Tag: December 2022

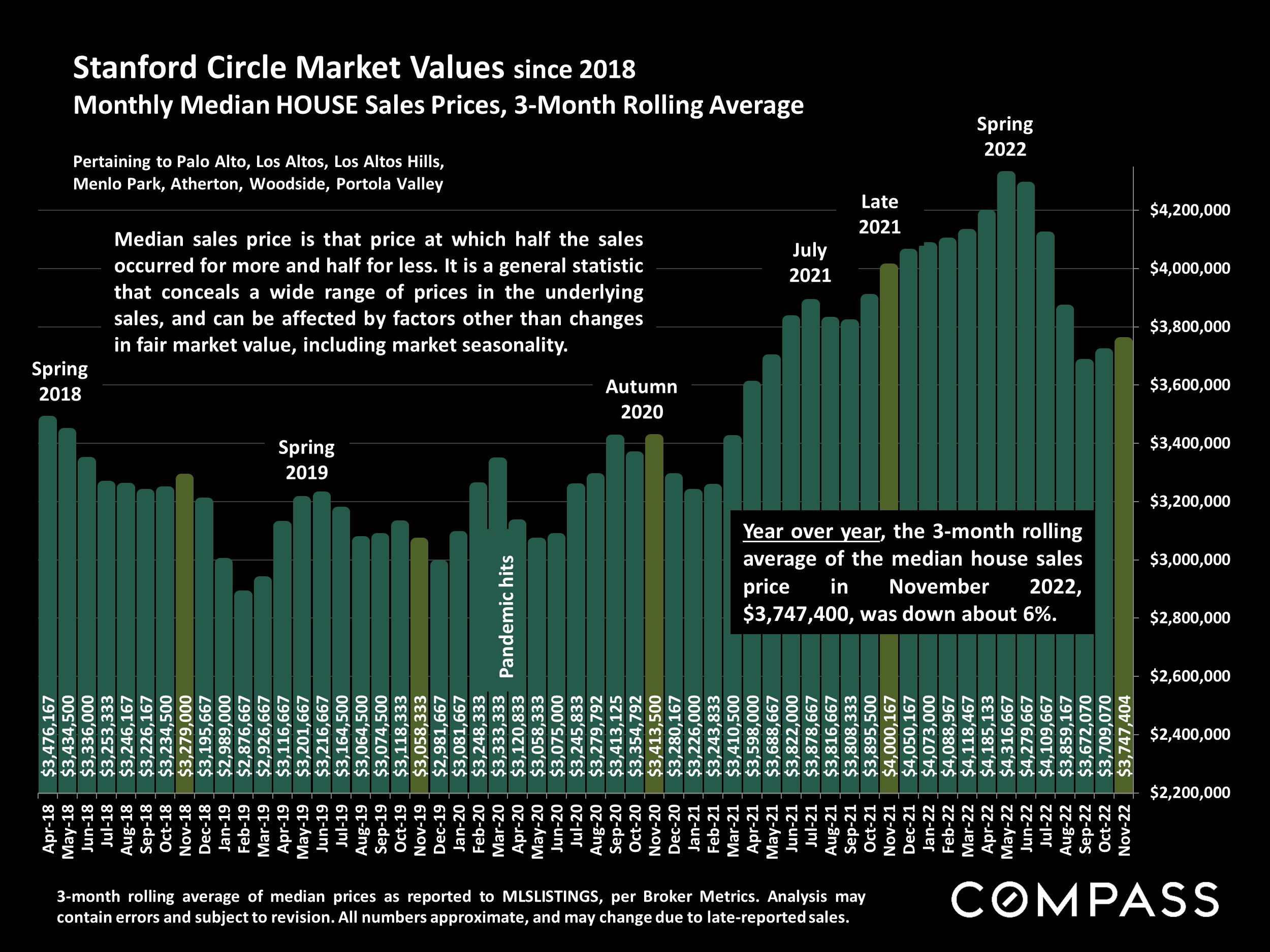

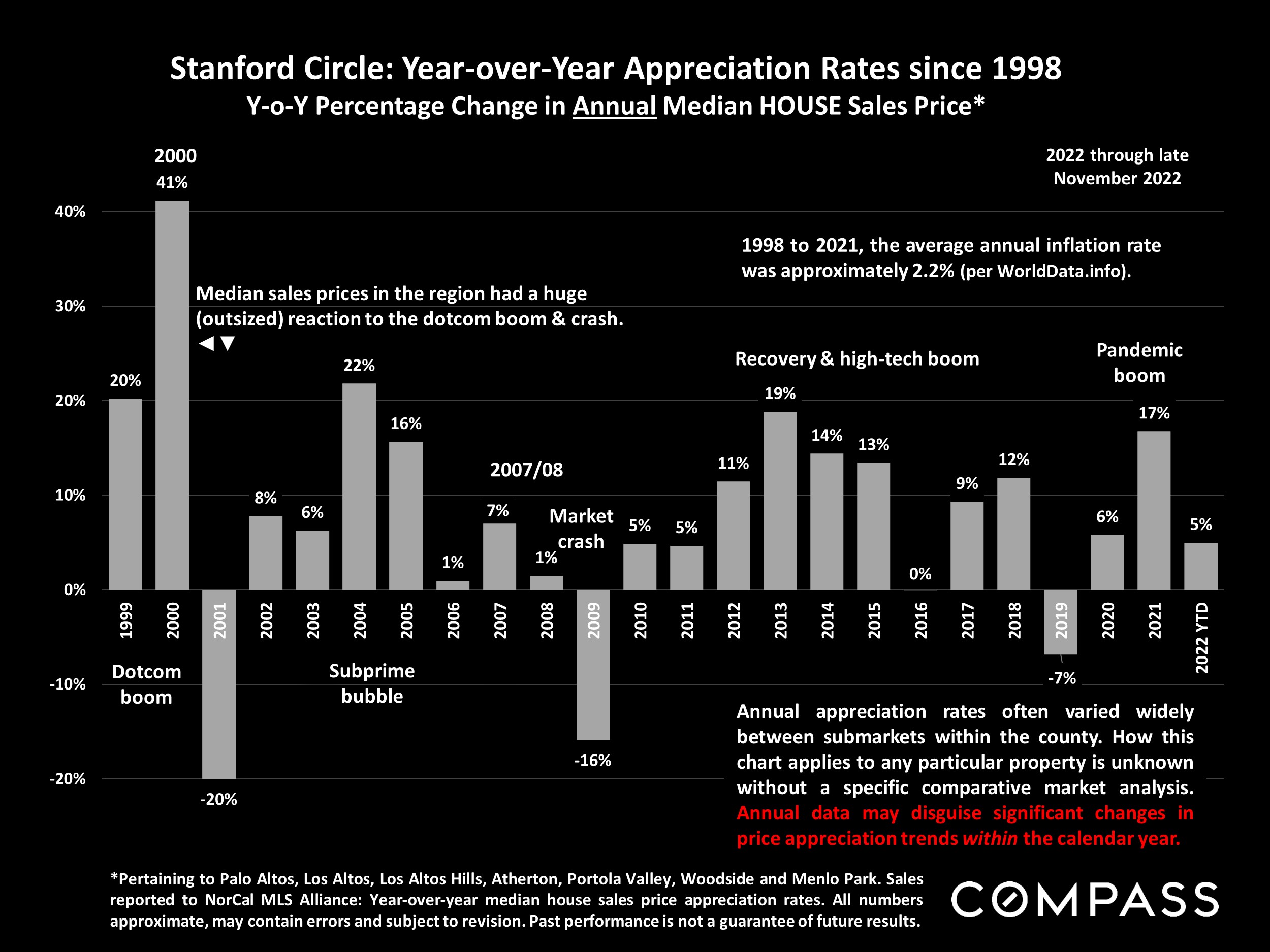

Stanford Circle Cities Real Estate, December 2022

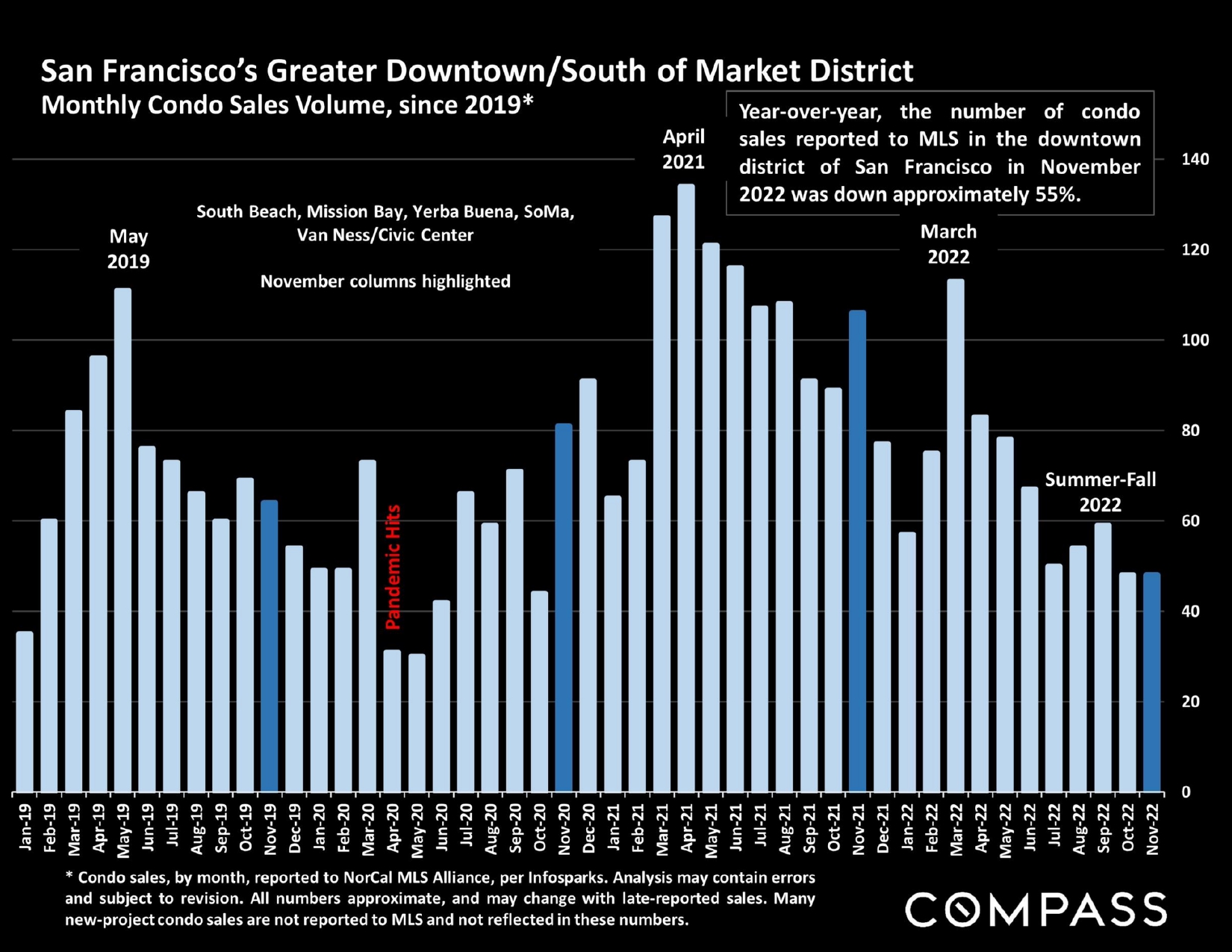

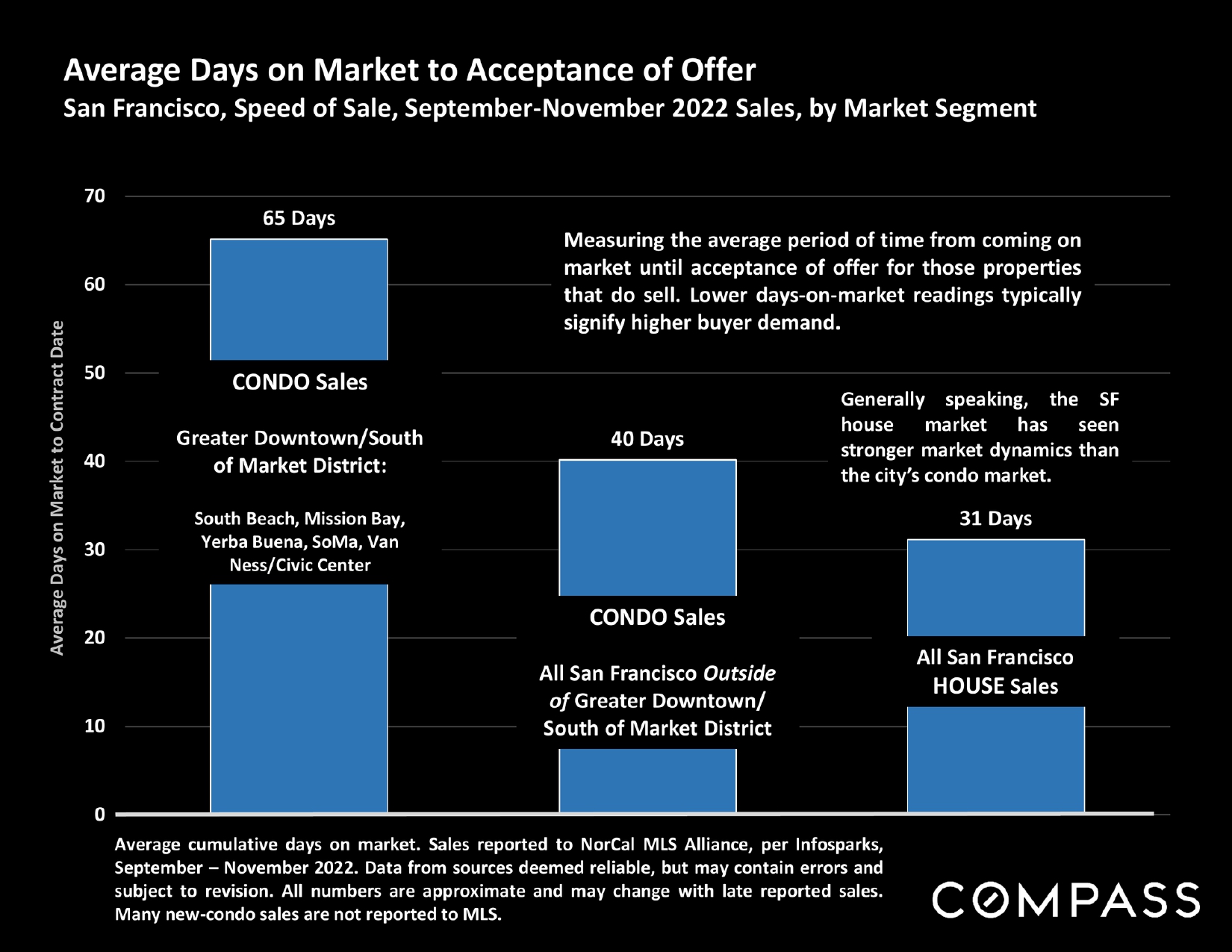

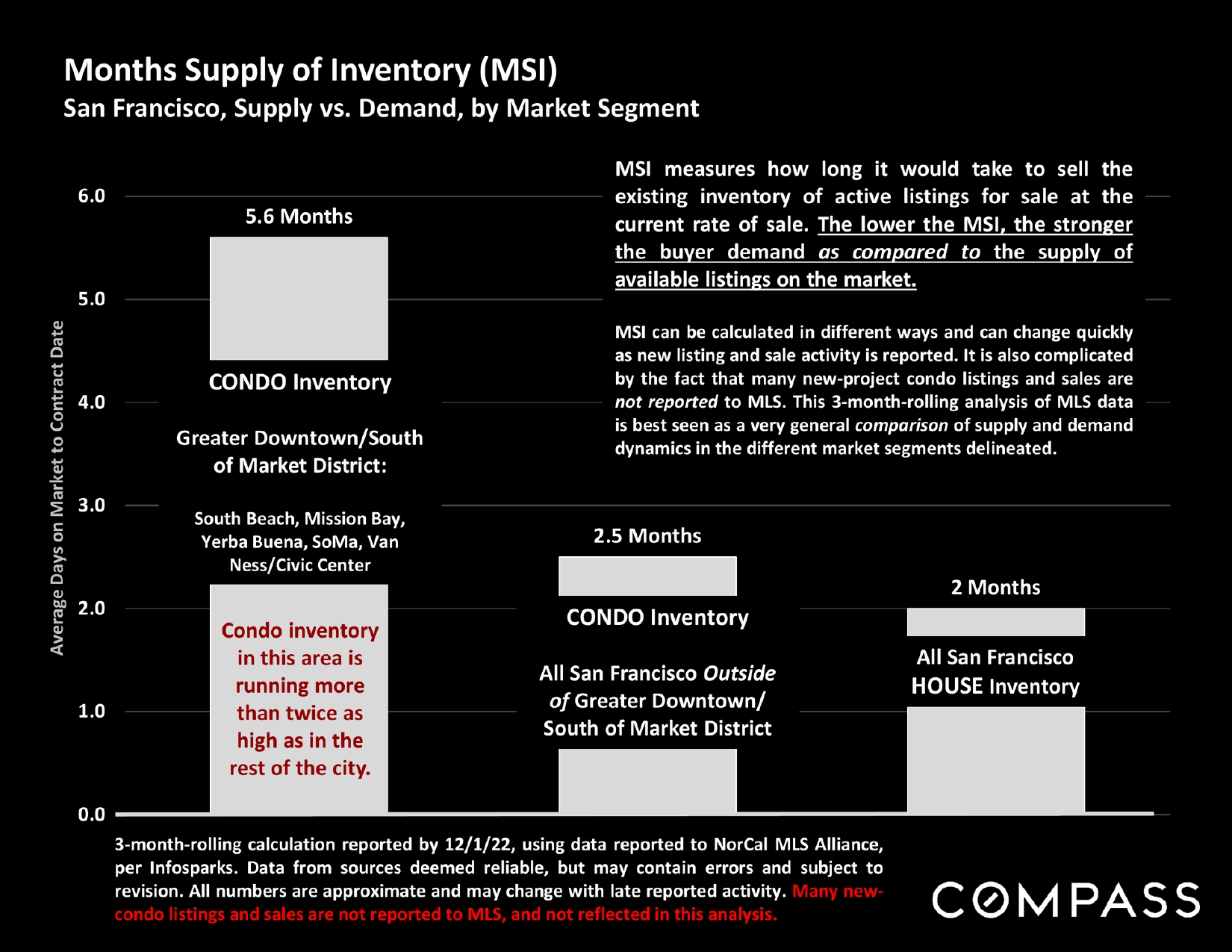

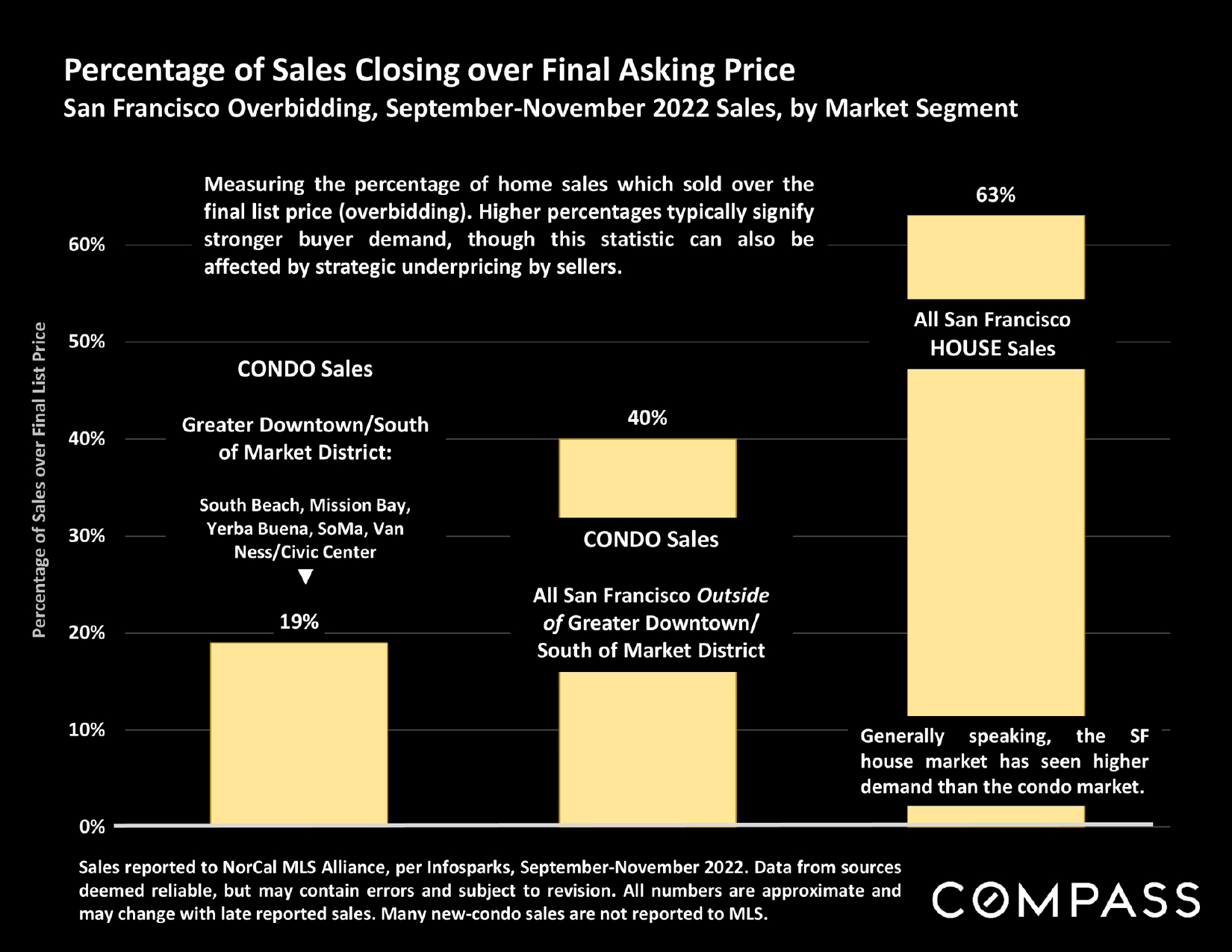

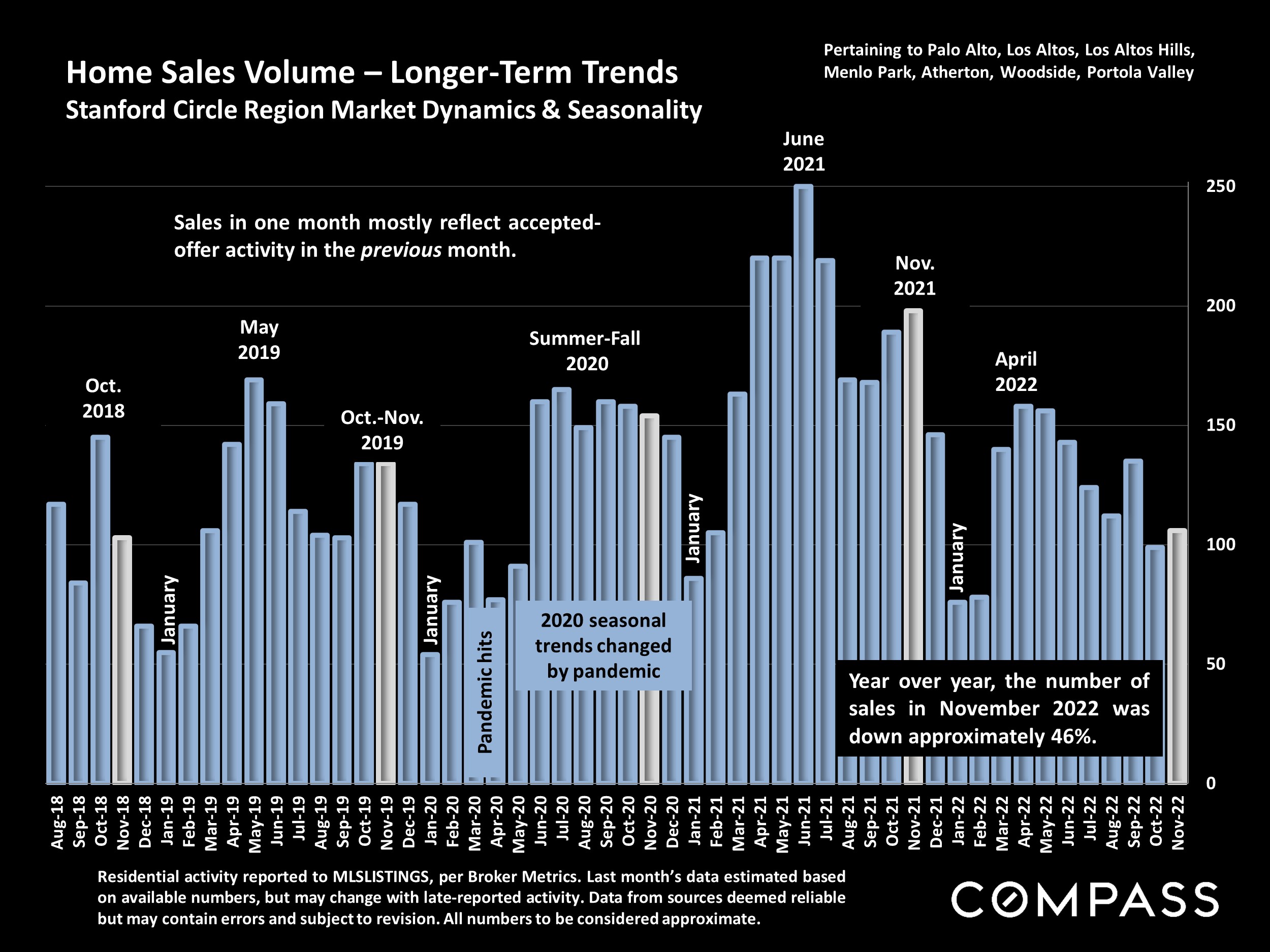

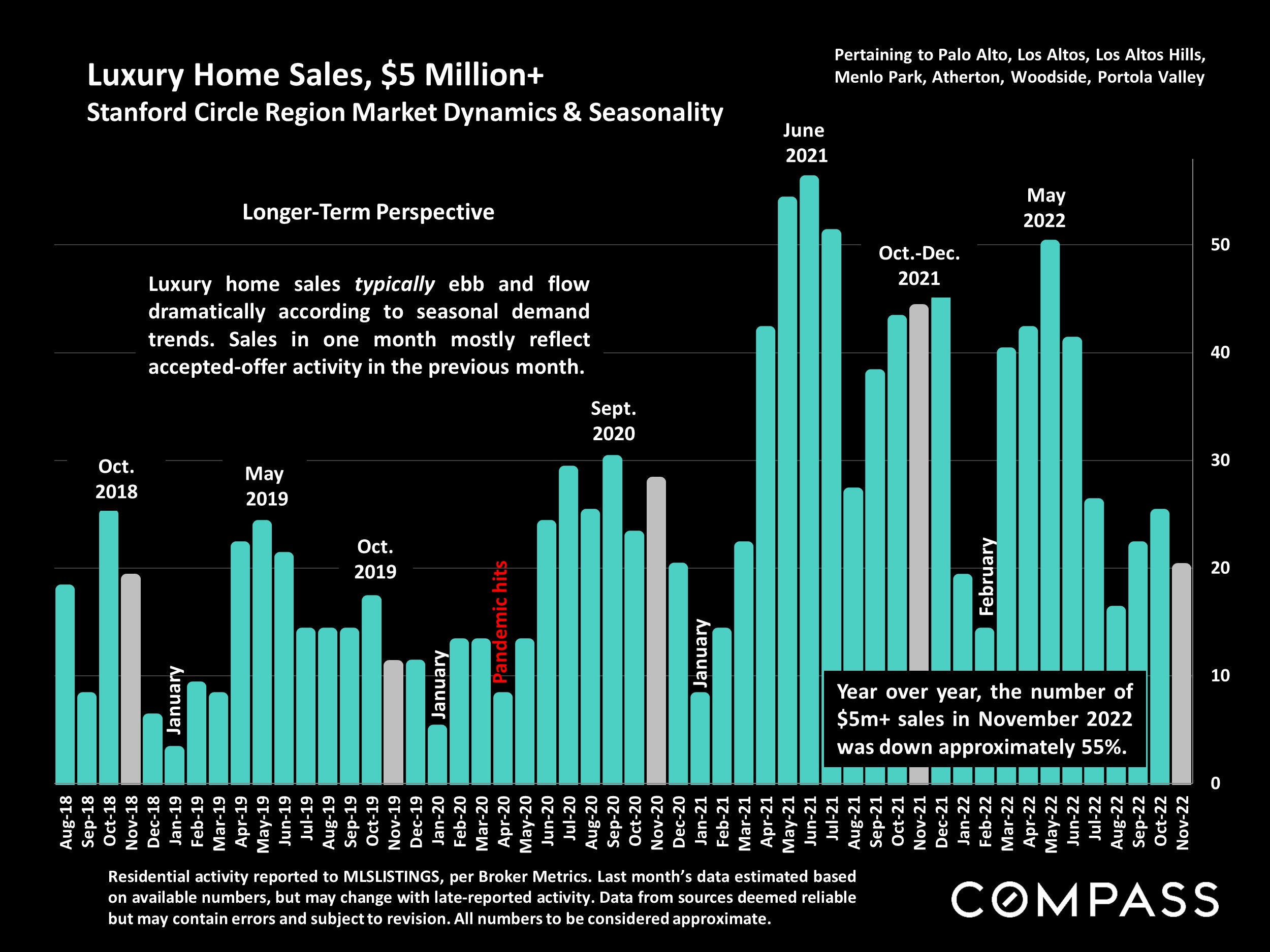

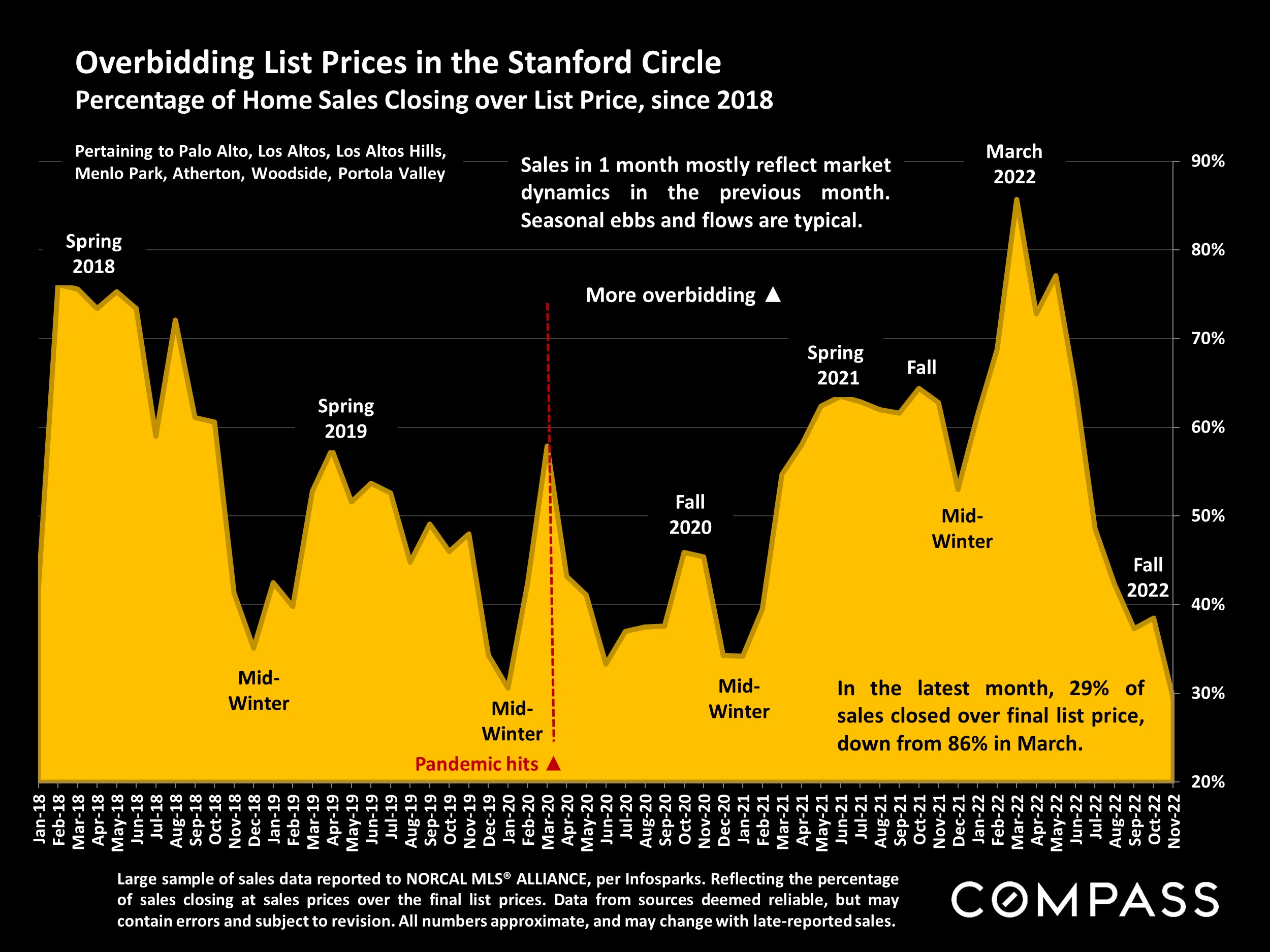

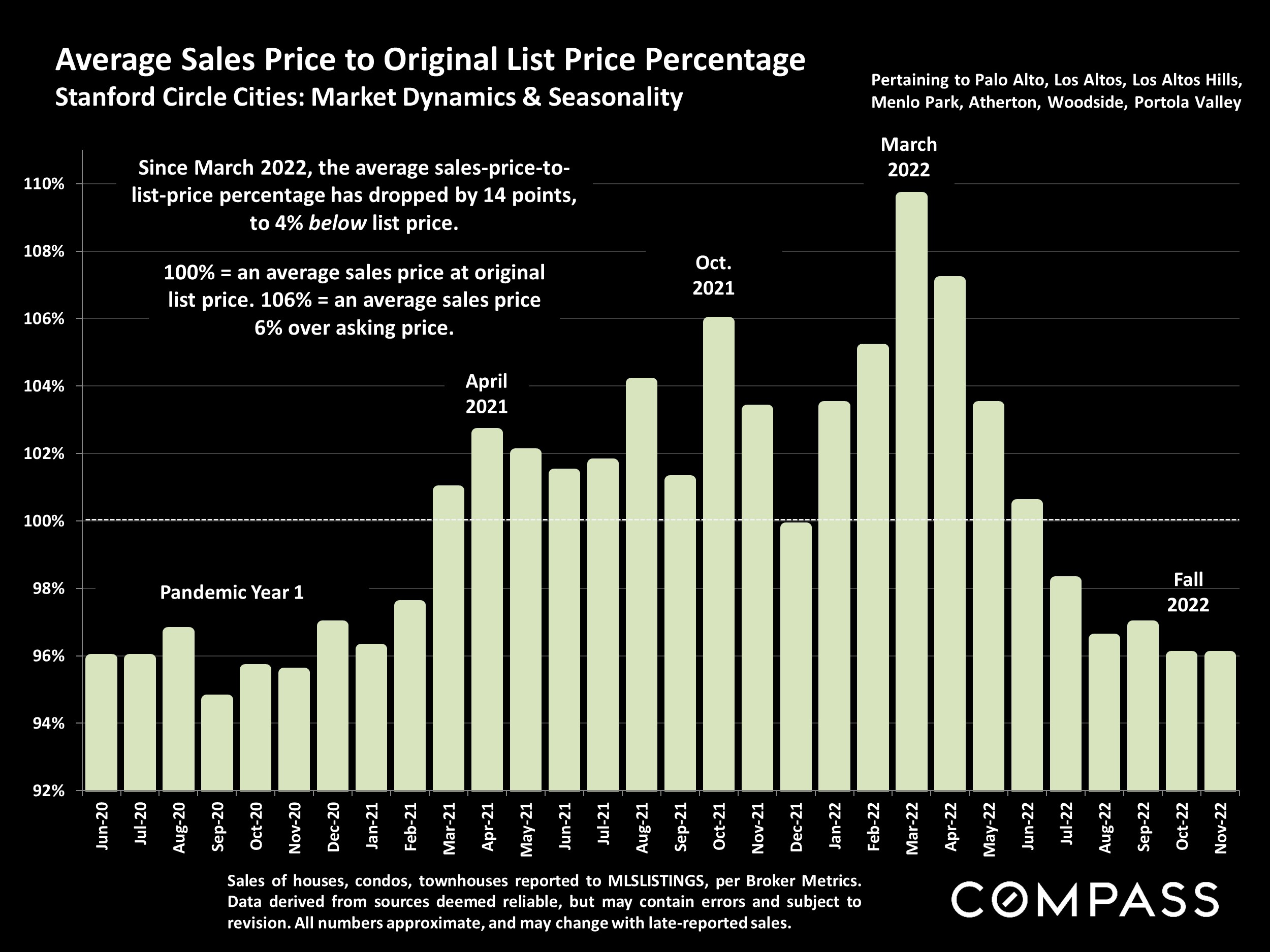

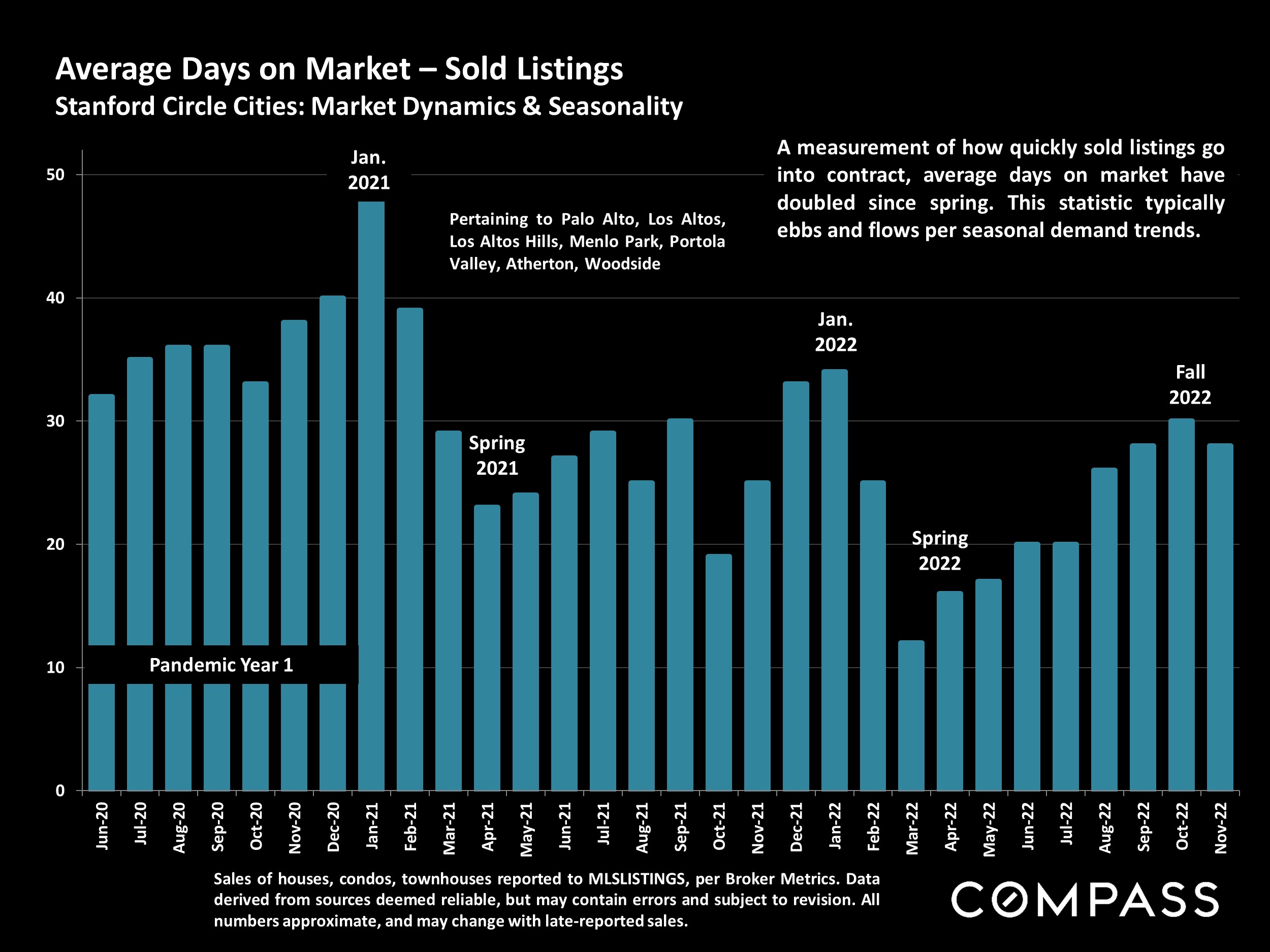

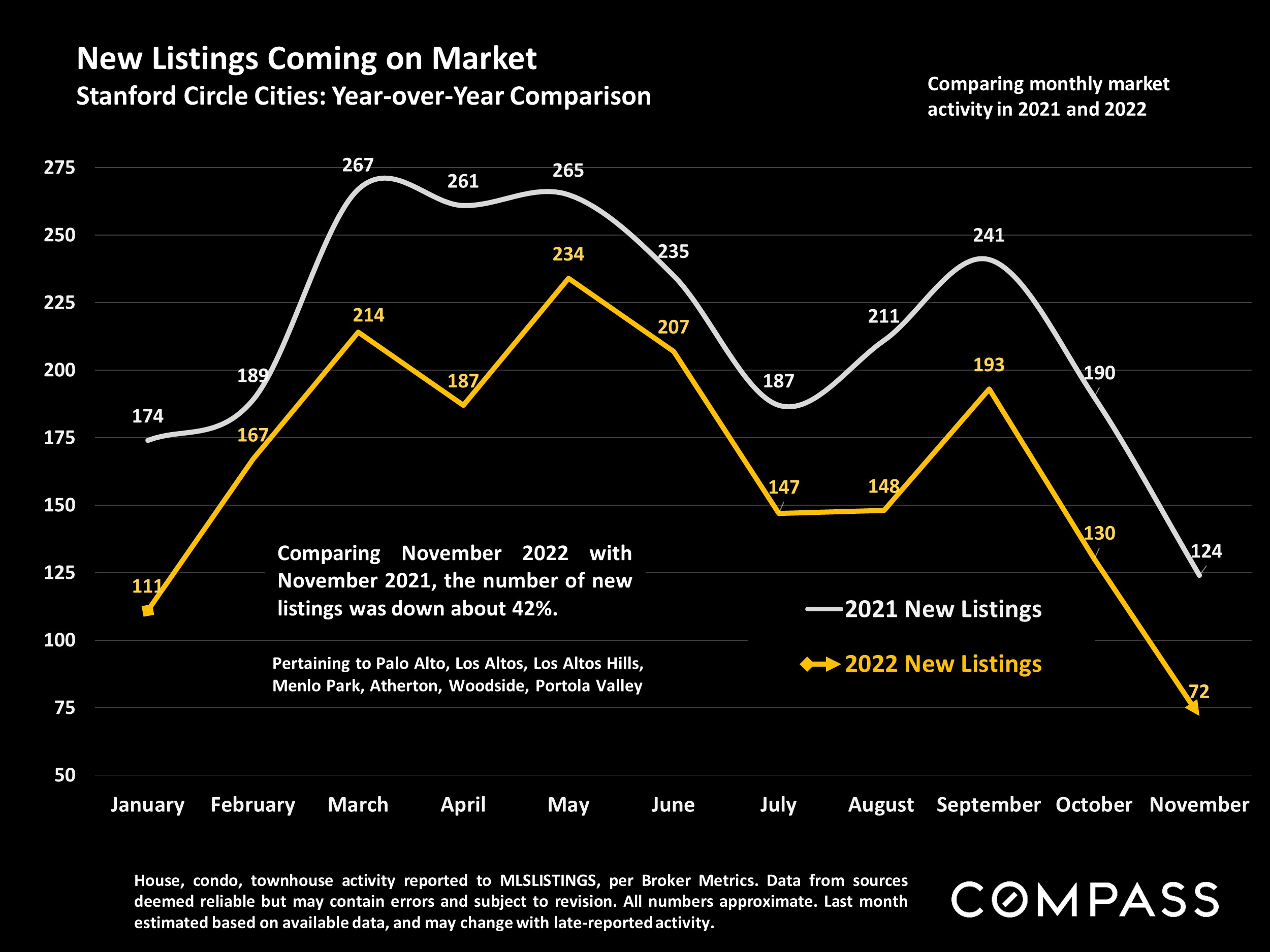

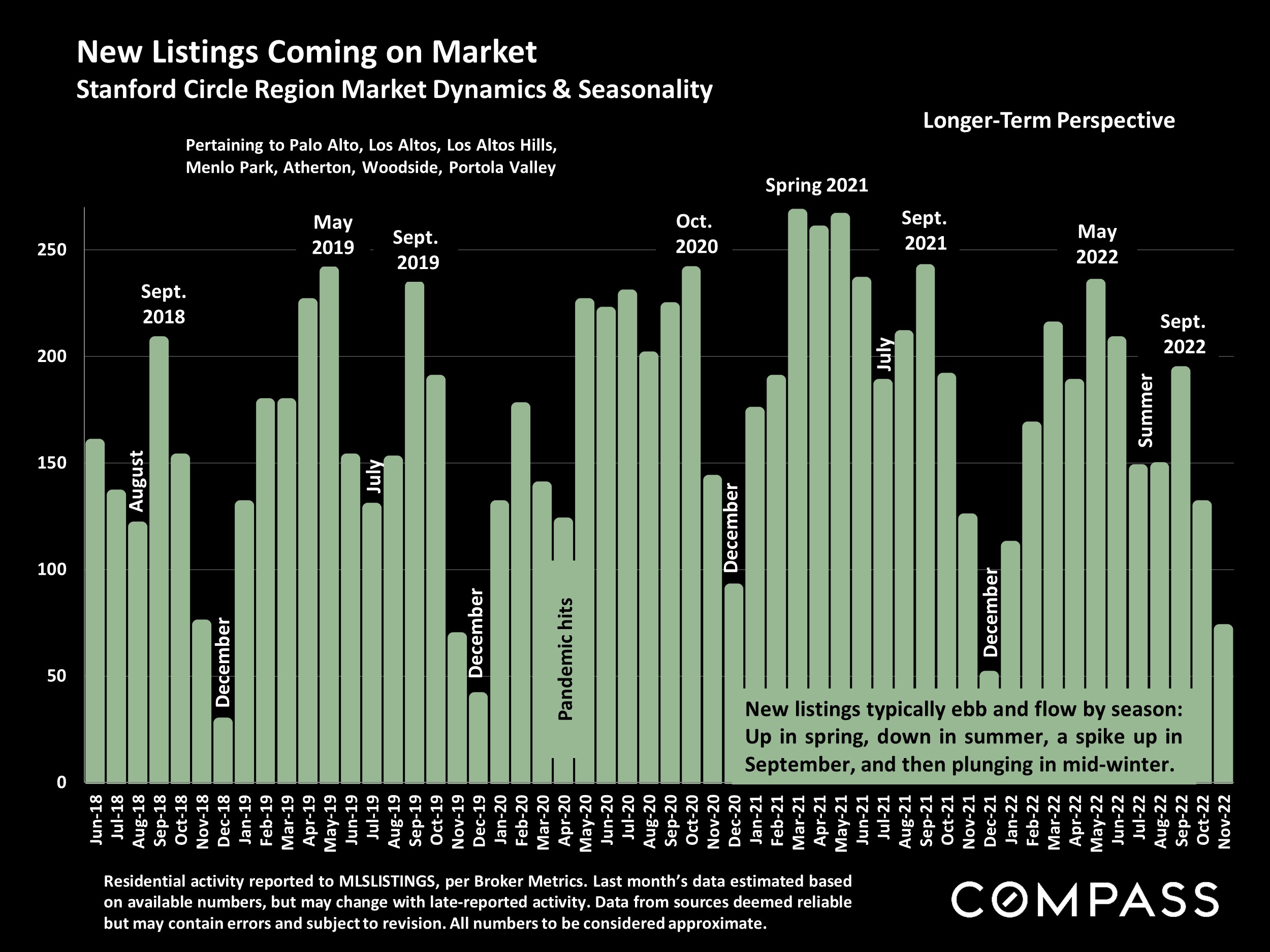

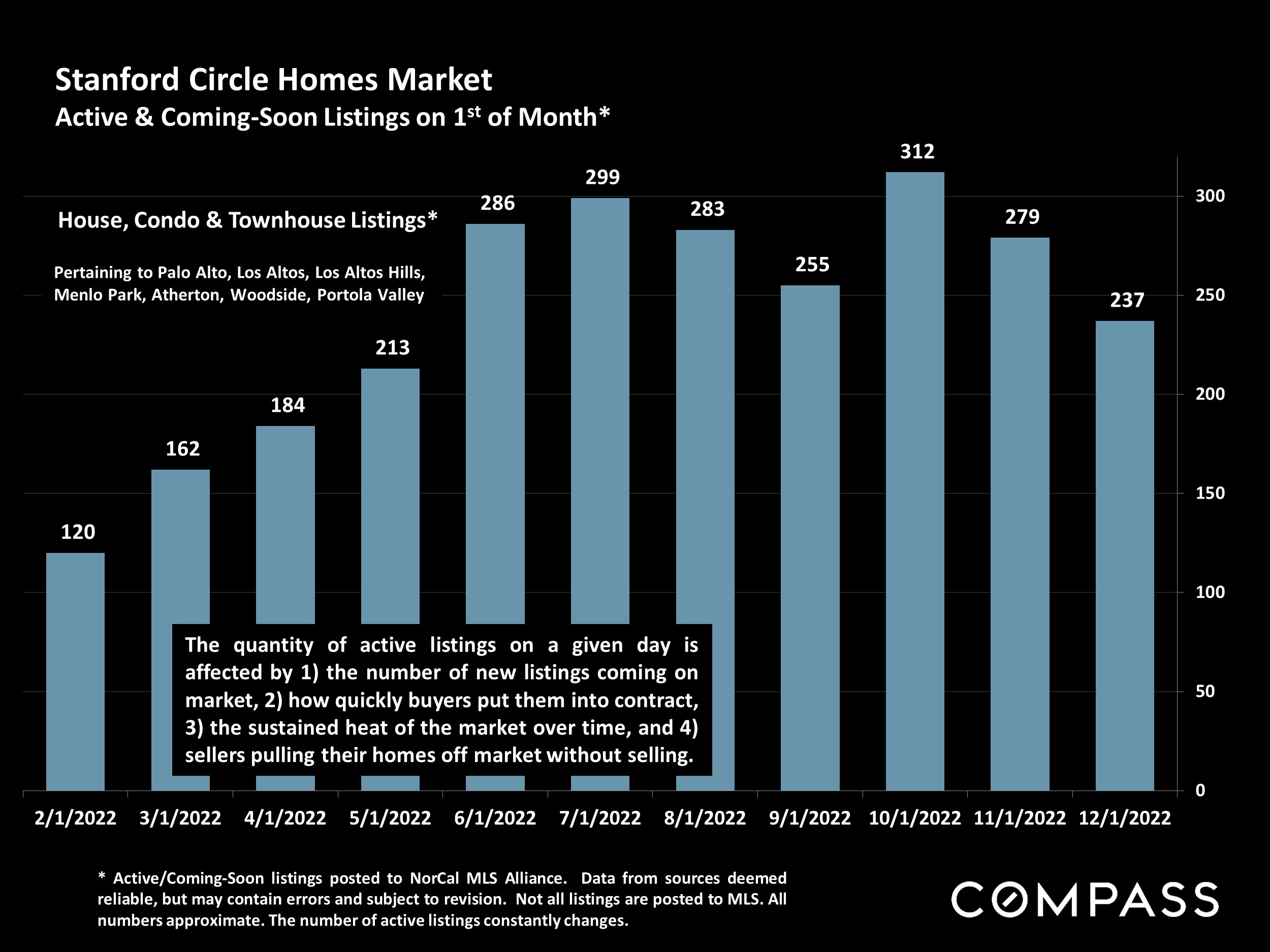

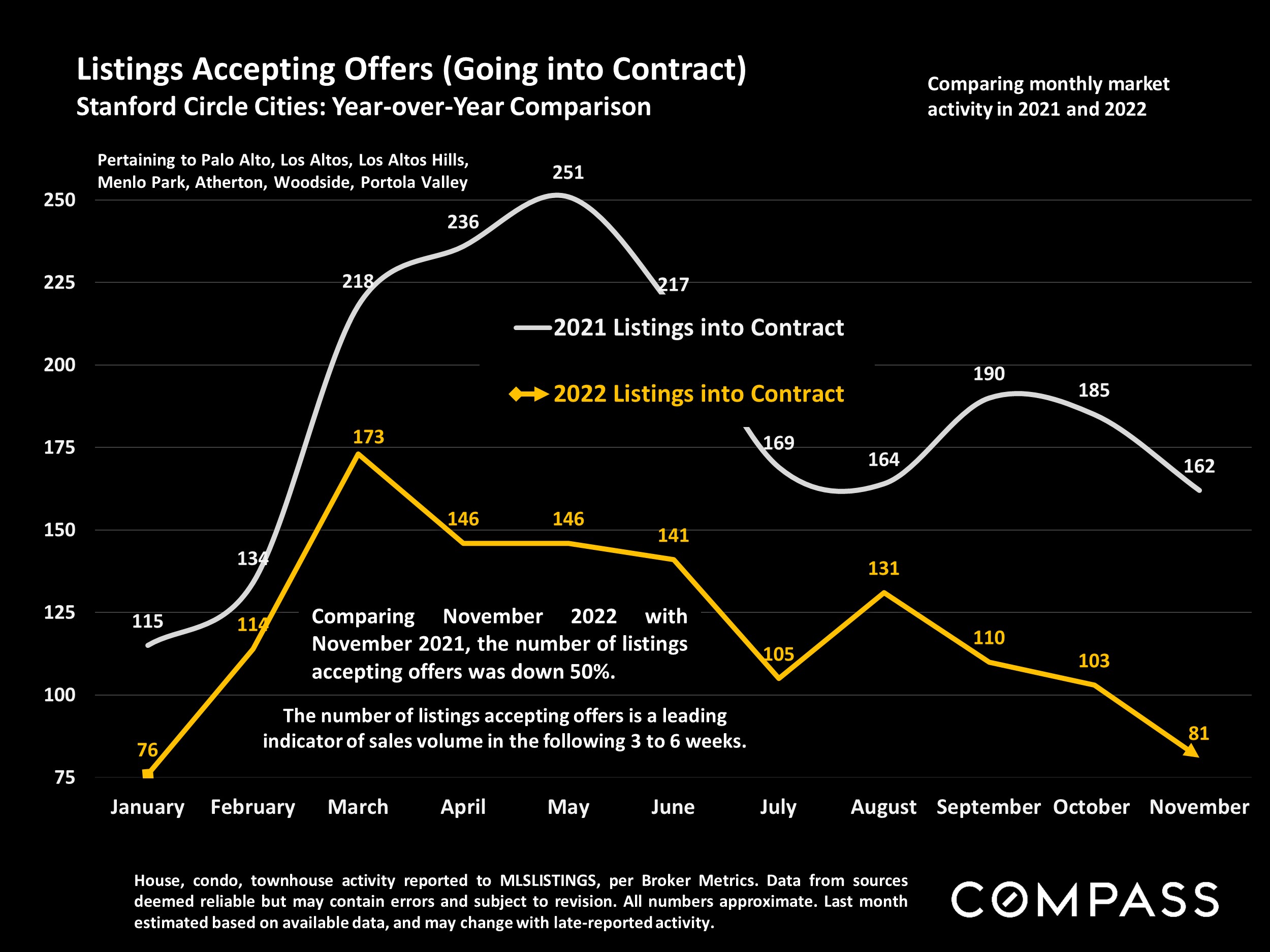

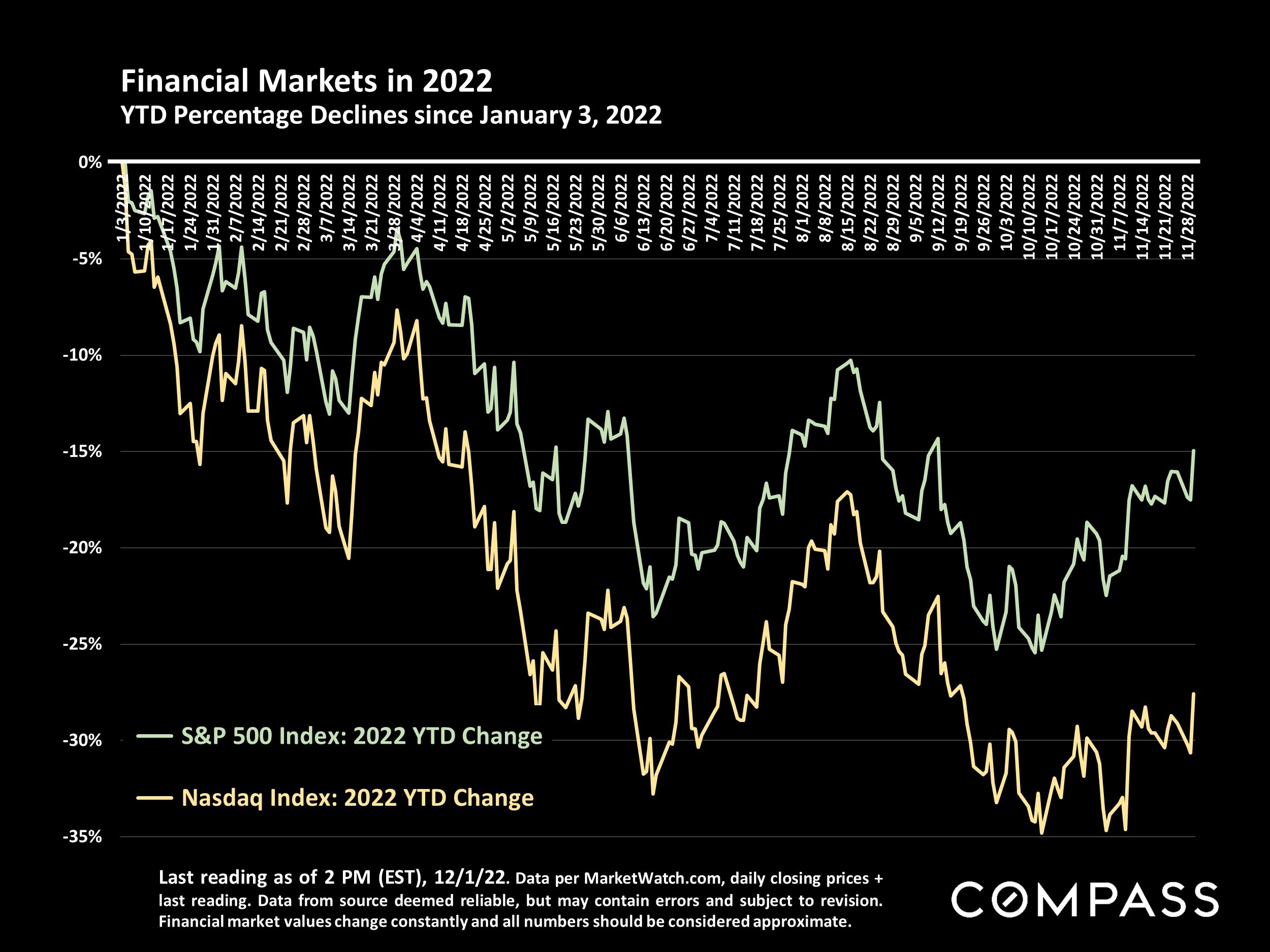

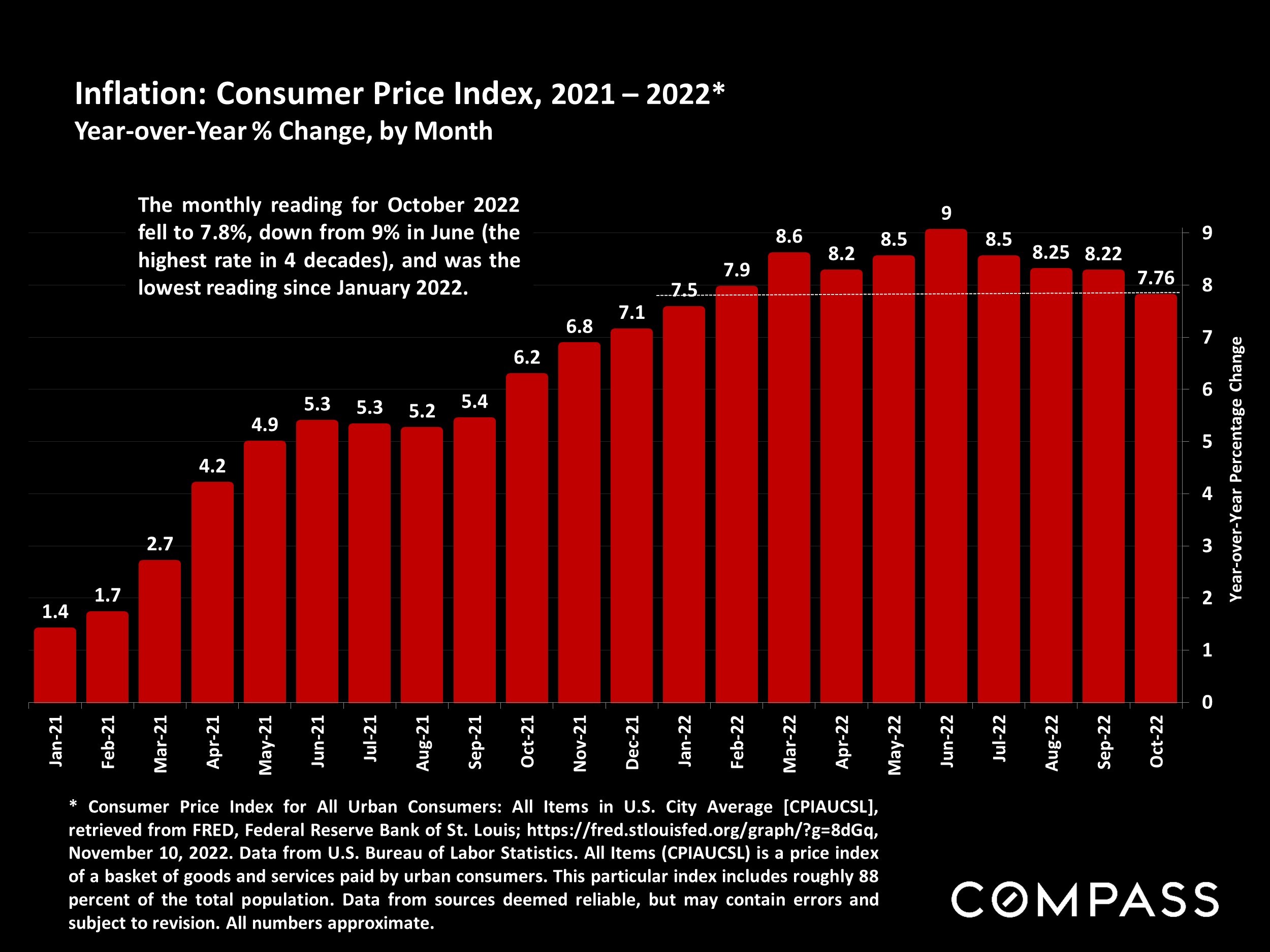

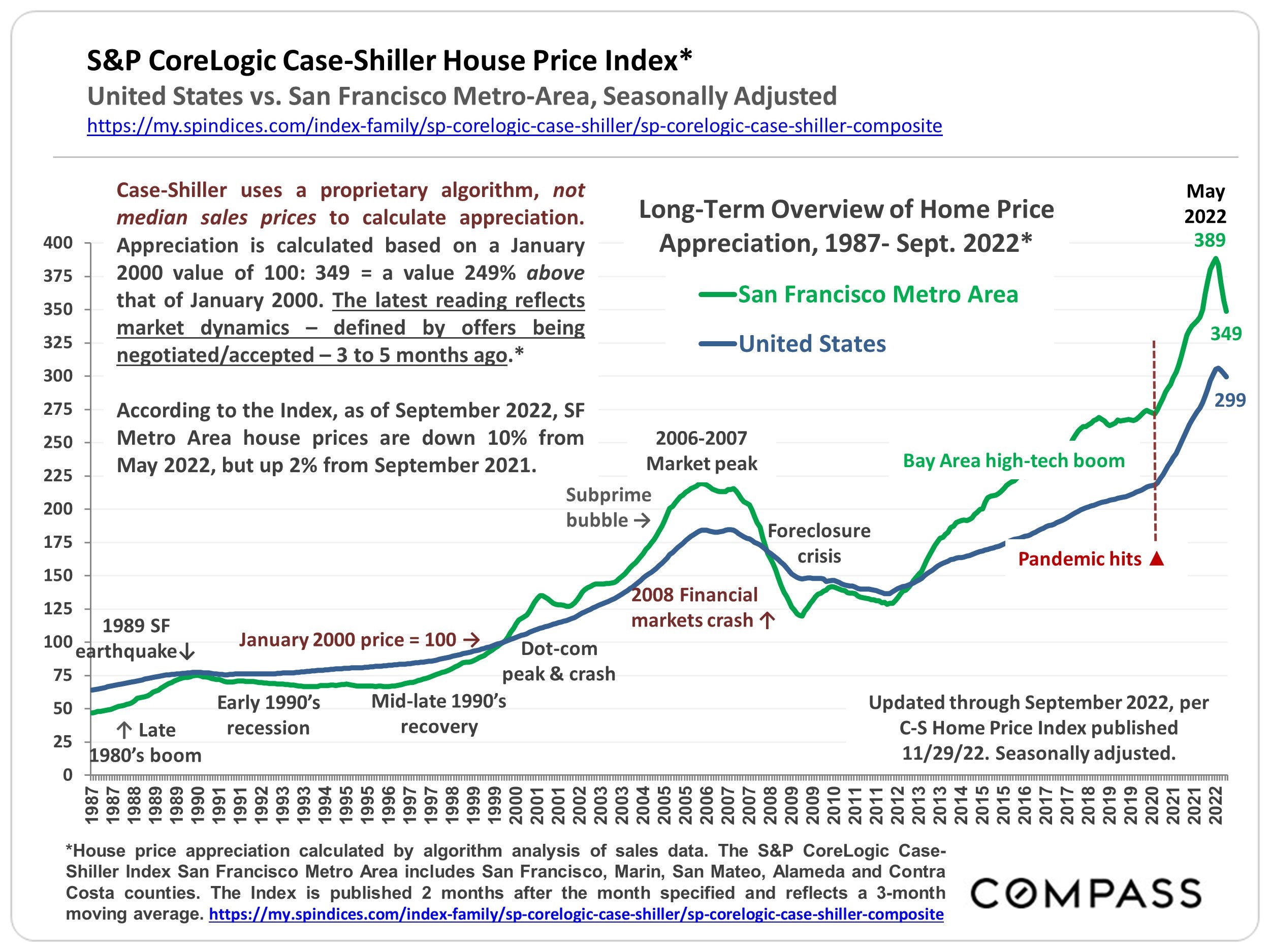

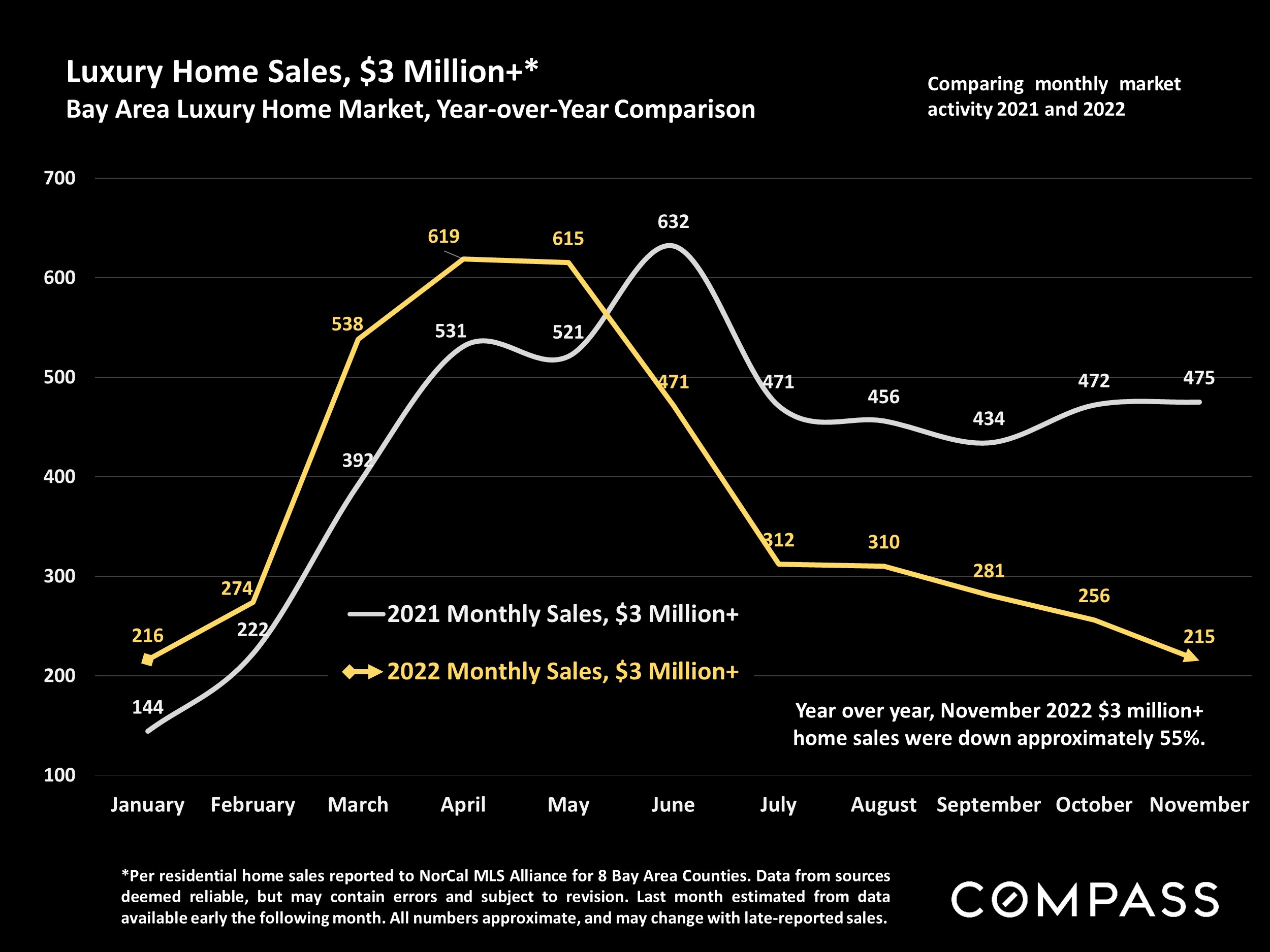

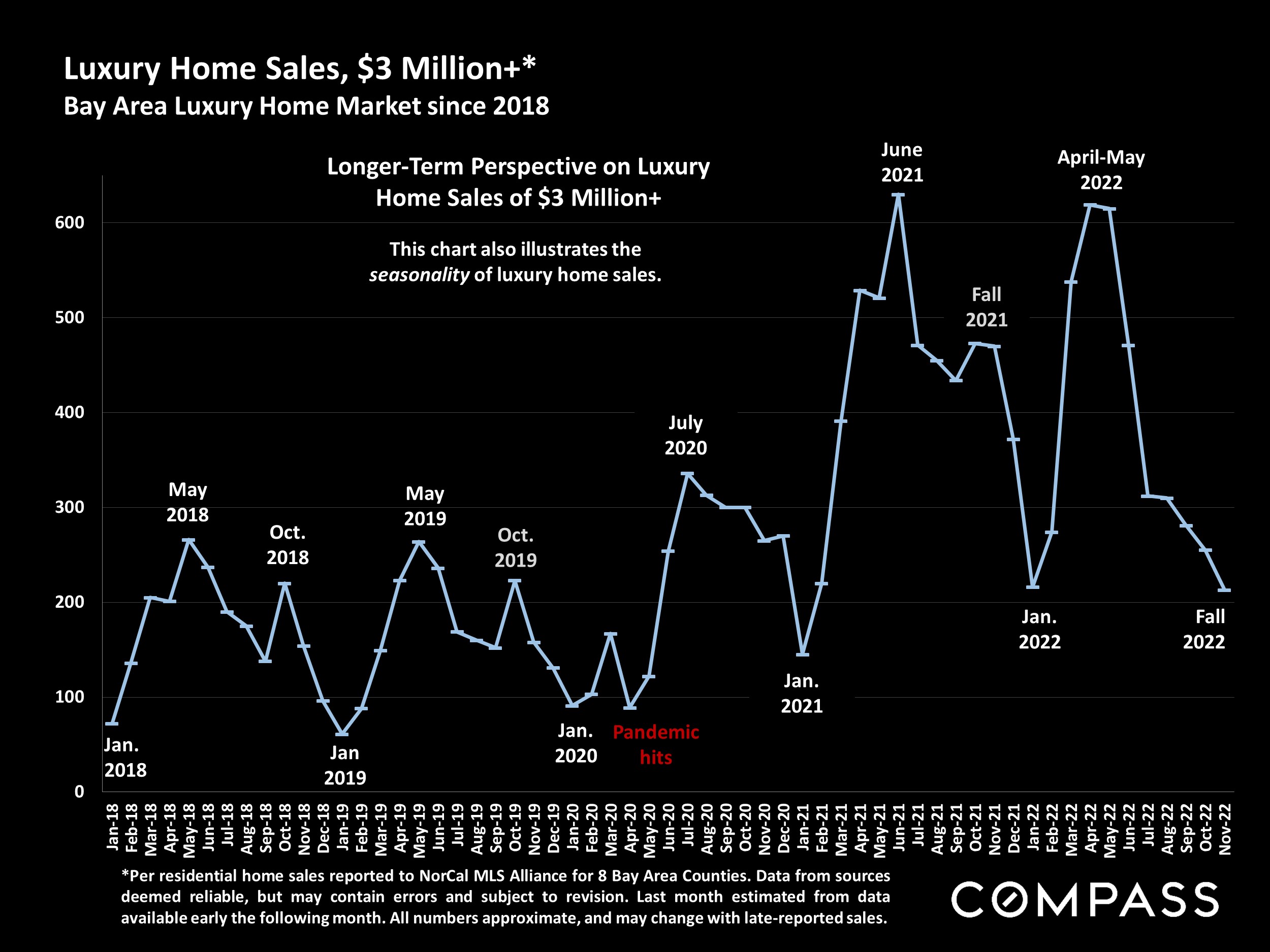

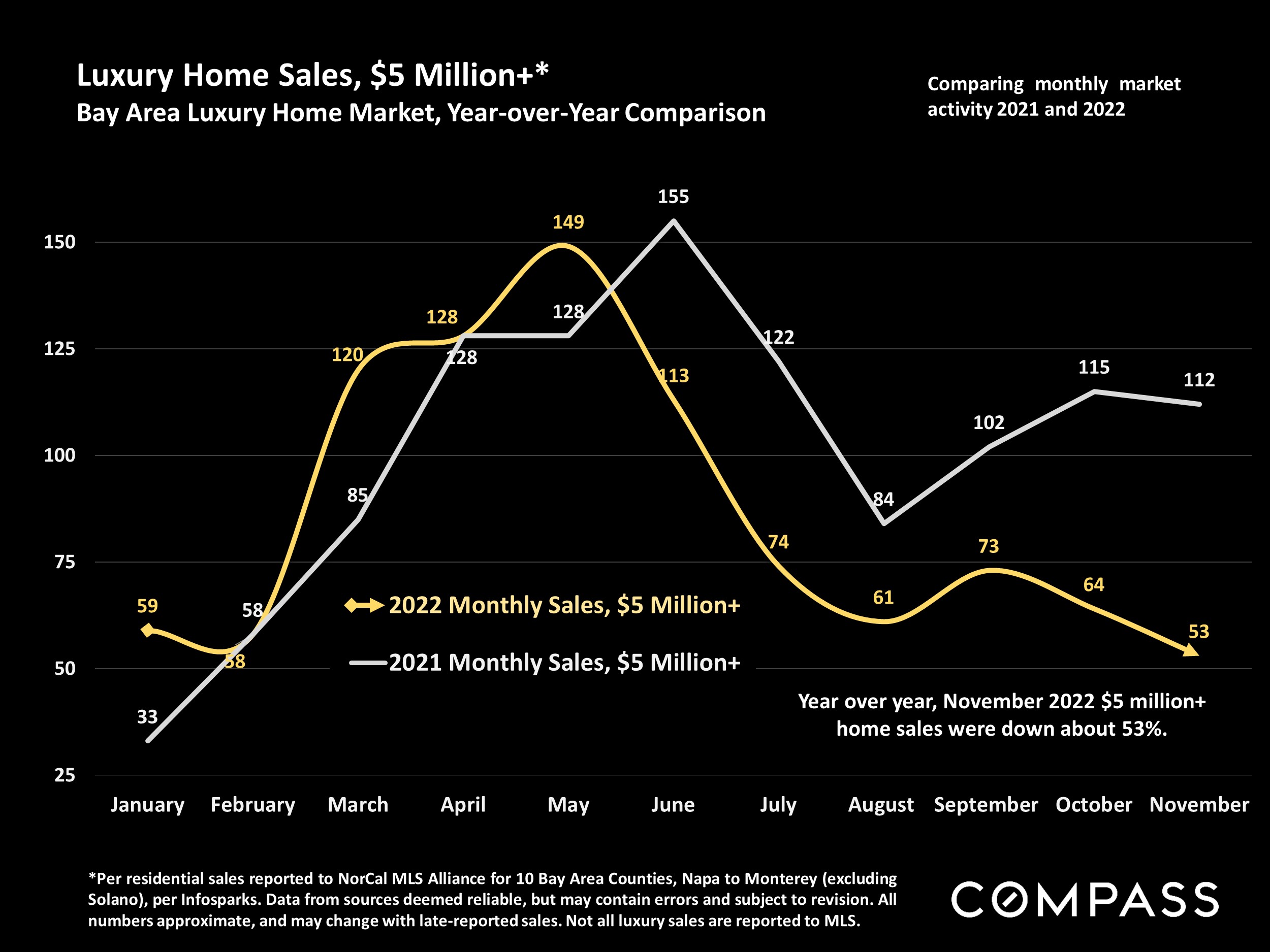

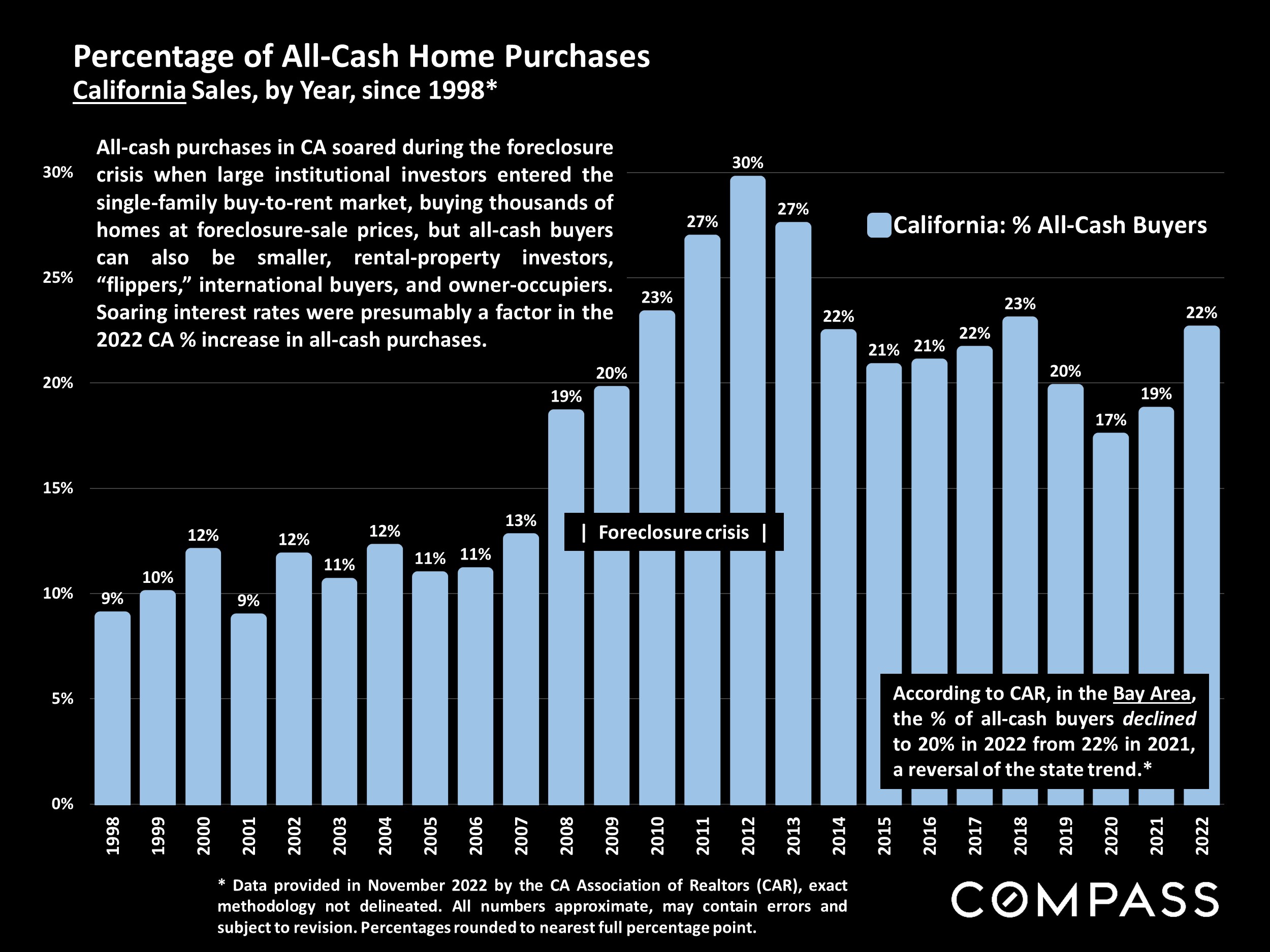

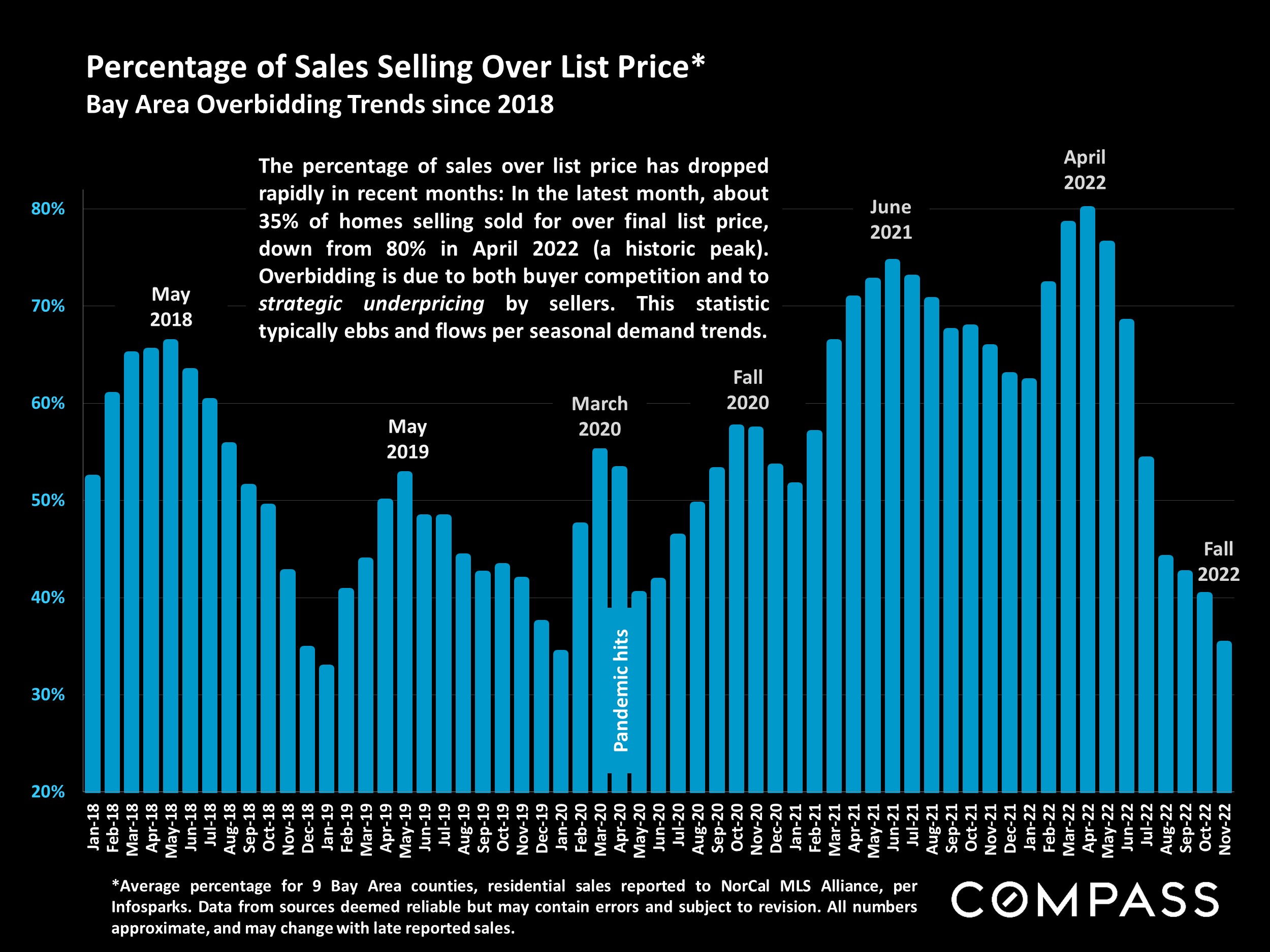

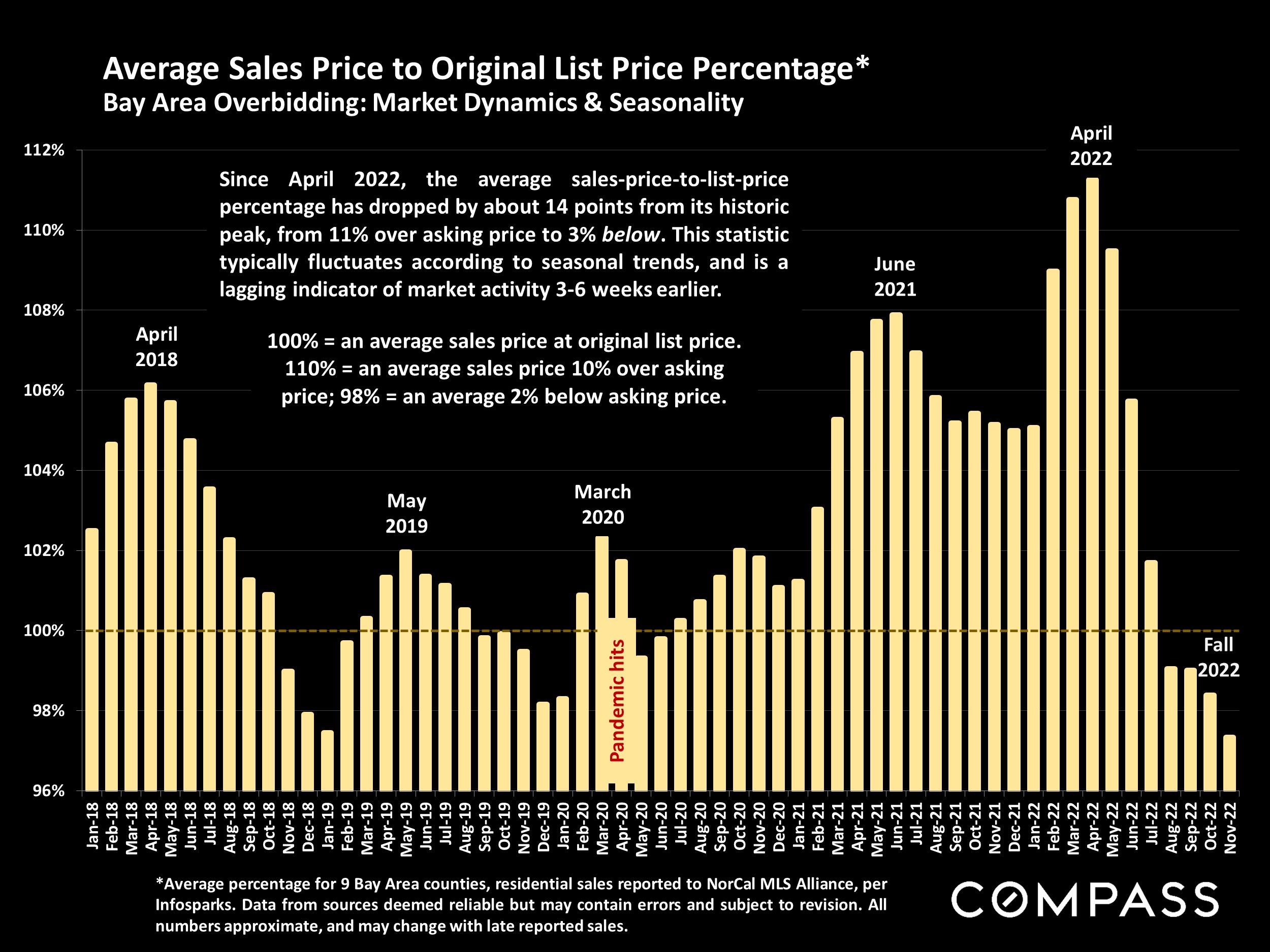

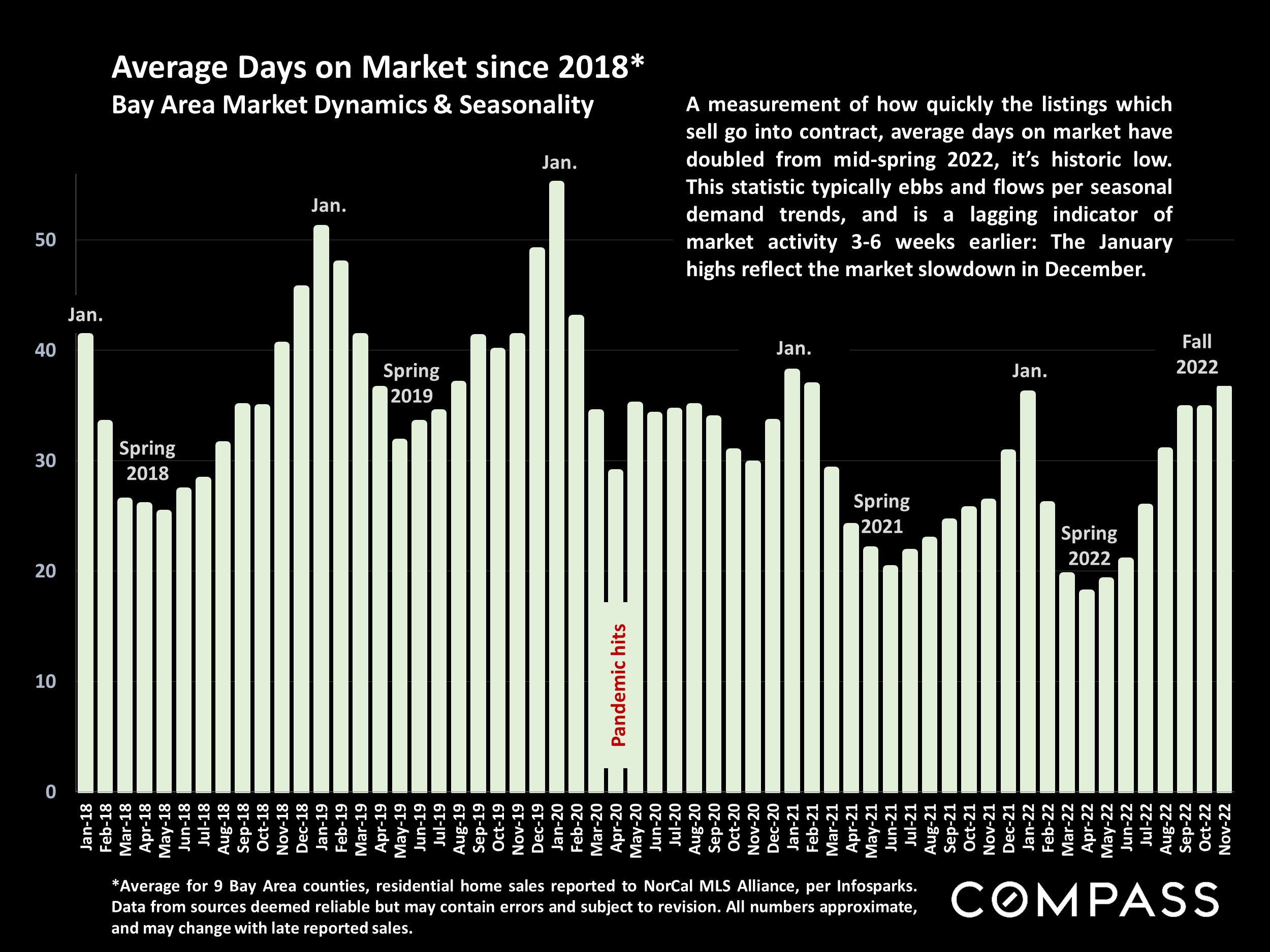

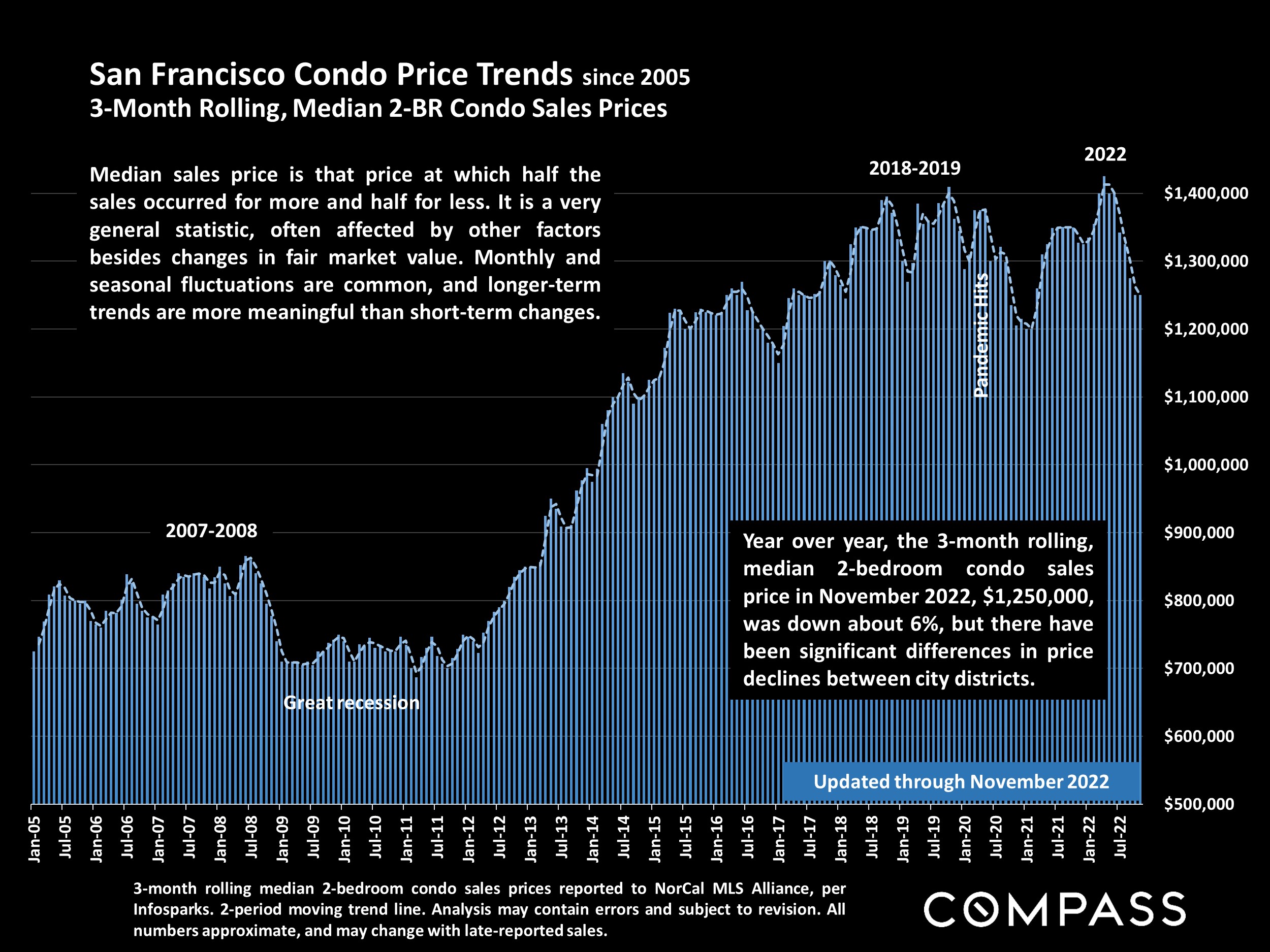

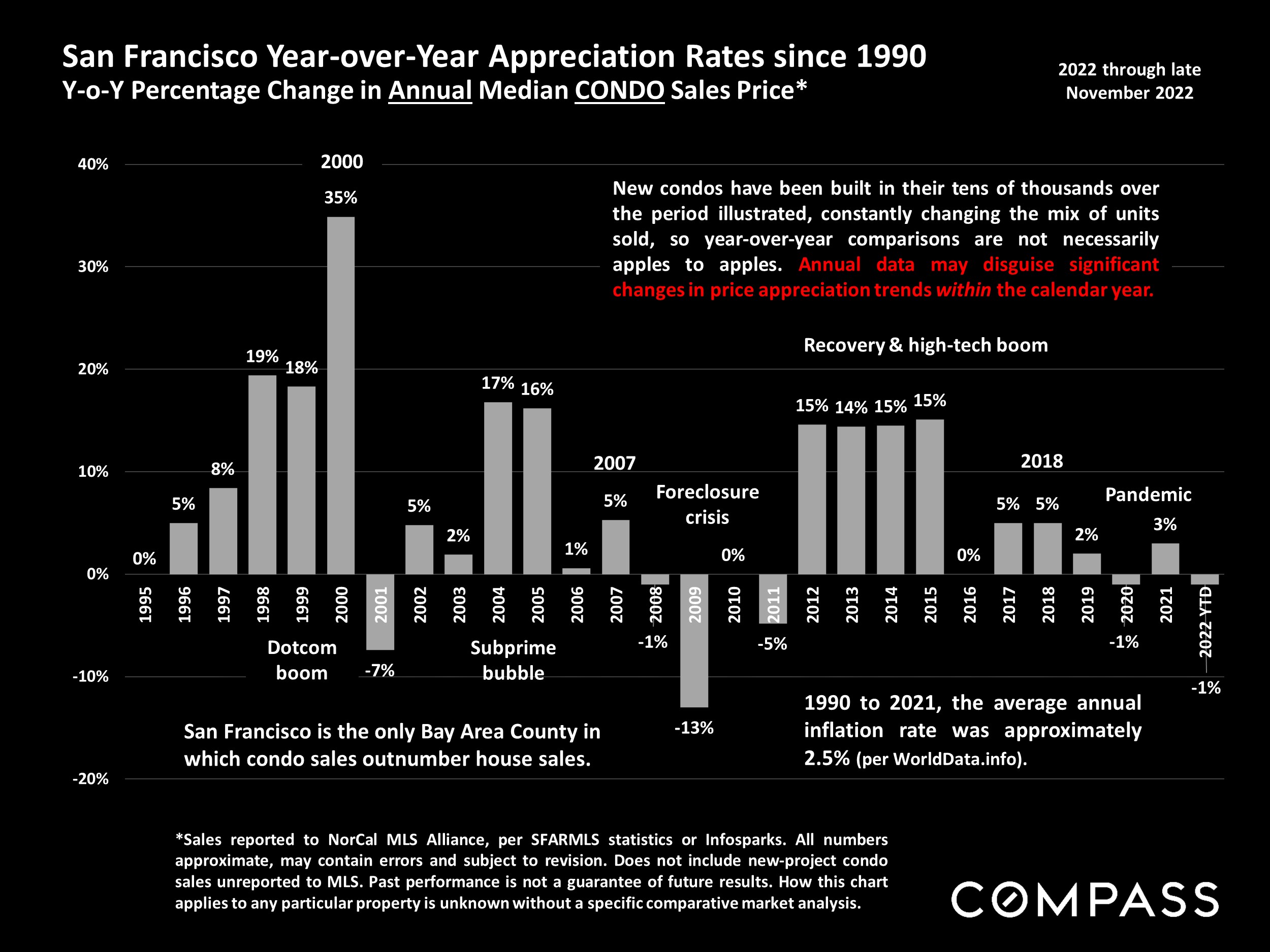

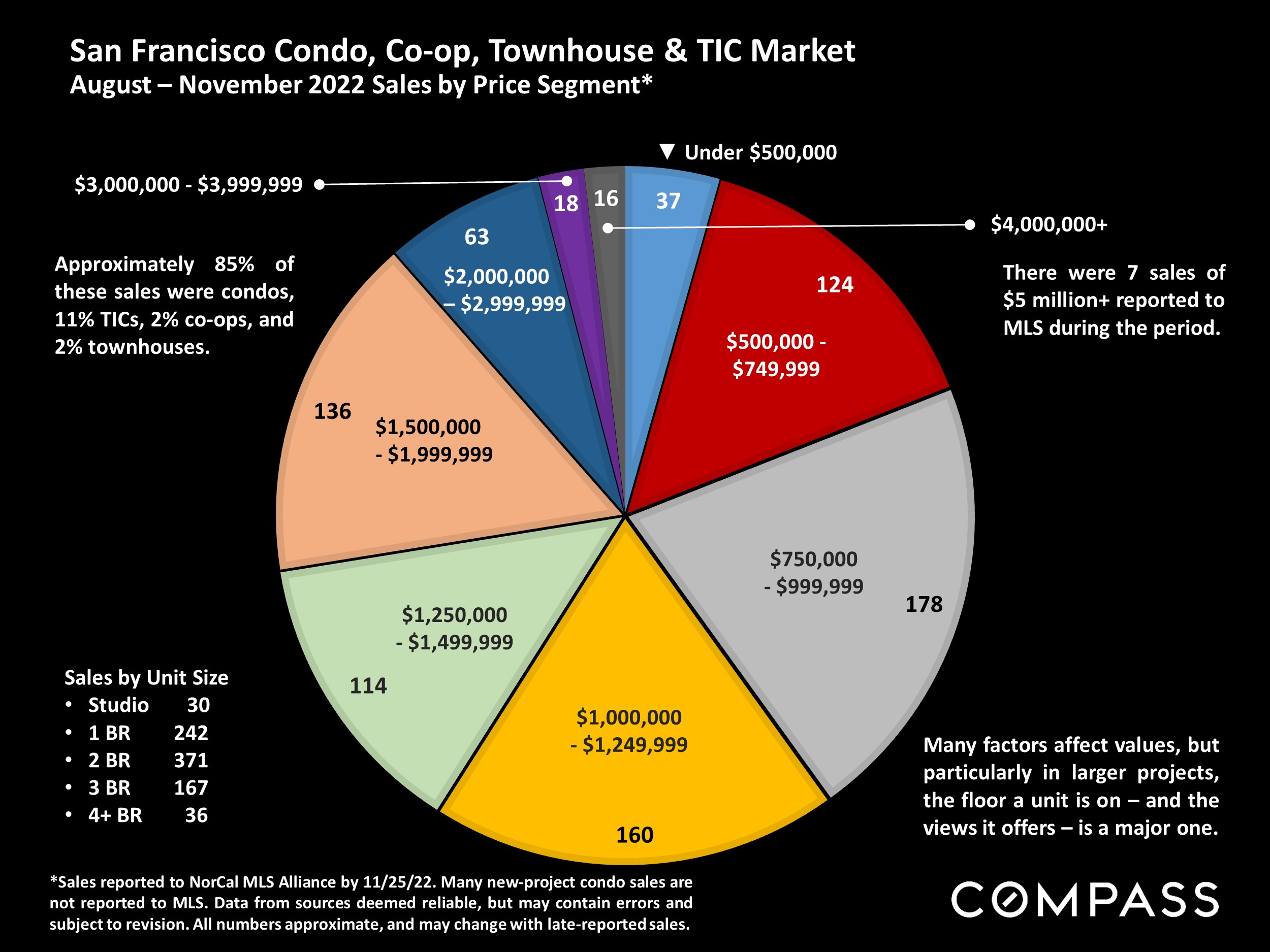

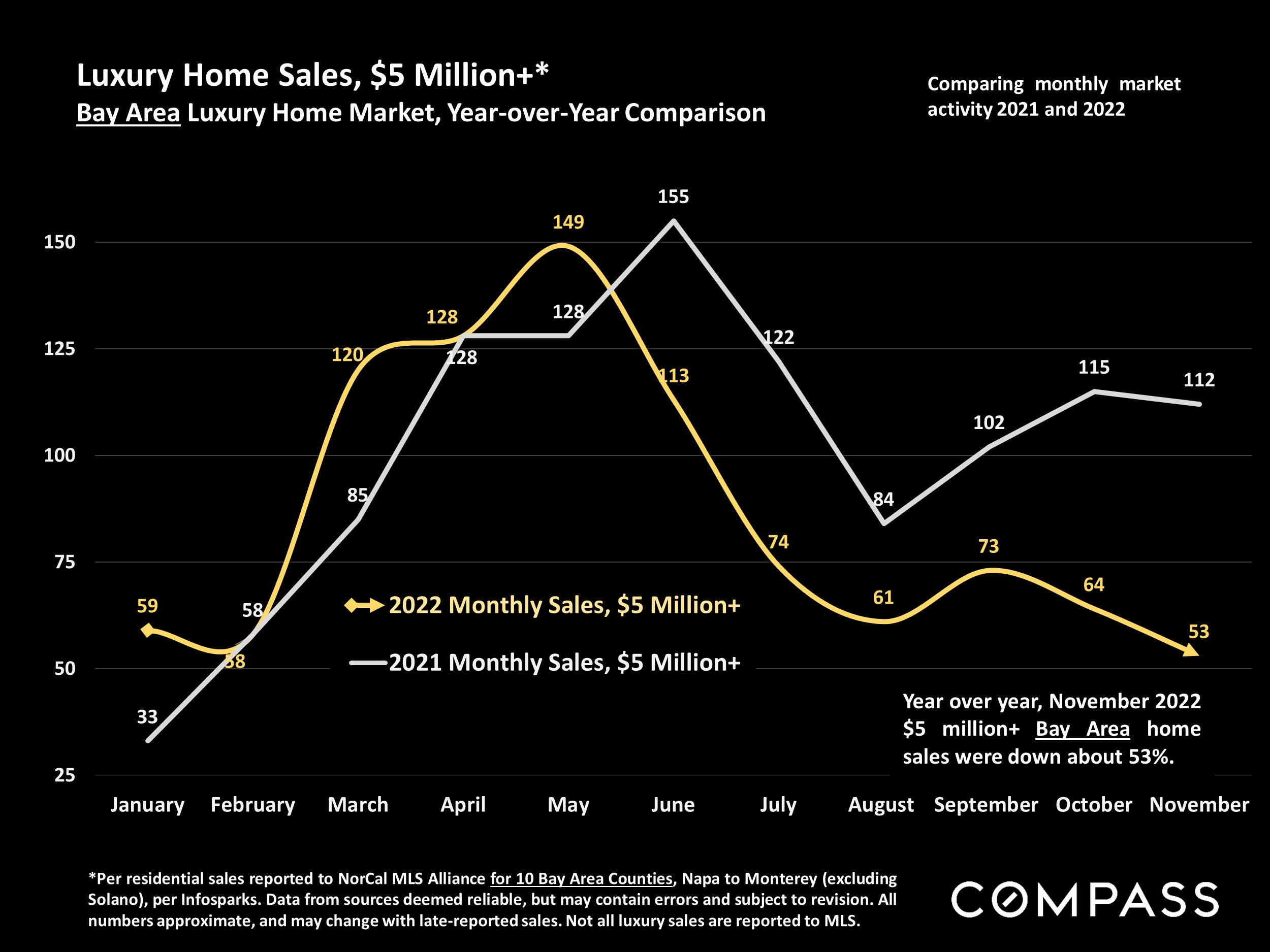

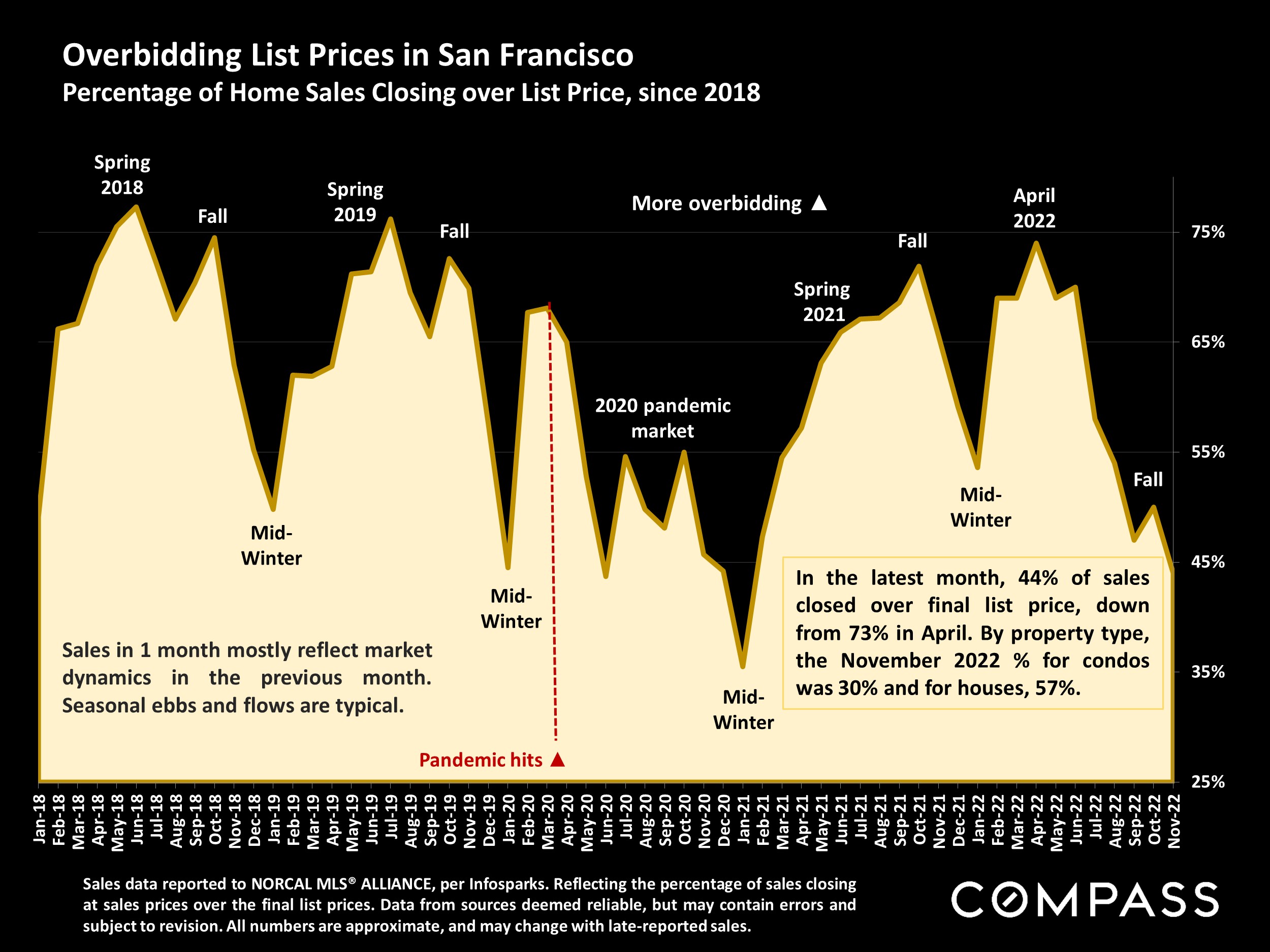

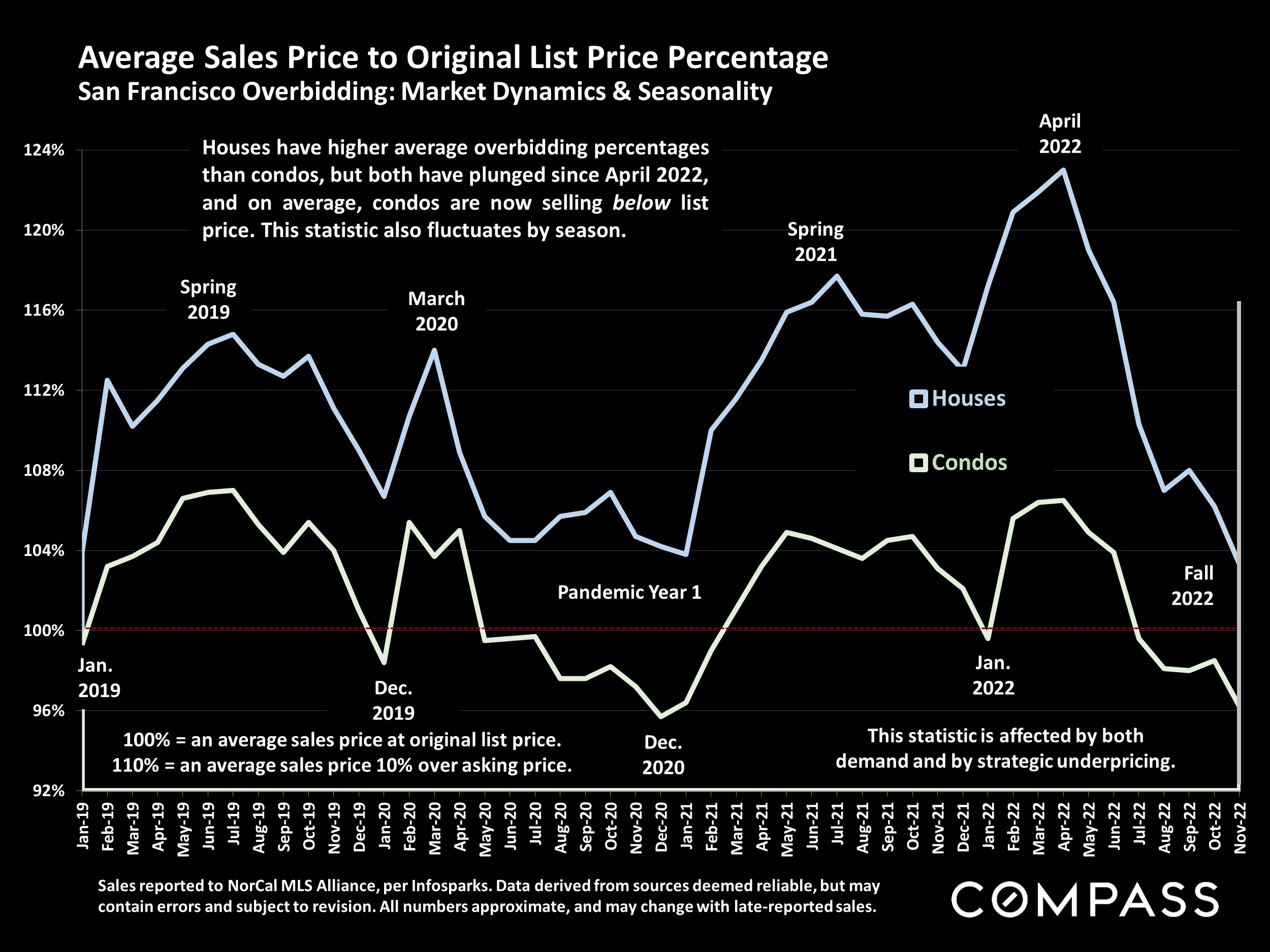

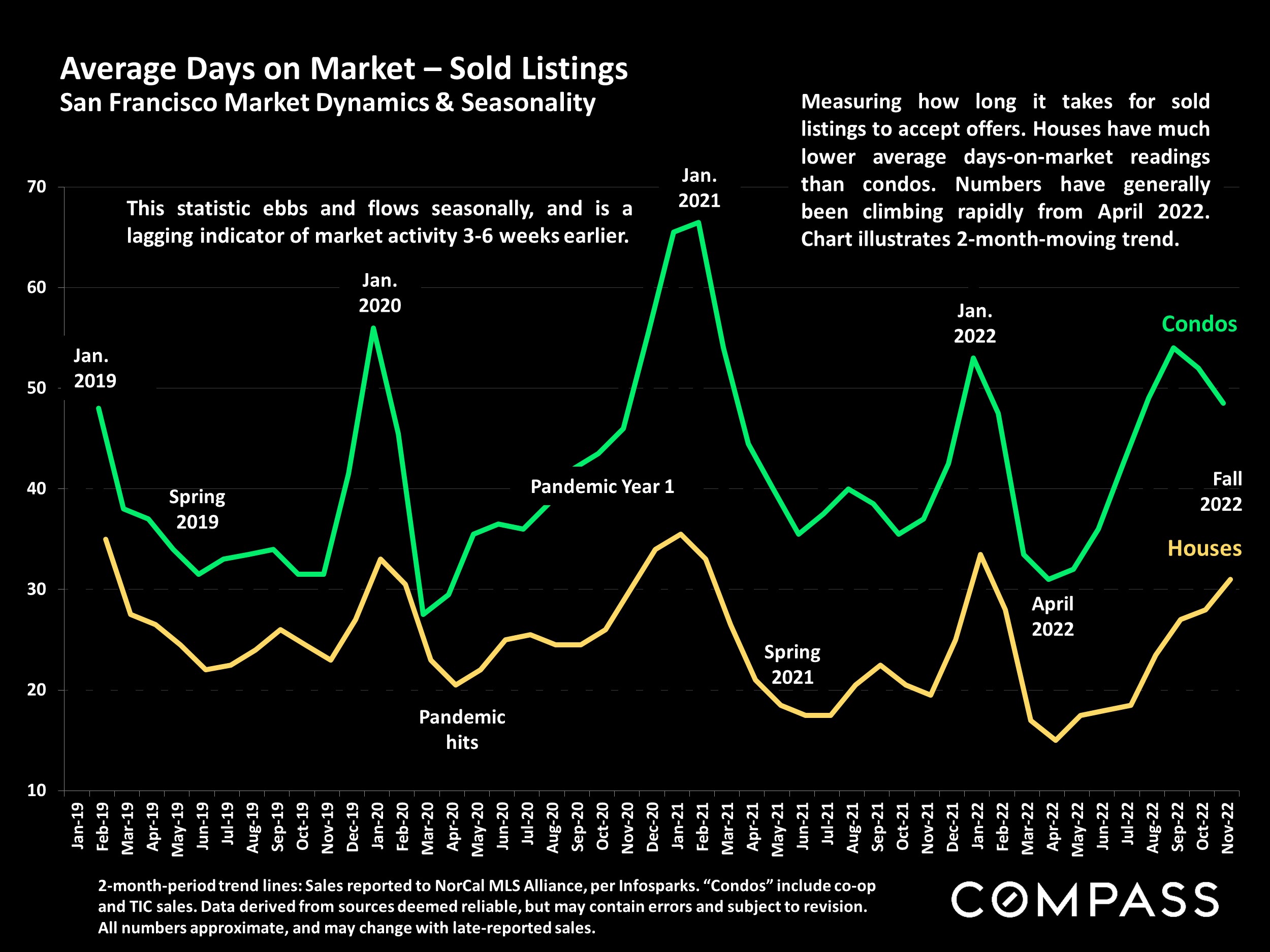

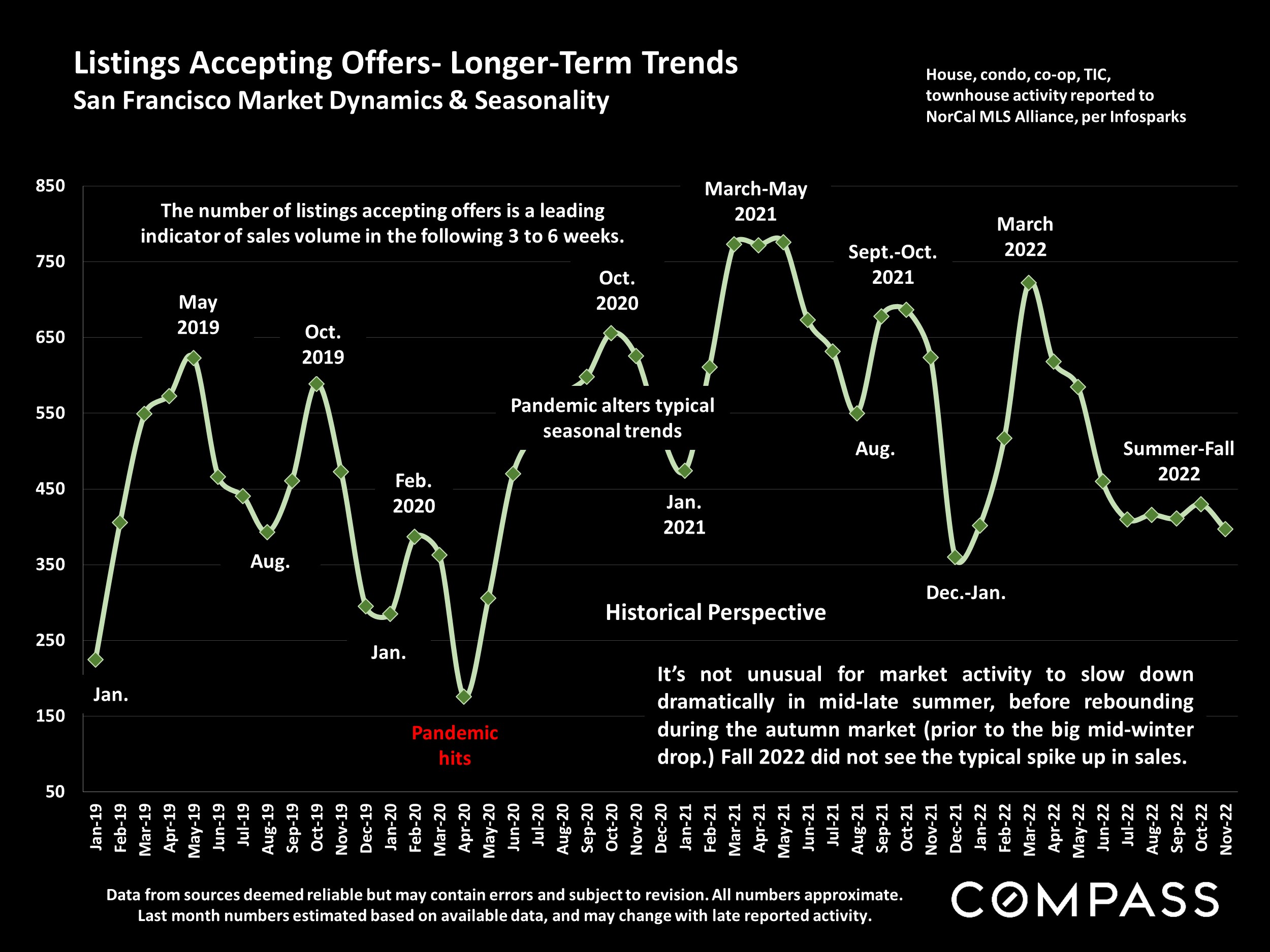

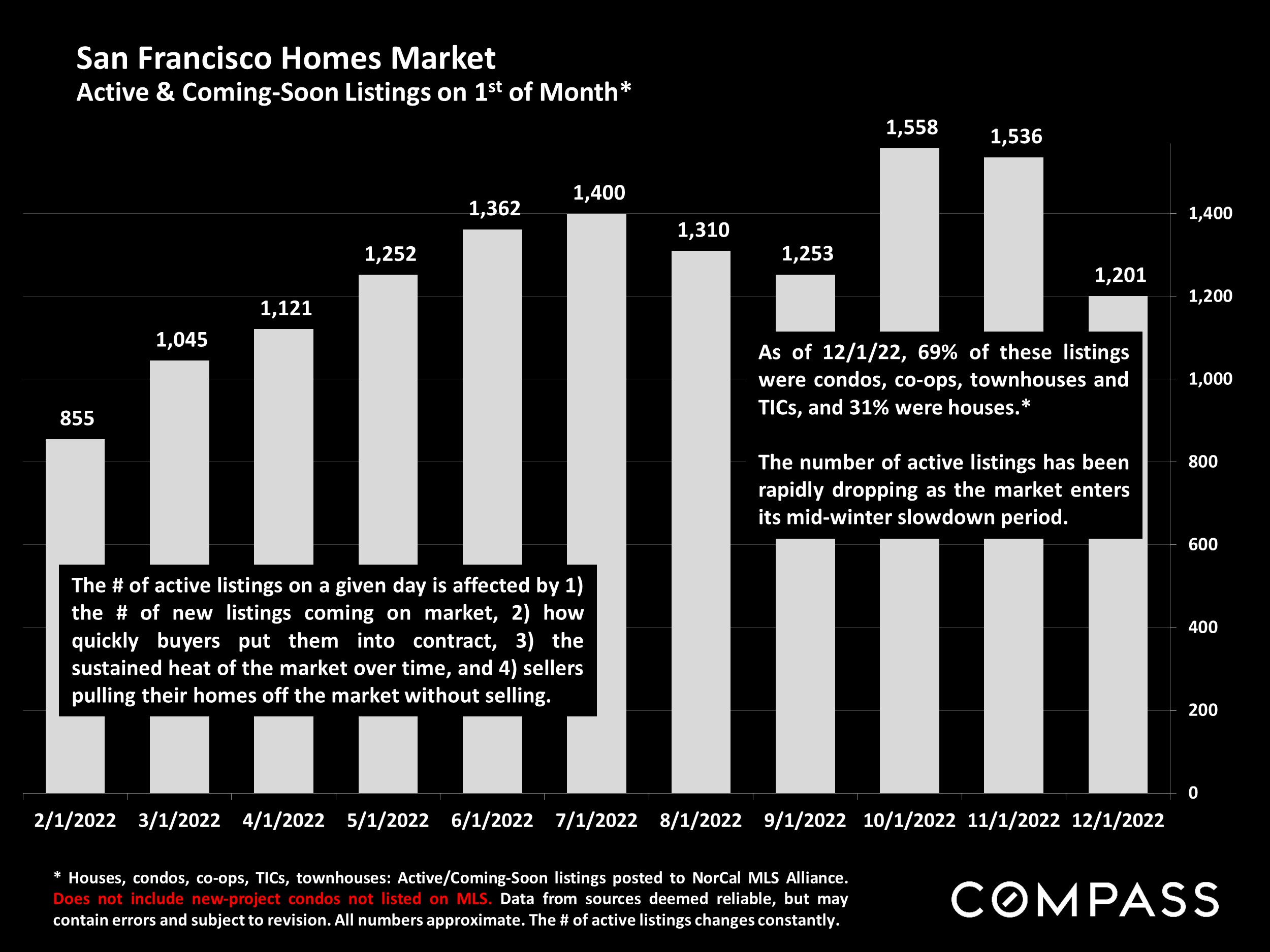

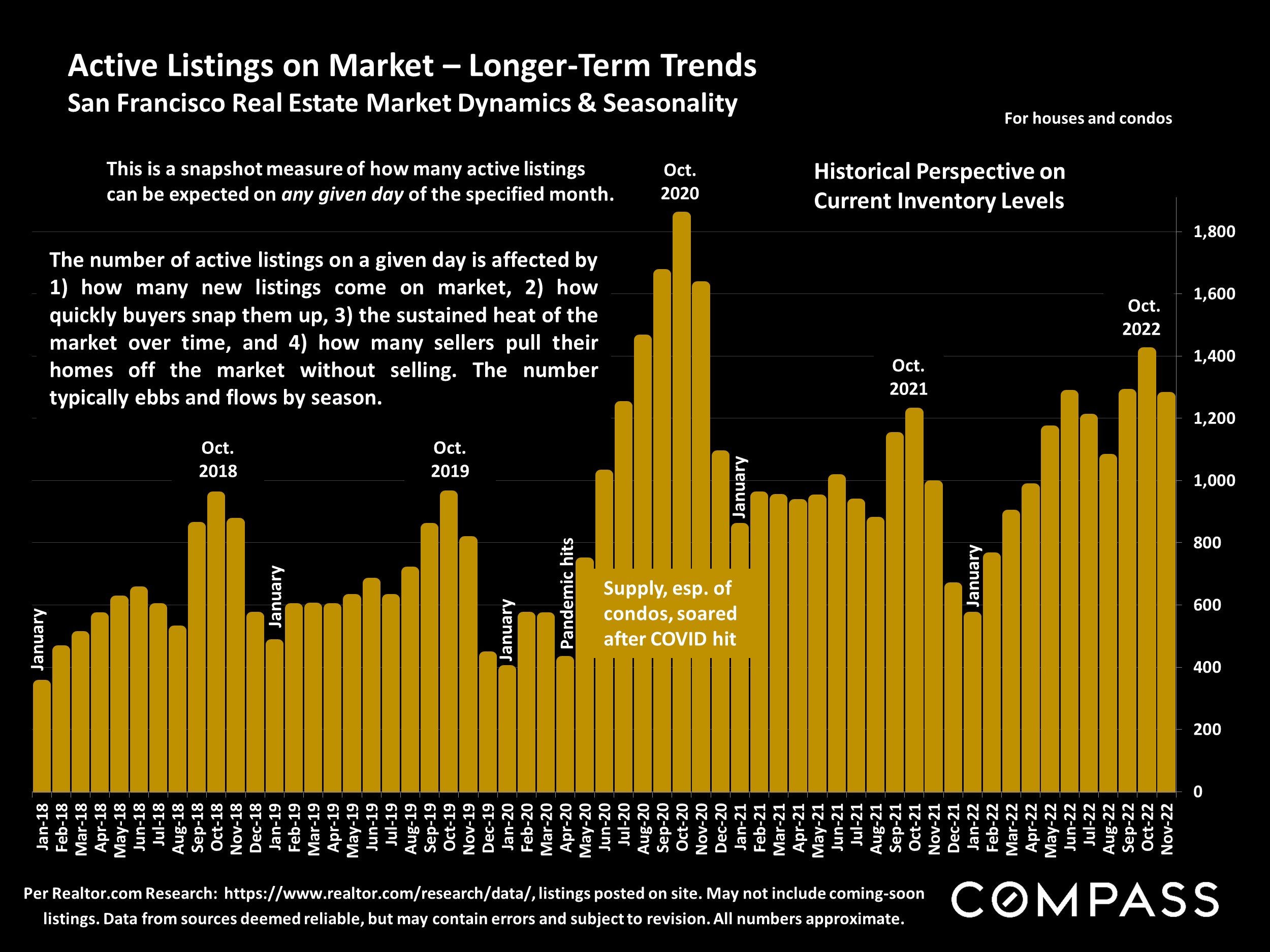

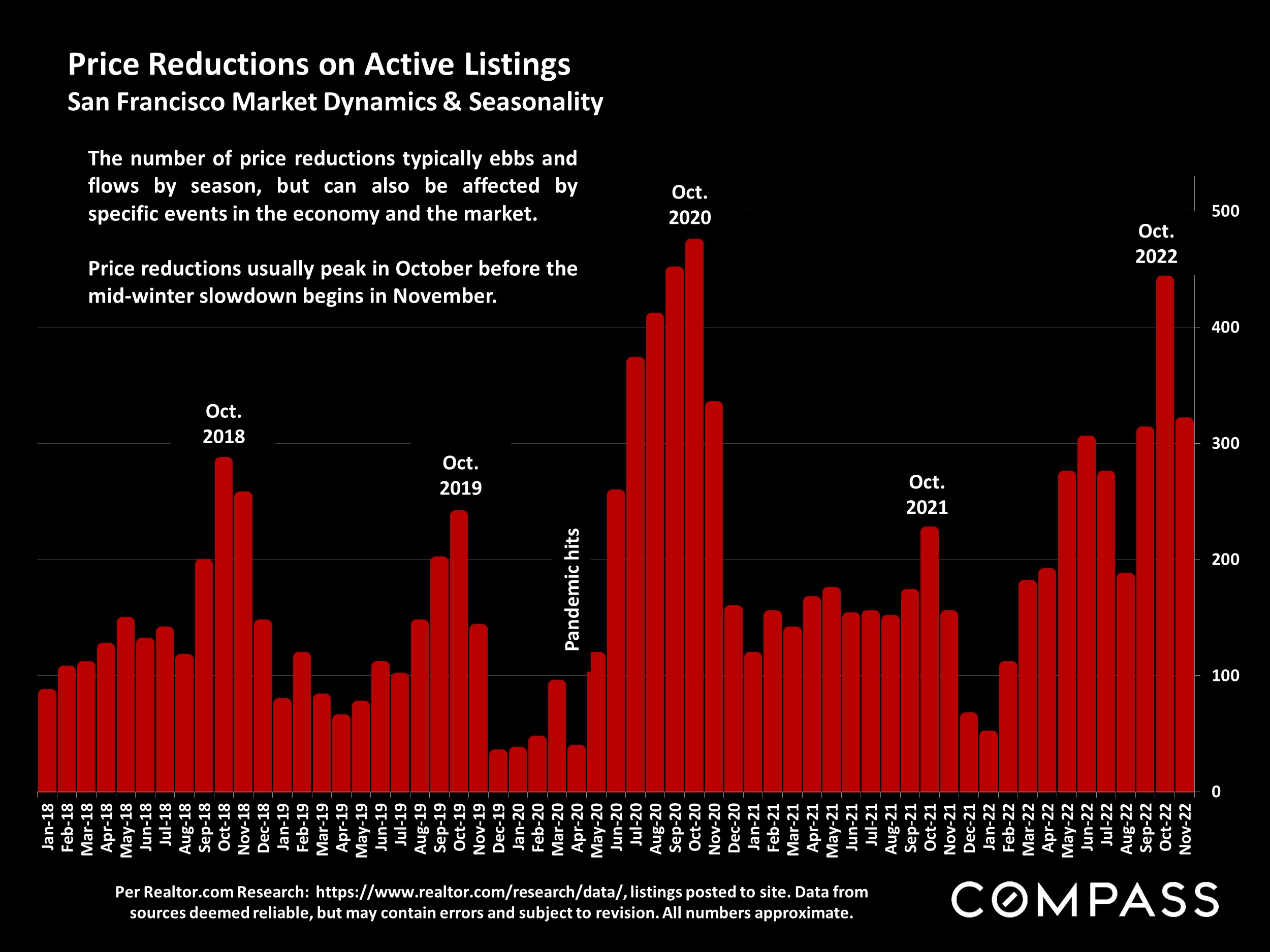

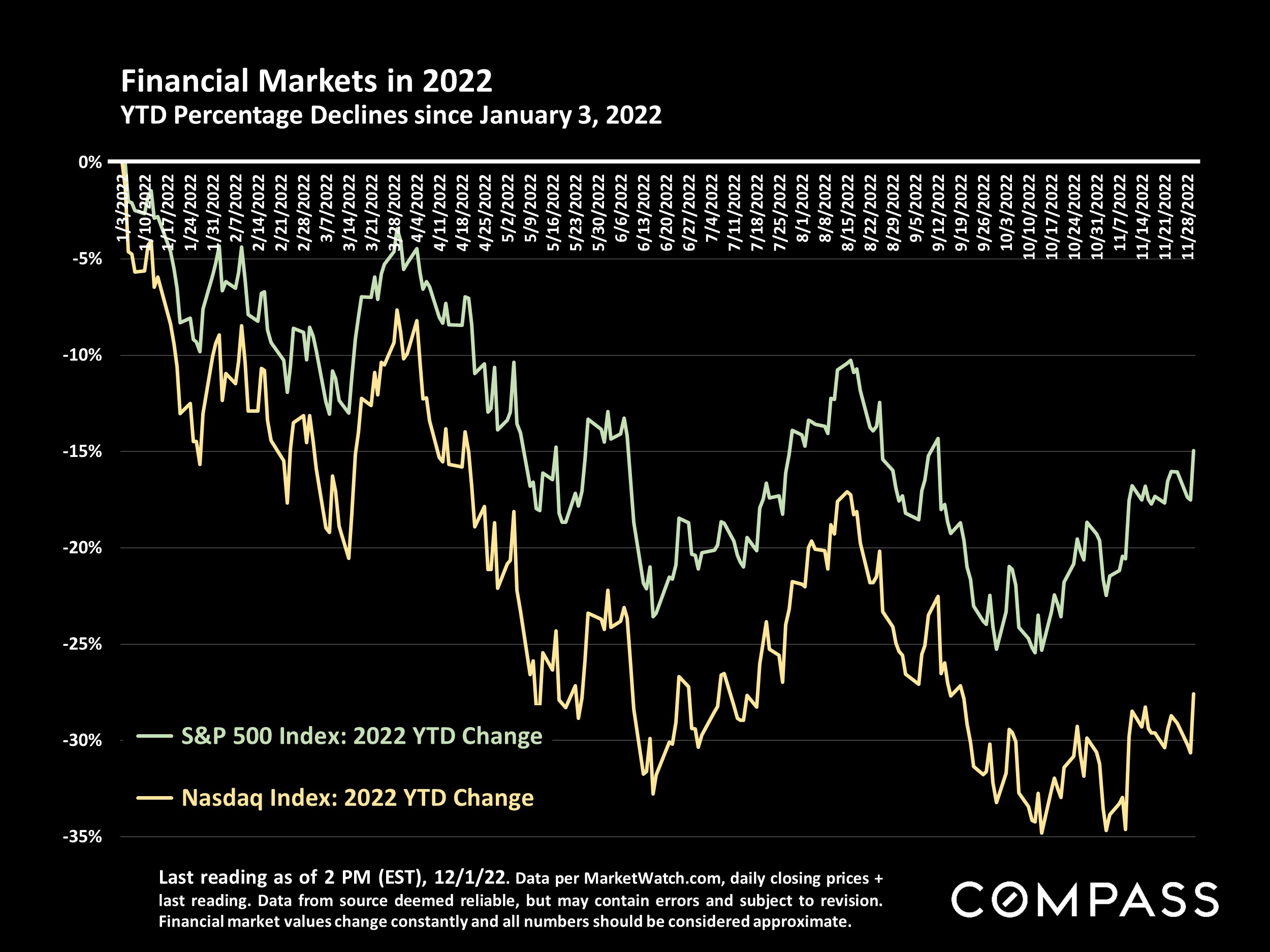

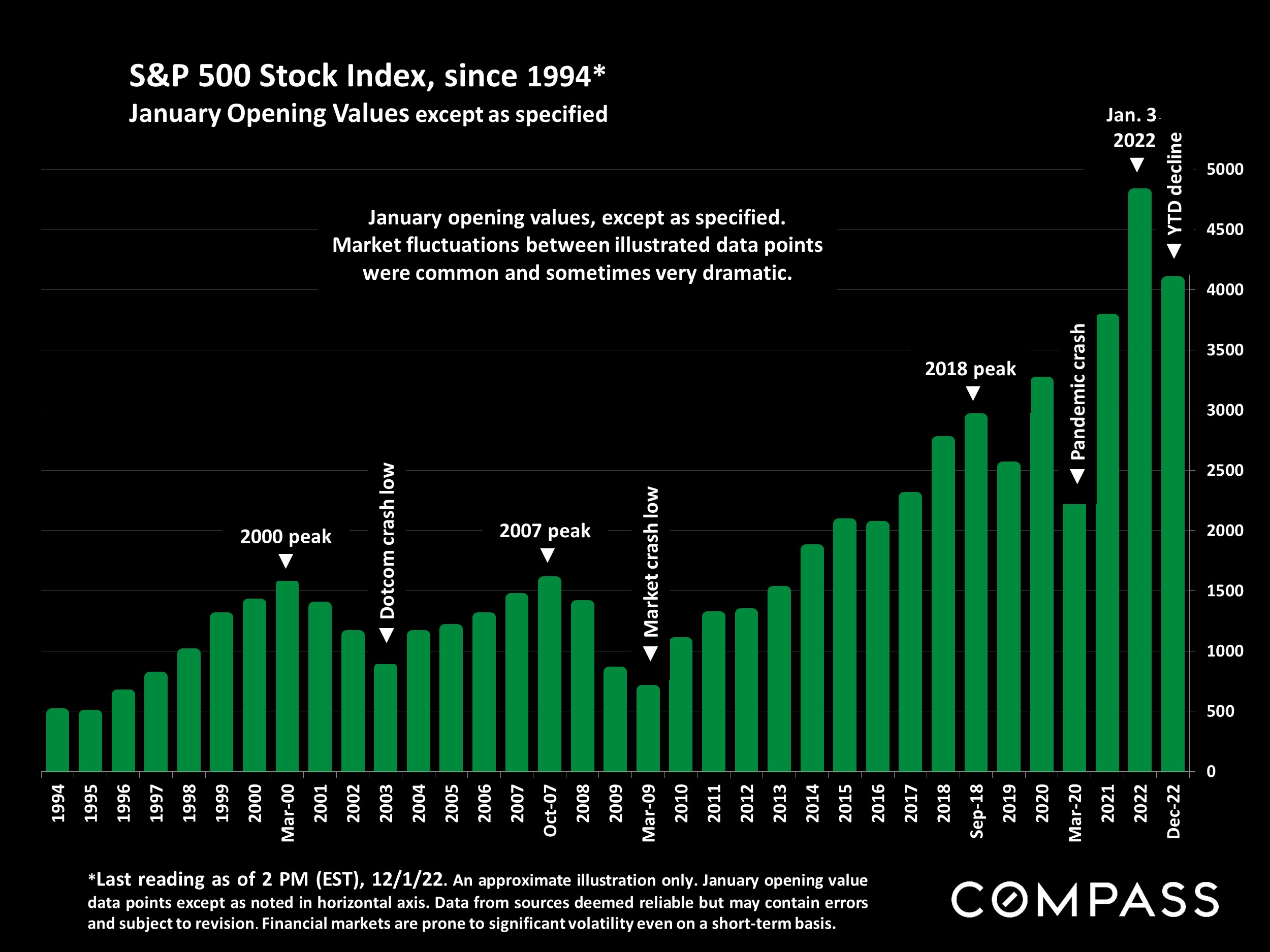

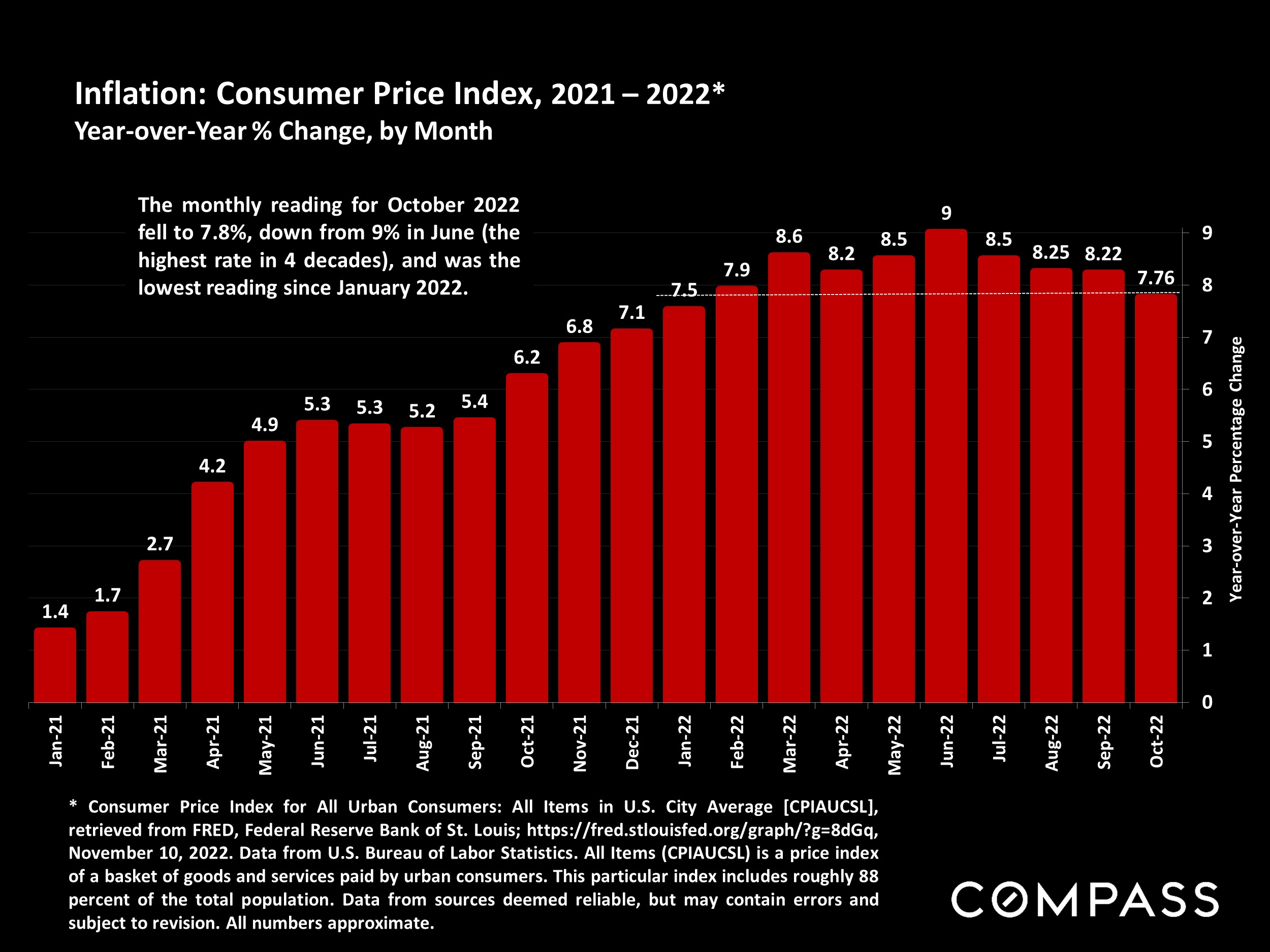

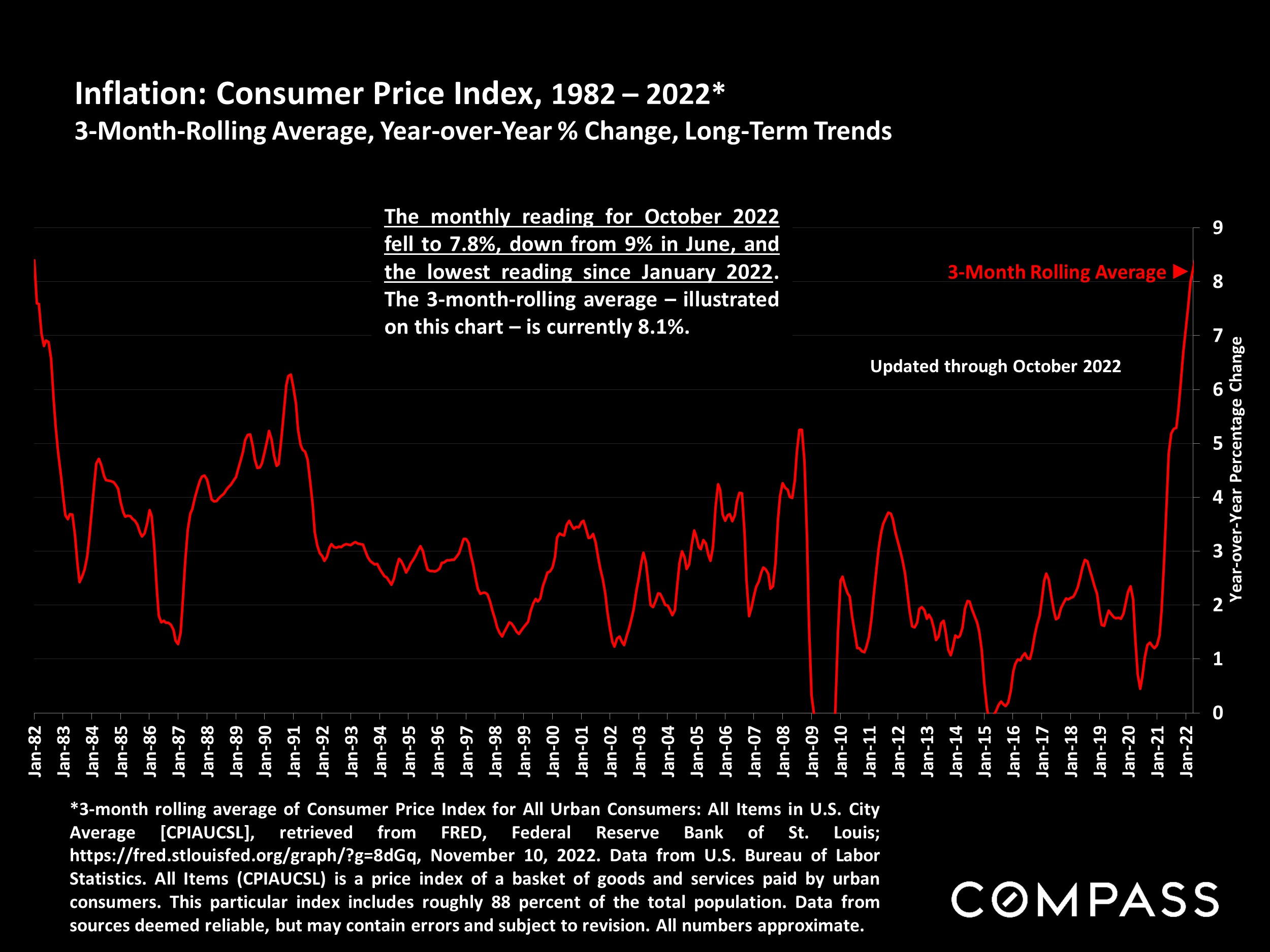

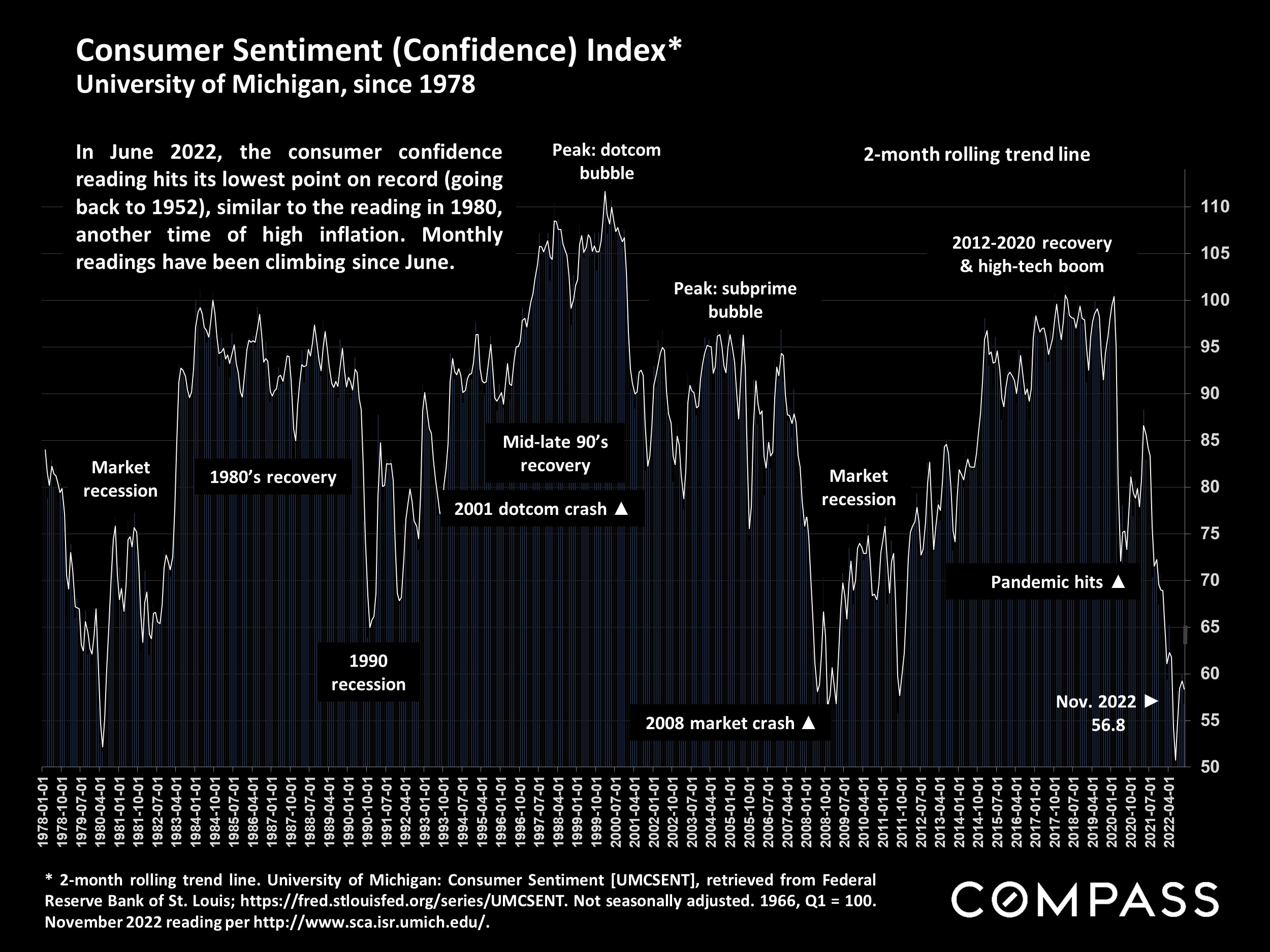

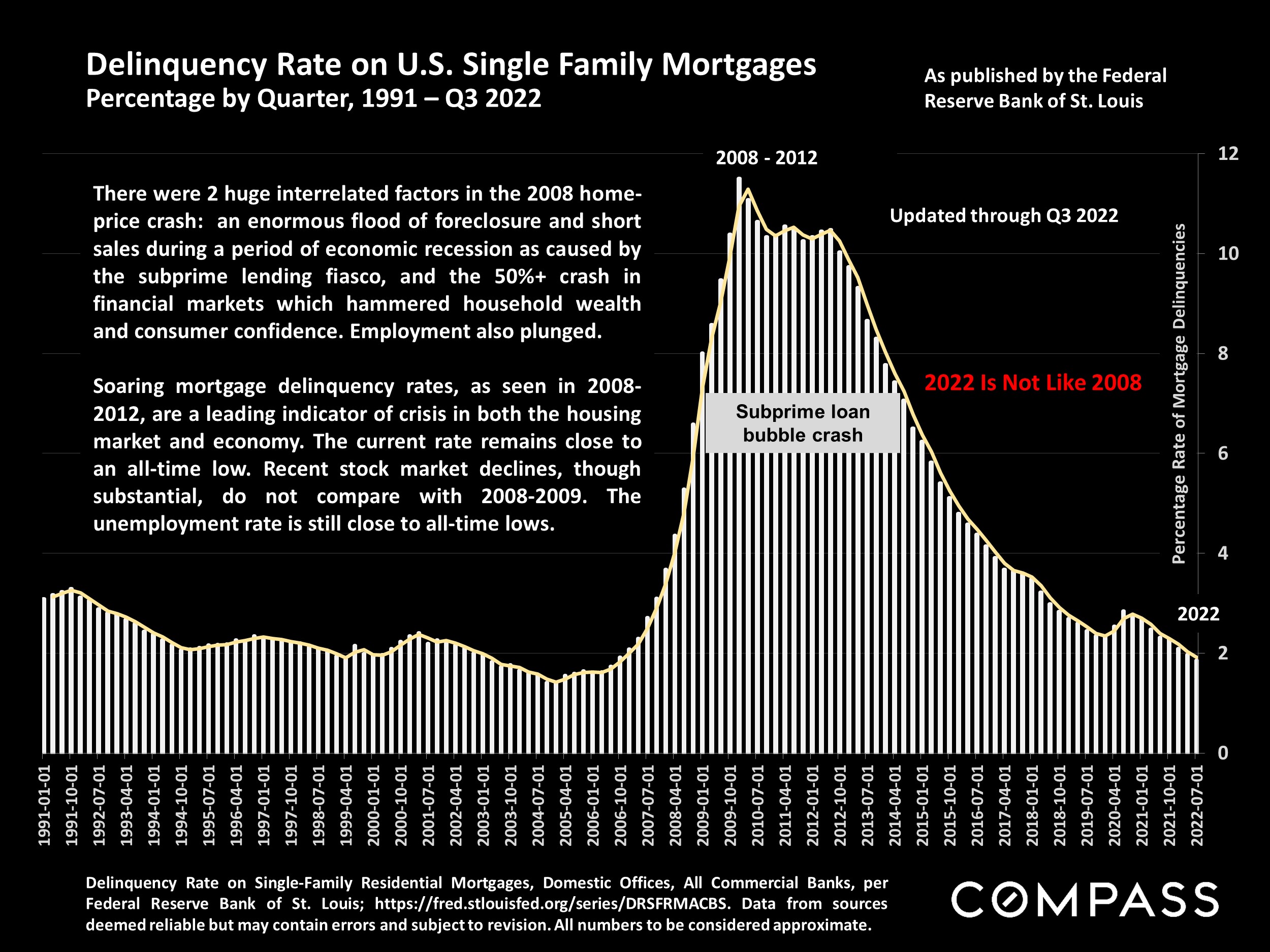

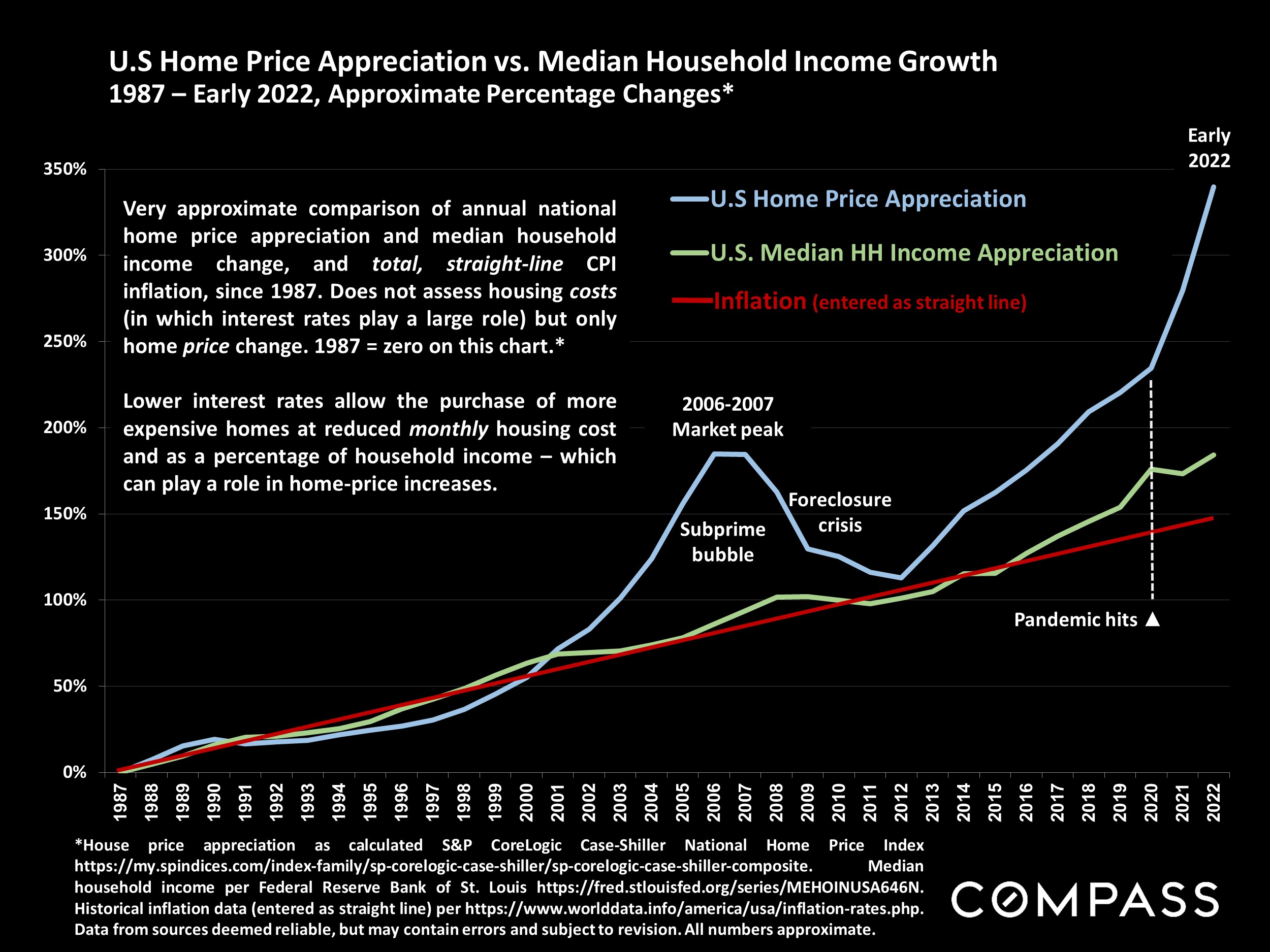

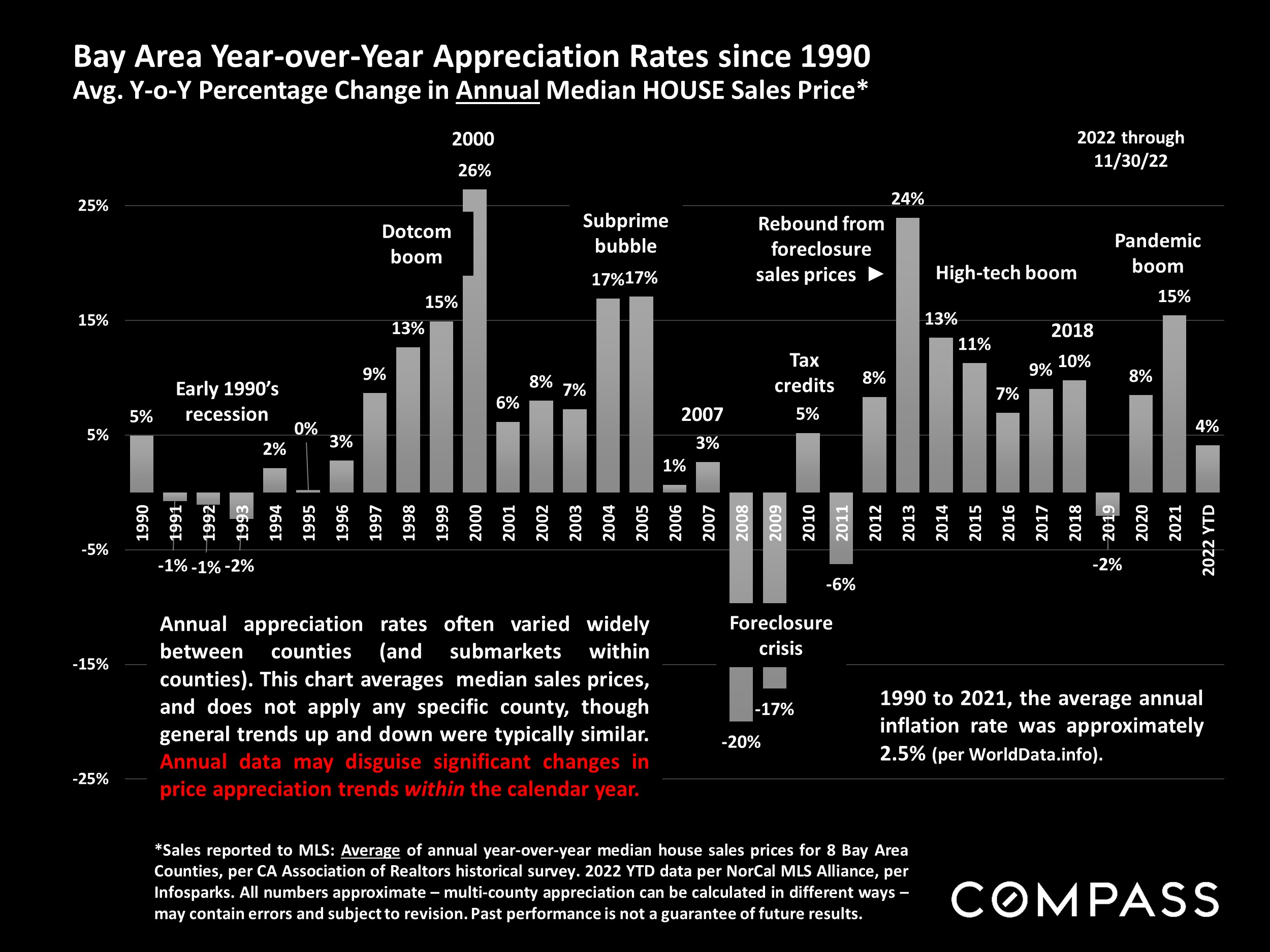

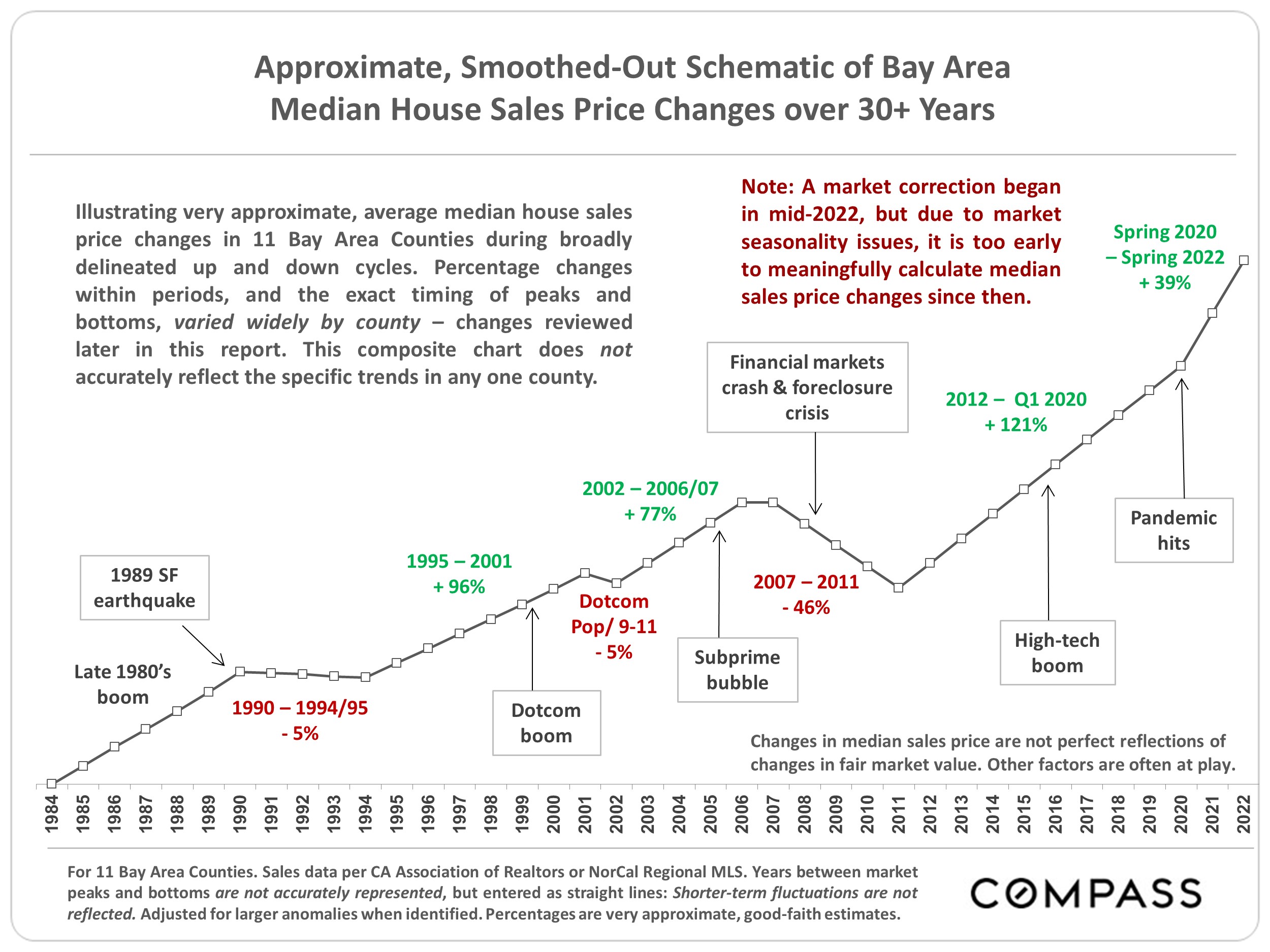

The changes in market dynamics that began in late spring/early summer 2022 generally continued in autumn due to the ongoing economic headwinds, including high inflation and interest rates, reduced consumer confidence, and volatile stock markets, though all have fluctuated significantly over the period, and some readings have recently improved. The great majority of indicators – home prices and appreciation rates, sales volumes, overbidding, days-on-market, months supply of inventory, and so on – continue to describe a market that has substantially cooled and “corrected” since spring 2022, when it appears that a long, dramatic, 10-year market