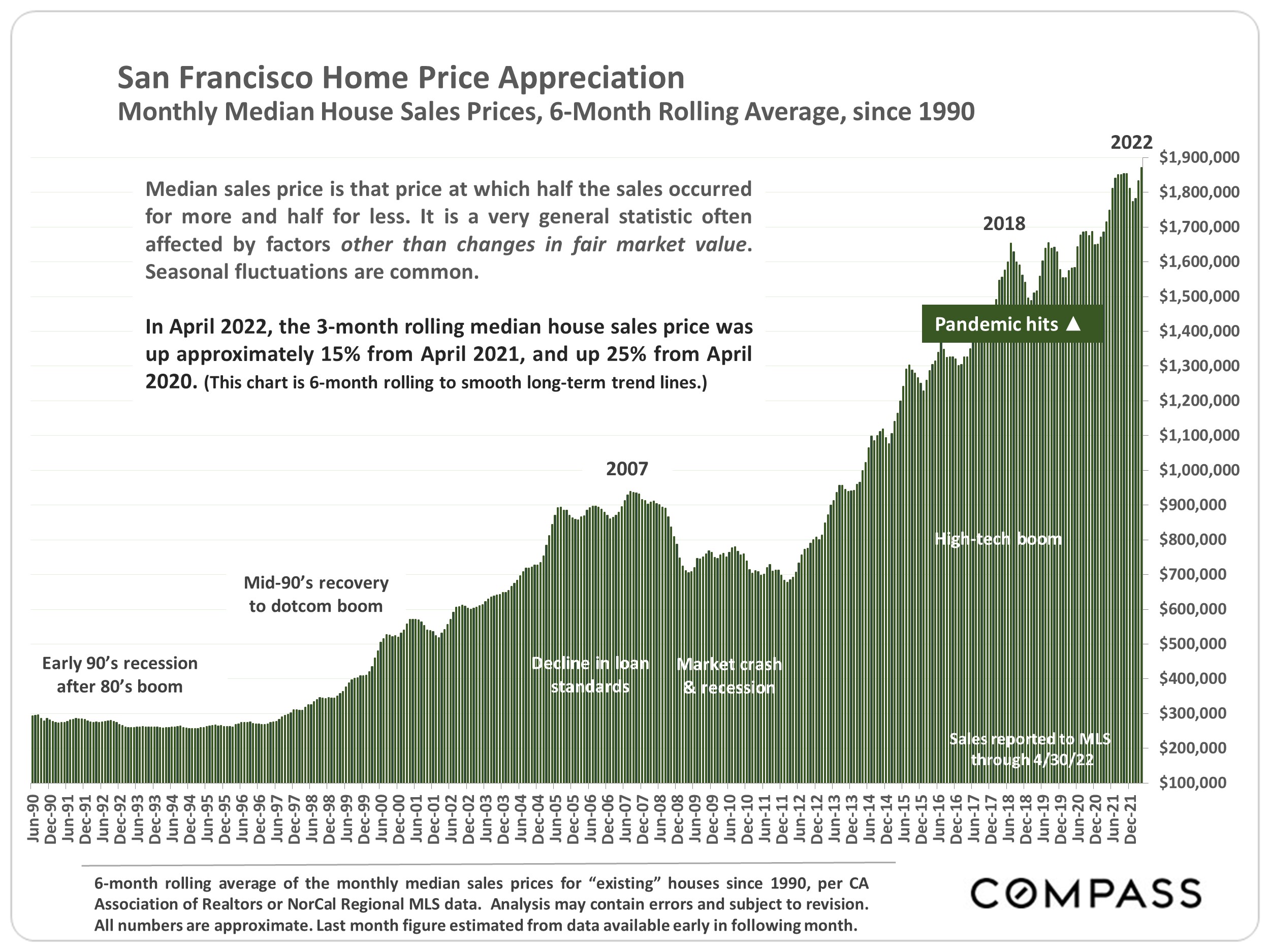

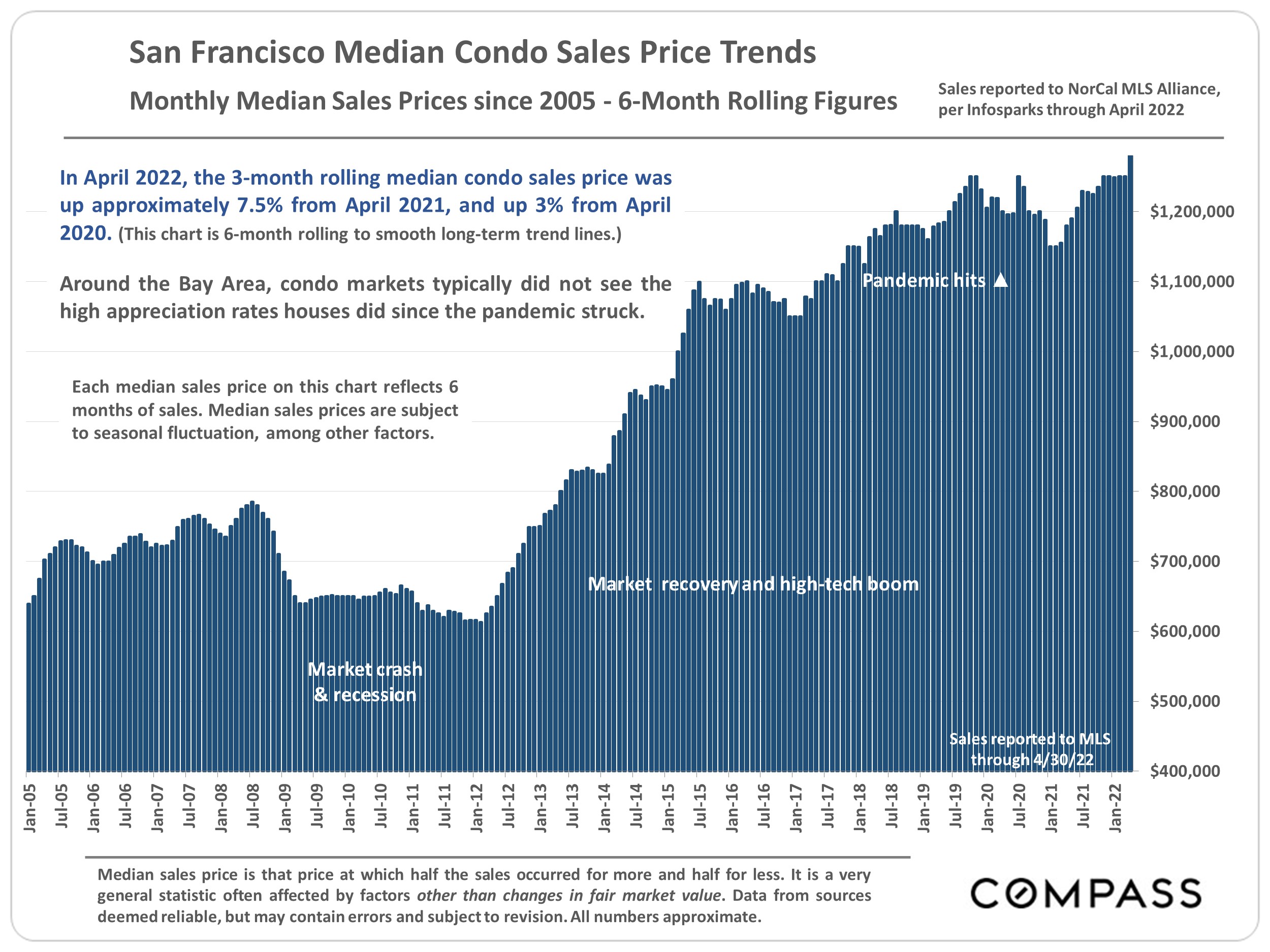

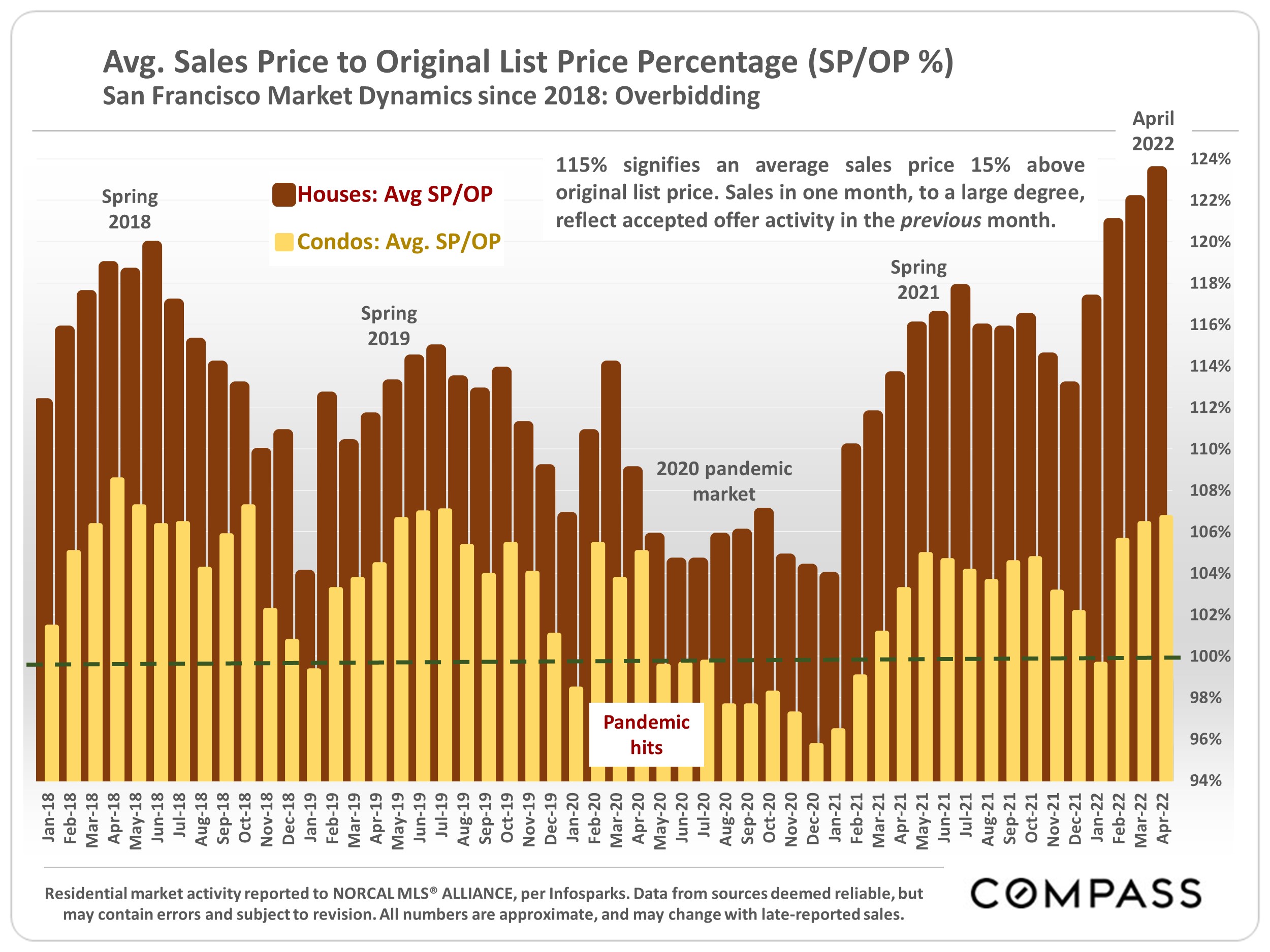

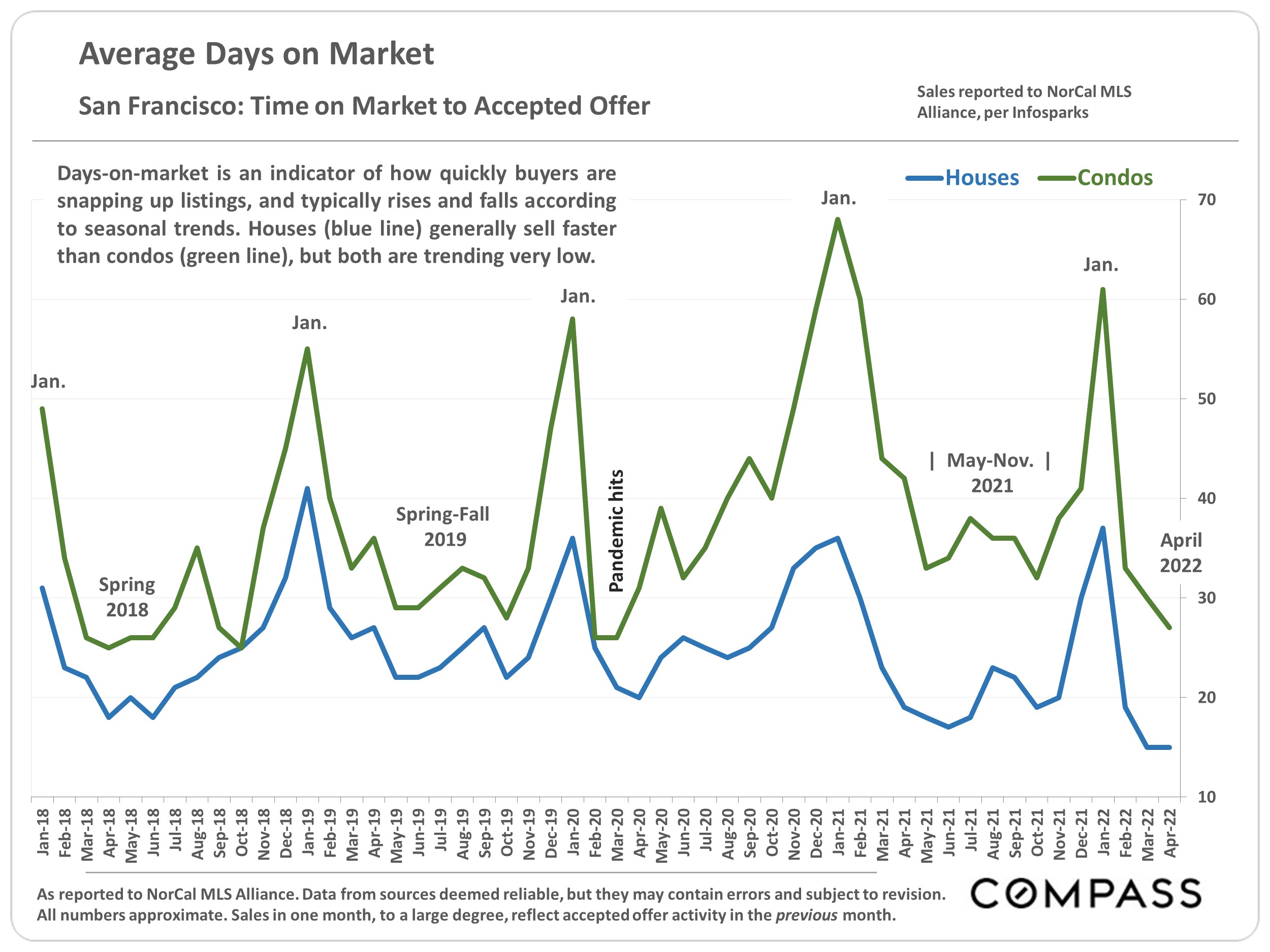

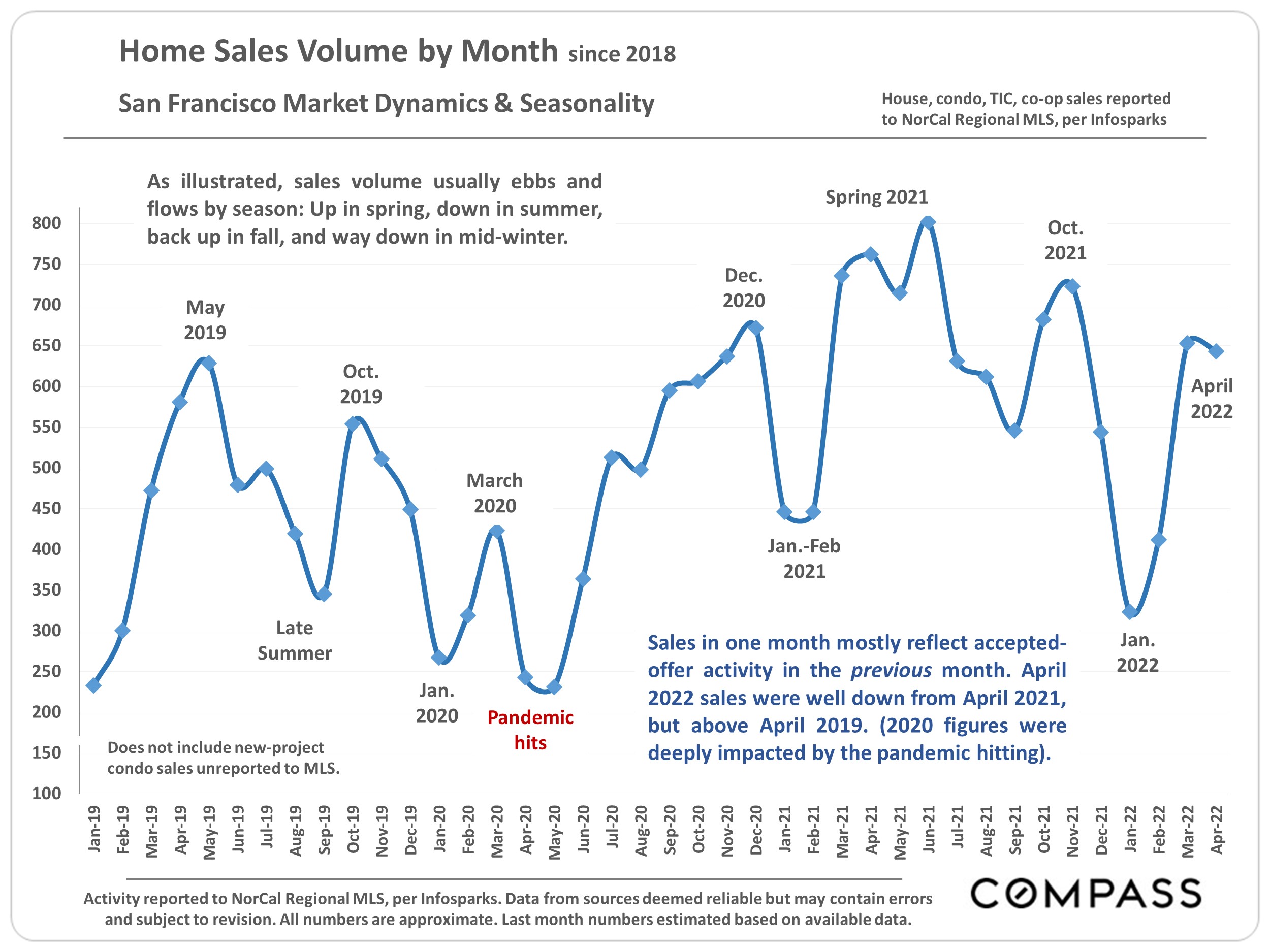

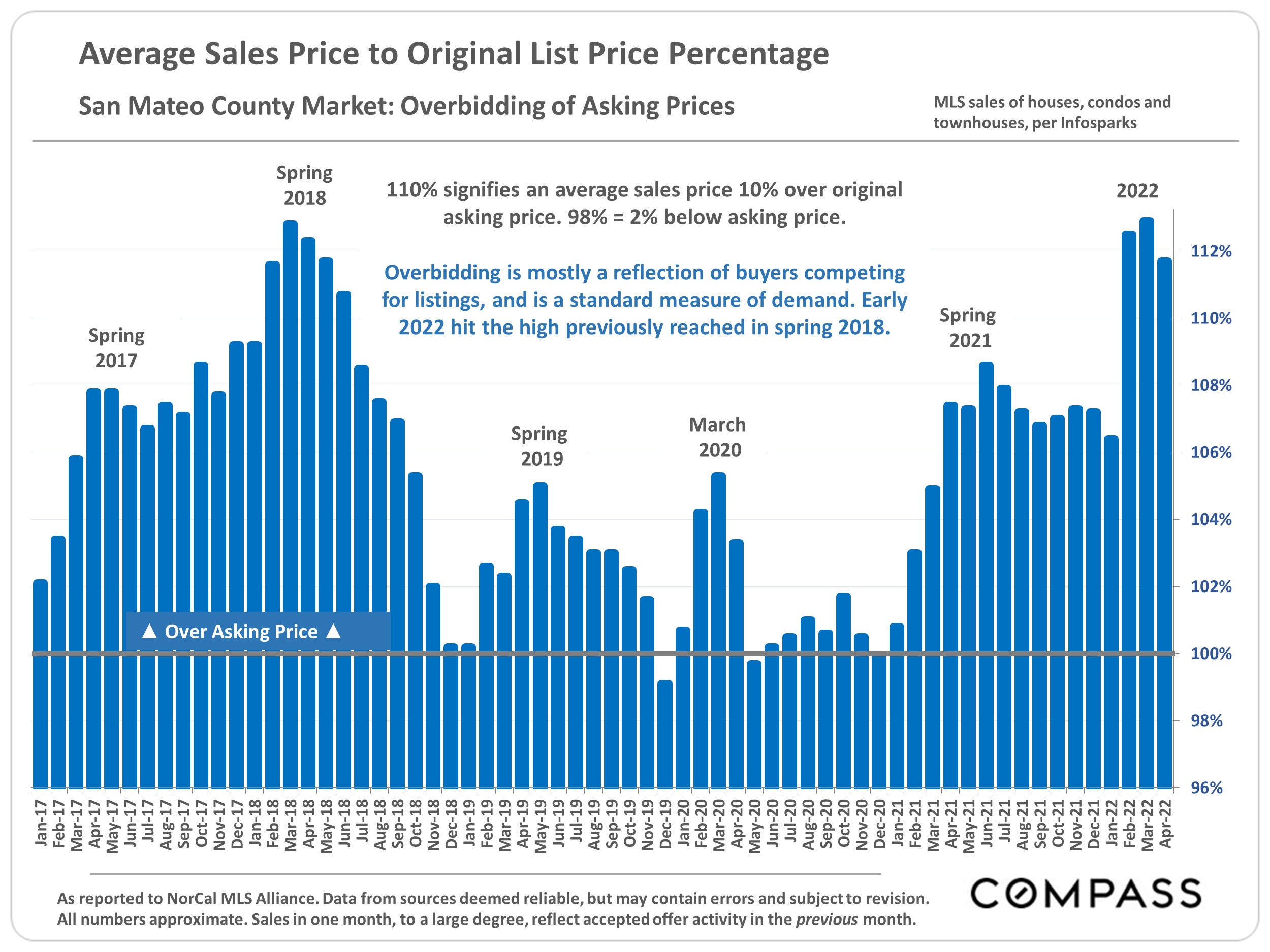

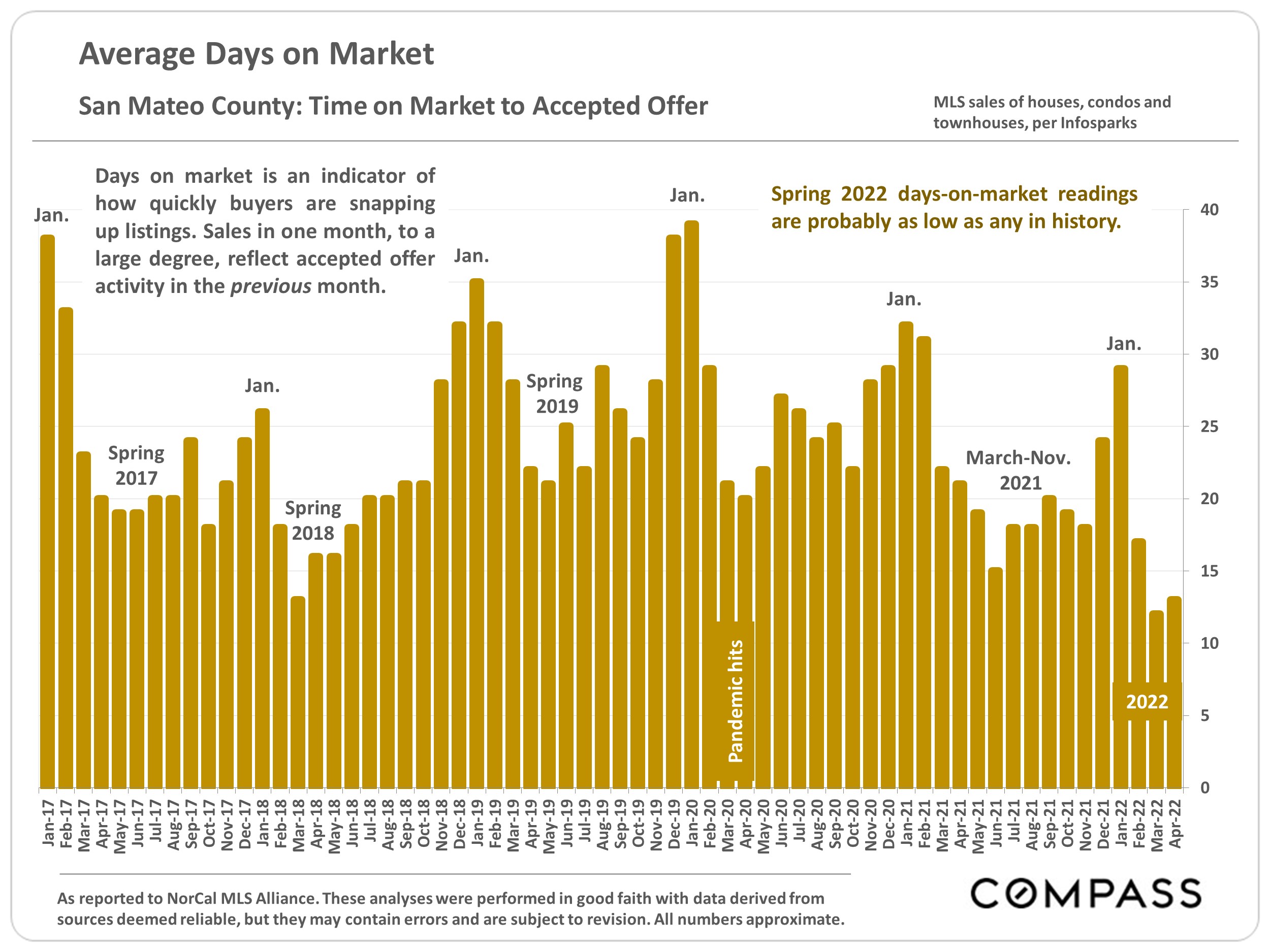

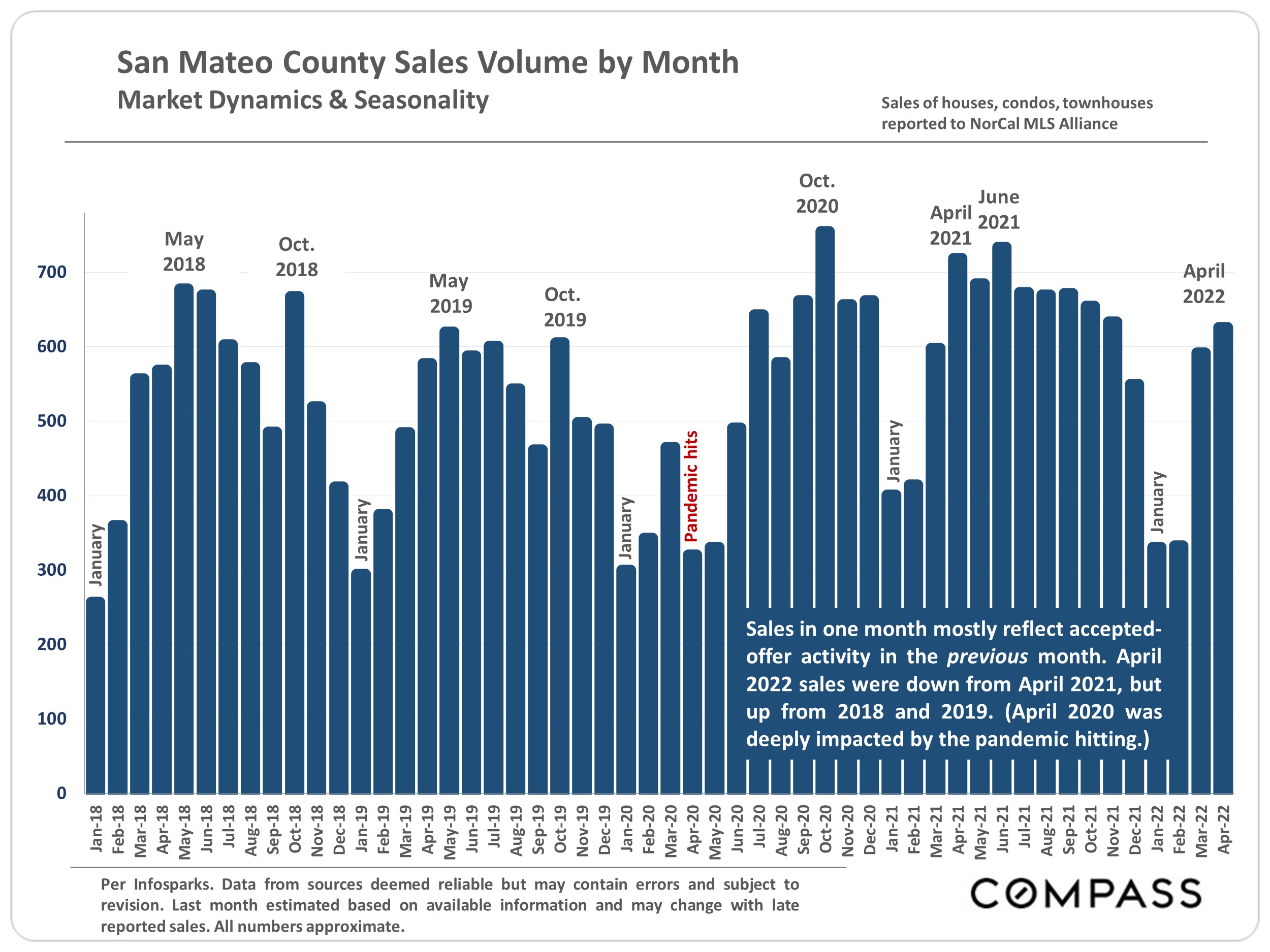

In April 2022, the Bay Area continued to see appreciation, overbidding and days-on-market reflecting extremely intense demand. But sales are a lagging indicator reflecting offers accepted 3-6 weeks earlier. April sales mostly reflect buyers who locked in mortgage rates before the big late-March/April jumps, buyers highly motivated to buy before their interest rate locks expired, adding short-term pressure to demand.

