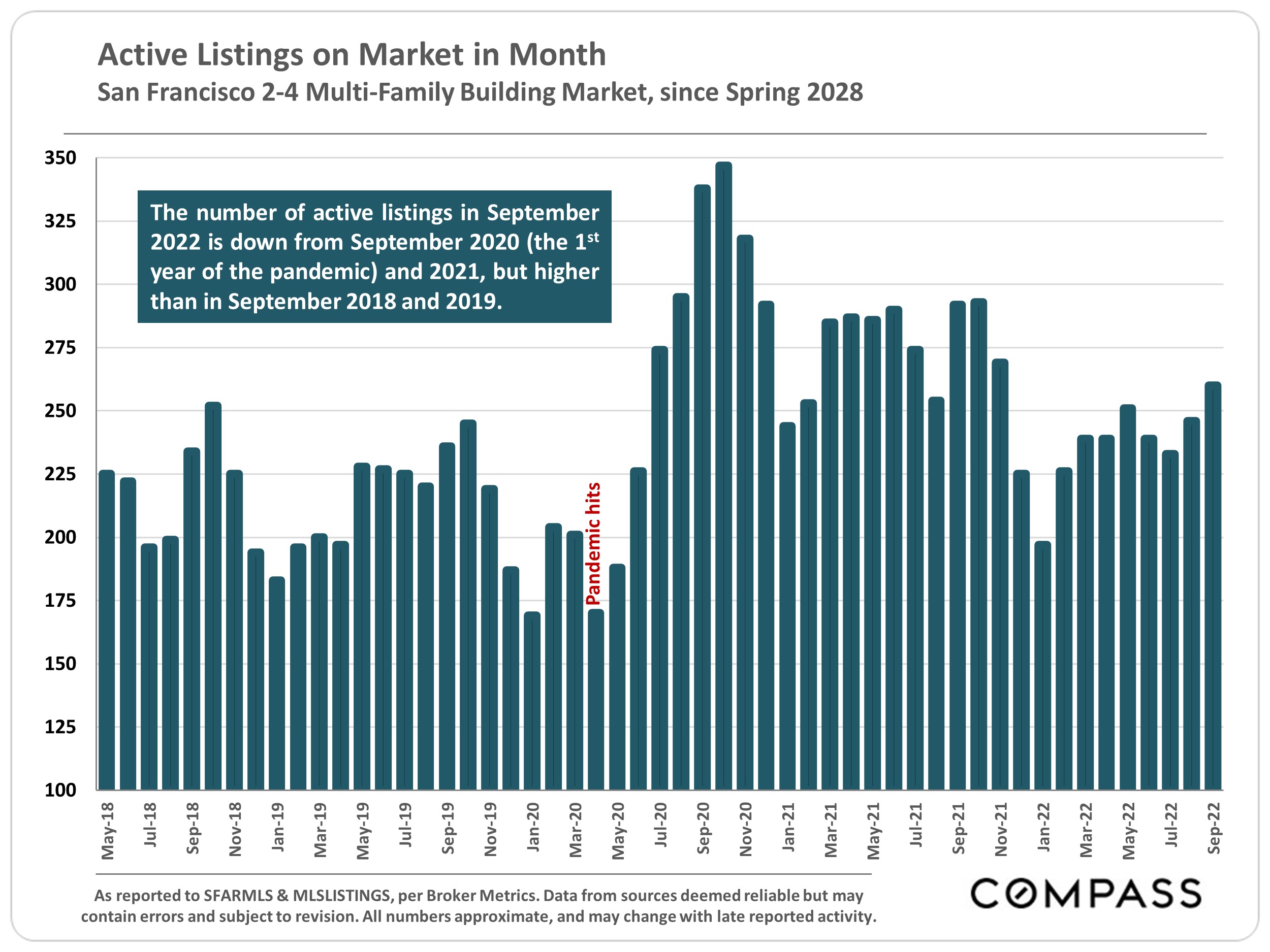

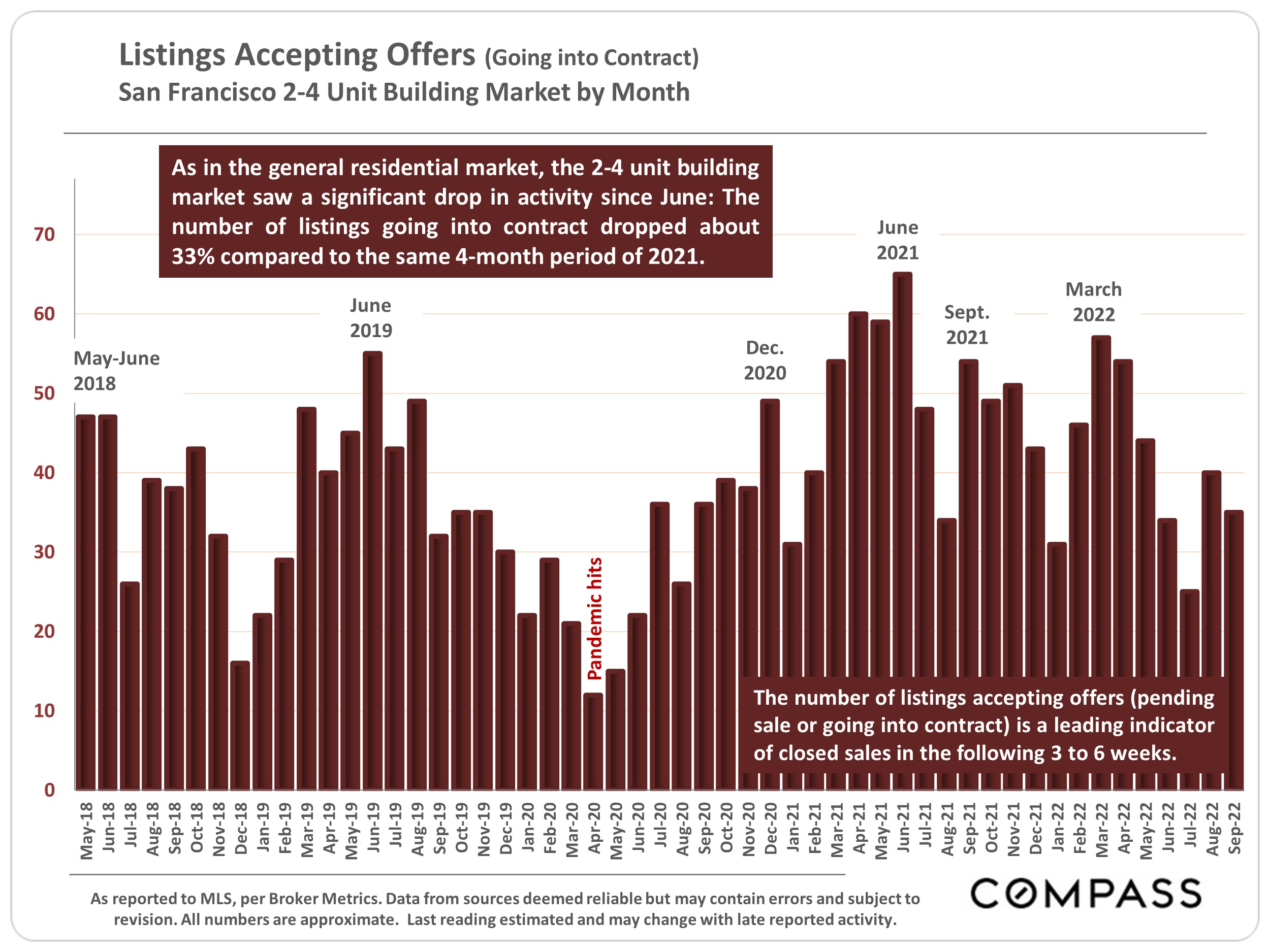

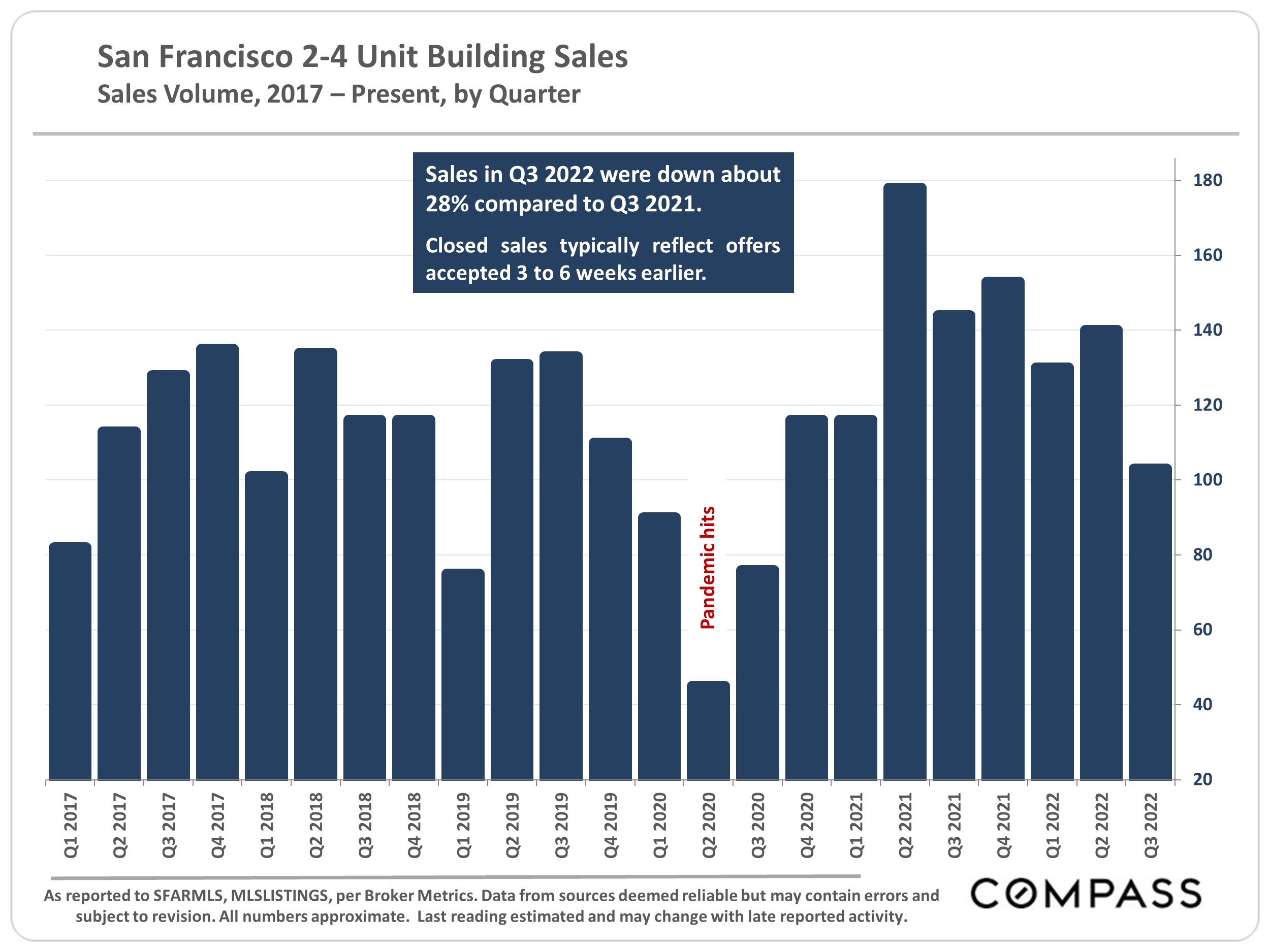