upcycle peaked. (Note that a “correction” is not remotely similar to a crash, such as was seen during the subprime loan/foreclosure crisis.) In recent months, luxury home sales have seen larger year-over-year percentage declines than the general market. But thousands of Bay Area homes continue to sell, some very quickly at over asking price: With the shifts in market conditions, pricing correctly has become an imperative for sellers.

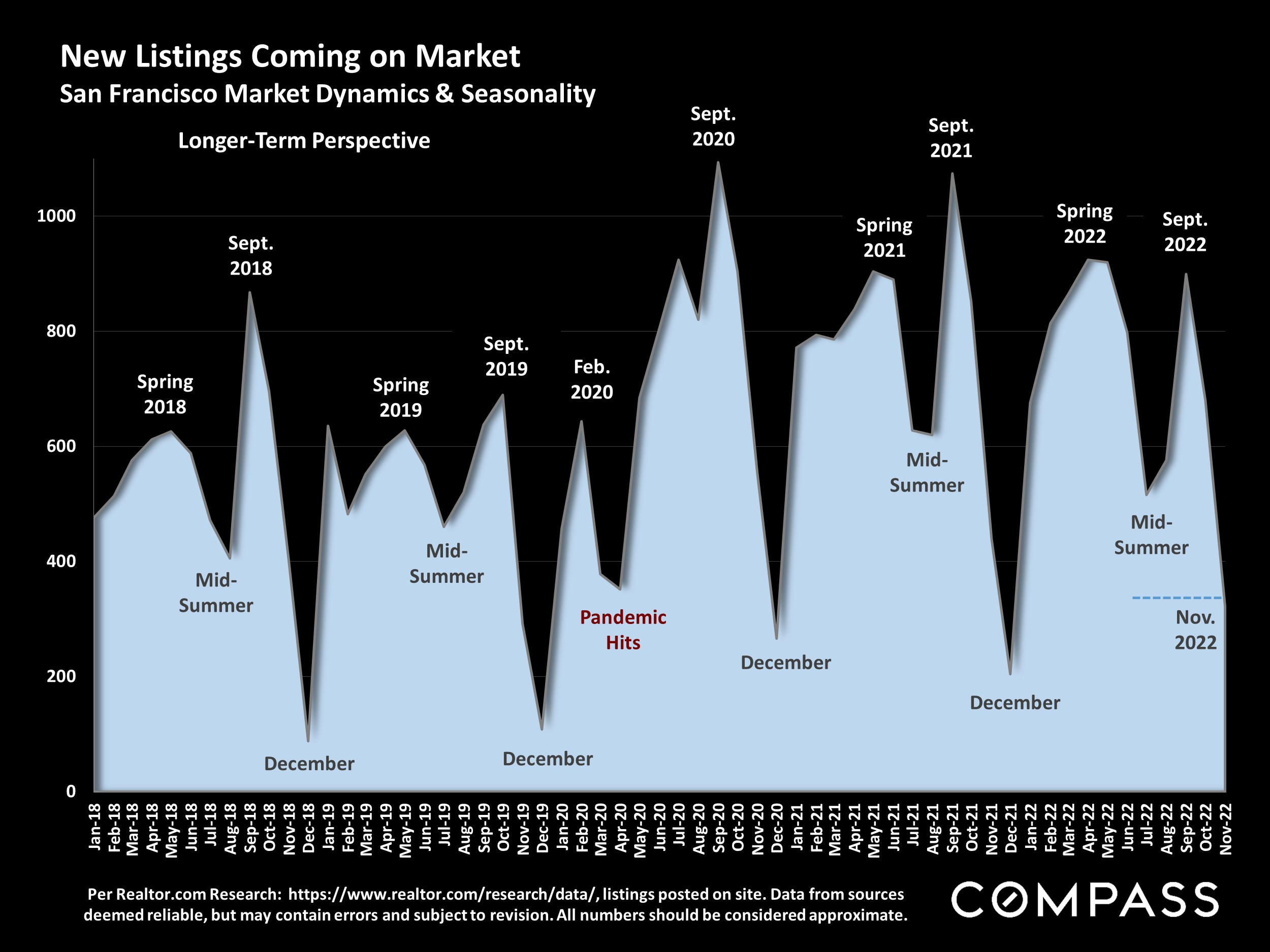

December typically sees the low point of new-listing and sales activity – with an increasing number of homes taken off the market to await the new year – but listing, buying and selling continues. This can be an excellent time for buyers to aggressively negotiate prices, though the supply of listings to choose from declines. The market usually begins to wake up in mid-January and then quickly accelerates in early spring: In the Bay Area, depending on the weather and economic conditions, the “early spring” market can begin as soon as February.

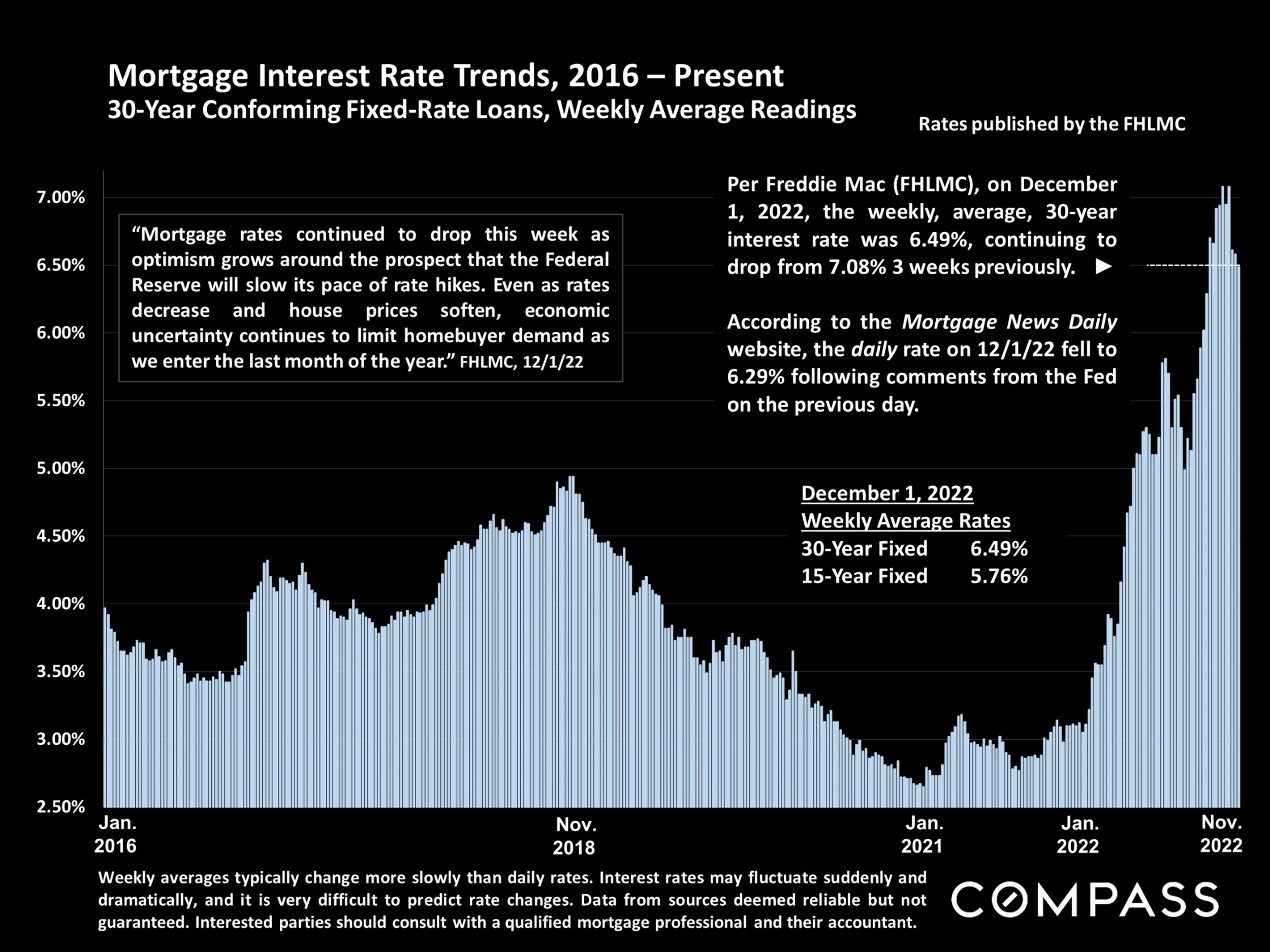

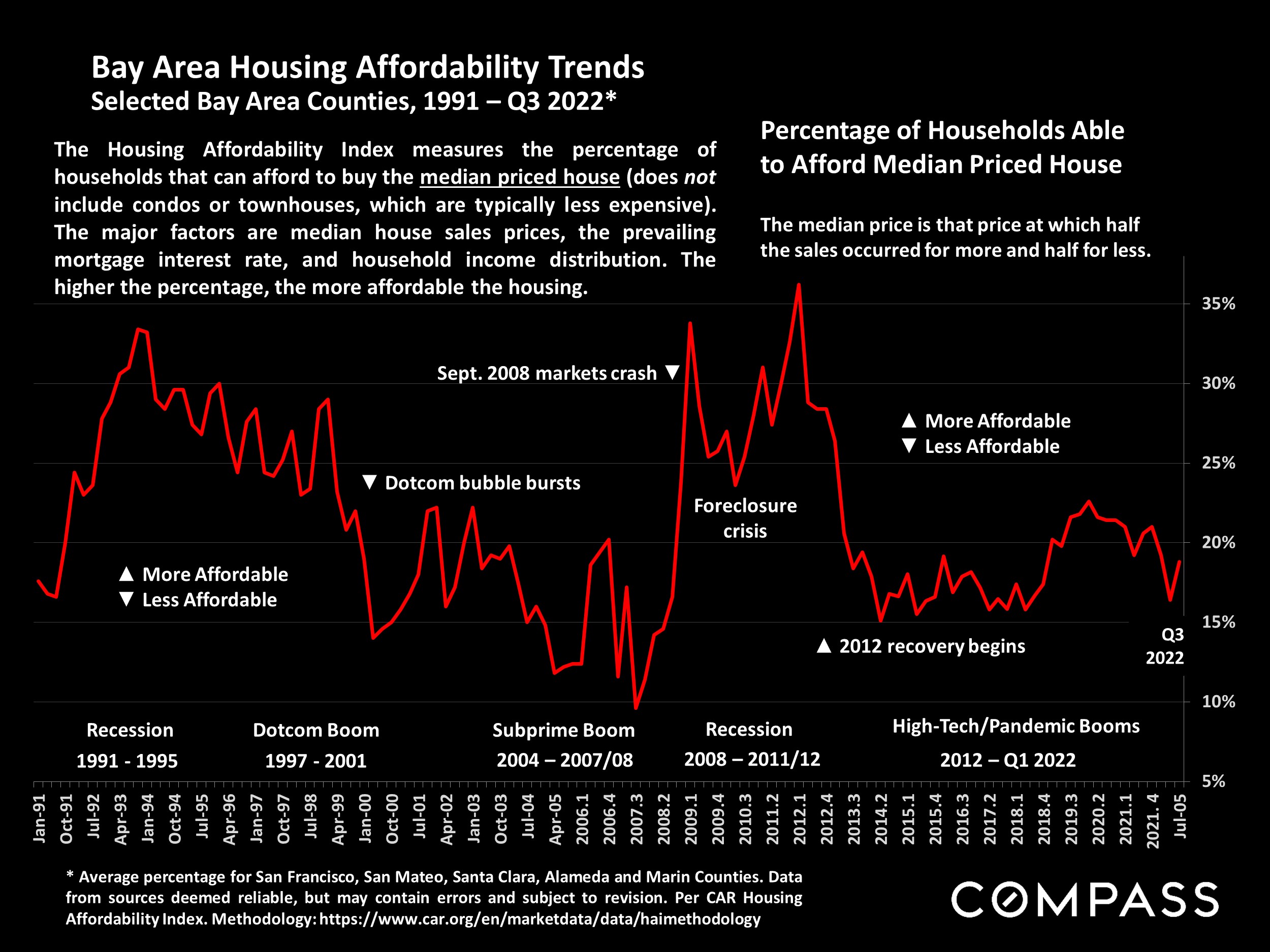

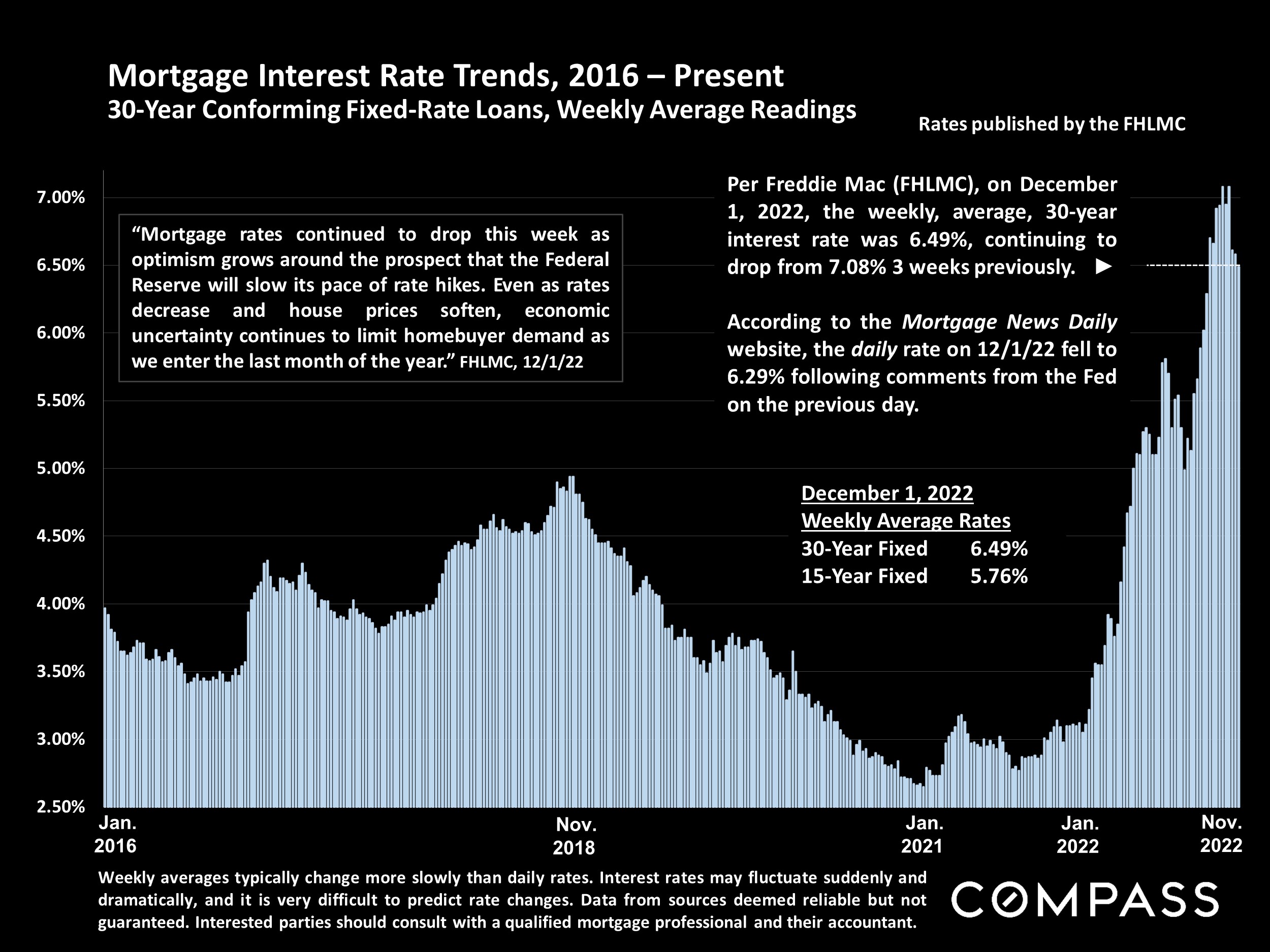

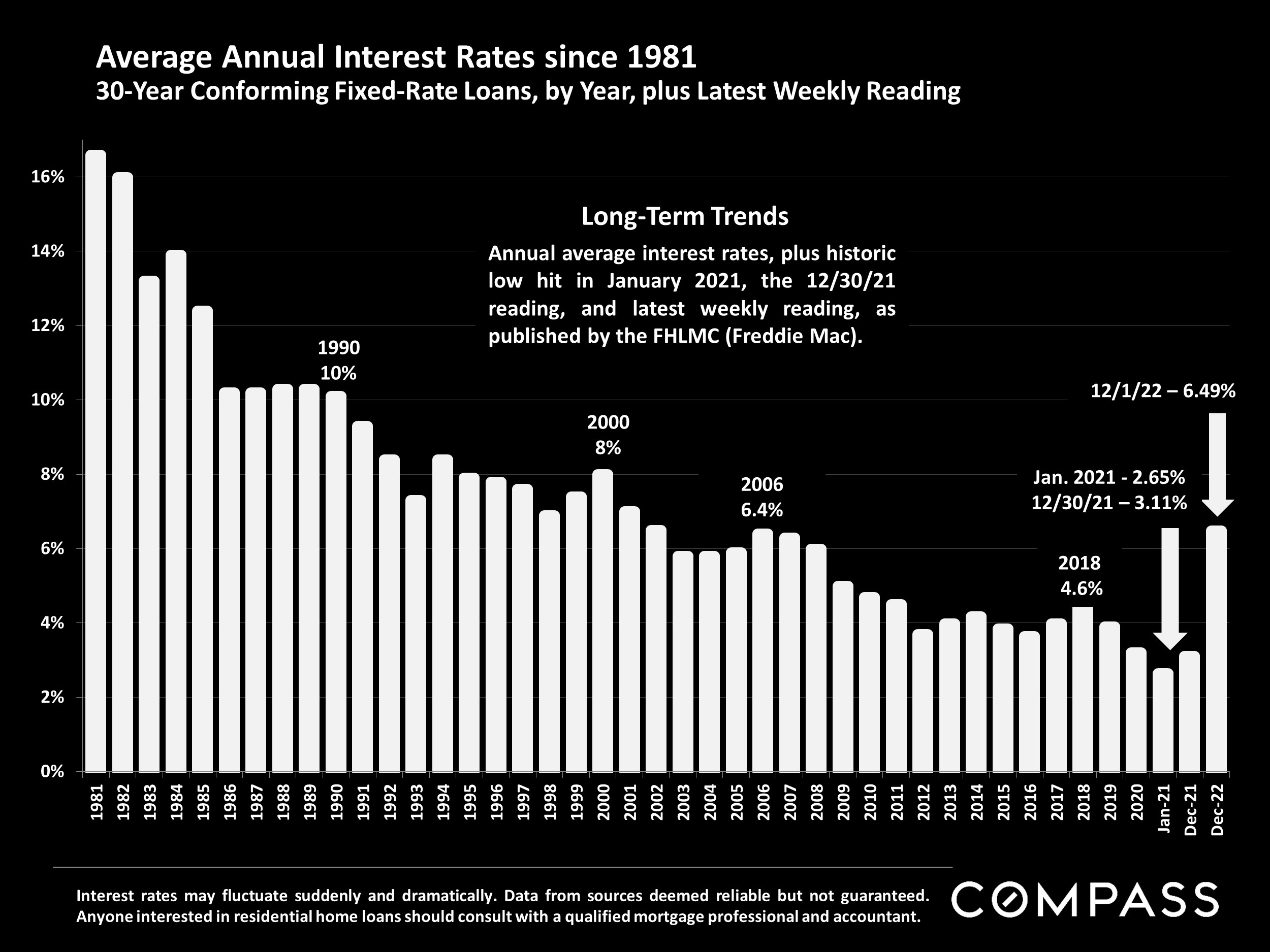

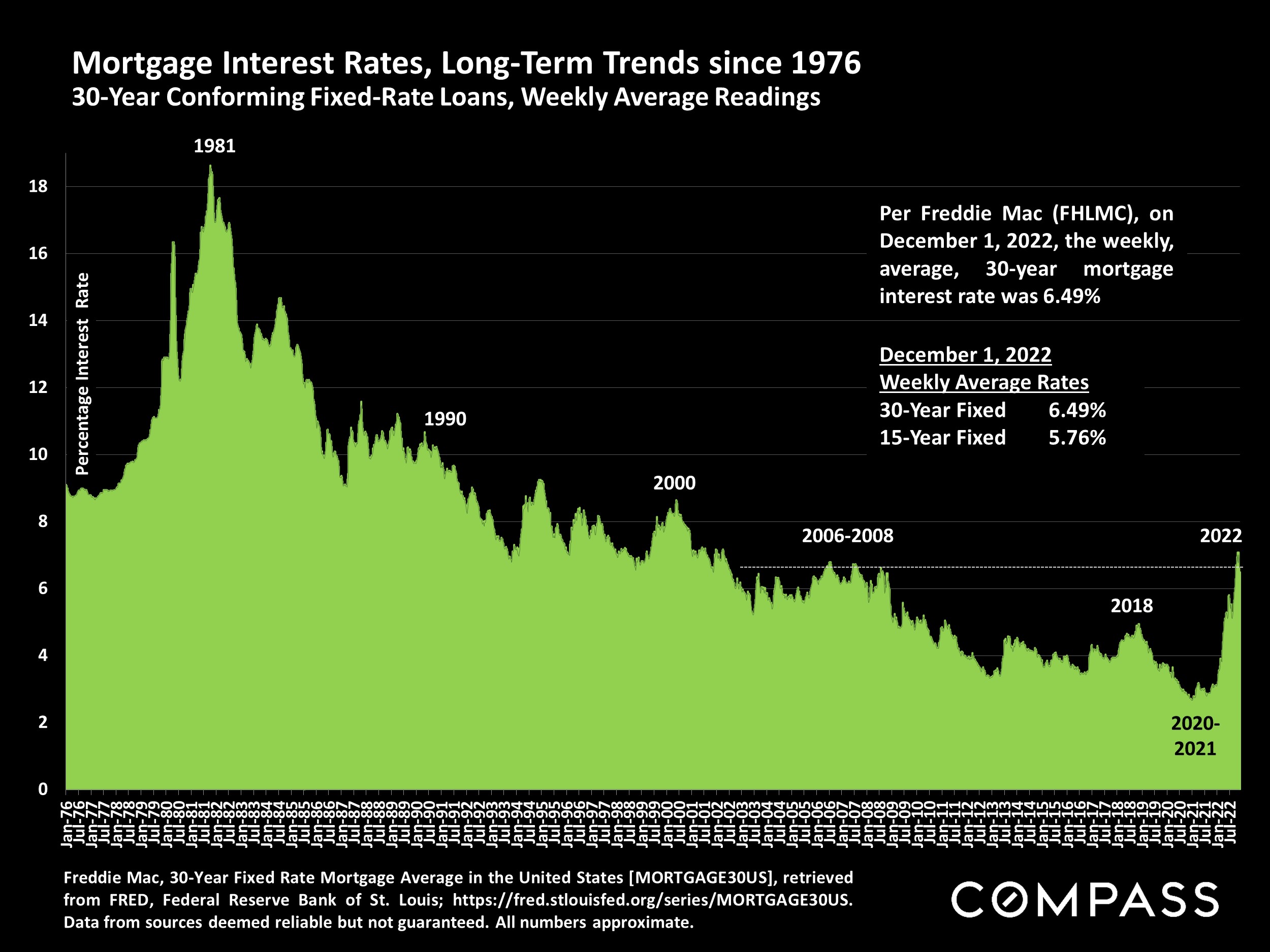

The single, most closely watched factor will be interest rates, since they have such an outsized impact on monthly housing costs and affordability, as well as on stock markets and consumer confidence. At the end of this report is a link to our extended review of macroeconomic issues.

Our reports are not intended to convince you regarding a course of action or to predict the future, but to provide, to the best of our ability, straightforward information and good-faith analysis to assist you in making your own informed decisions. Statistics should be considered very general indicators, and all numbers should be considered approximate. How they apply to any particular property is unknown without a specific comparative market analysis.

Source: Compass

It is impossible to know how median and average value statistics apply to any particular home without a specific comparative market analysis. These analyses were made in good faith with data from sources deemed reliable, but may contain errors and are subject to revision. It is not our intent to convince you of a particular position, but to attempt to provide straightforward data and analysis, so you can make your own informed decisions. Median and average statistics are enormous generalities: There are hundreds of different markets in San Francisco and the Bay Area, each with its own unique dynamics. Median prices and average dollar per square foot values can be and often are affected by other factors besides changes in fair market value. Longer term trends are much more meaningful than short-term.