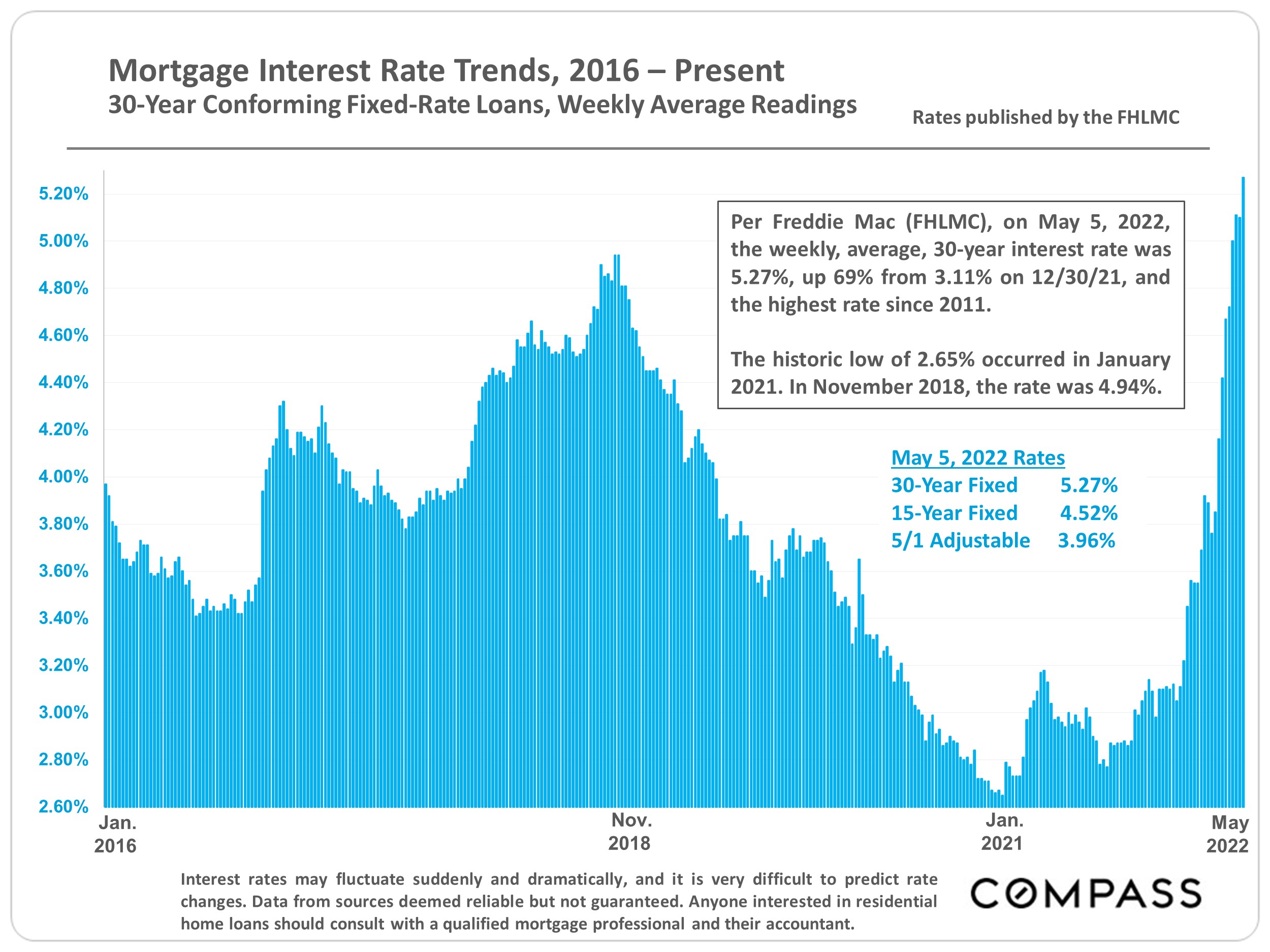

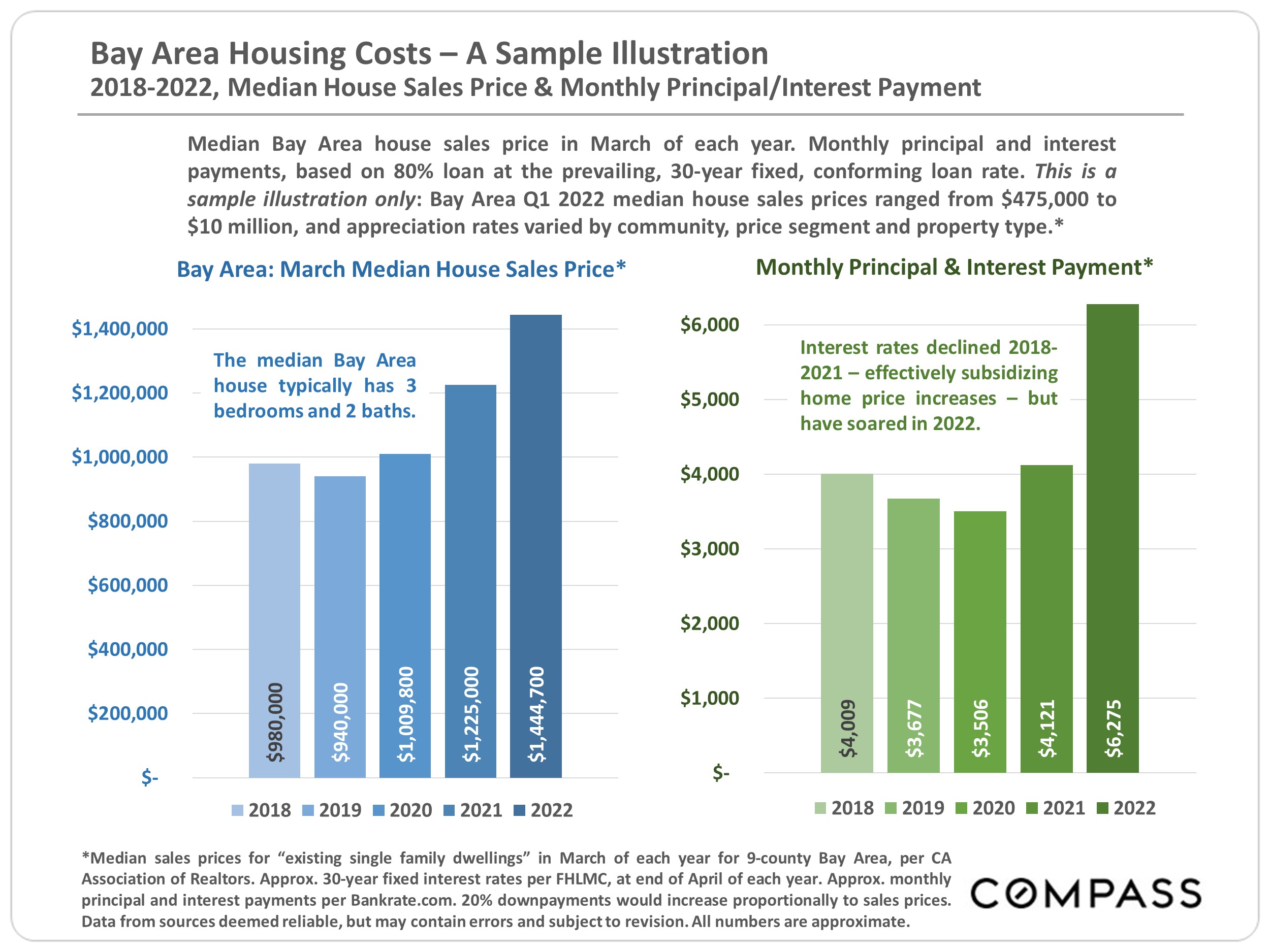

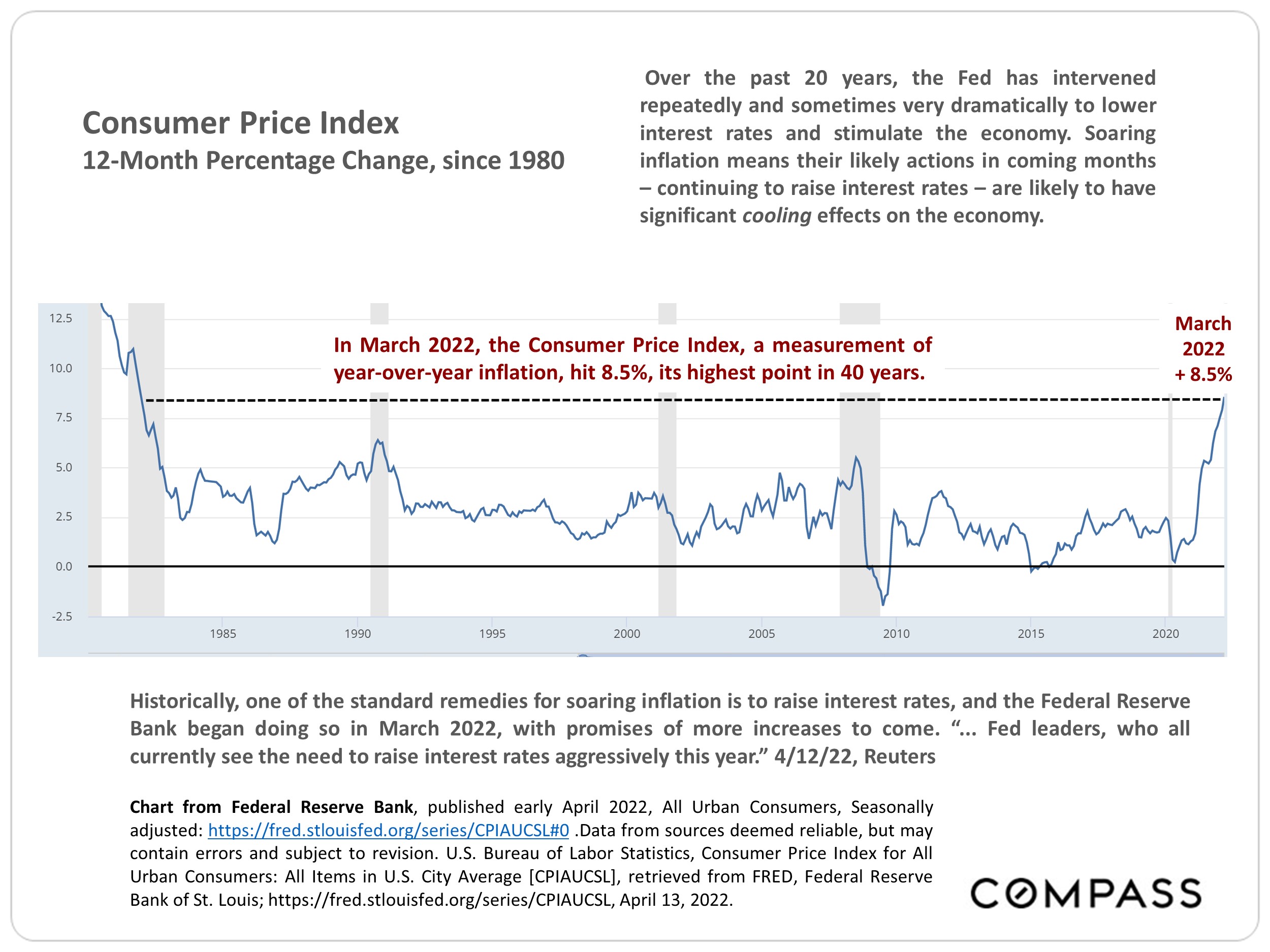

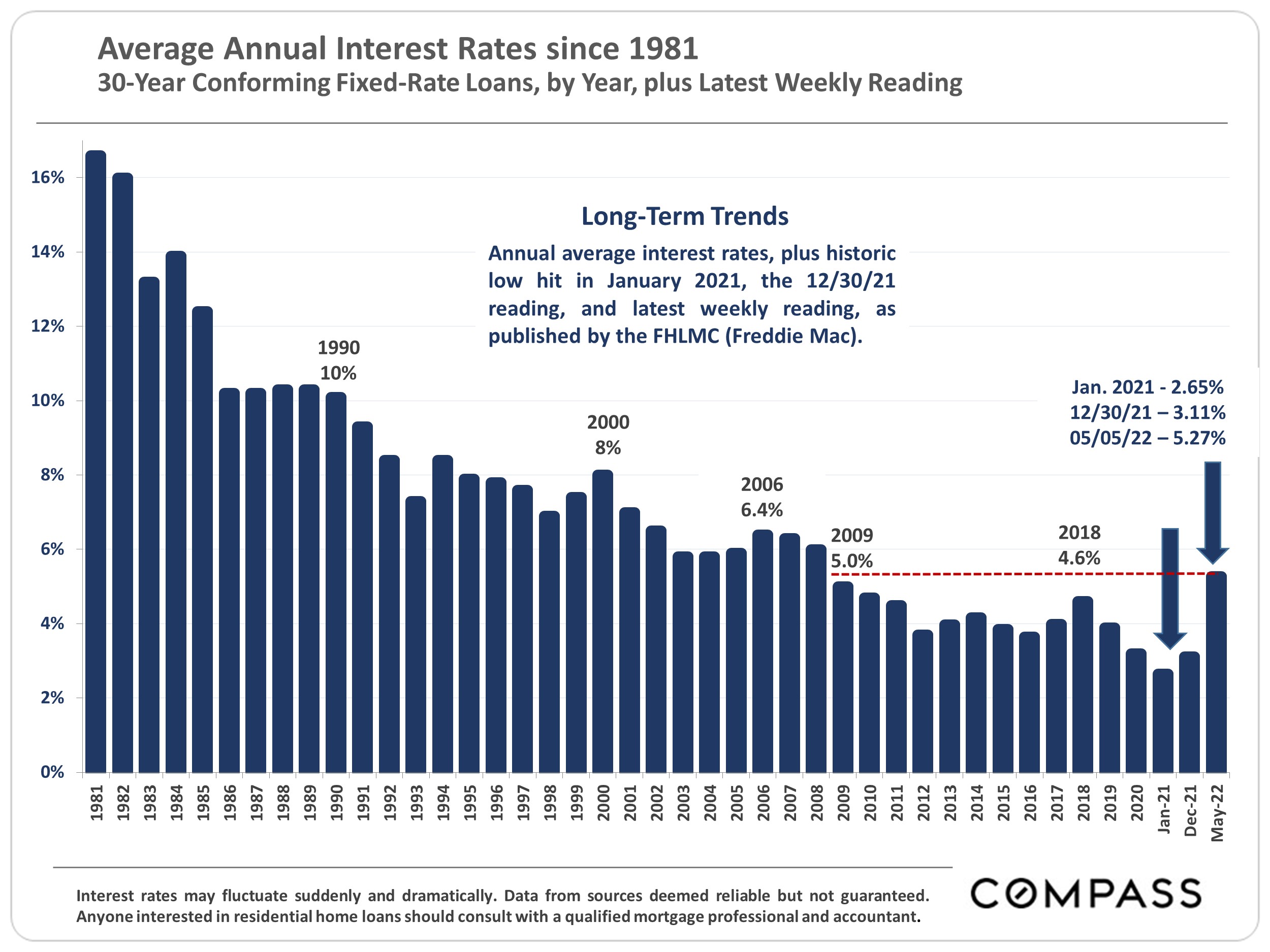

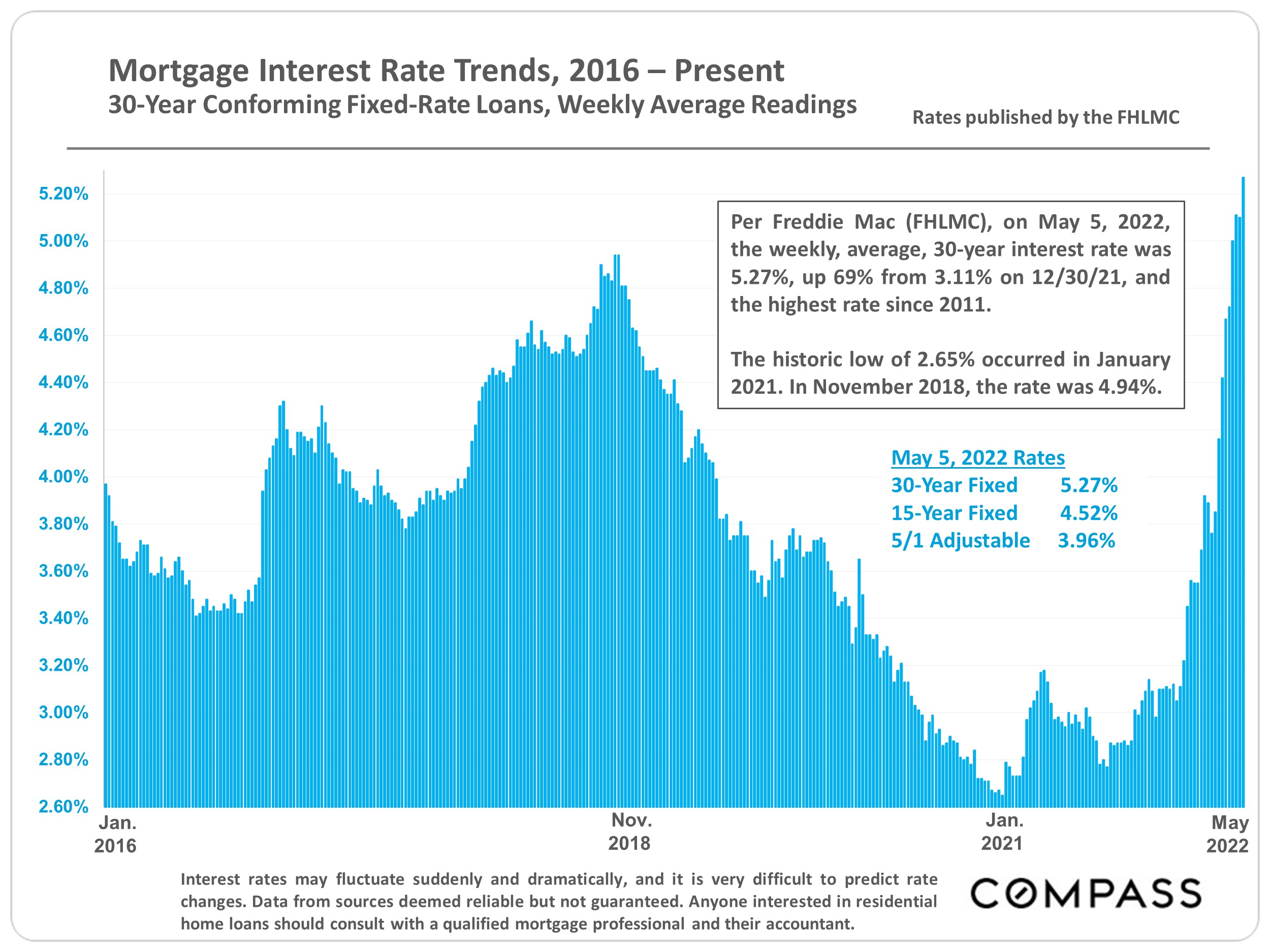

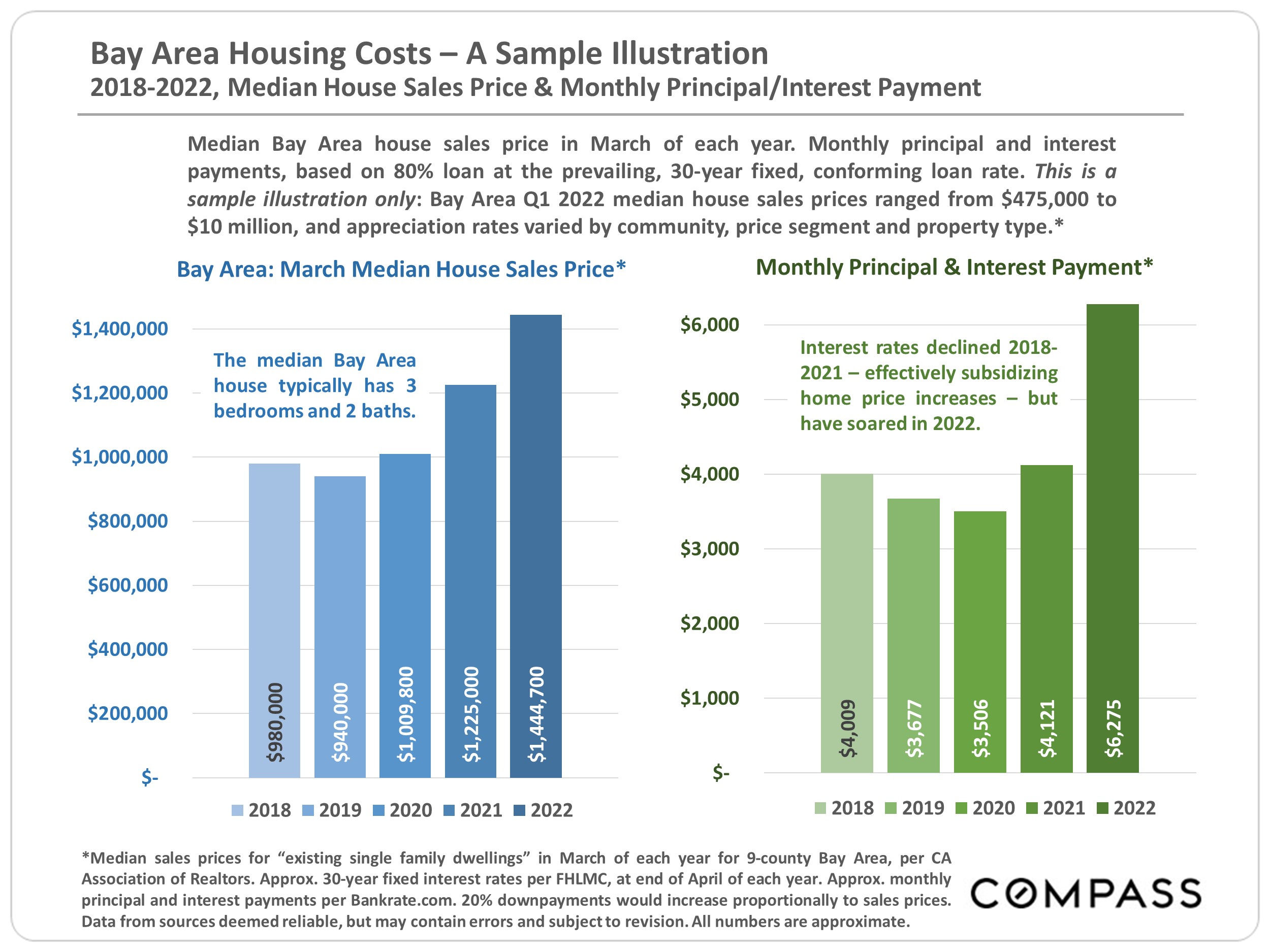

Declining interest rates stimulate demand: In recent years, large rate declines subsidized much of the surge in home prices. Escalating interest rates initially fueled demand in early 2022 as buyers rushed to avoid further rises, but at a certain point, big increases, especially if coupled with peak prices, batter affordability. And all buyers – even all-cash buyers – can be affected financially and psychologically by stock market declines and economic uncertainty. If continuing, these factors can be expected to dampen purchase activity.