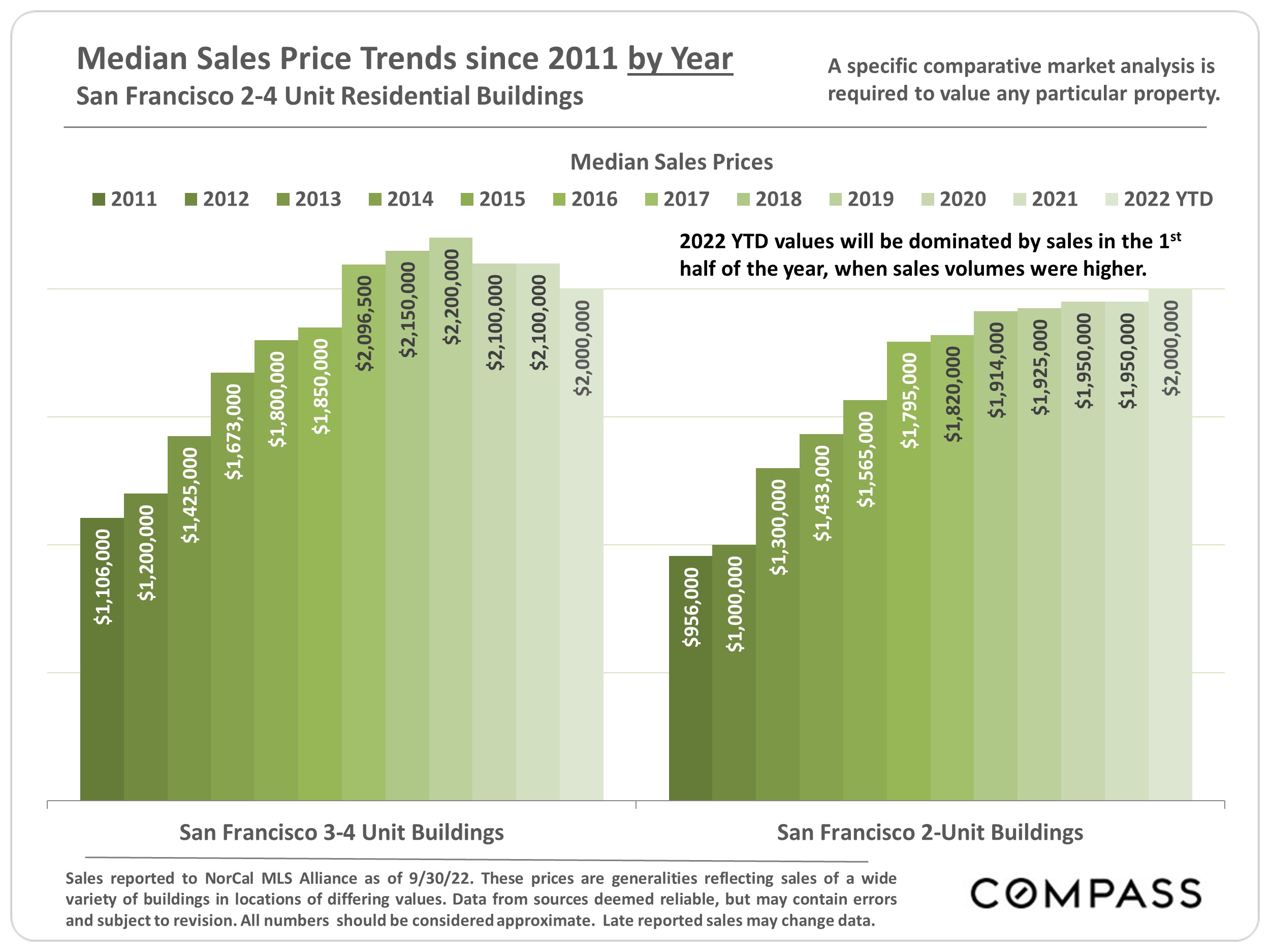

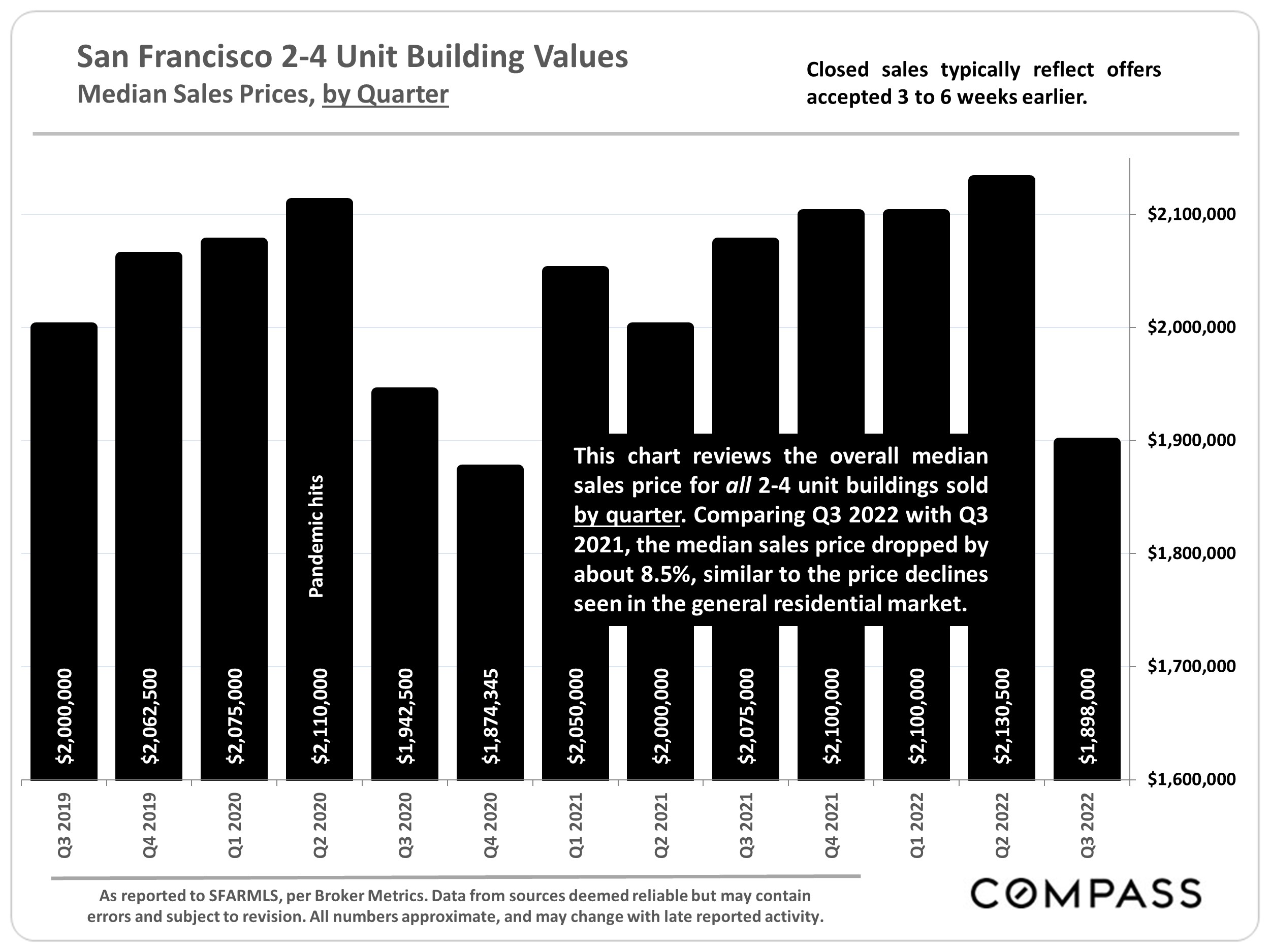

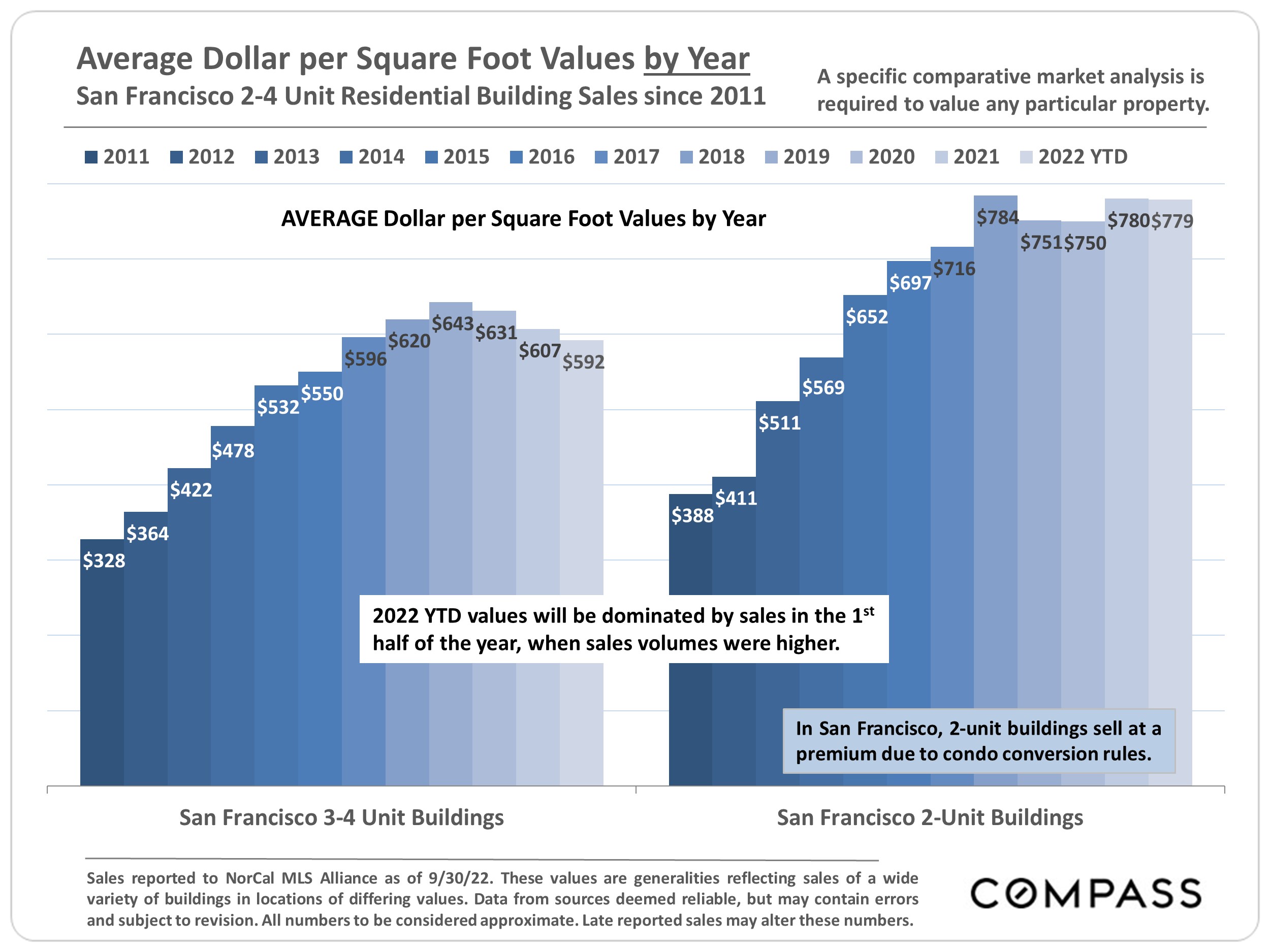