Compass is a real estate broker licensed by the State of California, DRE 01527235. Equal Housing Opportunity. This report has been prepared solely for information purposes. The information herein is based on or derived from information generally available to the public and/or from sources believed to be reliable. No representation or warranty can be given with respect to the accuracy or completeness of the information. Compass disclaims any and all liability relating to this report, including without limitation any express or implied representations or warranties for statements contained in, and omissions from, the report. Nothing contained herein is intended to be or should be read as any regulatory, legal, tax, accounting or other advice and Compass does not provide such advice. All opinions are subject to change without notice. Compass makes no representation regarding the accuracy of any statements regarding any references to the laws, statutes or regulations of any state are those of the author(s). Past performance is no guarantee of future results.

Bay Area Real Estate, December 2022

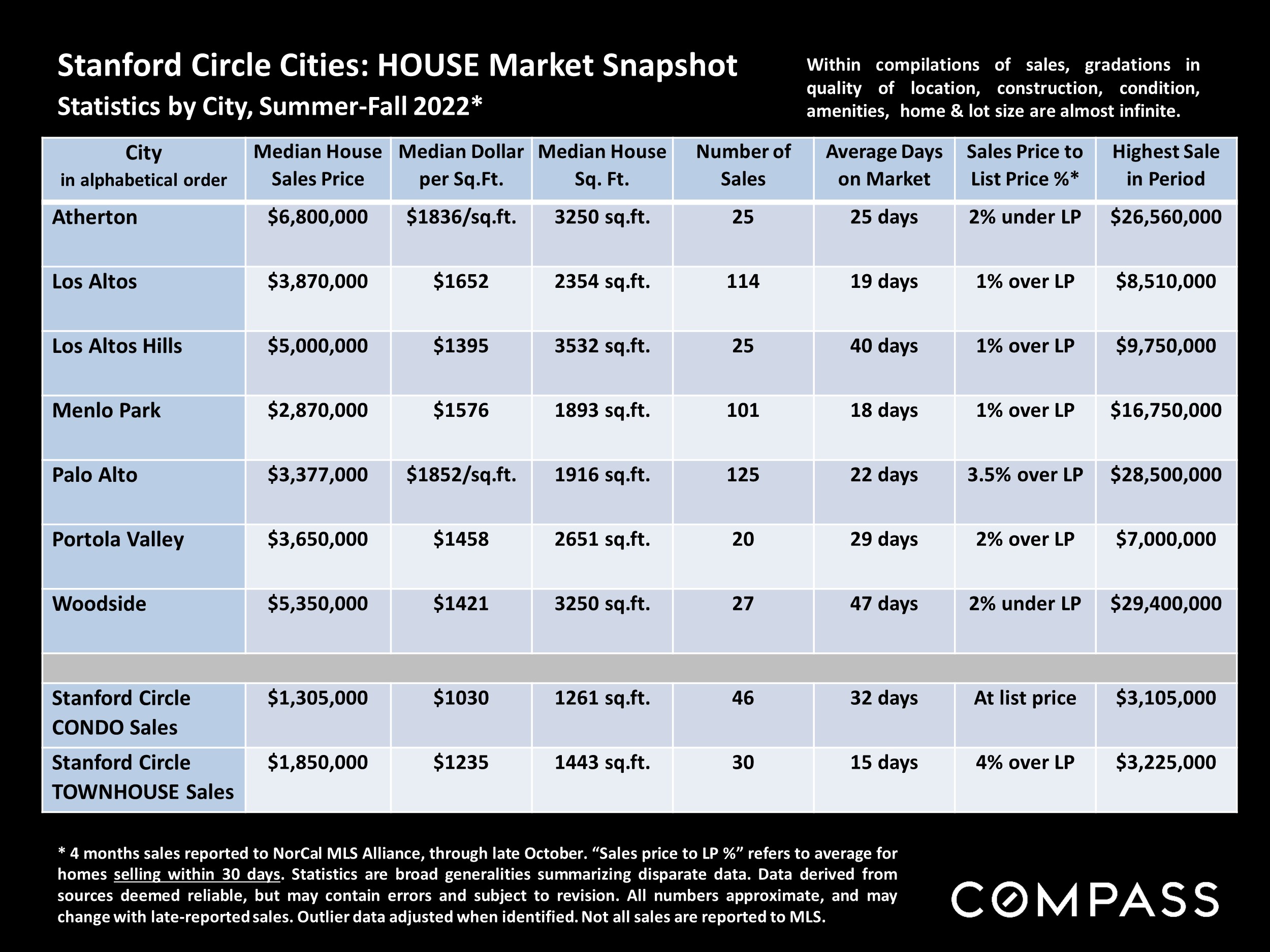

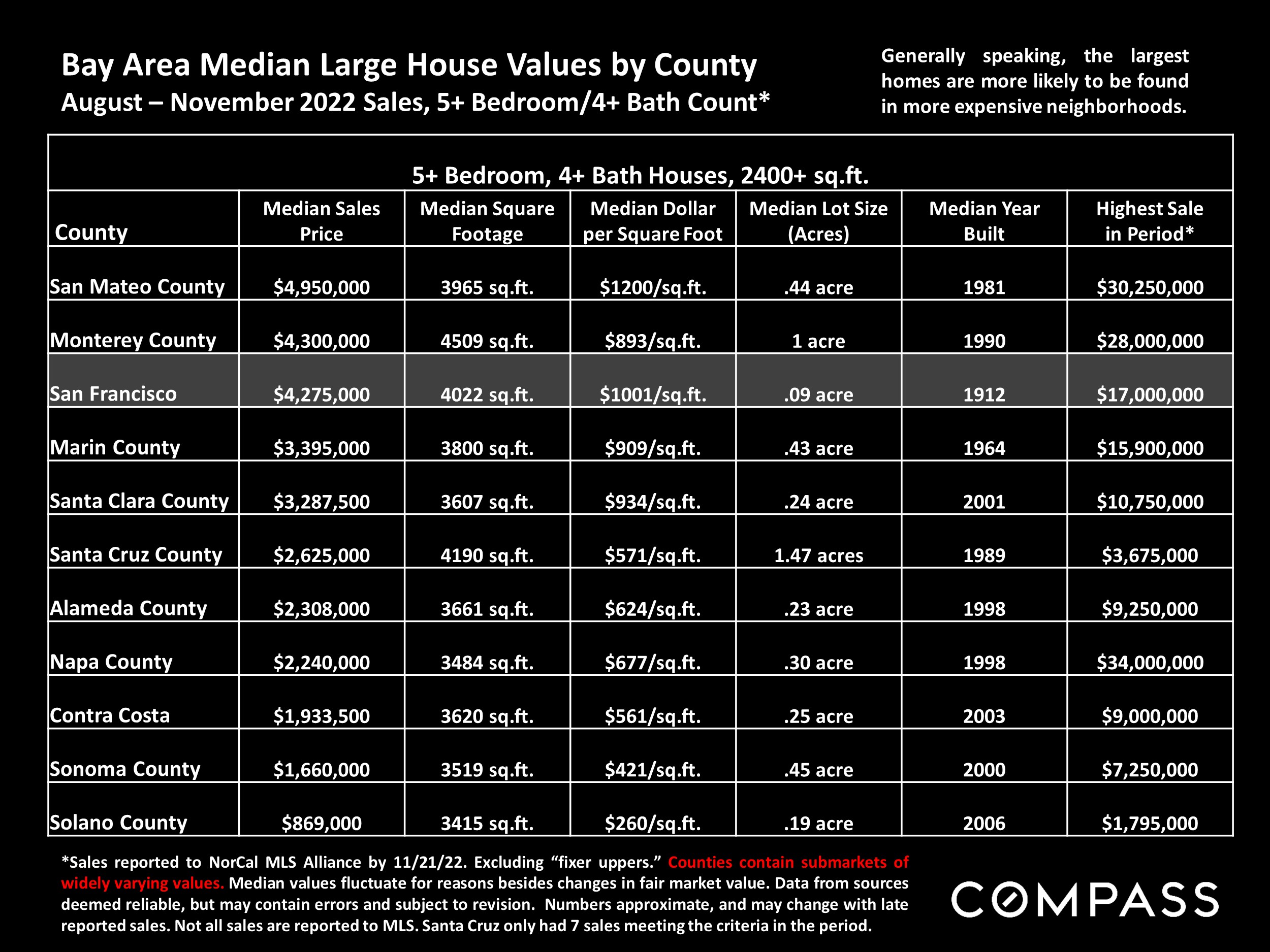

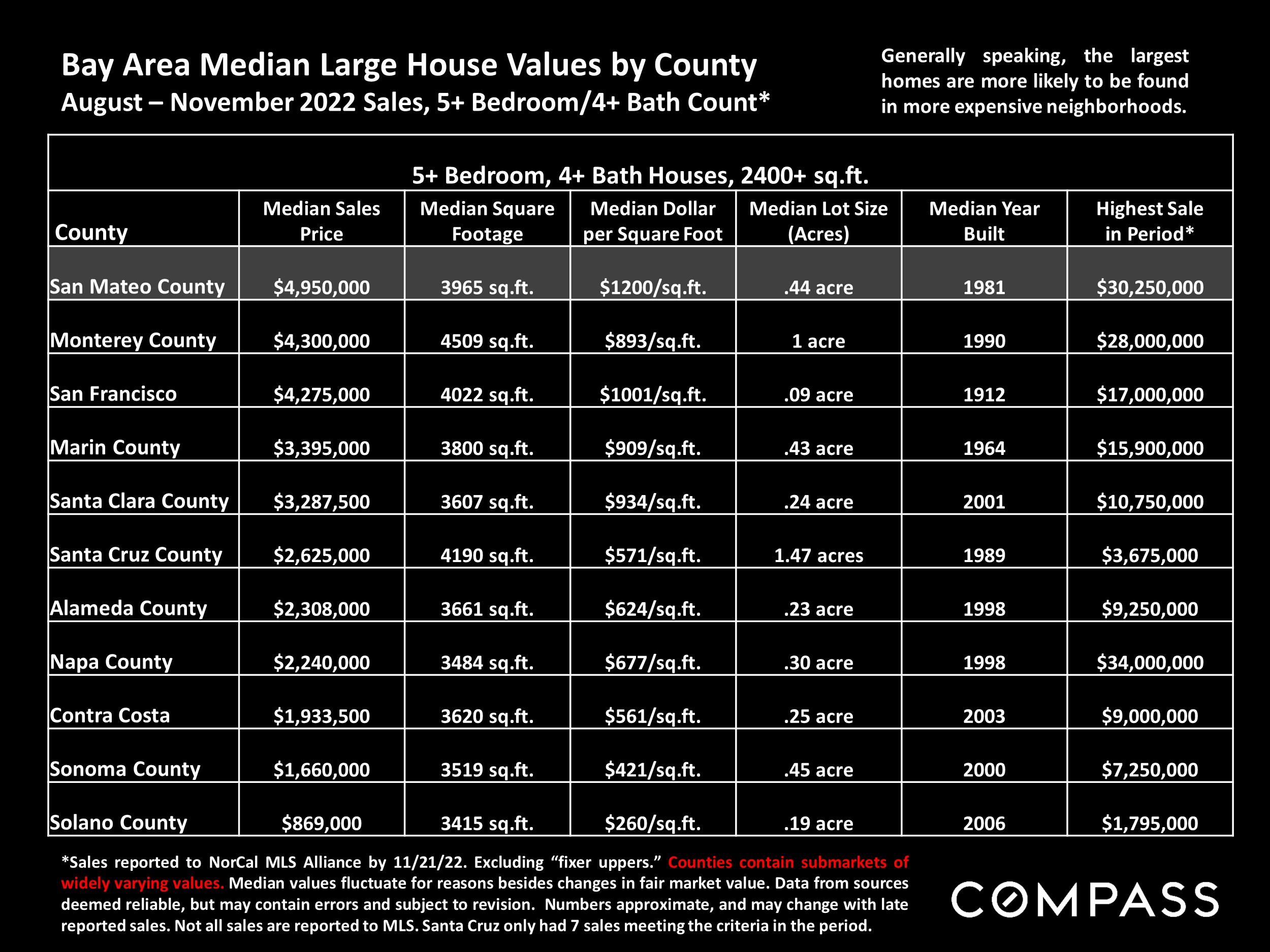

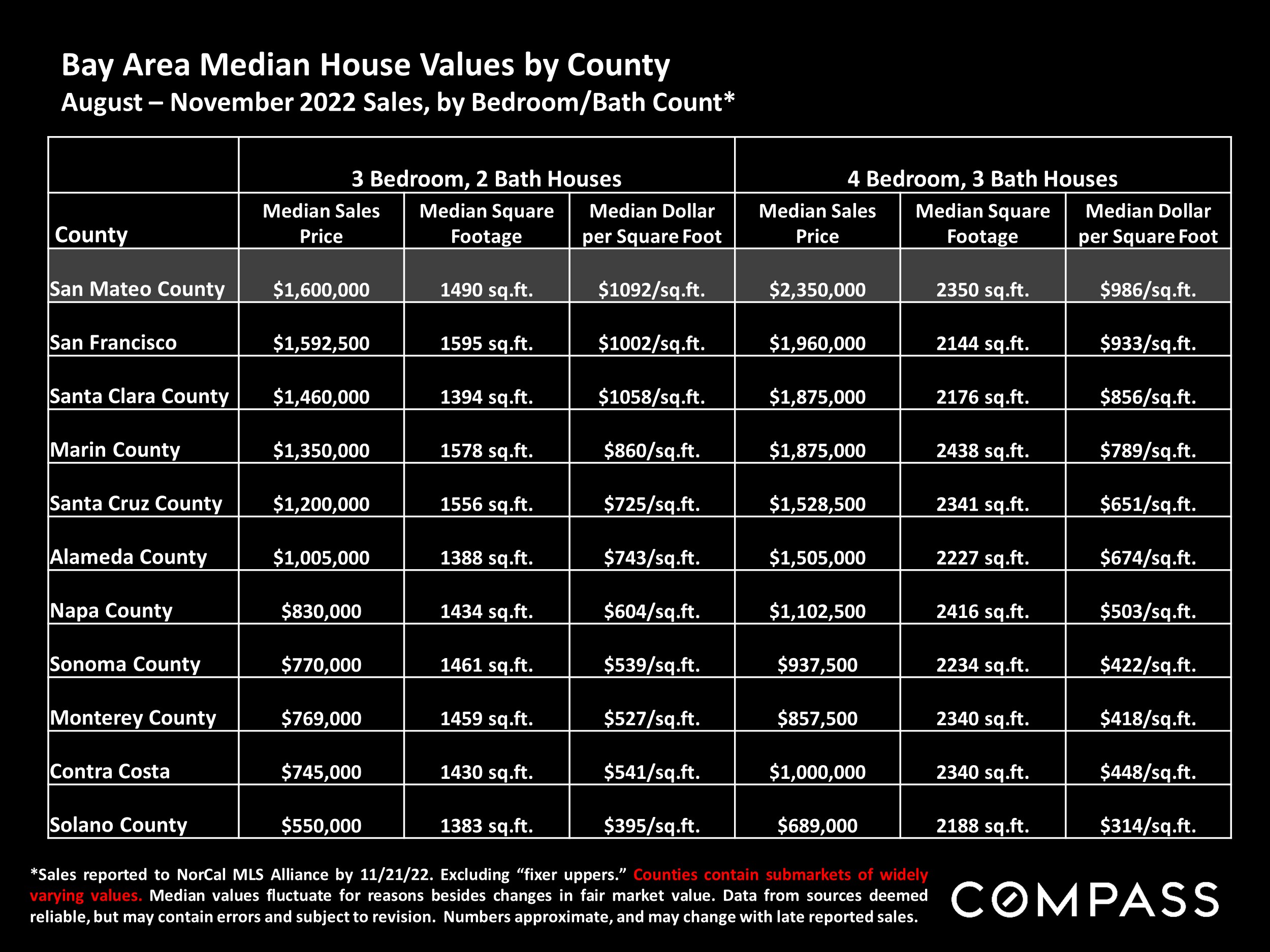

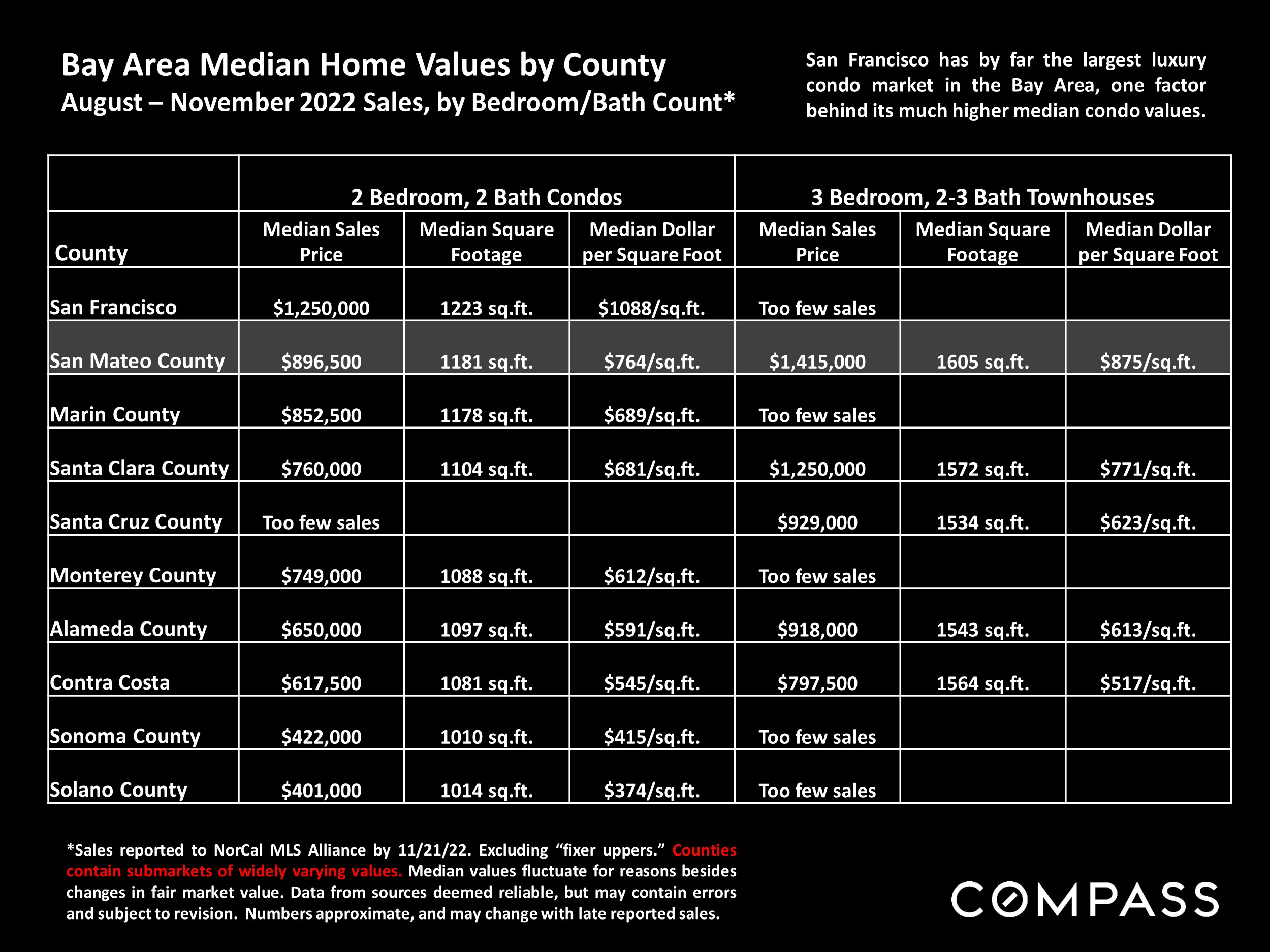

The focus of this survey is on broad, Bay Area market trends. Though submarkets will often diverge to various degrees, general trends in prices, and supply and demand typically move in parallel directions – especially over longer periods of time. Towards the end of the report is a link to a review of selected macroeconomic factors at play in the market.

Some analyses pertain to different selections of counties and different property types, depending on statistic and data source. Statistics are generalities, essentially summaries of data generated by dozens, hundreds or thousands of unique, individual sales. They are best seen not as precise measurements, but as broad, comparative indicators with reasonable margins of error – and how they apply to any particular property is unknown without a specific comparative market analysis. Anomalous fluctuations in statistics are not uncommon, and longer-term trends are typically more meaningful than short-term fluctuations. Data from sources deemed reliable, but may contain errors and subject to revision. All numbers are approximate.