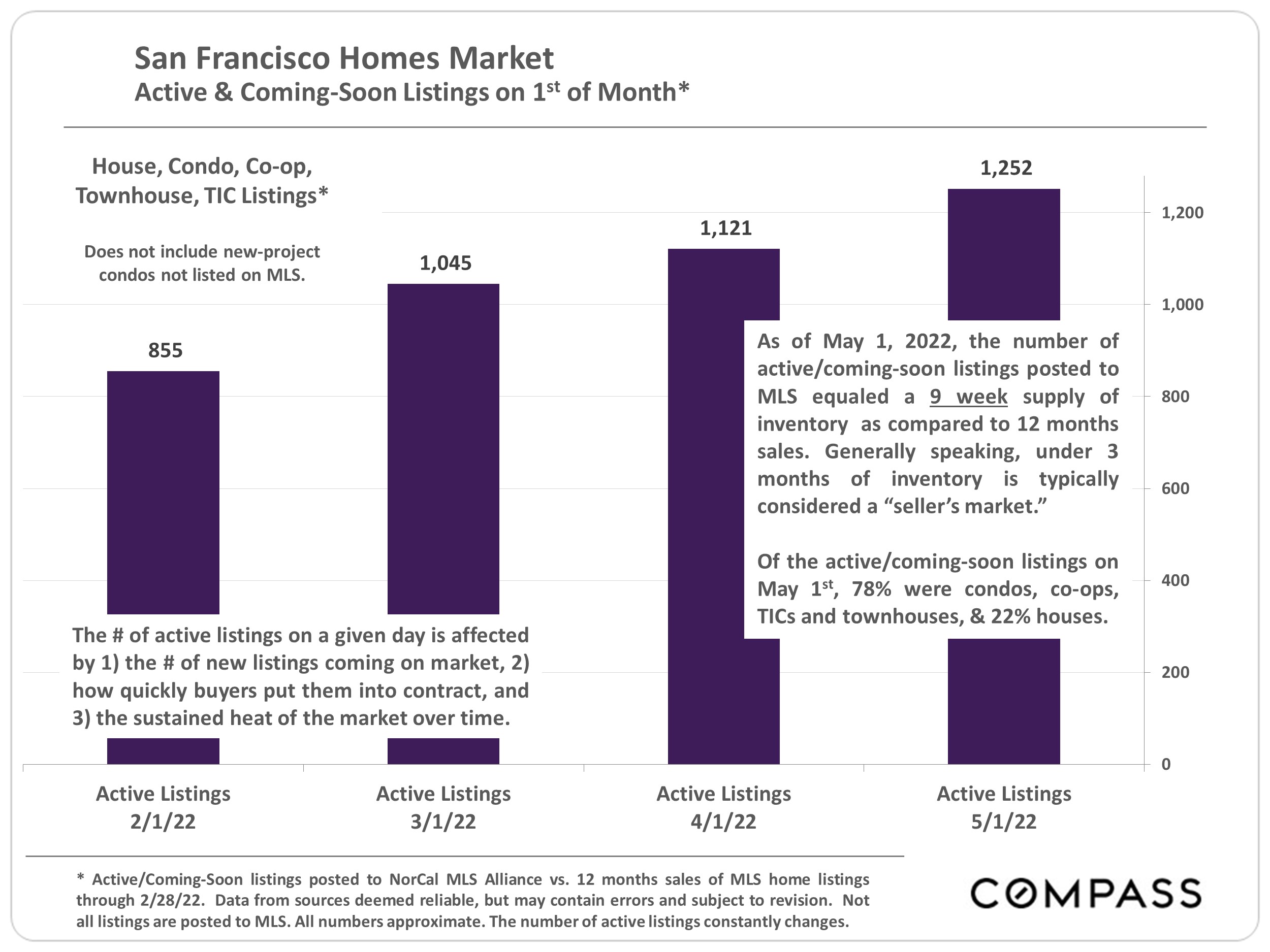

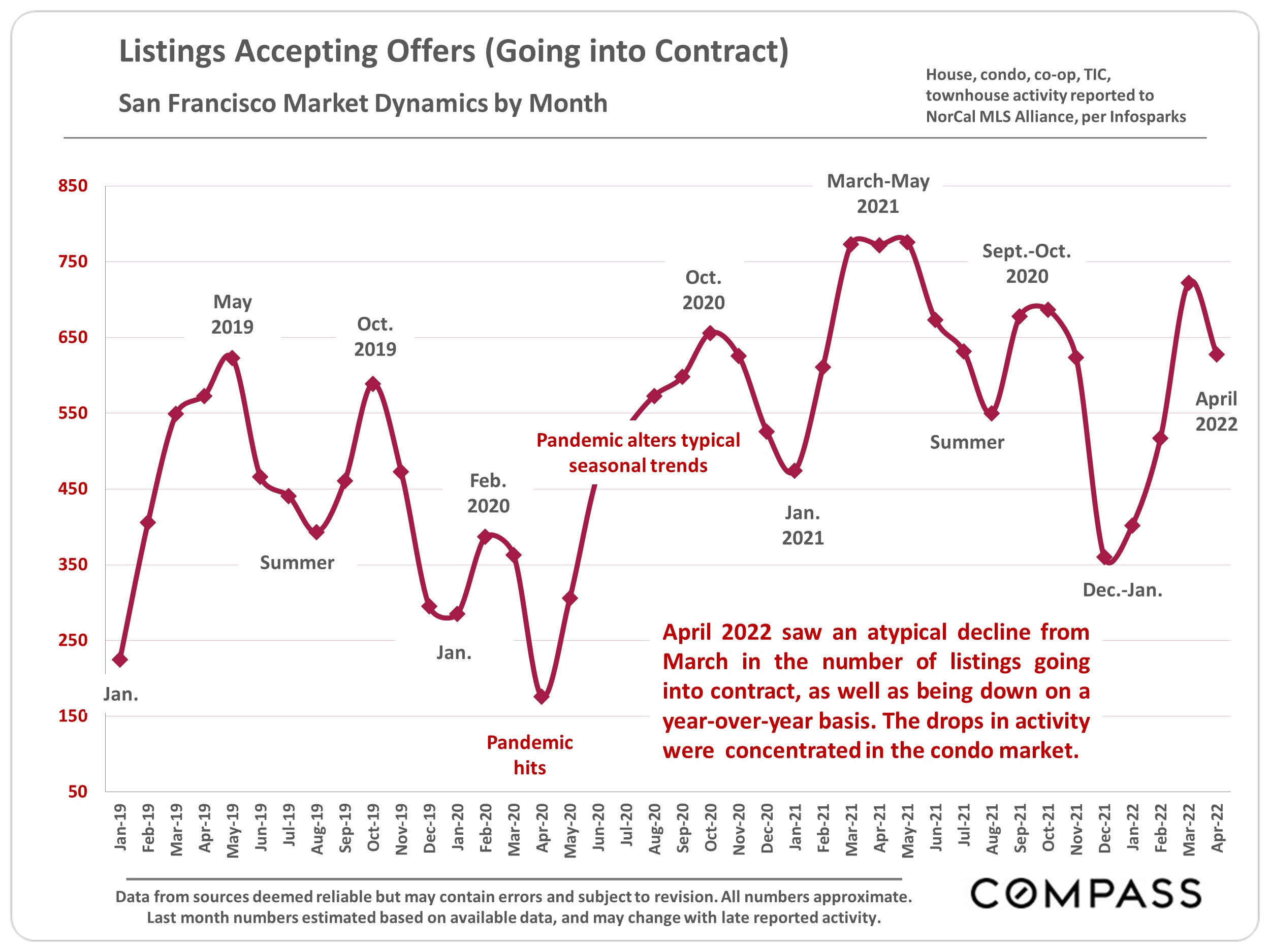

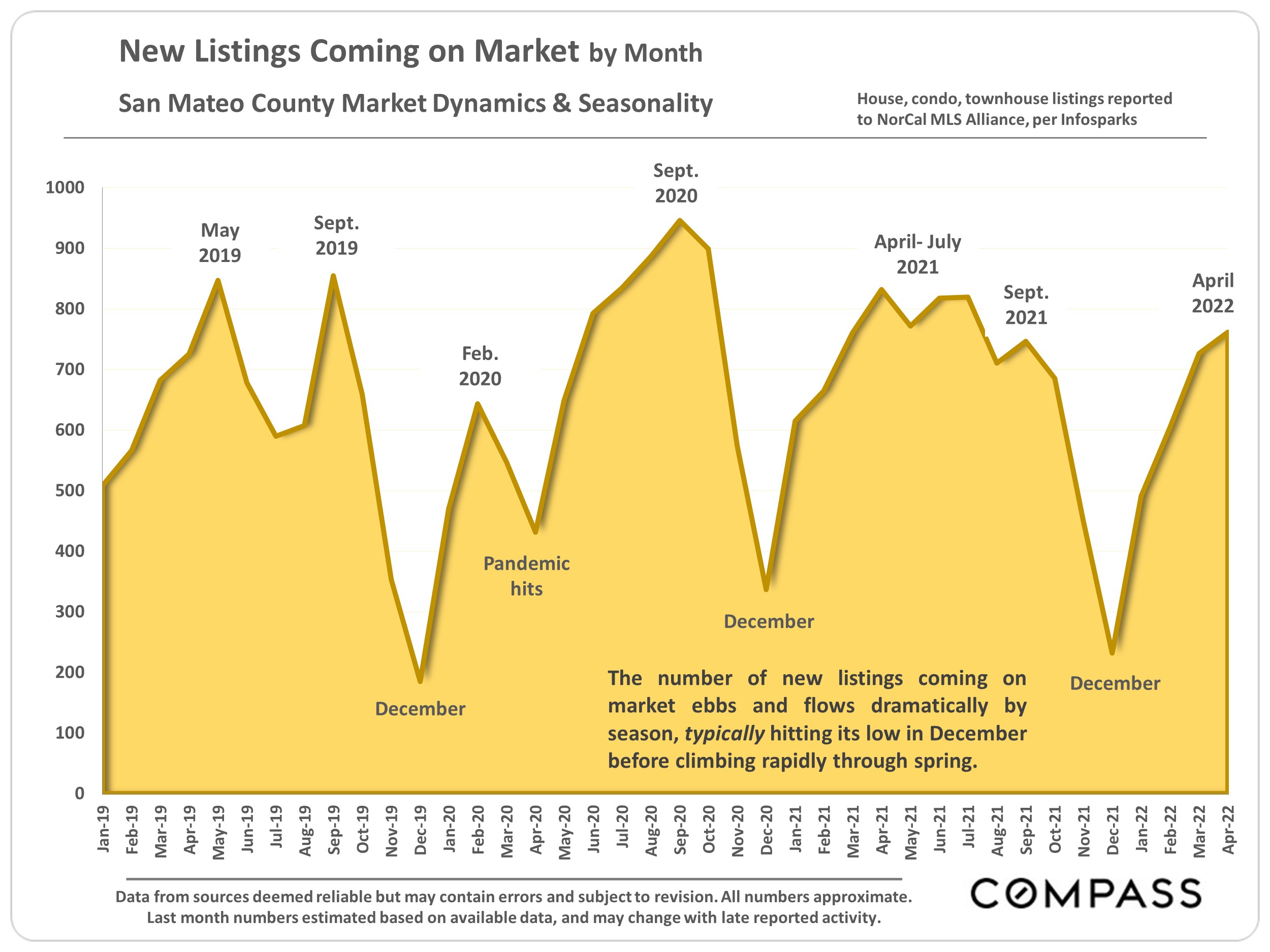

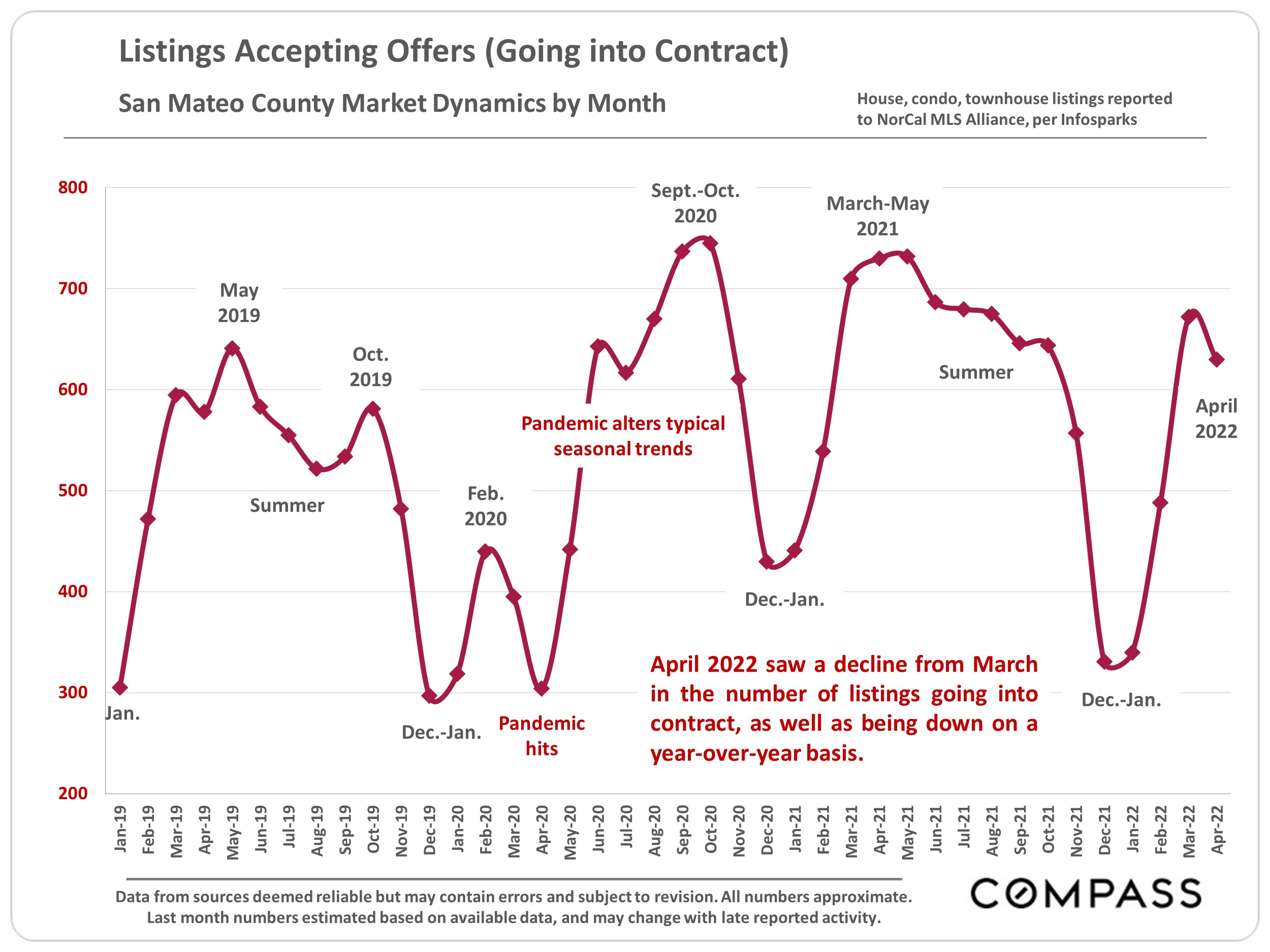

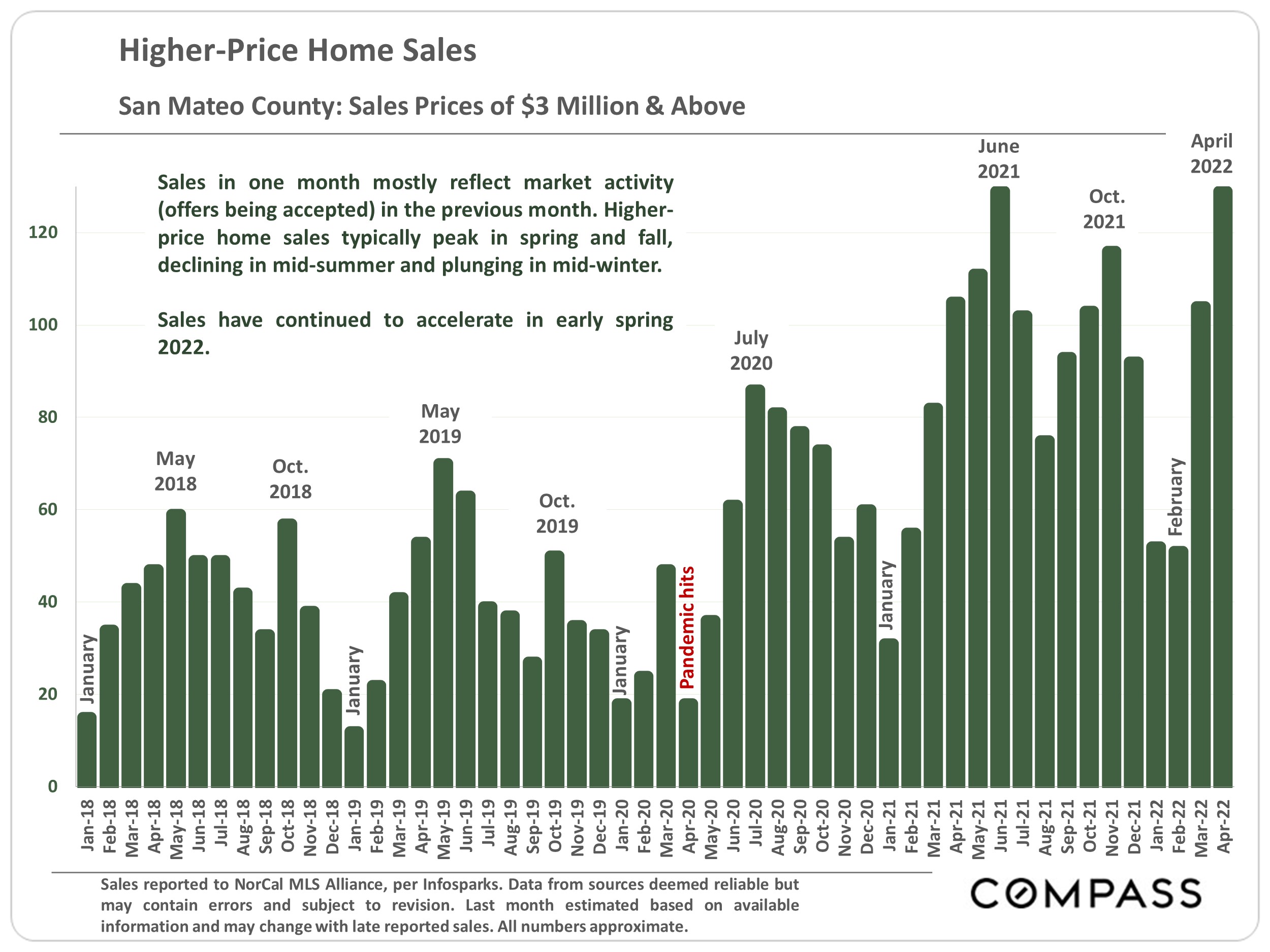

As of May 5, mortgage rates were up 69% in 2022, and the scale and speed of the increase make it difficult to predict precise effects; inflation is at a 40-year high; the S&P 500 is down 14% and the Nasdaq, 22%. *The housing market is beginning to show preliminary, but not universal reactions. Accounts of less crowded open houses and fewer offers on new listings are becoming more common. Some buyers are dropping out or becoming more selective; some sellers are moving listing dates forward. In many markets, declines in listings going into contract occurred in April. But some agents report no change, so far, in client plans or motivation. Due to the time involved in the home search/closing process, and the extremely heated conditions of early 2022, substantial changes in closed-sales statistics, if coming, won’t appear until later in Q2 or Q3.