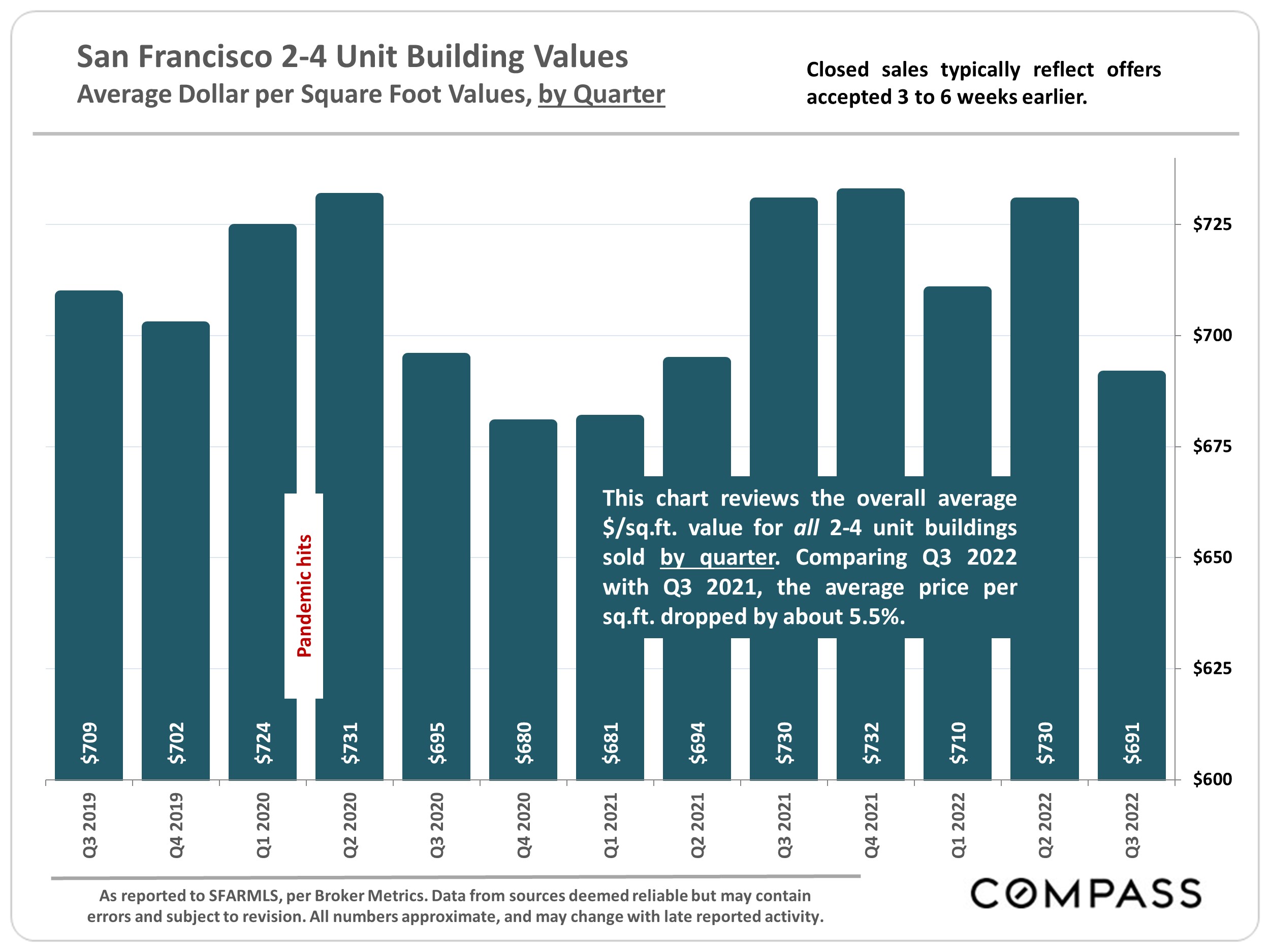

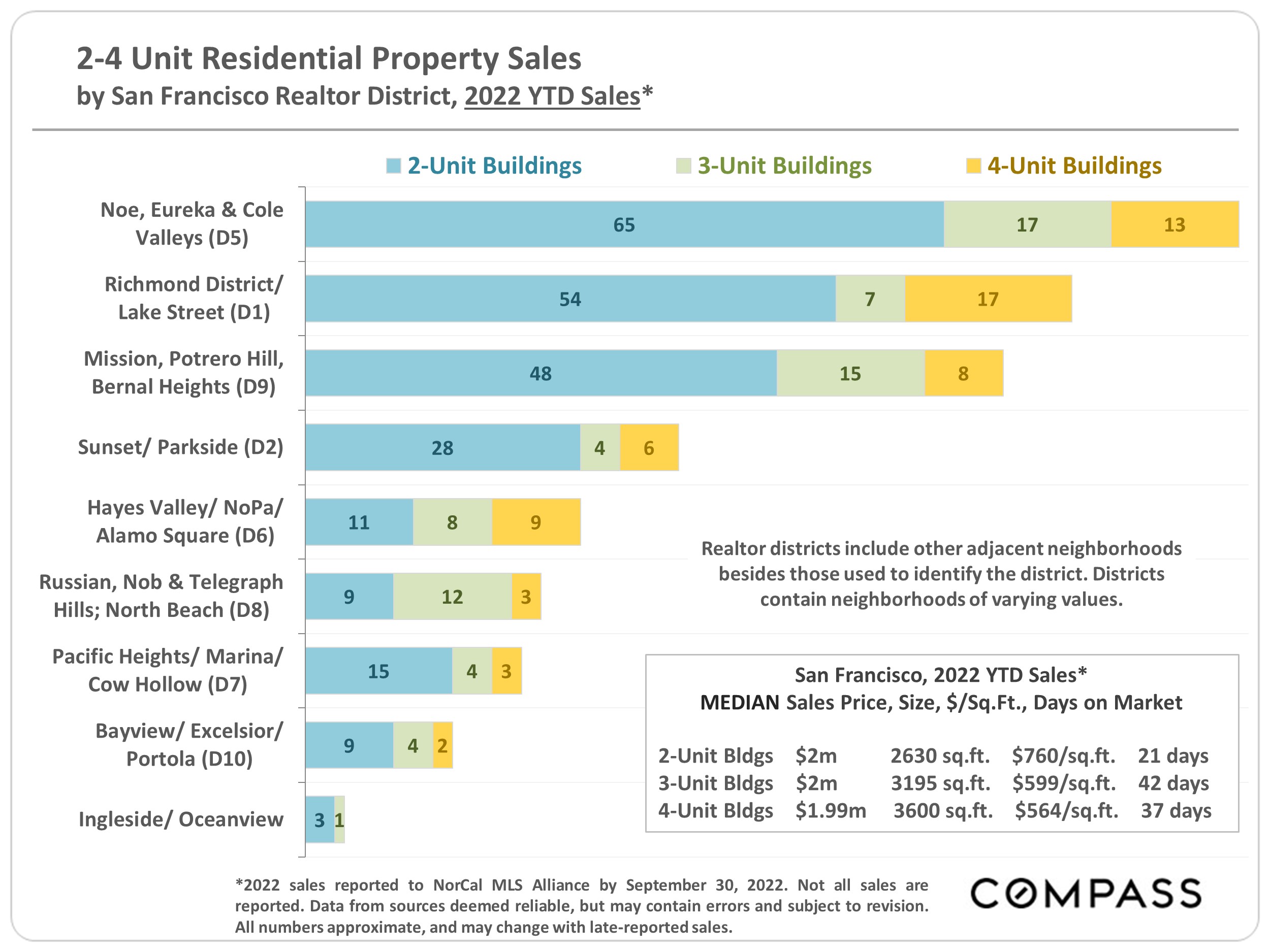

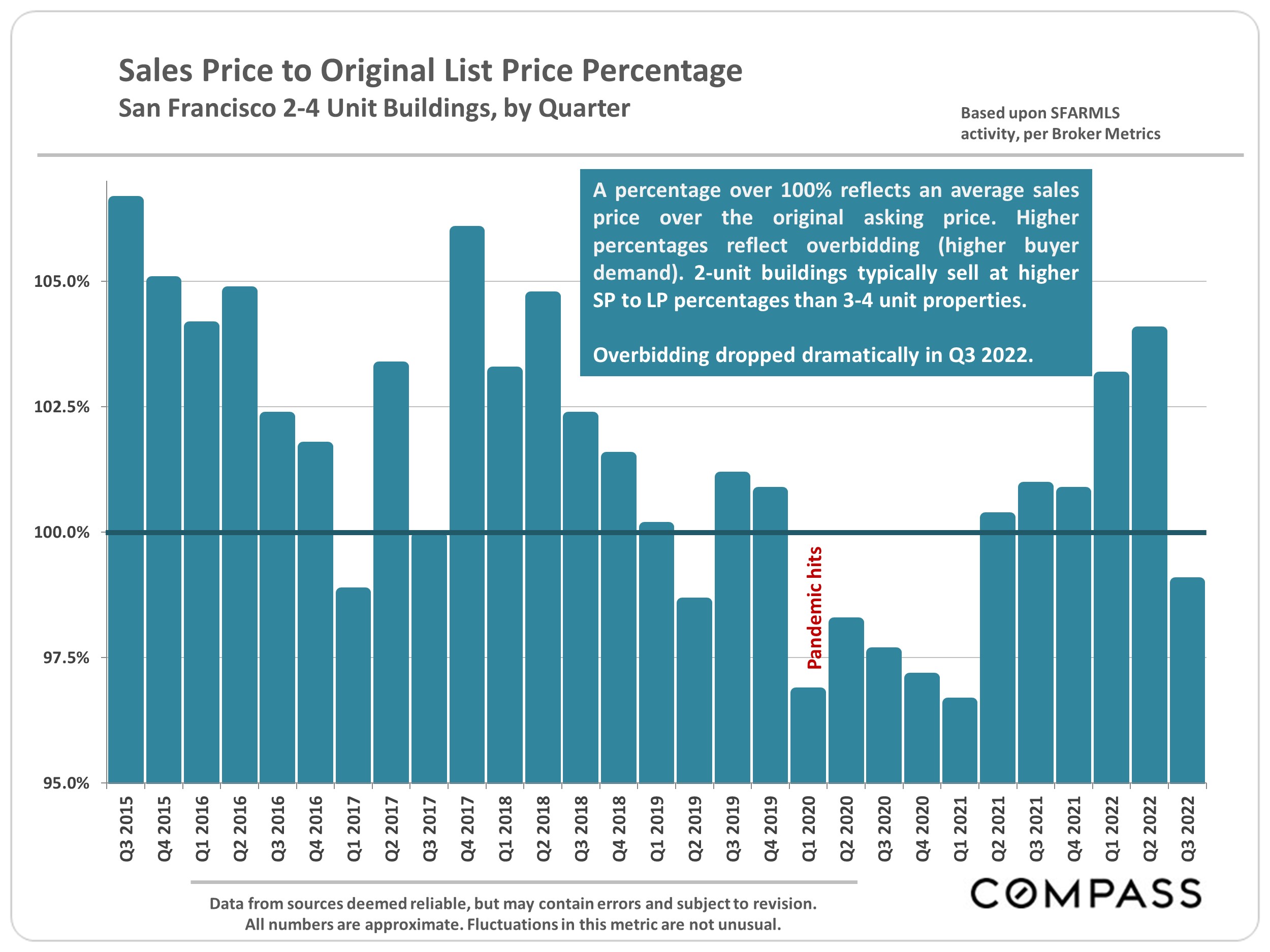