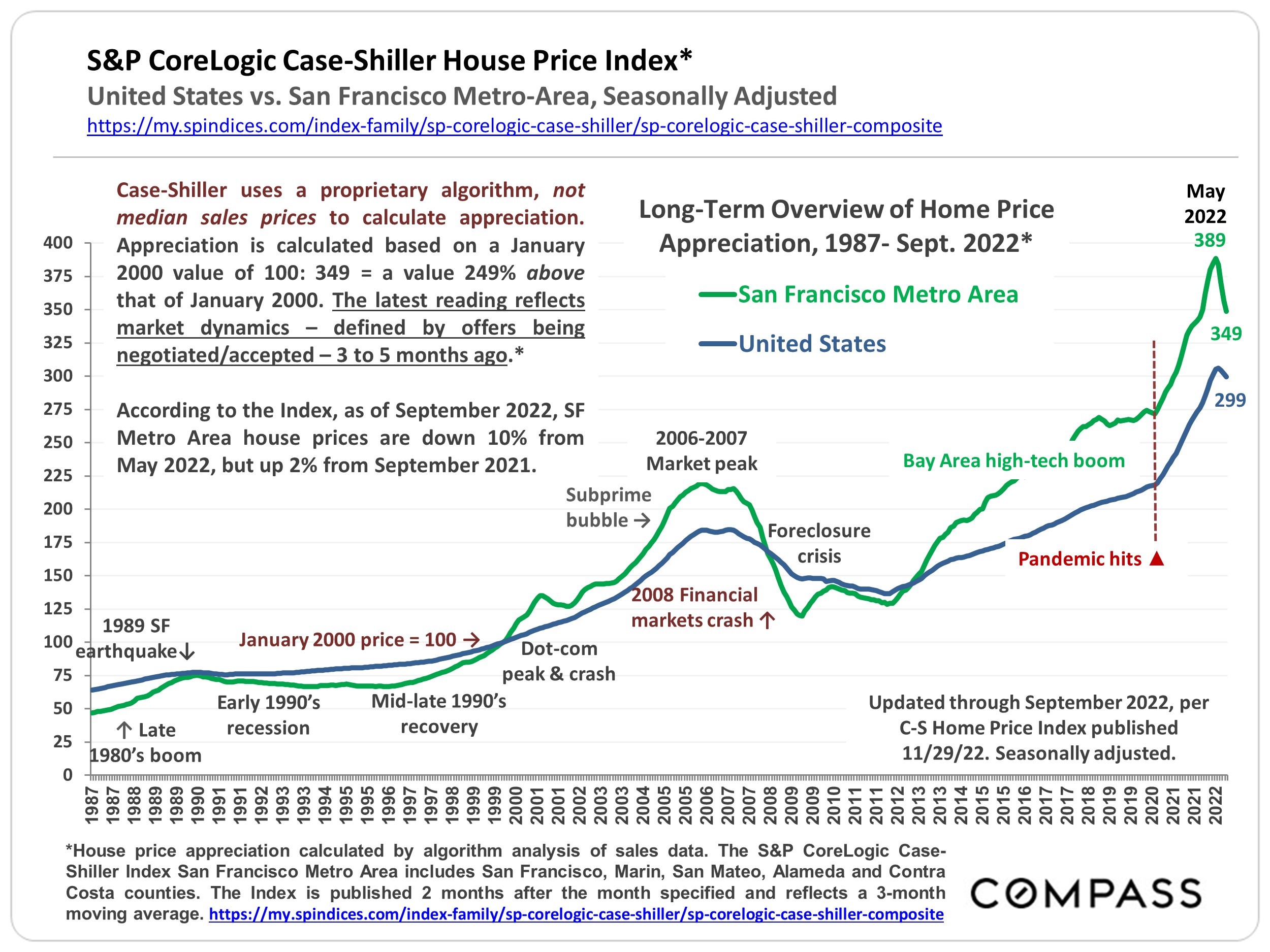

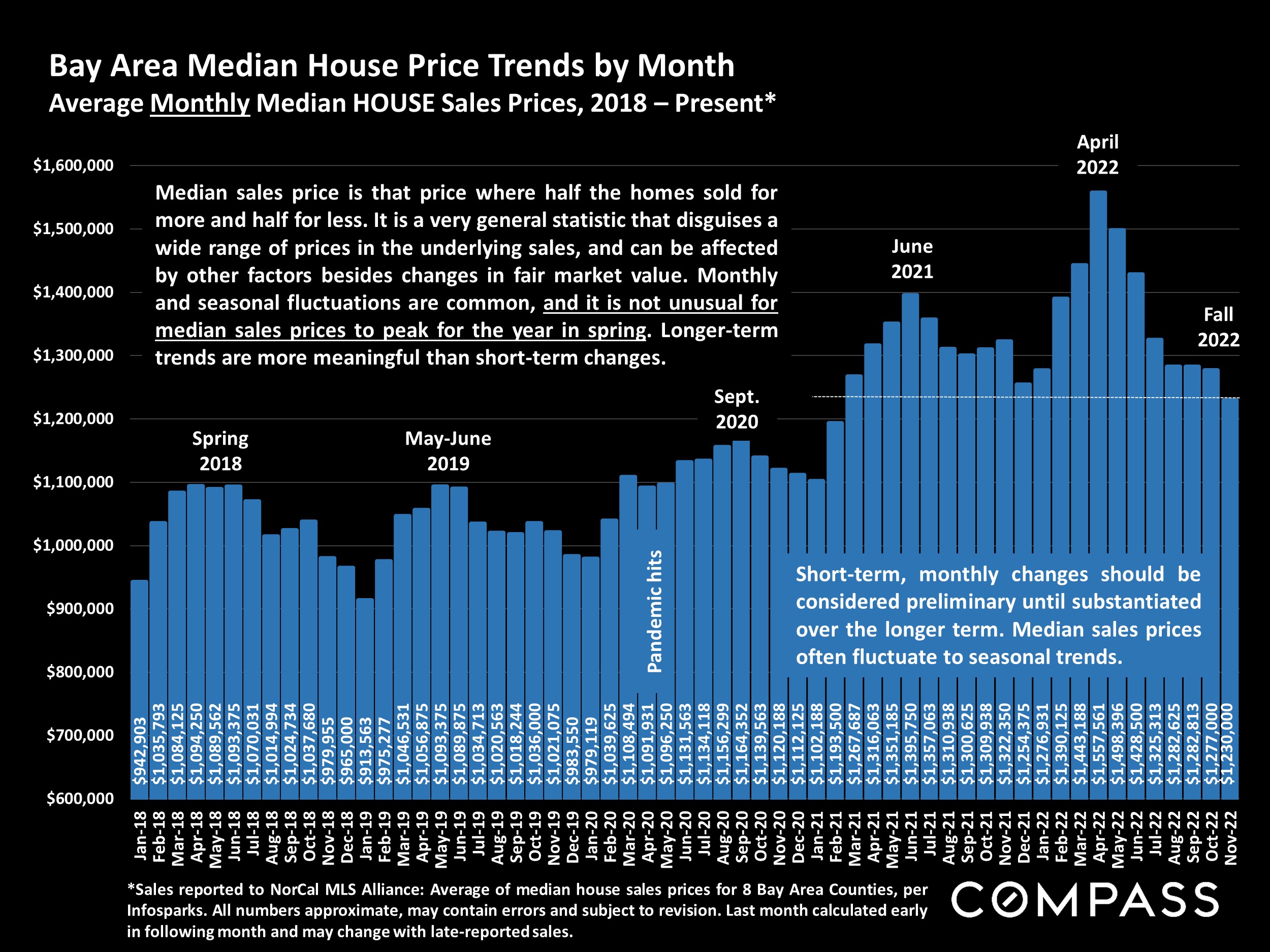

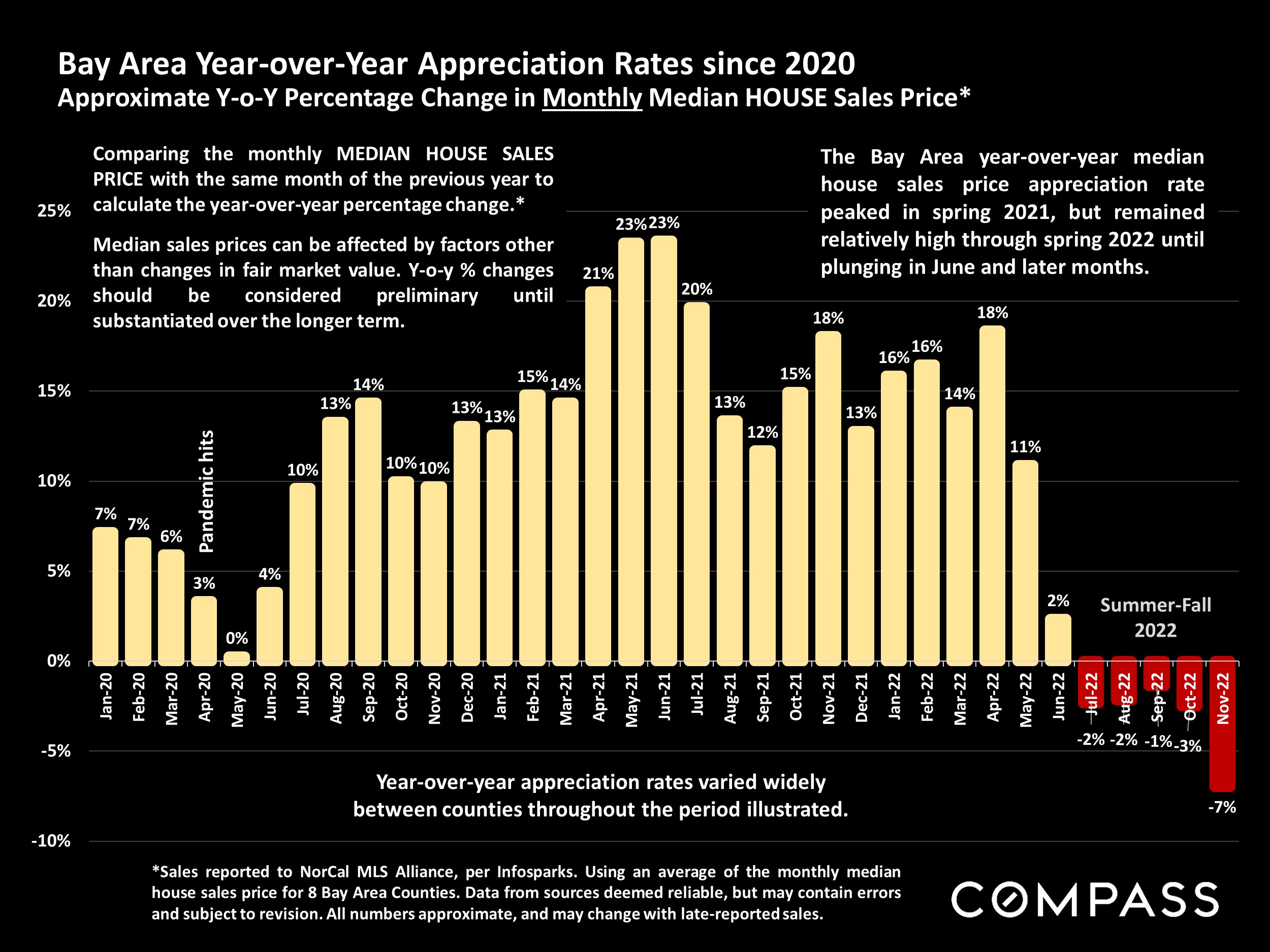

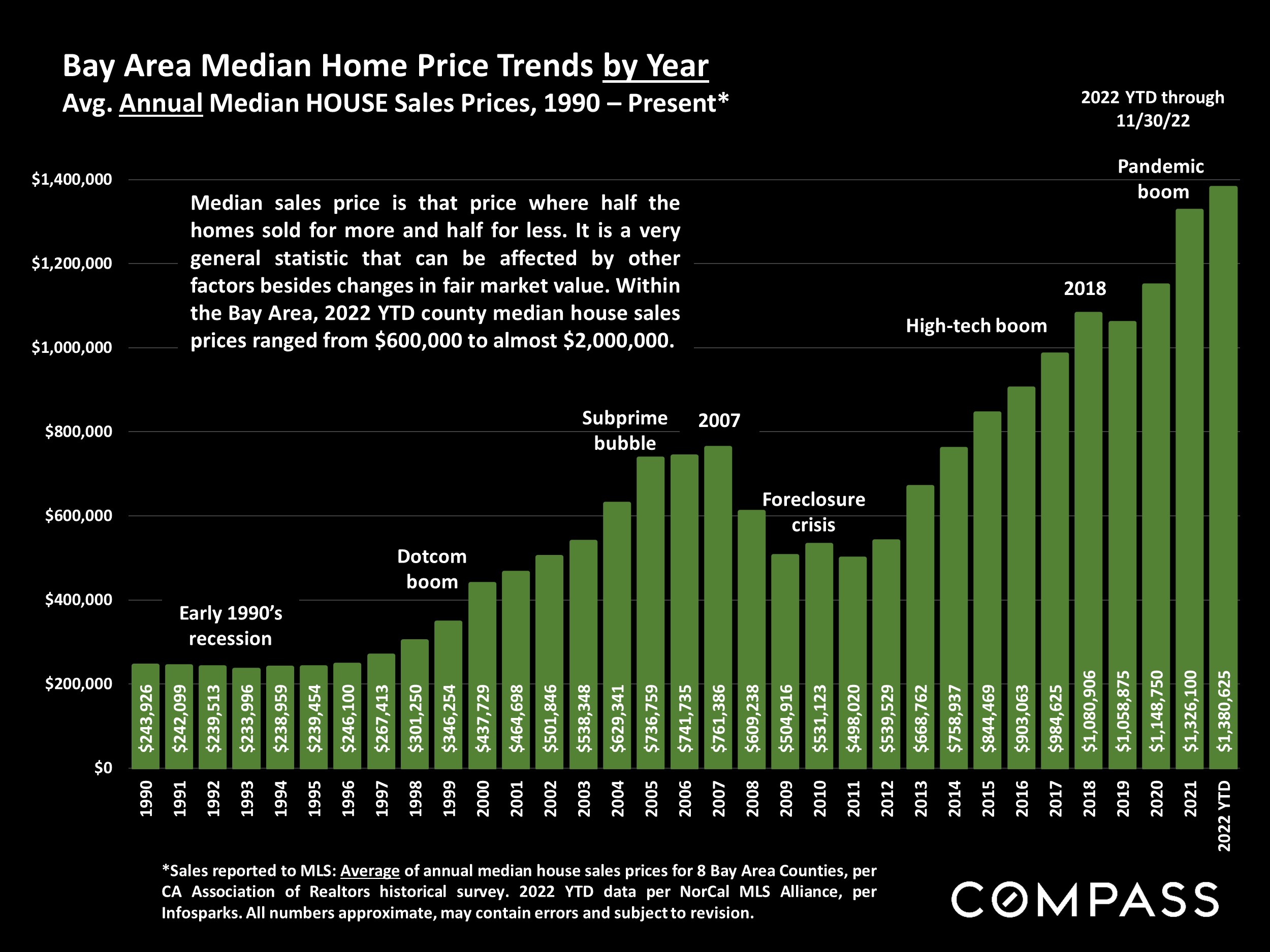

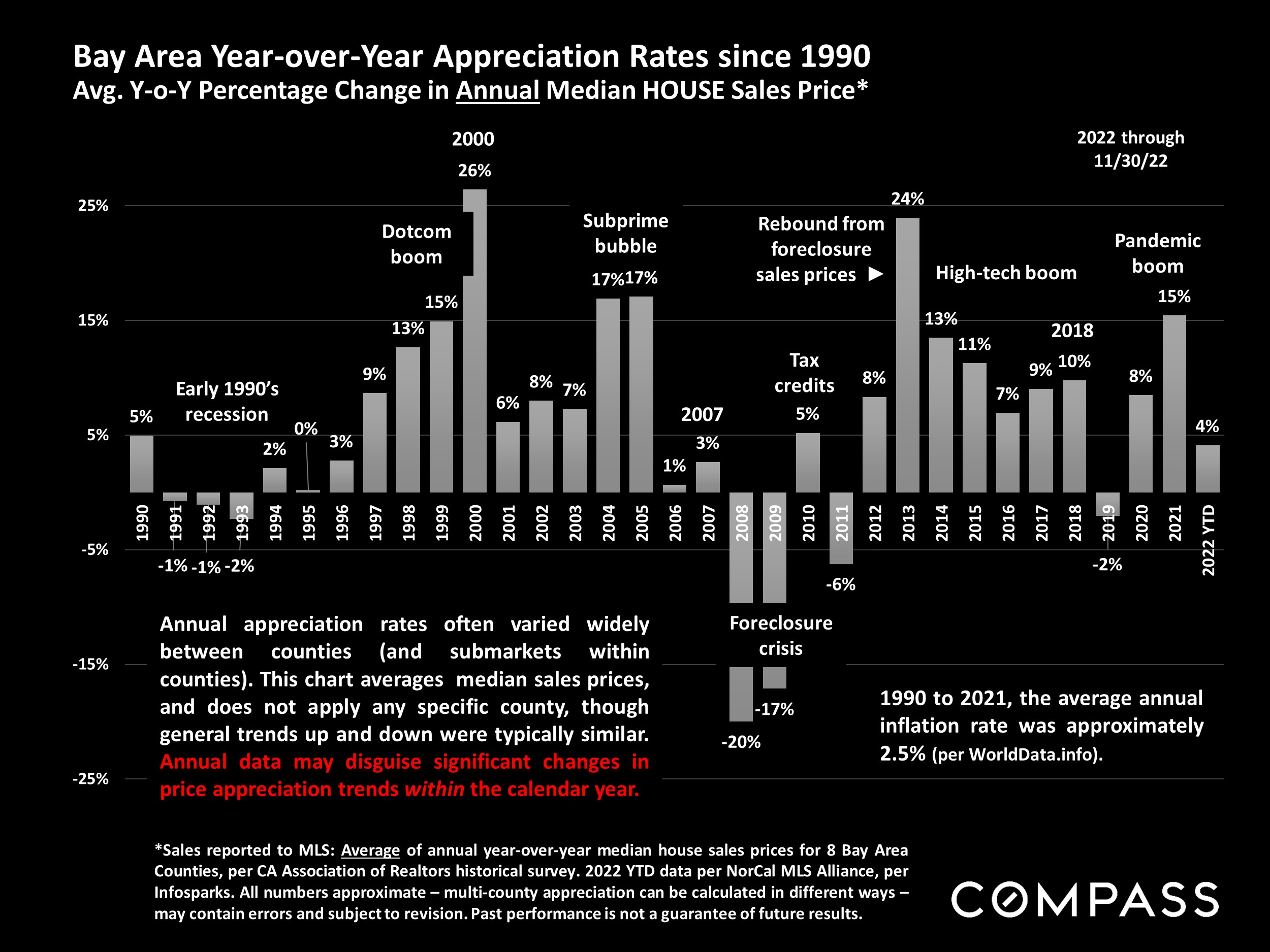

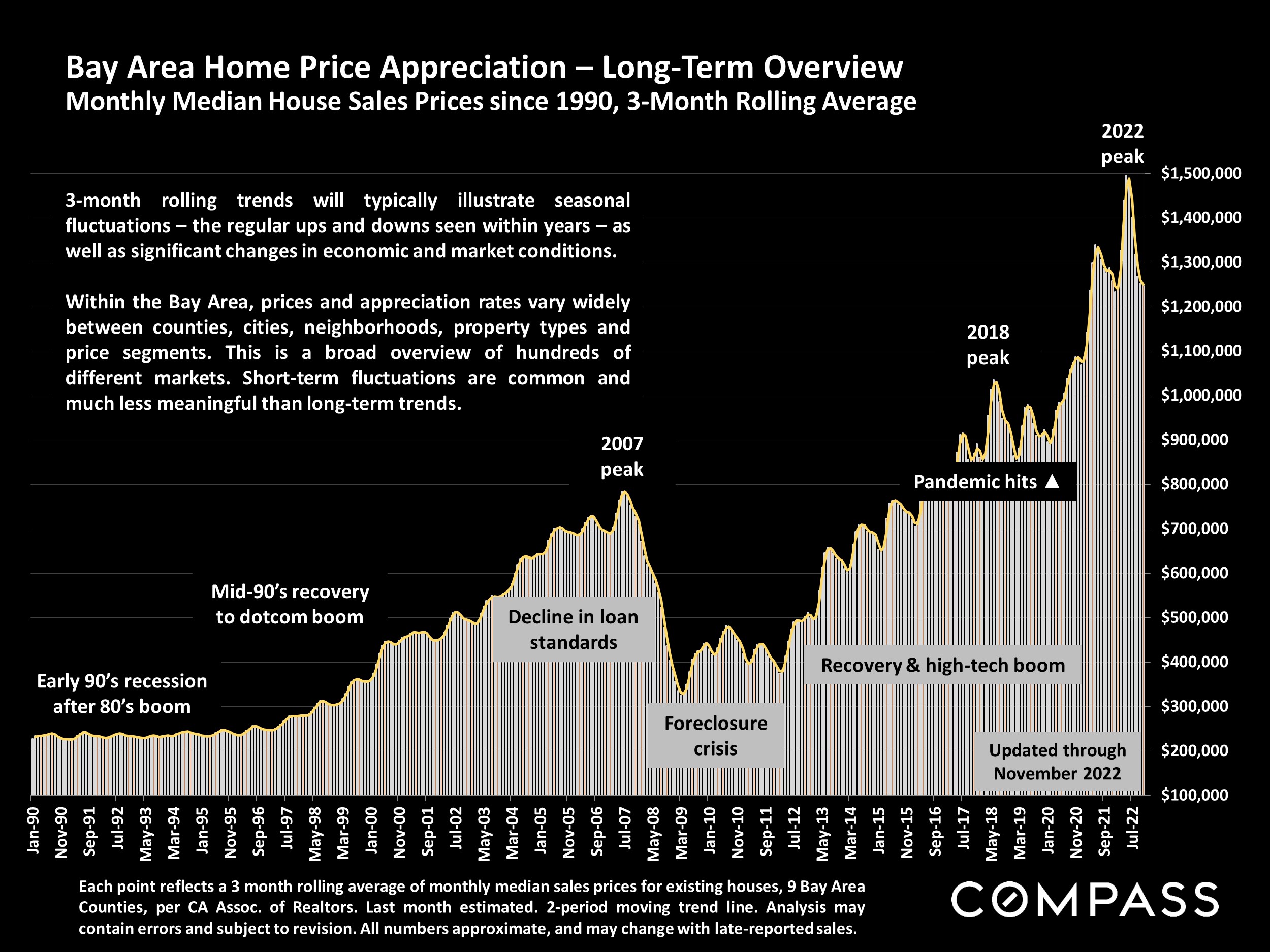

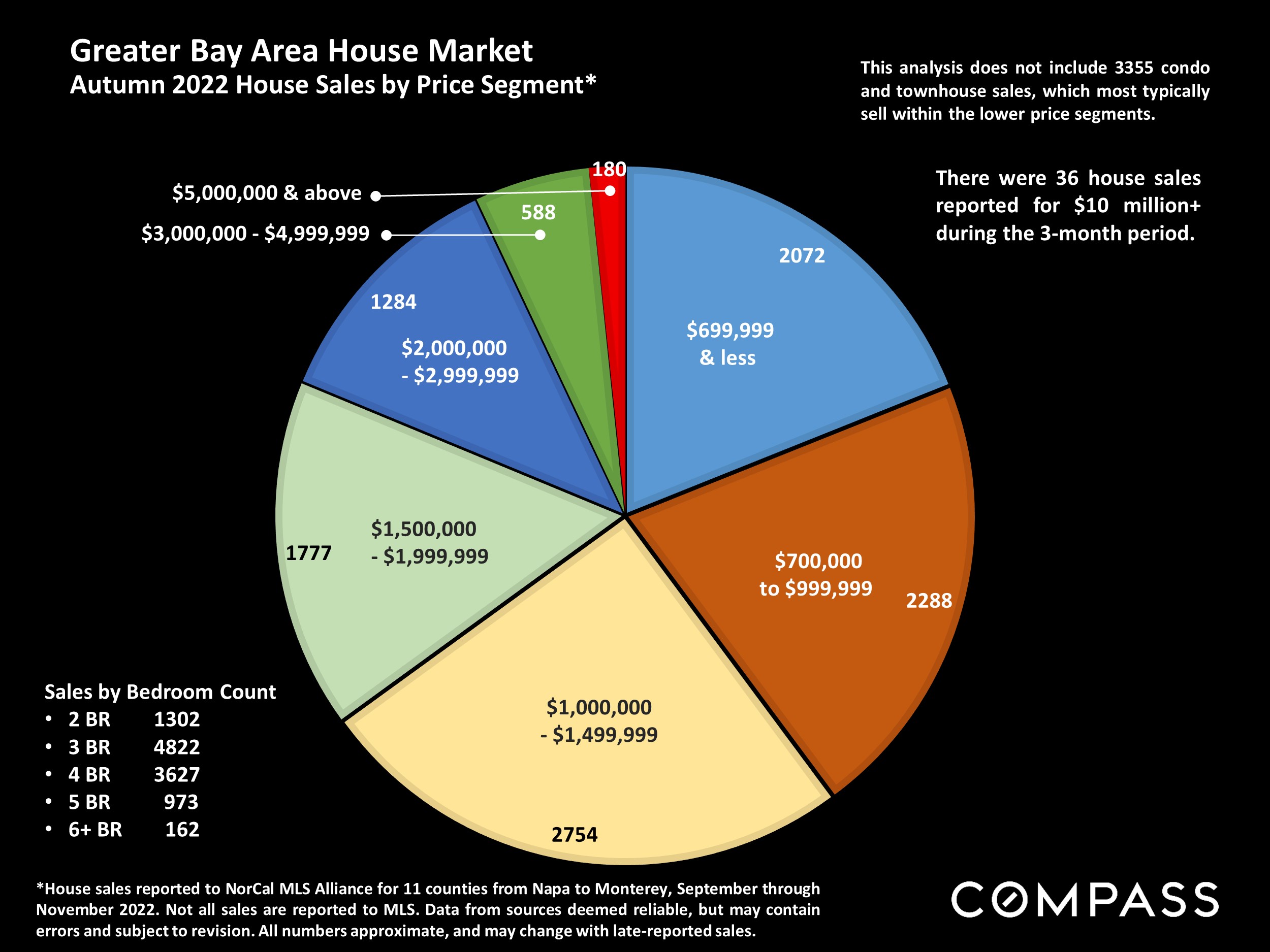

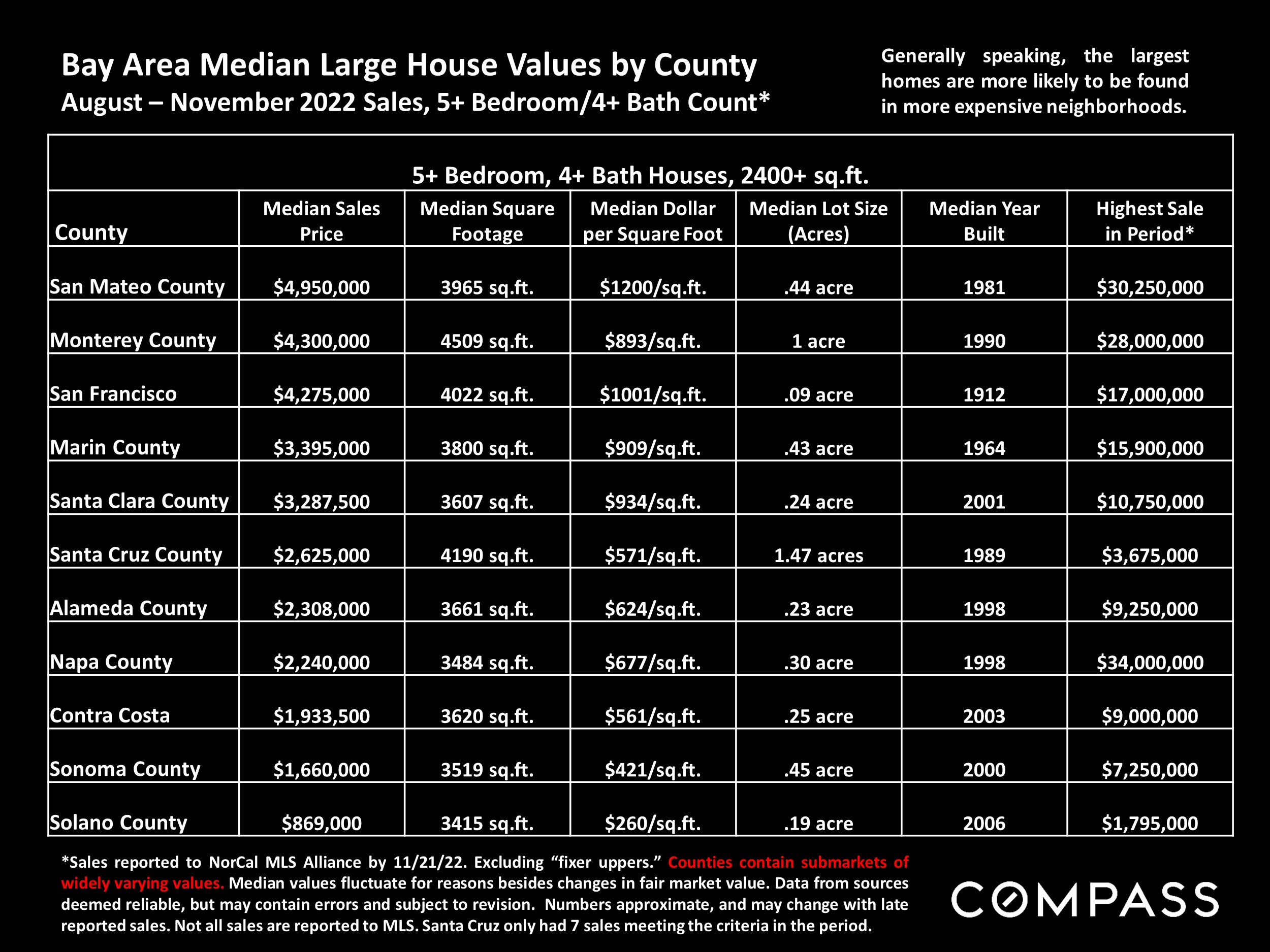

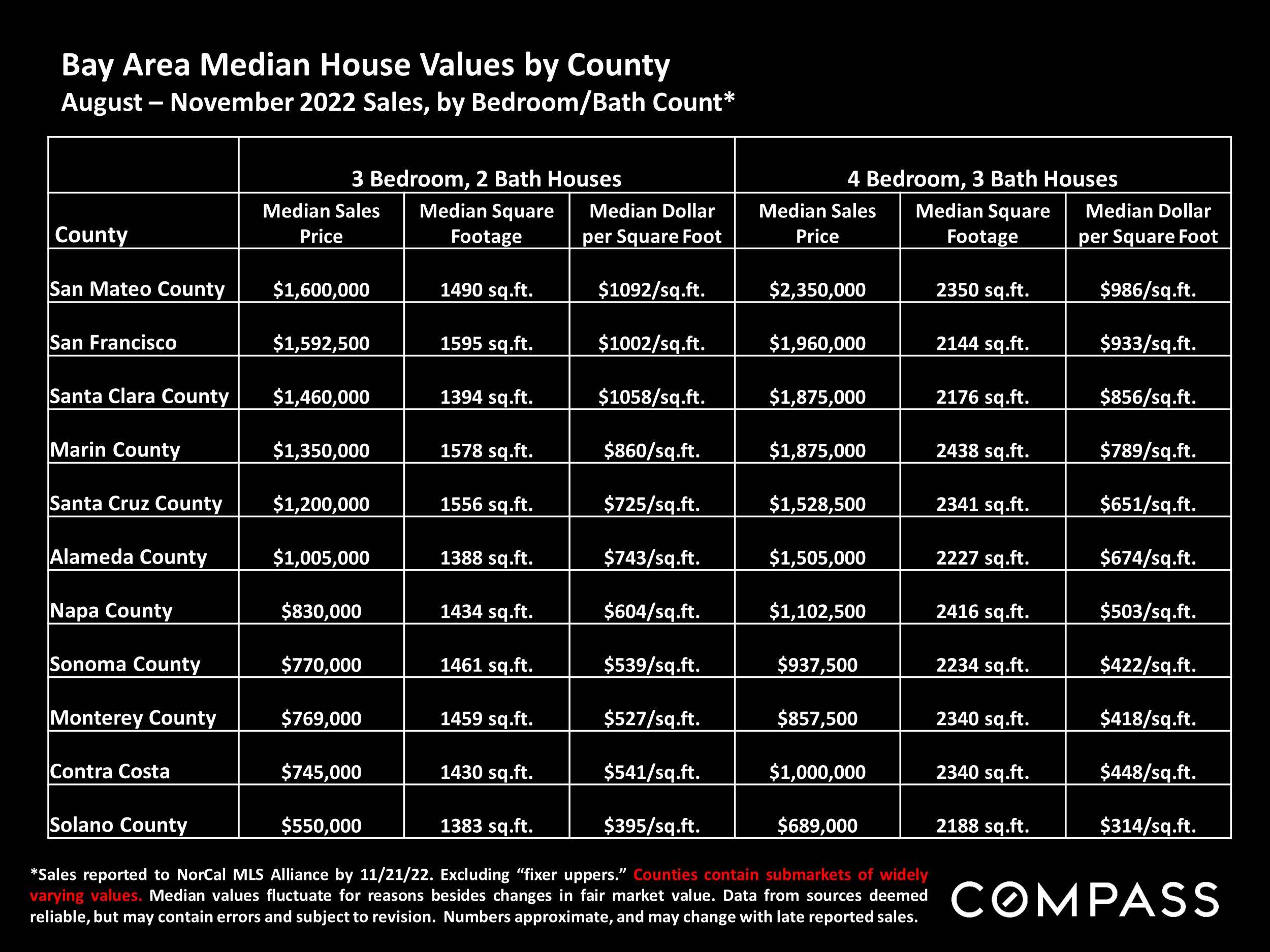

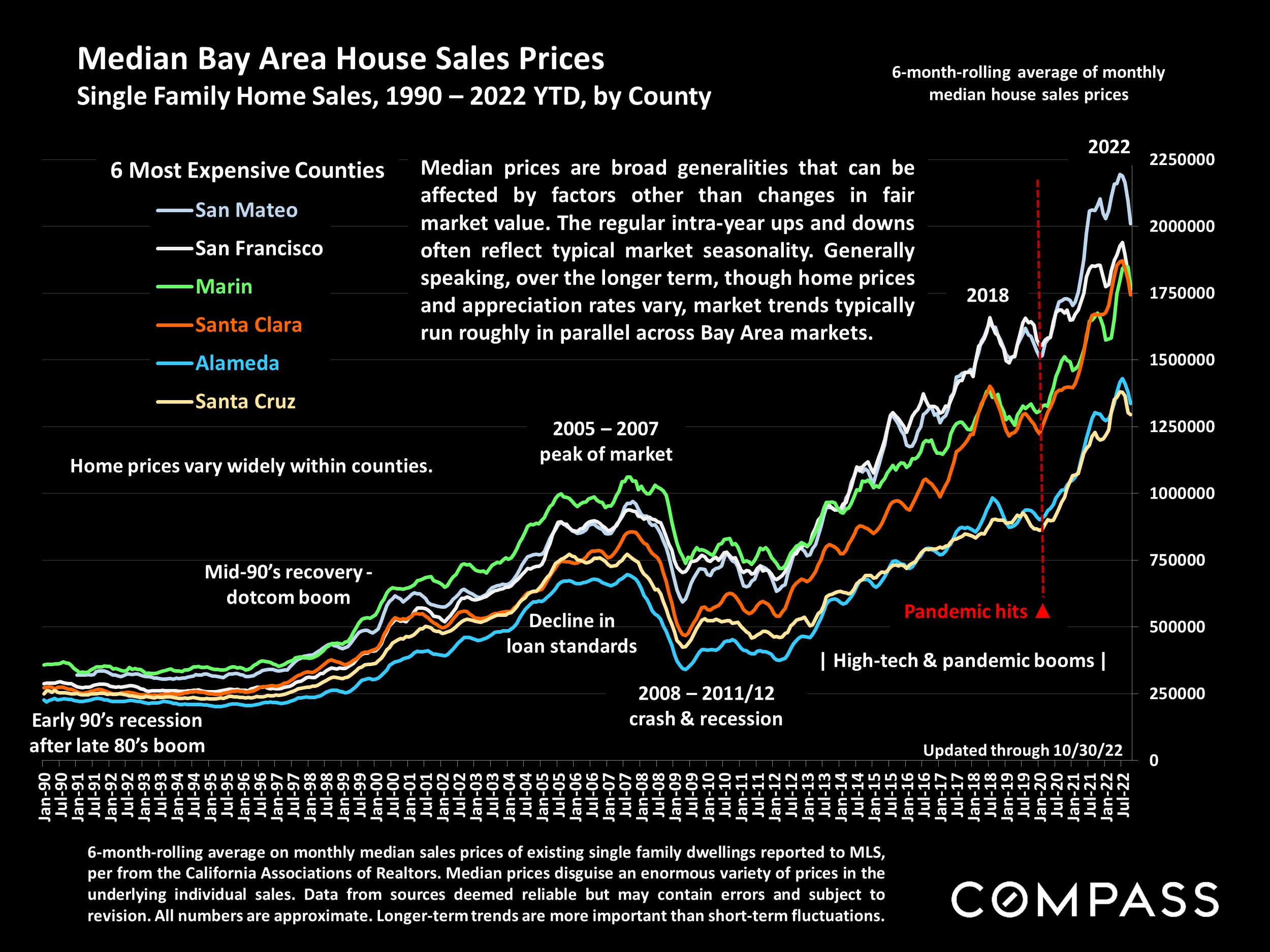

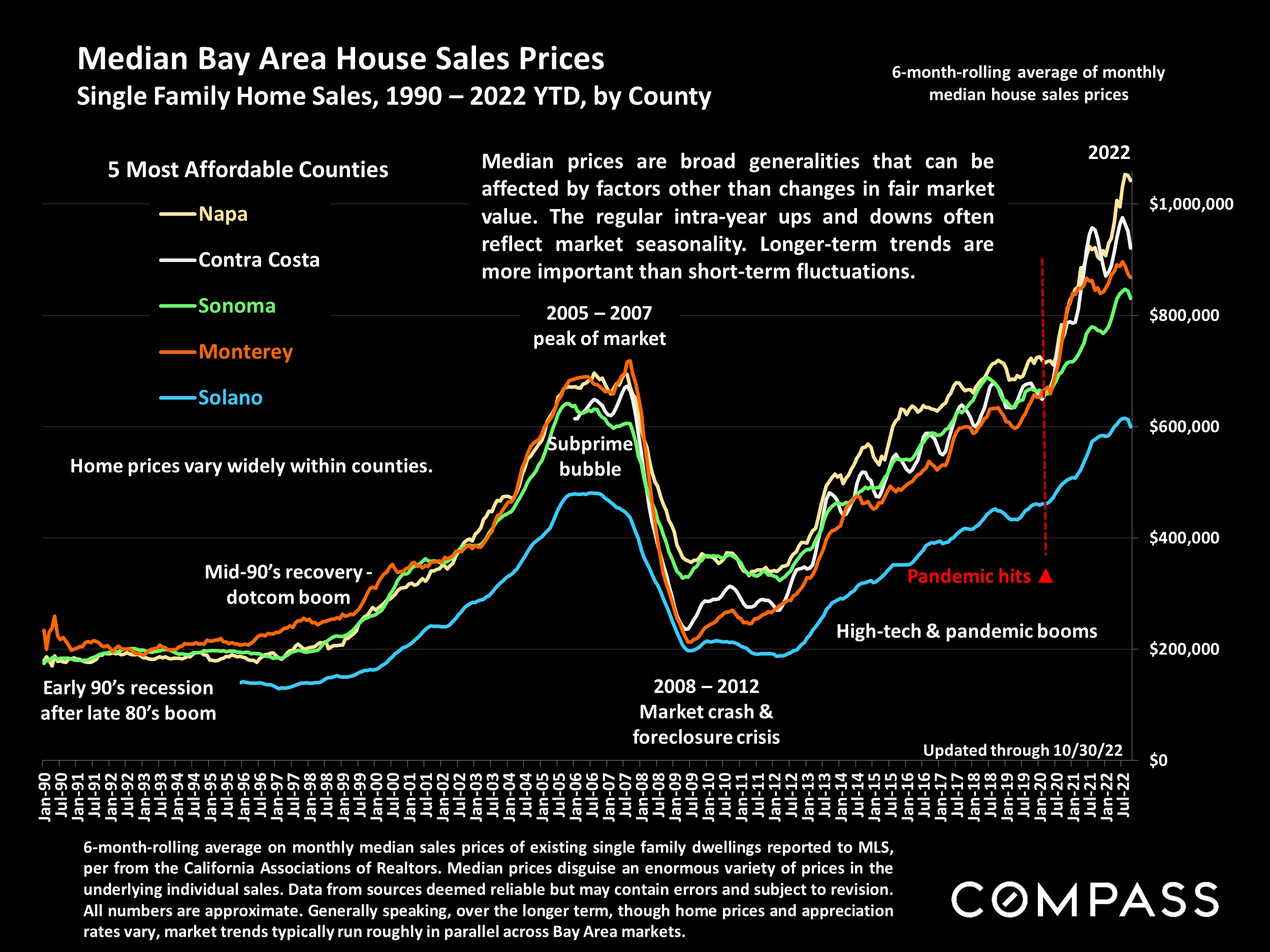

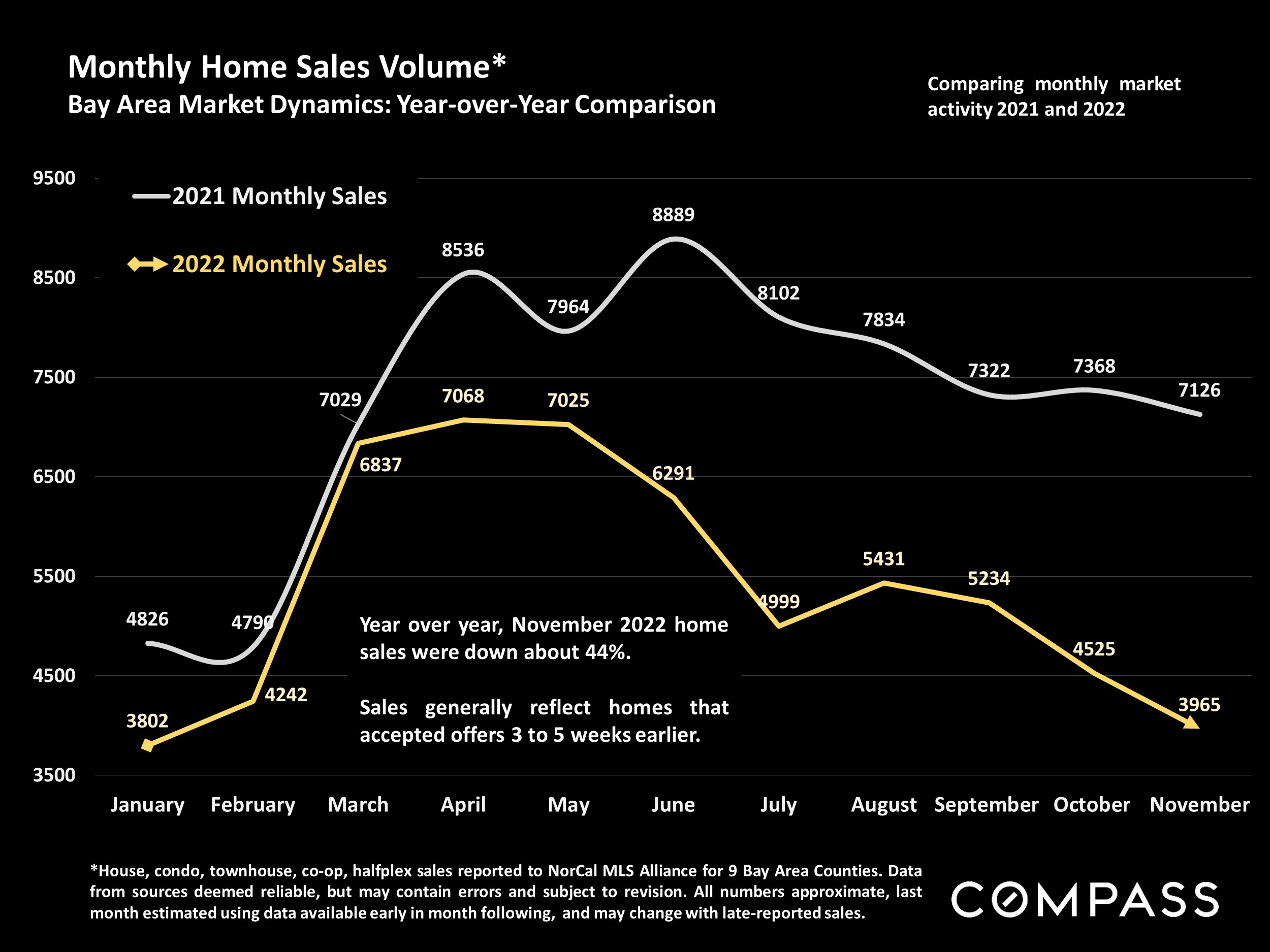

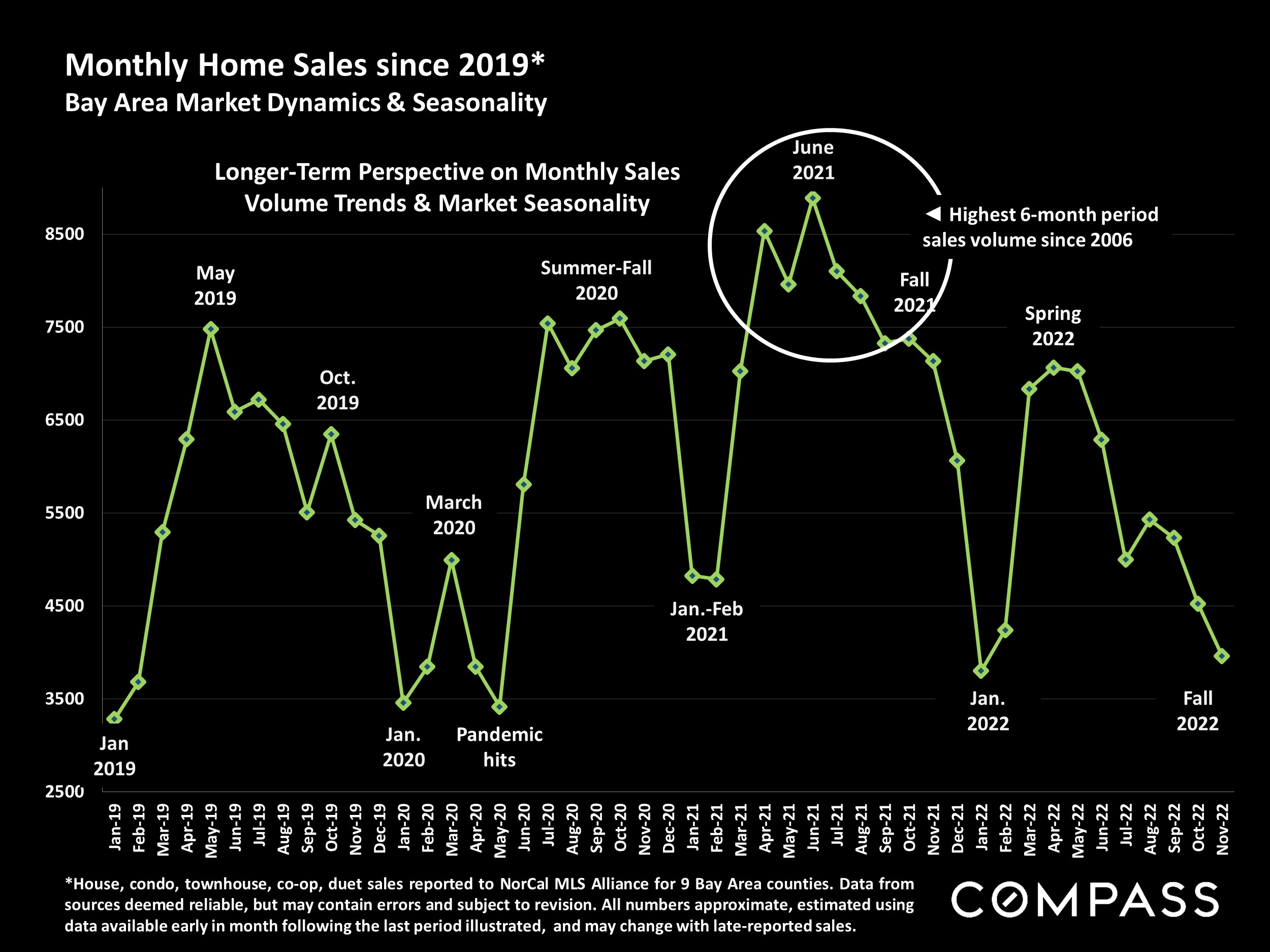

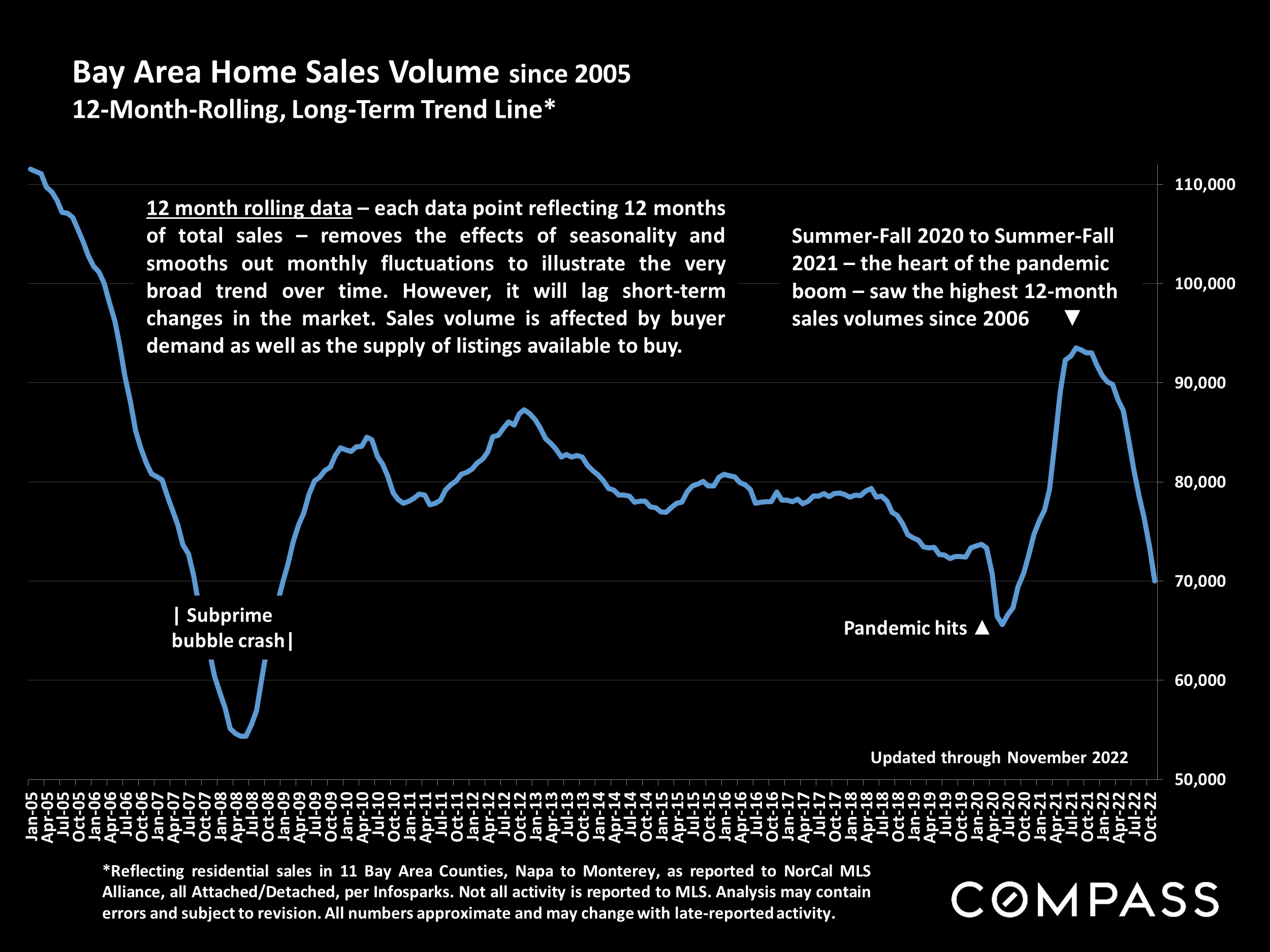

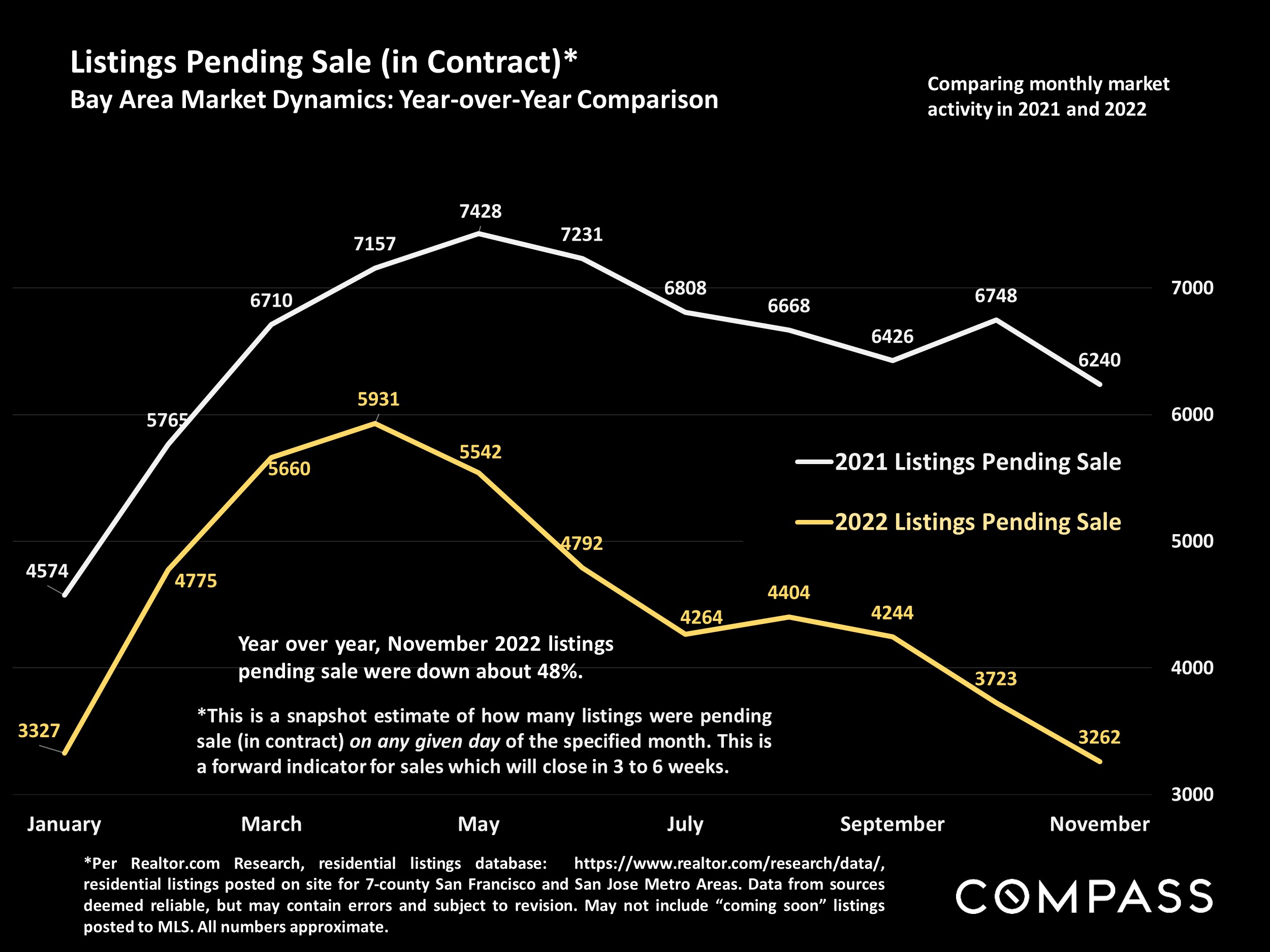

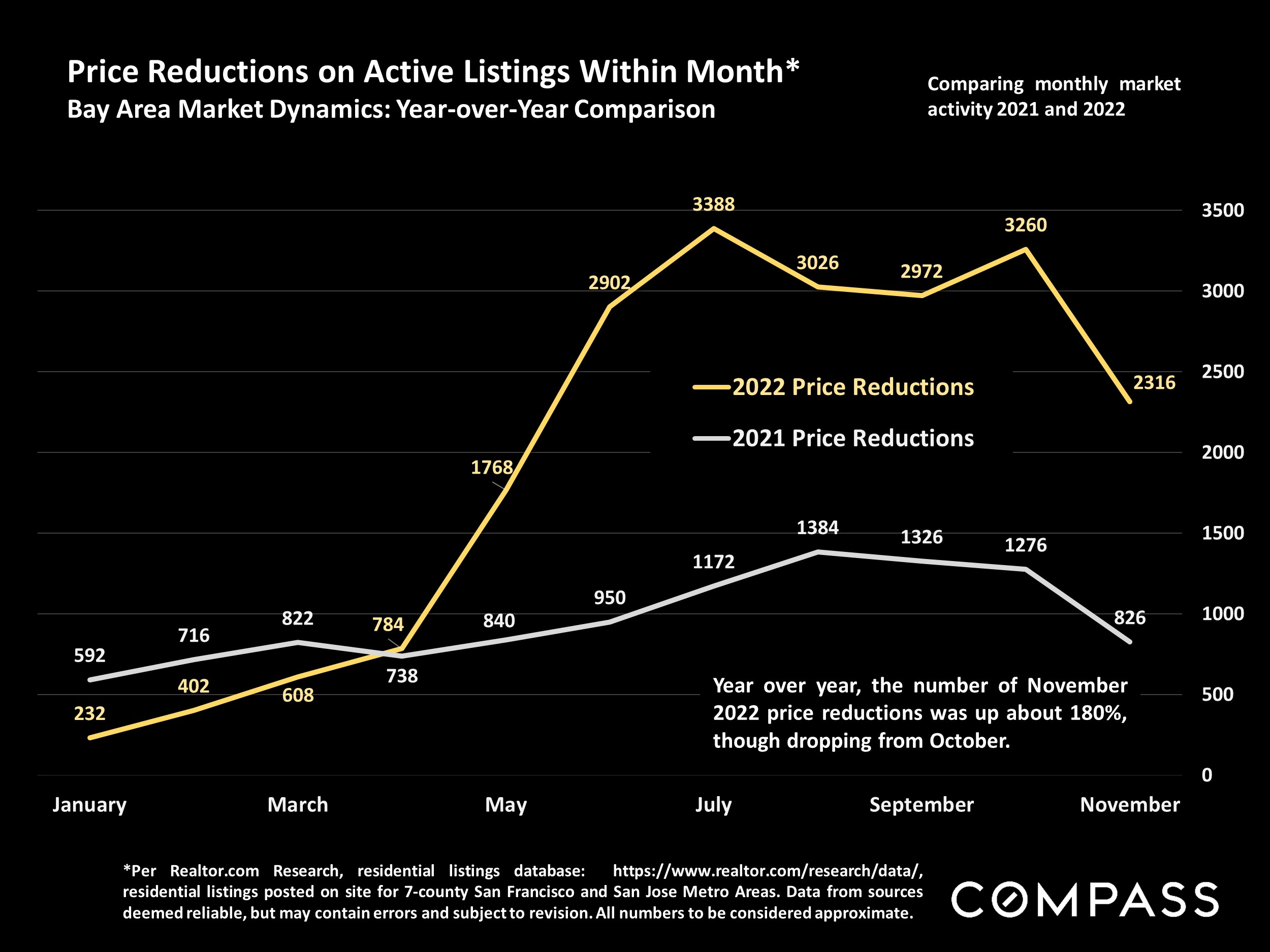

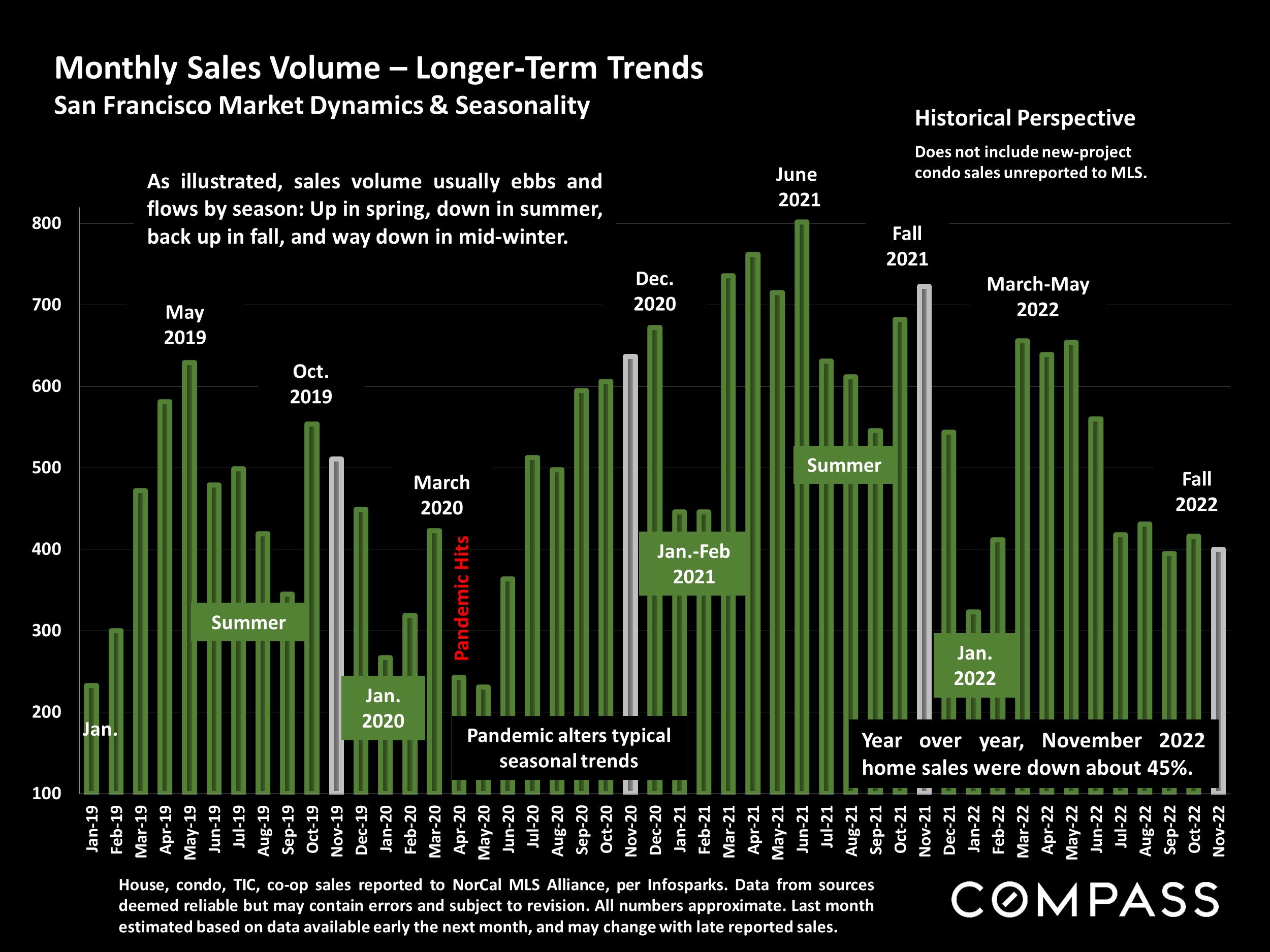

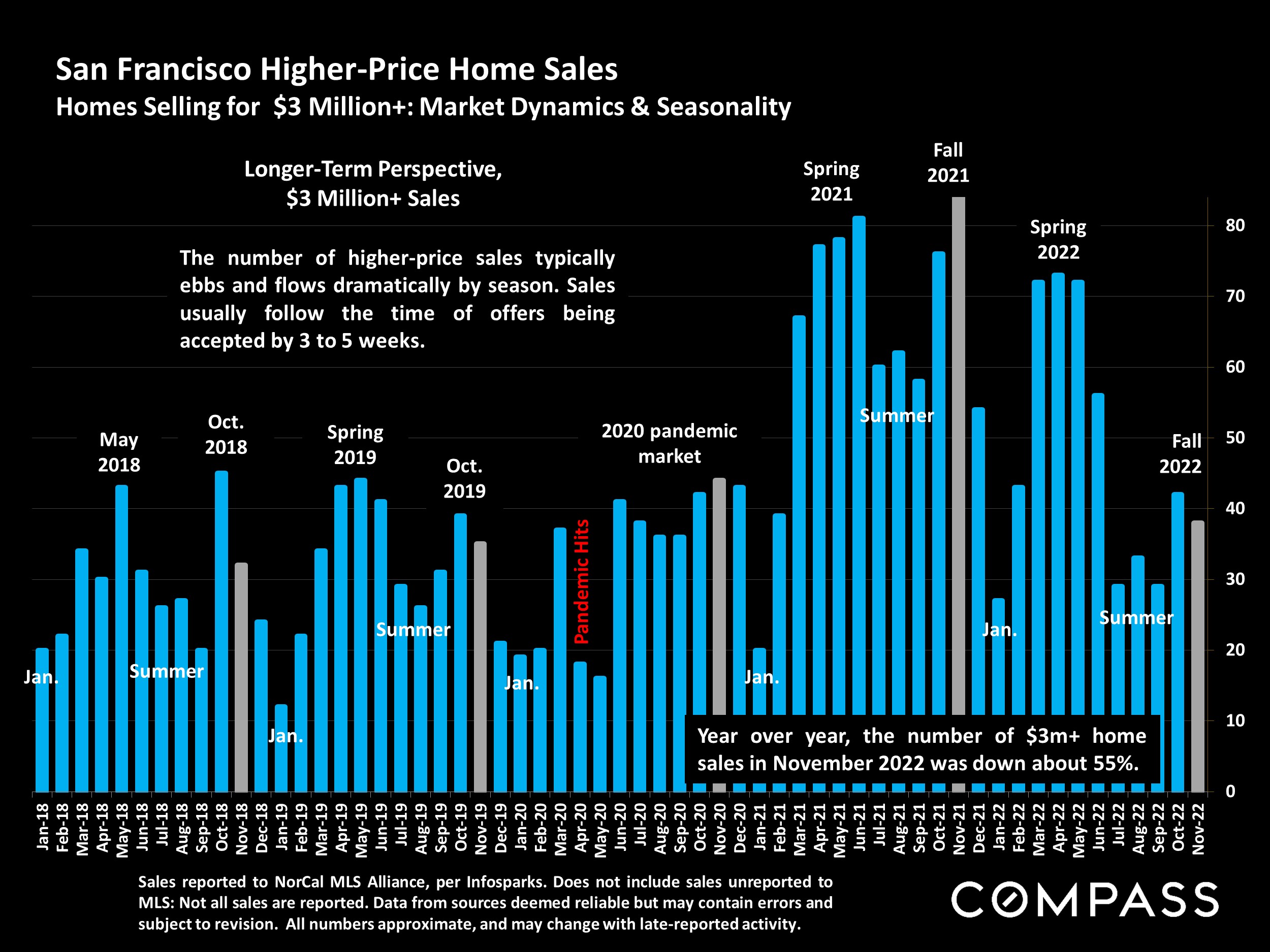

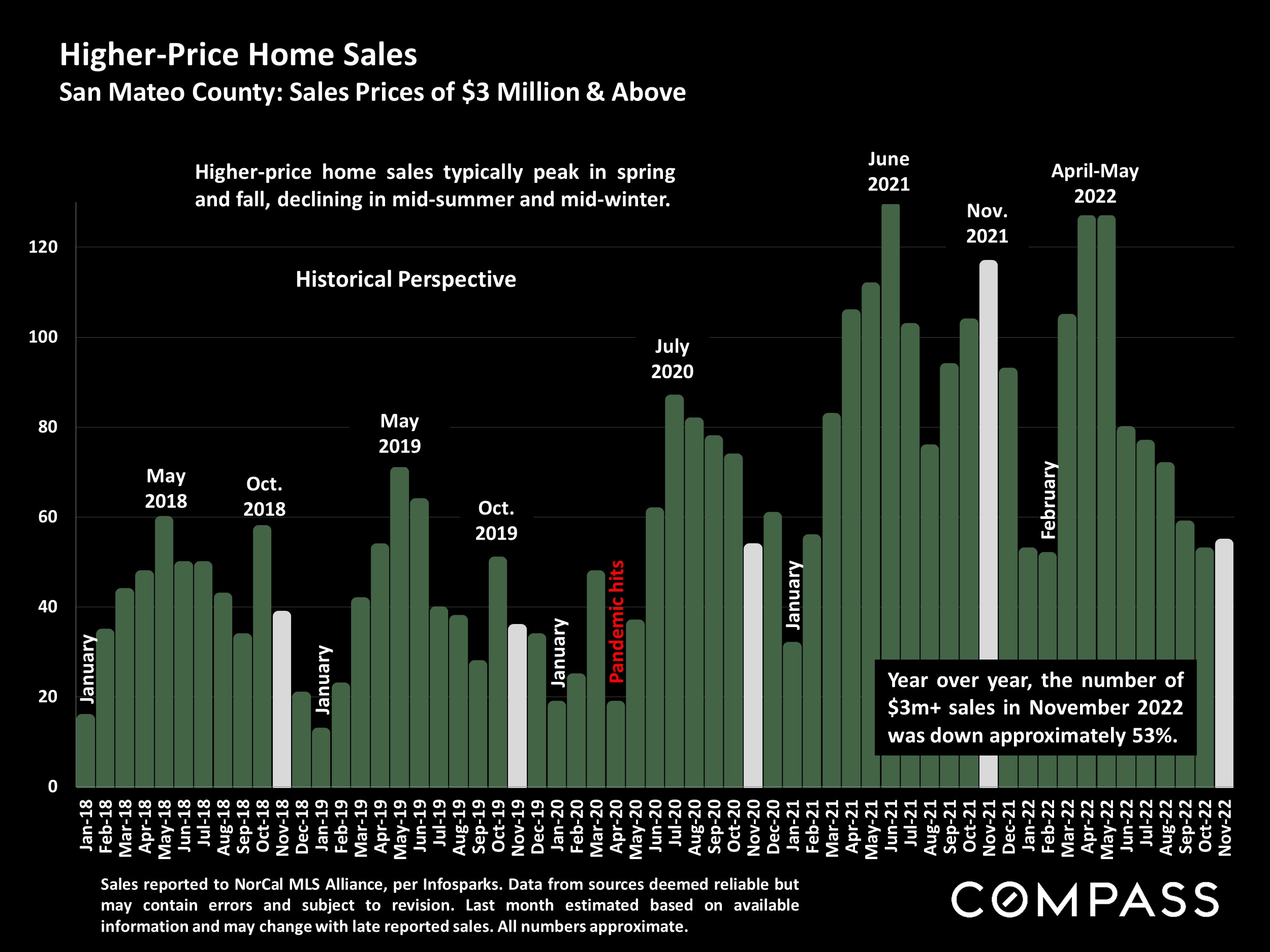

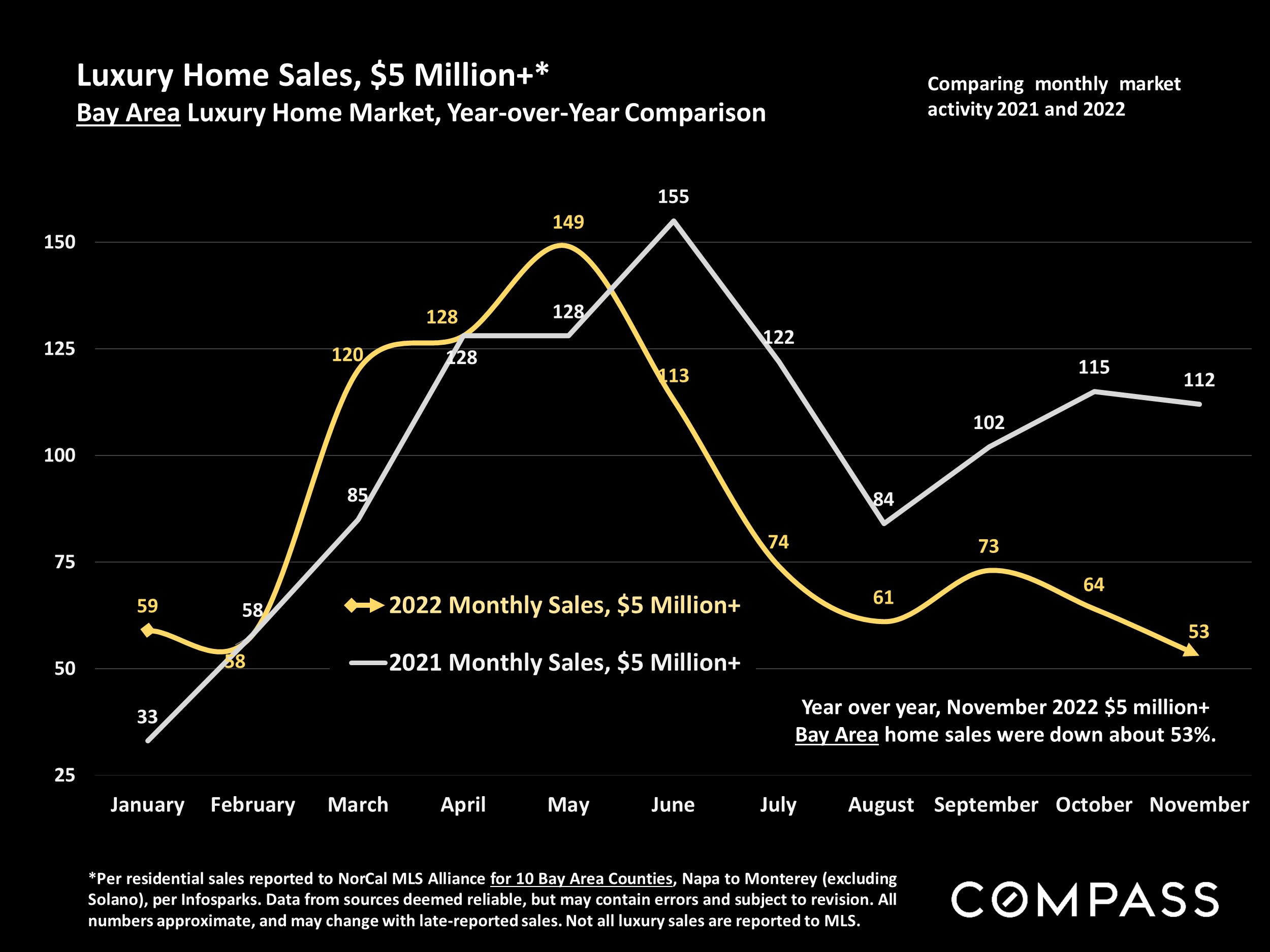

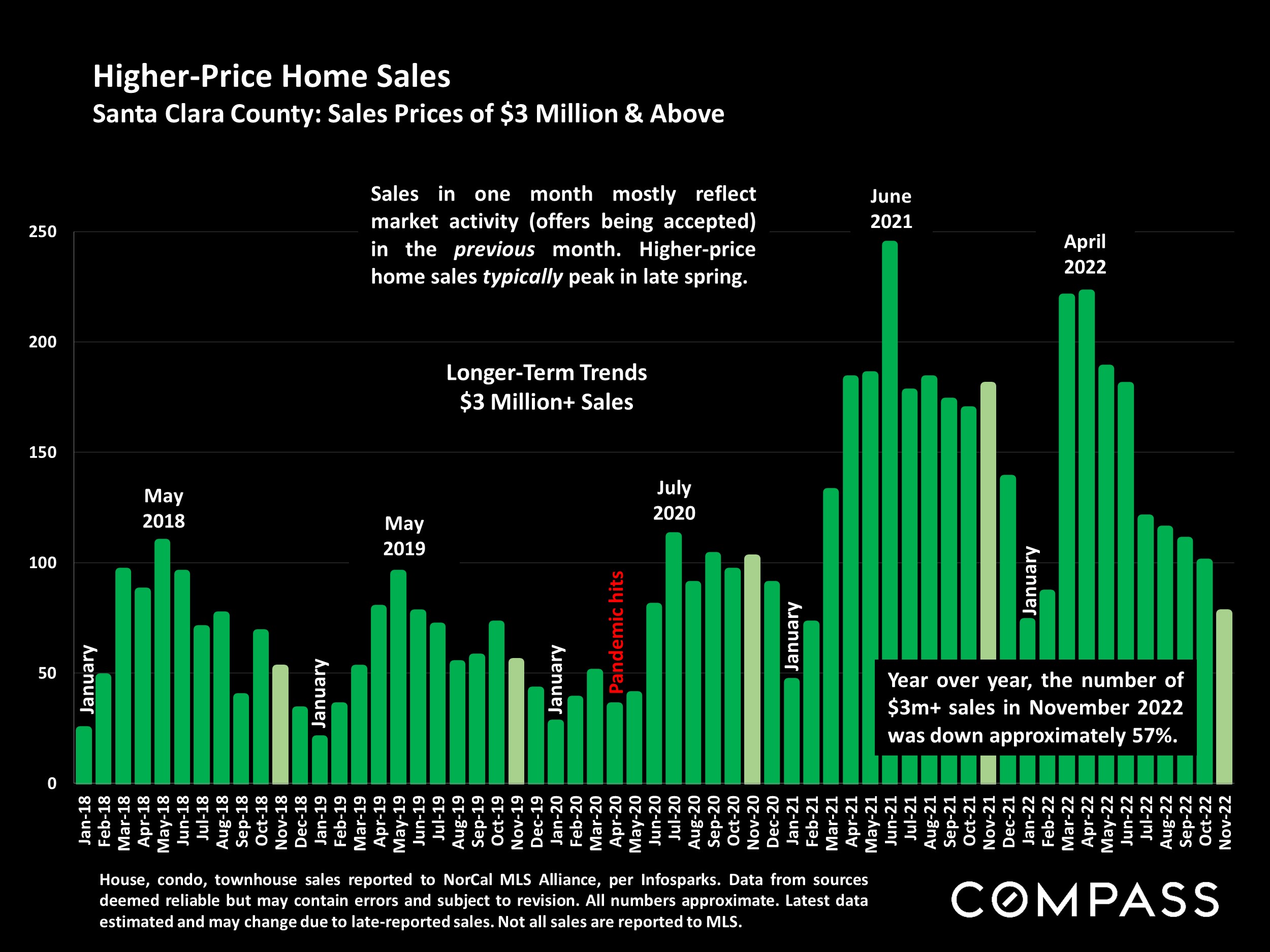

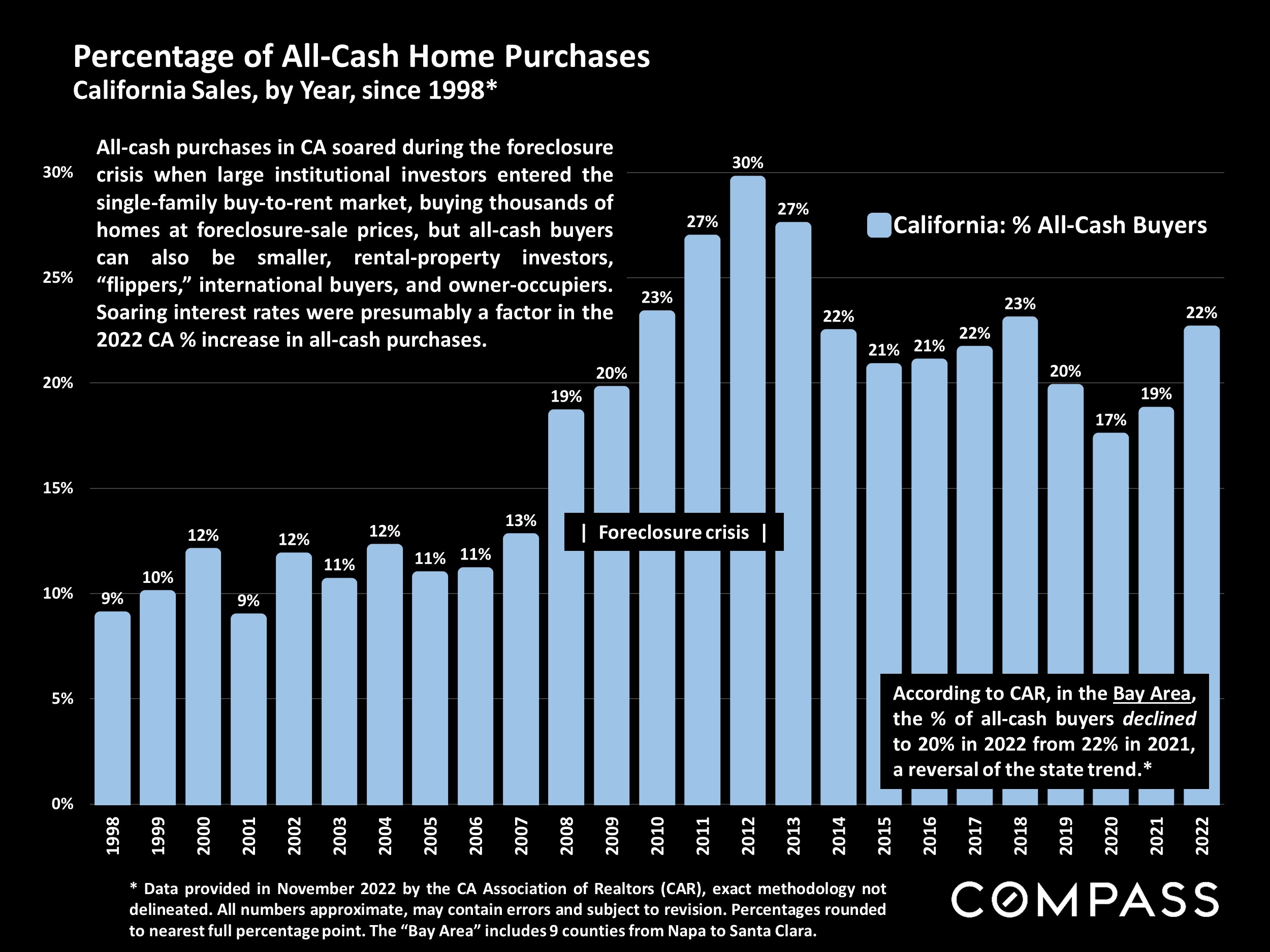

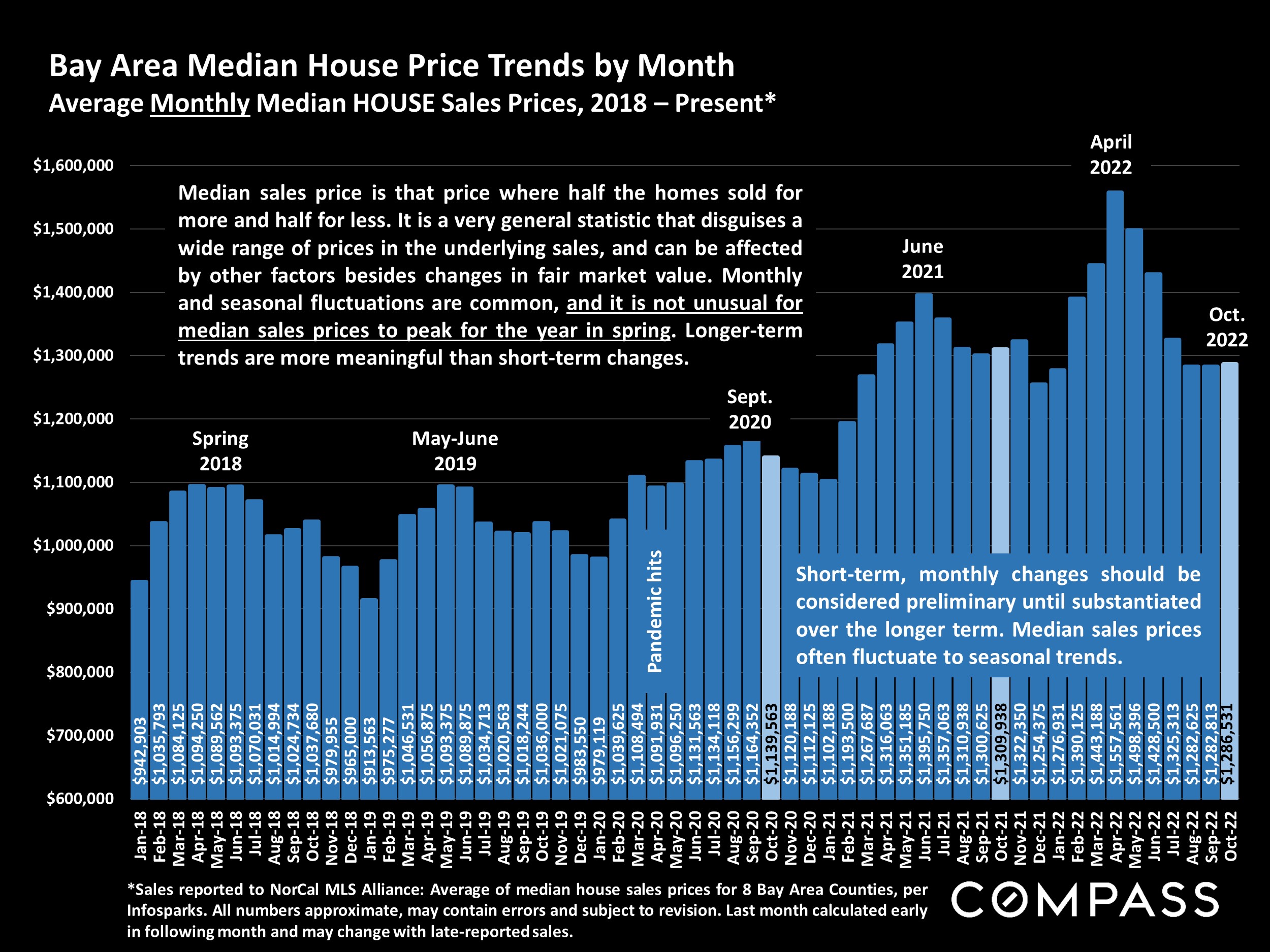

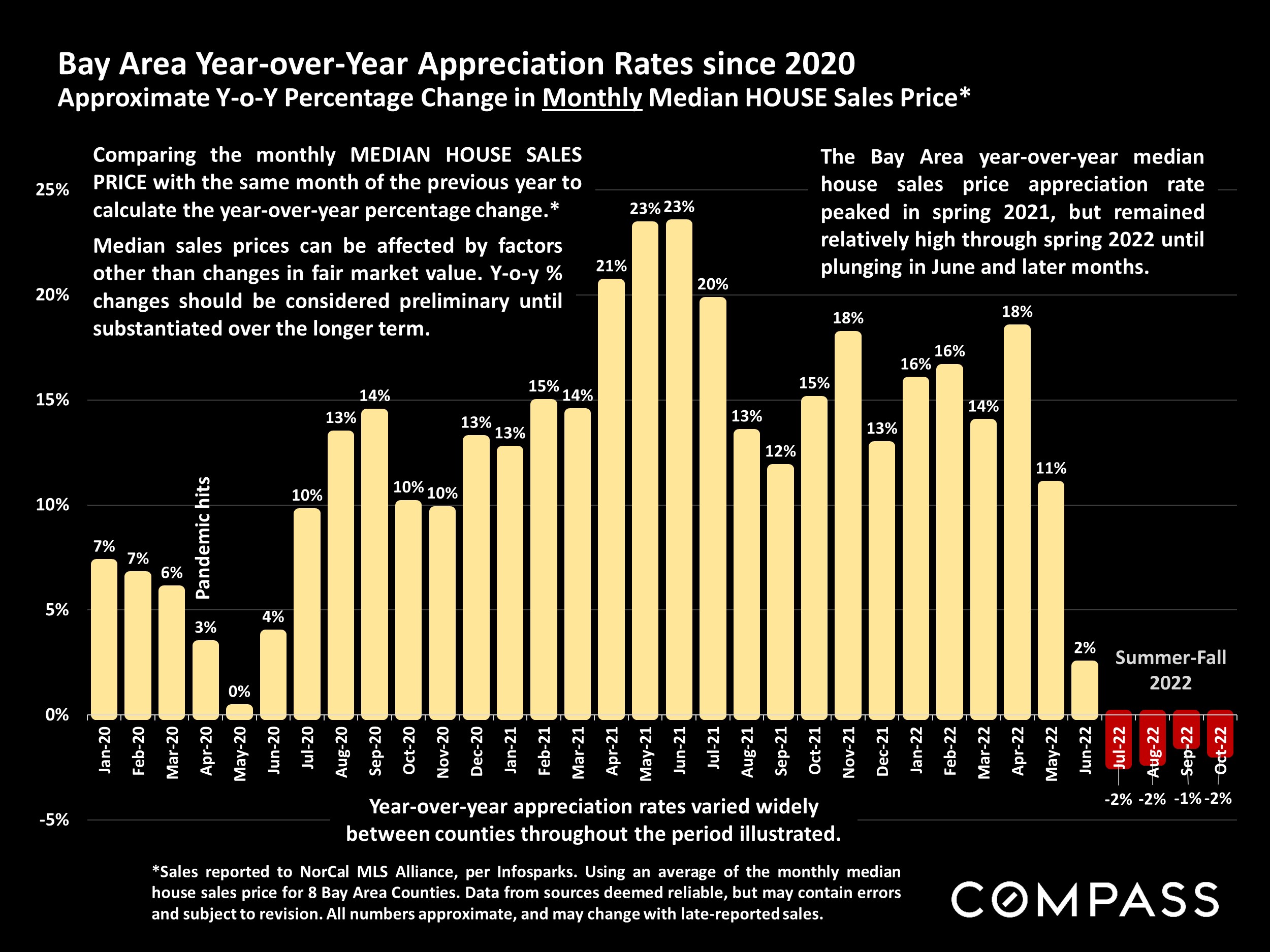

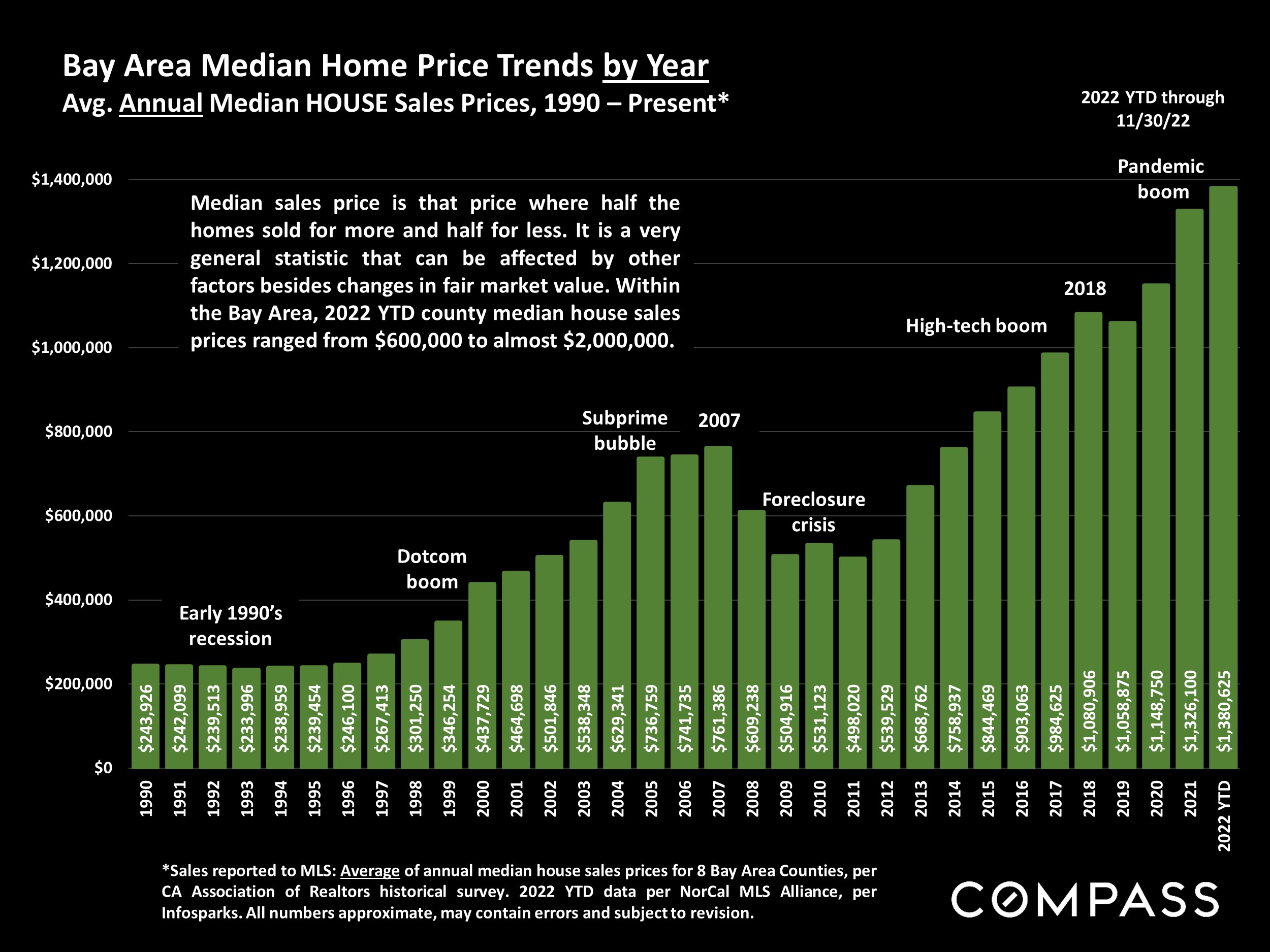

The significant changes in market dynamics that began in late spring/early summer 2022 due to a variety of macroeconomic headwinds – including increasing inflation and interest rates, and declining consumer confidence and stock markets (though all these have fluctuated over the period, and some readings have recently improved) – generally accelerated in autumn 2022. In the greater San Francisco Bay Area region, sales volumes and home-price appreciation rates have continued to decline on a year-over-year basis. The vast majority of statistics clearly illustrate a market that has substantially cooled and “corrected” since spring 2022, when it appears that a long, dramatic, 10-year market upcycle peaked. In recent months, luxury home sales have dropped more on a year-over-year percentage basis than the general residential market.

For the overall Bay Area, home prices are now lower year-over-year, though there are significant variations among the individual counties: Median sales prices in the most affordable counties are often still somewhat higher year over year. (Please refer to our individual county reports.)

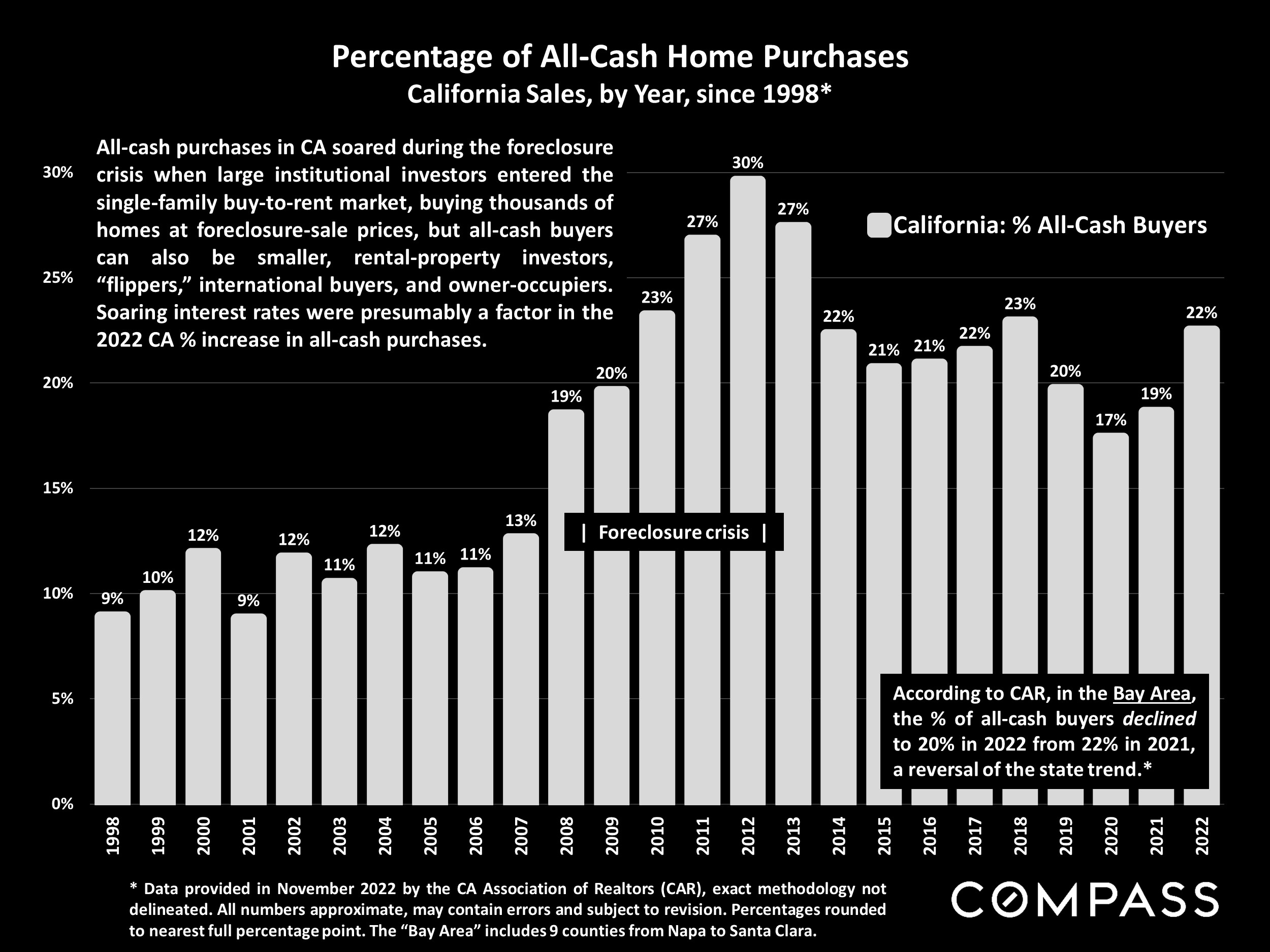

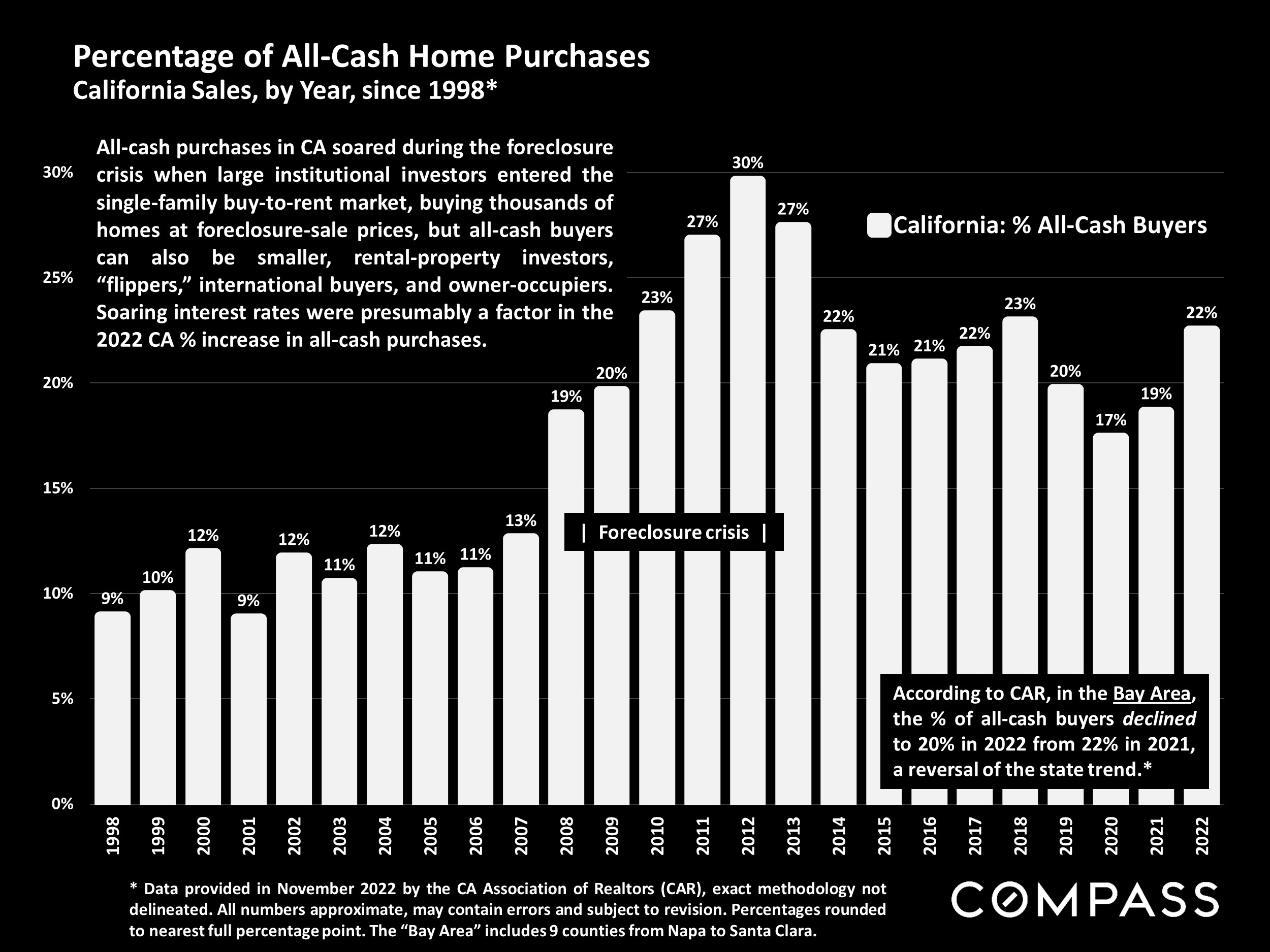

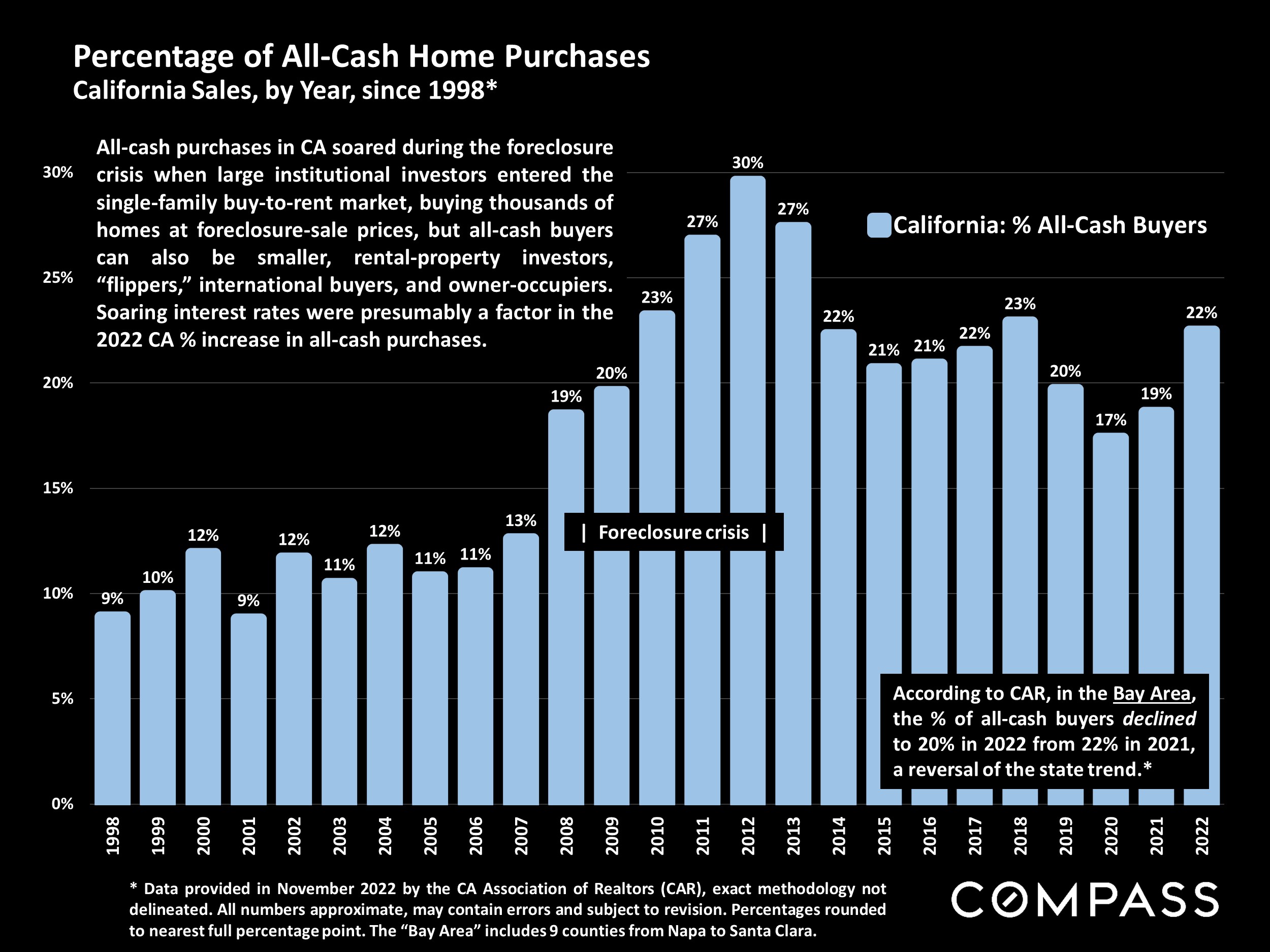

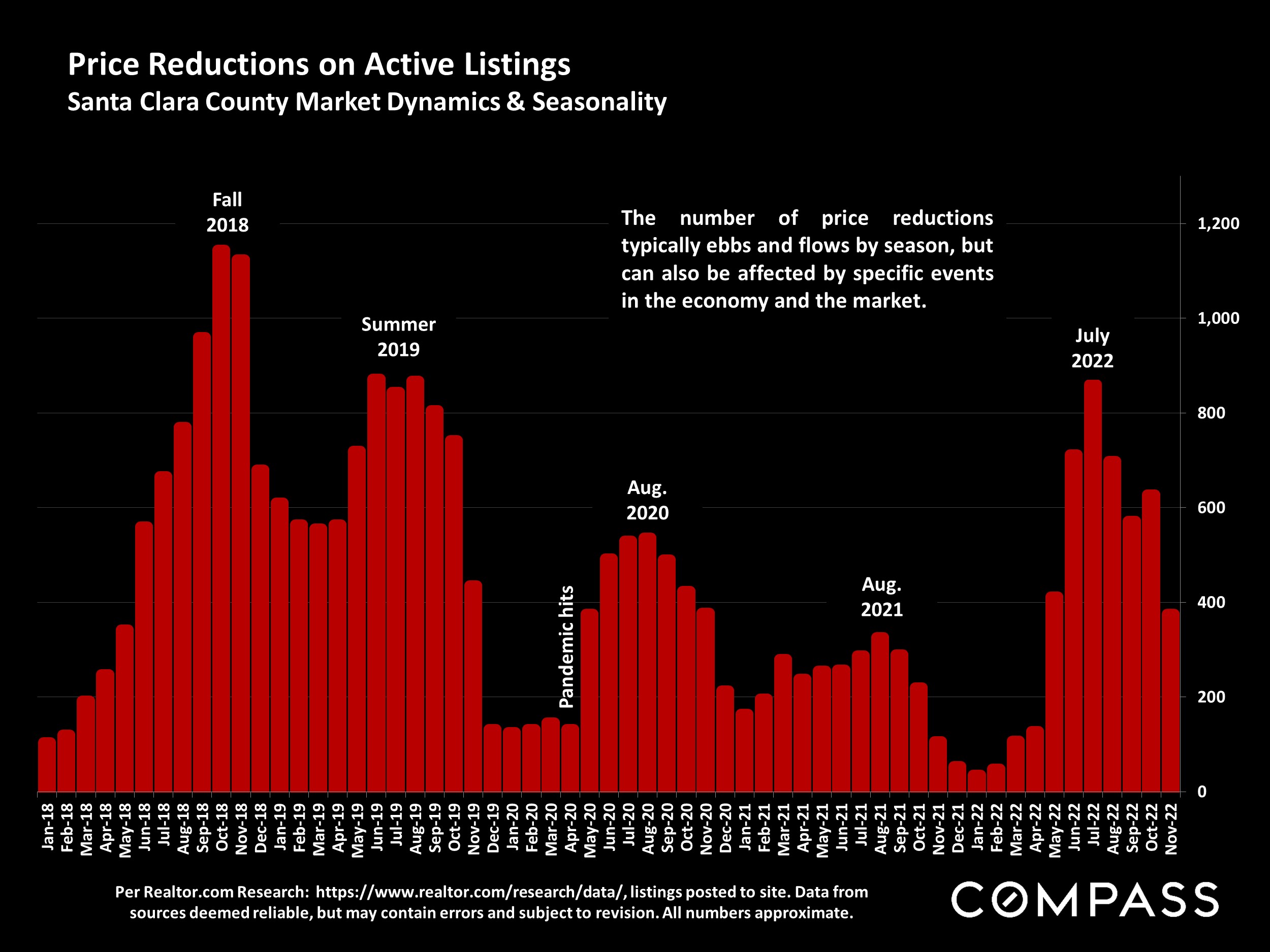

From a variety of short-term and long-term angles, this report will review data and trends in home prices and appreciation rates, sales volumes in the general and luxury market segments, overbidding and speed of sale, new listing and accepted-offer activity, the inventory of listings for sale, price reductions, all-cash purchases, and other housing metrics.

December typically sees the low point of listing and sales activity for the year – and some sellers take their homes off the market until the new year – but thousands of homes will continue to be marketed and sold. This can be an excellent time for buyers to aggressively negotiate prices, though the supply of homes to choose from dwindles. The market usually begins to wake up in mid-January and then quickly accelerates in early spring. In the Bay Area, depending on the weather and economic conditions, the “early spring” market can begin as soon as February. The single, most closely watched factor will be what happens in mortgage interest rates.

Source: Compass

It is impossible to know how median and average value statistics apply to any particular home without a specific comparative market analysis. These analyses were made in good faith with data from sources deemed reliable, but may contain errors and are subject to revision. It is not our intent to convince you of a particular position, but to attempt to provide straightforward data and analysis, so you can make your own informed decisions. Median and average statistics are enormous generalities: There are hundreds of different markets in San Francisco and the Bay Area, each with its own unique dynamics. Median prices and average dollar per square foot values can be and often are affected by other factors besides changes in fair market value. Longer term trends are much more meaningful than short-term.

Compass is a real estate broker licensed by the State of California, DRE 01527235. Equal Housing Opportunity. This report has been prepared solely for information purposes. The information herein is based on or derived from information generally available to the public and/or from sources believed to be reliable. No representation or warranty can be given with respect to the accuracy or completeness of the information. Compass disclaims any and all liability relating to this report, including without limitation any express or implied representations or warranties for statements contained in, and omissions from, the report. Nothing contained herein is intended to be or should be read as any regulatory, legal, tax, accounting or other advice and Compass does not provide such advice. All opinions are subject to change without notice. Compass makes no representation regarding the accuracy of any statements regarding any references to the laws, statutes or regulations of any state are those of the author(s). Past performance is no guarantee of future results.