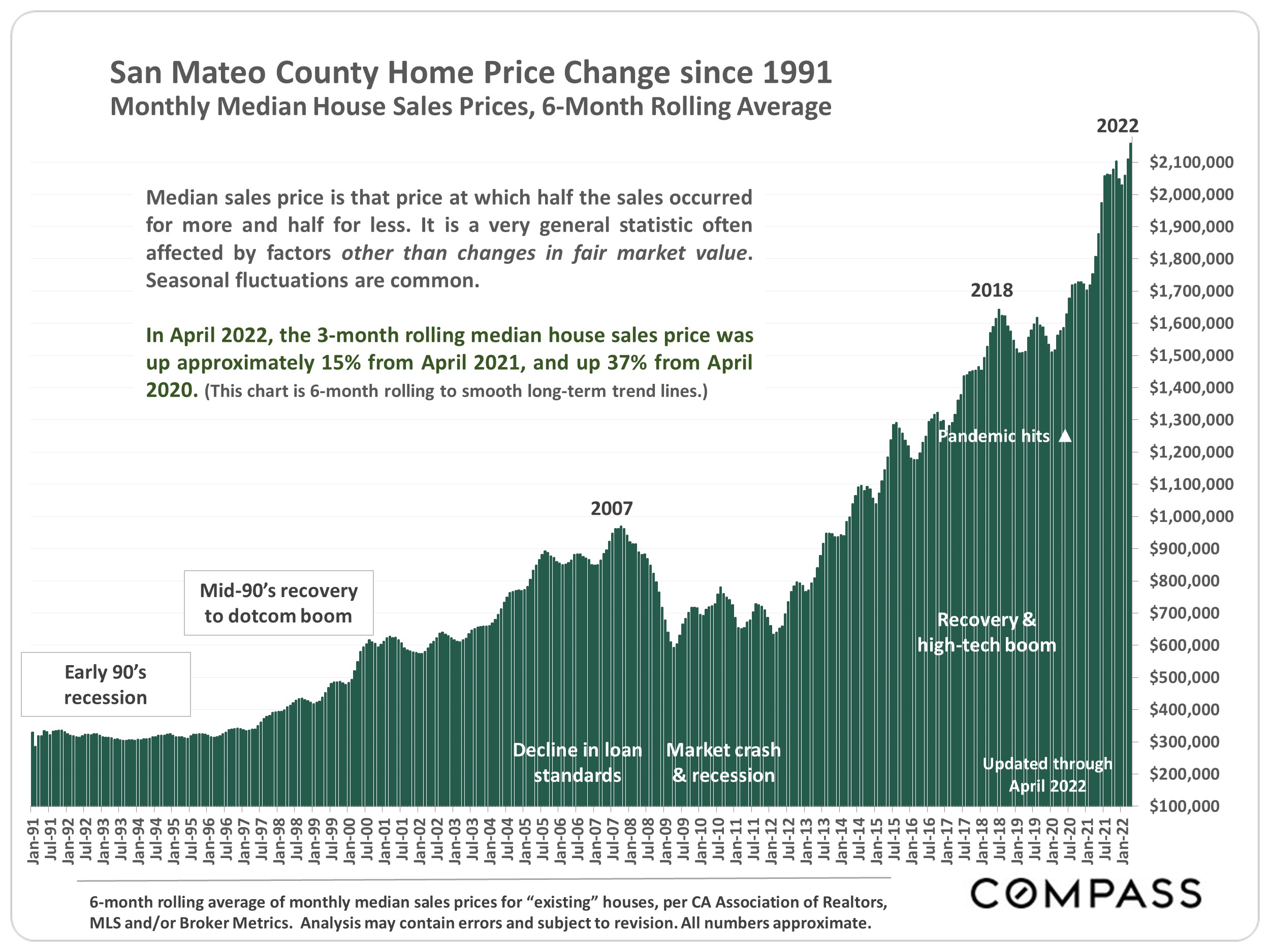

Even the hottest markets eventually cool. This does not necessarily imply a large “bubble and crash” (terms much overused). Over the past 4 decades, a cooling shift has typically meant a gradual decline in sales activity, then either a leveling off in appreciation or price declines of 5% to 10%: More like a slow leak in an over-pressurized tire than a blowout at high speed. The 2008 subprime crisis – a true bubble & crash – was an extreme event brought about by a massive failure of ethics, underwriting standards and risk management in the loan, banking, investment and ratings industries.

*Markets have been volatile: Interest rates and stock markets are subject to sudden, dramatic changes.

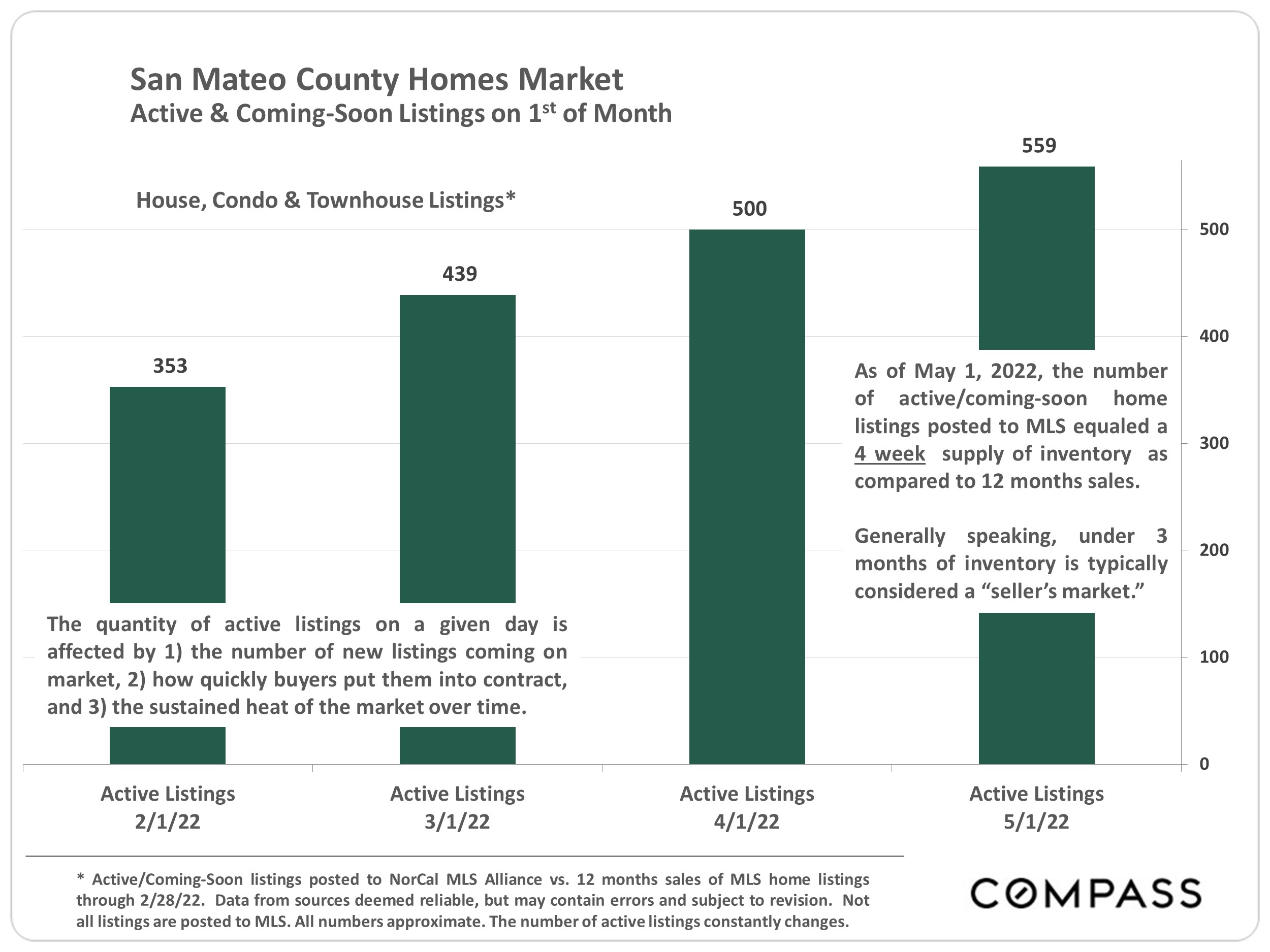

When hot markets shift cooler, effects are typically first reflected in reductions in multiple offers, overbidding and the number of homes going into contract; gradual increases in active listings and time-on-market; and gradual declines in year-over-year appreciation rates. Historically, after a down cycle runs its course, the market moves into the next upcycle and home prices climb (often relatively quickly) above previous peaks. Over the longer term, past appreciation trends – magnified by tax breaks & financing options – have typically made Bay Area real estate an excellent, and often spectacular investment.