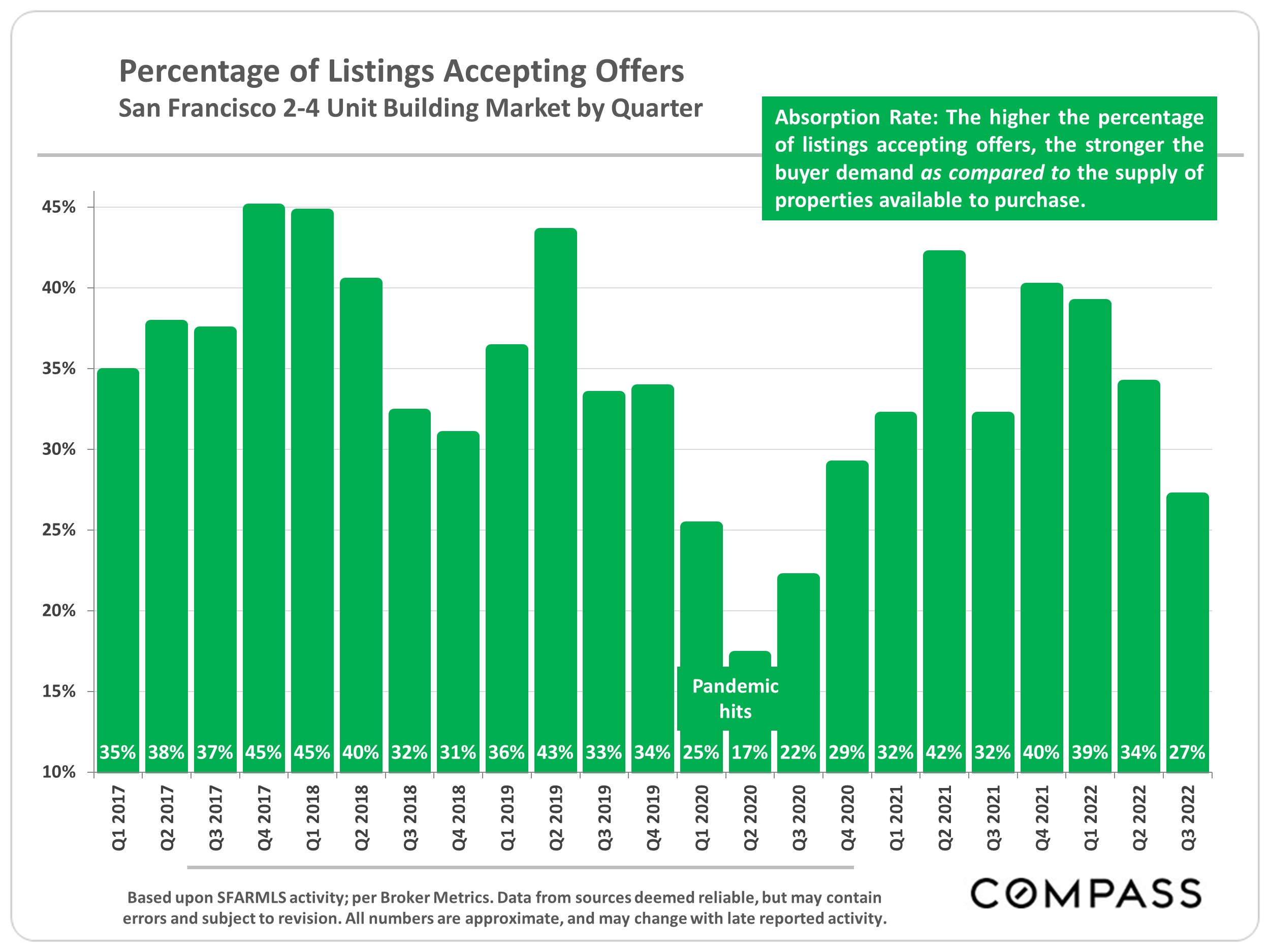

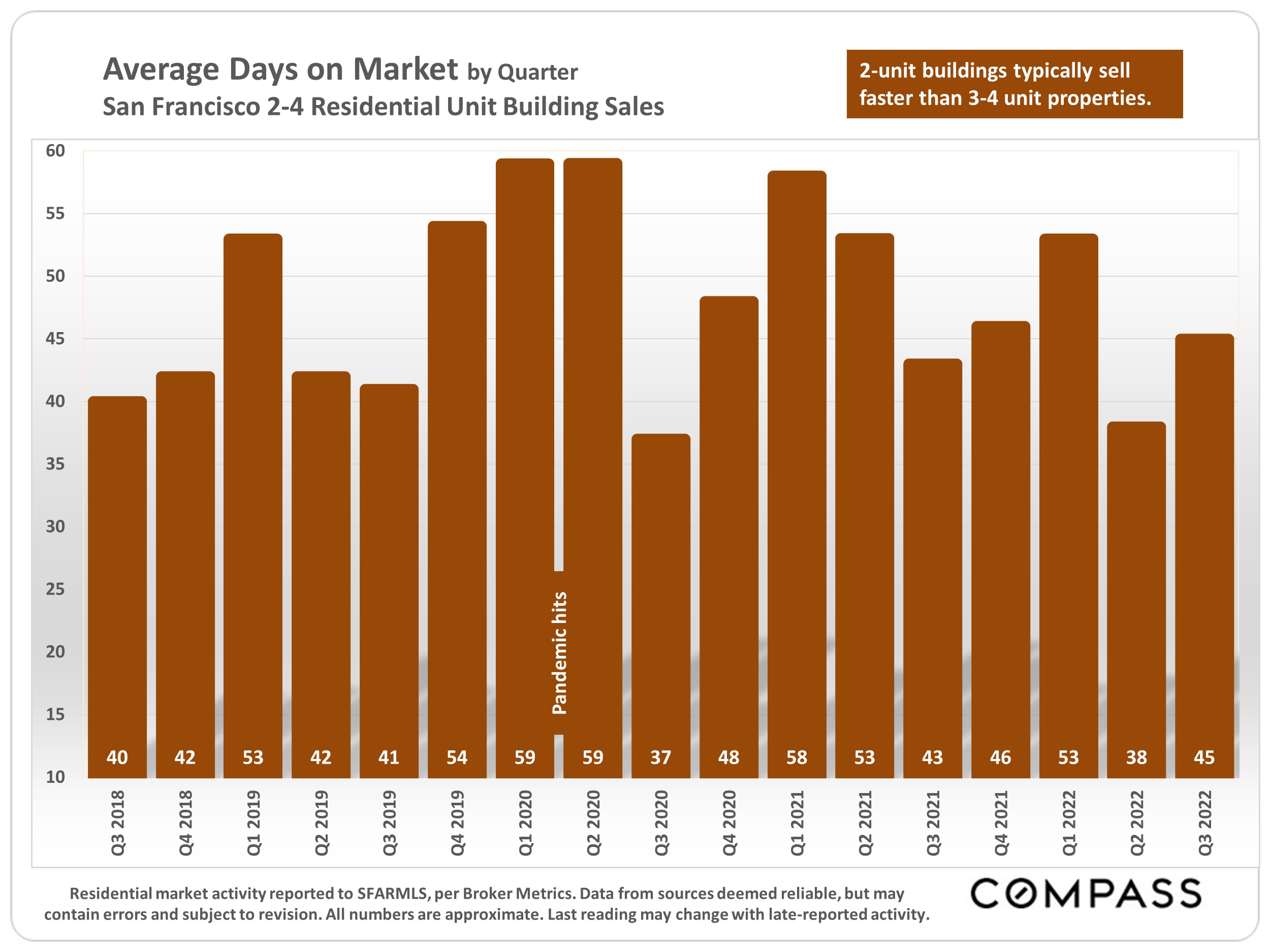

As in the general residential market in San Francisco and the Bay Area, the smaller apartment building market in the city saw significant effects on buyer demand and property values in the 3rd quarter from the economic headwinds that have arisen and strengthened since 2022 began: What could best be described as a market correction.