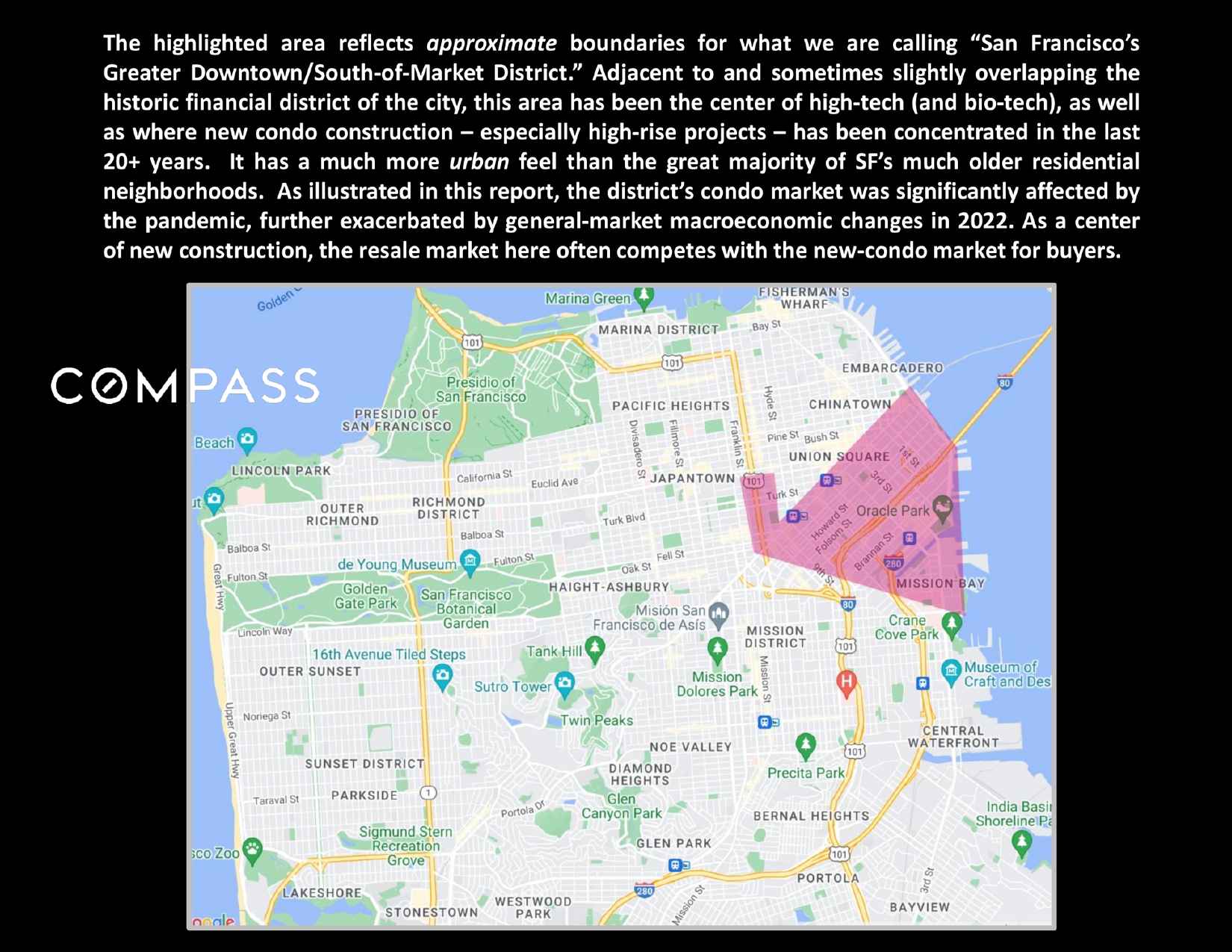

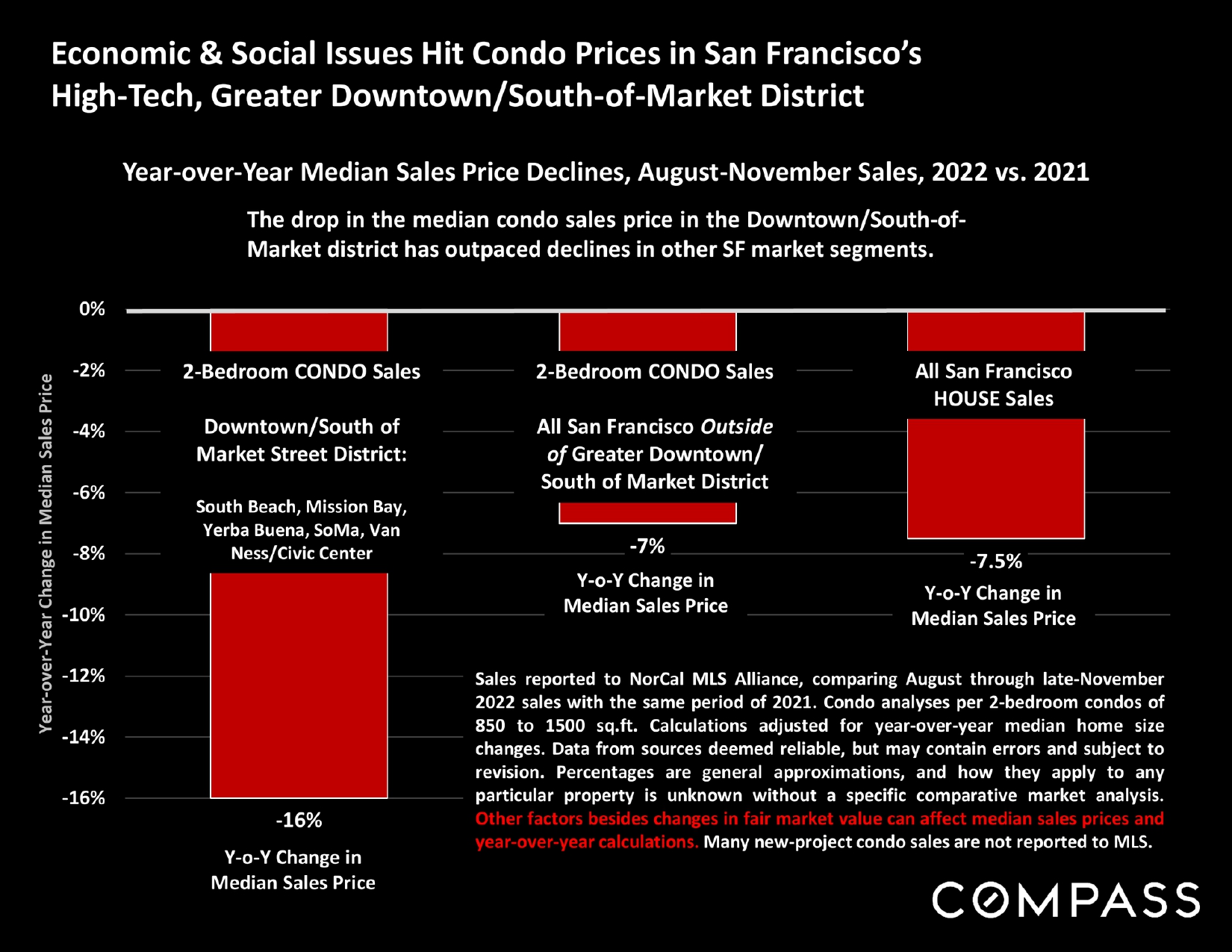

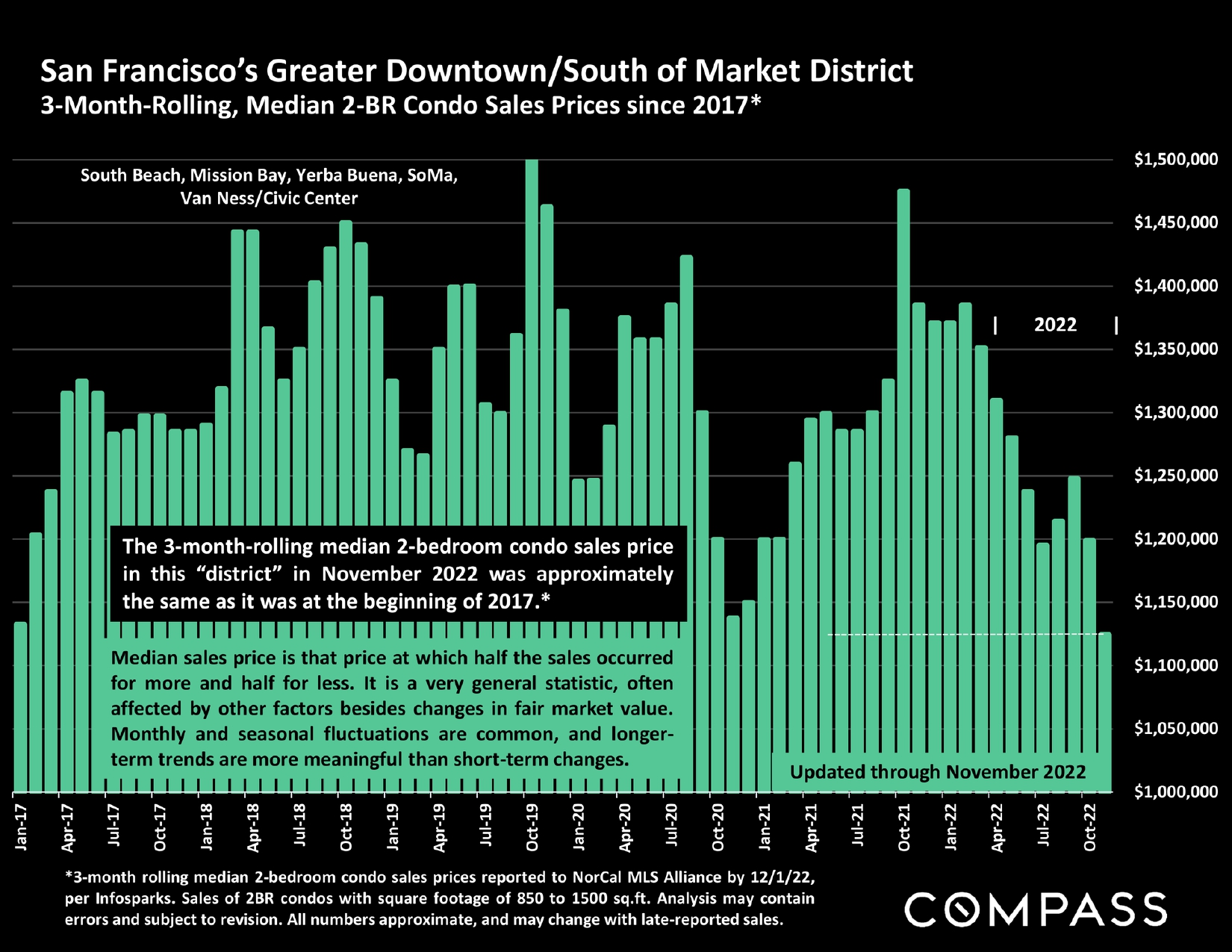

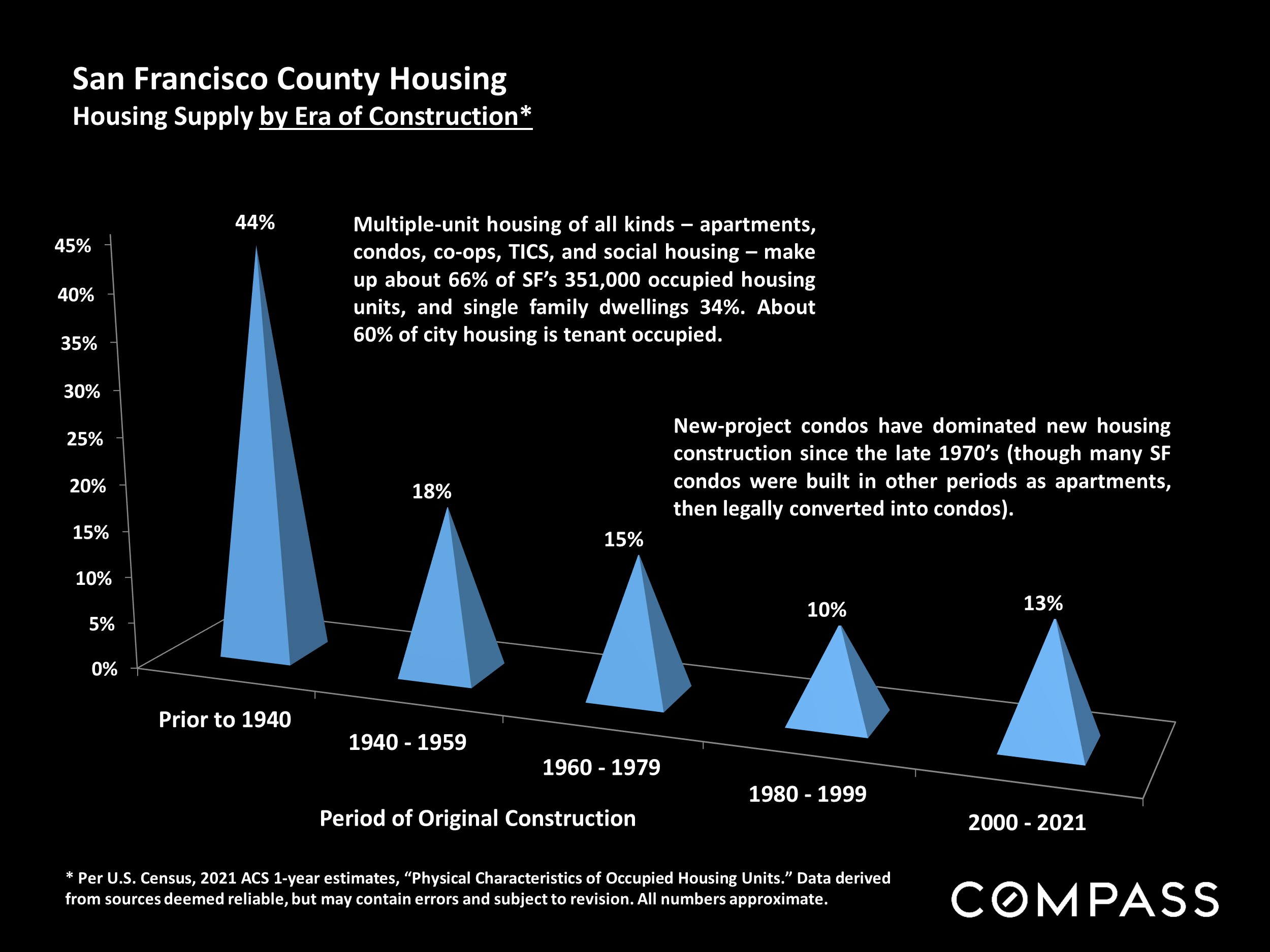

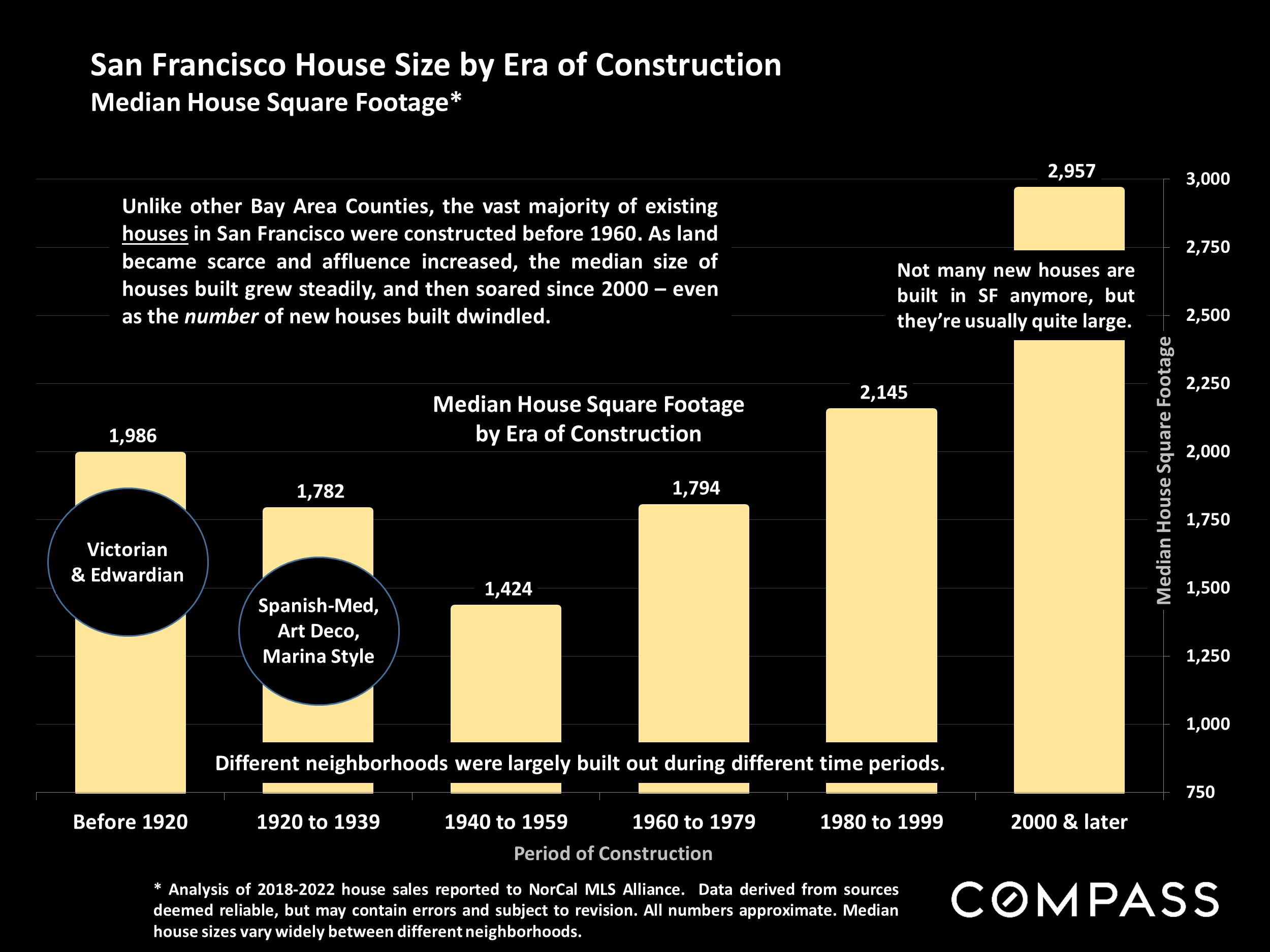

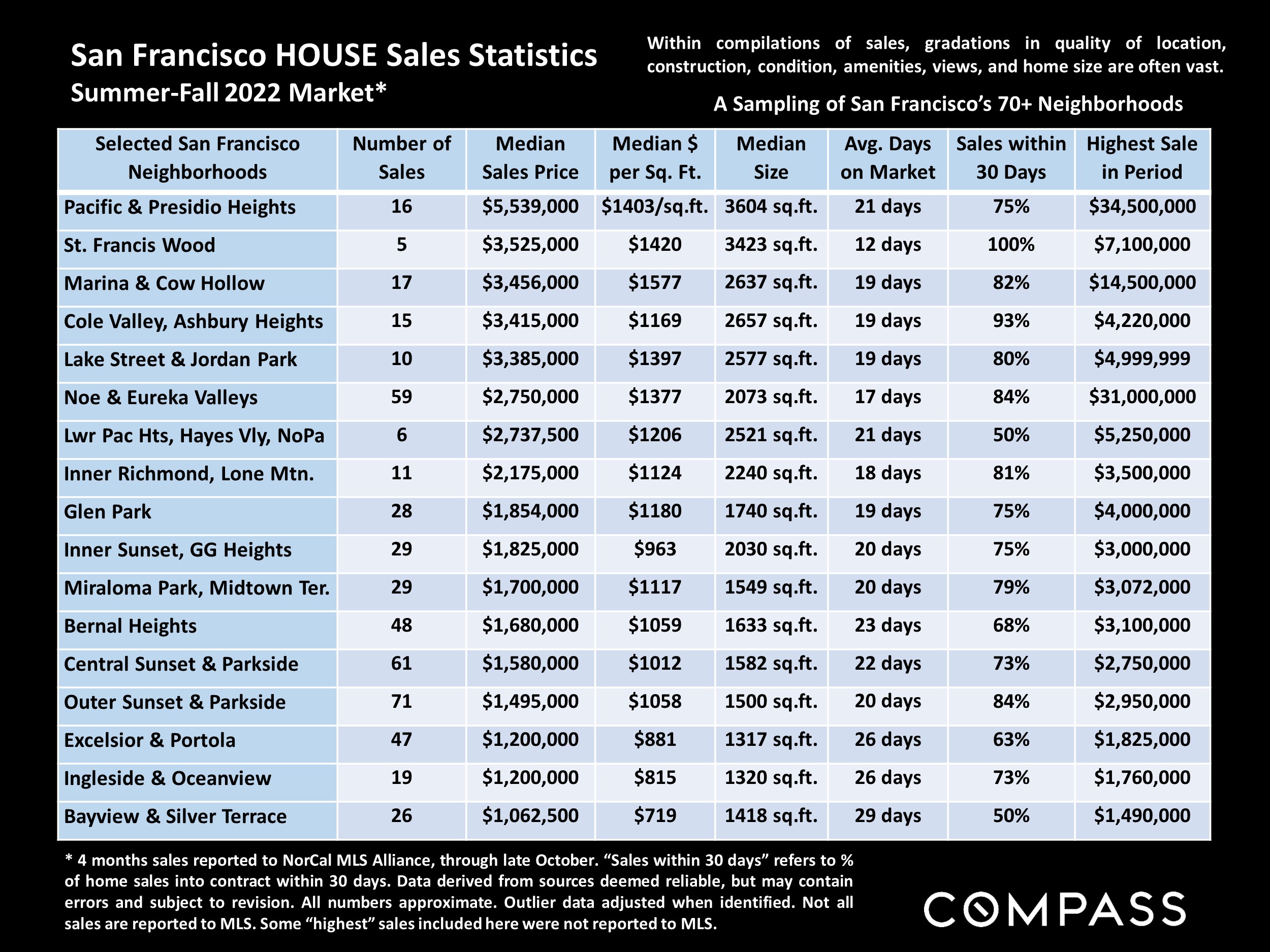

San Francisco County Real Estate, December 2022

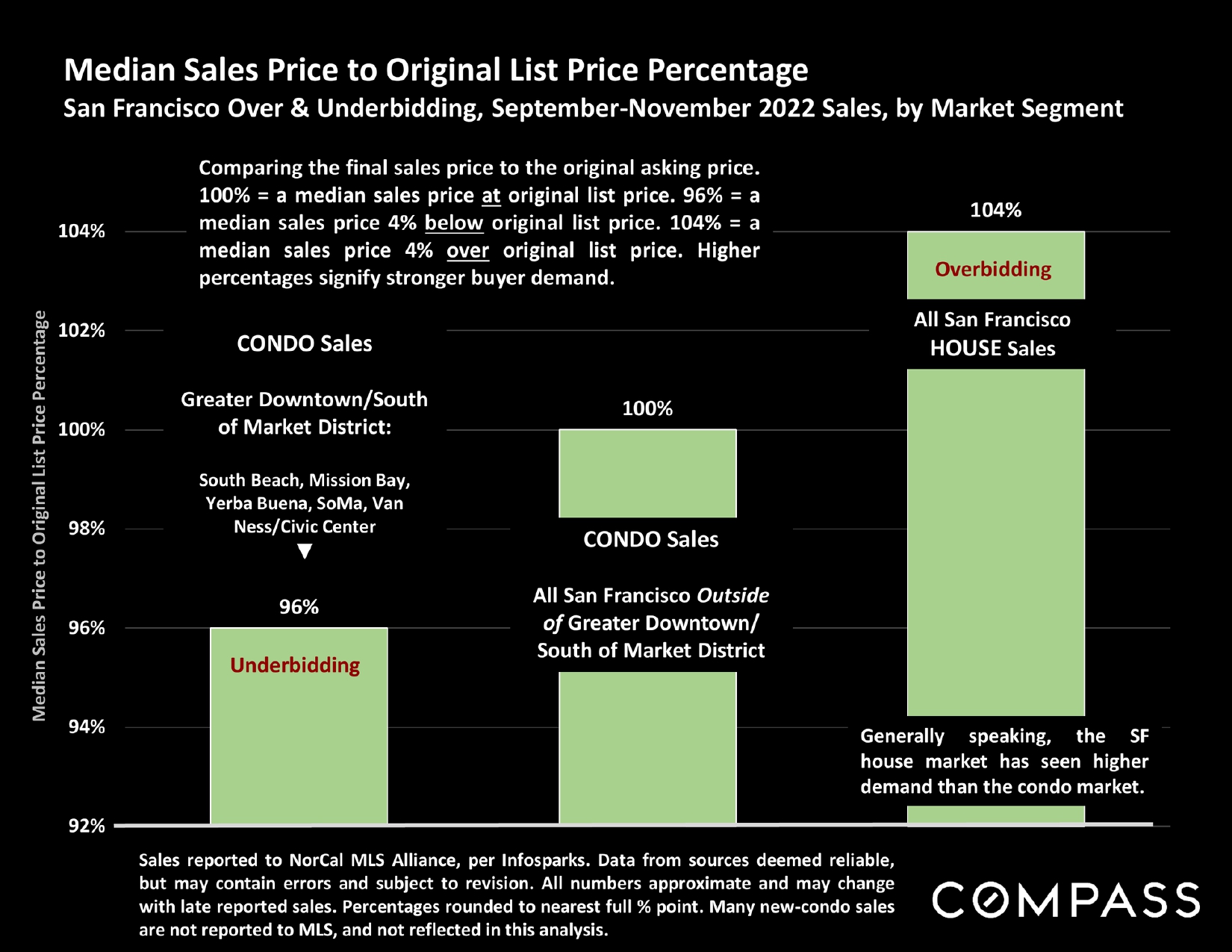

The changes in market dynamics that began in late spring/early summer 2022 generally continued in autumn due to the ongoing economic headwinds, including high inflation and interest rates, reduced consumer confidence, and volatile stock markets, though all have fluctuated significantly over the period, and some readings have recently improved. The great majority of indicators – home prices and appreciation rates, sales volumes, overbidding, days-on-market, months supply of inventory, and so on – continue to describe a market that has substantially cooled and “corrected” since spring 2022, when it appears that a long, dramatic, 10-year market upcycle peaked. The correction in San Francisco has been somewhat larger than in other Bay Area counties. (Note that a “correction” is not remotely similar to a crash, such as was seen during the subprime loan/foreclosure crisis.) In recent months, luxury home sales have seen larger year-over-year percentage declines than the general market. But thousands of Bay Area homes continue to sell, some very quickly at over asking price: With the shifts in market conditions, pricing correctly has become an imperative for sellers.

December typically sees the low point of new-listing and sales activity – with an increasing number of homes taken off the market to await the new year – but listing, buying and selling continues. This can be an excellent time for buyers to aggressively negotiate prices, though the supply of listings to choose from declines. The market usually begins to wake up in mid-January and then quickly accelerates in early spring: In the Bay Area, depending on the weather and economic conditions, the “early spring” market can begin as soon as February.

The single, most closely watched factor will be interest rates, since they have such an outsized impact on monthly housing costs and affordability, as well as on stock markets and consumer confidence. At the end of this report is a link to our extended review of macroeconomic issues.

Our reports are not intended to convince you regarding a course of action or to predict the future, but to provide, to the best of our ability, straightforward information and good-faith analysis to assist you in making your own informed decisions. Statistics should be considered very general indicators, and all numbers should be considered approximate. How they apply to any particular property is unknown without a specific comparative market analysis.

Source: Compass

It is impossible to know how median and average value statistics apply to any particular home without a specific comparative market analysis. These analyses were made in good faith with data from sources deemed reliable, but may contain errors and are subject to revision. It is not our intent to convince you of a particular position, but to attempt to provide straightforward data and analysis, so you can make your own informed decisions. Median and average statistics are enormous generalities: There are hundreds of different markets in San Francisco and the Bay Area, each with its own unique dynamics. Median prices and average dollar per square foot values can be and often are affected by other factors besides changes in fair market value. Longer term trends are much more meaningful than short-term.

Compass is a real estate broker licensed by the State of California, DRE 01527235. Equal Housing Opportunity. This report has been prepared solely for information purposes. The information herein is based on or derived from information generally available to the public and/or from sources believed to be reliable. No representation or warranty can be given with respect to the accuracy or completeness of the information. Compass disclaims any and all liability relating to this report, including without limitation any express or implied representations or warranties for statements contained in, and omissions from, the report. Nothing contained herein is intended to be or should be read as any regulatory, legal, tax, accounting or other advice and Compass does not provide such advice. All opinions are subject to change without notice. Compass makes no representation regarding the accuracy of any statements regarding any references to the laws, statutes or regulations of any state are those of the author(s). Past performance is no guarantee of future results.