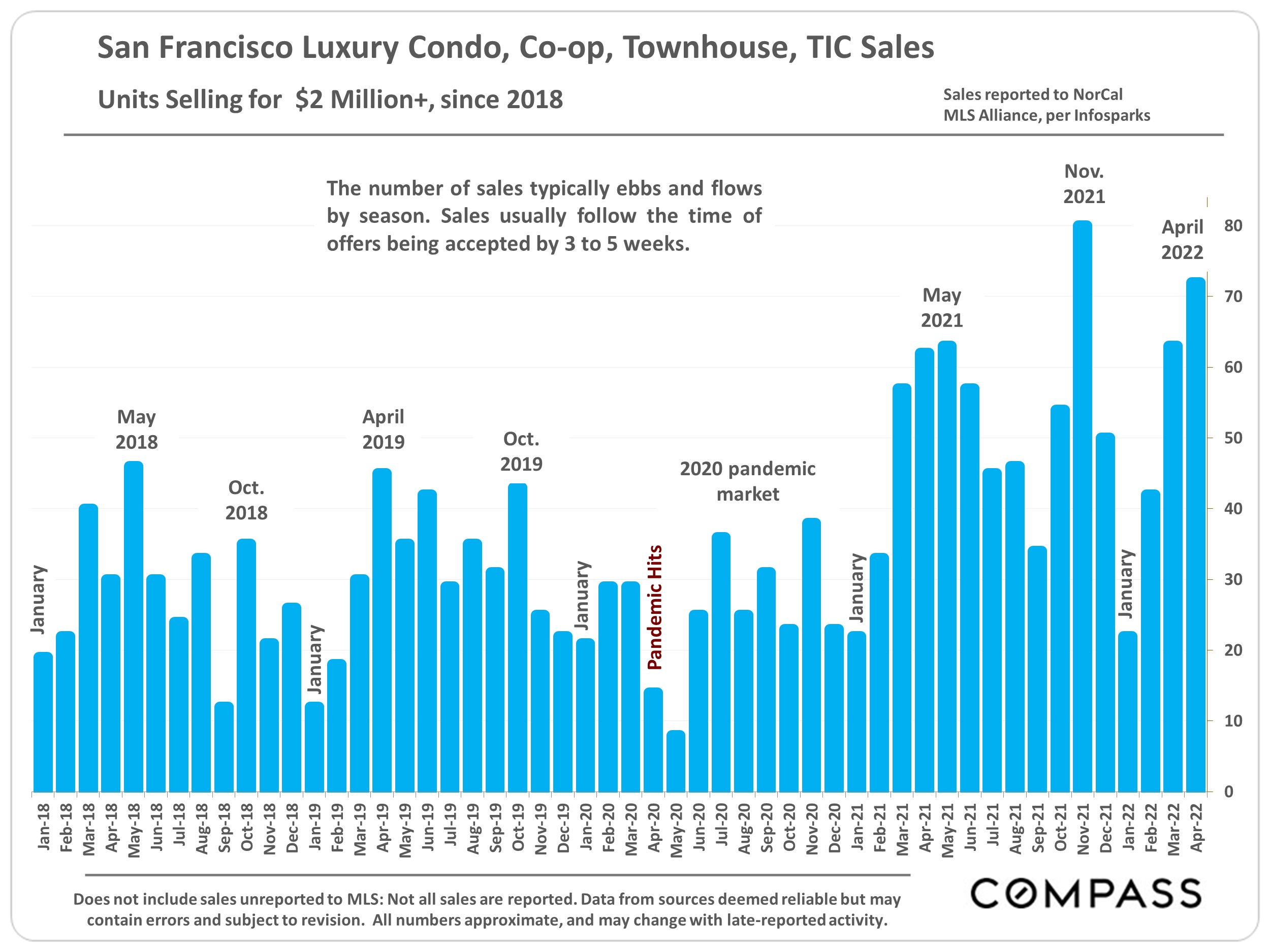

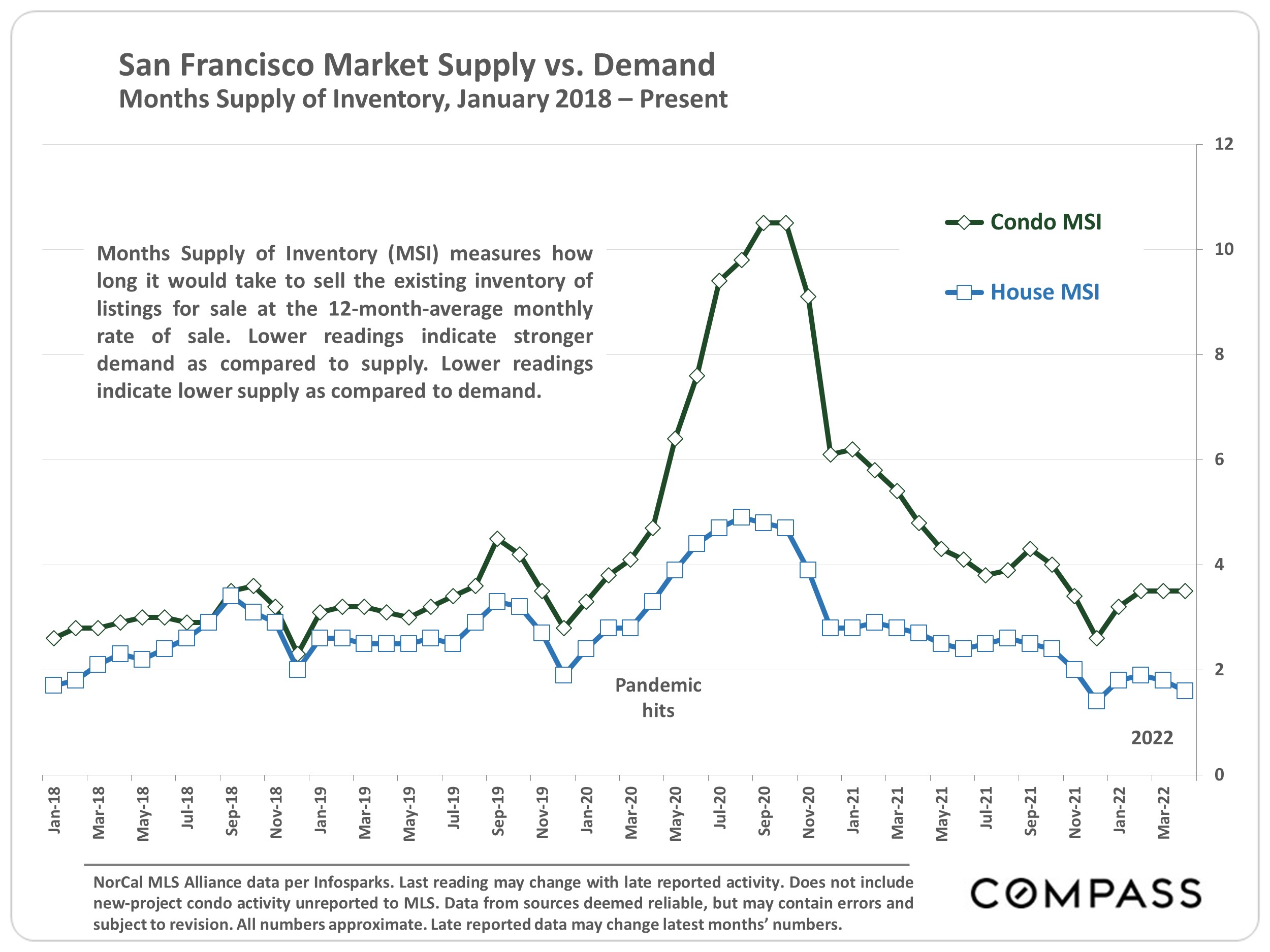

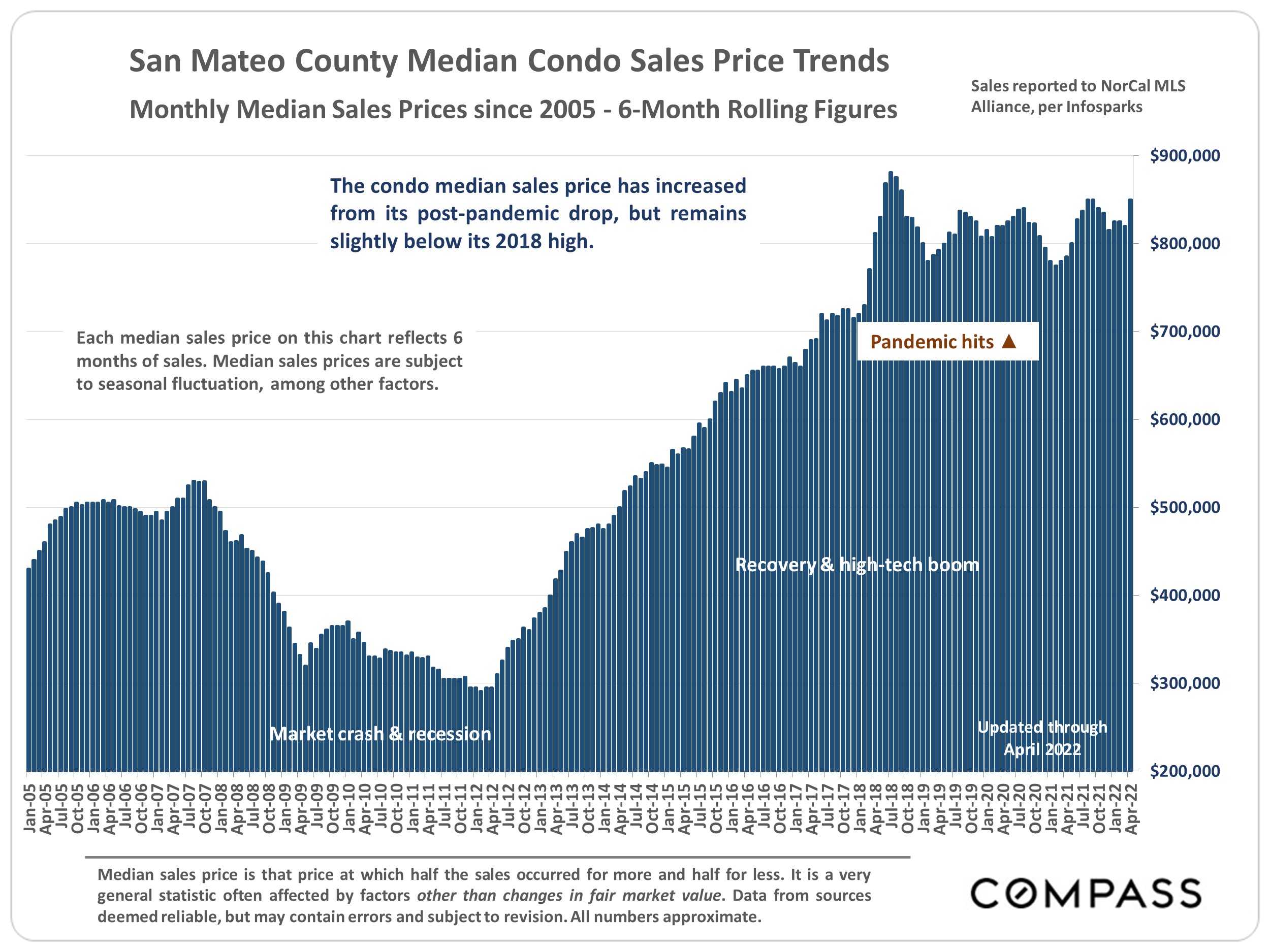

Looking back to spring 2018, 6 years into the market recovery from the foreclosure crisis, after an enormous boom in high-tech hiring, immigration and wealth, and dramatic home-price appreciation, Bay Area markets (and especially Santa Clara County) generally hit an intense peak in demand. In the second half of 2018, interest rates climbed 31% over the 2017 low, the S&P 500 dropped almost 20%, and supply and demand indicators swiftly cooled. By spring 2019, county median house sales prices were down about 7%: Not a huge drop, but after the high appreciation rates of previous years, a distinct shift in the psychology of the market. In Q3 2019, the Fed began lowering interest rates again. Then the pandemic struck in spring 2020, with profound social/economic effects, interest rates plunged, stock markets soared, and house prices rapidly climbed far above 2018 peaks. (Condo markets saw somewhat different pandemic-era dynamics.)

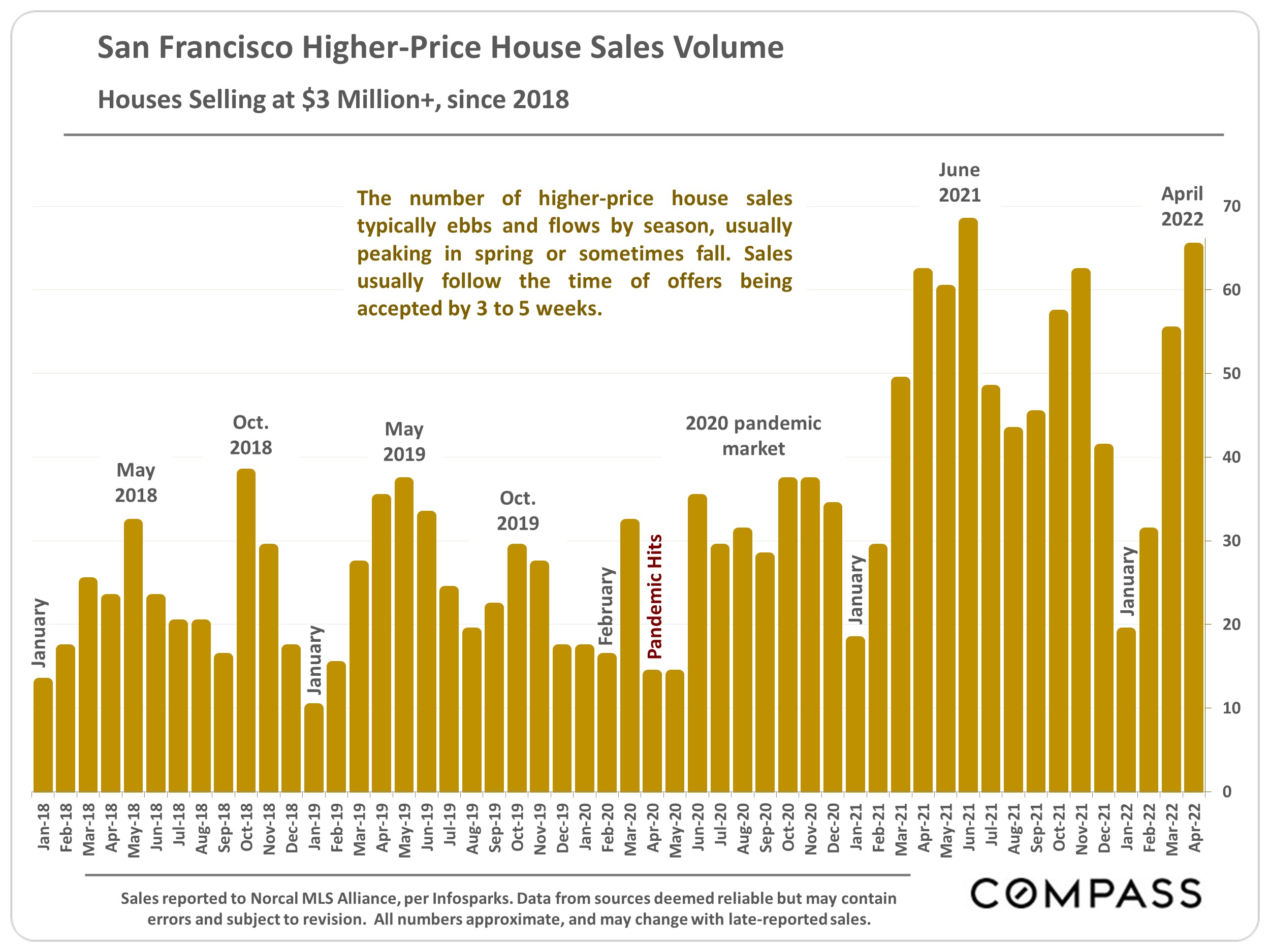

Many economic, political and demographic factors affect housing markets. What occurs with inflation, interest rates and stock markets will certainly be important. How the media covers the market will influence buyer and seller psychology. And major events often arise from off the radar (e.g. the pandemic, the war in Ukraine). The speed and scale of market changes often vary by region, price segment and property type. Less expensive homes may be more affected initially by rising interest rates, while affluent markets tend to be more influenced by sustained changes in financial markets. But over time, broad market trends tend to end up running roughly parallel across the Bay Area.

As always, analysts, economists and industry commentators are making diverging forecasts. Sales data in coming months should soon provide more concrete indications of market direction.

Not intended to convince anyone to take a specific course of action, or to predict the future, but only to provide, to the best of our ability, a straightforward analysis of market conditions and trends.

National Housing Market Reports Being the center of high-tech industry and other unique local factors have certainly had deep effects on Bay Area real estate markets, but over the past 20 years, the differences between local and national trends have generally been more of degree than direction: General economic conditions and market ups and downs run on similar tracks — which makes it useful to look at national data indicators as well. “National housing market indicators available as of April showed activity in housing markets slowed overall… Sales of existing homes declined to the slowest pace since June 2020… The inventory of homes for sale rose [month over month, and year-over-year].” U.S. Department of Housing and Urban Development, Housing Market Indicators Monthly Update for April 2022, published May 5, 2022 “Tin March 2022] All regions [of the country] reported decreases in year-over-year contract activity. Sales were down across each region year-over-year.” National Association of Realtors, April 27, 2022 “On the seller side, the number of new listings grew this week and there’s some evidence that the number of potential buyers is shrinking as high costs derail some buying plans. As new listings grow and home sales slow… we expect active inventory to surpass year ago levels in the next few months. [As] home sales lose momentum, price growth is likely to follow suit.” Realtor.com National Report, May 2, 2022 “The combination of swift home price growth and the fastest mortgage rate increase in over forty years is finally affecting purchase demand. Homebuyers… are coping in a variety of ways, including switching to adjustable-rate mortgages… We expect the decline in demand to soften home price growth… later this year.” Freddie Mac (FHLMC), April 28, 2022 “With mortgage rates increasing… [loan] applications continued to decline… to the lowest level since 2018.” Mortgage Bankers Association, April 27, 2022

|