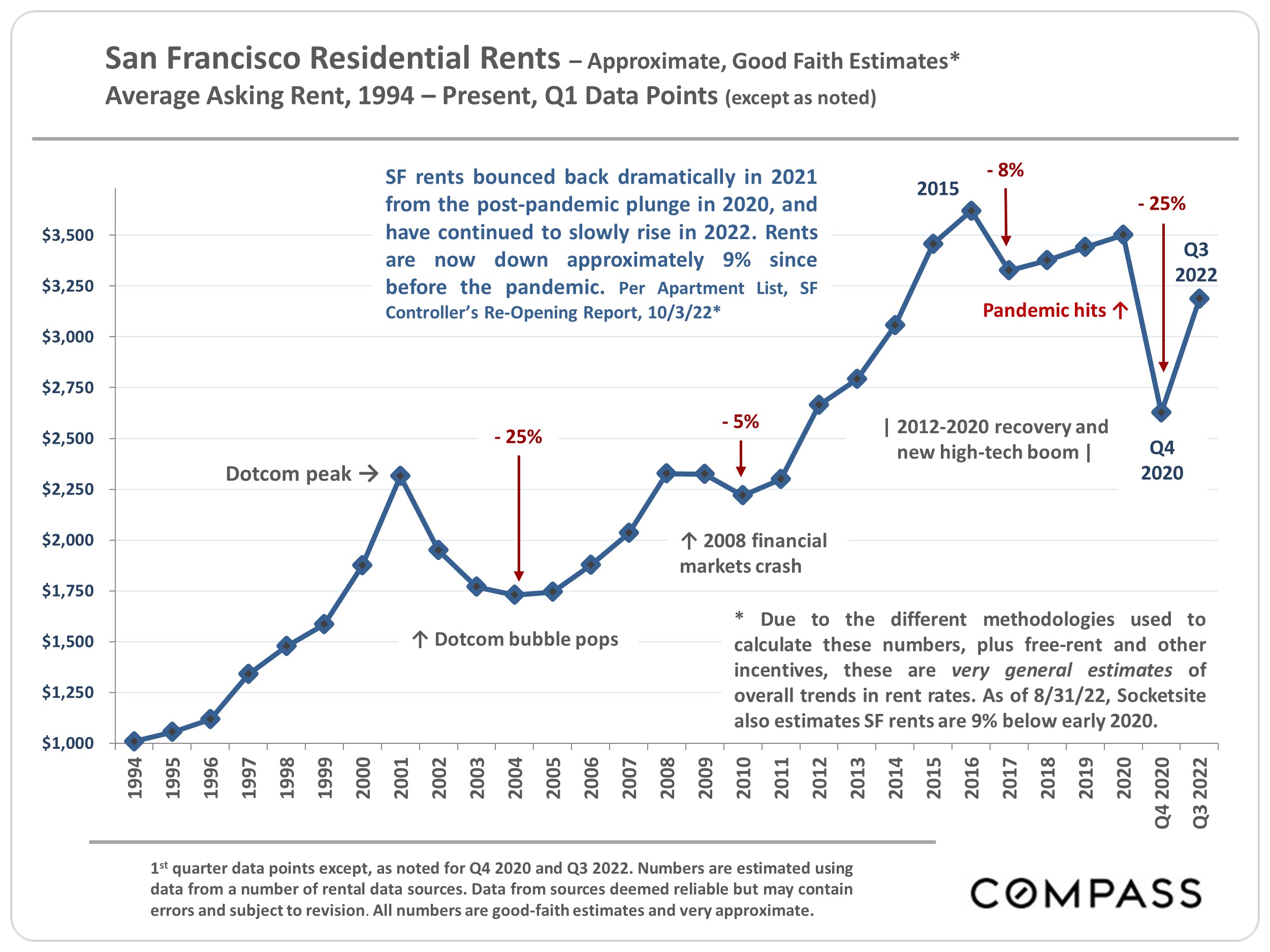

On the positive side, rental rates have continued to slightly improve.

The market is still adjusting to volatile and unsettled economic conditions, and definitive conclusions should not be made based upon a single quarter’s data. The autumn selling season runs until mid-November, when the mid-winter holiday slowdown usually begins.