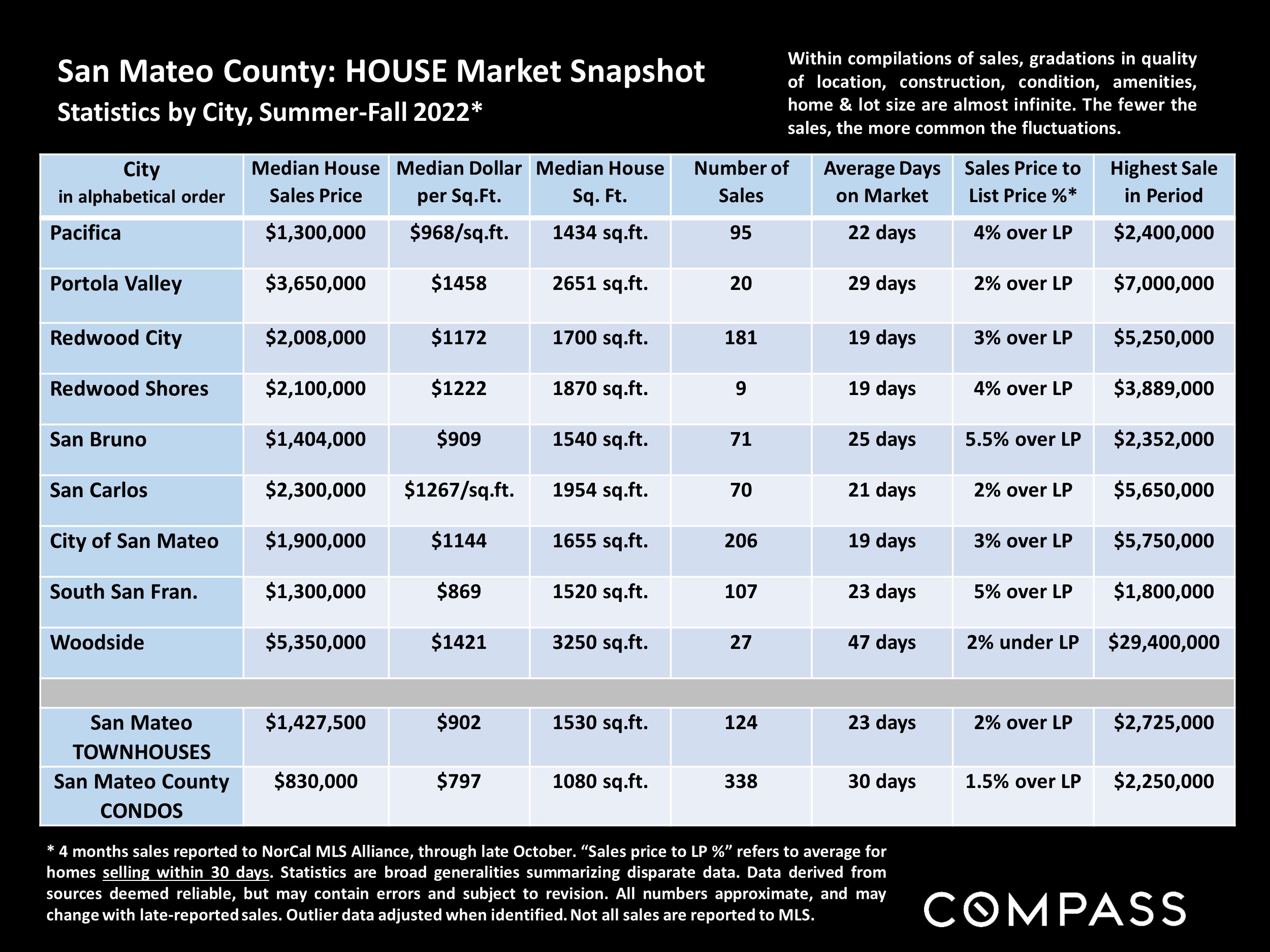

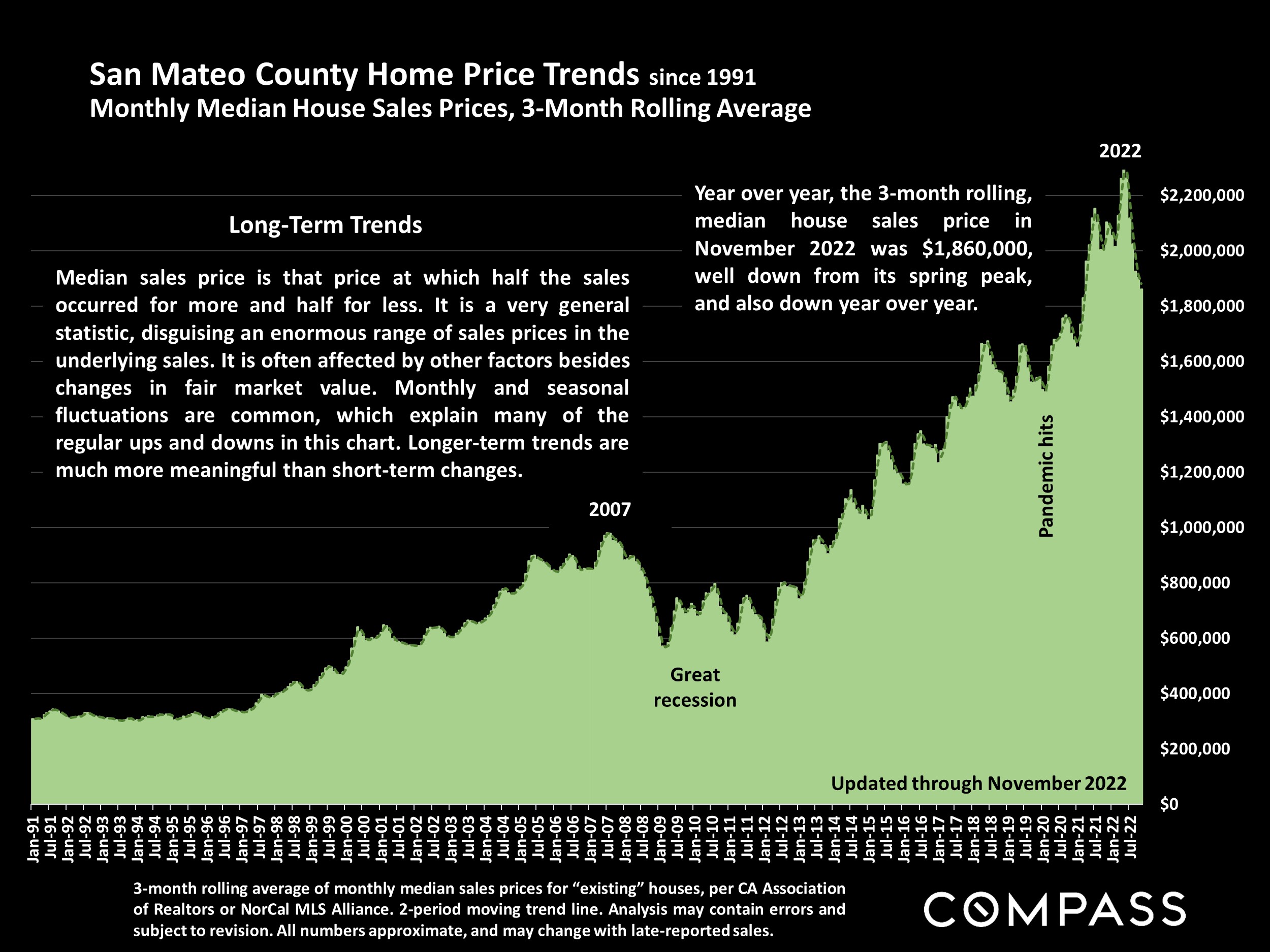

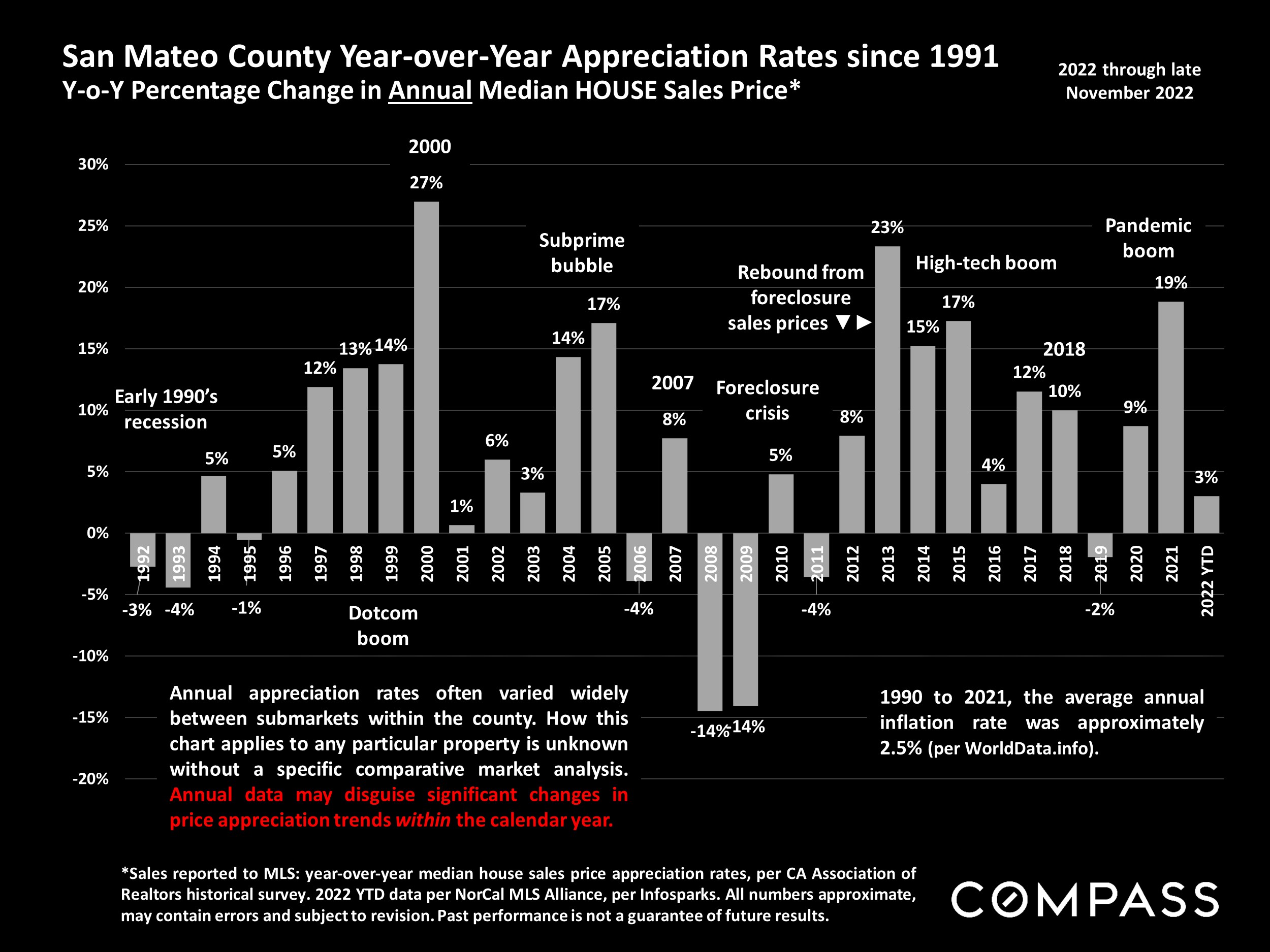

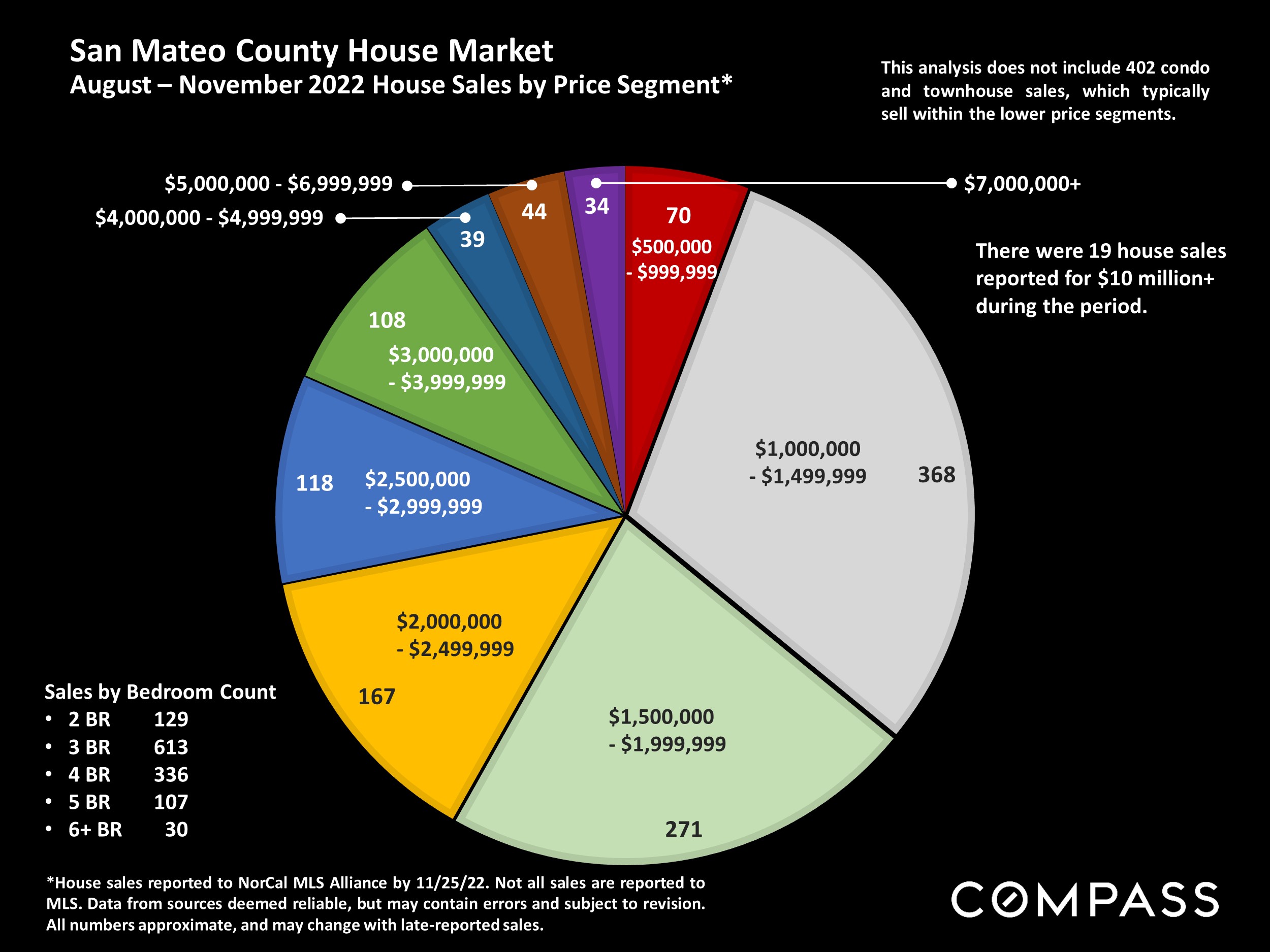

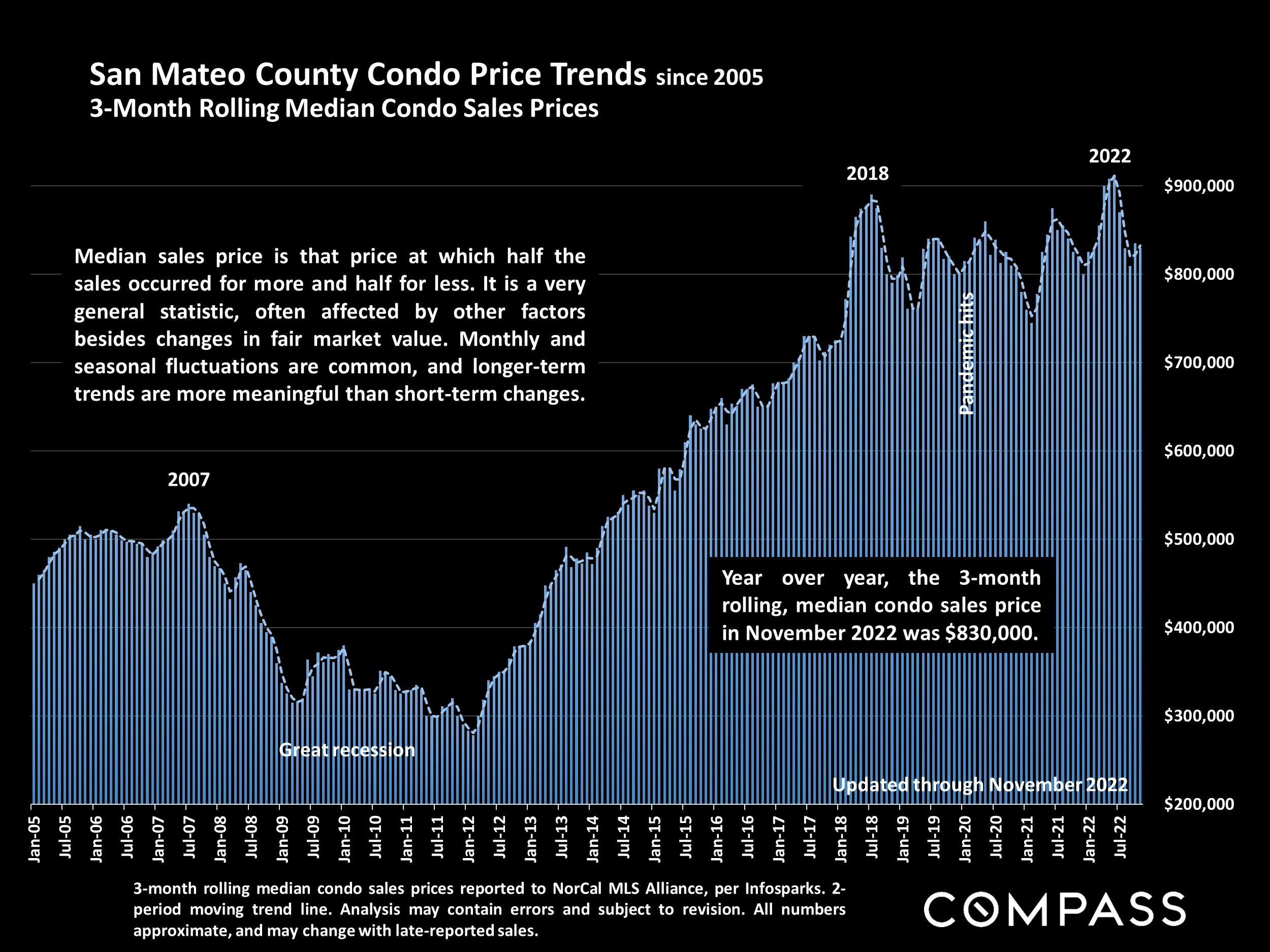

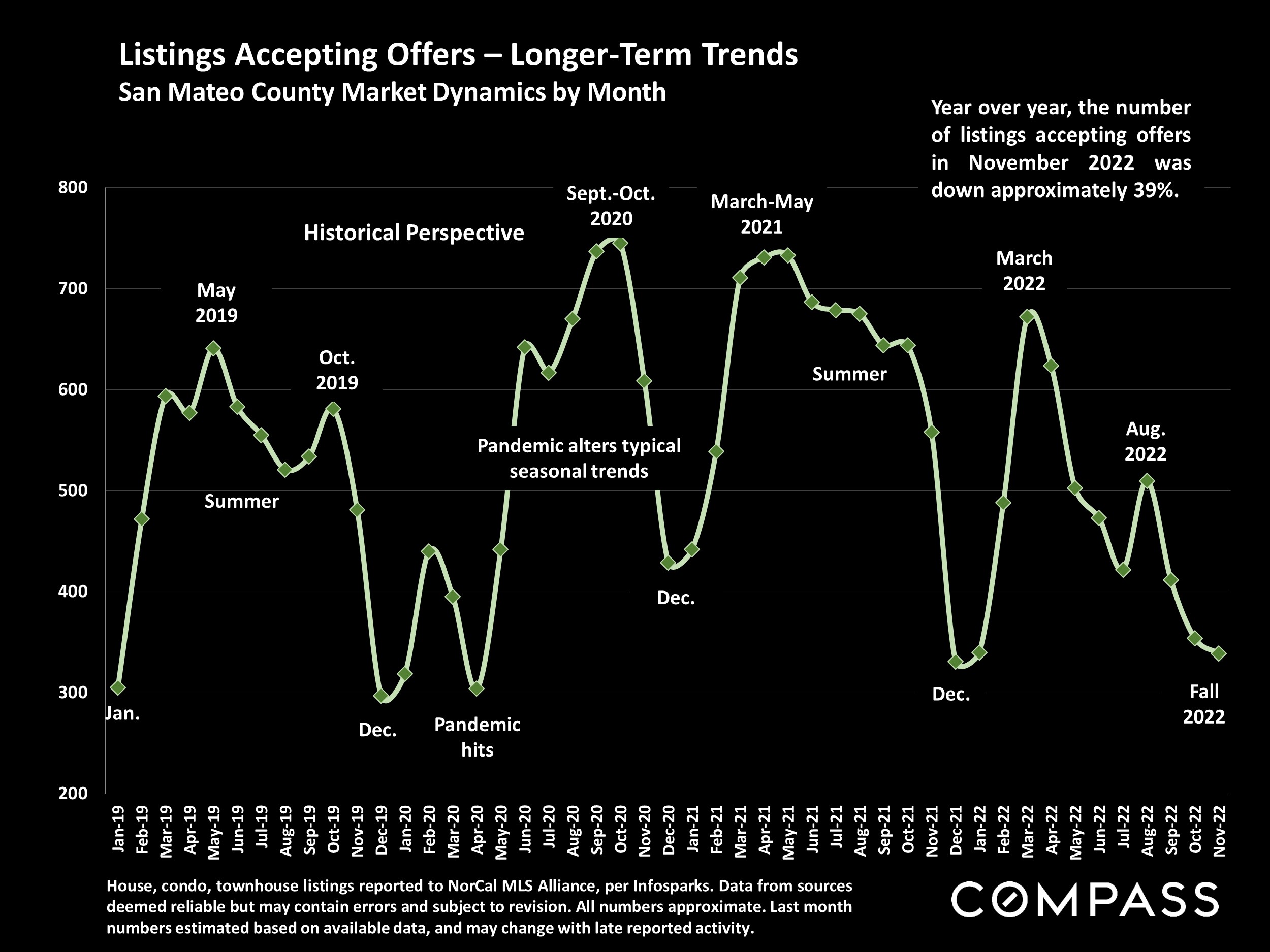

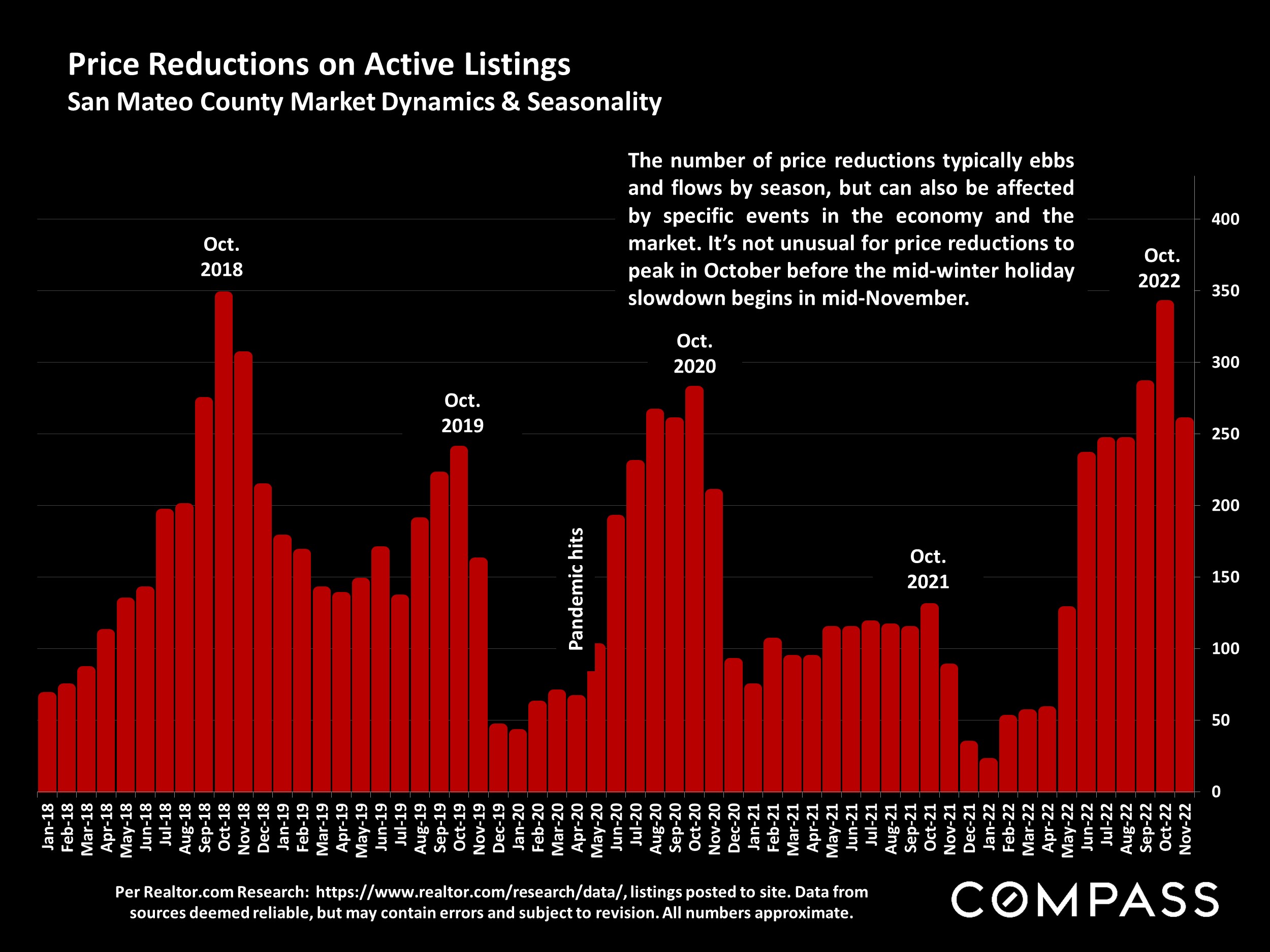

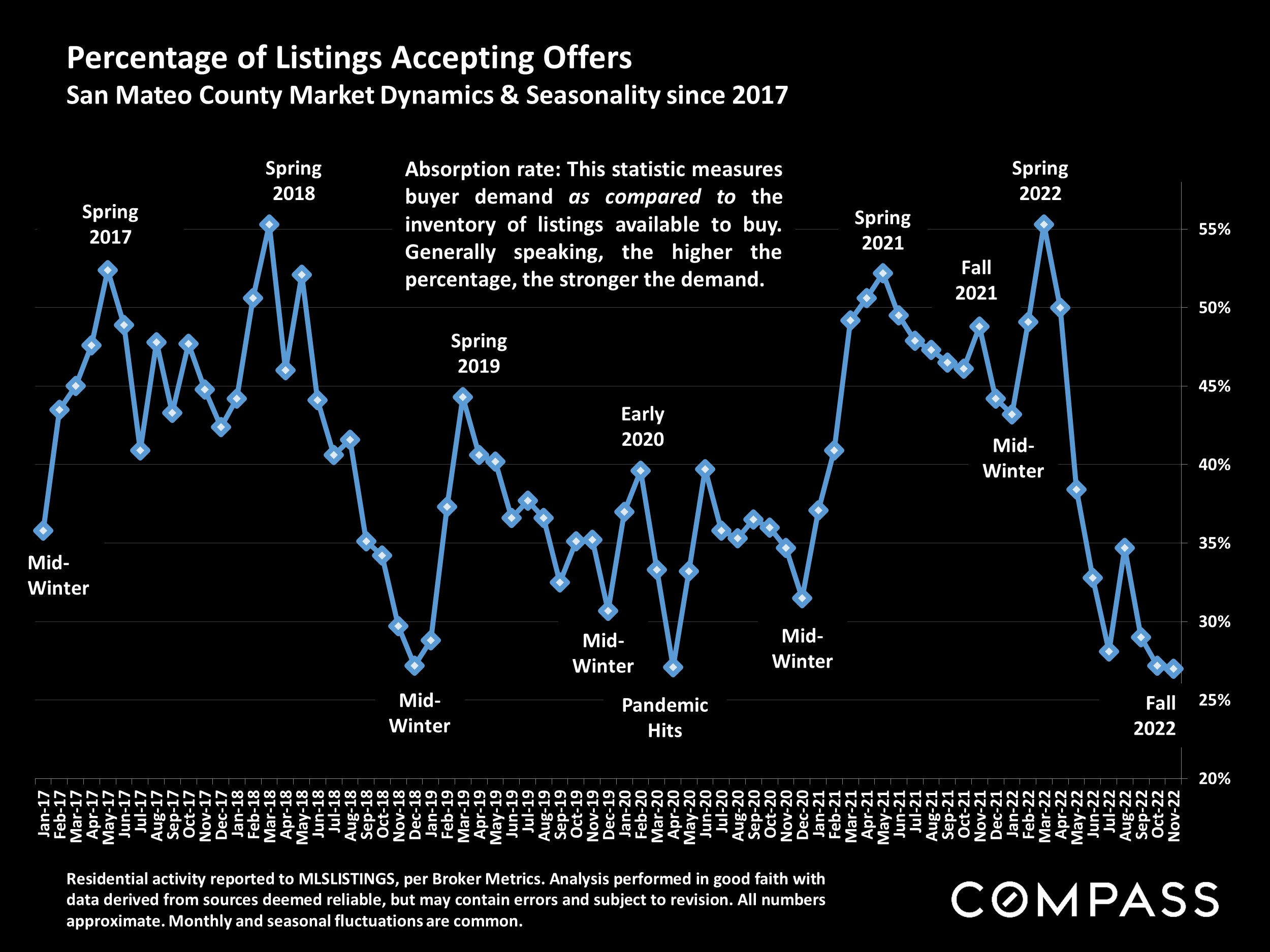

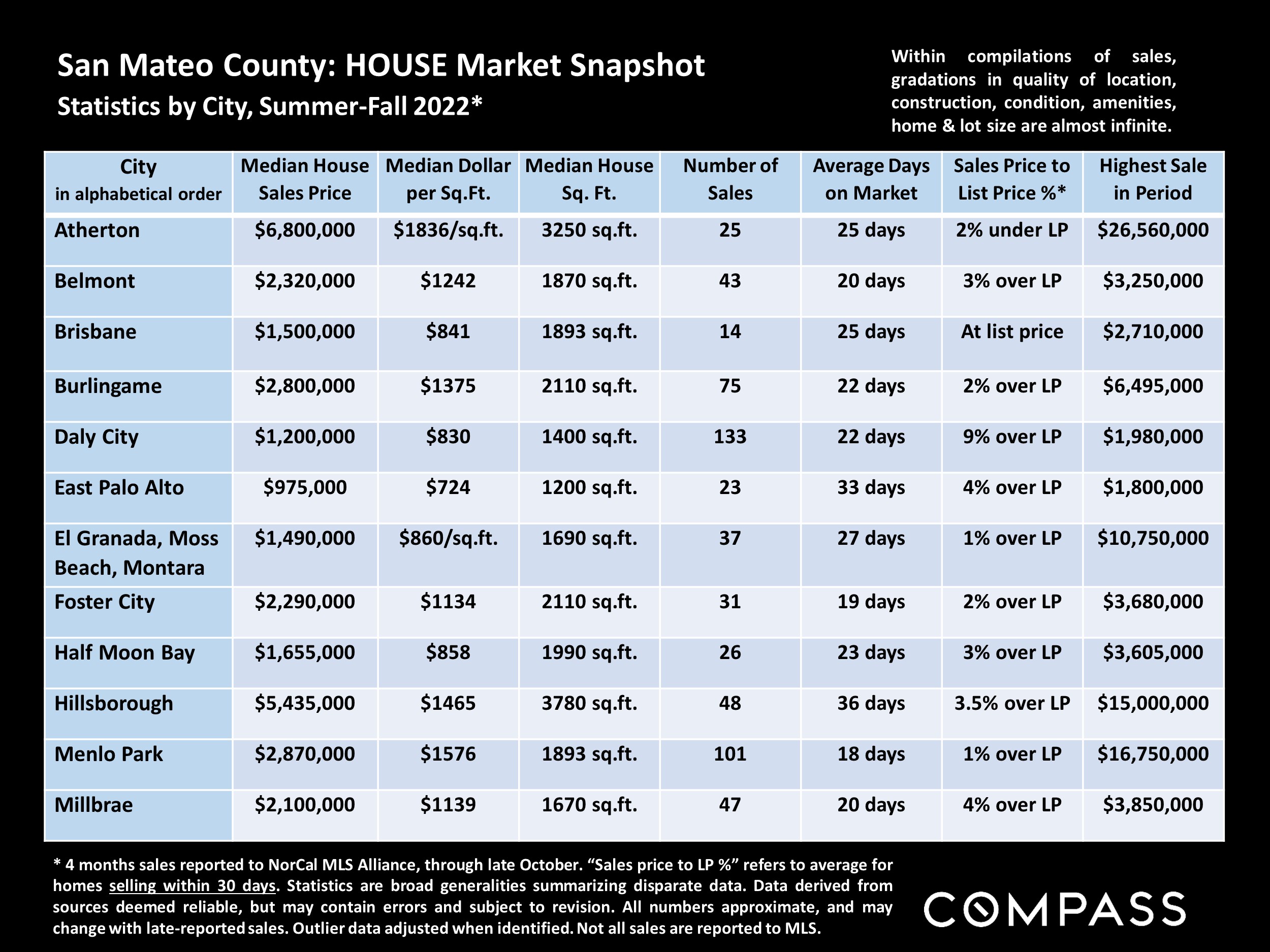

San Mateo County Real Estate, December 2022

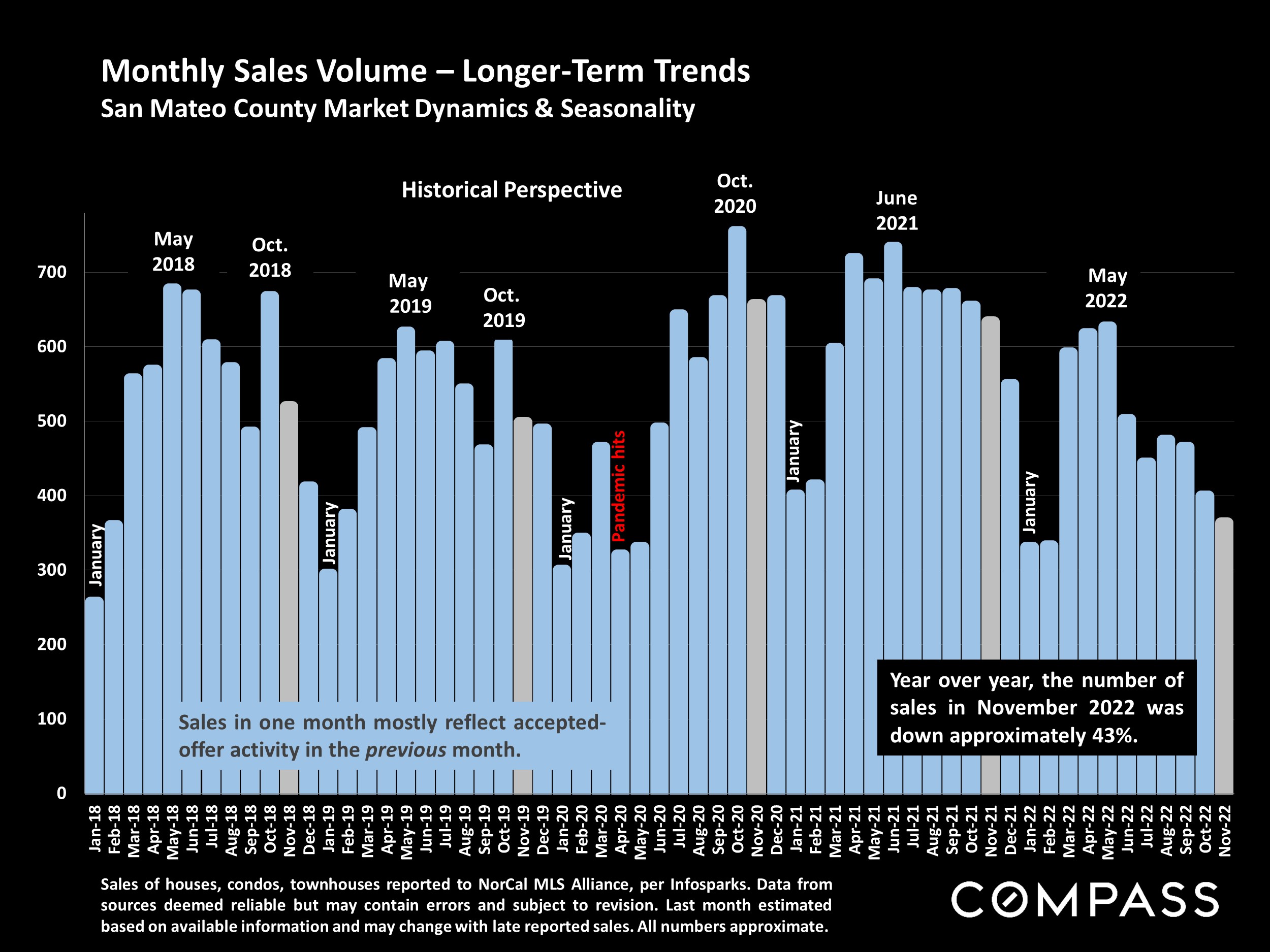

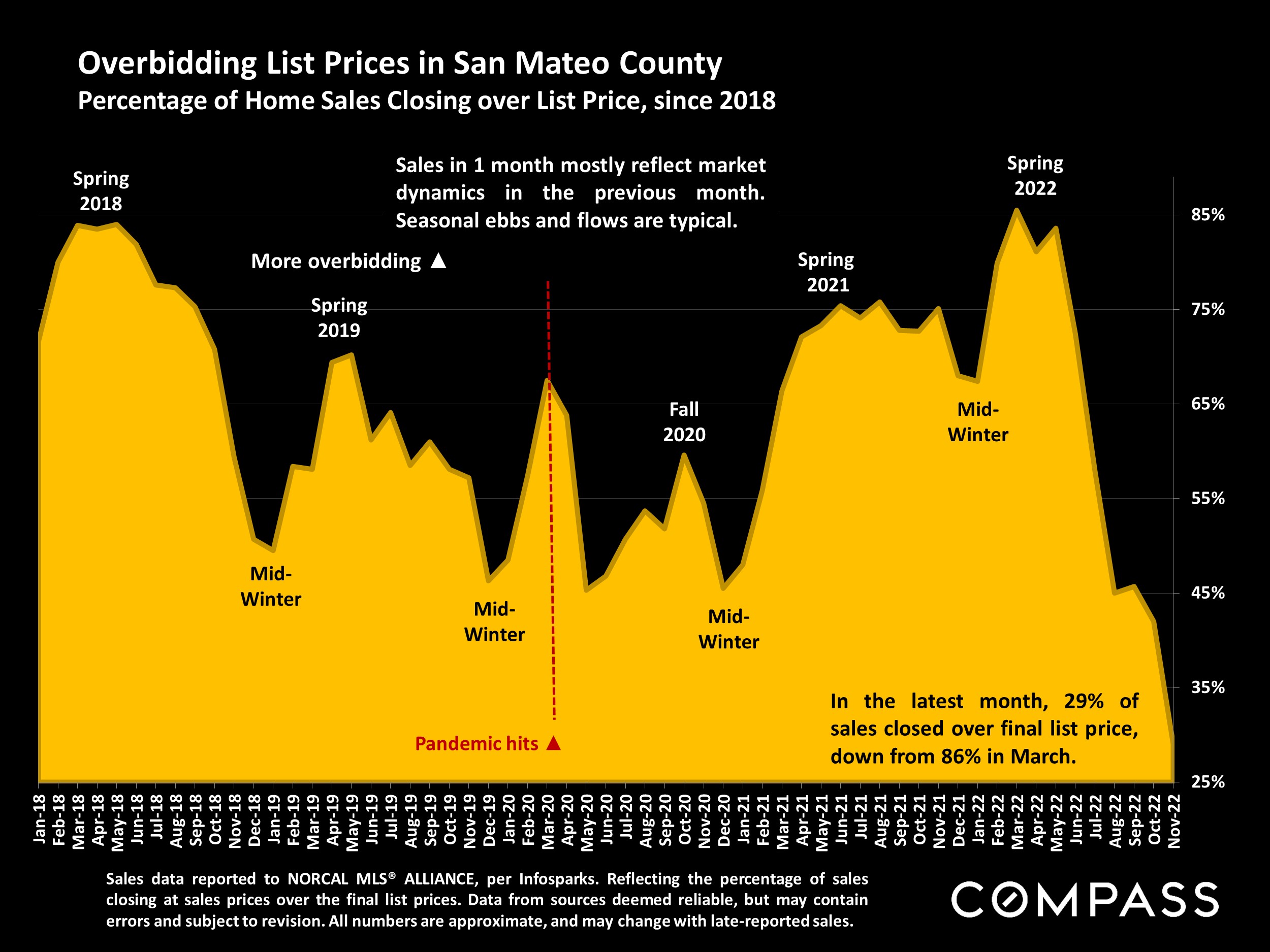

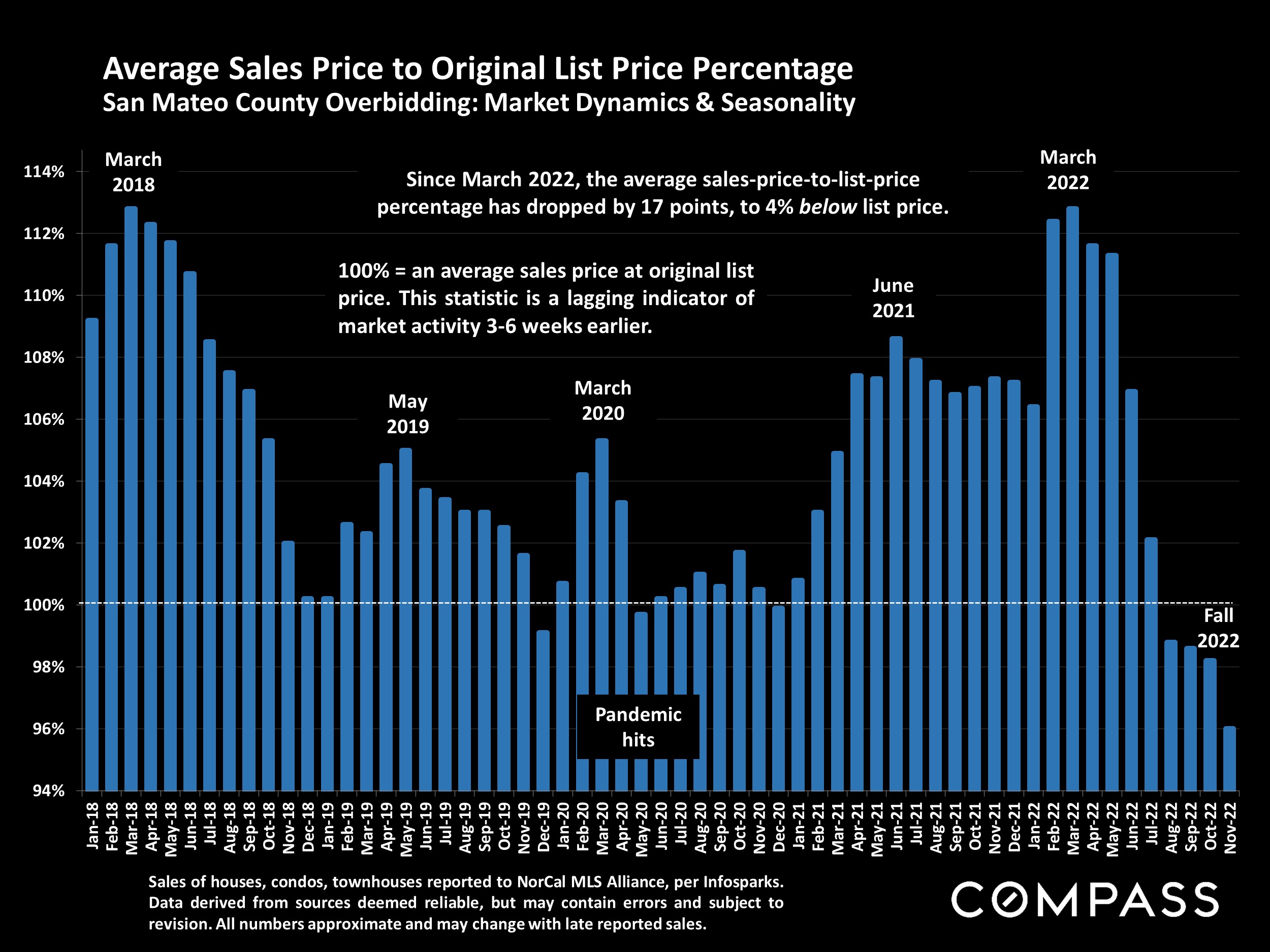

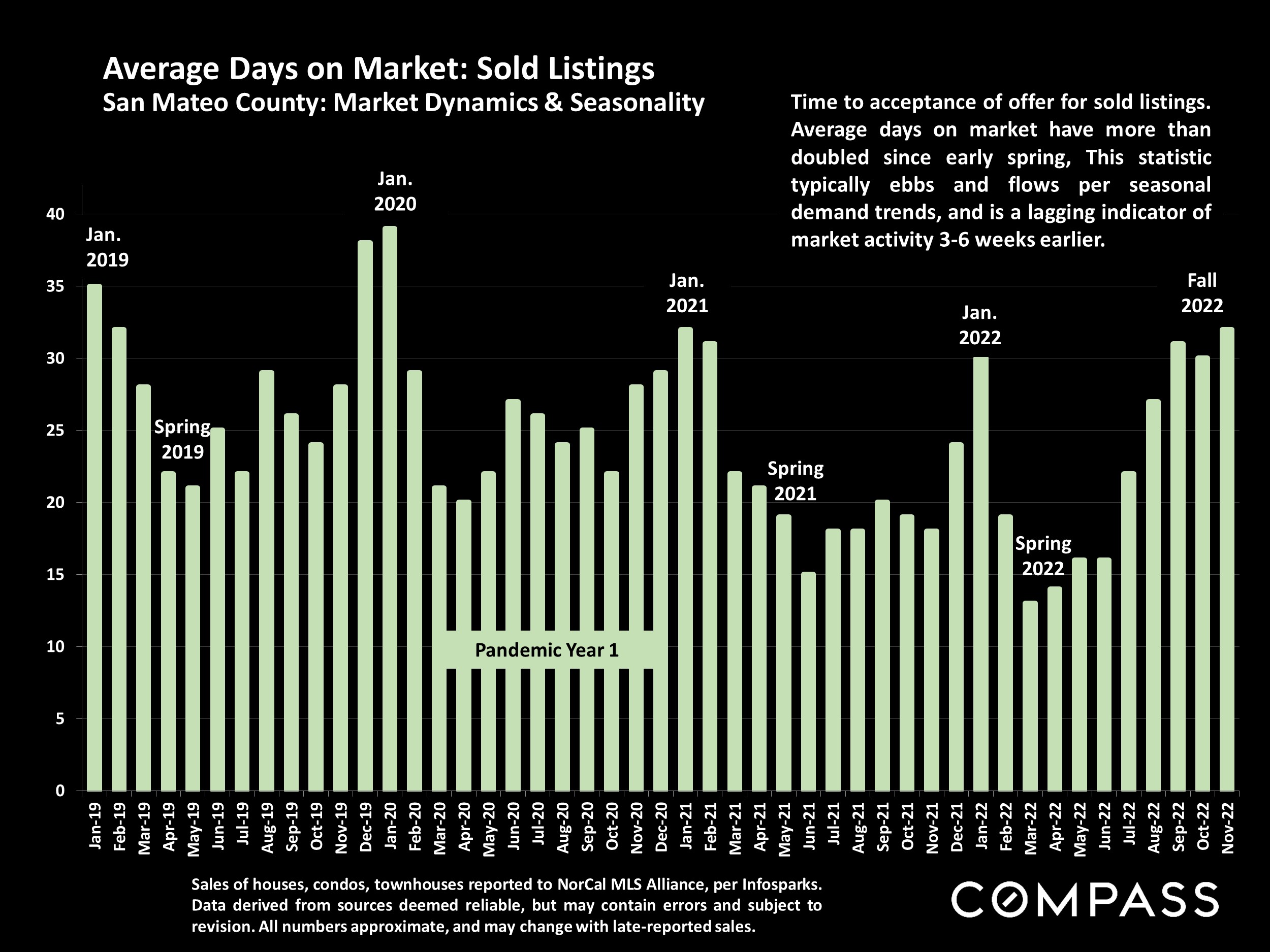

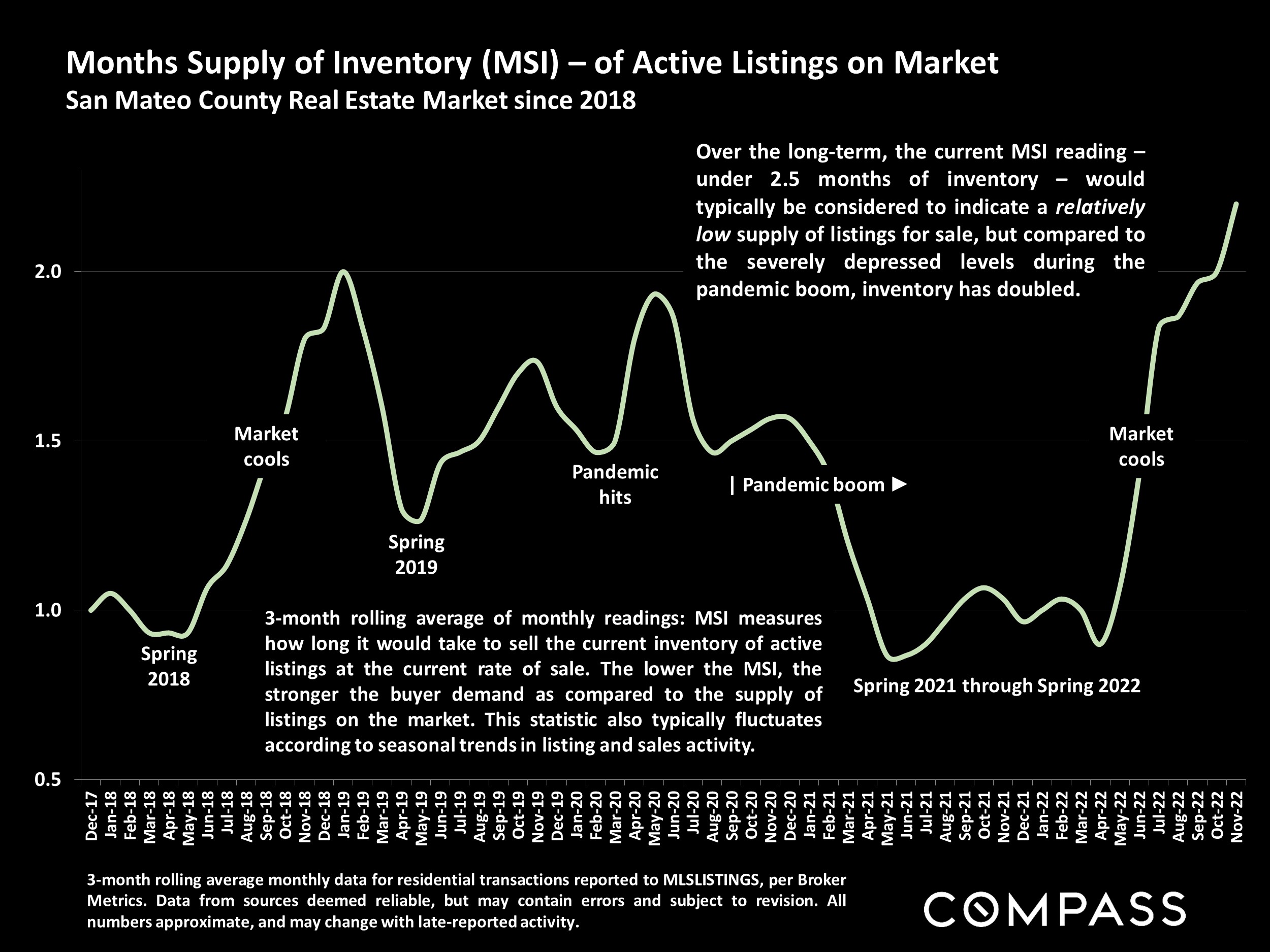

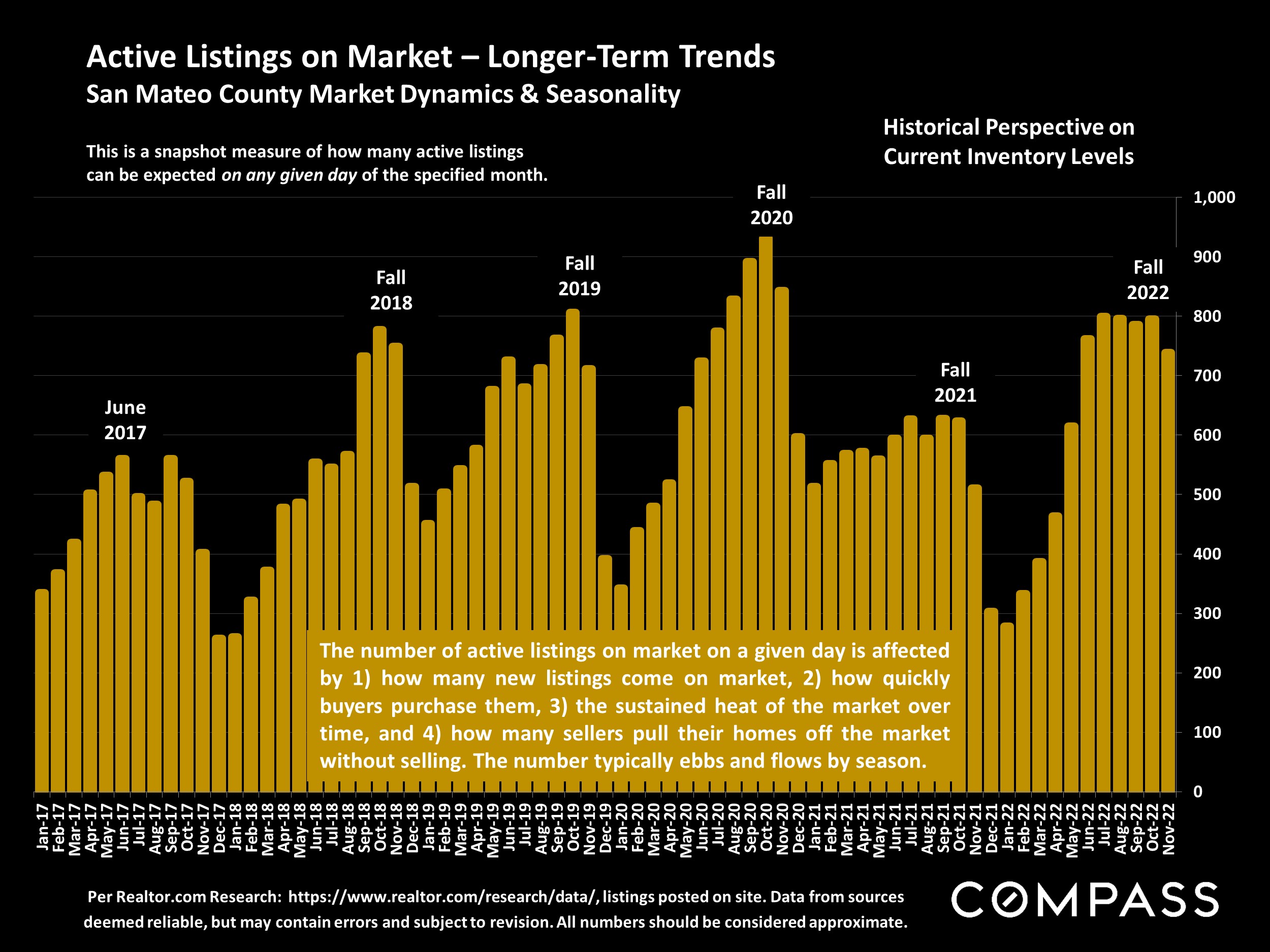

The changes in market dynamics that began in late spring/early summer 2022 generally continued in autumn due to the ongoing economic headwinds, including high inflation and interest rates, reduced consumer confidence, and volatile stock markets, though all have fluctuated significantly over the period, and some readings have recently improved. The great majority of indicators – home prices and appreciation rates, sales volumes, overbidding, days-on-market, months supply of inventory, and so on – continue to describe a market that has substantially cooled and “corrected” since spring 2022, when it appears that a long, dramatic, 10-year market upcycle peaked. (Note that a “correction” is not remotely similar to a crash, such as was seen during the subprime loan/foreclosure crisis.) In recent months, luxury home sales have seen larger year-over-year percentage declines than the general market. But thousands of Bay Area homes continue to sell, some very quickly at over asking price: With the shifts in market conditions, pricing correctly has become an imperative for sellers.

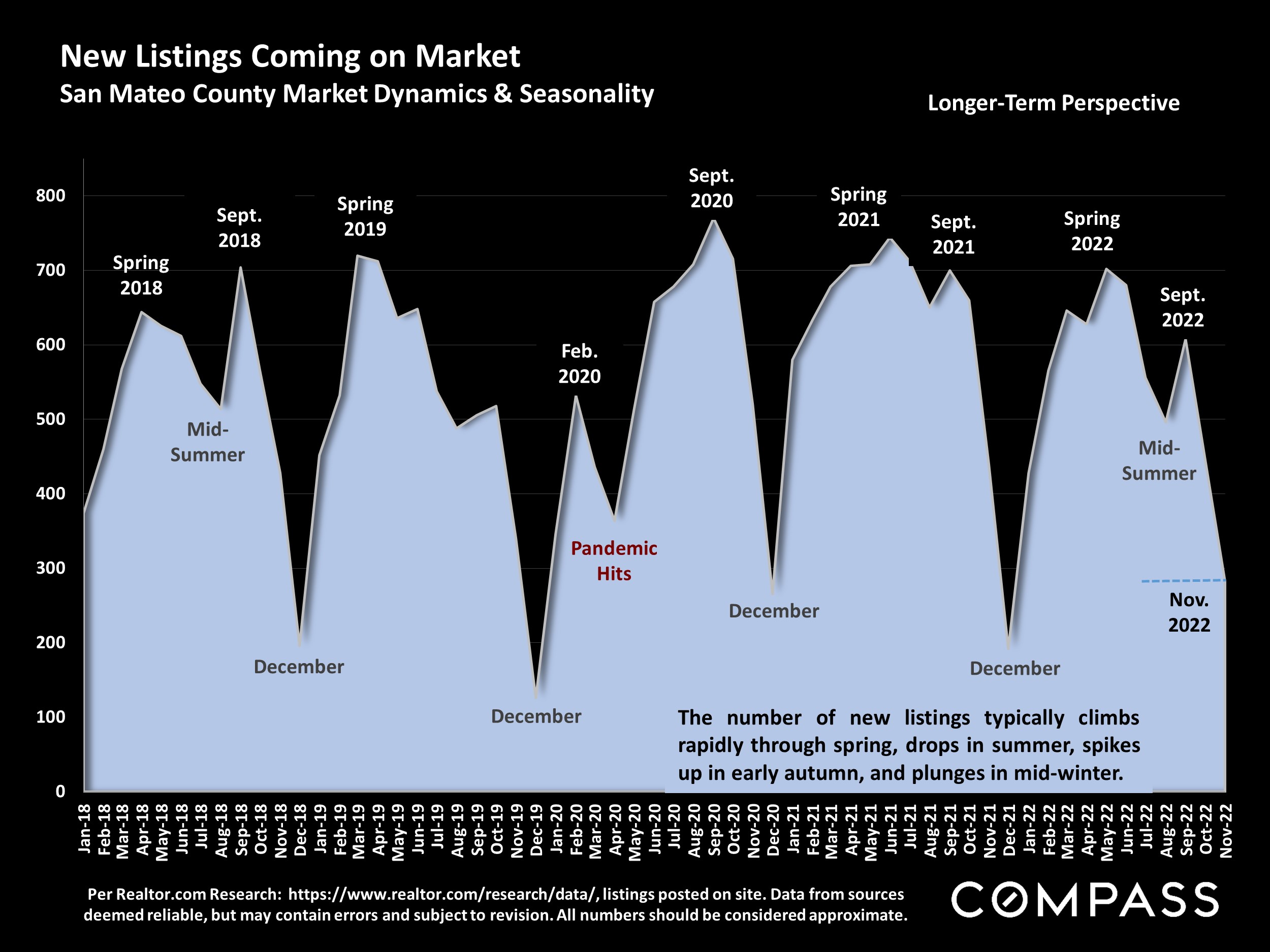

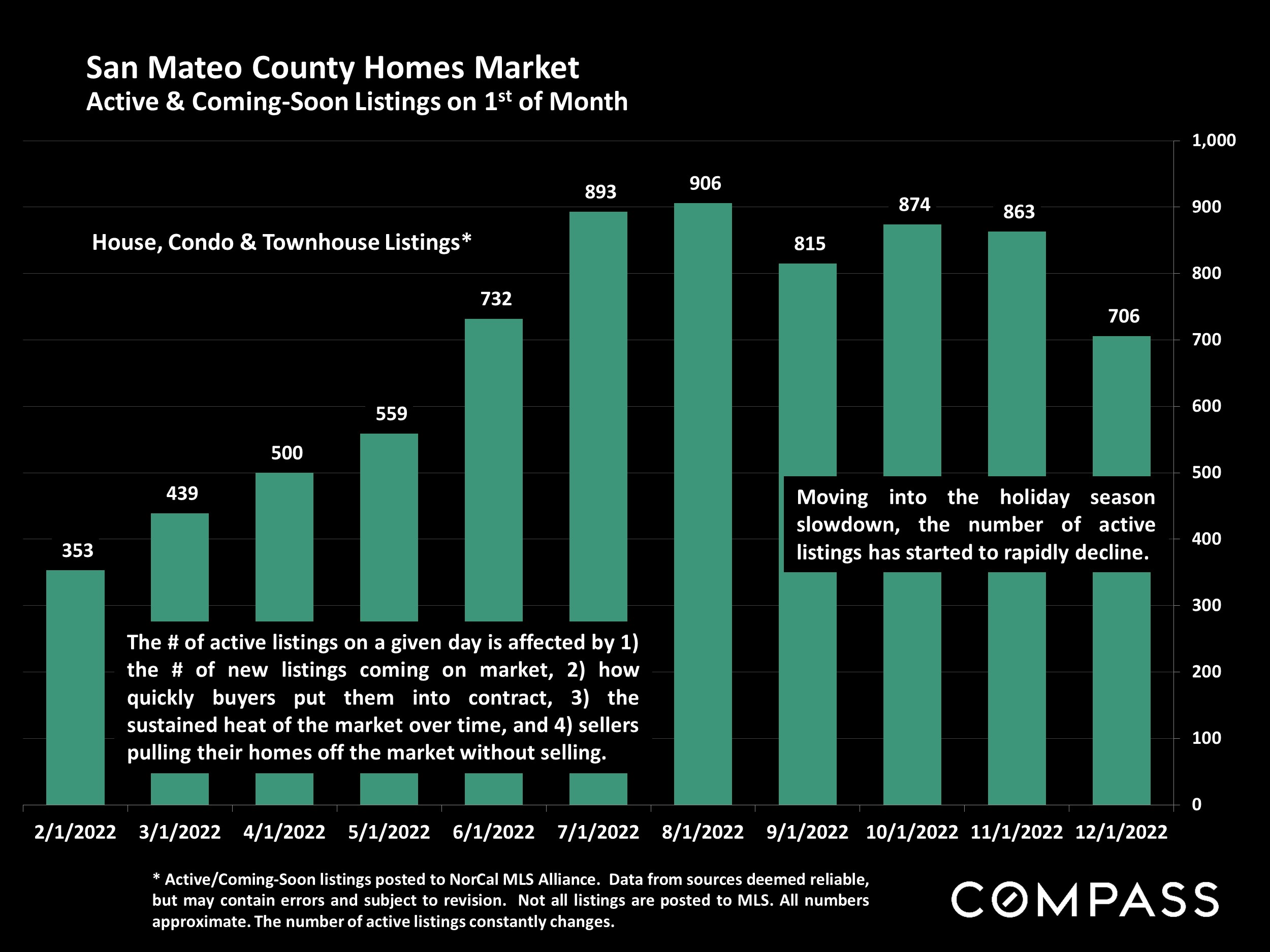

December typically sees the low point of new-listing and sales activity – with an increasing number of homes taken off the market to await the new year – but listing, buying and selling continues. This can be an excellent time for buyers to aggressively negotiate prices, though the supply of listings to choose from declines. The market usually begins to wake up in mid-January and then quickly accelerates in early spring: In the Bay Area, depending on the weather and economic conditions, the “early spring” market can begin as soon as February.

The single, most closely watched factor will be interest rates, since they have such an outsized impact on monthly housing costs and affordability, as well as on stock markets and consumer confidence. At the end of this report is a link to our extended review of macroeconomic issues.

Our reports are not intended to convince you regarding a course of action or to predict the future, but to provide, to the best of our ability, straightforward information and good-faith analysis to assist you in making your own informed decisions. Statistics should be considered very general indicators, and all numbers should be considered approximate. How they apply to any particular property is unknown without a specific comparative market analysis.

Source: Compass

It is impossible to know how median and average value statistics apply to any particular home without a specific comparative market analysis. These analyses were made in good faith with data from sources deemed reliable, but may contain errors and are subject to revision. It is not our intent to convince you of a particular position, but to attempt to provide straightforward data and analysis, so you can make your own informed decisions. Median and average statistics are enormous generalities: There are hundreds of different markets in San Francisco and the Bay Area, each with its own unique dynamics. Median prices and average dollar per square foot values can be and often are affected by other factors besides changes in fair market value. Longer term trends are much more meaningful than short-term.

Compass is a real estate broker licensed by the State of California, DRE 01527235. Equal Housing Opportunity. This report has been prepared solely for information purposes. The information herein is based on or derived from information generally available to the public and/or from sources believed to be reliable. No representation or warranty can be given with respect to the accuracy or completeness of the information. Compass disclaims any and all liability relating to this report, including without limitation any express or implied representations or warranties for statements contained in, and omissions from, the report. Nothing contained herein is intended to be or should be read as any regulatory, legal, tax, accounting or other advice and Compass does not provide such advice. All opinions are subject to change without notice. Compass makes no representation regarding the accuracy of any statements regarding any references to the laws, statutes or regulations of any state are those of the author(s). Past performance is no guarantee of future results.

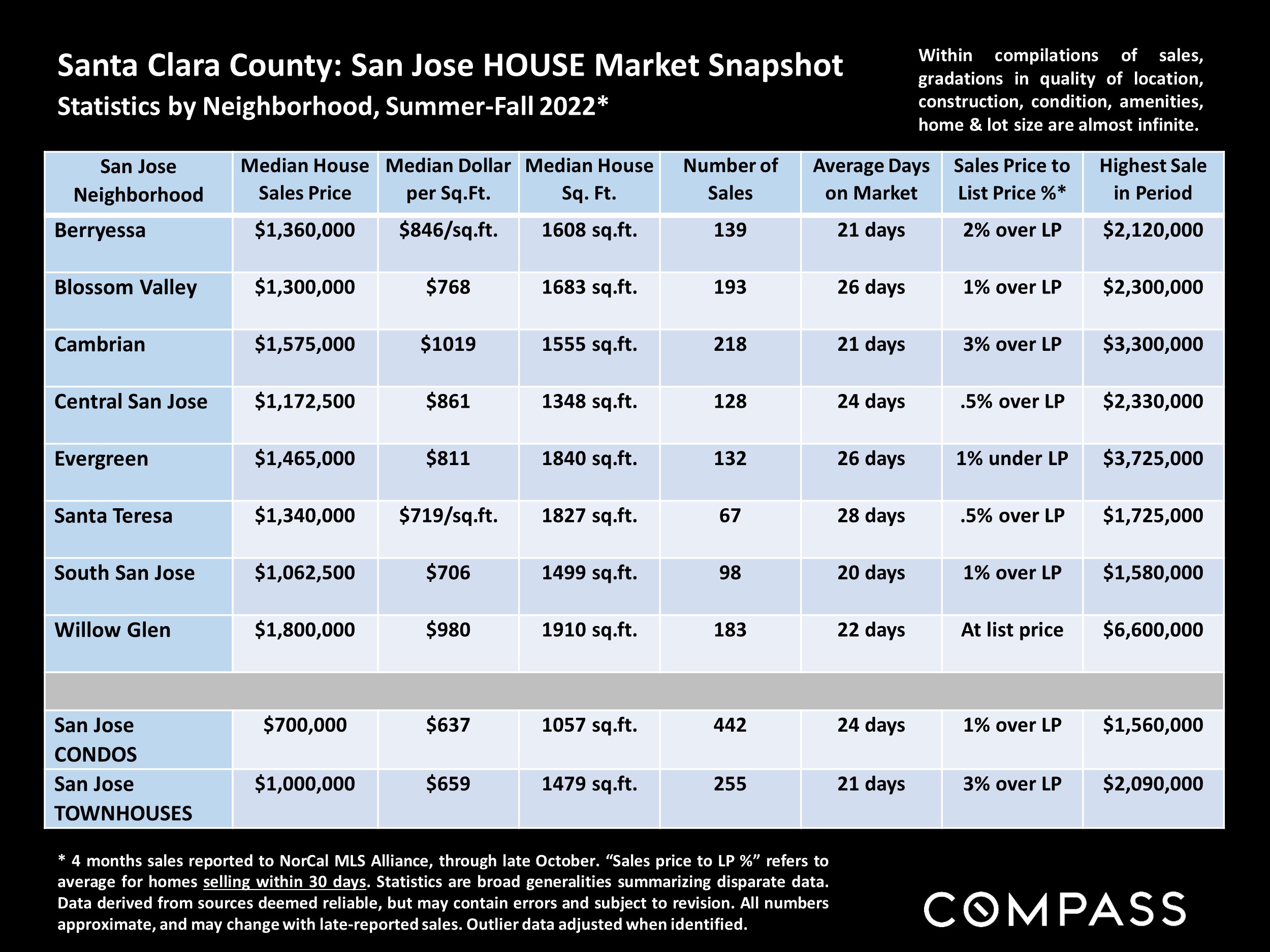

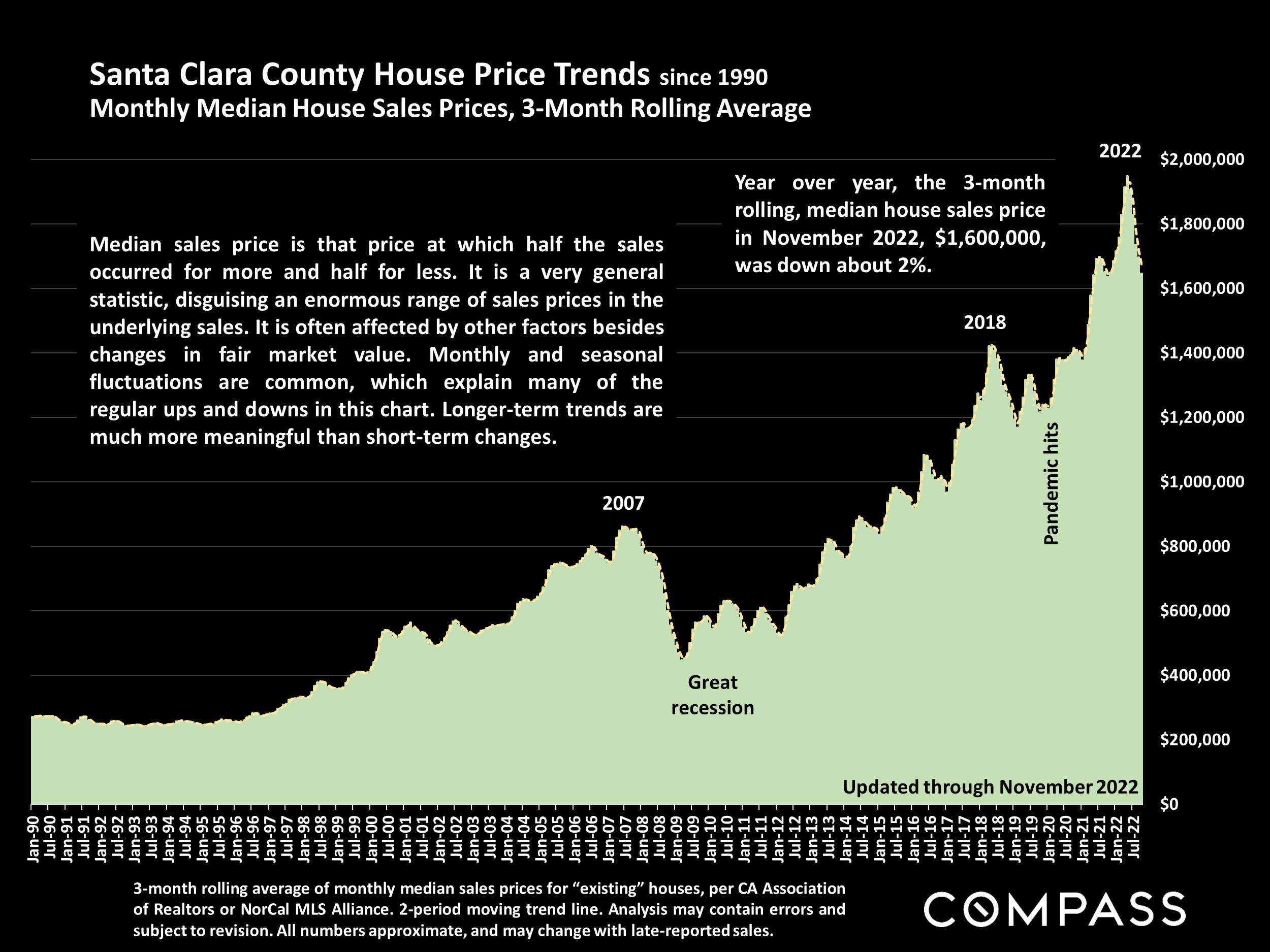

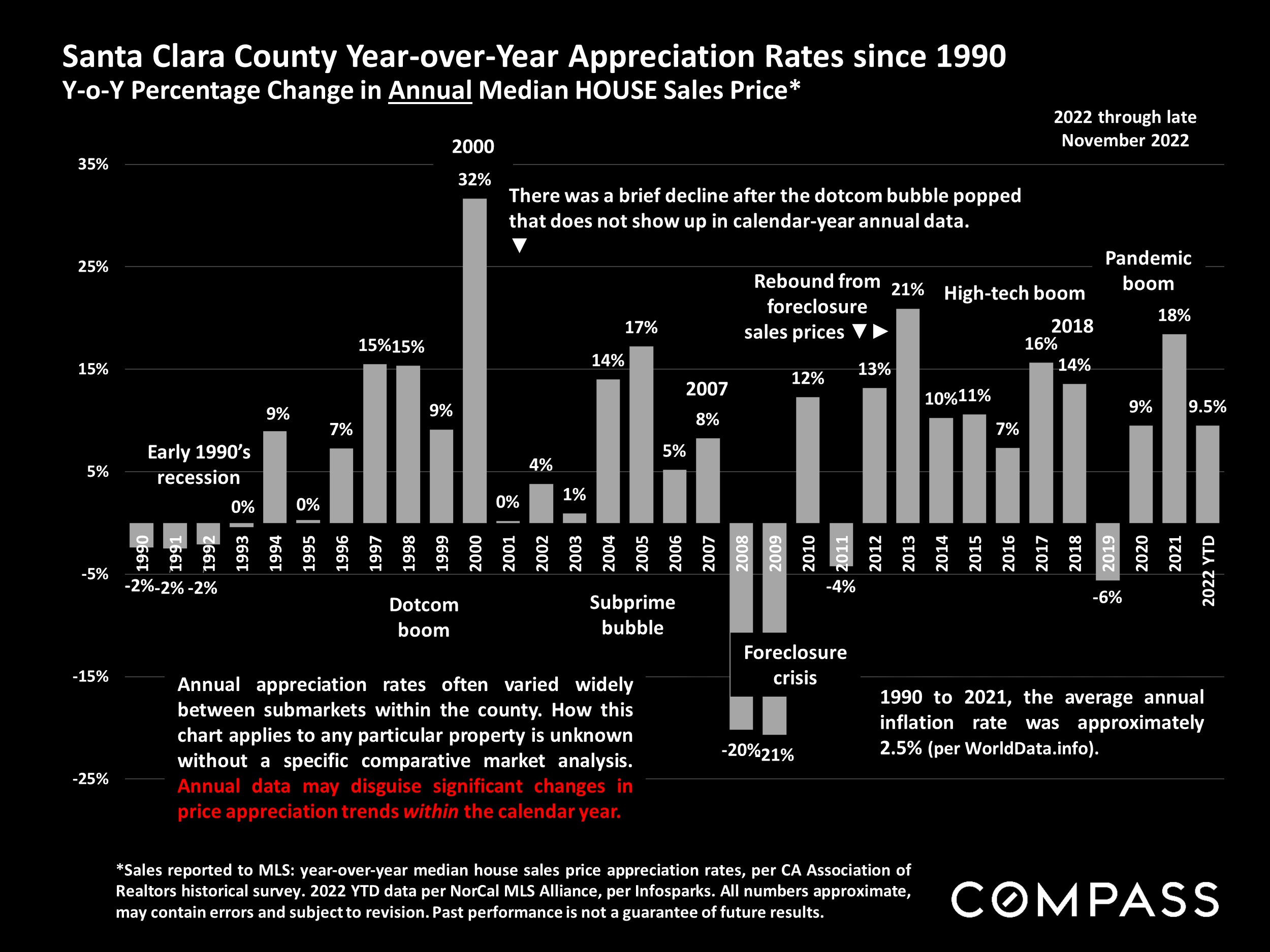

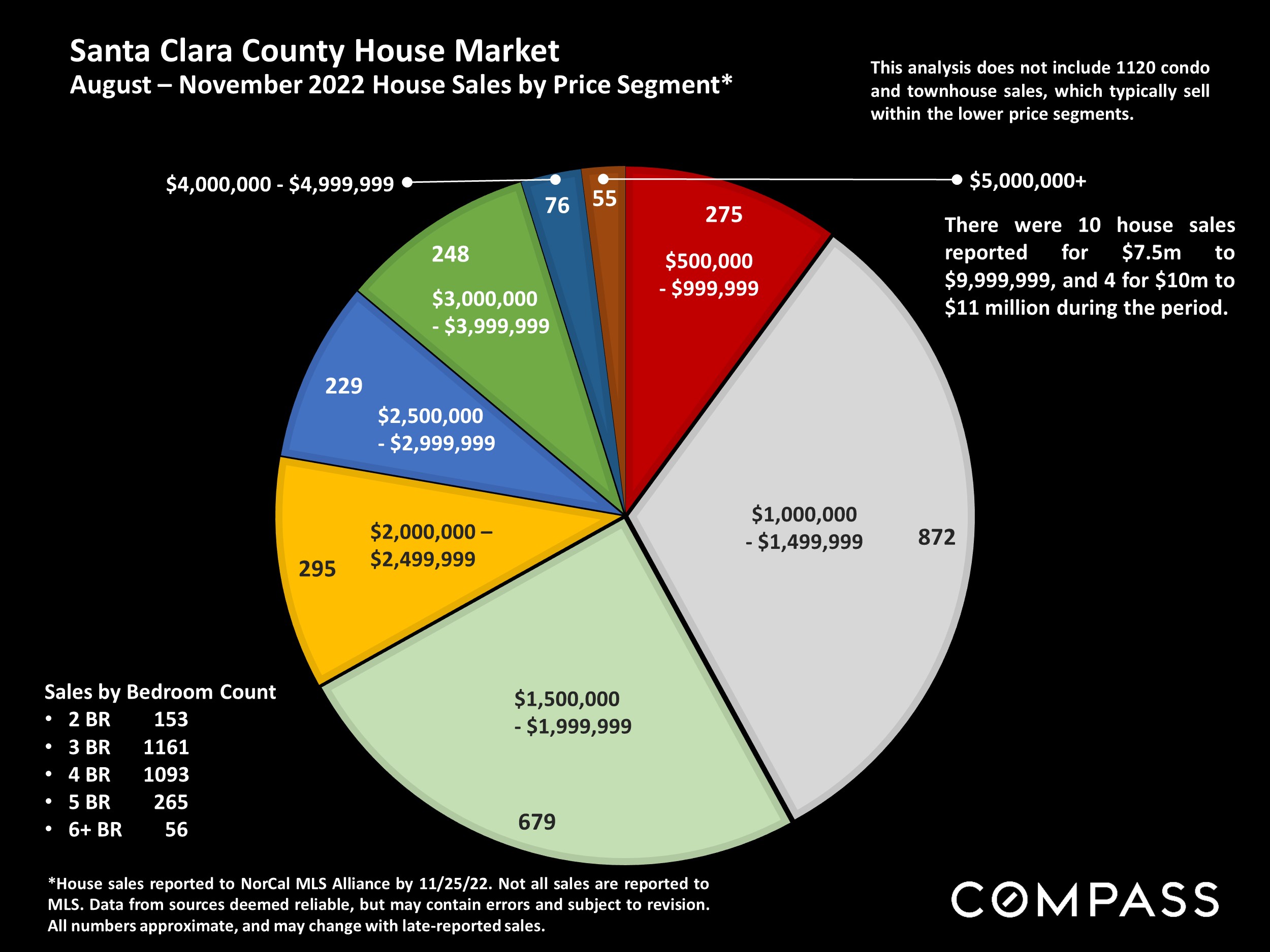

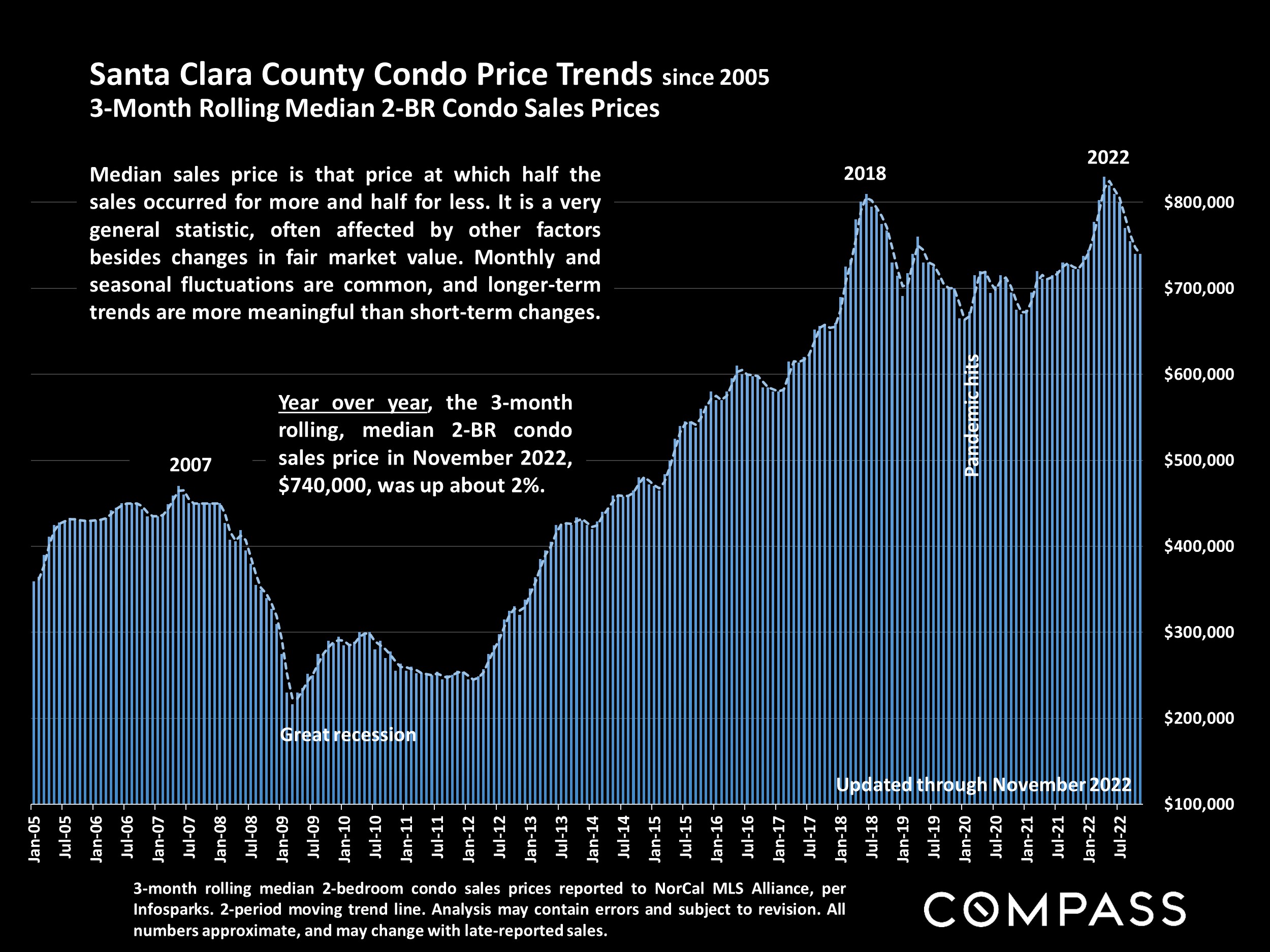

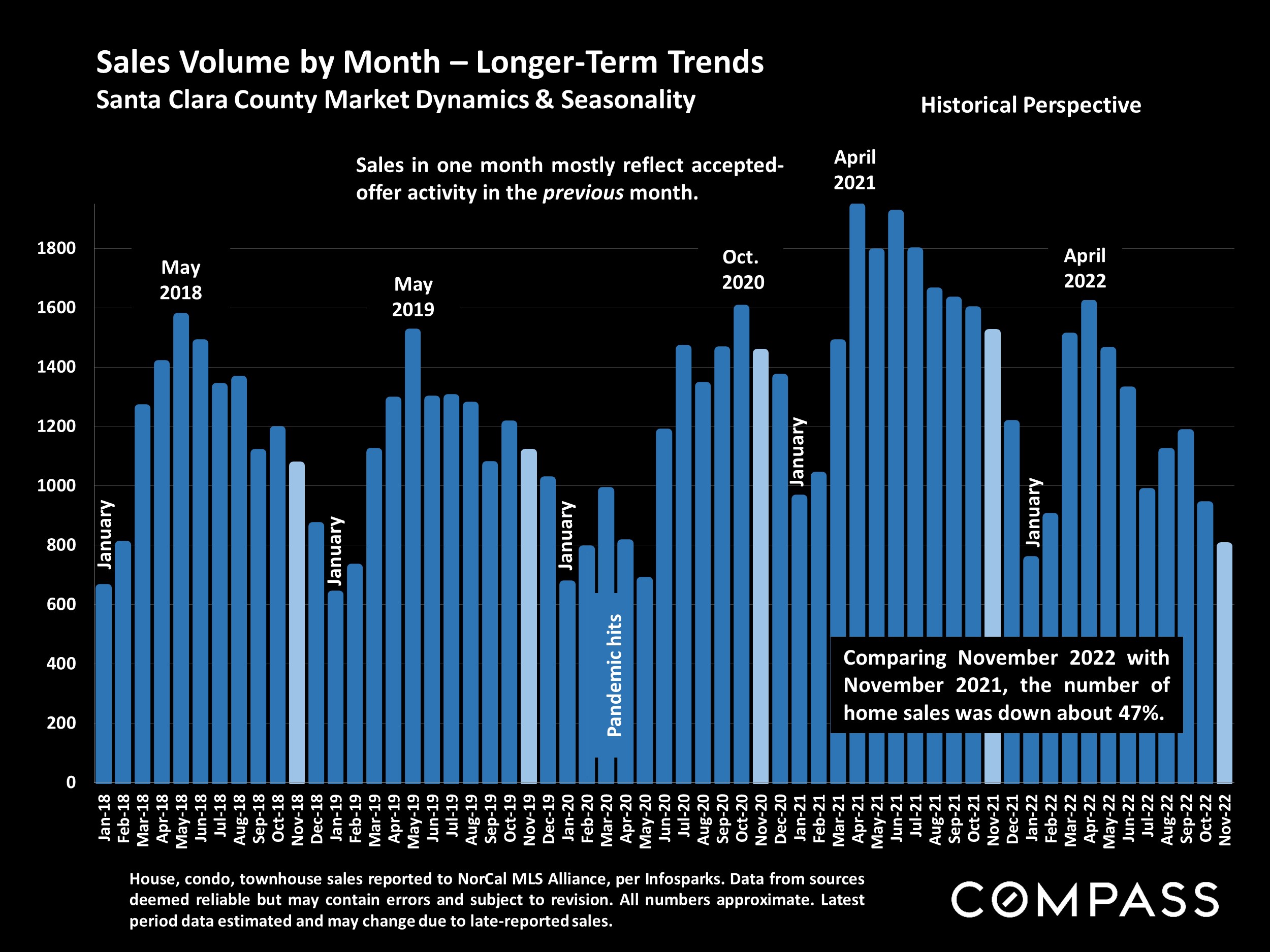

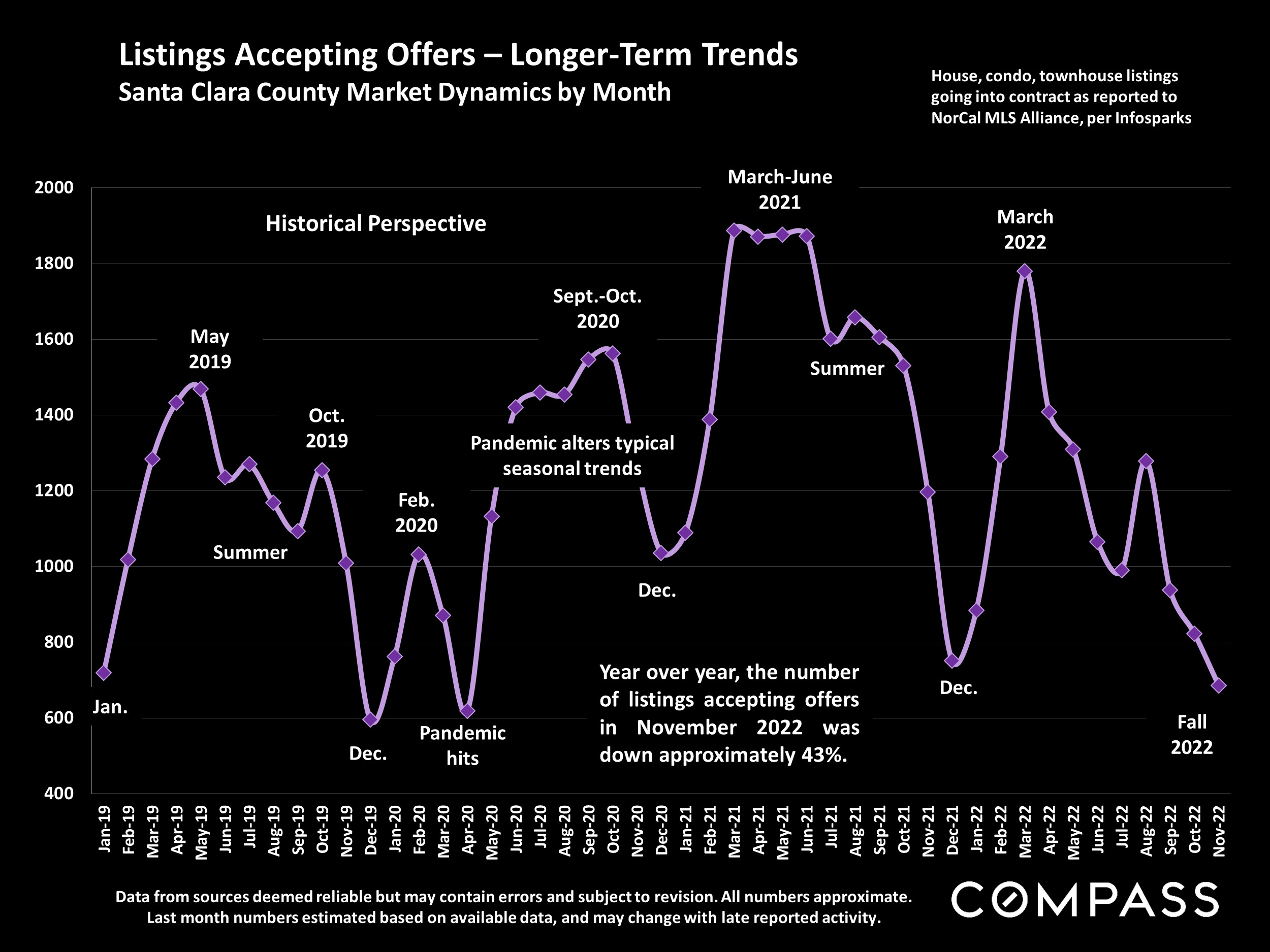

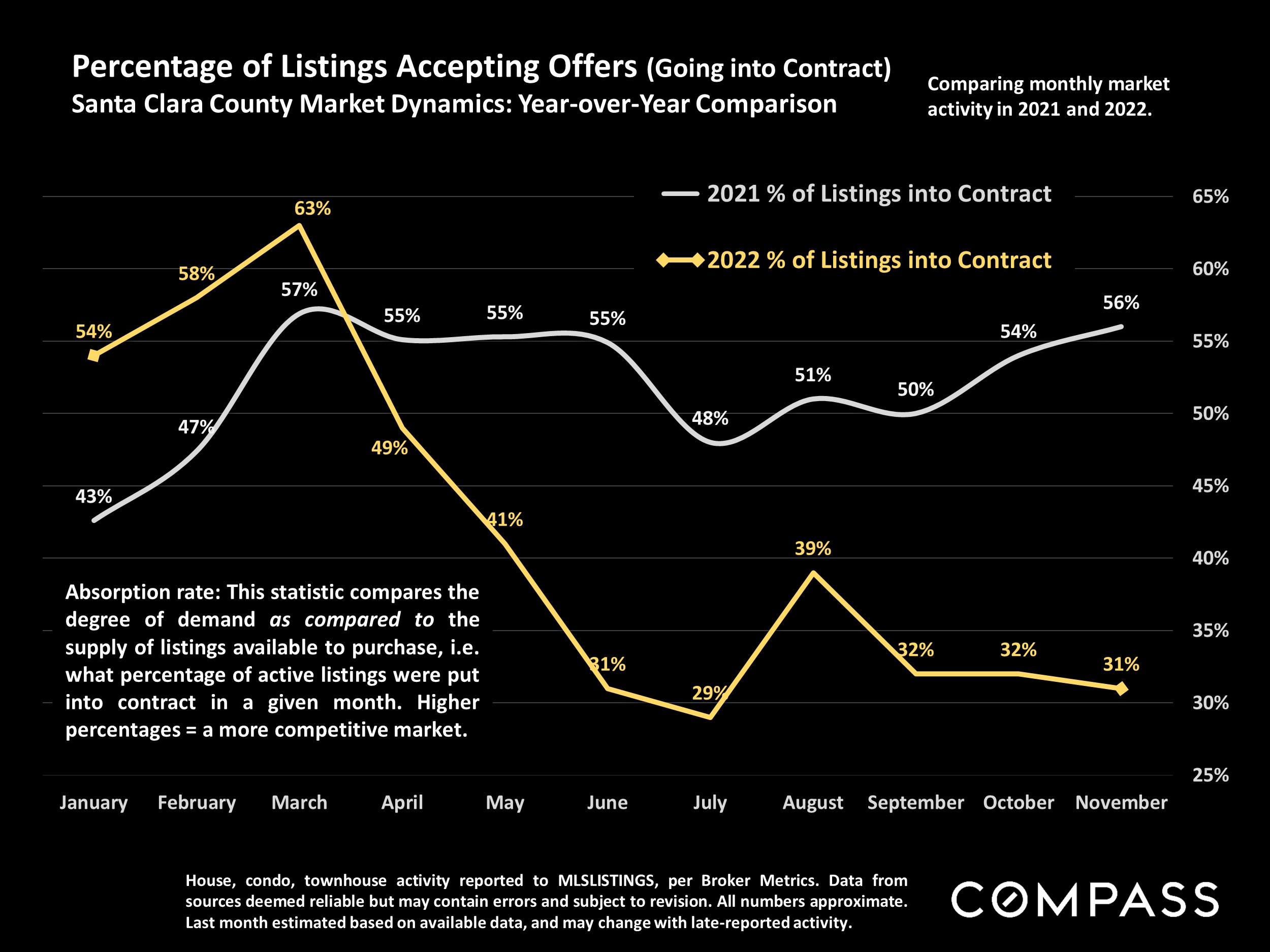

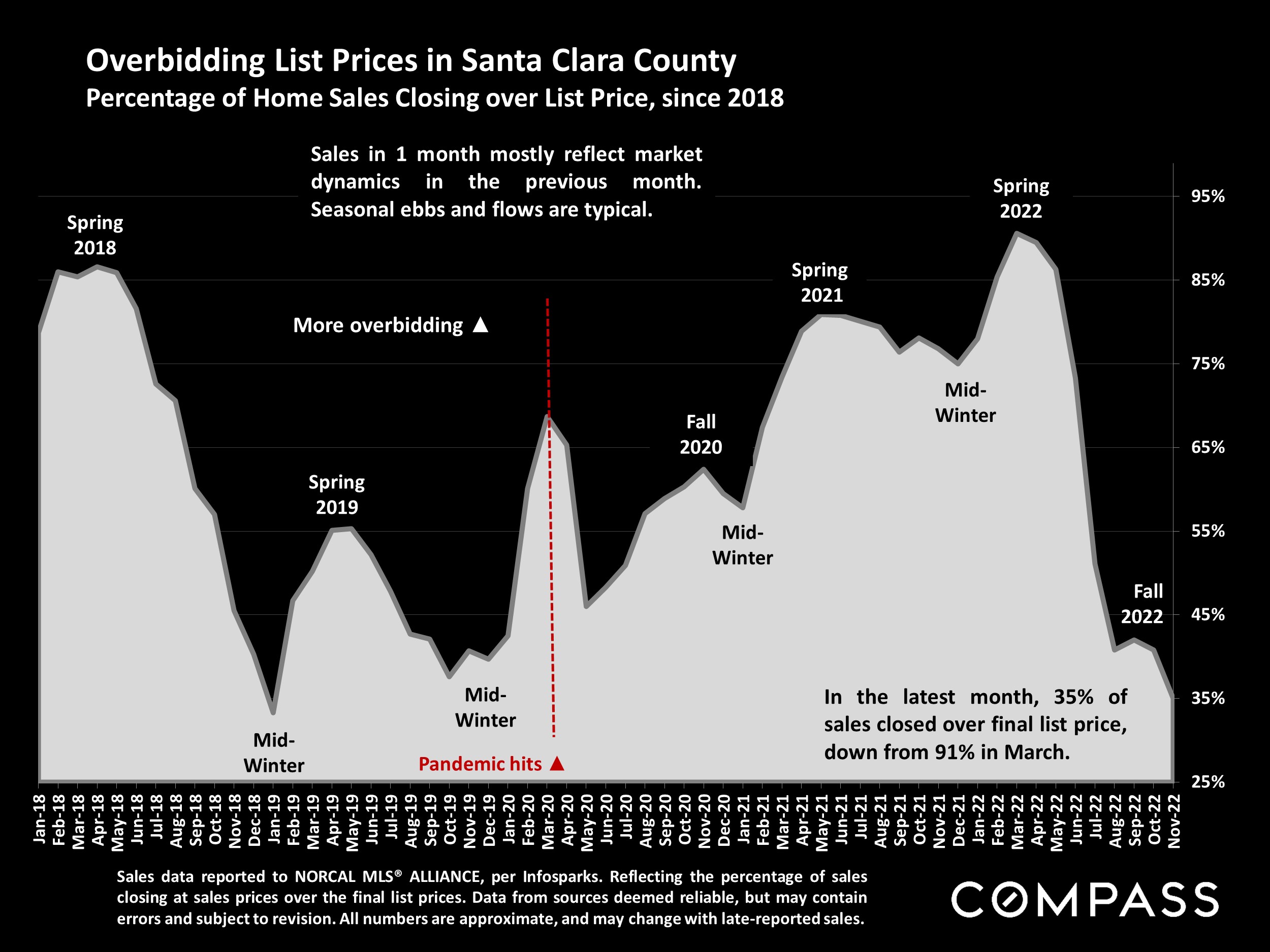

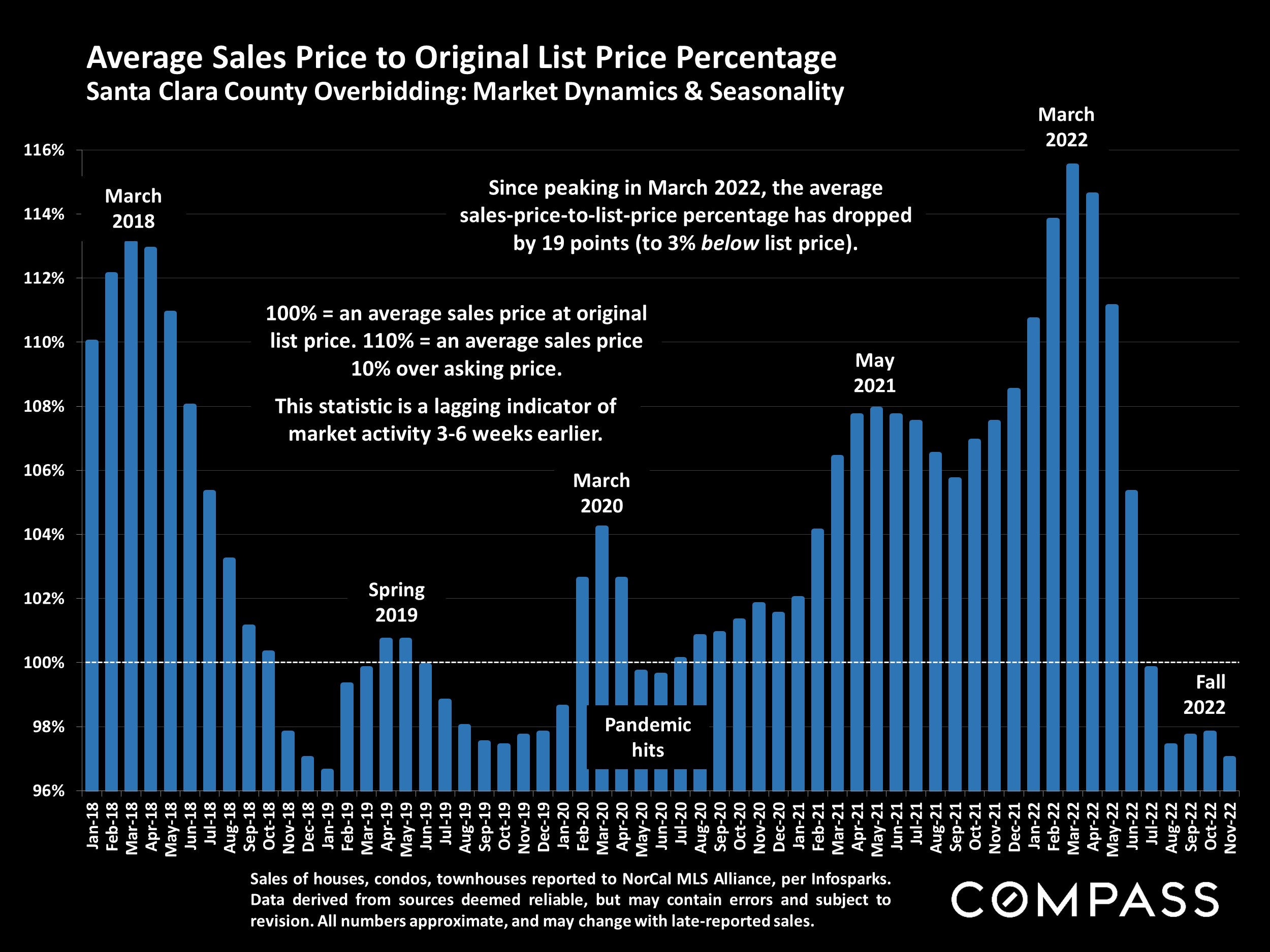

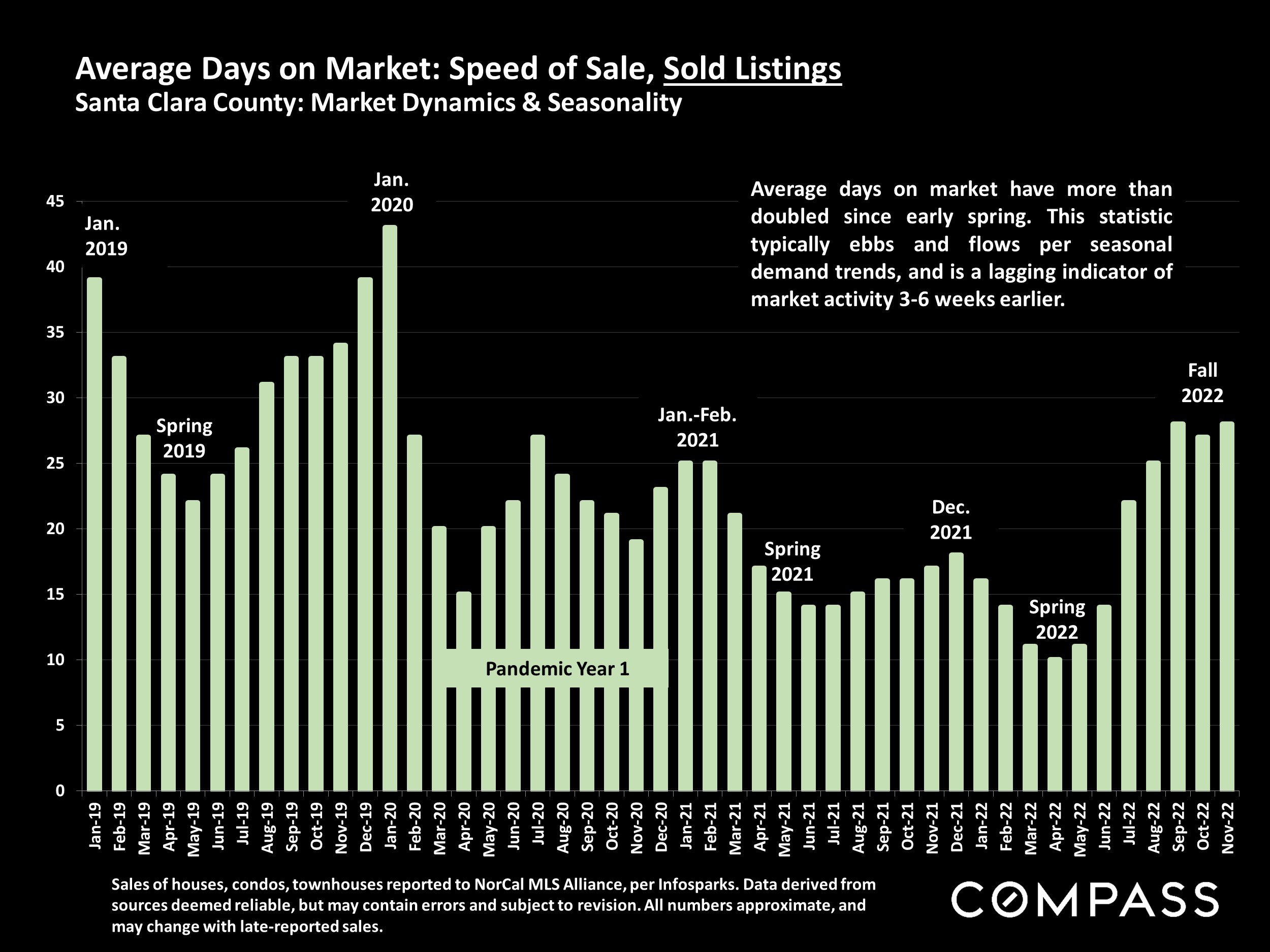

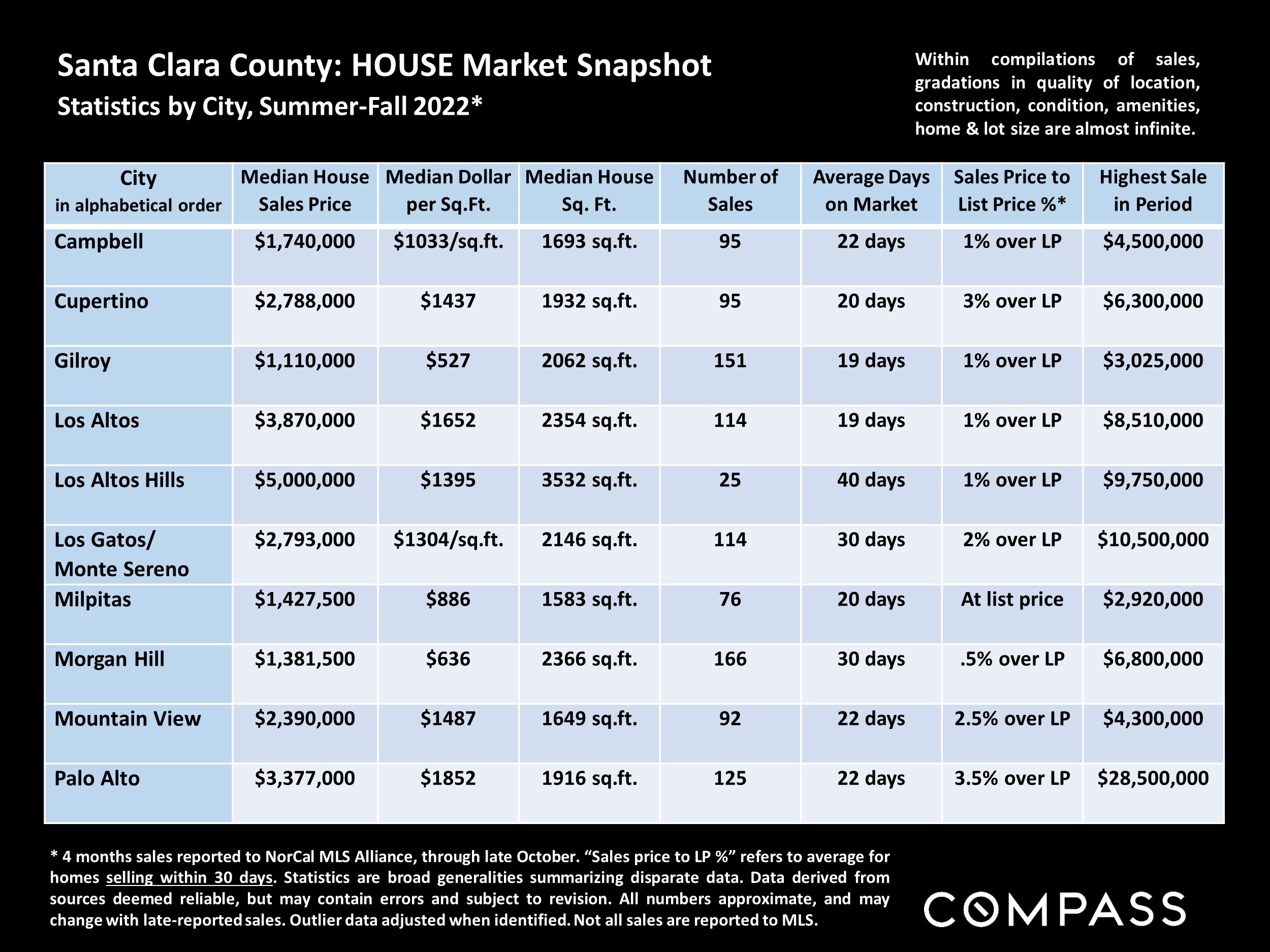

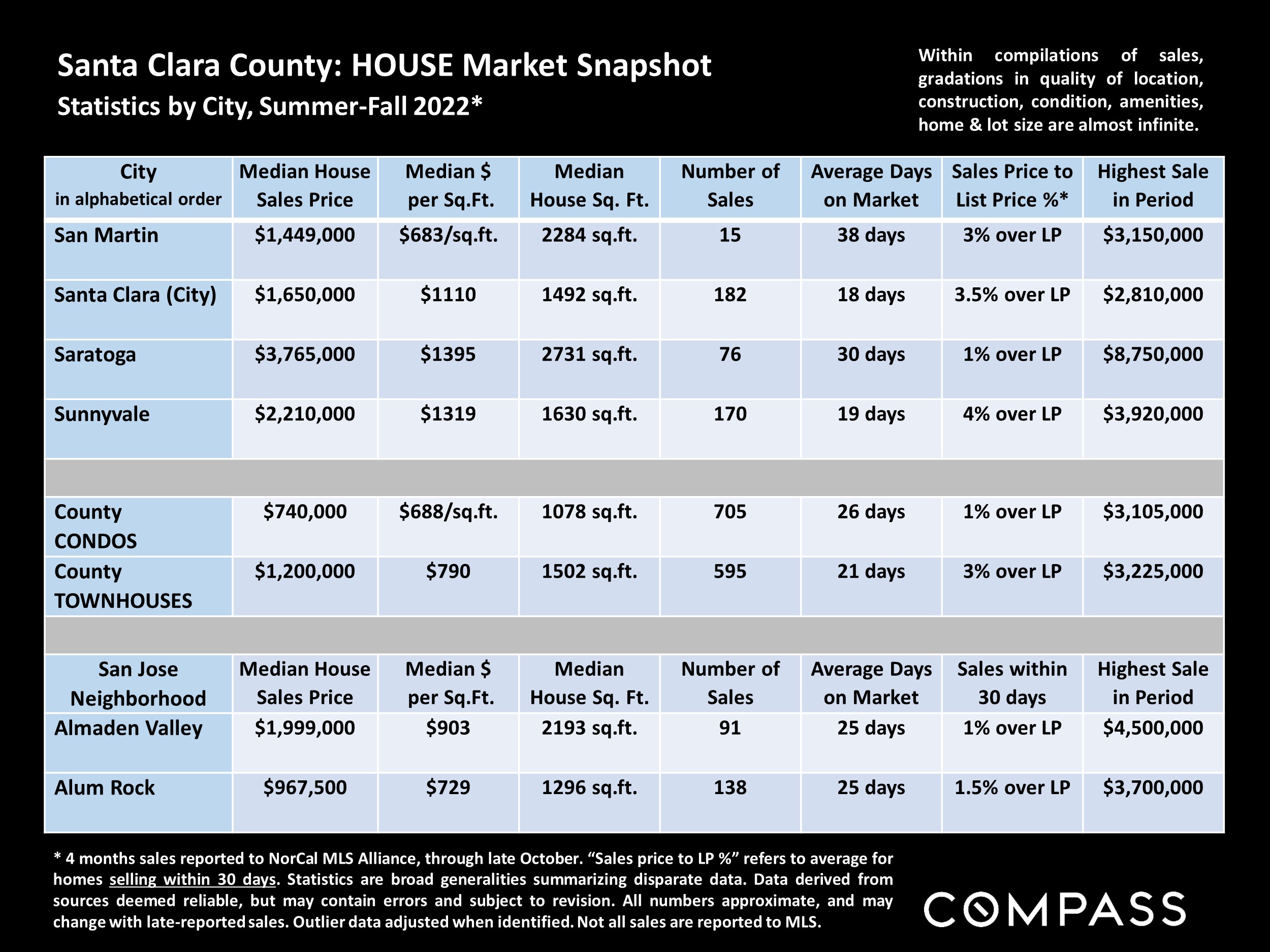

Santa Clara County Real Estate, December 2022

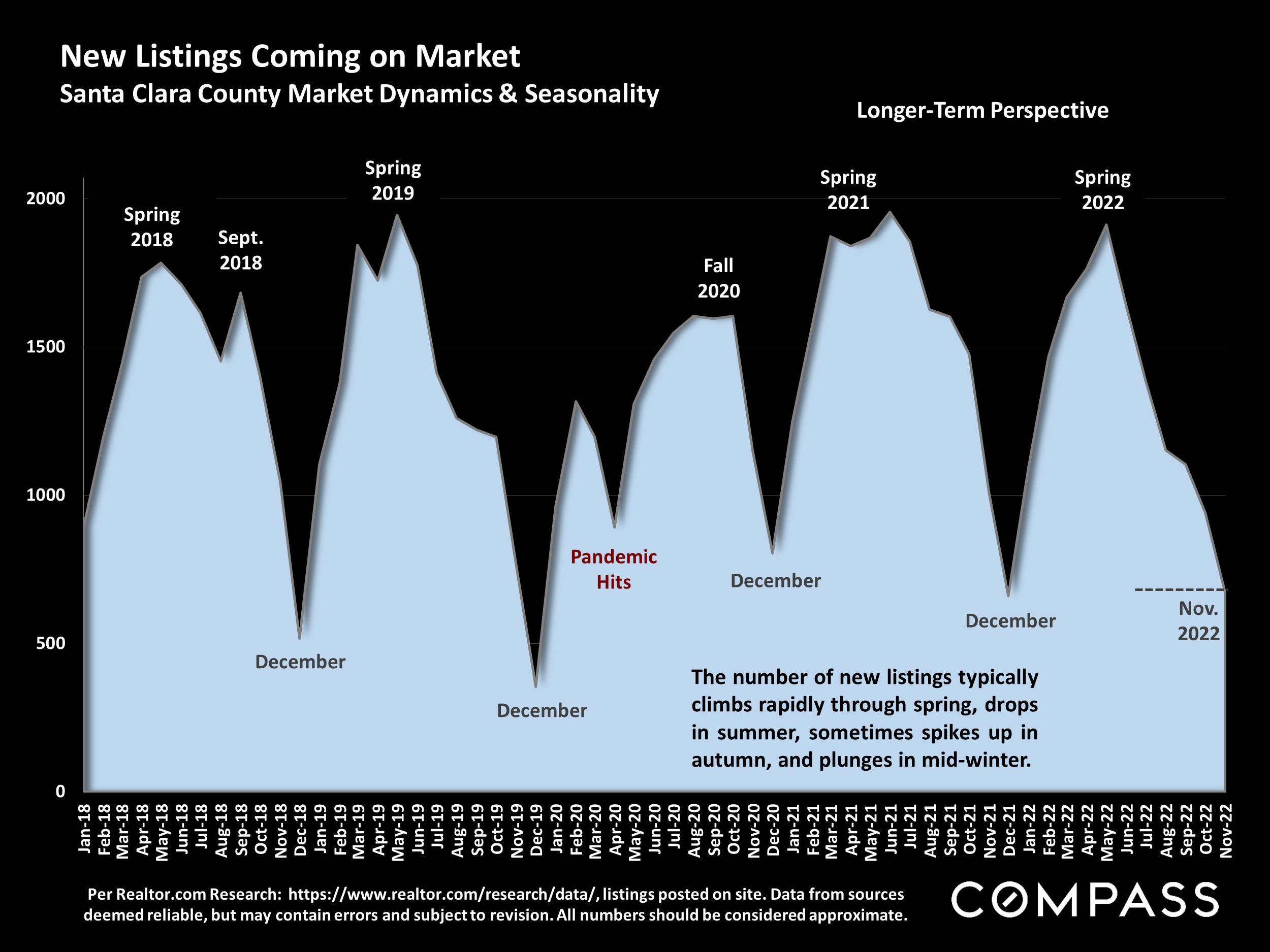

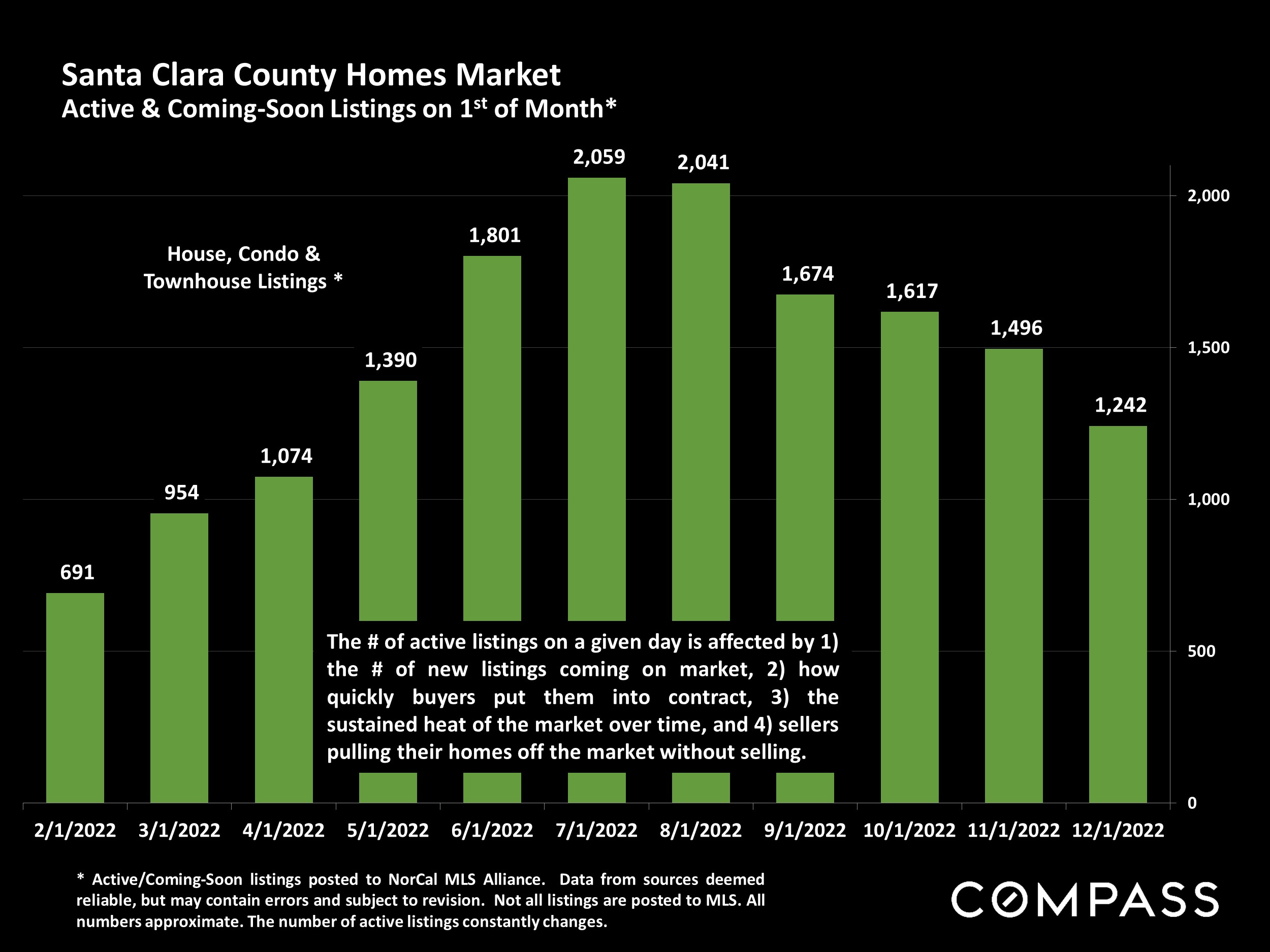

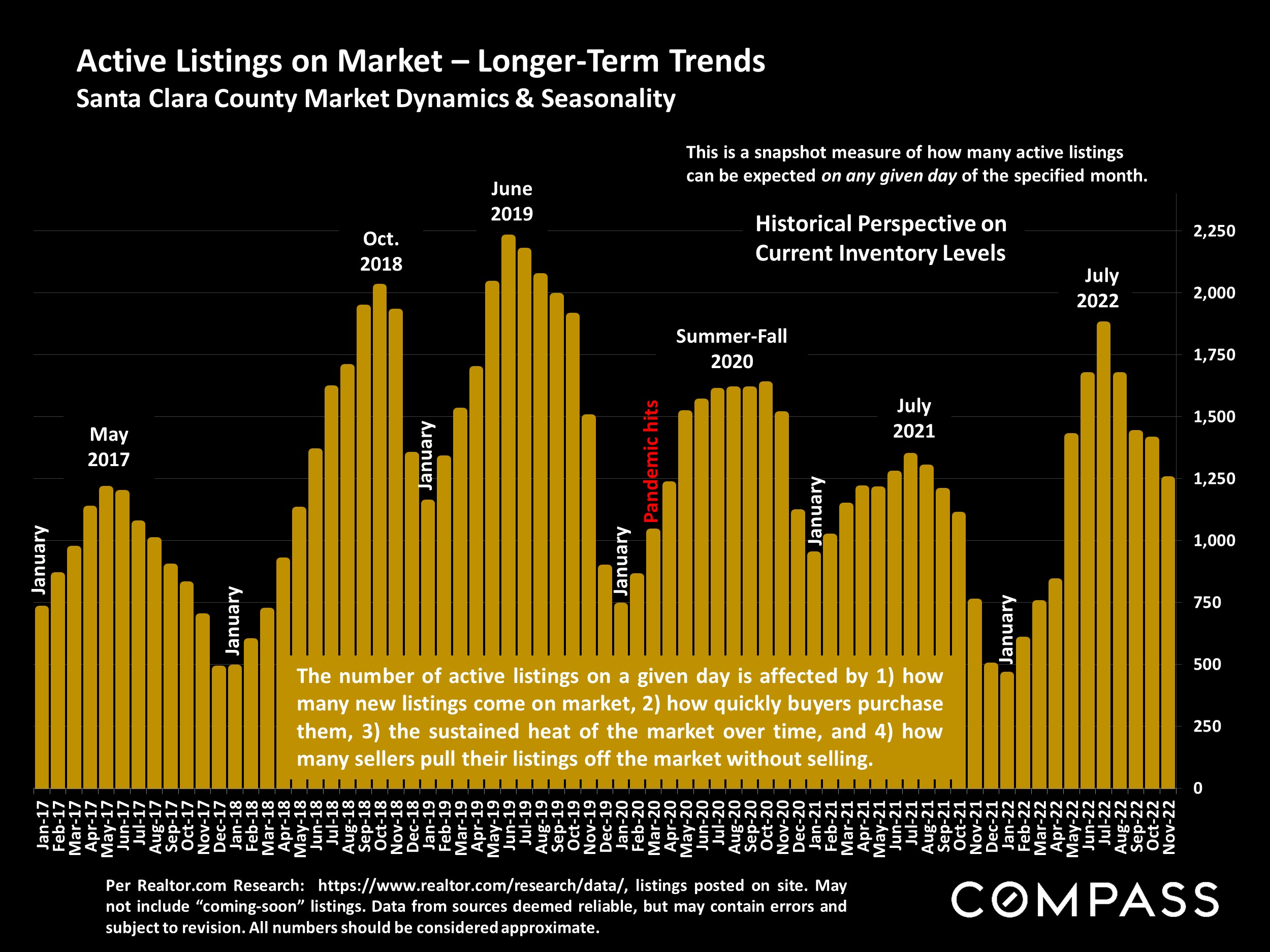

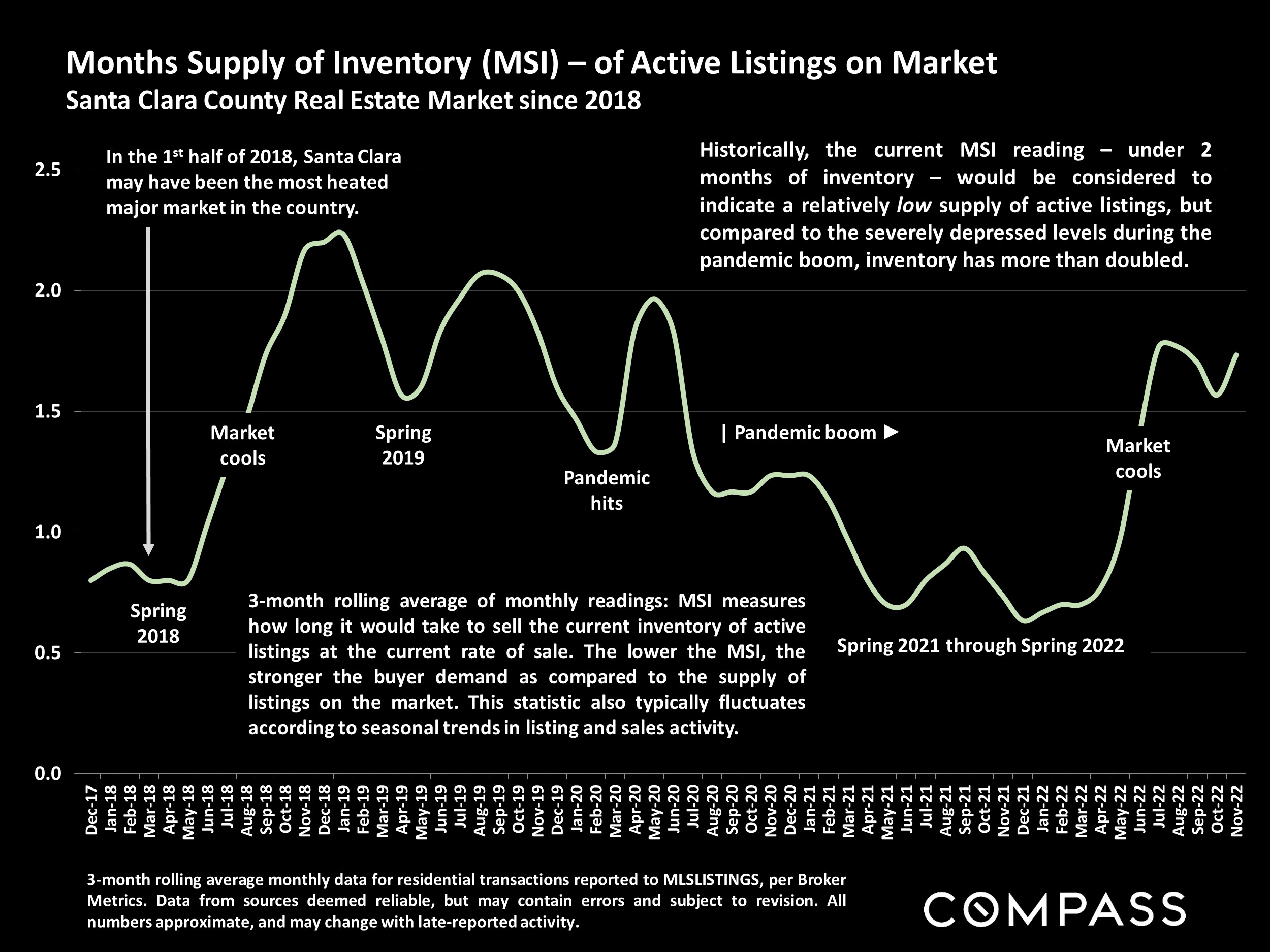

The changes in market dynamics that began in late spring/early summer 2022 generally continued in autumn due to the ongoing economic headwinds, including high inflation and interest rates, reduced consumer confidence, and volatile stock markets, though all have fluctuated significantly over the period, and some readings have recently improved. The great majority of indicators – home prices and appreciation rates, sales volumes, overbidding, days-on-market, months supply of inventory, and so on – continue to describe a market that has substantially cooled and “corrected” since spring 2022, when it appears that a long, dramatic, 10-year market upcycle peaked. (Note that a “correction” is not remotely similar to a crash, such as was seen during the subprime loan/foreclosure crisis.) In recent months, luxury home sales have seen larger year-over-year percentage declines than the general market. But thousands of Bay Area homes continue to sell, some very quickly at over asking price: With the shifts in market conditions, pricing correctly has become an imperative for sellers.

December typically sees the low point of new-listing and sales activity – with an increasing number of homes taken off the market to await the new year – but listing, buying and selling continues. This can be an excellent time for buyers to aggressively negotiate prices, though the supply of listings to choose from declines. The market usually begins to wake up in mid-January and then quickly accelerates in early spring: In the Bay Area, depending on the weather and economic conditions, the “early spring” market can begin as soon as February. The single, most closely watched factor will be interest rates, since they have such an outsized impact on monthly housing costs and affordability, as well as on stock markets and consumer confidence. At the end of this report is a link to our extended review of macroeconomic issues.

Our reports are not intended to convince you regarding a course of action or to predict the future, but to provide, to the best of our ability, straightforward information and good-faith analysis to assist you in making your own informed decisions. Statistics should be considered very general indicators, and all numbers should be considered approximate. How they apply to any particular property is unknown without a specific comparative market analysis.

Source: Compass

It is impossible to know how median and average value statistics apply to any particular home without a specific comparative market analysis. These analyses were made in good faith with data from sources deemed reliable, but may contain errors and are subject to revision. It is not our intent to convince you of a particular position, but to attempt to provide straightforward data and analysis, so you can make your own informed decisions. Median and average statistics are enormous generalities: There are hundreds of different markets in San Francisco and the Bay Area, each with its own unique dynamics. Median prices and average dollar per square foot values can be and often are affected by other factors besides changes in fair market value. Longer term trends are much more meaningful than short-term.

Compass is a real estate broker licensed by the State of California, DRE 01527235. Equal Housing Opportunity. This report has been prepared solely for information purposes. The information herein is based on or derived from information generally available to the public and/or from sources believed to be reliable. No representation or warranty can be given with respect to the accuracy or completeness of the information. Compass disclaims any and all liability relating to this report, including without limitation any express or implied representations or warranties for statements contained in, and omissions from, the report. Nothing contained herein is intended to be or should be read as any regulatory, legal, tax, accounting or other advice and Compass does not provide such advice. All opinions are subject to change without notice. Compass makes no representation regarding the accuracy of any statements regarding any references to the laws, statutes or regulations of any state are those of the author(s). Past performance is no guarantee of future results.