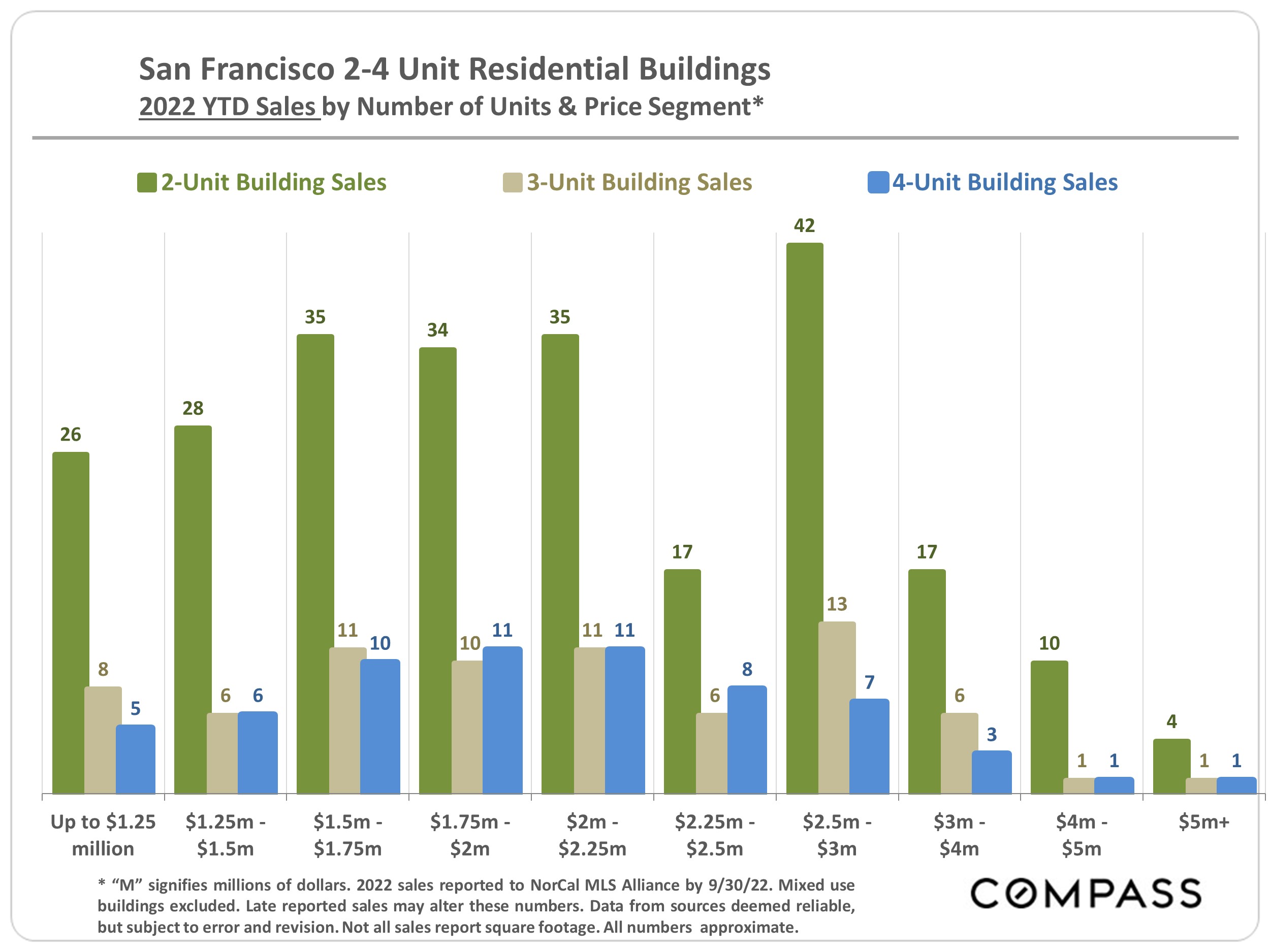

Data reported to regional MLS associations. Q3 2022 numbers are estimates using data available in early October: Late reported sales may alter these numbers. Statistics are generalities, essentially summaries of disparate data generated by dozens, hundreds or thousands of unique, individual sales. They are best seen not as precise measurements, but as broad, comparative indicators. Anomalous fluctuations in statistics are not uncommon, especially in smaller market segments with fewer sales. Data from sources deemed reliable, but may contain errors and subject to revision. All numbers approximate. How these figures apply to any particular property is unknown without a specific comparative market analysis.

Source: Compass

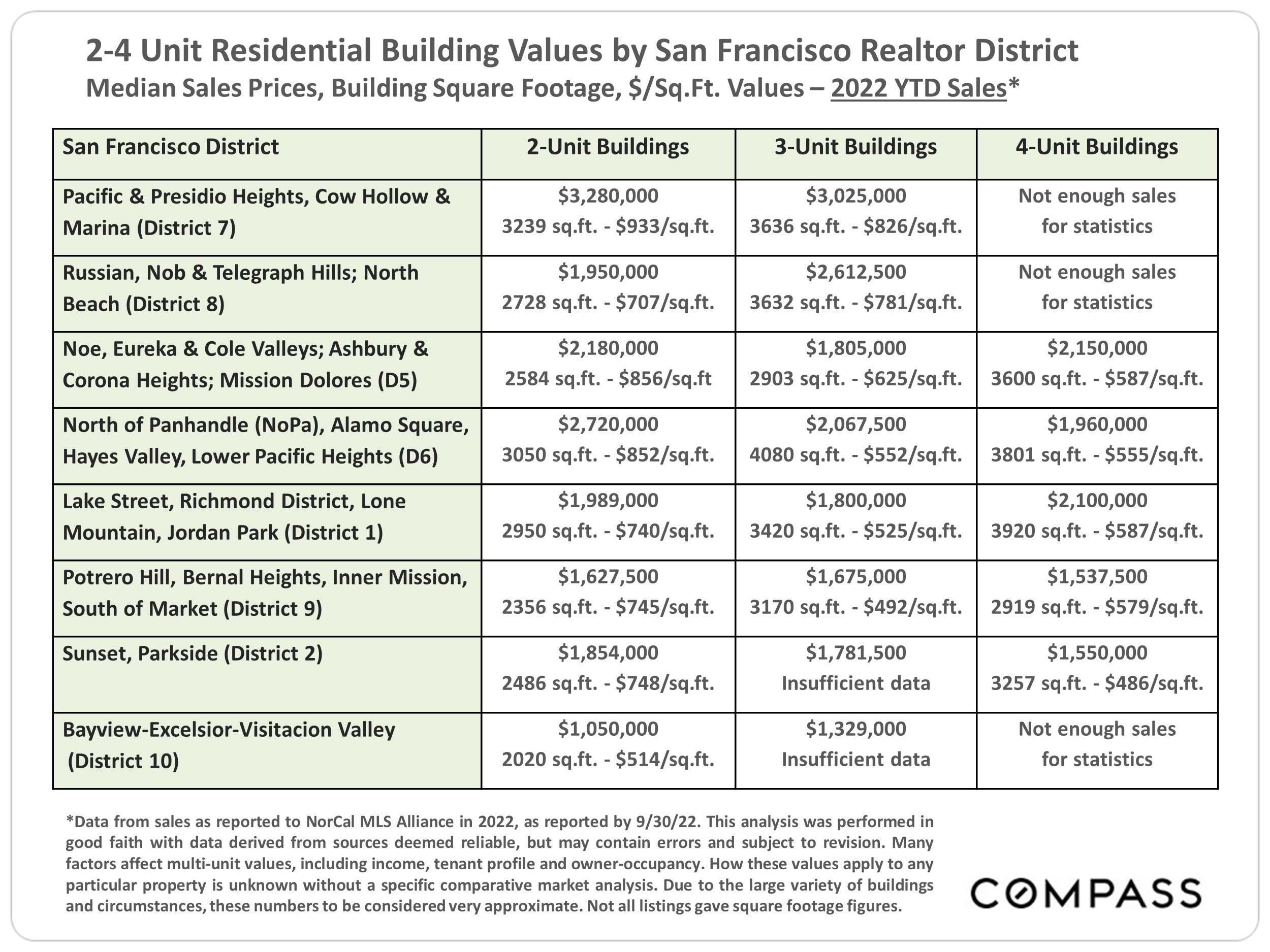

Note that the quantity of sales in any given local submarket is usually relatively small and/or the number of sales that report the necessary financial information can be limited. Buildings of different ages, qualities and sizes selling in different periods can cause these average and median figures to fluctuate significantly. Furthermore, the reliability of some of these calculations depends upon the quality of the income and expense figures provided by the listing agents, and sometimes instead of actual numbers, much less meaningful projected or scheduled figures are used. Therefore, the above statistics should be considered very general indicators, and how they apply to any particular property without a specific comparative market analysis is unknown.

These analyses were made in good faith with data from sources deemed reliable, but they may contain errors and are subject to revision. Statistics are generalities and all numbers should be considered approximate.

Compass is a real estate broker licensed by the State of California, DRE 01527235. Equal Housing Opportunity. This report has been prepared solely for information purposes. The information herein is based on or derived from information generally available to the public and/or from sources believed to be reliable. No representation or warranty can be given with respect to the accuracy or completeness of the information. Compass disclaims any and all liability relating to this report, including without limitation any express or implied representations or warranties for statements contained in, and omissions from, the report. Nothing contained herein is intended to be or should be read as any regulatory, legal, tax, accounting or other advice and Compass does not provide such advice. All opinions are subject to change without notice. Compass makes no representation regarding the accuracy of any statements regarding any references to the laws, statutes or regulations of any state are those of the author(s). Past performance is no guarantee of future results.