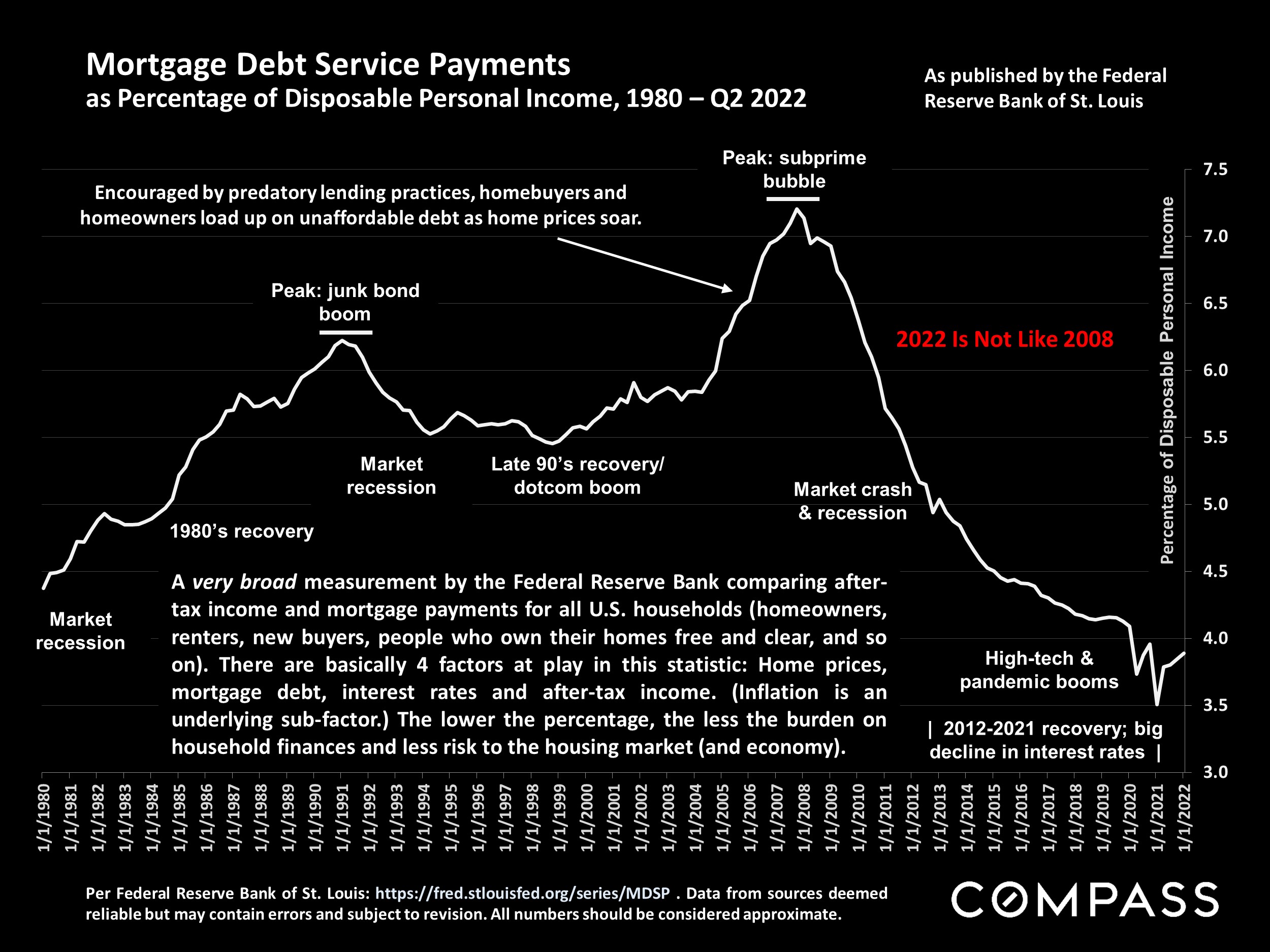

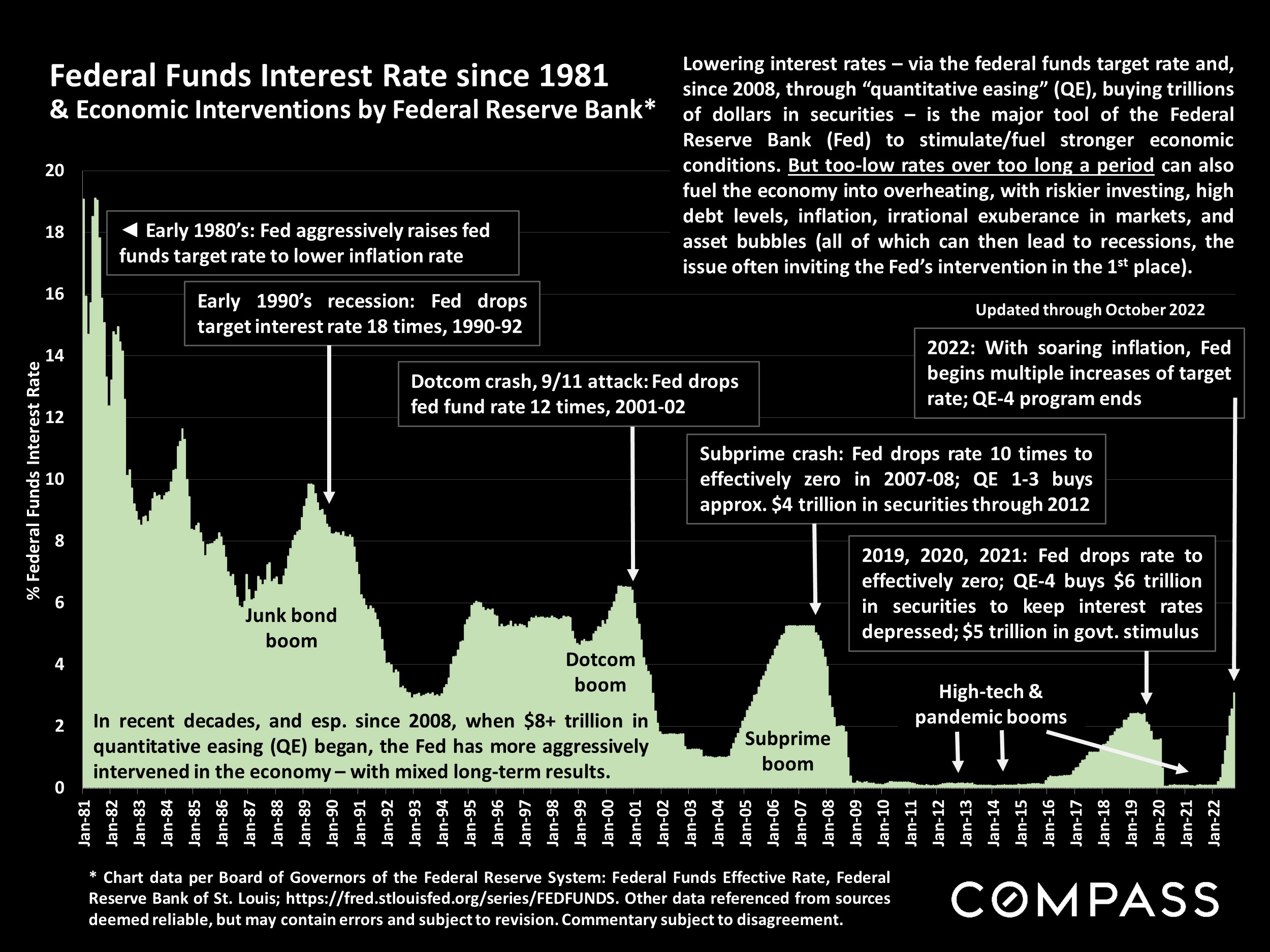

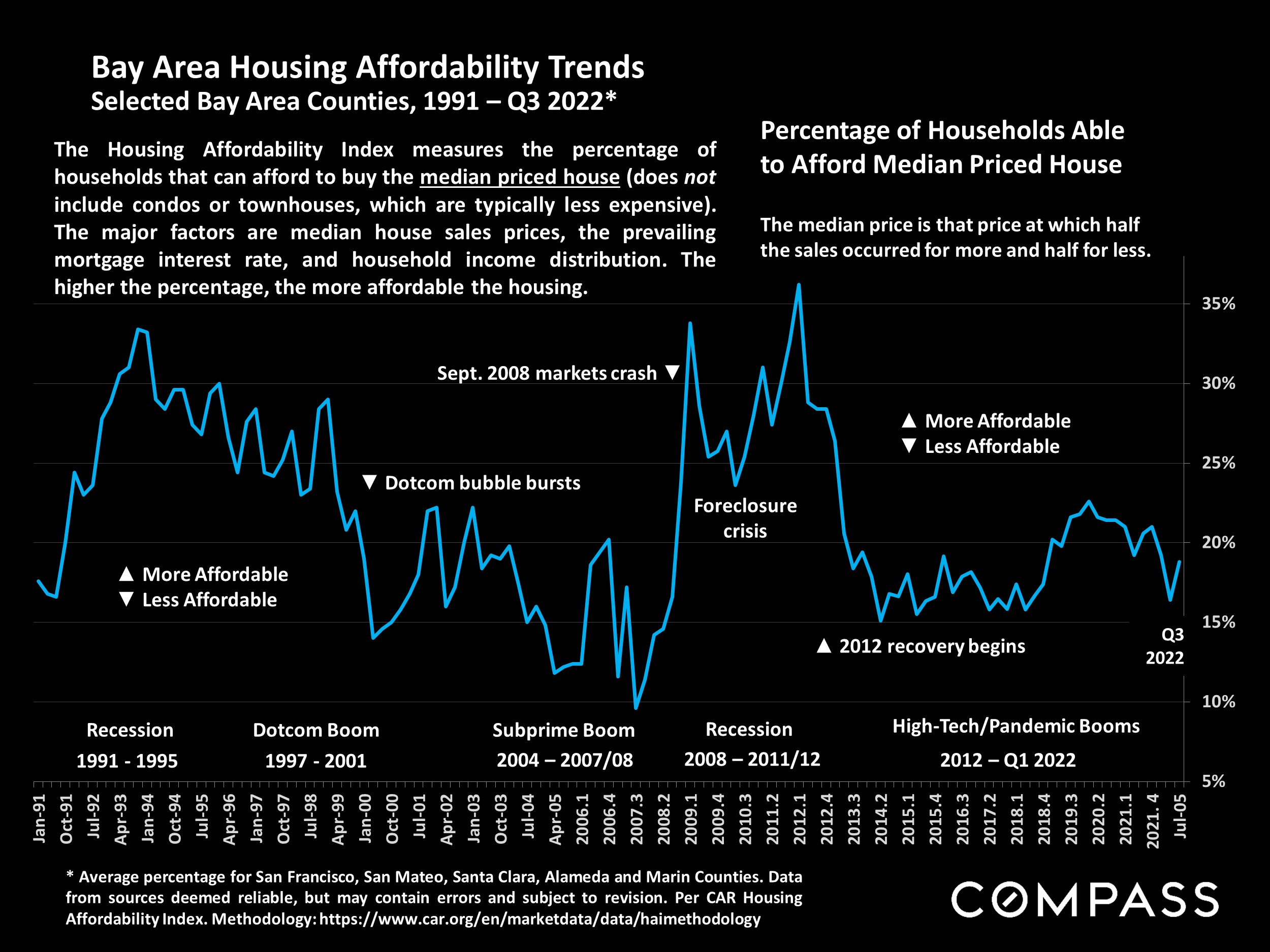

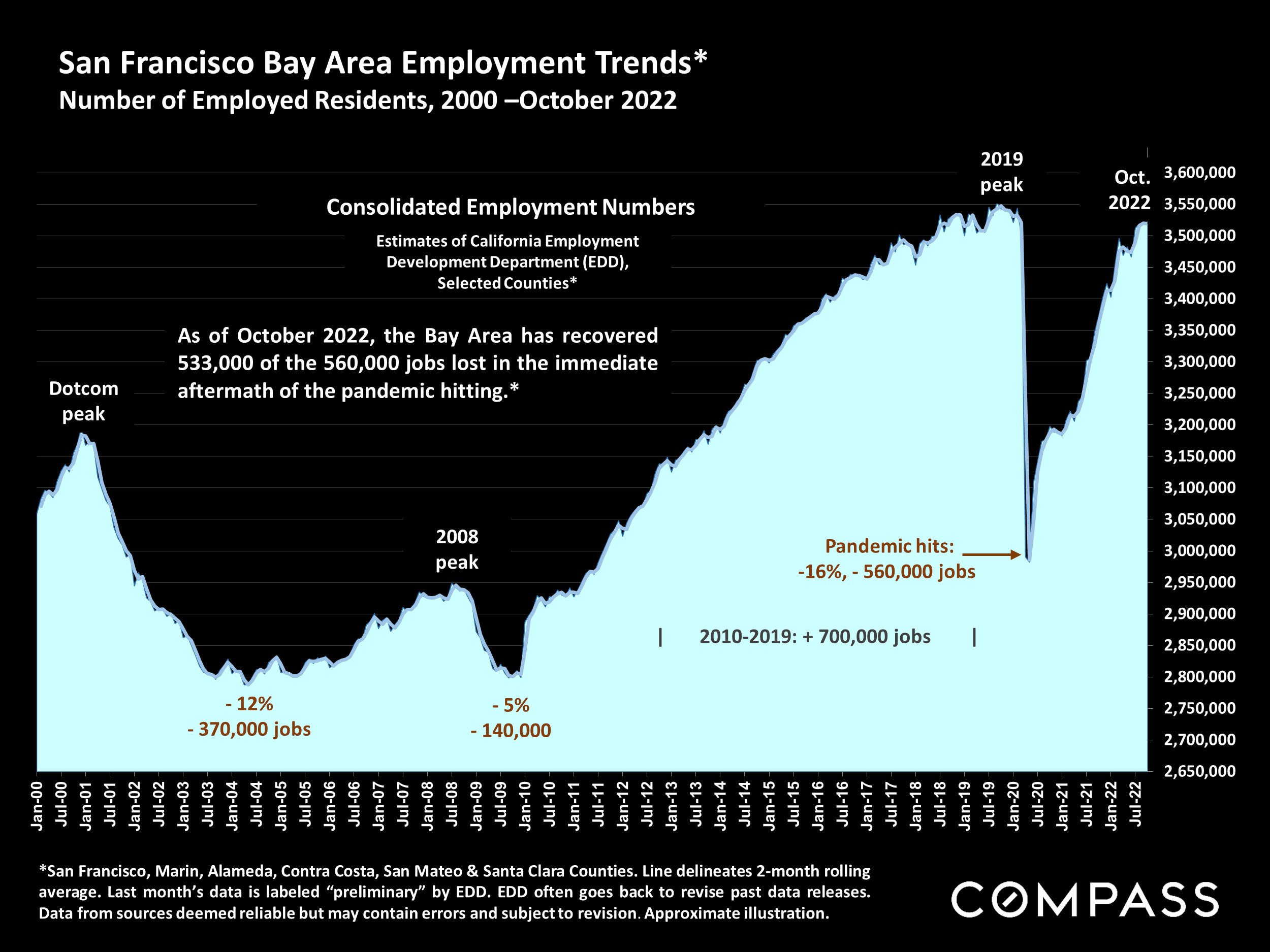

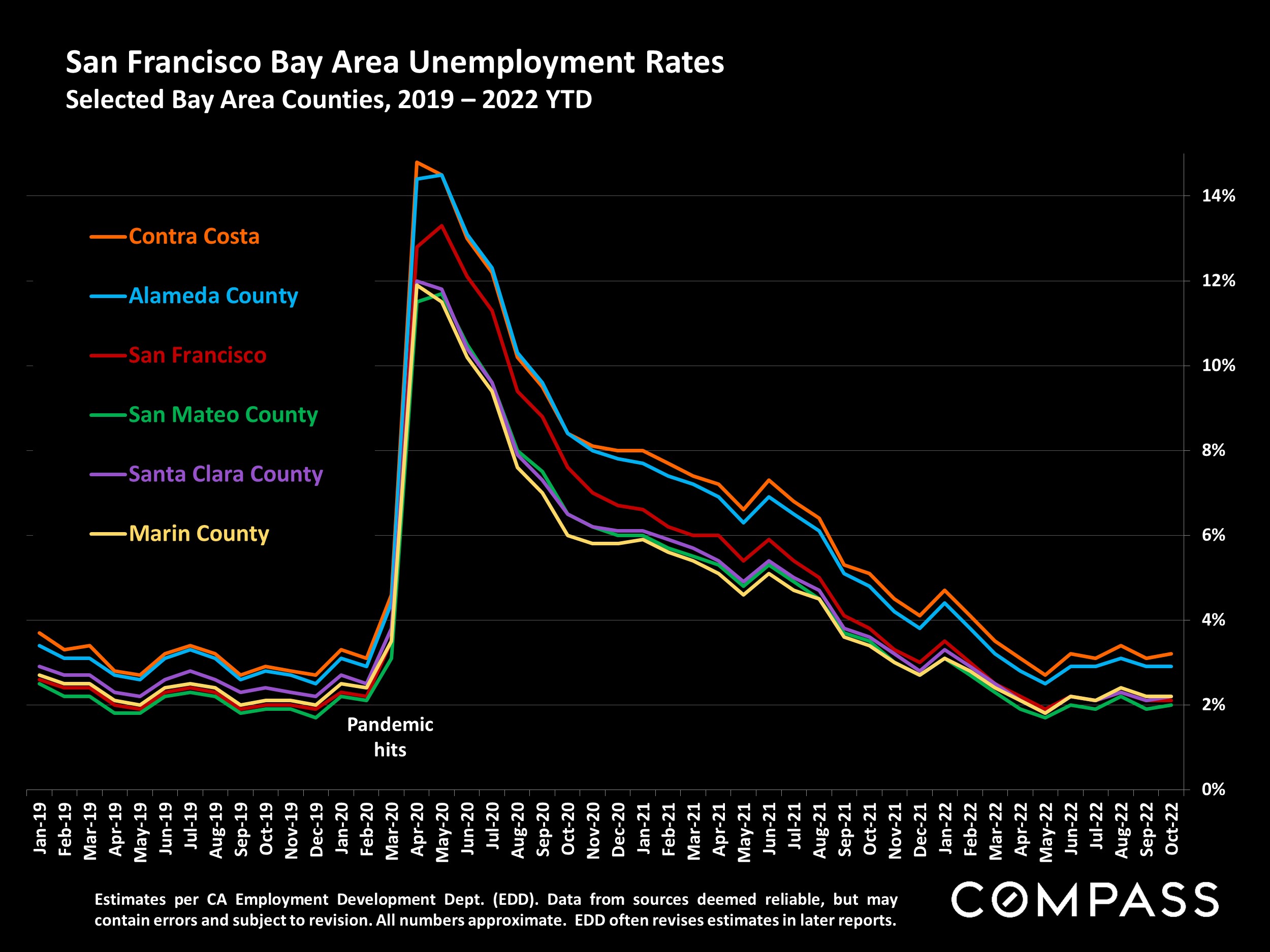

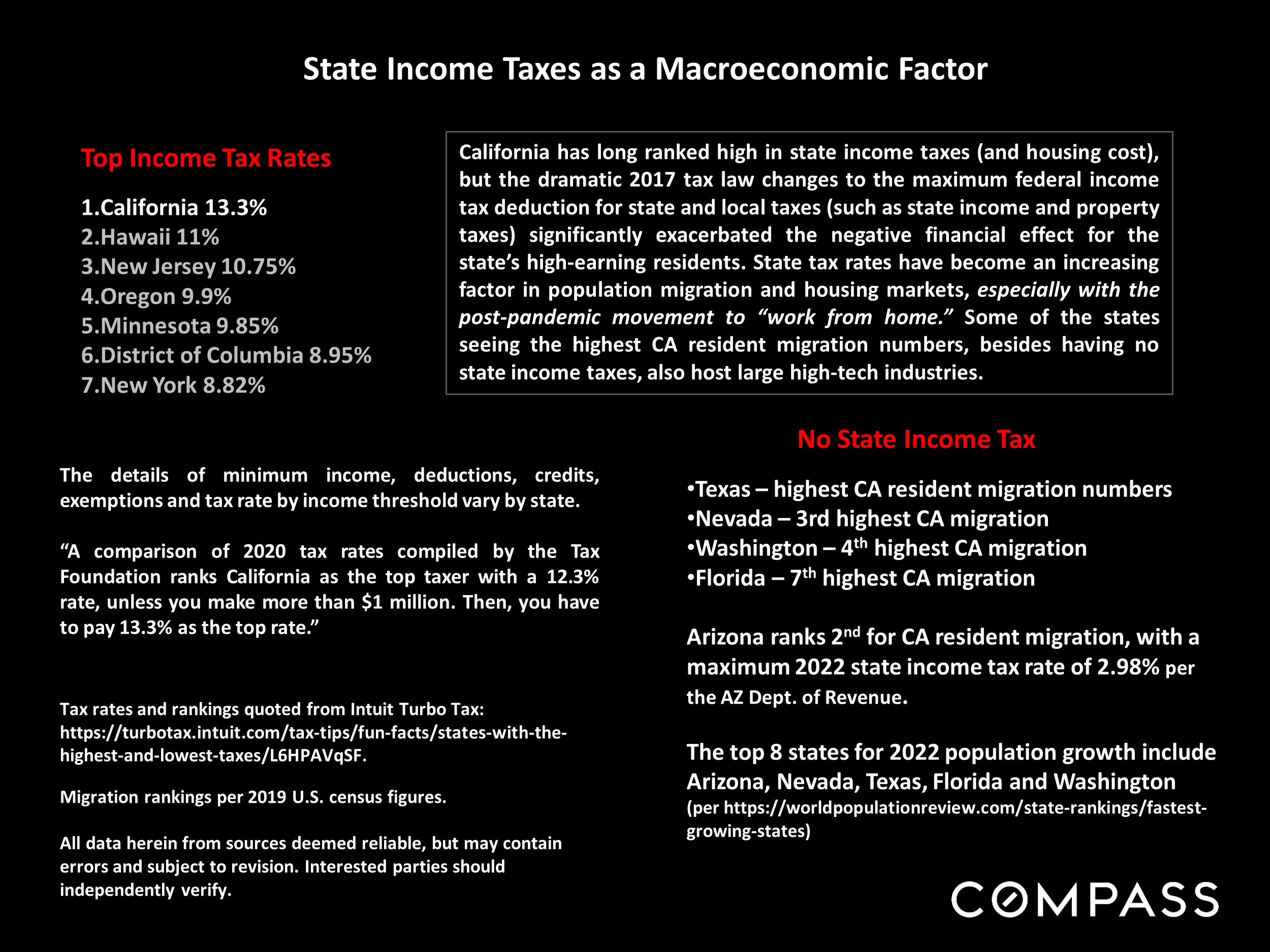

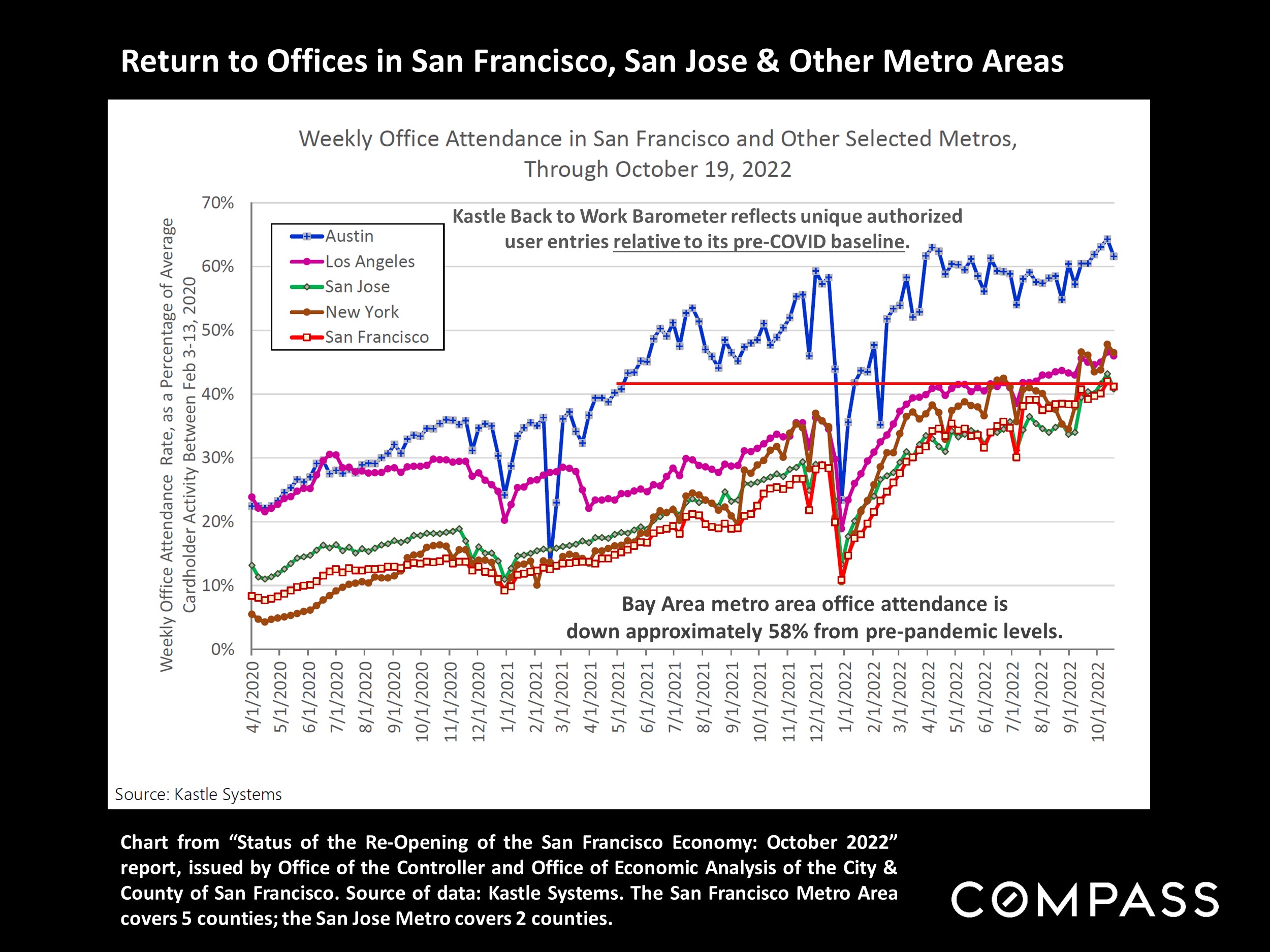

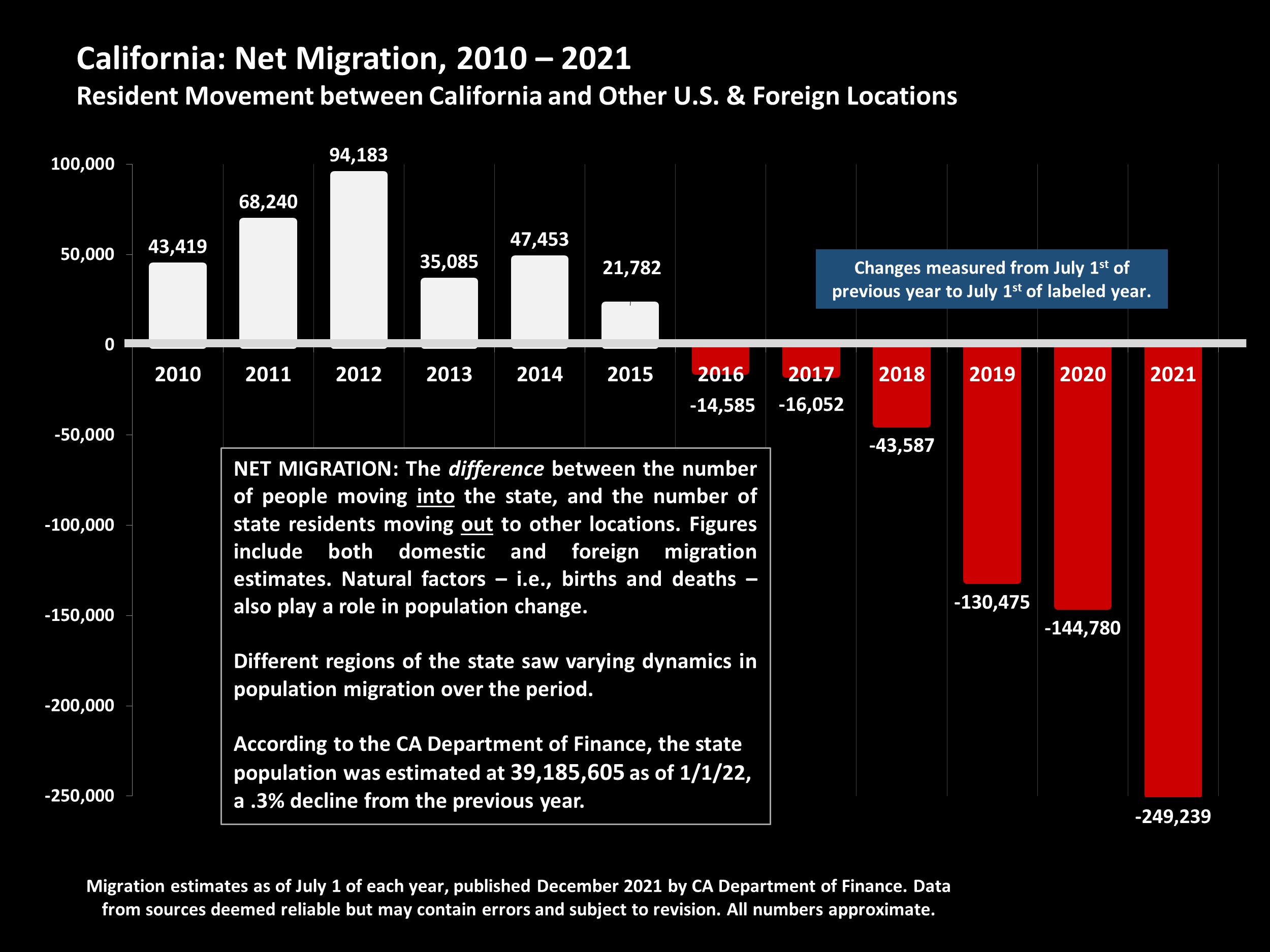

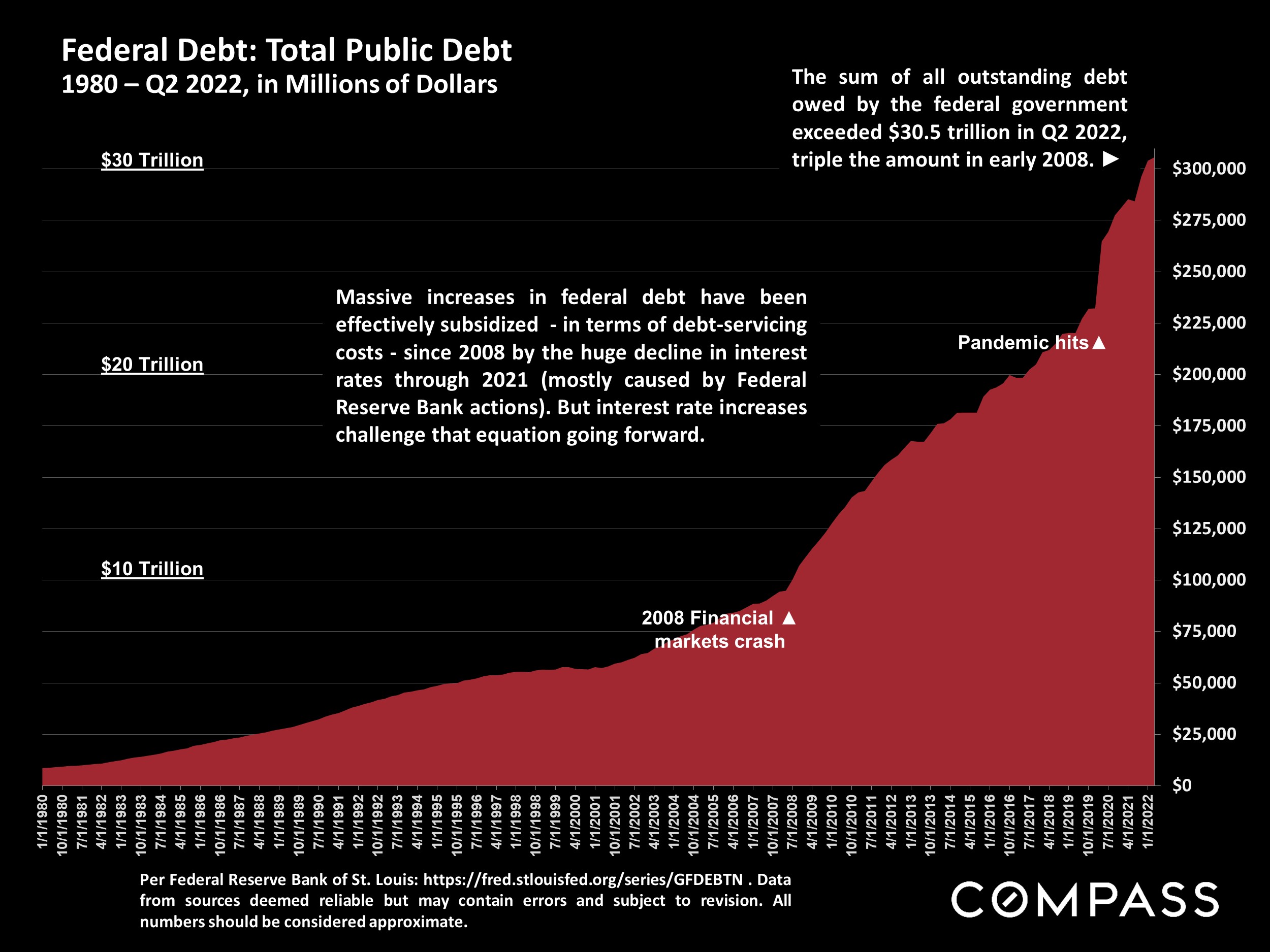

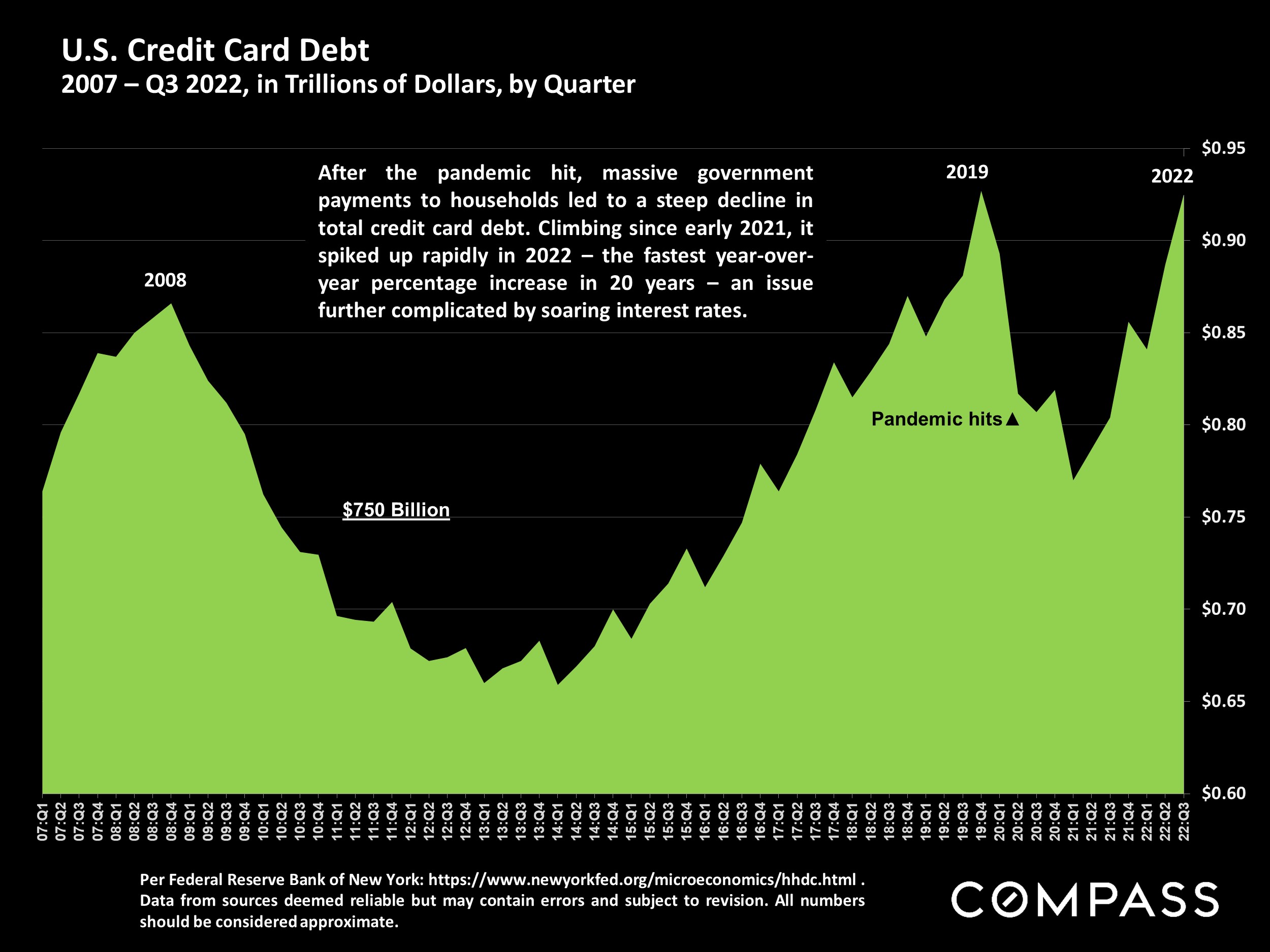

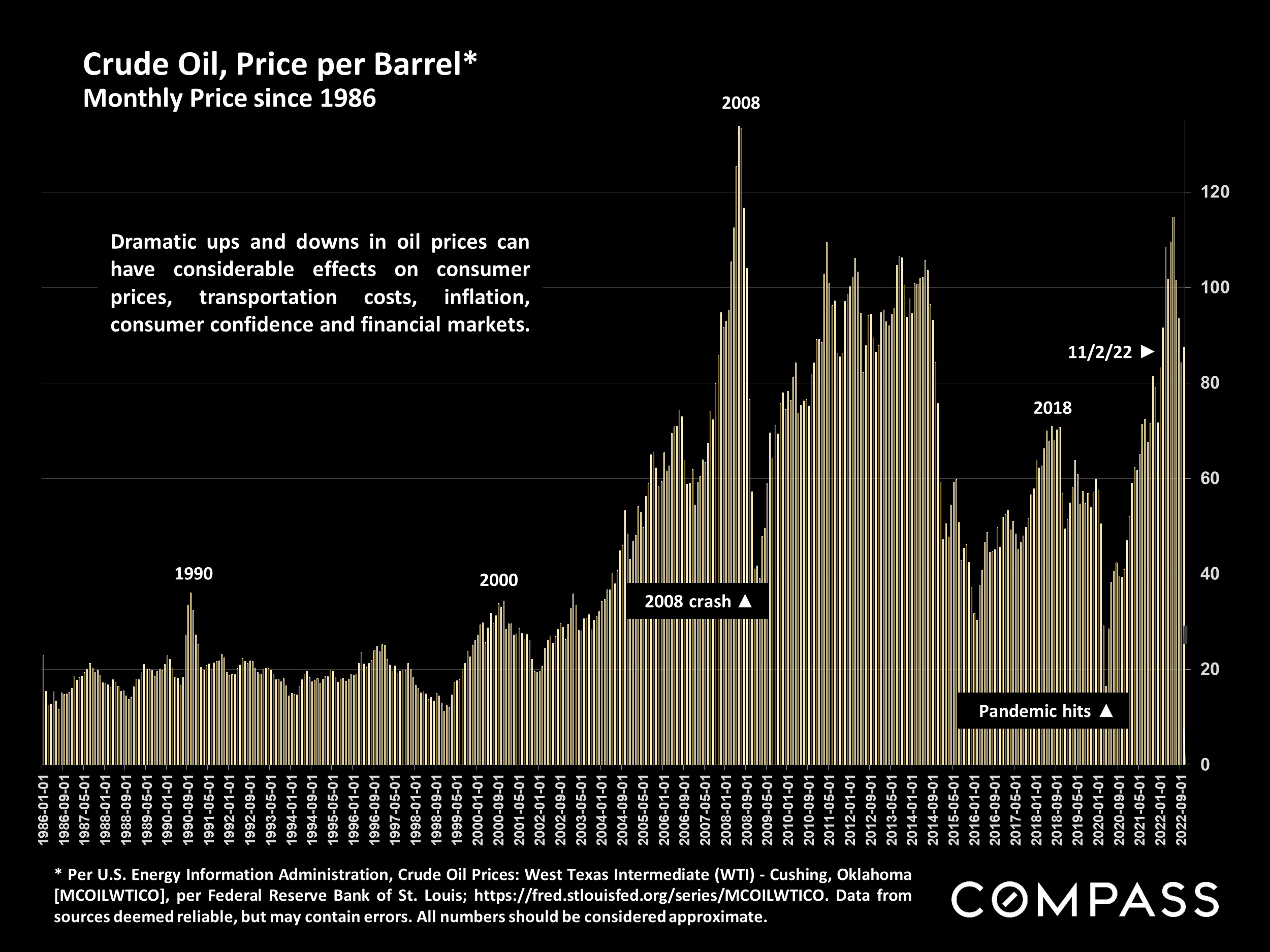

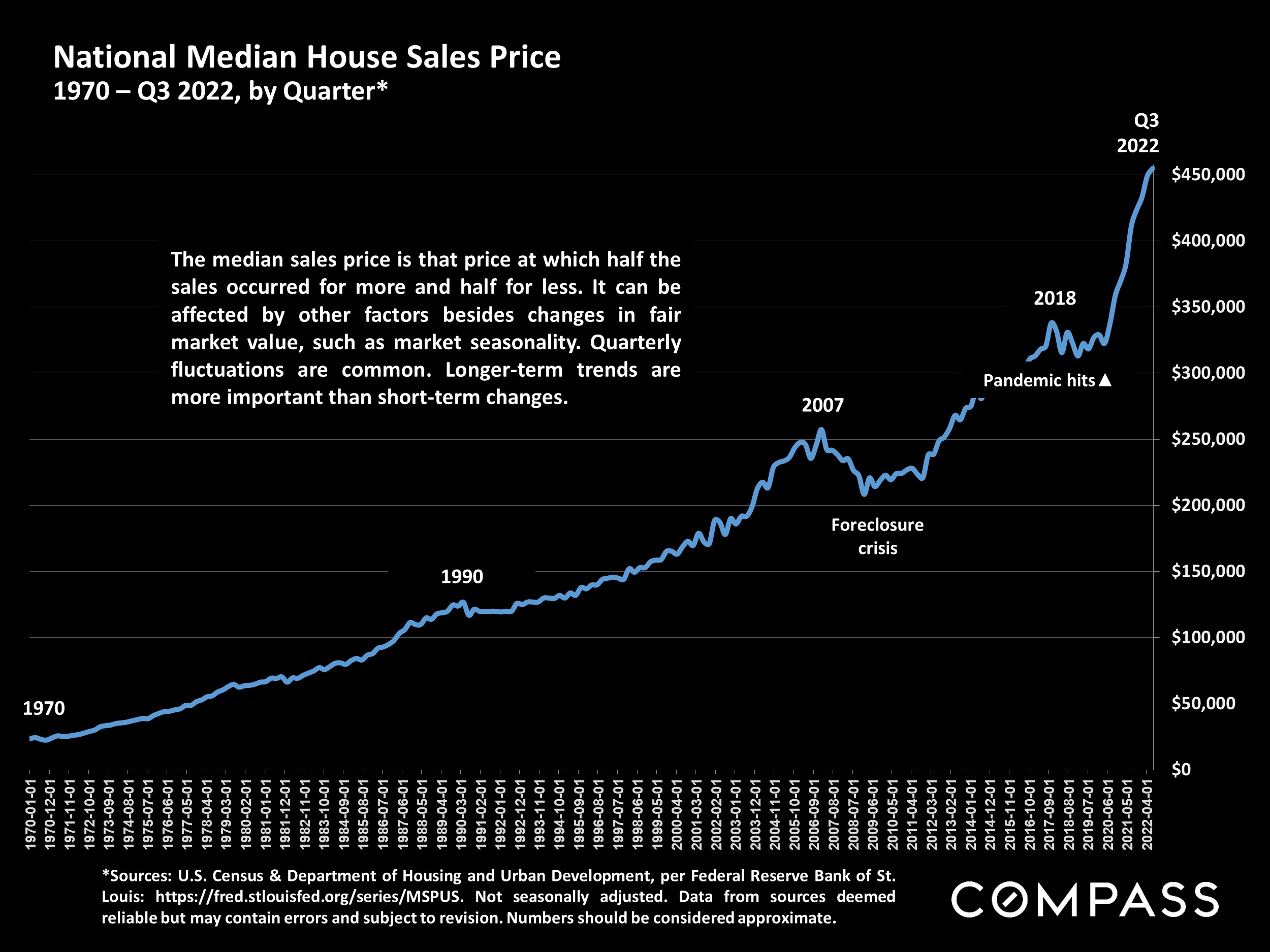

Selected Macroeconomic Factors & Indicators Pertinent to Bay Area Real Estate Markets

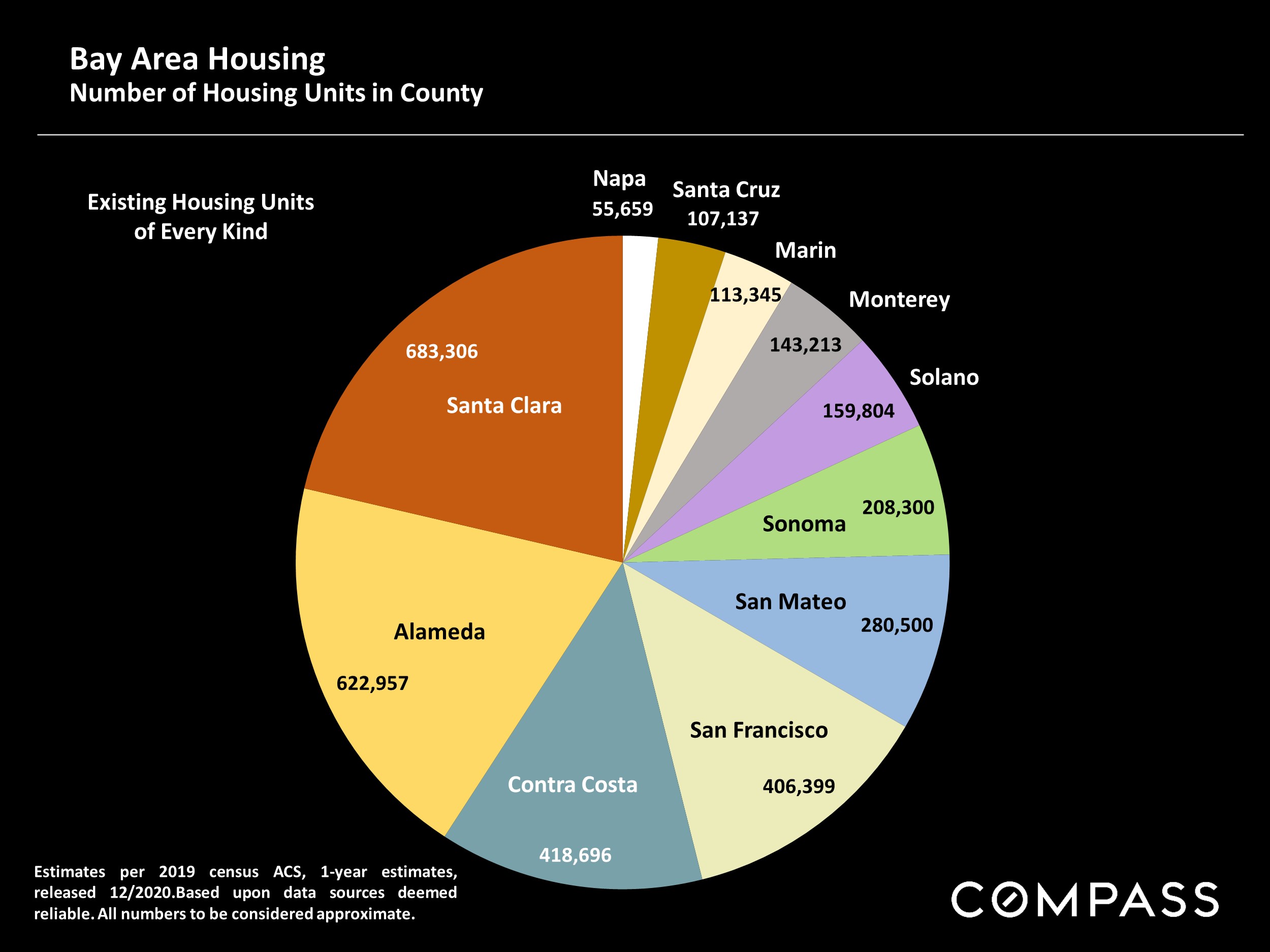

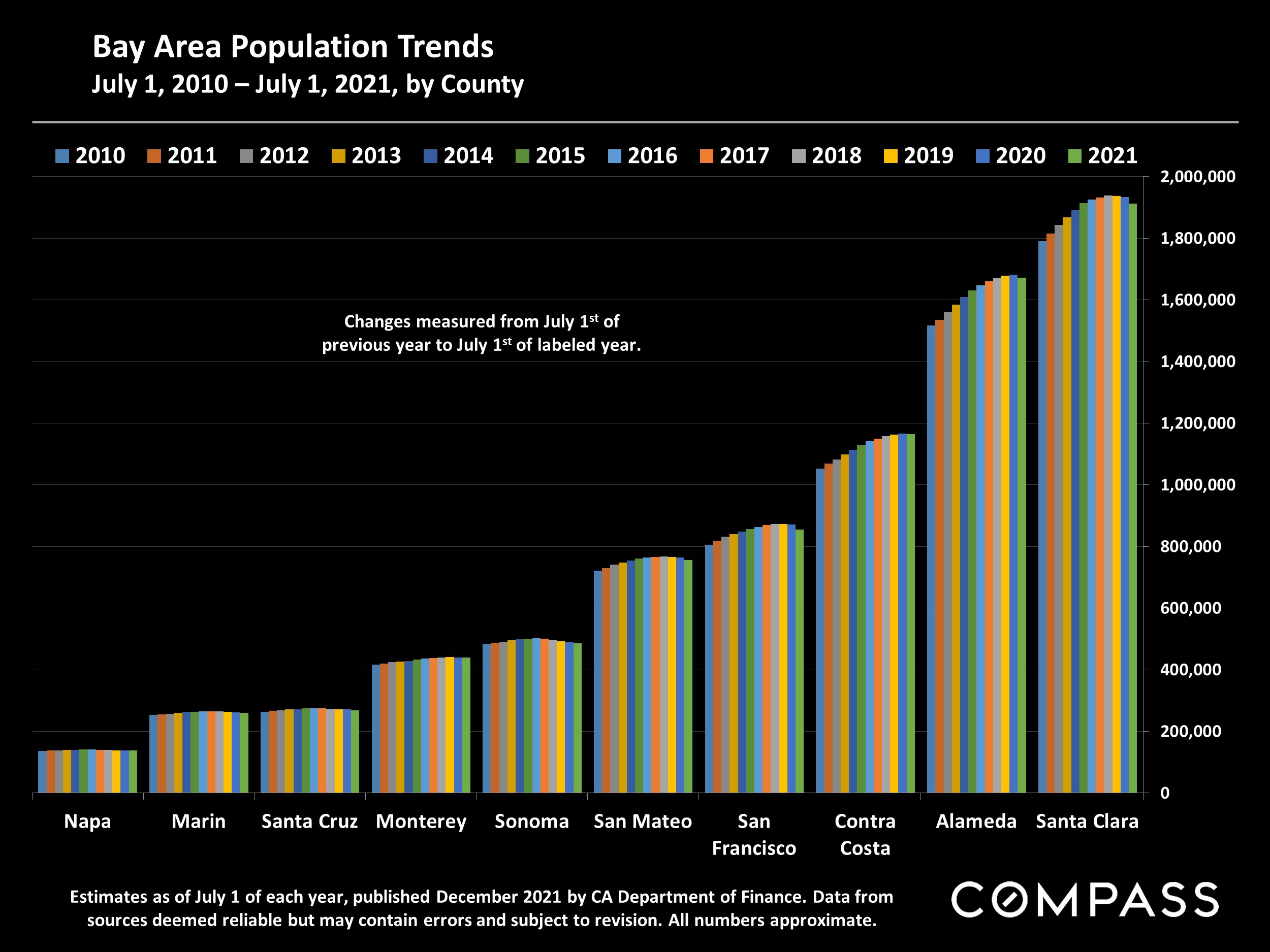

Interest rates, financial markets, inflation, housing affordability, consumer confidence, employment, population change, mortgage debt, and other factors and indicators.

Good-faith illustrations of data provided by sources deemed reliable, but may contain errors and subject to revision. Some of these indicators are highly volatile, and can change significantly even over the short term. All numbers should be considered approximate, and subject to independent verification by interested parties.

Source: Compass

It is impossible to know how median and average value statistics apply to any particular home without a specific comparative market analysis. These analyses were made in good faith with data from sources deemed reliable, but may contain errors and are subject to revision. It is not our intent to convince you of a particular position, but to attempt to provide straightforward data and analysis, so you can make your own informed decisions. Median and average statistics are enormous generalities: There are hundreds of different markets in San Francisco and the Bay Area, each with its own unique dynamics. Median prices and average dollar per square foot values can be and often are affected by other factors besides changes in fair market value. Longer term trends are much more meaningful than short-term.

Compass is a real estate broker licensed by the State of California, DRE 01527235. Equal Housing Opportunity. This report has been prepared solely for information purposes. The information herein is based on or derived from information generally available to the public and/or from sources believed to be reliable. No representation or warranty can be given with respect to the accuracy or completeness of the information. Compass disclaims any and all liability relating to this report, including without limitation any express or implied representations or warranties for statements contained in, and omissions from, the report. Nothing contained herein is intended to be or should be read as any regulatory, legal, tax, accounting or other advice and Compass does not provide such advice. All opinions are subject to change without notice. Compass makes no representation regarding the accuracy of any statements regarding any references to the laws, statutes or regulations of any state are those of the author(s). Past performance is no guarantee of future results.

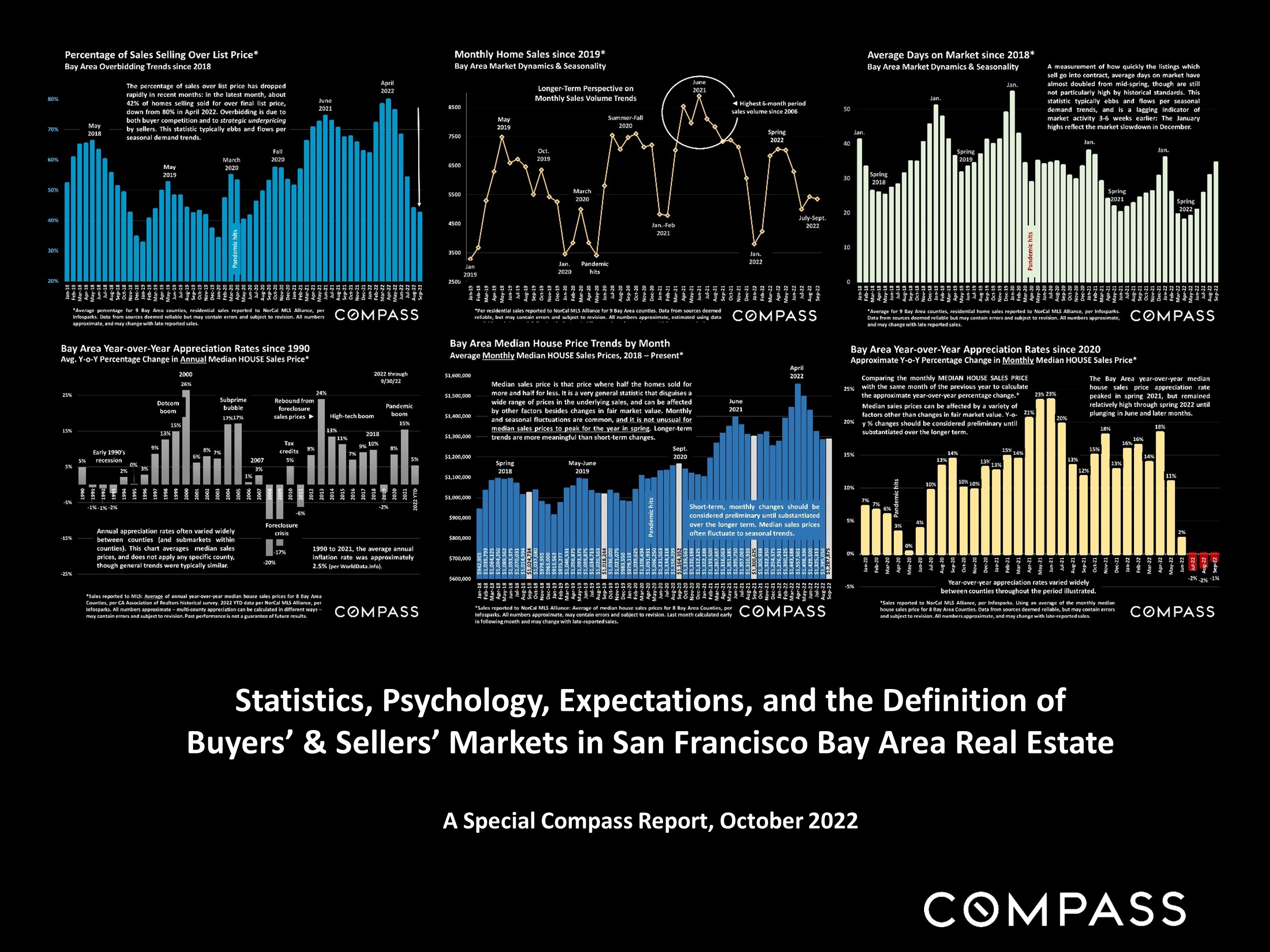

Statistics, Psychology, Expectations, and Buyers’ & Sellers’ Markets

Statistics and the Definition of Buyers’ & Sellers’ Markets

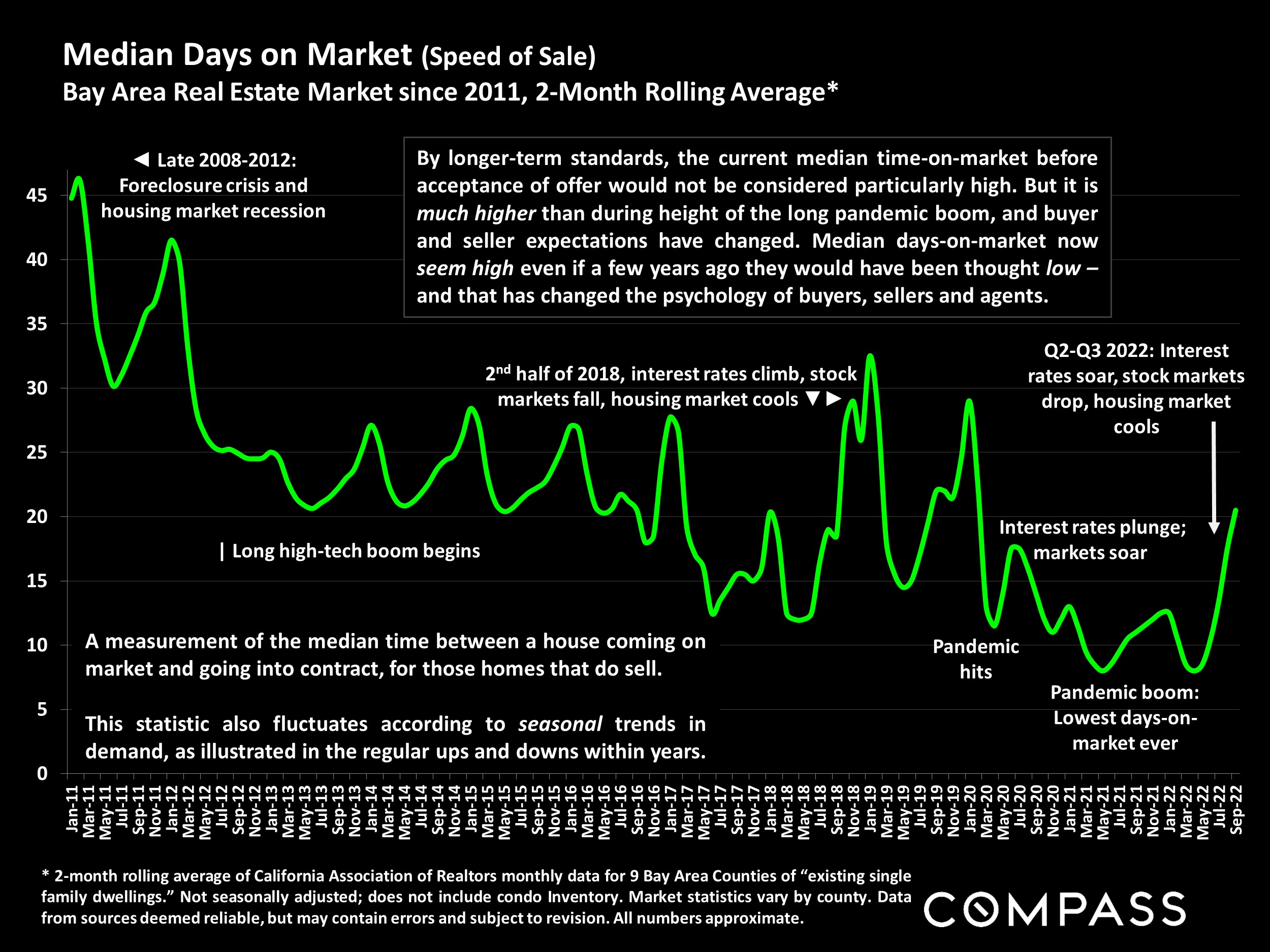

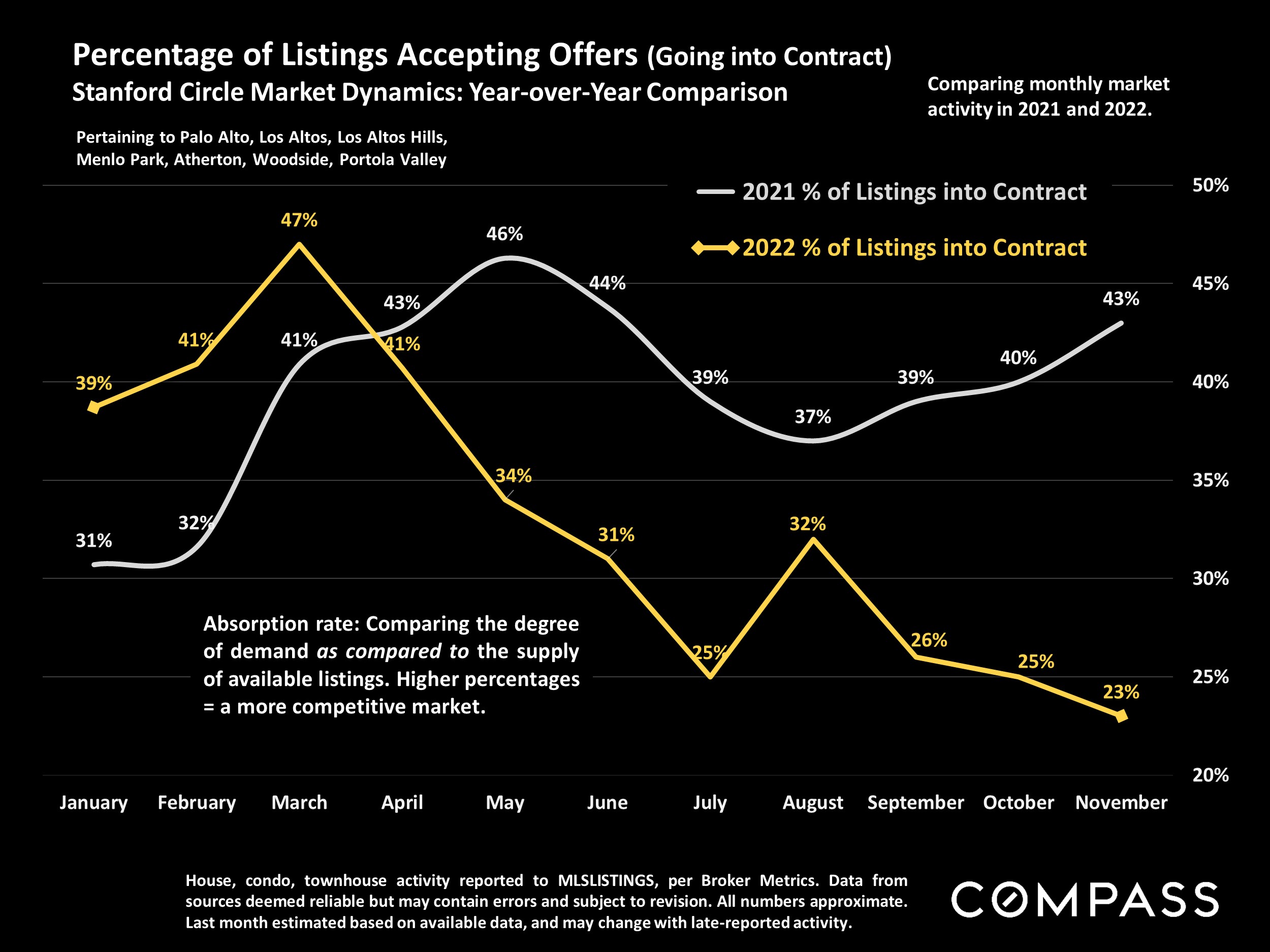

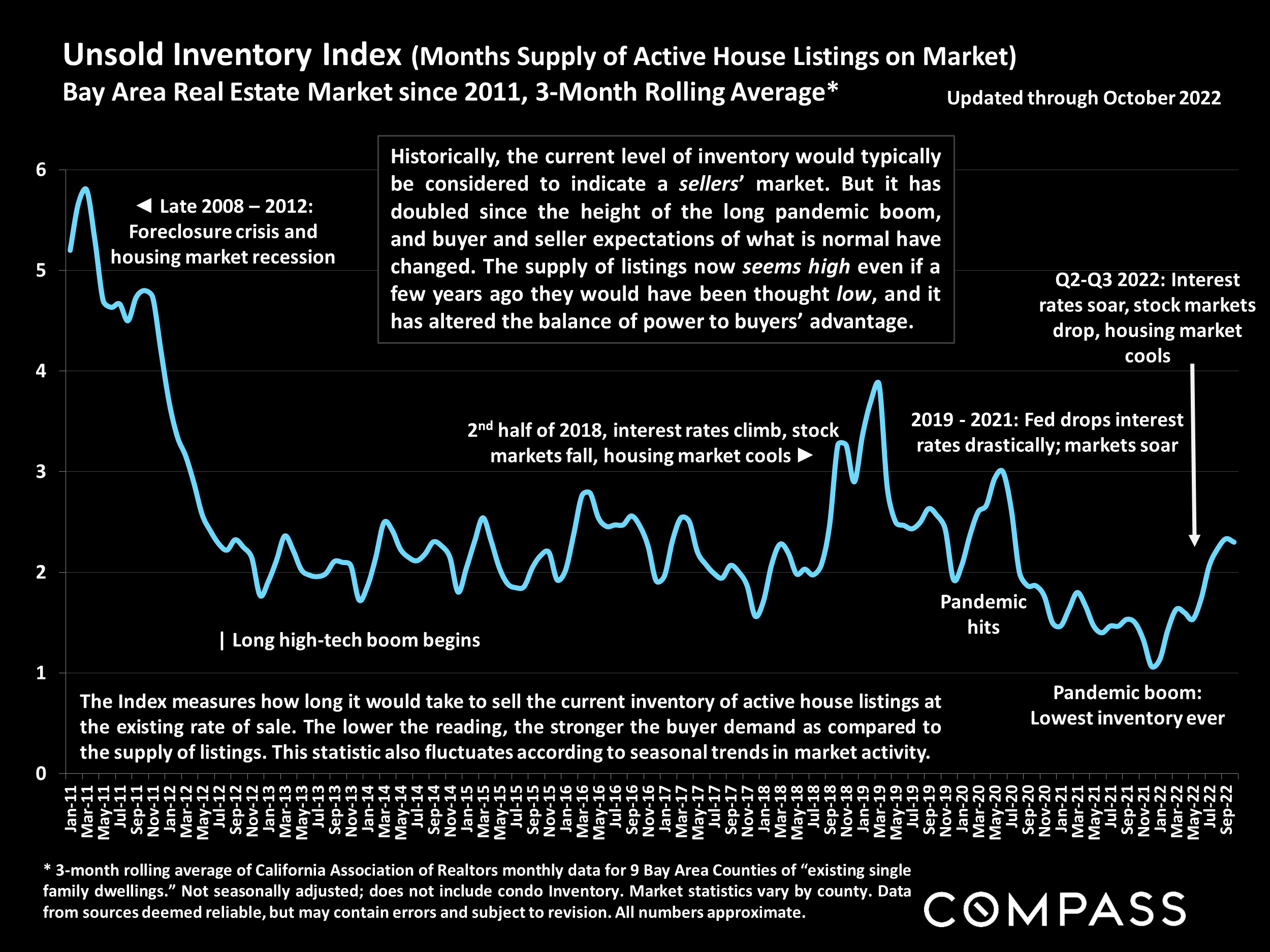

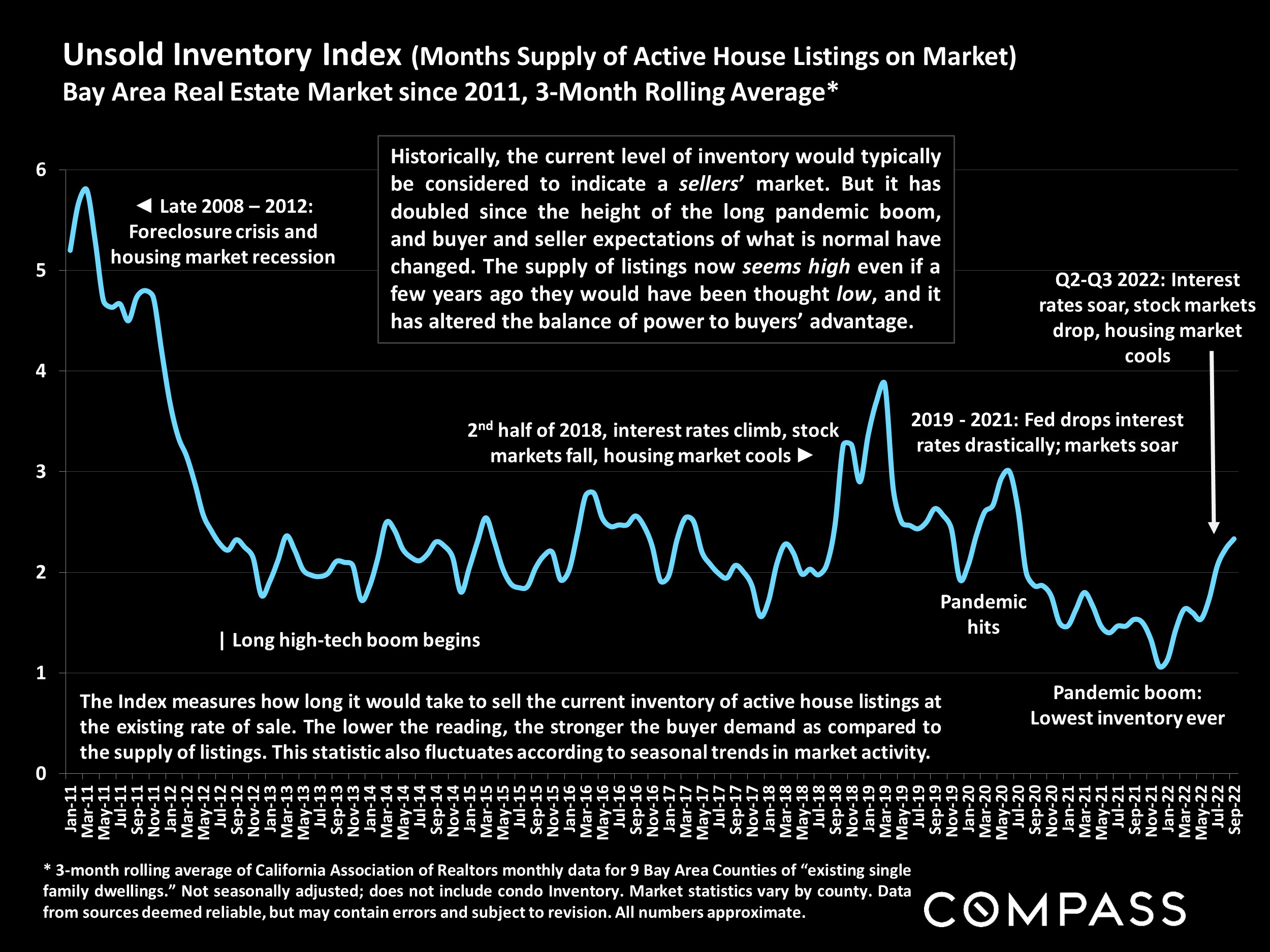

So-called “buyers’ markets” and “sellers’ markets” have typically been defined by certain statistical thresholds: Depending on readings for months-supply-of-inventory, absorption rate, days-on-market or other metrics, the market is pronounced to be relatively “balanced” between buyers and sellers, or to favor one party or the other, typically in terms of negotiating power and home-price appreciation.

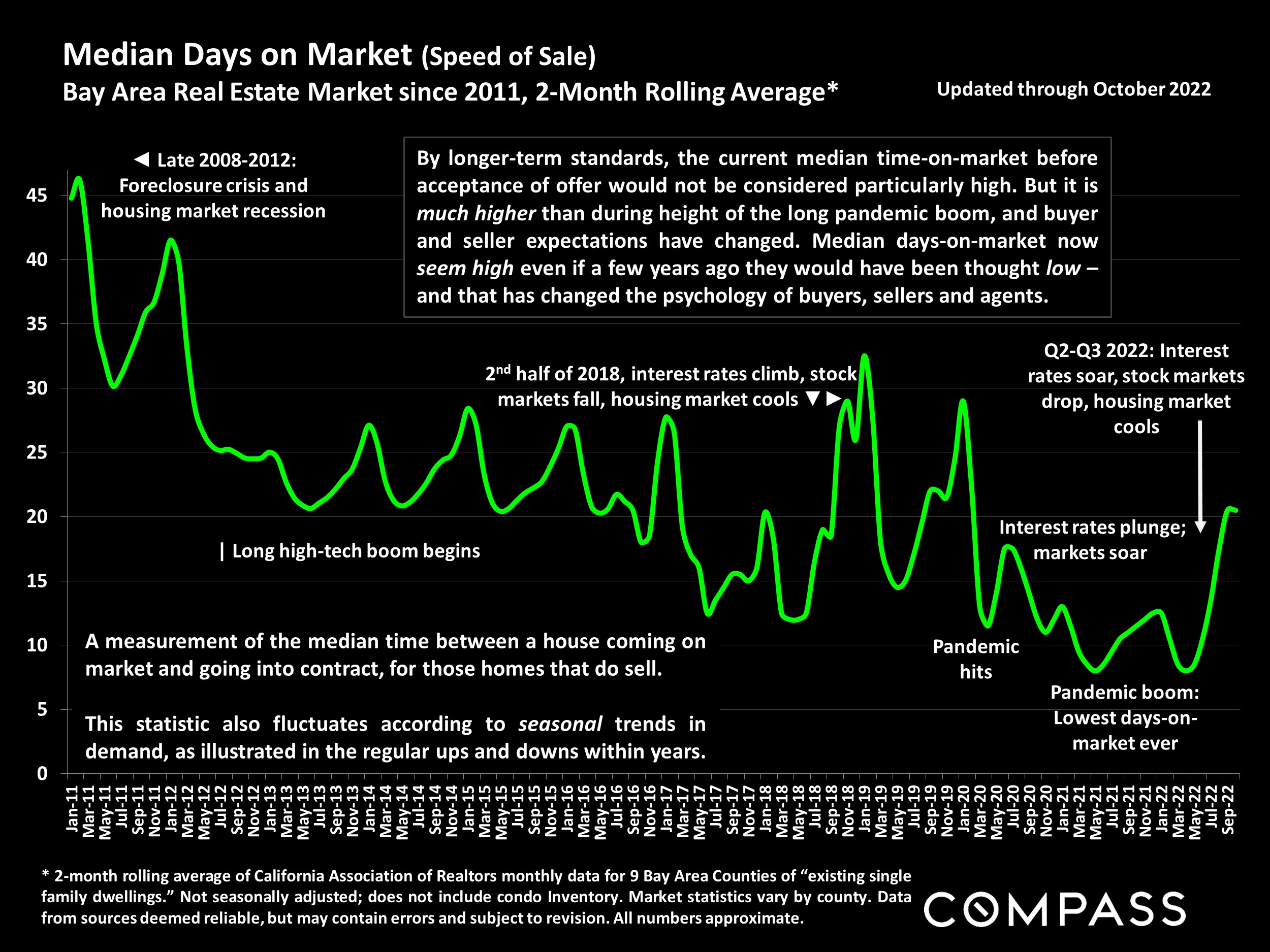

But it is actually buyer and seller psychology that determines the balance between the parties, and the perception of what constitutes a heated (sellers’) or weak (buyers’) market can change considerably depending on what people get used to. If it becomes the norm that listings sell within 1-7 days, with wild overbidding by a surplus of buyers, then getting 1 offer at or below list price, or no offers, after 15-20 days seems like a huge shift – causing anxiety on the selling side, and concern on the buying side (why hasn’t this home sold yet?) – even if, historically speaking, 15-20 days is a relatively short time on market. If it becomes typical that buyers’ choice of listings is rarely more than 1 or 2 homes, usually snapped up before day’s end, it’s an almost shocking change to see 4 or 5 active listings, most still available a week later, even if that would have been considered normal or low inventory a few years earlier.

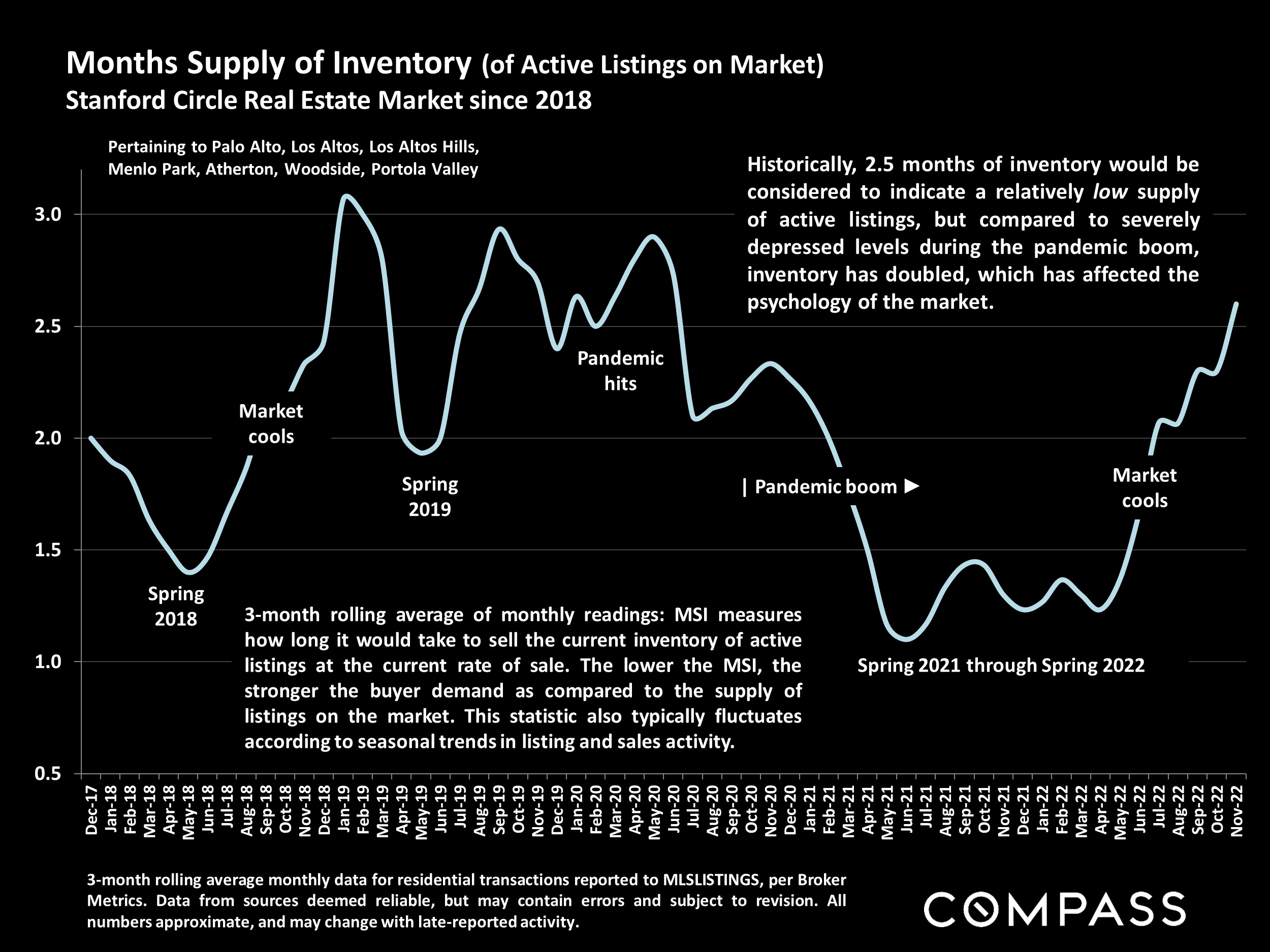

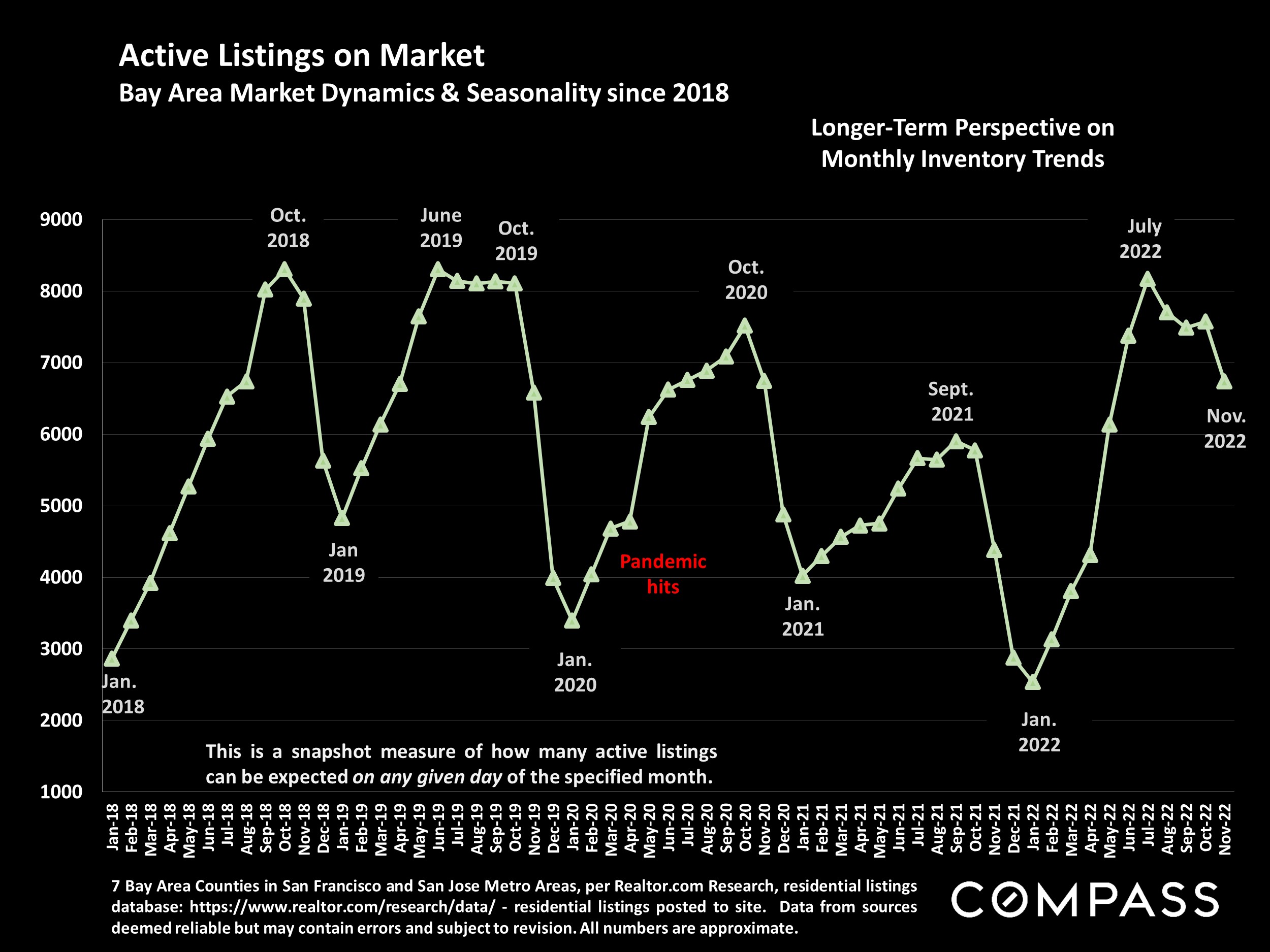

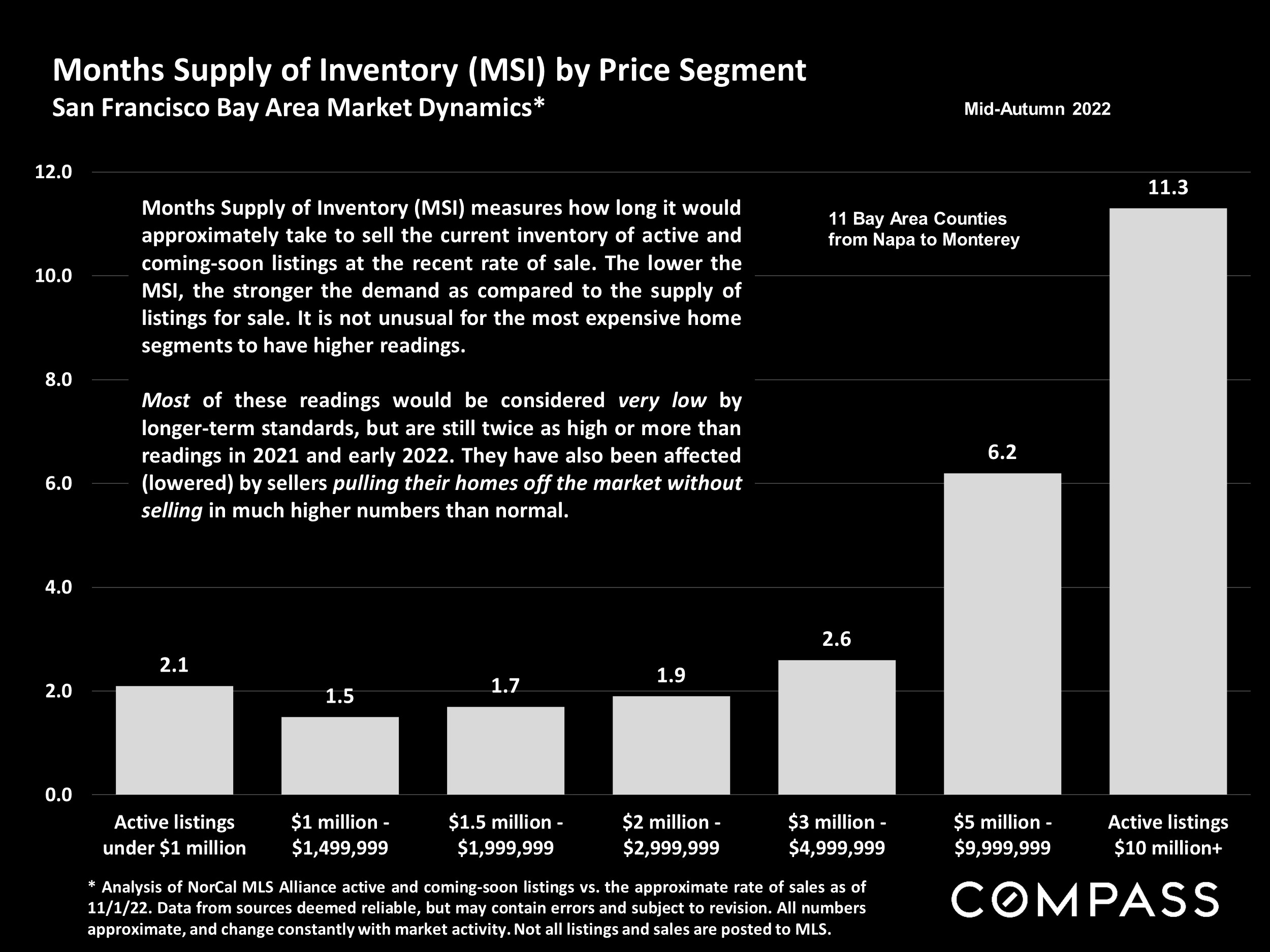

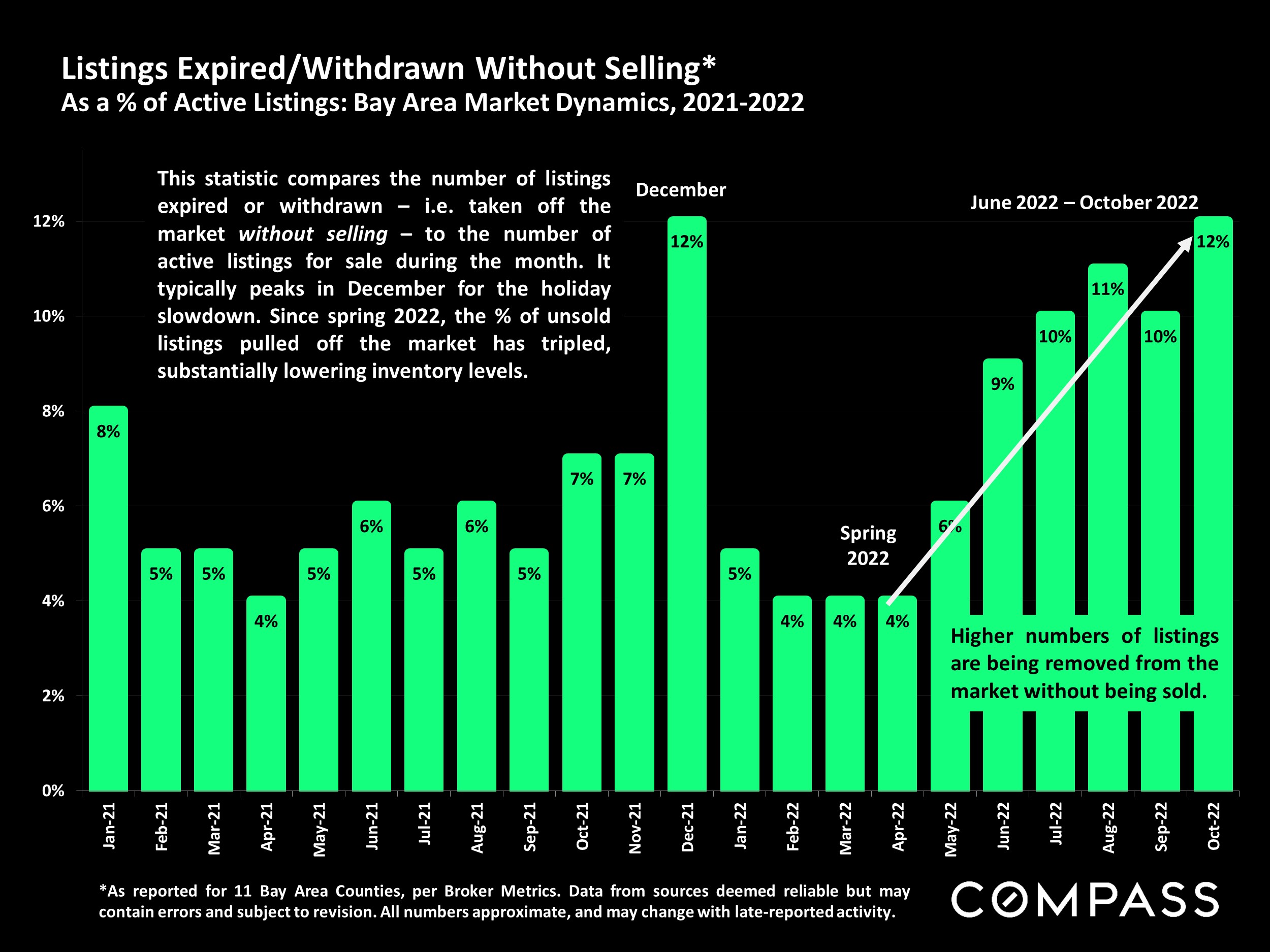

This is what has occurred since the end of the, often wildly overheated, pandemic boom. Abnormal market conditions – by far the lowest interest rates, months-supply-of-inventory and days-on-market; by far the highest stock values, absorption and overbidding rates, in history – became the norm for almost 2 years. When those indicators cooled in the Bay Area in Q2-Q3 2022, very significantly on a percentage basis – 1⁄2 to 1 month of inventory jumping to (a still historically low) 2 to 2.5 months; a median of 6-8 days-on-market climbing to (a still relatively low) 18 to 24 days – the speed and scale of change altered the balance of power to buyers’ advantage. Appreciation and overbidding rates have generally plunged, and price reductions soared, though many homes still sell quickly if priced correctly.

Older interpretations of statistical thresholds for defining buyers’ and sellers’ markets – often found online or in the media – are based on market-activity norms that no longer apply.

Demand has clearly weakened significantly due to the economic headwinds of 2022-inflation, interest rates, financial market volatility – but buyer, seller and agent expectations have also been somewhat twisted out of whack, fundamentally changing how we psychologically perceive and react to existing market realities. What might have been considered relatively healthy market dynamics are now seen as distinctly anemic in comparison to the pandemic boom. With the current market correction in progress, what will ultimately be considered heated, balanced or weak remains in flux while the market adjusts to the economic and demographic changes still in process.

The two charts which follow, illustrating Bay Area changes in inventory and time-on-market since 2011, speak to the shifting norms of supply and demand over the past 12 years.

Note: Market conditions, as measured by standard industry statistics, differ between regional markets and between price segments. The dynamics of distinct markets varied during the high-tech and pandemic booms: In each period, depending on a number of factors, some regions or segments experienced more dramatic changes in demand. However, generally speaking (and there are exceptions), Bay Area markets have seen similar trends, heating or cooling roughly in parallel during recent market eras – whether subprime boom, foreclosure crisis, high-tech or pandemic boom, or now during the current market adjustment.

Our reports are not intended to convince you regarding a course of action or to predict the future, but to provide, to the best of our ability, straightforward information and good-faith analysis to assist you in making your own informed decisions. Statistics should be considered very general indicators, and all numbers should be considered approximate. How they apply to any particular property is unknown without a specific comparative market analysis.

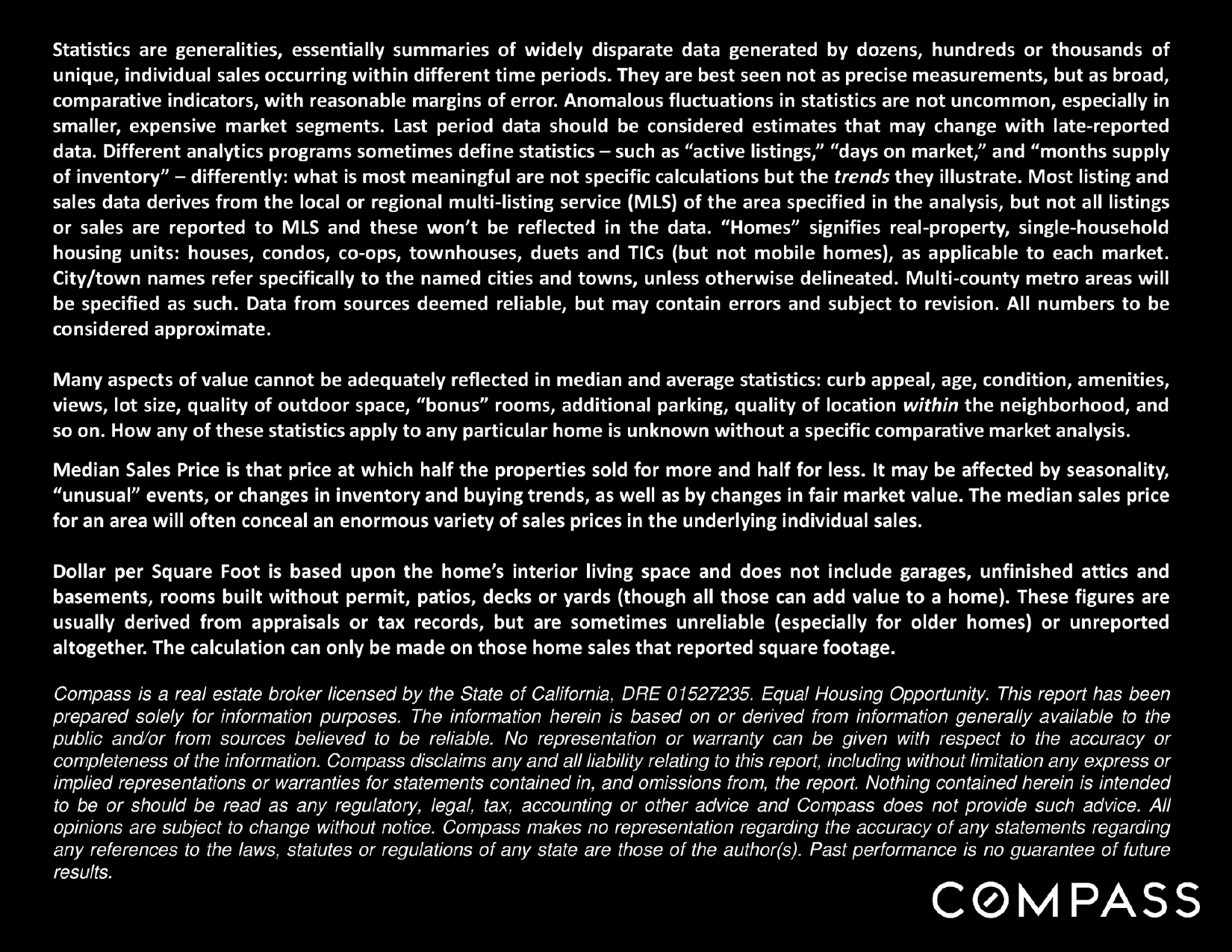

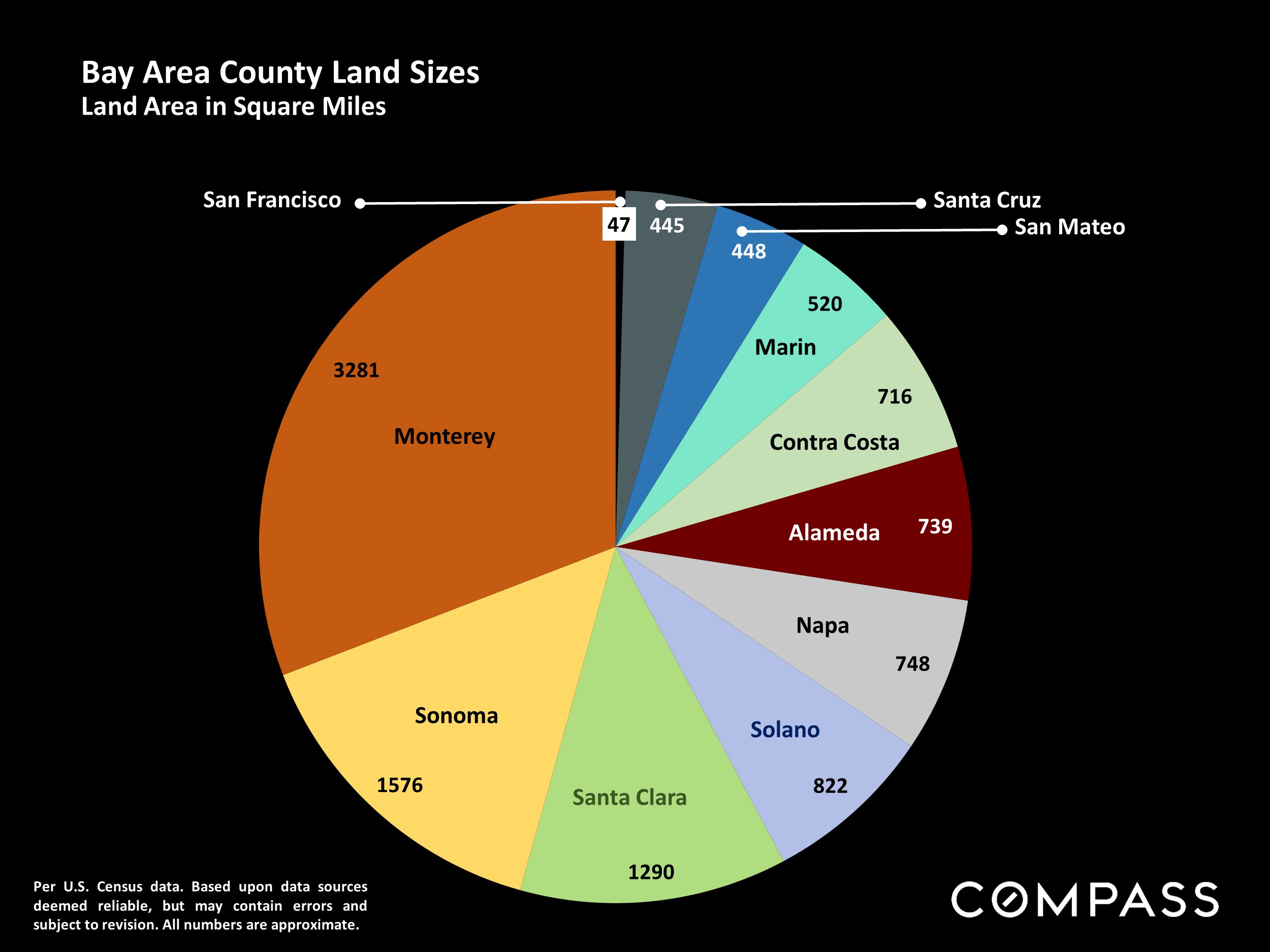

Statistics are generalities, essentially summaries of widely disparate data generated by dozens or hundreds of unique, individual sales occurring within different time periods. They are best seen not as precise measurements, but as broad, comparative indicators, with reasonable margins of error. Anomalous fluctuations in statistics are not uncommon, especially in smaller, expensive market segments. Last period data should be considered estimates that may change with late-reported data. Different analytics programs sometimes define statistics – such as “active listings,” “days on market,” and “months supply of inventory” – differently: what is most meaningful are not specific calculations but the trends they illustrate. Most listing and sales data derives from the local or regional multi-listing service (MLS) of the area specified in the analysis, but not all listings or sales are reported to MLS and these won’t be reflected in the data. “Homes” signifies real-property, single-household housing units: houses, condos, co-ops, townhouses, duets and TICs (but not mobile homes), as applicable to each market. City/town names refer specifically to the named cities and towns, unless otherwise delineated. Multi-county metro areas will be specified as such. Data from sources deemed reliable, but may contain errors and subject to revision. All numbers to be considered approximate.

Many aspects of value cannot be adequately reflected in median and average statistics: curb appeal, age, condition, amenities, views, lot size, quality of outdoor space, “bonus” rooms, additional parking, quality of location within the neighborhood, and so on. How any of these statistics apply to any particular home is unknown without a specific comparative market analysis.

Median Sales Price is that price at which half the properties sold for more and half for less. It may be affected by seasonality, “unusual” events, or changes in inventory and buying trends, as well as by changes in fair market value. The median sales price for an area will often conceal an enormous variety of sales prices in the underlying individual sales.

Dollar per Square Foot is based upon the home’s interior living space and does not include garages, unfinished attics and basements, rooms built without permit, patios, decks or yards (though all those can add value to a home). These figures are usually derived from appraisals or tax records, but are sometimes unreliable (especially for older homes) or unreported altogether. The calculation can only be made on those home sales that reported square footage.

Compass is a real estate broker licensed by the State of California, DRE 01527235. Equal Housing Opportunity. This report has been prepared solely for information purposes. The information herein is based on or derived from information generally available to the public and/or from sources believed to be reliable. No representation or warranty can be given with respect to the accuracy or completeness of the information. Compass disclaims any and all liability relating to this report, including without limitation any express or implied representations or warranties for statements contained in, and omissions from, the report. Nothing contained herein is intended to be or should be read as any regulatory, legal, tax, accounting or other advice and Compass does not provide such advice. All opinions are subject to change without notice. Compass makes no representation regarding the accuracy of any statements regarding any references to the laws, statutes or regulations of any state are those of the author(s). Past performance is no guarantee of future results.

Source: Compass

It is impossible to know how median and average value statistics apply to any particular home without a specific comparative market analysis. These analyses were made in good faith with data from sources deemed reliable, but may contain errors and are subject to revision. It is not our intent to convince you of a particular position, but to attempt to provide straightforward data and analysis, so you can make your own informed decisions. Median and average statistics are enormous generalities: There are hundreds of different markets in San Francisco and the Bay Area, each with its own unique dynamics. Median prices and average dollar per square foot values can be and often are affected by other factors besides changes in fair market value. Longer term trends are much more meaningful than short-term.

Compass is a real estate broker licensed by the State of California, DRE 01527235. Equal Housing Opportunity. This report has been prepared solely for information purposes. The information herein is based on or derived from information generally available to the public and/or from sources believed to be reliable. No representation or warranty can be given with respect to the accuracy or completeness of the information. Compass disclaims any and all liability relating to this report, including without limitation any express or implied representations or warranties for statements contained in, and omissions from, the report. Nothing contained herein is intended to be or should be read as any regulatory, legal, tax, accounting or other advice and Compass does not provide such advice. All opinions are subject to change without notice. Compass makes no representation regarding the accuracy of any statements regarding any references to the laws, statutes or regulations of any state are those of the author(s). Past performance is no guarantee of future results.